Professional Documents

Culture Documents

GL1435

GL1435

Uploaded by

Rochelle Joy CulasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GL1435

GL1435

Uploaded by

Rochelle Joy CulasCopyright:

Available Formats

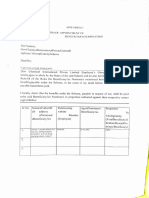

Please see reverse for assistance in completing this form.

Send the completed form to: Plan Member Administration

Manulife

Group Benefits PO BOX 11006, STN CENTRE-VILLE

Beneficiary Designation MONTREAL QC H3C 4T8

Fax: 1-877-733-4233

All sections of this page should be completed as it will replace any prior designations.

1 Plan member information Plan sponsor name Plan contract number Plan member certificate number

Plan member name (last, first and middle initial) Province of residence Date of birth (dd/mmm/yyyy)

2 Primary beneficiary Name of beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member Percentage

%

List all primary beneficiaries for

Basic Life and/or Basic Accidental Name of beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member Percentage

Death. %

Percentages must total 100% to Name of beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member Percentage

be valid. %

Irrevocability Note: If beneficiary is shown as irrevocable, his/ For Quebec residents only

her consent is required to change it. Include a In Quebec, the designation of your spouse as beneficiary is irrevocable

signed and dated consent with this form. You unless otherwise specified.

If spouse is beneficiary, the designation is:

are responsible for ensuring the validity of

your designation. Revocable Irrevocable

3 Optional coverage Name of beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member Percentage

(if applicable) %

Name of beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member Percentage

Plan contract number

%

Name of beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member Percentage

List all beneficiaries for Optional

Life and/or Optional Accidental %

Death.

Note: If beneficiary is shown as irrevocable, For Quebec residents only

Irrevocability his/her consent is required to change it. Include In Quebec, the designation of your spouse as beneficiary is irrevocable

a signed and dated consent with this form. You unless otherwise specified.

If spouse is beneficiary, the designation is:

are responsible for ensuring the validity of

your designation. Revocable Irrevocable

4 Contingent beneficiary You may wish to designate a contingent beneficiary(ies) to receive any proceeds under this group policy if all of

the primary beneficiary(ies), named above for either coverage, should die before you. In that event, a contingent

beneficiary will automatically be entitled to the benefit that would have been payable to the primary beneficiary(ies).

If you name more than one contingent beneficiary, then the proceeds will be split, evenly, amongst the contingent

beneficiaries you choose to name. Should there not be any surviving beneficiaries at the time of your death, the

proceeds will be paid to your estate.

Name of contingent beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member

Name of contingent beneficiary (last, first and middle initial) Date of birth (dd/mmm/yyyy) Relationship to plan member

5 Trustee appointment

I appoint as Trustee to receive any amount due to

Complete if any beneficiary named

any beneficiary under the age of majority (not applicable in Quebec).

is under the age of majority.

6 Declaration and I hereby revoke any previous beneficiary designations in relation to my foregoing coverage(s) and designate the

authorization person(s) named above.

Due to the legal significance of At Manulife, we know that confidentiality of personal information is important. Any information you provide to us will

a beneficiary appointment this be kept in a Group Life and Health Benefits file. Access to your information will be limited to:

designation must be signed and • our employees and service representatives in the performance of their jobs;

dated to be valid. • persons to whom you have granted access; and

• persons authorized by law.

A copy, fax, scan or image of the You have the right to request access to the personal information in your file and, if necessary, correct any inaccurate

beneficiary designation in this information.

form is as valid as the original.

I acknowledge that more detailed information concerning how and why Manulife collects, uses and discloses my

personal information is available at www.manulife.ca/planmember, or by requesting a copy from my plan sponsor.

Plan member signature Date signed (dd/mmm/yyyy)

PRINT

The Manufacturers Life Insurance Company Page 1 of 2 GL1435E (06/2015) GP/MC

Manulife assumes no responsibility for the validity or sufficiency of the content provided by you. The items ‘you’ and

‘yours’ refer to the plan member, the term “Plan Sponsor” refers to the entity that offers the group benefits plan, such as

an employer.

What is the purpose of a beneficiary?

If you intend for some or all of your death benefit to go to specific individuals, it is important to make sure that you plan

ahead and select those beneficiaries. Having an up-to-date beneficiary designation will make this possible by listing your

primary and contingent beneficiaries and intended allocations.

Beneficiary: the person, people or entity who will receive any death benefit from the basic or optional coverage you have

selected through your group benefits plan that becomes payable upon your death. Basic and optional beneficiaries may differ.

Types of beneficiary – Primary vs. Contingent

Primary: the person, people or entity you choose to receive the death benefits. If you choose more than one beneficiary,

you will need to indicate what percentage of the benefit you would like each person to receive. When multiple primary

beneficiaries are named, the total of the percentages allocated to each primary beneficiary must add up to 100%.

Contingent: the person, people or entity you designate to receive the death benefits if all of the primary beneficiaries die

before you. If you select more than one contingent beneficiary, the benefit will be split evenly between the contingent

beneficiaries.

What happens to the death benefit when...

The primary beneficiary dies before you and no contingent The death benefit will be paid to your estate.

beneficiary is named.

The primary beneficiary dies before you, but there is a The benefit will be paid to the contingent beneficiary(ies).

contingent beneficiary(ies) designated.

You assign two primary beneficiaries, and one beneficiary The entire death benefit that would have been paid to the

dies before you, and you have not updated your Beneficiary deceased beneficiary will be paid to the surviving primary

Form information. beneficiary.

Irrevocable vs. Revocable

Irrevocable: the beneficiary you choose cannot be changed without the written permission of that individual.

For example, if you choose your spouse or partner to be the designated beneficiary and you end up separating, you will not

be able to change the beneficiary designation without a completed release form from them.

In Quebec, naming your spouse (must be a civil union) as a beneficiary automatically means that he/she is an

irrevocable beneficiary, unless you specify otherwise or divorce.

Revocable: A revocable beneficiary means that the beneficiary you choose can be changed at any time without the

permission of that individual.

For example, if you choose your spouse or partner to be the designated beneficiary and you end up separating, you can then

change that beneficiary designation without asking for that person’s permission.

Naming a minor as a beneficiary

If a benefit becomes payable to a minor who is named as a primary or contingent beneficiary, the benefit can only be paid

on behalf of the minor to a trustee or guardian for property, otherwise it will be paid into court to be held until the beneficiary

has reached the age of majority for your specific province. It is important therefore, if you are choosing a beneficiary who is a

minor at the time of the designation to also name a trustee.

If you are a Quebec resident, the parents are considered tutors of their child.

If a minor has been designated as an irrevocable beneficiary, the policy is automatically frozen until the beneficiary has

reached the age of majority for your specific province. A parent, guardian or trustee cannot consent to a beneficiary change

on behalf of a minor.

Minor: a person named as a beneficiary who is under the age of majority for your specific province.

Trustee: a person appointed by you to hold the minor’s proceeds in trust until the minor reaches the age of majority for your

specific province.

Tutor: a tutor acts like a trustee.

The Manufacturers Life Insurance Company Page 2 of 2 GL1435E (06/2015) GP/MC

You might also like

- Indemnity AgreementDocument3 pagesIndemnity AgreementAngie Douglas100% (1)

- Career Agent'S Master Agreement: Know All Men by These PresentsDocument36 pagesCareer Agent'S Master Agreement: Know All Men by These PresentsMeynard MagsinoNo ratings yet

- RF1 FORM - Phil HealthDocument2 pagesRF1 FORM - Phil Healthjtravel91% (11)

- Contact Person: SR No. Company Number E-Mail IdDocument4 pagesContact Person: SR No. Company Number E-Mail IdAnand MandalNo ratings yet

- Sun Life Beneficiary FormDocument2 pagesSun Life Beneficiary FormNihal PednekarNo ratings yet

- Beneficiary Change: 1. General InformationDocument1 pageBeneficiary Change: 1. General InformationAndy De GuzmanNo ratings yet

- Beneficiary Designation Form: Policy and Member Information Rogers Communications IncDocument2 pagesBeneficiary Designation Form: Policy and Member Information Rogers Communications IncLiliana GomezNo ratings yet

- MetLife Enroll Form All ProductDocument5 pagesMetLife Enroll Form All ProducttxceoNo ratings yet

- Payable On Death (POD) Designation: A. Primary Member InformationDocument2 pagesPayable On Death (POD) Designation: A. Primary Member InformationNdoublePNo ratings yet

- Financial Amendment Form: 1 General InformationDocument3 pagesFinancial Amendment Form: 1 General InformationEjNo ratings yet

- Financial Amendment Form: 1 General InformationDocument3 pagesFinancial Amendment Form: 1 General InformationyamNo ratings yet

- Beneficiary Designation m6463Document2 pagesBeneficiary Designation m6463Saravpreet Singh DhillonNo ratings yet

- Financial Amendment Form: Estapia, Clint Lou Matthew PDocument3 pagesFinancial Amendment Form: Estapia, Clint Lou Matthew PClint Lou Matthew EstapiaNo ratings yet

- Change of Benificiary Non Financial Amedment FormDocument2 pagesChange of Benificiary Non Financial Amedment FormDhin PadayaoNo ratings yet

- American Funds Beneficiary DesignationDocument2 pagesAmerican Funds Beneficiary Designationambasyapare1No ratings yet

- Beneficiary Designation: Policy InformationDocument2 pagesBeneficiary Designation: Policy Informationjaniceseto1No ratings yet

- RSP - Application FormDocument3 pagesRSP - Application FormTamara Julia HannestoNo ratings yet

- MYDocument6 pagesMYshekharindanezerdaNo ratings yet

- TIAABeneficiary FormDocument12 pagesTIAABeneficiary Formibrahimanass002No ratings yet

- 25 Mar 2022 Endorsement For Designating Irrevocable Beneficiary Form FillableDocument1 page25 Mar 2022 Endorsement For Designating Irrevocable Beneficiary Form FillableFEBBY TONGAANNo ratings yet

- Barrick Enrollment Form Apr 2022Document3 pagesBarrick Enrollment Form Apr 2022jorge ordinolaNo ratings yet

- Great American: FORM TO FILL OUTDocument8 pagesGreat American: FORM TO FILL OUTMax PowerNo ratings yet

- Dividends PDFDocument2 pagesDividends PDFAnnalene Ramores OlitNo ratings yet

- Employee Waiver FormDocument1 pageEmployee Waiver FormL.A Review CenterNo ratings yet

- Amendment of Application SLOCPIDocument1 pageAmendment of Application SLOCPIChristine Joy PrestozaNo ratings yet

- NONFIN - App For Fund Switch and Investment Allocation Change (V. 03.2019)Document1 pageNONFIN - App For Fund Switch and Investment Allocation Change (V. 03.2019)Bev's AblaoNo ratings yet

- GL3189Document2 pagesGL3189dsfdsfNo ratings yet

- Policy Servicing Request Form Health Plans 2 Major AlterationDocument4 pagesPolicy Servicing Request Form Health Plans 2 Major Alterationsaichinni7036No ratings yet

- Application For ReinstatementDocument1 pageApplication For ReinstatementLALENE VALENTINNo ratings yet

- Ola OlaolaDocument3 pagesOla Olaolabhanu rajawatNo ratings yet

- Optima RestoreDocument6 pagesOptima RestoreYOGESH SHARMANo ratings yet

- Long Form Health Certificate 167EDocument3 pagesLong Form Health Certificate 167EAmir mushtaqNo ratings yet

- Proposal Form For LIC's Jeevan ShantiDocument9 pagesProposal Form For LIC's Jeevan ShantivasilirajeshNo ratings yet

- Ap421fe 0216B NDDocument3 pagesAp421fe 0216B NDDen NisNo ratings yet

- Flexishield Application Form2024 02 February 21 2Document6 pagesFlexishield Application Form2024 02 February 21 2Karl LabagalaNo ratings yet

- Name of Proprietor/partner(s) Category SC/ST/Other S Alive / Deceased / Incapacitated Existing % Share Wish To Continue / Retire Proposed % ShareDocument9 pagesName of Proprietor/partner(s) Category SC/ST/Other S Alive / Deceased / Incapacitated Existing % Share Wish To Continue / Retire Proposed % ShareDiwakar Minz100% (1)

- Application FOR Pre-Need Plans: 08 JULY 2020Document2 pagesApplication FOR Pre-Need Plans: 08 JULY 2020Gerry Avila NaguitNo ratings yet

- 4 Reconstitution ApplicationDocument3 pages4 Reconstitution ApplicationkannakiyinsilambuNo ratings yet

- MILTON F11468 BeneficiaryDesignationFormDocument13 pagesMILTON F11468 BeneficiaryDesignationFormryandNo ratings yet

- New CDFDocument2 pagesNew CDFad7830899No ratings yet

- Fa Ia Fa2210d.2 923 CDocument11 pagesFa Ia Fa2210d.2 923 CtjyxwvjyttNo ratings yet

- Gratuity FormDocument4 pagesGratuity Formsravan1760No ratings yet

- ReconstitutionDocument45 pagesReconstitutionMayank Singh YadvenduNo ratings yet

- Policy Document Shriram Life Wealth Plus PDFDocument25 pagesPolicy Document Shriram Life Wealth Plus PDFAdithyan SuneendranNo ratings yet

- CDF SPC All LOB Except HL LevelDocument2 pagesCDF SPC All LOB Except HL LevelSRIKANTA ROUTNo ratings yet

- Muthoot Finance Business Loan XH Enrolment Form v1Document2 pagesMuthoot Finance Business Loan XH Enrolment Form v1Subramanyam JonnaNo ratings yet

- Annexures For Reconstitution-Commissioned Dealership Dhanbad DoDocument12 pagesAnnexures For Reconstitution-Commissioned Dealership Dhanbad Dolaw conquerorNo ratings yet

- Financial Amendment Form: 1 General InformationDocument3 pagesFinancial Amendment Form: 1 General InformationRandolph QuilingNo ratings yet

- Policy Details Change Form: General InformationDocument2 pagesPolicy Details Change Form: General InformationTawfiq4444No ratings yet

- Digi International Inc. 401-K Savings and Profit Sharing Plan 48951Document4 pagesDigi International Inc. 401-K Savings and Profit Sharing Plan 48951axis99No ratings yet

- Pre-Mature Exit Form Jan 19Document2 pagesPre-Mature Exit Form Jan 19antriksh82No ratings yet

- Royal Sundaram CustomerDocument8 pagesRoyal Sundaram CustomerShubham goyalNo ratings yet

- Duplex Flashcards 1Document32 pagesDuplex Flashcards 1jose felix JoseNo ratings yet

- GL 2002 140Document9 pagesGL 2002 140net2useNo ratings yet

- Policy Document - JeevanUtsavDocument27 pagesPolicy Document - JeevanUtsavbinu bsNo ratings yet

- Afterburner - Spring-Summer 2019-Final Crcted-FinalDocument12 pagesAfterburner - Spring-Summer 2019-Final Crcted-FinalArt SanchezNo ratings yet

- VERHOEVEN_JOHN_Beneficiary formDocument1 pageVERHOEVEN_JOHN_Beneficiary formankitanand12121No ratings yet

- HDFC Life Click 2 Protect 3D Plus - BrochureDocument28 pagesHDFC Life Click 2 Protect 3D Plus - BrochureankitNo ratings yet

- Candidate Form DependentNominationsInfoDocument13 pagesCandidate Form DependentNominationsInfoSrishty ChhabraNo ratings yet

- Form 03092015 Application For Pre Need PlansDocument2 pagesForm 03092015 Application For Pre Need PlansRosalyn DelfinNo ratings yet

- Change Request Form: This Is A Watermark For Trial Version, Register To Get Full One!Document1 pageChange Request Form: This Is A Watermark For Trial Version, Register To Get Full One!Kumari MadhumitaNo ratings yet

- Annexures For Reconstitution Commissioned DealershipDocument45 pagesAnnexures For Reconstitution Commissioned DealershipsangeetsinghashanNo ratings yet

- Amendment of Application SLOCPIDocument1 pageAmendment of Application SLOCPILourdes Erika CruzNo ratings yet

- Disaster Dollars: Financial Preparation and Recovery for Towns, Businesses, Farms, and IndividualsFrom EverandDisaster Dollars: Financial Preparation and Recovery for Towns, Businesses, Farms, and IndividualsNo ratings yet

- Comparison of PoliciesDocument2 pagesComparison of PoliciesRukshar AbbasNo ratings yet

- Random Variables: Prof. Megha SharmaDocument35 pagesRandom Variables: Prof. Megha SharmaAnil SoniNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseTine TineNo ratings yet

- SLM in Stat Week 3Document10 pagesSLM in Stat Week 3Ares Jude M MalinisNo ratings yet

- Car InsuranceDocument1,304 pagesCar InsuranceEntertainment BNo ratings yet

- INS 21 Chapter7-Risk ManagementDocument19 pagesINS 21 Chapter7-Risk Managementvenki_hinfotechNo ratings yet

- Instructions For Schedule R (Form 941) : (Rev. June 2021)Document3 pagesInstructions For Schedule R (Form 941) : (Rev. June 2021)Josh JasperNo ratings yet

- Annual Report 2019-20Document501 pagesAnnual Report 2019-20ankitNo ratings yet

- Construction BondDocument3 pagesConstruction BondNiño Rey LopezNo ratings yet

- ICICI Pru Smart Life BrochureDocument23 pagesICICI Pru Smart Life Brochuresrinivas reddyNo ratings yet

- New York 02.13.2023Document84 pagesNew York 02.13.2023Carla Pía Ruiz PereiraNo ratings yet

- B NageshDocument1 pageB Nageshmahesh kNo ratings yet

- Contracts 123Document12 pagesContracts 123SAHIL GUPTANo ratings yet

- Accounting Notes 3Document24 pagesAccounting Notes 3sino akoNo ratings yet

- 4D Classes of InsuranceDocument19 pages4D Classes of InsuranceNurul SyazwaniNo ratings yet

- Motor TP Ppt. For September 14 ClassDocument53 pagesMotor TP Ppt. For September 14 ClassLaxmikant GawadeNo ratings yet

- PSBank Auto Loan Application Form - IndividualDocument2 pagesPSBank Auto Loan Application Form - IndividualJp Dela CruzNo ratings yet

- Case 7 - CRM Implementation Failure at Cigna CorporationDocument15 pagesCase 7 - CRM Implementation Failure at Cigna CorporationvijayselvarajNo ratings yet

- Contract of Indemnity and Guarantee AutosavedDocument41 pagesContract of Indemnity and Guarantee AutosavedKathuria AmanNo ratings yet

- Hawley V Luminar Leisure PLC Hawley V Luminar Leisure PLCDocument29 pagesHawley V Luminar Leisure PLC Hawley V Luminar Leisure PLCTyler ReneeNo ratings yet

- Salary Extract of The Year 2020-21: Name: Ashwin Loyal Mendonca Designation: Pan: Address: Salary (RS) Deductions (RS)Document15 pagesSalary Extract of The Year 2020-21: Name: Ashwin Loyal Mendonca Designation: Pan: Address: Salary (RS) Deductions (RS)sharathNo ratings yet

- 406 Legal Notice FormatDocument3 pages406 Legal Notice FormatSEVA LAW OFFICESNo ratings yet

- Project Title: Effectiveness of Recruitment and Training Programs For Sales Force A Case Study of HDFC Standard LifeDocument47 pagesProject Title: Effectiveness of Recruitment and Training Programs For Sales Force A Case Study of HDFC Standard Lifeanon_45072No ratings yet

- AttachmentDocument1 pageAttachmentMallu MohanreddyNo ratings yet

- Analysis of BankingDocument56 pagesAnalysis of BankingYashNo ratings yet

- Explanation:: (Round Your Answer To 2 Decimal Places.)Document7 pagesExplanation:: (Round Your Answer To 2 Decimal Places.)Joel Christian MascariñaNo ratings yet