Professional Documents

Culture Documents

CIR v. Algue Inc

CIR v. Algue Inc

Uploaded by

zacOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR v. Algue Inc

CIR v. Algue Inc

Uploaded by

zacCopyright:

Available Formats

COMMISSIONER OF INTERNAL REVENUE,

petitioner,

vs.

ALGUE, INC., and THE COURT OF TAX APPEALS, respondents.

G.R. No. L-28896 February 17, 1988

DOCTRINES

Taxes are the lifeblood of the government and so should All the ordinary and necessary expenses paid or incurred

be collected without unnecessary hindrance. On the other during the taxable year in carrying on any trade or

hand, such collection should be made in accordance with business, including a reasonable allowance for salaries or

law as any arbitrariness will negate the very reason for other compensation for personal services actually

government itself. It is therefore necessary to reconcile the rendered are deductible from the Gross Income

apparently conflicting interests of the authorities and the

taxpayers so that the real purpose of taxation, which is the

promotion of the common good, may be achieved.

FACTS:

Algue Inc., a domestic corporation engaged in CTA - held that the said amount had been legitimately paid

engineering, construction and other allied activities, was by the private respondent for actual services rendered.

assessed by the CIR amounting to P83,183.85 as The payment was in the form of promotional fees.

delinquency income taxes for the years 1958 and 1959.

Algue received as agent a commission of P126,000.00 for

CIR - claimed deduction of P75,000.00 was properly the sale of Philippine Sugar Estate Development

disallowed because it was not an ordinary reasonable or Company properties, and it was from this commission that

necessary business expense the P75,000.00 promotional fees were paid to the

aforenamed individuals.

ISSUE:

whether or not the Collector of Internal Revenue correctly disallowed the P75,000.00 deduction claimed by Algue Inc as

legitimate business expenses in its income tax returns.

RULING:

NO. Algue Inc has proved that the payment of the fees was necessary and reasonable in the light of the efforts exerted

by the payees in inducing investors and prominent businessmen to venture in an experimental enterprise and involve

themselves in a new business requiring millions of pesos.

It is said that taxes are what we pay for civilization society. Without taxes, the government would be paralyzed for lack

of the motive power to activate and operate it. Hence, despite the natural reluctance to surrender part of one's hard

earned income to the taxing authorities, every person who is able to must contribute his share in the running of the

government

You might also like

- Sample Legal Opinion by Atty. Ralph SarmientoDocument4 pagesSample Legal Opinion by Atty. Ralph Sarmientofamigo45188% (32)

- CIR vs. AlgueDocument2 pagesCIR vs. AlgueJayson AbabaNo ratings yet

- TSNDocument16 pagesTSNPj Tigniman100% (7)

- Counter Affidavit Robbery With HomicideDocument3 pagesCounter Affidavit Robbery With HomicideRen Concha100% (1)

- CIR Vs Cebu Toyo CorpDocument3 pagesCIR Vs Cebu Toyo Corplance100% (2)

- CIR Vs AlgueDocument2 pagesCIR Vs AlgueRodney AtibulaNo ratings yet

- CIR v. Algue, Inc.Document1 pageCIR v. Algue, Inc.Jo DevisNo ratings yet

- Commissioner V AlgueDocument2 pagesCommissioner V AlgueRyan Vic AbadayanNo ratings yet

- CIR vs. AlgueDocument1 pageCIR vs. AlgueprincessconsuelaNo ratings yet

- Cir Vs Algue, Inc. GR No. L-28896 February 7, 1996Document2 pagesCir Vs Algue, Inc. GR No. L-28896 February 7, 1996ian ballartaNo ratings yet

- Commissioner of InternalDocument3 pagesCommissioner of InternalNaif OmarNo ratings yet

- CIR v. AlgueDocument2 pagesCIR v. AlgueGM AlfonsoNo ratings yet

- 3 CIR vs. AlgueDocument2 pages3 CIR vs. AlguemaggiNo ratings yet

- CIR Vs Algue, Inc.Document1 pageCIR Vs Algue, Inc.AngelNo ratings yet

- G.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, Petitioner, ALGUE, INC., and THE COURT OF TAX APPEALS, RespondentsDocument1 pageG.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, Petitioner, ALGUE, INC., and THE COURT OF TAX APPEALS, RespondentsJon SantosNo ratings yet

- Cir Vs AlgueDocument2 pagesCir Vs AlgueYan Lean DollisonNo ratings yet

- 3 - Commissioner v. AlgueDocument2 pages3 - Commissioner v. AlgueAbegaile LucianoNo ratings yet

- Tax CasesDocument39 pagesTax CasesDanica Irish RevillaNo ratings yet

- CIR v. Algue DigestsDocument1 pageCIR v. Algue Digestspinkblush717No ratings yet

- CIR v. Algue - G.R. No. L-28896 - February 17, 1988 - DIGESTDocument1 pageCIR v. Algue - G.R. No. L-28896 - February 17, 1988 - DIGESTAaron AristonNo ratings yet

- Commissioner of Internal Revenue V Algue Inc: #1 G.R. No. L-28896 February 17, 1988Document2 pagesCommissioner of Internal Revenue V Algue Inc: #1 G.R. No. L-28896 February 17, 1988Fred GoNo ratings yet

- Commissioner of Internal Revenue vs. Algue IncDocument8 pagesCommissioner of Internal Revenue vs. Algue IncBesprenPaoloSpiritfmLucenaNo ratings yet

- Tax 1 Midterms CasesDocument11 pagesTax 1 Midterms CasesJett LabillesNo ratings yet

- CIR Vs Algue IncDocument2 pagesCIR Vs Algue IncQuoleteNo ratings yet

- G.R. No. L-28896 February 17, 1988 Case DiegstDocument2 pagesG.R. No. L-28896 February 17, 1988 Case DiegstChiiBiiNo ratings yet

- 1 CIR V Algue DGSTDocument2 pages1 CIR V Algue DGSTMiguelNo ratings yet

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsDocument1 pageCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsRobehgene Atud-JavinarNo ratings yet

- Issue: W/N The Collector of Internal RevenueDocument2 pagesIssue: W/N The Collector of Internal RevenueRalph Romeo BasconesNo ratings yet

- CIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988Document2 pagesCIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988piptipaybNo ratings yet

- Commissioner of Lnternal Revenue v. Algue, Inc., GR L-28896. Feb. 17, 1988, 158 SCRA 9Document1 pageCommissioner of Lnternal Revenue v. Algue, Inc., GR L-28896. Feb. 17, 1988, 158 SCRA 9Baisy VillanozaNo ratings yet

- Taxation CasesDocument49 pagesTaxation CasesMadzGabiolaNo ratings yet

- Commissioner VS AlgueDocument2 pagesCommissioner VS AlguebelleferiesebelsaNo ratings yet

- General Principles of TaxationDocument2 pagesGeneral Principles of TaxationemgraceNo ratings yet

- CIR v. AlgueDocument1 pageCIR v. Algue8111 aaa 1118No ratings yet

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsDocument9 pagesCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsPer PerNo ratings yet

- CIR vs. Algue Inc.: TaxationDocument4 pagesCIR vs. Algue Inc.: Taxationianmaranon2No ratings yet

- CIR vs. Algue, Inc.Document2 pagesCIR vs. Algue, Inc.Leyard100% (1)

- Commissioner v. Algue, G.R. No. L-28896, 1988Document2 pagesCommissioner v. Algue, G.R. No. L-28896, 1988Jeffrey Medina100% (1)

- G.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, Petitioner, ALGUE, INC., and THE COURT OF TAX APPEALS, Respondents. FactsDocument4 pagesG.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, Petitioner, ALGUE, INC., and THE COURT OF TAX APPEALS, Respondents. FactsTess YgrubayNo ratings yet

- Cir vs. Algue DigestDocument1 pageCir vs. Algue DigestTinyssa Paguio50% (2)

- FACTS: Philippine Sugar Estate Development CompanyDocument66 pagesFACTS: Philippine Sugar Estate Development CompanyStephNo ratings yet

- PAL To KAP Vs TANDocument45 pagesPAL To KAP Vs TANPaulo SantosNo ratings yet

- Taxation Law 1 CasesDocument4 pagesTaxation Law 1 CasesAna RobinNo ratings yet

- Taxation DigestDocument3 pagesTaxation Digestkenneth odimosNo ratings yet

- CIR v. Algue, L-28896, 1988Document2 pagesCIR v. Algue, L-28896, 1988Michael TampengcoNo ratings yet

- Issue: W/N The Collector of Internal Revenue CorrectlyDocument8 pagesIssue: W/N The Collector of Internal Revenue CorrectlyRio LorraineNo ratings yet

- Case 182 - Limitations On Revenue, Appropriations and Tariff MeasuresDocument3 pagesCase 182 - Limitations On Revenue, Appropriations and Tariff MeasuresannamariepagtabunanNo ratings yet

- Tax Rev - Case DigestDocument12 pagesTax Rev - Case DigestCk Bongalos AdolfoNo ratings yet

- Tax Case DigestsDocument13 pagesTax Case DigestsArisa BajanaNo ratings yet

- Paseo V CIRDocument16 pagesPaseo V CIRzacNo ratings yet

- Comm. of Customs vs. PH Phosphate FertilizerDocument3 pagesComm. of Customs vs. PH Phosphate FertilizerMara VinluanNo ratings yet

- E5. CIR V Algue (Taxation)Document1 pageE5. CIR V Algue (Taxation)Michael VillalonNo ratings yet

- CIR v. AlgueDocument2 pagesCIR v. AlgueRaish RojasNo ratings yet

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988Document12 pagesCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988Helen Joy Grijaldo JueleNo ratings yet

- CIR DigestDocument1 pageCIR DigestNoriNo ratings yet

- CIR v. Algue, Inc., 158 SCRA 9 (1988)Document3 pagesCIR v. Algue, Inc., 158 SCRA 9 (1988)I took her to my penthouse and i freaked itNo ratings yet

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsDocument4 pagesCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsMae Sntg OraNo ratings yet

- CIR v. AlgueDocument3 pagesCIR v. AlguedyosaNo ratings yet

- Taxation 1 Digests: # Case Title Case DigestDocument14 pagesTaxation 1 Digests: # Case Title Case DigestgabbieseguiranNo ratings yet

- Taxation 1 DigestsDocument14 pagesTaxation 1 DigestsgabbieseguiranNo ratings yet

- CIR vs. Algue, IncDocument1 pageCIR vs. Algue, IncimXinYNo ratings yet

- G.R. No. L-28896Document7 pagesG.R. No. L-28896Klein CarloNo ratings yet

- Tax Digests MidtermDocument43 pagesTax Digests MidtermJoshua Became A CatNo ratings yet

- Transportation Milky NotesDocument13 pagesTransportation Milky NoteszacNo ratings yet

- Trademarks - CASESDocument66 pagesTrademarks - CASESzacNo ratings yet

- A.M. No. 20 07 04 SC DTD 07.14.20Document17 pagesA.M. No. 20 07 04 SC DTD 07.14.20zacNo ratings yet

- SAMMA-LIKHA vs. SAMMA CORPORATIONDocument4 pagesSAMMA-LIKHA vs. SAMMA CORPORATIONzacNo ratings yet

- 2023 Purple Notes - Remedial Law, Legal and Judicial Ethics and Practical ExercisesDocument29 pages2023 Purple Notes - Remedial Law, Legal and Judicial Ethics and Practical ExerciseszacNo ratings yet

- INTELLECTUAL PROPERTY ASSOCIATION OF THE PHILIPPINES v. HON. PAQUITO OCHOA, G .R. No. 204605, July 19, 2016Document88 pagesINTELLECTUAL PROPERTY ASSOCIATION OF THE PHILIPPINES v. HON. PAQUITO OCHOA, G .R. No. 204605, July 19, 2016zacNo ratings yet

- VERCELES v. BLR-DOLEDocument2 pagesVERCELES v. BLR-DOLEzacNo ratings yet

- Special Power of AttorneyDocument3 pagesSpecial Power of AttorneyzacNo ratings yet

- Filcar Transport Services V EspinasDocument2 pagesFilcar Transport Services V EspinaszacNo ratings yet

- Complex Electronics Employees Asso. v. Complex Electronics, G.R. No. 122136, July 19, 1999Document2 pagesComplex Electronics Employees Asso. v. Complex Electronics, G.R. No. 122136, July 19, 1999zacNo ratings yet

- Robles v. ConcepcionDocument2 pagesRobles v. ConcepcionzacNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LosszacNo ratings yet

- BPi Unioin V BPIDocument2 pagesBPi Unioin V BPIzacNo ratings yet

- Case Digest - LegMedDocument22 pagesCase Digest - LegMedzacNo ratings yet

- Digest - Agan, Jr. v. Philippine International Air Terminals Co., Inc., 450 Phil. 744Document9 pagesDigest - Agan, Jr. v. Philippine International Air Terminals Co., Inc., 450 Phil. 744zacNo ratings yet

- JUSMAG Philippines vs. NLRC 239 SCRA 224 (1994)Document7 pagesJUSMAG Philippines vs. NLRC 239 SCRA 224 (1994)zacNo ratings yet

- Fisher v. Trinidad, G.R. No. L-17518, October 30, 1922Document13 pagesFisher v. Trinidad, G.R. No. L-17518, October 30, 1922zacNo ratings yet

- DR. RUBI LI vs. SPOUSES REYNALDO and LINA SOLIMANDocument14 pagesDR. RUBI LI vs. SPOUSES REYNALDO and LINA SOLIMANzacNo ratings yet

- Case Digest - 1stDocument34 pagesCase Digest - 1stzacNo ratings yet

- Digest - Albano v. Reyes, 256 Phil. 718Document1 pageDigest - Albano v. Reyes, 256 Phil. 718zacNo ratings yet

- Mamon v. QuirinoDocument5 pagesMamon v. QuirinozacNo ratings yet

- Theresa Avelau Isturis-Rebuelta Et Al v. Peter P. RebueltaDocument2 pagesTheresa Avelau Isturis-Rebuelta Et Al v. Peter P. Rebueltazac100% (1)

- Berteni Cataluna Causing v. People of The PhilippinesDocument1 pageBerteni Cataluna Causing v. People of The PhilippineszacNo ratings yet

- Talavera v. Court of AppealsDocument4 pagesTalavera v. Court of AppealszacNo ratings yet

- Vianzon v. Macaraeg, G.R. No. 171107, 5 September 2012Document10 pagesVianzon v. Macaraeg, G.R. No. 171107, 5 September 2012zacNo ratings yet

- DR. NINEVETCH CRUZ v. COURT OF APPEALSDocument16 pagesDR. NINEVETCH CRUZ v. COURT OF APPEALSzacNo ratings yet

- Conwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992Document6 pagesConwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992zac100% (1)

- LIMPAN INVESTMENT VS. CIR - Actual Vs ConstructiveDocument5 pagesLIMPAN INVESTMENT VS. CIR - Actual Vs ConstructivezacNo ratings yet

- Cir V CaDocument12 pagesCir V CazacNo ratings yet

- Cir v. FortuneDocument14 pagesCir v. FortunezacNo ratings yet

- Ambassador & Ambassadress: OF CBADocument11 pagesAmbassador & Ambassadress: OF CBAAnthony Tunying MantuhacNo ratings yet

- Correspondence Between The Election Assistance Commission and ES&SDocument9 pagesCorrespondence Between The Election Assistance Commission and ES&SChristopher GleasonNo ratings yet

- FABM2Document27 pagesFABM2Shai Rose Jumawan QuiboNo ratings yet

- Scalpers.comDocument5 pagesScalpers.comDomainNameWireNo ratings yet

- Superior Commercial Enterprises IncDocument6 pagesSuperior Commercial Enterprises IncRalph HonoricoNo ratings yet

- El Corazon Triste Esim CanDocument4 pagesEl Corazon Triste Esim CanGeirr O. PedersenNo ratings yet

- NJC Payscales 2016-18 With Hourly RateDocument7 pagesNJC Payscales 2016-18 With Hourly RateRadu Lucian MihaiNo ratings yet

- Digest - Locsin II V Mekeni Food CorporationDocument2 pagesDigest - Locsin II V Mekeni Food CorporationPerry RubioNo ratings yet

- Swami Ramanandteerth Marathwada University Syllabus B.S.L.-II Year Semester-III W.E.F 2011-12 General English IIIDocument9 pagesSwami Ramanandteerth Marathwada University Syllabus B.S.L.-II Year Semester-III W.E.F 2011-12 General English IIIsonali yadavNo ratings yet

- LHXXXXXXXXXXXX24Document2 pagesLHXXXXXXXXXXXX24Dhananjay RambhatlaNo ratings yet

- Bactoso-v-Govt-of-Cebu - DigestDocument2 pagesBactoso-v-Govt-of-Cebu - DigestSyd Geemson ParrenasNo ratings yet

- Commercial LawDocument6 pagesCommercial LawLatanya BridgemohanNo ratings yet

- Application Form For Medical Certificate: Health & Family Welfare Department Government of OrissaDocument3 pagesApplication Form For Medical Certificate: Health & Family Welfare Department Government of OrissaluvintrainNo ratings yet

- MAINTENANCEDocument5 pagesMAINTENANCEGanesh Nair100% (1)

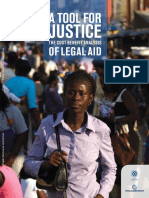

- A Tool For Justice The Cost Benefit Analysis of Legal AidDocument63 pagesA Tool For Justice The Cost Benefit Analysis of Legal Aid289849849852984721No ratings yet

- Itad Bir Ruling No. 191-15 Uk VatDocument8 pagesItad Bir Ruling No. 191-15 Uk VatKarla TigaronitaNo ratings yet

- Labor Law Case Digest: Jamias Et Al. v. NLRC G.R. No. 159350 March 9, 2016 Bersamin, J.: FactsDocument2 pagesLabor Law Case Digest: Jamias Et Al. v. NLRC G.R. No. 159350 March 9, 2016 Bersamin, J.: FactsKaye Stephanie SorrosaNo ratings yet

- Administrative LawDocument87 pagesAdministrative Lawtanya vermaNo ratings yet

- 1990 91Document434 pages1990 91zahid khanNo ratings yet

- Collapse of The Soviet Union ReadingDocument3 pagesCollapse of The Soviet Union Readingapi-278140768No ratings yet

- TermsOfUse en US SalesforceDocument47 pagesTermsOfUse en US SalesforceSevNo ratings yet

- Clarence Tiu - Specpro TablesDocument18 pagesClarence Tiu - Specpro TablesResin Bagnette100% (1)

- College of Law PDFDocument1 pageCollege of Law PDFknicky FranciscoNo ratings yet

- Lectures On Comparative Law of ContractsDocument194 pagesLectures On Comparative Law of ContractsIrma Rahmanisa100% (1)

- Notes in Criminal Procedure Class of Atty. Plaridel Bohol II (UE & San Beda)Document2 pagesNotes in Criminal Procedure Class of Atty. Plaridel Bohol II (UE & San Beda)Witch BRIONNENo ratings yet

- Demand letter-BETH TAYLORDocument2 pagesDemand letter-BETH TAYLORBeverly Fuentes LauronNo ratings yet