Professional Documents

Culture Documents

Geweke

Geweke

Uploaded by

brighton moyoCopyright:

Available Formats

You might also like

- Autocad Architecture - Floor PlansDocument34 pagesAutocad Architecture - Floor PlansGeorge MargheticiNo ratings yet

- John C. Cox Jonathan E. Ingersoll, Jr. Stephen A. Ross: Econometrica, Vol. 53, No. 2. (Mar., 1985), Pp. 363-384Document27 pagesJohn C. Cox Jonathan E. Ingersoll, Jr. Stephen A. Ross: Econometrica, Vol. 53, No. 2. (Mar., 1985), Pp. 363-384Machine LearningNo ratings yet

- (1983) Engle, R. F. Hendry, D. F. Richard, J .F. - Exogeneity.Document29 pages(1983) Engle, R. F. Hendry, D. F. Richard, J .F. - Exogeneity.Raphael CavalcantiNo ratings yet

- Lucas's Signal-Extraction Model: A Finite State Exposition With Aggregate Real ShocksDocument15 pagesLucas's Signal-Extraction Model: A Finite State Exposition With Aggregate Real ShocksOIBNo ratings yet

- A Simplified Jump Process for Common Stock Returns Author ( s ) Clifford A . Ball and Walter N . Torous Source The Journal of FinancialDocument14 pagesA Simplified Jump Process for Common Stock Returns Author ( s ) Clifford A . Ball and Walter N . Torous Source The Journal of FinancialEakkarat PattrawutthiwongNo ratings yet

- Testing The Intercept Wang PingDocument18 pagesTesting The Intercept Wang PingjozsefNo ratings yet

- Nonlinear Scaling Behavior of Visible Volatility Duration ForDocument18 pagesNonlinear Scaling Behavior of Visible Volatility Duration ForArmando Salas IparrazarNo ratings yet

- Multifractality and Heteroscedastic DynaDocument5 pagesMultifractality and Heteroscedastic DynaHeather Dea JenningsNo ratings yet

- This Content Downloaded From 79.71.10.15 On Sun, 26 Mar 2023 22:10:13 UTCDocument34 pagesThis Content Downloaded From 79.71.10.15 On Sun, 26 Mar 2023 22:10:13 UTCSazid AhmadNo ratings yet

- Holtz-Eakin, Newey and Rosen (1988)Document26 pagesHoltz-Eakin, Newey and Rosen (1988)trofffNo ratings yet

- Stock1993 DOLStemporalDocument39 pagesStock1993 DOLStemporalramiro.cuenta.laboralNo ratings yet

- Monetory Ploicy Stock Return and InflationDocument19 pagesMonetory Ploicy Stock Return and InflationJohnNo ratings yet

- Theoretical Analysis and Simulations of The Generalized Lotka-Volterra ModelDocument18 pagesTheoretical Analysis and Simulations of The Generalized Lotka-Volterra ModelTzeHoung LeeNo ratings yet

- Sources of Exchange-Rate Volatility: Impulses or Propagation?Document14 pagesSources of Exchange-Rate Volatility: Impulses or Propagation?Anonymous xjWuFPN3iNo ratings yet

- American Statistical AssociationDocument14 pagesAmerican Statistical AssociationAgatha SekarNo ratings yet

- Diebold 2015 Paper PDFDocument24 pagesDiebold 2015 Paper PDFswopguruNo ratings yet

- Econometrica: EywordsDocument51 pagesEconometrica: EywordsJun ChenNo ratings yet

- NDE 0310nonlineardynamics PDFDocument31 pagesNDE 0310nonlineardynamics PDFvahidNo ratings yet

- Engle 1982Document22 pagesEngle 1982elvisgonzalesarceNo ratings yet

- J Antti 1994Document9 pagesJ Antti 1994assyifaaNo ratings yet

- BF 02638452Document25 pagesBF 02638452du1125538821No ratings yet

- CTR18 04 C PDFDocument22 pagesCTR18 04 C PDFJoyce MalitNo ratings yet

- Phillips & Perron - Biometrika - 1988 - Unit Root TestDocument13 pagesPhillips & Perron - Biometrika - 1988 - Unit Root TestLAURA VALENTINA RIQUETH PACHECONo ratings yet

- This Content Downloaded From 147.188.128.74 On Mon, 01 Jun 2015 14:21:48 UTC All Use Subject ToDocument20 pagesThis Content Downloaded From 147.188.128.74 On Mon, 01 Jun 2015 14:21:48 UTC All Use Subject ToCarlos Mejía ReyesNo ratings yet

- Error Correction ModelDocument37 pagesError Correction ModelRollins JohnNo ratings yet

- Methods of Stochastic Field Theory in Non-Equilibrium Systems - Spontaneous Symmetry Breaking of ErgodicityDocument42 pagesMethods of Stochastic Field Theory in Non-Equilibrium Systems - Spontaneous Symmetry Breaking of ErgodicityOBXONo ratings yet

- Common Dynamics Between The US and Puerto Rico EconomiesDocument11 pagesCommon Dynamics Between The US and Puerto Rico EconomiesCésar R. SobrinoNo ratings yet

- 1 s2.0 S1051137702903098 MainDocument35 pages1 s2.0 S1051137702903098 Mainkajani nesakumarNo ratings yet

- BoxTiao Canonical Bio 77 PDFDocument11 pagesBoxTiao Canonical Bio 77 PDFgzanotti1No ratings yet

- Gaussian Closure Technique For Bouc's Hysteretic Model Under White Noise ExcitationDocument8 pagesGaussian Closure Technique For Bouc's Hysteretic Model Under White Noise ExcitationManuel VegaNo ratings yet

- Consumption, Income andDocument11 pagesConsumption, Income andmax barrios pradoNo ratings yet

- Economics 2008 28Document21 pagesEconomics 2008 28Ankit PandeyNo ratings yet

- Damage 99Document29 pagesDamage 99ing_costeroNo ratings yet

- Complex Systems From Nuclear Physics To Financial MarketsDocument10 pagesComplex Systems From Nuclear Physics To Financial MarketsArmando Salas IparrazarNo ratings yet

- Explaining Cointegration Analysis Part IIDocument35 pagesExplaining Cointegration Analysis Part IIGerman GaldamezNo ratings yet

- Social Impact Theory Based OptimizerDocument6 pagesSocial Impact Theory Based OptimizerAlyssa LimosneroNo ratings yet

- Stock Watson Ecta 1993Document38 pagesStock Watson Ecta 1993lorenzo costaNo ratings yet

- Itô Type Stochastic Fuzzy Differential Equations With DelayDocument10 pagesItô Type Stochastic Fuzzy Differential Equations With DelayRituparna ChutiaNo ratings yet

- Ochuba Final PDFDocument13 pagesOchuba Final PDFOchubaNo ratings yet

- Scalar Evolution Equations For Shear Waves in Incompressible Solids: A Simple Derivation of The Z, ZK, KZK and KP EquationsDocument12 pagesScalar Evolution Equations For Shear Waves in Incompressible Solids: A Simple Derivation of The Z, ZK, KZK and KP EquationsMazen DiabNo ratings yet

- Lectura 1Document25 pagesLectura 1karen.lasso1405No ratings yet

- FCM The Fuzzy C Means Clustering AlgorithmDocument14 pagesFCM The Fuzzy C Means Clustering AlgorithmSnr Kofi Agyarko AbabioNo ratings yet

- Ohio State University PressDocument6 pagesOhio State University PressLeulNo ratings yet

- Wooldridge InstrumentalVariablesEstimation 2005Document6 pagesWooldridge InstrumentalVariablesEstimation 2005DWI NOVA WIJAYANo ratings yet

- A Multifrequency Theory of The Interest Rate Term Structure: Laurent Calvet, Adlai Fisher, and Liuren WuDocument24 pagesA Multifrequency Theory of The Interest Rate Term Structure: Laurent Calvet, Adlai Fisher, and Liuren WuTom WuNo ratings yet

- McKean Vlasov Stochastic Differential Equation 2023 Journal of MathematicalDocument20 pagesMcKean Vlasov Stochastic Differential Equation 2023 Journal of Mathematicalpepito perezNo ratings yet

- Lecture Note 11 Panel AnalysisDocument11 pagesLecture Note 11 Panel AnalysisKasun PereraNo ratings yet

- Seasonal Integration and Cointegration": of Aarhus, DK-00 Aurhus, DenmurkDocument24 pagesSeasonal Integration and Cointegration": of Aarhus, DK-00 Aurhus, DenmurkAllister HodgeNo ratings yet

- Bivariate Extreme Statistics, Ii: Authors: Miguel de CarvalhoDocument25 pagesBivariate Extreme Statistics, Ii: Authors: Miguel de CarvalhoDamon SNo ratings yet

- Long-Time Dynamics of A Nonlinear Timoshenko Beam With Discrete Delay Term and Nonlinear DampingDocument18 pagesLong-Time Dynamics of A Nonlinear Timoshenko Beam With Discrete Delay Term and Nonlinear DampingRenato Fabrício Costa LobatoNo ratings yet

- Katarina CointegrationDocument34 pagesKatarina CointegrationisaNo ratings yet

- Jun Ma Et Al - The Instability of The Spiral Wave Induced by The Deformation of Elastic Excitable MediaDocument11 pagesJun Ma Et Al - The Instability of The Spiral Wave Induced by The Deformation of Elastic Excitable MediaGretymjNo ratings yet

- Estimation of Nonstationary HeterogeneousDocument12 pagesEstimation of Nonstationary HeterogeneousSeydou OumarouNo ratings yet

- Goodness-Of-Fit Tests For The General Cox Regression ModelDocument18 pagesGoodness-Of-Fit Tests For The General Cox Regression ModelwonduNo ratings yet

- James Tobin: Econometrica, Vol. 26, No. 1. (Jan., 1958), Pp. 24-36Document16 pagesJames Tobin: Econometrica, Vol. 26, No. 1. (Jan., 1958), Pp. 24-36MichelleNo ratings yet

- Cao 2019Document11 pagesCao 2019Graphix GurujiNo ratings yet

- Nickell-Biases DynamicModels-1981Document11 pagesNickell-Biases DynamicModels-1981Tsegachew DeguNo ratings yet

- Period Three Implies ChaosDocument9 pagesPeriod Three Implies ChaosPedro CoelhoNo ratings yet

- Mathematical Aspects of Nonlinear Dispersive Equations (AM-163)From EverandMathematical Aspects of Nonlinear Dispersive Equations (AM-163)No ratings yet

- Multiple Objetc Tracking Method Using Kalman FilterDocument5 pagesMultiple Objetc Tracking Method Using Kalman FiltermaxzoelNo ratings yet

- Annex 3.2 Industrial Processes Sector-Ammonia Production-Kellog Process Detailed Description PDFDocument5 pagesAnnex 3.2 Industrial Processes Sector-Ammonia Production-Kellog Process Detailed Description PDFErol DAĞNo ratings yet

- - Thời gian thi: 60 phút. Trong đó thời gian quy định, sinh viên làm bài và sao chép đáp án vào tờ làm bài. - Nội dung kiểm tra: liên quan đến các nội dung trong 5 bài học đã họcDocument4 pages- Thời gian thi: 60 phút. Trong đó thời gian quy định, sinh viên làm bài và sao chép đáp án vào tờ làm bài. - Nội dung kiểm tra: liên quan đến các nội dung trong 5 bài học đã họcTuyet Nhi100% (1)

- Catalytic Wet Air OxidationDocument10 pagesCatalytic Wet Air OxidationAman PrasadNo ratings yet

- Class Xii-Ip-Practical Questions ProbablesDocument20 pagesClass Xii-Ip-Practical Questions Probablesrohitsrohit100% (1)

- Optimization With Scilab: Michaël BAUDIN & Vincent COUVERTDocument52 pagesOptimization With Scilab: Michaël BAUDIN & Vincent COUVERTLazNgcengulaNo ratings yet

- Prog 3112 First-Quarter-Exam - Attempt-ReviewDocument18 pagesProg 3112 First-Quarter-Exam - Attempt-ReviewBrail anne Grapa100% (1)

- Aashto TP 61 Determining The Percentage of Fracture in Coarse AggregateDocument5 pagesAashto TP 61 Determining The Percentage of Fracture in Coarse AggregateawangNo ratings yet

- Film Formation in Coatings - Properties, Mechanisms, and ApplicationsDocument10 pagesFilm Formation in Coatings - Properties, Mechanisms, and ApplicationsAadhi InnovativesNo ratings yet

- Volume 2 Construction For Bore Well 2 Nos at IIM Indore2Document3 pagesVolume 2 Construction For Bore Well 2 Nos at IIM Indore2Abir SenguptaNo ratings yet

- Antenna I: Chapter 4: Linear Wire AntennasDocument25 pagesAntenna I: Chapter 4: Linear Wire AntennasMahdi ZafarmandNo ratings yet

- Finite Element Analysis in DesignDocument3 pagesFinite Element Analysis in DesignShivangAggarwalNo ratings yet

- Heat Transfer, Incopera 977 988Document12 pagesHeat Transfer, Incopera 977 988Rayhan HakimNo ratings yet

- Maptek Vulcan 10.1 Whats NewDocument4 pagesMaptek Vulcan 10.1 Whats NewMr AyNo ratings yet

- Percentile: ClassesDocument18 pagesPercentile: ClassesVIBHANSHU SINGHNo ratings yet

- CH 10 SupplementaryDocument9 pagesCH 10 SupplementaryAdila ZambakovićNo ratings yet

- Design, Implementation and Verification of 32-Bit ALU With VIODocument6 pagesDesign, Implementation and Verification of 32-Bit ALU With VIONubia DiazNo ratings yet

- No. 10 No. 10 Chain Anchoring, Mooring and Towing Equipment: (Cont)Document24 pagesNo. 10 No. 10 Chain Anchoring, Mooring and Towing Equipment: (Cont)Bouzid OussamaNo ratings yet

- Basic Principles in Formworks Design-ACELDocument44 pagesBasic Principles in Formworks Design-ACELronelyn bernalNo ratings yet

- Why The History of MathematicsDocument2 pagesWhy The History of MathematicsMark Cliffton BadlonNo ratings yet

- Kinetics of MethaneDocument7 pagesKinetics of MethaneLEIDY JOHANA PALACIOS SOLERNo ratings yet

- Ethylene Glycol&EO UllmannDocument41 pagesEthylene Glycol&EO UllmannCristina NegreaNo ratings yet

- Irrationality of Values of The Riemann Zeta FunctionDocument54 pagesIrrationality of Values of The Riemann Zeta Functionari wiliamNo ratings yet

- Kruss - Polarrimeter - BrochureDocument16 pagesKruss - Polarrimeter - BrochureMohammad Abu NuwarNo ratings yet

- Intro To Data Science SummaryDocument17 pagesIntro To Data Science SummaryHussein ElGhoulNo ratings yet

- Concrete Masonry Cantilever Retaining WallsDocument4 pagesConcrete Masonry Cantilever Retaining Wallsing_fernandogalvez2015No ratings yet

- CHEG411 Chemical Reaction Engineeirng. F PDFDocument206 pagesCHEG411 Chemical Reaction Engineeirng. F PDFSarang GohNo ratings yet

- Abaqus Tunnel LiningDocument7 pagesAbaqus Tunnel LiningAhsan SattarNo ratings yet

- Vani's Blog 1Document21 pagesVani's Blog 1priyaNo ratings yet

Geweke

Geweke

Uploaded by

brighton moyoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Geweke

Geweke

Uploaded by

brighton moyoCopyright:

Available Formats

The Superneutrality of Money in the United States: An Interpretation of the Evidence

Author(s): John Geweke

Source: Econometrica, Vol. 54, No. 1 (Jan., 1986), pp. 1-21

Published by: The Econometric Society

Stable URL: http://www.jstor.org/stable/1914154 .

Accessed: 21/06/2013 03:44

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

The Econometric Society is collaborating with JSTOR to digitize, preserve and extend access to Econometrica.

http://www.jstor.org

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

ECONOMETRICA

VOLUME 54 January, 1986 NUMBER 1

THE SUPERNEUTRALITY OF MONEY IN THE UNITED STATES:

AN INTERPRETATION OF THE EVIDENCE'

BY JOHN GEWEKE

Structural and stochastic neutrality have refutable implications for aggregate economic

time series only in conjunction with other maintained hypotheses. Simple and commonly

employed maintained hypotheses lead to restrictions on measures of feedback and their

decomposition by frequency. These restrictions also suggest an empirical interpretation of

the notional long and short runs. It is found that a century of annual U.S. data, and postwar

monthly data, consistently support structural superneutrality of money with respect to

output and the real rate of return and consistently reject its superneutrality with respect

to velocity. A quantitative characterization of the long run is suggested.

1. INTRODUCTION

IN STATIC MODELS neutrality is defined as the condition that alternative values

for a first set of exogenous variables x be consistent with unchanged values for

a second set of endogenous variables y [3, p. 369; 16, pp. 42-43]. There is no

single, obvious extension of this idea to stochastic dynamic models of economic

time series. One applied widely in recent years is stochastic neutrality [16, pp.

357-359], in which a set of variables y, depends on a set of variables x, only

through current and lagged values of the innovations (?,-S - Et -(xtOc ) j > s ? 0)

in xt. An alternative extension is implicit in the routine simulation of conventional

econometric models and in the definition of the total multiplier [10]. Suppose

the structural equations of the model are

H*(L) G*(L) yt Pt

var =T*

C*1 T*

where B*(L), E*(L), etc., are polynomials in the lag operator L normalized by

E*(O) = I and G*(O) = I; and E* is serially uncorrelated. The equations in each

block are expressed in reduced form, but each block remains structural with

respect to interventions in the other block. The first block of equations determines

x, given current and past yt and disturbances u,, and the second block determines

y, given current and past xt and disturbances vt. This is equivalent to the

'This work had the benefit of helpful discussions with Mark Gertler, Bennet McCallum, Kenneth

Singleton, and George Tauchen, who bear no responsibility for the confusion that may remain.

Detailed comments from Mary McGarvey and two anonymous referees have substantively improved

the paper. Financial support was provided by NSF Grant SES8005603 and the Sloan Foundation.

Luke Froeb, Suk Kang, Bernd Luedecke, and Mike Zwecker provided research assistance at various

points.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

2 JOHN GEWEKE

assumption that B*(L)-', E*(L)-', and G*(L)-l exist and have convergent

expansions in nonnegative powers of L We shall say that the variables x, are

structurally neutral with respect to y, if H*(1) = 0, that is, the total multiplier in

x, with respect to yt is zero.

Structural and stochastic neutrality share two important characteristics. Neither

is refutable by itself: (1.1) requires identifying restrictions, and Sargent [15] first

pointed out the observational equivalence of stochastic neutrality and non-

neutrality. Both extend the notion of neutrality in static models. If xt is stochasti-

cally neutral with respect to yt and the mean of xt is changed (but not because

of a change in the mean of yt and feedback to xt) then the mean of Yt must

remain unchanged, since E[x,_s - Et_(xts)] =0. If the mean of ut is changed

in (1.1) and the second block of equations is structural with respect to this kind

of intervention, then E(yt) remains the same. On the other hand the two concepts

clearly are quite different, as McCallum [13] has emphasized at some length.

This paper has two empirical objectives. The first is to test the superneutrality

of money [21, pp. 206-207]-the proposition that the growth rate in money is

structurally neutral with respect to real macroeconomic variables-under broad

maintained hypotheses. The intention is to embed the proposition of structural

superneutrality in a maintained model in which we have the greatest prior

confidence. We are attempting, insofar as possible, to set up a situation in which

formal rejection of the null hypothesis is most plausibly interpreted as rejection

of superneutrality and not rejection of ancillary maintained hypotheses. The

paper's second empirical objective is to provide an empirical counterpart for the

elusive "long run" of economic theory that is consistent with the data. In meeting

these objectives two new methodological devices are employed. First, we show

how measures of feedback between time series and the decomposition by

frequency developed in [7] are related to structural neutrality and to the somewhat

elusive notions of "long run" and "short run." The relationship between structural

neutrality and feedback at frequency zero is explored in the next section. In

Section 3 it is shown that the measure of feedback at a given frequency summarizes

the outcome of a hypothetical experiment undertaken with a replication of

economies to determine the extent to which short or long run fluctuations in one

group of variables are reflected in another. The second methodological innovation

in the paper is the use of a variant of Efron's [4, Section 5.2] parametric bootstrap

in an effort to increase the reliability of inference from vector autoregressions.

This leads to new estimation techniques, discussed in Section 4.

The empirical portion of the paper reports tests of the structural neutrality of

the growth rate in money with respect to the growth rate of output, the growth

rate of real balances, and the real interest rate. The work is undertaken with the

annual series of Friedman and Schwartz for three long subintervals of the

1870-1970 period, and with monthly postwar series, for the United States. The

results provide strong support for the structural superneutrality of money with

respect to output measures and real interest rates in all periods of U.S. economic

history. There is substantial evidence against the structural superneutrality of

money with respect to velocity.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 3

2. MEASLJRES OF FEEDBACK AND STRUCTURAL NEUTRALITY

With further identifying restrictions (1.1) determines the autoregressive rep-

resentation for z, which can be normalized in various ways. The standard

normalization is

E

(2.1) B(L)z, (L) F(L) |-, = |t Et

H (L) G (L) Yt Pt

var -= Y,

Pt, C' T

with B(O)= L This representation provides the linear projection of zt on its own

past. We shall assume, in all of what follows, that {z,} satisfies the regularity

conditions set forth in detail in Section 2 of [7]: the process is wide sense stationary,

has a moving average representation with square summable coefficients, and has

a spectral density matrix whose eigenvalues are uniformly bounded above and

below almost everywhere. The further assumption that the autocovariance func-

tion of {z,} is absolutely summable will guarantee that a continuous spectral

density for {z,} exists [2, p. 476]; this is required to interpret population charac-

teristics of {z,}, like spectral density and feedback, and their estimates, at

individual frequencies.

One of two possible normalizations recursive in x, and y, is

(2.2) B+(L)z,= ++(L) F+(L) |t = | +

H4(L) G L)yr Pt

yr- + 0

var + =Y

pt 0 T

E+(O) = I, G+(O)= I, H+(O) = 0. This representation provides the linear projec-

tion of x, on its own past and current and past y,, and the linear projection of

y, on current and past x, and y,. The restrictions on (1.1) need not necessarily

satisfy either normalization, but all three are observationally equivalent.

Consider also standard vector autoregressive reprsentations for {x,} and {y,}

alone,

(2.3) C(L)x,=2 4, var(u,)= x, C(O)=Ik;

(2.4) D(L)y, = vP, var (v,) =T , D(O) =

x

The measure of linear feedback from Y to X is Fy x-ln (Il I/ l x 1) and that

from X to Y is Fx ln (IT"Il/lTj). These measures are nonnegative, and one

or the other being zero is equivalent to the existence of a Granger [11] or Sims

[17] unidirectional causal ordering. When Y is univariate, the fraction of the

variance in v-' which is expained by past X is pxy- exp (-Fx,). The

measure of instantaneous linear feedback is F. y = ln (ITj 121/1YI). The condi-

tions Fx. y = 0, C = 0, F+(O) = 0, and absence of instantaneous causality between

X and Y (in Granger's sense) are equivalent. When Y is univariate, the fraction

of variance in v, explained by current and past X (equivalently, the squared

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

4 JOHN GEWEKE

partial multiple correlation coefficient between y, and x, conditional on the entire

past of X and Y) is Px y 1 - exp (- Fx. y). The measure of linear dependence

between X and Y is Fx y ln (Ix x * Tyt/IYI), which is zero if and only if the

time series X and Y are uncorrelated at all leads and lags. Analogous to the

case for linear feedback, and with an interpretation given in [7], we may further

define Px y = 1 - exp (- Fx y). All three definitions are motivated by consideration

of the limiting values of likelihood ratio statistics for unidirectional causal

orderings, absence of instantaneous causality, and absence of correlation at all

leads and lags, respectively, when {Zt} is Gaussian. From these definitions,

(2.5) FX,Y = Fy,x + Fx, y + FXY

The measures of directional feedback Fyx and Fx, y may be decomposed

by frequency. We shall illustrate the decomposition for Fx, y, which begins with

the normalization (2.2). Observe that in this normalization all contemporaneous

effects are accounted for through F+(O) in the X equations, with H+(O)=

cov (v, u+) =0. The moving average representation corresponding to (2.2) is

-

(2.6) | B+(L) = R+(L) S+(L) |tv

Yt=Z

yr~~~~~~~~~~~~~~

Since cov(y+, vt) = 0,

(2.7) Sy(A) = R+(A) S+R+(A)'+ S+(A) T+S+(AY;

here Sy(A) denotes the spectral density matrix of {yt}, R+(A) the Fourier transform

of R+(L), and S+(A) the Fourier transform of S+(L), all at the frequency

A E [-I, ir]. The measure of feedback from X to Y at frequency A is f,,(A) =

In [ISy(Ak)I/IS+(A)T+S+(Ak)'I].This definition is motivated by consideration of the

limiting value of the likelihood ratio statistic for the hypothesis that variation in

{y,} at frequency A is attributable entirely to v+. It may be shown [7] that so

long as S+(L) (equivalently, E+(L)) is invertible,

(2.8) Fx, y =- f,Y(A ) dA.

2,7r _i

The decomposition of Fy,x proceeds in the same way, but begins with the

recursive normalization from X to Y instead of (2.2).

THEOREM 1: If (2.2) is structural, then X is structurallyneutral with respect to

Y if and only iffx,Y(O) = 0.

(Proofs are in an Appendix.)

The conditions H*(0) = 0, C*(0) = 0 are examples of restrictions without which

structural neutrality is untestable: in fact, the restrictions H*(1) = 0, C* = 0, are

just identifying in (1.1) [8, Theorem 1]. Since the choice of such restrictions can

be critical to the outcome of the test it seems desirable to keep them as simple

as possible. The restriction C* = 0 is assumed, impicitly or explicitly, whenever

the response of the variables in a model to a shock in a disturbance is traced.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 5

This sort of experiment is common with structural models [10] and in the

interpretation of vector autoregressions [18]. Recursivity is the normalization

that makes the model appropriate for this class of conceptual experiments. A

choice like H*(O)=O requires somewhat more care, and may be less tenable.

With this motivation, consider requiring only that the structural model be recursive

without specifying the order.

DEFINITION: Suppose there exists a permutation of the rows and columns of

B*(O) which produces a lower triangular matrix. Suppose also that T* is diagonal.

Then B*( L)Z, = 4, var (4) Y is a fully recursive structural model.

In a fully recursive model all contemporaneous relations between X and Y

(conditional on past history) are attributed to coefficients of the structural

equations. The issue of attributing instantaneous feedback to a directional effect

is resolved a priori and it is natural to define F* =ln (ITyl/lT*), F* =

structural model F* y + F* =

THEOREM 2: In any fully recursive

Fx, YFy-x SF*-x Fy-x+Fx S

y,and yx >F*,y-, V Fxy+ Fx.

In a fully recursive structural model, dependence between X and Y(Fx,y) is

fully allocated to directional feedback (F*,y and F*,x). The measure of

instantaneous feedback Fx. - indicates the range of variation of F*x y and F* x

that is possible over the class of all fully recursive structural models. It is evident

that measures of feedback by frequencyf (A) and f (A) may be constructed,

and that

T

r

F* -=2 ff *(A) dA

27r _-,f-Y

so long as E*(L) is invertible. Theorem 2 cannot be extended directly to the

decomposition of feedback by frequency, but the following result is useful in

conjunction with Theorem 1.

THEOREM 3: Suppose that f* (A) = 0 for some fully recursive structural model.

Then f -V(A)--< FX-

Y-

This result is useful becausetyv (0) > Fx. y implies that there is no fully recursive

structural model characterized by structural neutrality of X with respect to Y.

Theorem 3 is thus an intermediate result between the fact that structural neutrality

per se is irrefutable from a single time series realization, and Theorem 1, which

shows the equivalence of structural neutrality and the absence of feedback at

A =0 in the specific case of (2.2). Results similar in spirit exist for stochastic

neutrality. By itself, stochastic neutrality has no implications for a single time

series realization [15], but as sometimes implemented in empirical applications,

it implies unidirectional Granger causality [14] and hence restricts measures of

feedback to zero.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

6 JOHN GEWEKE

In summary, structural and stochastic neutrality have no refutable implications

ipsofacto. Only in conjunction with other assumptions-for example, recursivity

in the case of structural neutrality and constraints on lags in the case of stochastic

neutrality-do testable restrictionis emerge. These have been cast in terms of

measures of feedback, but they could also have been stated more conventionally

as restrictions on linear combinations of coefficients. Working with measures of

feedback has two advantages. The first is that it provides an escape from the

artifice of testing point null hypotheses. Since there is a one-to-one correspondence

between a measure of feedback and proportion of variance explained (which

obviously is restricted to lie between 0 and 1), there is a natural metric available

to judge the extent of departure from the null hypothesis. It becomes possible

to assess both the informativeness of the data and the likely departure from the

null hypothesis separately, which is not possible from a single test statistic and

very difficult at best from the coefficients of models or vector autoregressive

representations themselves. The second advantage of measures of feedback is

that they are closely related to the outcomes of hypothetical experiments of the

type discussed in the second section of this paper. We turn now to the development

of this relationship.

3. FEEDBACK AND THE LONG AND SHORT RUN

Comparative statics models are not intended to convey any but the most long

run properties, and sharp distinctions between long run and short run are not

natural to continuous-equilibrium dynamic models. However, there is a well-

defirned sense in which measures of feedback by frequency are amenable to

interpretation in terms of long run and short run properties of a model. Here we

shall describe a set of hypothetical experiments that might be undertaken with

a set of economies or models, that would reveal the same information that is

inherent in measures of feedback decomposed by frequency. The experiments,

in turn, plausibly correspond to what is commonly meant by the short run

properties of models or characteristics of economic behavior. These experiments

involve deterministic and artificial manipulations of the innovations in X and

Y, chosen not for their realism but for the fact that they elucidate important

properties of the model. They are artificial and useful as are the reactions of key

endogenous variables to transitory or permanent changes in exogenous variables

[10] or the response of variables in vector autoregressions to one-time-only shocks

to innovations [18]. In none of these cases is there any pretension that the result

of the experiment has anything to do with the way the world would behave if

the zero-probability event of an innovation following a cosine wave, or exogenous

variable exhibiting a purely transitory change, or an innovation changing once

in its entire realization were actually to occur. Rather, they provide useful means

of interpreting involved dynamics; the experiments here reveal the same properties

in a different way than the earlier approaches exemplified by [10 and 18]. We

consider only univariate X and Y to simplify the exposition; the multivariate

case is similar [8, Section 5].

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 7

Let x be a univariate, strictly indeterministic wide sense stationary process

with moving average representation x, = YS=oaE,-s, var (e,) = o-22 Let i index

replications of an experiment (later, to be interpreted as independent samplings

from a model or a population of economies) in which the values of ?, may be

fixed, or generated randomly according to some design. Suppose Ei,=

41i cos (At) + 2i sin (At), with VIi and 42i jointly zero-mean Gaussian. For

var (Ei,It)= a2, it is necessary and sufficient that var (,i)=var (,2i) =

CO (i,

C2,92i) = 0. Equivalently, we have Ei, pip cos (4i + At) where (using the

_

Box and Muller transform [1]) p2 = + 2 o-2X2(2) and (/i= tan-' (l2j/4li) iS

uniformly distributed on (-ir, ir]. Since

00 OC

xit = Ii I aj cos[A(t-j)]+L2 I aj sin [A(t-j)]

j=O j=O

= [4l1 cos (At) + 2 sin (At)] E aj cos (Aj)

j=O

+ [gIi sin (At) -2i COS (At)] I a, sin (Aj),

j=O

var (xi,) = o2{ [ a3 cos (Aj)] + [ aj sin (Aj)]j = S.(A).

The spectral density can thus be recovered from observations made at a single

point in time in an appropriately designed experiment.

This approach may be taken to recovering the measure of feedback fll,(A)

from replications of a structural model (1.1) with C* 0 in the bivariate case

(k = I = 1). Let

u it = vi cos (At) + 42 sin (At), vt = i1i cos (At) + 772i sin (At).

If conditional on t u(i) and v?l) are jointly Gaussian with zero means, var (u(if)

or, var (v(,`) = r*; cov (u(1) v(f)) = 0, then the random variables g1i, L2i, -qI, and

T2i must be zero-mean Gaussian, var (nji) o=*, var( ,ji) r*, cov (ii, ni) = 0,

and all other covariances zero. Letting

P*(L) Q*(L)

B*(L)-1_

R*(L) S*(L)

we have

OC) 0O

Yjf=ZL R*u(l) + I S.*v'1).

j=O~~~~O

= [;i cos (At) + 2 sin (At))] Z R3*cos (Aj)

j=o

+[4I sin (At)-42 COS (At)] i R* sin (Aj)

j=o

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

8 JOHN GEWEKE

+ [71licos (At) + q2i sin (At)] ESj* cos (Aj)

j=o

+[Ili sin (At)- 2i COS(At)] IS* cos (Aj)

j=O

00 00

- Z R* cos

j=O

(Aj)u P+ E R* sin (Aj)u(2

j=O

+ E S* cos (Aj)vM + Y

=

Sj*sin (Aj)v t,

j=O

where we have implicitly defined u(2) and v(2). Note that u, = (U(), u(2) and

v't = (vt ), vit ) are orthogonal transformations of (4Ii, ;2i) and (qii, q2i), respec-

tively, with cov (u(f) V(M,) = 0. In this setup, the attribution of var (yit) = SY(A)

to ui, and vi, is a conventional analysis of variance problem. Given a sample

(u,, yi,, i = 1, .. ., n) a test of the hypothesis that y,i is unrelated to ui, might

proceed from ordinary least squares estimates of the regression equation

yit = 'ui, + wi, and the formation of the likelihood ratio test statistic

Ln = ln (n = Yi,/n i= 12 ). Then plim n1lLn = In (var (yi,)/var (wi,)) = ln (SY(Ak)/

IS(A)I%=*)f=fX,(A).The measure of feedback at the frequency A thus arises

naturally in the analysis of variance from the indicated experiment.

4. INFERENCE

Inference about measures of feedback is complicated by the usual parameteriz-

ation problems for time series. There is no obvious parametric form for the lag

operators in our autoregressions. Within any given parametric form-e.g., a lag

polynomial of finite order in either the moving average or the autoregression-the

number of parameters actually estimated is a difficult choice [9]. A further

difficulty in the case of measures of feedback is that asymptotic theory beyond

that reported in [7, Section 4] seems to lead to intractable computations. Given

the nonlinearity of expressions like fx, y(A) in the parameters of (2.2) or (2.6)

and the length of time series records typically available, one might well hesitate

to rely on asymptotic theory in any event.

The parameterization chosen for the work reported here is a vector

autoregression of order p. The choice of an autoregression leads to efficient

computational procedures, and can be justified on the grounds that if the

coefficients are square summable then Z, may be approximated arbitrarily well

in mean square by an autoregression of suitably large, but finite order. While

various criteria for the choice of p have been proposed (see the review in [9])

none of these are designed for subsequent inference in the case in which the

order of the autoregression is not really finite. A lag length of three years is used

for most of the empirical work; the robustness of key findings with respect to

this choice is documented in [8].

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 9

In the estimation of the vector autoregression of order p presumed deterministic

components (e.g., nonzero means or deterministic trends) are removed by ordinary

least squares (OLS) regression. Given a sample of size T, the estimate 1j=

T-1 Zj+I x,x' of Fj = Ex,x, j is computed, for j =0, .. , p. The algorithm of

Whittle [22] is then used to solve the Yule-Walker equations, providing estimates

B(L) of B(L) and Y of Y. This computational procedure has four attractions.

First, the estimator is asymptotically equivalent to the OLS estimator in the sense

that the limit of the difference of the estimators scaled by T' 2 is zero. Second,

B(L) is an invertible lag oerator [22] whereas the OLS estimate of B(L) can well

be noninvertible even when B(L) is invertible. This is an attractive property,

since measures like fx, (A) are constructed by inverting B(L). Third, computa-

tion time is proportional to p2 n3 (compared with p3n3 for OLS) and storage is

proportional to pn2 (compared with p2n2). Finally, Whittle's algorithm provides

recursive estimates of vector autoregressions of order 1, 2,. . . , p and the corre-

sponding variance matrices of the residuals; more on this below. The single

disadvantage of the algorithm is that it provides no analogue of the moment

matrix from which the variance of OLS estimates is approximated, but that is

irrelevant for the approach to inference taken here.

Point estimates of the measures of feedack are formed by replacinf B(L) with

B(L) and Y with Y in the equations of Section 2. The estimates X, T, and C are

formed by partitioning Y; the estimated parameters of (2.2) are the obvious

transformation of B(L) using these estimates; the Fourier transform of the

estimated lag operators in (2.2) is inverted to provide estimates of R+(A) and

S+(A) in (2.6). The estimates of 1Yjl and ITyl are those implied by B(L) and Y,

rather than those which would be obtained from direct estimation of (2.3) and

(2.4). An algorithm for the efficient computation of I2JXIand ITyl is described in

[8, Appendix B].

There is no tractable, reliable asymptotic distribution theory available to

approximate the variances or distributions of estimators like Fx-y of Fxy and

.A

f,c y(A) of xy(A). In addition, there is obviously finite sample bias since, for

example, FV > ? 0 and fx ,y(A) ? 0 by construction: it is natural to suspect that

such upward biases become substantial as (in this example) kp becomes a

nonnegligible fraction of T. One might try to adduce evidence on this point as

follows. Suppose that -, in (2.1) is normally distributed and the autoregression

is in fact of order p. Generate R replications of sample size T directly from the

synthetic population

B( L) t.= ft, ft - N(10, Y)

for t = p + 1, . . ., T; for t : p, use the shorter autoregressions provided by Whittle's

algorithm.

Obtain the R-fold replication of estimates of the measures of interest from the

synthetic sample, e.g. Fx y i 1,...,R. Let F(J2_ R_-Y R=z FX y, and define

bR- FX /FxR >. It the percentage bias in Fx y is the same for all B(L) and

P, then F\- y -b: R )F_ +,=(b( R)2pX ) w converges to an unbiased estimator of

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

10 JOHN GEWEKE

Fx- almost surely in R. Let l=[aR/2],u= R-[aR/2], and Fxy denote a

typical order statistic. Mlaintainingthe assumption of constant percentage bias,

a 100(1 -Ca) per cent confidence interval is (b2F(x, -, b2FYx,y). All confidence

intervals reported subsequently were formed in this way.

The bias correction and confidence interval are much like those made in the

bootstrap as discussed in [4]. There are three differences. First, we assumed a

distributional form for E, and in this respect the nrocedure is like the parametric

bootstrap [4, Section 5.2]. This was done only for computational convenience.

The empirical distribution function of B(L)zg, or other parametric forms, could

have been used. Second, the procedure applied here implicitly takes the bias

function to be linear homogeneous in the parameter of interest, whereas the

bootstrap usually takes it to be constant. Neither assumption is likely to be true

globally, and both will be true locally if the true bias function is smooth. Both

procedures are asymptotically defensible in the latter case. The present procedure

is relatively attractive because Fx,y is arithmetically nonnegative. Finally, in

lieu of the random sampling assumption which is fundamental to the boot-

strap procedure we have assumed the Et are i.i.d. The procedure used here is

thus best motivated if {Zt} is known to be an autoregressive, linear process of

order p; robustness with respect to this assumption remains an outstanding

problem.

5. EMPIRICAL RESULTS WITH ANNUAL DATA

The first data set employed in the empirical investigations is taken from a

larger set compiled and documiented by Friedman and Schwartz [6] in their work

with U.S. and U.K. money, income, prices, and interest rates. Table I details the

construction of the four basic series employed here-the growth rate of money

balances, m; the growth rate of output, y, the growth rate of real balances, m -p;

and the real interest rate, r-from their data.

The link between any data set and the theoretical constructs of a macroeconomic

model is never strong; there are two preeminent difficulties with this data set.

The first is that the real interest rate series r is not properly aligned, either

internally or with the other series. The series i(t - 1) is the average of monthly

quotations on 4-6-month commercial paper issued in the year t - 1, and therefore

represents a yield to maturity over a holding period centered on July to October

or December of that year. The rate of price inflation log [P( t)/ P( t - 1)] is centered

on the period July of t - 1 to June of t, however. For the late nineteenth and

early twentieth centuries, the basic series required to construct annual holding

period yields appear not to exist. This problem is circumvented in our twentieth

century monthly data set introduced in the next section.

The second and greater difficulty is that m may be a poor proxy for the growth

rate of money balances employed in mracroeconomicmodels. The problem arises

at two levels. There is the problem of definition and measurement elicountered

with any stock, owing to the fact that market data cannot be employed as it is

with flows and prices. More fundamentally, money in macroeconomic models is

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 11

a distinctive commodity, whereas monetary data must be an aggregation of a

continuum of assets. This induces an unavoidable measurement error in any

monetary series, whose statistical properties are difficult to characterize. Measure-

ment error in one series which is uncorrelated with all other series in the vector

lowers measures of overall feedback, and if feedback at a particular frequency

is zero with the true series, then it will also be zero with the contaminated series.

Hence there is at least one condition under which dynamic neutrality of "true"

m with respect to y and/or r would be reflected also in the relationship between

measured m and y and/or r. The same cannot be said of any vector which

includes m and m-p. Furthermore, systematic departures of measured from

conceptual m with long periodicities seem inherently plausible. The measurement

problem therefore potentially masks structural neutrality of m with respect to

vectors including m - p.

Prior to estimation, tests for regime change for each group of variables con-

sidered were conducted as follows. Point estimates for a vector autoregression

with three lags were obtained as described in Section 4 for each of two chronologi-

cally adjacent periods, leading to estimated innovation variance matrices Y1 and

Y2 computed using T1and T2observations, respectively. The vector autoregression

was also estimated using the T = T1+ T2observations from both periods together,

producing the estimated innovation variance matrix Y. The test statistic T ln YI-

T1In i Yll - T2In i Y21for structural stability over the two regimes was computed

and is reported in Table II. When one regime, say the second, was too short the

statistic T In (IYl/l Y,f) was computed instead. Assuming a linear autoregressive

process of order three, the asymptotic distribution of the first statistic as T, and

T2 increase is X2(17); based on analogy with the fixed regressor model with

normal disturbances, the second statistic might be presumed approximately x2( )

with the degrees of freedom indicated in Table II. (Since the estimates are not

exact maximum likelihood, the test statistics are not identically nonnegative.)

The asymptotic marginal significance levels (in the "(a)" columns) reported are

based on the x2 approximation. Since the asymptotic theory is at best circumspect

in this application, the calculation of each test statistic was supplemented with

a small sampling study. Using the estimated parameters of the vector

autoregression for the entire period 200 replications of data were generated with

normally distributed innovations. The test statistic was then calculated, and the

fraction of replications in which it exceeded the value in the sample is reported

as "sampled marginal significance" in the "(b)" columns of Table II. The

difference in asymptotic and sampled marginal significance levels is not dramatic,

but quite systematic for the bivariate autoregressions: the asymptotic always

exceeds the sampled marginal significance level when the level exceeds .100,

whereas below .100, the relationship is generally reversed.

Based largely on the earlier work of Friedman and Schwartz [5], the eleven

regimes in Table I were selected, and it was presumed that there were no shifts

within these regimes. The World War II regime was excluded from consideration

a priori. Of the remaining 10 regimes, those adjacent in time were tested for

stability as just described, for each of the three bivariate vector autoregressions of

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

12 JOHN GEWEKE

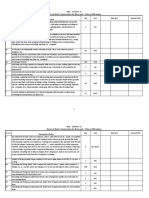

TABLE I

ANNUAL DATA

Basic series (Column numbers of [5, Table 4.8] shown):

M2(t) Money stock M2 (1)

NNP(t) National income (2)

P(t) NNP price deflator (4)

i(t) Commercial paper rate (6)

Pop(t) Population (5)

Definitions:

RNNP( t) = NNP( t)/P( t)

RM2(t) = M2(t)/P(t)

m(t) = log [M2(t)/Pop(t)] -log [AM2(t- 1)/Pop(t -1)]

y( t) = log [ RNNPt t)/ Pop t)]-log [ RNNP( t-l )/ Pop( t-1 )]

m(t)-p(t) = log [RM2(t)/Pop(t)]-log [RM2(t-l)/Pop(t-1)]

r(t) = i(t -1) -log [ P(t)/ P(t -1)]

v ( t) = y (t) - Im (t) - p (t)]

Regimes:

1870-1878 Greenback 1934-1941 Bank reform

1879-1896 Gold Standard resumption 1942-1947 World War II

1897-1906 Gold inflation 1948-1953 Pre accords

1907-1913 Bank reform 1954-1965 Post accords

1914-1921 Early Fed to post WWI 1966-1970 Monetary/fiscal breakdown

1922-1929 Federal Reserve activism 1971-1978 Post controls

1929-1933 Great contraction

interest. There were three regime combinations for which stability was not rejected

at the 25 per cent level of significance for at least two of the three vectors: 1870-96,

1907-21, and 1954-70 (see the upper half of table II). Attempts to incorporate

regimes adjacent in time with these three periods showed strong evidence of

instability at the break points initially identified (lower half of Table II). For the

1870-96 and 1954-70 periods, stability tests can be conducted with three variables;

outcomes were favorable for the latter period, less so for the former.

A concise summary of the results obtained with annual data is given in Table

III. Here, as elsewhere in the tables, the X vector consists of the variable m and

the Y vector is indicated. This table provides point estimates, adjusted point

estimates, and confidence intervals for fx, y(A) at A = 0, the infinite periodicity,

and averaged over low frequencies ranging from A = 0 to A = ir/6, corresponding

to periodicities of at least 12 years. The adjusted point estimate Fx, y indicates

the average value of fx , y(A) across all frequencies, so comparison of reported

feedback at low frequencies with this estimate provides a rough contrast of long

with shorter run properties. The potential for a change in measures of feedback

at low frequepnciesunder alternative recursive normalizations of the vector is

indicated by Fx. y, as discussed in Section 2: when Fx. y = 0, the reported feedback

measures would be characteristic of any recursive normalization, but when Fx. y

is large, they could be quite different. The estimates reported here are robust

with respect to changes in lag length [8, Appendices C and D].

The results for m, y, and r (in the first, third, and fifth panels of Table III)

provide very strong support for the structural neutrality of money in a system of

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 13

TABLE II

TESTS FOR REGIME CHANGE

m and y m and m-p m and r

Test Marg. Sig. Test Marg. Sig. Test Marg. Sig.

Period Split DF Stat. (a) (b) Stat. Asy. Samp. Stat. (a) (b)

1870-96 78/79 17 12.76 .752 .495 10.15 .897 .725 35.45 .000 .000

1879-06 96/97 17 14.51 .631 .505 32.73 .012 .020 28.51 .039 .040

1897-13 06/07 14 11.01 .685 .450 29.14 .010 .045 22.34 .071 .070

1907-21 13/14 14 8.90 .837 .575 13.73 .470 .415 11.09 .678 .465

1914-29 21/22 17 43.20 .000 .005 36.24 .004 .010 33.27 .010 .030

1922-33 29/30 8 42.68 .000 .005 42.83 .000 .005 43.68 .000 .000

1930-41 33/34 8 -3.25 - .785 42.74 .000 .000 45.76 .000 .000

1948-65 53/54 12 25.94 .011 .065 31.29 .002 .010 28.21 .005 .030

1954-70 65/66 10 4.07 .944 .365 7.76 .652 .355 -3.10 - .760

1966-78 70/71 10 26.96 .003 .100 37.03 .000 .015 19.71 .032 .145

1870-06 78/79 17 14.76 .613 .330 12.78 .751 .585 28.91 .035 .005

1870-06 96/97 17 16.50 .488 .315 35.37 .006 .005 35.89 .005 .005

1879-13 96/97 17 11.53 .828 .560 34.40 .007 .025 30.59 .022 .020

1879-13 06/07 14 -3.54 - .805 2.81 .999 .515 -0.86 - .710

1897-21 06/07 17 18.77 .342 .265 48.05 .000 .000 41.81 .001 .005

1897-21 13/14 14 27.84 .047 .055 59.75 .000 .000 55.74 .000 .000

1907-29 13/14 14 -0.29 - .725 5.30 .981 .460 2.78 .999 .550

1907-29 21/22 17 38.41 .002 .000 29.94 .027 .045 26.43 .067 .065

1948-70 53/54 12 13.41 .340 .185 31.78 .001 .000 31.69 .002 .005

1948-70 65/66 10 -14.22 - .960 2.30 .994 .585 -8.55 - .900

1954-78 65/66 17 26.62 .064 .080 30.52 .023 .023 23.37 .138 .090

1954-78 70/71 17 47.24 .000 .000 53.91 .000 .000 39.00 .002 .010

Vectors of Order 3

Test Marg. Sig.

Vector Period Split DF Stat. (a) (b)

m, y, m-p 1870-96 78/79 27 35.51 .126 .200

m, y, r 1870-96 78/79 27 43.02 .026 .085

m, m-p, r 1870-96 78/79 27 39.14 .061 .085

m,y, m-p 1954-70 65/66 15 5.10 .991 .720

m,y, r 1954-70 65/66 15 12.55 .637 .625

m, m-p, r 1954-70 65/66 15 39.07 .001 .110

NOTES: (a) Based on limiting chi-square distibution with degrees of freedom shown.

(b) Based on sampling study as described in text.

the form (2.2). Adjusted point estimates of feedback from m, fx,y(A), range

from 0 to .06 at low frequencies. Testing at the 10 per cent level, one would never

reject the hypothesis that money accounts for less than one per cent of the variance

in y and/or r at the infinite periodicity and in only one of the nine cases for

periodicities of 12 or more years. Adjusted point estimatesAof feedback at low

frequencies are always less than those of overall feedback Fx, y in some cases

dramatically so. Even if one takes the opposing prior position that m is not

structurally neutral with respect to y and r in a model of the form (2.2) the results

provide little support: (0, .1) provides at least a 90 per cent confidence interval

for feedback from m to r or m to (y, r) at low frequencies; upper bounds for

feedback from m to y in this interval are somewhat higher. In identifying

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

14 JOHN GEWEKE

y, y, y, y,

80%

v v v y, y, y, m r r r y y y

bSampled r

m-p,

m-p, r r

m-p,mr-p,r

mr-p, r r m-pm-p

mr-p Vector

r r -p

y,rm-pm-p

confidence

marginal

intervals

Period

are 1907-21

1954-70

1870-96

1954-70 1907-21

1870-96

1954-70 1907-21

1954-70

1870-96 1907-21

1870-96 1907-21

1870-96

1954-70 1954-70 1907-21

1954-70

1870-96 1907-21

1870-96 1870-96

1954-70

significance

level,

shown.

X 3 3 3 2 3 2 2 3 2 2 3 2 2 3 3 3 3 4 3 3 3 3 3

Lags

"(b)"

vector

is

column

of

always .740_ -

.545

.370 .110 - .085

- .085.625 - .200

.720 .465

.760 .000.355

.415

.725.365

.575

.495 Chowb

Table

11.m(t).

Fx

.003

.000 2.5881.701

.2721.661 1.141

2.618.086

4.779 .731

.1551.968 .721 .076

.753

.1022.274 .825.299

.002 .077 Y

1.064

SUMMARY

.949

.389 .545.041

.147.085 .028 .281.094

.322

.329.054 .153 .023

.088 .281

.242.002

.742 .199.132 .156 FX.

.066

OF

_

f

5.708

.825

.3752.330

.542.455

.170 .067

.302.084 .0281.540 .025

.067 .015

.049 .103

.002.043 .047.019 .047 ,-

.084 TABLE

5(0) RESULTS,

A

III

-=0,

12.607

1.015

.4093.895

.454310.096

.244.036 .0062.585

.024 .023 .003

.017 .009

.000.020 .033.012

.079 .059

.040 ANNUAL

Infinite

f,.Y(0) DATAa

periodicity

(.144,

(.062, (.005, (.000, (.001, (.001,

(.727,9.819)

1.274) (.042,.765)

(.016,.400)

(.145,1.321) .080)

(.001,.021)

(.004,.109) .018)

(.002,.070)(.000,.059)

(.003,.081)(.000,.000)

(.000,.129)

(.003,.524)

.159)(.000,.084)

(.003,.360)

.219)

3.120)

(3.007,28.307) (.042,1.152) (.571,9.210)

2.064 .372.881

.827 .577.478 .329.091

.155 .081.710

.079 .076 .021

.054 .053.031

.024 .155

.057.038 .071

.070 0<

fx-,(A)A

<ir/I6,

12+

3.064 .401.941

1.015 .490.147 .031

.275.043

.085 .033.861 .029 .004

.020 .027.010

.008 .138

.039.029

.045

.064

fx years,

y(A) Low

(.073,

(.253, (.011,

(.007, (.001,(.007 (.007, (.009,

frequencies

(.069,4.846)

(.176,2.655)

1.103)

1.883) (.026,.405)

(.019,.269)

(.077,.640)

(.217,1.051) (.009,.125)

.090)(.238,2.013)

.093) (.006,.091)

(.003,.072)

.020) 102)(.001,.044)

(.001,.046) .152)(.005,.118)

(.025,.616)(.006,.192)

.273)

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 15

fx-y (O) =0 with structural superneutrality of money we interpret the contem-

poraneous partial correlation between m and real variables as a passive response

in m (Theorem 1). This assumption has been widely debated and is far from

settled [20, 19]. For the periods 1870-96 and 1954-70, however, conclusions

about structural superneutrality are fairlayrobust with respect to assumptions of

alternative recursive orderings because Fx. y is low when Y consists of y and/or

r; recall Theorems 2 and 3.

Bivariate results for money and real balances (second panel of Table III) are

not as decisive. The adjusted point estimate for low frequencies in 1907-21 is

.138, and the interpretation of the findings for the other two periods is clouded

by substantial instantaneous feedback. When real balances are added to y and/or

r (fourth, sixth, and seventh panels of Table III), the evidence refutes structural

neutrality at least as often as it supports it. For no period does m appear

structurally neutral with respect to mr-p and r jointly, and for 1954-70 it does

not appear structurally neutral with respect to y and m -p. These findings are

mitigated by two factors. The first is that feedback between m and vectors

containing m - p could have been induced by measurement error in m. Still, it

seems unlikely that this could account entirely for the fact that the evidence

against structural neutrality is usually stronger for m -p in combination with

other variables than for m - p alone. The second factor is that evidence against

structural neutrality aiways occurs in conjunction with substantial estimates of

instantaneous feedback. The conditions of Theorem 3 indicate that neither the

adjusted or unadjusted point estimates are inconsistent with the existence of

recursive models in which money is structurally superneutral.

A conceptually simpler explanation of the findings involving m - p is provided

in the last panel of Table III which presents estimates of feedback between the

rate of monetary growth, m, and the growth rate of velocity v = (m -p) -y. In

every case, feedback from m to v is greater than feedback from m to any pair

of variables, and for 1954-70, it is greater than feedback from m to the entire

vector of real variables, at low frequencies. The evidence of 1954-70 is especially

strong because m accounts for over 99 per cent of the variance in velocity at the

lowest frequenCyand instantaneous feedback is zero. Our empirical findings may

therefore be summarized as strongly supporting structural neutrality of m with

respect to (j, r) in a model of the form (2.2), while decisively rejecting structural

neutrality of m with respect to v in any fully recursive structural model for all

three periods.

More detailed results for in, y, and r are provided in Tables IV through VI.

In these tables "variance reduction" refers to reduction in one-step-ahead forecast

error, as described in Section 2: e.g., for 1870-96 the estimate .122 of Fy,x

corresponds to an 11.5 per cent reduction in the orne-step-ahead mean square

forecast error for m when there lagged values of y and r are added to three lagged

values of m as conditioning variables. In the decomposition of feedback by

frequency "proportion of variance explained"'indicates the fraction of the spectral

density attributed to the other variables' innovations at the frequency in the

decomposition (2.7): e.g., at frequencies corresponding to periodicities of 3 to

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

16 JOHN GEWEKE

TABLE IV

FEEDBACK BETWEEN m, y, AND r, 1870-1896"

X=m; Y=(y,r)

Feedback measure Variance reduction

Fxy =.508 (.363,.682) 39.9%

Fx.y =.155 (.038, .350) 14.4%

~X_y = .281 (.142, 498) 24.5%

Fy_x =.122 (.059,.222) 11.5%

Decomposition by Frequency Groups, fx s (A)

Frequency Average Proportion of

Group Periodicity Feedback measure Variance Explained

0 0c .006 (.001, .021) 0.6%

(0, .167ir] c12 years .033 (.011, .090) 3.2%

(.167r, .3087r] 6.5-12 years .405 (.188, .842) 33.3%

(.308ir, .667ir] 3-6.5 years .467 (.233, .788) 37.3%

(.667ir, iT] 2-3 years .224 (.067, .469) 20.1%

Decomposition by Frequency Groups, fyx(A)

Frequency Average Proportion of

Group Periodicity Feedback Measure Variance Explained

0 cx .067 (.014, .196) 6.5%

(0,.167ir] 12 years .071 (.018, .179) 6.9%

(.167ir, .308Tr] 6.5-12 years .142 (.045, 302) 13.2%

(.308m, .667IT] 3-6.5 years .191 (.076, .357) 17.4%

(.667r, I] 2-3 years .062 (.021, .140) 6.0%

Estimated autoregressions incorporated three lags and intercept. 80% confidence intervals are shown.

6.5 years m innovations account for about 37.3 per cent of the generalized variance

in r, for the period 1870-96. Because the estimates reported here have been

corrected for bias as described in Section 4, the identities (2.5) and (2.8) are not

reflected precisely but agreement is close. Notice the confidence intervals are

asymmetric, with more of the interval above than below the point estimate: this

is plausible given the resemblance of our estimators to maximum likelihood

estimators, but would not be characteristic of intervals based on a limiting normal

distribution.

Presumed structural neutrality of m with respect to y and r, in conjunction

with the approach taken in Section 3, permits an empirical characterization of

the long run. Tables IV, V, and VI indicate clearly that the statistical structure

was not the same in the three time periods; in particular, feedback from (y, r)

to m appears to increase sharply proceeding through the successive periods. In

1870-96, feedback from m to (y, r) occurs in the intermediate run and shorter

periodicities, in 1907-21 at the business cycle and shorter periodicities, and in

1954-70, it appears to be absent altogether. This suggests that, in the framework

of Section 3, we may take the empirical counterpart of the long run to be

periodicities of about 12 years and longer.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 17

TABLE V

FFEDBACK BETWEEN "I, y, ANM) r, 1907-1921'

X ---m; Y (y, r)

Feedback meaasure Variance reduction

Fx> -- 1.742 (1.284,2.202) 83.5%

Fx y= 1.141 (.697, 1.721) 68.0%

Fx- y= .322 (.097,678) 27.5%

Fy-x =.378 (.138,.733) 31.5%.,

Decomposition by Frequency Groups, fX -(A)

Frequency Average Proportion of

Group Periodicity Feedback Measure Variance Explained

0 cc .024 (.005, .080) 2.4%

(0, .167 ir) ? 12 years .031 (.007, .093) 3.1%

(.167ix,.308ir] 6.5-12 years .095 (.035, .224) 9.1%

(.3087T,.6677r] 3-6.5 years .374 ( .144, .740) 31.2%

(.6677r, ir] 2.3 years .512 (.137, 1.066) 40.1%

Decomposition by Frequency Groups, f-,x(A)

Frequency Average Proportion of

Group Periodicity Feedback Measure Variance Explained

0 oo .307 (.053,.972) 26.4%

(0, .1677r] 12 years .302 (.056, .884) 26.0%O

(.167ir,.308ir] 6.5-12 years .325 (.073, .815) 27.8 '%

(.308r, .6677r] 3-6.5 years .270 (.101, .517) 23.6%

(.667ir, 7r] 2-3 years .521 (.173, 1.036) 40.6?,h

Estimated autoregressions incorporated three lags and intercept. 80% confidence intervals are shown.

6. EMPIRICAL RESULTS WITH MONTHLY DATA

Essentially the same analysis as the one just reported was undertaken for the

postwar period with a monthly data set which is described in Table VII. All of

the variables in this data set differ from the previous one: MI is used instead of

M2, industrial production in place of net national product, and the consumer

price index in lieu of the implicit net national product deflator. Most important,

one-month holding period returns on U.S. Treasury Bills are used in place of

the four-to-six month prime commercial paper rate, thus obviating one of the

chief conceptual difficulties with the annual data set. There is still a minor

alignment problem since nominal holding period returns are calculated at the

end of the month while the consumer price index (like most price indices) is

recorded about midmonth. Results are insensitive to the obvious alternative

calculation of the real holding period return and to the substitution of wholesale

prices for consumer prices in the definition of r [8, Table E.10].

A concise summary of the results with the monthly data is provided in Table

VIII. The findings are broadly consistent with the results of the previous section

for the postwar period, and the results involving the rate of return are remarkably

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

18 JOHN GEWEKE

TABLE VI

FEEDBACK BETWEEN m, Y, AND r, 1954-1970a

X=m; Y=(y,r)

Feedback measure Variance reduction

F-y =.721 (.482, 1.045) 51.4%

Fx. y =.086 (.016,.218) 8.2%

F y= .054 (.017, .129) 5.2%

Fy,x= .785 (.368, 1.365) 54.4%

Decomposition by Frequency Groups, fx, Y(A)

Frequency Average Proportion of

Group Periodicity Feedback Measures Vanance Explained

0 x .036 (.004, .109) 3.6%

(0, .167r3 al12years .043 (.009, .125) 4.2%

(.167ir,.308Xr] 6.5-12 years .070 (.024,.165) 6.7%

(.3081r,.6677r] 3-6.5 years .071 (.022,.167) 6.9%

(.6671r,7r] 2-3 years .059 (.012, .170) 5.7%

Decomposition by Frequency Groups, fyx(A)

Frequency Average Proportion of

Group Periodicity Feedback Measure Variance Explained

0 so 1.912 (.385, 5.474) 85.3%

(0,.1677r] 212 years 1.342 (.307, 2.883) 73.9%

(.167ir, .308ir] 6.5-12 years .420 (.143, .880) 34.3%

(.3087r,.6677] 3-6.5 years .375 (.187, .627) 31.3%

(.667r, 7r] 2-3 years .728 (.285, 1.293) 51.7%

Estimated autoregressions incorporated three lags and intercept. 80% confidence intervals are shown.

TABLE VII

MONTHLYDATA

Basic series:

MI(t) Money stock Ml (Survey of Current Business, various issues)

IP(t) Industrial production (Survey of Current Business, various issues)

CPI(t) Consumer price index [12, Exhibit B-23]

R(t) Monthly total nominal returns on U.S. Treasury Bills [12, Exhibit B-8]

Definitions:

mf t) 3=log [MI(t)I Ml(t -1)J

y(t) = log [P(t)/IP(t - 1)]

m(t) -p(t) = log {[M1(t)/CPI(t)]/[Ml(t - 1)/CPI(t- 1)]}

r(t) = R(t)-log [CPI(t)/CPI(t- 1)]

v( t) = Yttt- m(t-P(t0l

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 19

TABLE VIII

SUMMARY OF RESULTS, MONTHLY DATAa

A =0, Infinite periodicity 0< A < .1677r, 12+ years

Y

Vector Chowh F _ v fx (0) fX_Y(0) fj_ y(A) fx_y(A)

y .850 .001 .188 .007 .000 (.000,.001) .412 .388 (.099,.886)

mr-p .440 2.565 .187 .131 .114 (.004, .996) .126 .070 (.009, .308)

r .350 .001 .105 .012 .001 (.000, .006) .056 .021 (.004, .109)

y, m-p .150 2.265 .518 4.081 6.750 (1.902, 16.159) 2.520 3.238 (1.096, 5.924)

y, r .150 .000 .229 .039 .004 (.000, .019) .265 .135 (.021, .336)

m-p, r .470 .347 .453 .005 .000 (.000,.001) .620 .574 (.207,1.399)

v .800 .130 .285 .303 .468 (.009, 2.384) .563 .618 (1.134, 1.300)

X vector is always m(t). 80% confidence intervals are shown.

hSampled marginal significance level based on 20 replications with sample split at 1965: 12/1966:1.

similar. There are a few noticeable contrasts. At the infinite periodicity, the only

substantial differences for the annual and monthly data appear with m and

(m -p, r), where there is no evidence of feedback for the monthly data. Super-

neutrality of money with respect to output and the real rate of return is again

supported with the monthly data, while the superneutrality of money with respect

to velocity is rejected. The operational definition of the long run which emerges

from the empirical results is not always the same with the monthly data set as

with the annual one, however. Most noticeably, there is substantial feedback

from m to y at some low frequencies, and this is reflected in feedback from m

to y and r jointly. The difference is attributable to temporal disaggregation rather

than from the different construction of the series [8, Tables E.8, E.9, F.8-F.15]:

for the annual aggregates, the adjusted point estimate of feedback over the secular

long run is .034 for m and y, and .049 for m and (y, r). Lag length is not a factor:

point estimates presented in [8, Appendix E] show that the summary results of

Table VIII would remain substantially unchanged were lag length changed to 24

or 48 months.

The findings with monthly data suggest that our broad interpretation of the

empirical evidence on superneutrality is not affected by variable construction.

The empirical counterpart of the notional long run in the framework of Section

3 may, however, be sensitive to temporal aggregation; further analytical or

empirical work on this point is desirable.

Duke University

Manuscript received September, 1983; final revision received February, 1985.

APPENDIX

PROOF OF THEOREM 1: Immediate from H'(1) = 0< R'(1) = 0, and R (0) = R (1).

PROOF OF THEOREM 2: Consider the standard representation (2.1) and the structural model (1.1)

with the variables reordered so that no permutations are required for the recursive ordering, and

denote the variance matrices of the disturbances by Y and Y* respectively in the reordered equations.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

20 JOHN GEWEKE

Then IYj = IYI and IY*j = IYI*. Furthermore Y* = PYP', where P is a lower triangular matrix with

diagonal elements unity. Since IPI= 1, IY* = YI. Clearly, Y*1= 1*1* T*, so Fxy=

ln (I T!'|/| TI) =In (I X I/I1 *I) + In (ITYI/I T*I) = F*-x + F*y . The structural equations

KI- in

X, E*(L)x, + F*(L)y, = u*, are the projection of x, on all lagged values of x, and y, and from 0 to

I of the elements of-y,; hence 1I+1 1I*1 I1.1. Thus

Fx - y = In I1X/ 1 n (|IYx11/ *|) --- In |X/+)

= In (| *|/|E|) + In (|1E1 E1) = Fy_x + Fx.y,

the last equality from [7, Theorem 1(b)].

PROOF OF THEOREM 3: Since f*.,(A)==O, R*(A)=O; and since the structural model is

fully recursive, C* =0. Hence [8, eq. A.6], S+(A) = S*(A) T*S*(O)'(T+)-Y. Then

f (A) =J(A) )-f*y (A) = In [IS?(Ak) T?S+(Ak)'I/IS*(Ak) T*S*(Ak)|I]

= In (I T*I/ IT+I)+In (IS*(0)12).

Since the structural model is fully recursive, there is a permutation of the rows and columns of A*(0)

that is lower triangular, and all principal minors of this permutation are unity. Hence, In (IS*(0)12) = 0;

and In (IT*I/I T+|) ln (ITl/l T?l) = Fx- y.

REFERENCES

[1] Box, G. E. P., AN) M. E. MULLER:"A Note on the Generation of Random Normal Deviates,"

Annals of Mathematical Statistics, 29(1958), 610-611.

[2] DOOB, J. L.: Stochastic Processes. New York: Wiley, 1953.

[3] DORNBUSH, R., AND S. FISCHER: Macroeconomics (Third Edition). New York: McGraw-Hill,

1984.

[4] EFRON, B.: The Jackknife, the Bootstrap, and Other Resampling Plans. Philadelphia: Society for

Industrial and Applied Mathematics, 1982.

[5] FRIEDMAN, M., AND A. J. SCHWARTZ: A Monetary History of the United States 1867-1960.

New York: National Bureau of Economic Research, 1963.

[6] : Monetary Trends in the United States and the United Kingdom. Chicago: The University

of Chicago Press, 1982.

[7] GEWEKE,J.: "The Measurement of Linear Dependence and Feedback Between Multiple Time

Series," Journal of the American Statistical Association, 77(1982), 304-324.

[8] :

."The Superneutrality of Money in the United States: An Interpretrationof the Evidence,"

Carnegie-Mellon University Working Paper, May, 1983.

[9] GEWEKE, J., AND R. MEESE: "Estimating Regression Models of Finite but Unknown Order,"

International Economic Review, 22(1981), 55-70.

[10] GOLDBERGER, A. S.: Impact Multipiers and the Dynamic Properties of the Klein-Goldberger

ModeL Amsterdam: North-Holland, 1959.

[11] GRANGER,C. W. J.: "Investigating Causal Relations by Econometric Models and Cross-Spectral

Methods," Econometrica, 37(1969), 424-438.

[12] IBBOTSON, R. G., AND R. A. SINQUEFIELD: Stocks, Bonds, Billsand Inflation, HistoricalReturns

(1926-1978). Charlottesville: Financial Analysis Research Foundation, 1979.

[13] MCCALLUM, B. T.: "On Low-Frequency Estimates of 'Long Run' Reationships in

Macroeconomics," Journal of Monetary Economics, 14(1984), 3-14.

[14] SARGENT, T. J.: "A Classical Macroeconometric Model for the United States," Journal of

Political Economy, 84(1976), 207-238.

[15] : "The Observational Equivalence of Natural and Unnatural Rate Theories of

Macroeconomics," Journal of Political Economy, 84(1976), 631-640.

[16] : Macroeconomic Theory. New York: Academic Press, 1979.

[17] SIMS, C. A.: "Money, Income and Causality," American Economic Review, 62(1972), 540-552.

[18] : "Macroeconomics and Reality," Econometrica, 48(1980), 1-48.

[19] : "Policy Analysis with Econometric Models," Brookings Papers on Economic Activity,

1(1982), 107-164.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

SUPERNEUTRALITY OF MONEY 21

[20] TOBIN, J.: "Money and Income: Post Hoc Ergo Propter Hoc?" QuarterlyJournal of Economics,

84(1970), 301-317.

[21] TOBIN,J., AND W. BUITER:"Fiscal and Monetary Policies, Capital Formation, and Economic

Activity," reprinted in J. Tobin, Essays in Economics: Theoryand Policy. Cambridge: The MIT

Press, 1982.

[22] WHITTLE, P.: "On the Fitting of Multivariate Autoregressions, and the Approximate Canonical

Factorization of a Spectral Density Matrix," Biometrika, 50(1963), 129-134.

This content downloaded from 41.78.76.202 on Fri, 21 Jun 2013 03:45:00 AM

All use subject to JSTOR Terms and Conditions

You might also like

- Autocad Architecture - Floor PlansDocument34 pagesAutocad Architecture - Floor PlansGeorge MargheticiNo ratings yet

- John C. Cox Jonathan E. Ingersoll, Jr. Stephen A. Ross: Econometrica, Vol. 53, No. 2. (Mar., 1985), Pp. 363-384Document27 pagesJohn C. Cox Jonathan E. Ingersoll, Jr. Stephen A. Ross: Econometrica, Vol. 53, No. 2. (Mar., 1985), Pp. 363-384Machine LearningNo ratings yet

- (1983) Engle, R. F. Hendry, D. F. Richard, J .F. - Exogeneity.Document29 pages(1983) Engle, R. F. Hendry, D. F. Richard, J .F. - Exogeneity.Raphael CavalcantiNo ratings yet

- Lucas's Signal-Extraction Model: A Finite State Exposition With Aggregate Real ShocksDocument15 pagesLucas's Signal-Extraction Model: A Finite State Exposition With Aggregate Real ShocksOIBNo ratings yet