Professional Documents

Culture Documents

Illustration of Cascading Effect of Vat

Illustration of Cascading Effect of Vat

Uploaded by

patricia gunioCopyright:

Available Formats

You might also like

- 2.2 Problems - VAT PayableDocument11 pages2.2 Problems - VAT PayableHafi DisoNo ratings yet

- Tax2 - Seatworks-04 06 2020-AnswersDocument7 pagesTax2 - Seatworks-04 06 2020-AnswersAllen Fey De JesusNo ratings yet

- Advac Guerero Chapter 15Document18 pagesAdvac Guerero Chapter 15Drew BanlutaNo ratings yet

- CHAPTER13 Home Office and Branch - Special ProblemsDocument21 pagesCHAPTER13 Home Office and Branch - Special ProblemsAlgifariAdityaNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013Eliza BethNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument7 pagesValue-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersCha DumpyNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument6 pagesValue-Added Tax: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersiajycNo ratings yet

- Tax Lecture VAT Answer KeyDocument2 pagesTax Lecture VAT Answer KeyKathreen Aya ExcondeNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013libraolrack100% (4)

- Assign 3.1Document1 pageAssign 3.1Gie MaeNo ratings yet

- Assign 3.1Document1 pageAssign 3.1Gie MaeNo ratings yet

- Multiple Choices - Computational: Balance of Allowance For Overvaluation Account Before Adjustment P 35,000Document16 pagesMultiple Choices - Computational: Balance of Allowance For Overvaluation Account Before Adjustment P 35,000Love FreddyNo ratings yet

- Chapter 10 - Concepts of Vat 7thDocument11 pagesChapter 10 - Concepts of Vat 7thEl Yang100% (3)

- CHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1Document8 pagesCHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1kathNo ratings yet

- Tax Endterm Business Taxes: ExampleDocument4 pagesTax Endterm Business Taxes: ExampleCharmaine ChuaNo ratings yet

- VAT IntroductionDocument22 pagesVAT IntroductionMa.annNo ratings yet

- Chapter 9 - Input VAT True or False 1Document7 pagesChapter 9 - Input VAT True or False 1Angelo BagabaldoNo ratings yet

- Answer Key-AccontingDocument15 pagesAnswer Key-AccontingÌÐølJåyskëiUvNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1Hina SanNo ratings yet

- Sol Man 17Document7 pagesSol Man 17samsungacerNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Bsa1202-Fs2122-Incometax-03-Solutionx: Problem 1 - Mr. F. FicienteDocument6 pagesBsa1202-Fs2122-Incometax-03-Solutionx: Problem 1 - Mr. F. FicienteLampel Louise LlandaNo ratings yet

- Chapter 13Document20 pagesChapter 13xinfamousxNo ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- Chapter 14Document16 pagesChapter 14Kristian Romeo NapiñasNo ratings yet

- Local Media603729699590229664Document3 pagesLocal Media603729699590229664Mallari, Princess Diane D.No ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- Chapter 9 - Input VAT True or False 1Document55 pagesChapter 9 - Input VAT True or False 1Angelo Bagabaldo100% (1)

- Gwapa Ko Chapter 3 Tax 1Document10 pagesGwapa Ko Chapter 3 Tax 1adarose romaresNo ratings yet

- INCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Document7 pagesINCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Erlle AvllnsaNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Valencia Chap 5 Estate TaxDocument11 pagesValencia Chap 5 Estate TaxCha DumpyNo ratings yet

- Tax 8 9 12Document5 pagesTax 8 9 12Maix19No ratings yet

- Chapter 10 (Part 1)Document2 pagesChapter 10 (Part 1)Hakdog SadNo ratings yet

- Assignment-2 2Document11 pagesAssignment-2 2CPAREVIEWNo ratings yet

- Chapter 14 Other SolutionDocument18 pagesChapter 14 Other SolutionChristine BaguioNo ratings yet

- Advac Solmal Chapter 13Document16 pagesAdvac Solmal Chapter 13john paul100% (1)

- Advacc 2 Guerrero Chapter 14Document15 pagesAdvacc 2 Guerrero Chapter 14Drew BanlutaNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Chapter 12 - Input Vat2013Document8 pagesChapter 12 - Input Vat2013libraolrack0% (3)

- Exercises in Corporation SolutionsDocument6 pagesExercises in Corporation Solutionsdiane camansagNo ratings yet

- Assignment1 AIS GunioDocument2 pagesAssignment1 AIS Guniopatricia gunioNo ratings yet

- Week 5 Q2Document35 pagesWeek 5 Q2patricia gunioNo ratings yet

- Pre Final Fin 04Document89 pagesPre Final Fin 04patricia gunioNo ratings yet

- DEMETER Online Market Place With Data Analytics For Agricultural Products Using Dynamic Programming Algorithm 1Document169 pagesDEMETER Online Market Place With Data Analytics For Agricultural Products Using Dynamic Programming Algorithm 1patricia gunioNo ratings yet

- Manila LGU Health Facilities Tracking SystemDocument11 pagesManila LGU Health Facilities Tracking Systempatricia gunioNo ratings yet

- Chapter 3Document6 pagesChapter 3patricia gunioNo ratings yet

- Chapter 1Document5 pagesChapter 1patricia gunioNo ratings yet

- RegistrationDocument2 pagesRegistrationpatricia gunioNo ratings yet

- F. FeasibilityDocument2 pagesF. Feasibilitypatricia gunioNo ratings yet

- Group 1 Full Docu. RevisedDocument142 pagesGroup 1 Full Docu. Revisedpatricia gunioNo ratings yet

- B. Test CaseDocument2 pagesB. Test Casepatricia gunioNo ratings yet

- RRL OsorioDocument9 pagesRRL Osoriopatricia gunioNo ratings yet

- RRL Appointment and SchedulerDocument2 pagesRRL Appointment and Schedulerpatricia gunioNo ratings yet

- Title Proposal Group8Document16 pagesTitle Proposal Group8patricia gunioNo ratings yet

- COT Thesis and Capstone Project Procedures and Guidelines 2023Document7 pagesCOT Thesis and Capstone Project Procedures and Guidelines 2023patricia gunioNo ratings yet

- Final Final Final LastDocument35 pagesFinal Final Final Lastpatricia gunioNo ratings yet

- Group 8: Angel Maluyo Iii Juan Carlos Miguel Osorio John Allan TorrenteDocument26 pagesGroup 8: Angel Maluyo Iii Juan Carlos Miguel Osorio John Allan Torrentepatricia gunioNo ratings yet

- Group8 Chapter2Document29 pagesGroup8 Chapter2patricia gunioNo ratings yet

- RRLDocument9 pagesRRLpatricia gunioNo ratings yet

- ACCT045Document4 pagesACCT045patricia gunioNo ratings yet

- Midterm Fin Oo4Document82 pagesMidterm Fin Oo4patricia gunio100% (1)

Illustration of Cascading Effect of Vat

Illustration of Cascading Effect of Vat

Uploaded by

patricia gunioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration of Cascading Effect of Vat

Illustration of Cascading Effect of Vat

Uploaded by

patricia gunioCopyright:

Available Formats

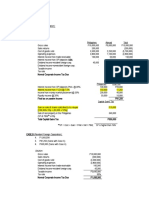

Taxpayer MR.

O

Upon importation

Landed cost of imported article 40,000

Input Value added tax (P40,000 x 12%) 4,800

Upon the sale to Mr. P

Selling price 90,000

Output tax (P90,000 x 12%) 10,800

Less: Input tax (upon improtation) 4,800

Value-added tax payable 6,000

Taxpayer MR. P

Upon the sale to Mr. Q

Selling price 170,000

Output tax (P170,000 x 12%) 20,400

Less: input tax on purchase form Mr. O 10,800

Value added tax payable 9,600

Taxpayer MR. Q

Upon the sale

Selling price 400,000

Output tax (P400,000 x 12%) 48,000

Less: Input taxes-

On purchase from Mr.P 20,400

On purchase from Mr. R 6,000

Total input taxes 26,400

Value added tax payable 21,600

Taxpayer MR. R

Upon the sale to Mr. Q

Value added tax - Output tax (P50,000 x 12%) 6,000

You might also like

- 2.2 Problems - VAT PayableDocument11 pages2.2 Problems - VAT PayableHafi DisoNo ratings yet

- Tax2 - Seatworks-04 06 2020-AnswersDocument7 pagesTax2 - Seatworks-04 06 2020-AnswersAllen Fey De JesusNo ratings yet

- Advac Guerero Chapter 15Document18 pagesAdvac Guerero Chapter 15Drew BanlutaNo ratings yet

- CHAPTER13 Home Office and Branch - Special ProblemsDocument21 pagesCHAPTER13 Home Office and Branch - Special ProblemsAlgifariAdityaNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013Eliza BethNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument7 pagesValue-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersCha DumpyNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument6 pagesValue-Added Tax: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersiajycNo ratings yet

- Tax Lecture VAT Answer KeyDocument2 pagesTax Lecture VAT Answer KeyKathreen Aya ExcondeNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013libraolrack100% (4)

- Assign 3.1Document1 pageAssign 3.1Gie MaeNo ratings yet

- Assign 3.1Document1 pageAssign 3.1Gie MaeNo ratings yet

- Multiple Choices - Computational: Balance of Allowance For Overvaluation Account Before Adjustment P 35,000Document16 pagesMultiple Choices - Computational: Balance of Allowance For Overvaluation Account Before Adjustment P 35,000Love FreddyNo ratings yet

- Chapter 10 - Concepts of Vat 7thDocument11 pagesChapter 10 - Concepts of Vat 7thEl Yang100% (3)

- CHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1Document8 pagesCHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1kathNo ratings yet

- Tax Endterm Business Taxes: ExampleDocument4 pagesTax Endterm Business Taxes: ExampleCharmaine ChuaNo ratings yet

- VAT IntroductionDocument22 pagesVAT IntroductionMa.annNo ratings yet

- Chapter 9 - Input VAT True or False 1Document7 pagesChapter 9 - Input VAT True or False 1Angelo BagabaldoNo ratings yet

- Answer Key-AccontingDocument15 pagesAnswer Key-AccontingÌÐølJåyskëiUvNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1Hina SanNo ratings yet

- Sol Man 17Document7 pagesSol Man 17samsungacerNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Bsa1202-Fs2122-Incometax-03-Solutionx: Problem 1 - Mr. F. FicienteDocument6 pagesBsa1202-Fs2122-Incometax-03-Solutionx: Problem 1 - Mr. F. FicienteLampel Louise LlandaNo ratings yet

- Chapter 13Document20 pagesChapter 13xinfamousxNo ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- Chapter 14Document16 pagesChapter 14Kristian Romeo NapiñasNo ratings yet

- Local Media603729699590229664Document3 pagesLocal Media603729699590229664Mallari, Princess Diane D.No ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- Chapter 9 - Input VAT True or False 1Document55 pagesChapter 9 - Input VAT True or False 1Angelo Bagabaldo100% (1)

- Gwapa Ko Chapter 3 Tax 1Document10 pagesGwapa Ko Chapter 3 Tax 1adarose romaresNo ratings yet

- INCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Document7 pagesINCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Erlle AvllnsaNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Valencia Chap 5 Estate TaxDocument11 pagesValencia Chap 5 Estate TaxCha DumpyNo ratings yet

- Tax 8 9 12Document5 pagesTax 8 9 12Maix19No ratings yet

- Chapter 10 (Part 1)Document2 pagesChapter 10 (Part 1)Hakdog SadNo ratings yet

- Assignment-2 2Document11 pagesAssignment-2 2CPAREVIEWNo ratings yet

- Chapter 14 Other SolutionDocument18 pagesChapter 14 Other SolutionChristine BaguioNo ratings yet

- Advac Solmal Chapter 13Document16 pagesAdvac Solmal Chapter 13john paul100% (1)

- Advacc 2 Guerrero Chapter 14Document15 pagesAdvacc 2 Guerrero Chapter 14Drew BanlutaNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Chapter 12 - Input Vat2013Document8 pagesChapter 12 - Input Vat2013libraolrack0% (3)

- Exercises in Corporation SolutionsDocument6 pagesExercises in Corporation Solutionsdiane camansagNo ratings yet

- Assignment1 AIS GunioDocument2 pagesAssignment1 AIS Guniopatricia gunioNo ratings yet

- Week 5 Q2Document35 pagesWeek 5 Q2patricia gunioNo ratings yet

- Pre Final Fin 04Document89 pagesPre Final Fin 04patricia gunioNo ratings yet

- DEMETER Online Market Place With Data Analytics For Agricultural Products Using Dynamic Programming Algorithm 1Document169 pagesDEMETER Online Market Place With Data Analytics For Agricultural Products Using Dynamic Programming Algorithm 1patricia gunioNo ratings yet

- Manila LGU Health Facilities Tracking SystemDocument11 pagesManila LGU Health Facilities Tracking Systempatricia gunioNo ratings yet

- Chapter 3Document6 pagesChapter 3patricia gunioNo ratings yet

- Chapter 1Document5 pagesChapter 1patricia gunioNo ratings yet

- RegistrationDocument2 pagesRegistrationpatricia gunioNo ratings yet

- F. FeasibilityDocument2 pagesF. Feasibilitypatricia gunioNo ratings yet

- Group 1 Full Docu. RevisedDocument142 pagesGroup 1 Full Docu. Revisedpatricia gunioNo ratings yet

- B. Test CaseDocument2 pagesB. Test Casepatricia gunioNo ratings yet

- RRL OsorioDocument9 pagesRRL Osoriopatricia gunioNo ratings yet

- RRL Appointment and SchedulerDocument2 pagesRRL Appointment and Schedulerpatricia gunioNo ratings yet

- Title Proposal Group8Document16 pagesTitle Proposal Group8patricia gunioNo ratings yet

- COT Thesis and Capstone Project Procedures and Guidelines 2023Document7 pagesCOT Thesis and Capstone Project Procedures and Guidelines 2023patricia gunioNo ratings yet

- Final Final Final LastDocument35 pagesFinal Final Final Lastpatricia gunioNo ratings yet

- Group 8: Angel Maluyo Iii Juan Carlos Miguel Osorio John Allan TorrenteDocument26 pagesGroup 8: Angel Maluyo Iii Juan Carlos Miguel Osorio John Allan Torrentepatricia gunioNo ratings yet

- Group8 Chapter2Document29 pagesGroup8 Chapter2patricia gunioNo ratings yet

- RRLDocument9 pagesRRLpatricia gunioNo ratings yet

- ACCT045Document4 pagesACCT045patricia gunioNo ratings yet

- Midterm Fin Oo4Document82 pagesMidterm Fin Oo4patricia gunio100% (1)