Professional Documents

Culture Documents

GEAR371 - CT3 Scenario Final

GEAR371 - CT3 Scenario Final

Uploaded by

akeeraCopyright:

Available Formats

You might also like

- BSBWOR203 Learner Assessment Tool V1.3Document27 pagesBSBWOR203 Learner Assessment Tool V1.3Ambika SuwalNo ratings yet

- Jennifer Li FEP 107086 S1Document23 pagesJennifer Li FEP 107086 S1Niraj ThapaNo ratings yet

- Platinum Partnership Member Success Guide OFFICIAL 2016Document16 pagesPlatinum Partnership Member Success Guide OFFICIAL 2016JB Ravishankar50% (2)

- BSBMGT517 Task 3 Project 2020Document7 pagesBSBMGT517 Task 3 Project 2020Hoàng My50% (2)

- BSBMGT517 Assessment 3 - Operational Plan: Assessment Tasks and InstructionsDocument7 pagesBSBMGT517 Assessment 3 - Operational Plan: Assessment Tasks and InstructionsArmughan Bukhari0% (1)

- Information Asset Management Part 1Document7 pagesInformation Asset Management Part 1Steve SimpsonNo ratings yet

- GSPP 805 Teaching Notes Factor MarketsDocument5 pagesGSPP 805 Teaching Notes Factor MarketsKushal GuptaNo ratings yet

- CT3 - Gear371 - 2023 - Final - V4Document6 pagesCT3 - Gear371 - 2023 - Final - V4wonderfulmabNo ratings yet

- CT1 - GEAR371 - 2023 - FINAL Question For PrintingDocument5 pagesCT1 - GEAR371 - 2023 - FINAL Question For PrintingwonderfulmabNo ratings yet

- 2022+ACCF+111+Class+test+3 FinalDocument6 pages2022+ACCF+111+Class+test+3 Finalndzalo050822No ratings yet

- r06 January 2023 Eg v2Document33 pagesr06 January 2023 Eg v2Dion AngoveNo ratings yet

- 21-4-TM1 Pts-Institutional AssessmentDocument18 pages21-4-TM1 Pts-Institutional Assessmentbob guintoNo ratings yet

- Assignment Brief BA (Hons.) International Business & Finance Academic Year 2019-20Document6 pagesAssignment Brief BA (Hons.) International Business & Finance Academic Year 2019-20Aiswarya AshaNo ratings yet

- The 34 Most Common Outsourcing Questions Asked by A Potential Client DAS SolutionsDocument8 pagesThe 34 Most Common Outsourcing Questions Asked by A Potential Client DAS SolutionscolzmasterNo ratings yet

- 2022+ACCF+111+Class+test+2 Moderated+versionDocument8 pages2022+ACCF+111+Class+test+2 Moderated+versionLucas LuluNo ratings yet

- Quantity Surveyor Interview Questions Part-2Document7 pagesQuantity Surveyor Interview Questions Part-2Ravi KumarNo ratings yet

- Important Tips For Interview For SAP SDDocument86 pagesImportant Tips For Interview For SAP SDPradeep SelokarNo ratings yet

- R06 2022-23 Practice Test 3 (October 2018 EG)Document23 pagesR06 2022-23 Practice Test 3 (October 2018 EG)Dion AngoveNo ratings yet

- Quality Auditor Case StudyDocument3 pagesQuality Auditor Case Studyminiom19No ratings yet

- SAQA - 12891 - Summative AssessmentsDocument21 pagesSAQA - 12891 - Summative AssessmentsjabuNo ratings yet

- Specific Instructions For The CandidateDocument7 pagesSpecific Instructions For The CandidateKenneth Dela Cruz AcasioNo ratings yet

- MFR Assignment 3 Front SheetdDocument8 pagesMFR Assignment 3 Front SheetdSyed Imam BakharNo ratings yet

- Assignment 2Document9 pagesAssignment 2sajaniNo ratings yet

- SAQA - 115367 - Summative AssessmentsDocument18 pagesSAQA - 115367 - Summative AssessmentsjabuNo ratings yet

- SAQA - 10153 - Summative AssessmentsDocument49 pagesSAQA - 10153 - Summative AssessmentsTalent100% (1)

- G8 Mar 2Document67 pagesG8 Mar 2Kaicie Dian BaldozNo ratings yet

- SAQA 8964 - Summative AssessmentsDocument24 pagesSAQA 8964 - Summative AssessmentsTapiwa Glen Dube MdangweNo ratings yet

- Best Practices For Testing Process: By, Poorna MuthukumarDocument27 pagesBest Practices For Testing Process: By, Poorna MuthukumarshilpakhaireNo ratings yet

- SAQA - 11241 - Summative AssessmentsDocument15 pagesSAQA - 11241 - Summative Assessmentsnkosinathisellobobo7944No ratings yet

- Assessment ICTSUS601 3 of 3 V2Document9 pagesAssessment ICTSUS601 3 of 3 V2sammy0% (1)

- Posting To LedgerDocument34 pagesPosting To LedgerBridgett Florence CaldaNo ratings yet

- Estimator Interview QuestionsDocument24 pagesEstimator Interview QuestionsMustapha SamuelNo ratings yet

- 04 Institutional Assessment ToolsDocument11 pages04 Institutional Assessment ToolsJerson Mejares ViagedorNo ratings yet

- AssignmentDocument25 pagesAssignmentPrashan Shaalin FernandoNo ratings yet

- Assignment Cover Sheet Lecturer's Comments Form: Section A: To Be Completed by StudentDocument10 pagesAssignment Cover Sheet Lecturer's Comments Form: Section A: To Be Completed by StudentPeter ChngNo ratings yet

- 6HO740 Financial Accounting - Assessment Brief-Winter 2024Document10 pages6HO740 Financial Accounting - Assessment Brief-Winter 2024JosephNo ratings yet

- 1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021Document38 pages1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021Hasantha IndrajithNo ratings yet

- 1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021Document16 pages1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021rivindu ranasinghe0% (1)

- SAQA 8964 - Summative MemoDocument16 pagesSAQA 8964 - Summative MemoTapiwa Glen Dube MdangweNo ratings yet

- BSBMKG417 Assessment Task 3Document7 pagesBSBMKG417 Assessment Task 3Nguyễn Thu HàNo ratings yet

- Course - Guide - Quantity SurveyDocument7 pagesCourse - Guide - Quantity SurveyUtsav ThakrarNo ratings yet

- Oli - SITXFIN004 Assessment 1 - Short Answers (1) 2Document13 pagesOli - SITXFIN004 Assessment 1 - Short Answers (1) 2dipakoli127No ratings yet

- RICS CQSP Course-GuideDocument9 pagesRICS CQSP Course-Guidemuhammadanas70No ratings yet

- Auditing and Investigations R.K 05 - 05 - 2006 DR MaunguDocument506 pagesAuditing and Investigations R.K 05 - 05 - 2006 DR MaunguJasiz Philipe Ombugu100% (1)

- Unit 01 ProgrammingDocument174 pagesUnit 01 Programmingmohammed shalmanNo ratings yet

- Research Paper Exam QuestionsDocument4 pagesResearch Paper Exam Questionsgz8reqdc100% (1)

- 1150-1619622396900-Unit-01 Programming Assignment Reworded 2021Document46 pages1150-1619622396900-Unit-01 Programming Assignment Reworded 2021Rodrick FernandoNo ratings yet

- Coordinate SITHKOP005Document27 pagesCoordinate SITHKOP005v6vdj9xc79No ratings yet

- 3001 AssessmentsDocument52 pages3001 Assessmentsadnanarif929No ratings yet

- Sajani - Unit 11 - Maths For Computing - Reworded - 2021Document74 pagesSajani - Unit 11 - Maths For Computing - Reworded - 2021Charles RodrigoNo ratings yet

- Reassessment Coursework F28SD Software Development Done1Document15 pagesReassessment Coursework F28SD Software Development Done1TESLAENo ratings yet

- R06 2022-23 Practice Test 1 (October 2017 EG)Document25 pagesR06 2022-23 Practice Test 1 (October 2017 EG)Dion AngoveNo ratings yet

- SAQA 8964 - Summative AssessmentsDocument23 pagesSAQA 8964 - Summative AssessmentsNomsa ZunguNo ratings yet

- Summative Assessment MemorandumDocument25 pagesSummative Assessment MemorandumForbetNo ratings yet

- Tletechdrafting-Grade7-8-Qtr1-Module2part2 (Without Edits) PDFDocument16 pagesTletechdrafting-Grade7-8-Qtr1-Module2part2 (Without Edits) PDFAnna Navalta100% (1)

- BSBMGT517 Assessment 1 - Short AnswerDocument10 pagesBSBMGT517 Assessment 1 - Short Answerozdiploma assignmentsNo ratings yet

- BSBCRT401 Task 1 1Document20 pagesBSBCRT401 Task 1 1uchralsaruul2222No ratings yet

- EX02527 CMA304 2F 2015 PartBDocument8 pagesEX02527 CMA304 2F 2015 PartBLance NgNo ratings yet

- Zolbayar and Ochir BSBPMG531 Assessment TasksDocument47 pagesZolbayar and Ochir BSBPMG531 Assessment TasksAniqa ZafiraNo ratings yet

- Muhammad Atta Ur Rehman Bscs 5B S.E (Software Engineering) Final Assignment 1 8-ARID-5198Document7 pagesMuhammad Atta Ur Rehman Bscs 5B S.E (Software Engineering) Final Assignment 1 8-ARID-5198Atta RandhawaNo ratings yet

- Certificate in Quantity Surveying Practice Course Guide 2023Document8 pagesCertificate in Quantity Surveying Practice Course Guide 2023Rey MichaelNo ratings yet

- Kertas Soalan Ini Mengandungi 3 Soalan Dalam 6 Halaman Yang DicetakDocument10 pagesKertas Soalan Ini Mengandungi 3 Soalan Dalam 6 Halaman Yang DicetakThiya. TtNo ratings yet

- ABC Context and TheoryDocument10 pagesABC Context and TheoryakeeraNo ratings yet

- ABC MethodologyDocument17 pagesABC MethodologyakeeraNo ratings yet

- TAXC+371+ +Second+Opportunity+ +paper+2Document6 pagesTAXC+371+ +Second+Opportunity+ +paper+2akeeraNo ratings yet

- BSCI BSST 371 Integrated Session 2Document1 pageBSCI BSST 371 Integrated Session 2akeeraNo ratings yet

- Question+10+ +optimeyes+ +Suggested+SolutionDocument2 pagesQuestion+10+ +optimeyes+ +Suggested+SolutionakeeraNo ratings yet

- TAXC371+-+Second+Opportunity+2019+Solution+ UpdatedDocument18 pagesTAXC371+-+Second+Opportunity+2019+Solution+ UpdatedakeeraNo ratings yet

- BSCI BSST+321+SU+E6+Strategy,+Trust+and+Corporate+Governance+ NotesDocument11 pagesBSCI BSST+321+SU+E6+Strategy,+Trust+and+Corporate+Governance+ NotesakeeraNo ratings yet

- F&F ATS - SellerDocument1 pageF&F ATS - SellerAdarsh PandeyNo ratings yet

- Itil V3 - at A Glance: Service DesignDocument1 pageItil V3 - at A Glance: Service DesignAleksandr TsirkunovNo ratings yet

- W12-Module 010 Contracting For Catering ServiceDocument12 pagesW12-Module 010 Contracting For Catering ServiceRonalyn C. CariasNo ratings yet

- Rationale of CRMDocument41 pagesRationale of CRMMuniza Maknojiya0% (1)

- Anti-Money Laundering and Combating The Financing of TerrorismDocument124 pagesAnti-Money Laundering and Combating The Financing of TerrorismLaurette M. BackerNo ratings yet

- Likuidasi PersekutuanDocument33 pagesLikuidasi Persekutuansilmi sofyanNo ratings yet

- Entrepreneursh IP AAT: Presented By: Diwakar R Shubhra DebnathDocument20 pagesEntrepreneursh IP AAT: Presented By: Diwakar R Shubhra DebnathDiwakar RajNo ratings yet

- A Paradigm For Developing Better Measures of Marketing ConstructsDocument19 pagesA Paradigm For Developing Better Measures of Marketing ConstructsRavi ShankarNo ratings yet

- Art 1956-1957Document6 pagesArt 1956-1957Kathleen Rose TaninasNo ratings yet

- KAPE'T KWENTUHAN FINAL PAPER (Revised)Document7 pagesKAPE'T KWENTUHAN FINAL PAPER (Revised)Csiemon RiveroNo ratings yet

- AcumaticaERP AccountsPayable PDFDocument334 pagesAcumaticaERP AccountsPayable PDFpaulinoemersonpNo ratings yet

- Nature and CharacteristicsDocument6 pagesNature and CharacteristicsrajendrakumarNo ratings yet

- Iso 37001:2016 Abms Documentation Toolkit Contents and Iso 37001:2016 Requirement MappingDocument3 pagesIso 37001:2016 Abms Documentation Toolkit Contents and Iso 37001:2016 Requirement Mappinggeorge50% (2)

- Intended, Emergent, Deliberate and Realised StrategyDocument3 pagesIntended, Emergent, Deliberate and Realised StrategyChami100% (1)

- Afar 3603 Franchise-AccountingDocument3 pagesAfar 3603 Franchise-AccountingDenise RamilNo ratings yet

- Case Analysis An Irate Distribtor Group 6Document5 pagesCase Analysis An Irate Distribtor Group 6Manish Kumar83% (6)

- Unified Proposal UpdatedDocument14 pagesUnified Proposal UpdatedBhattarai PrashantNo ratings yet

- Crush Wine Trademark ComplaintDocument14 pagesCrush Wine Trademark ComplaintMark JaffeNo ratings yet

- Uttar Pradesh Minimum Wages October 2017 March Up MW Wef 01-10-2017 31Document1 pageUttar Pradesh Minimum Wages October 2017 March Up MW Wef 01-10-2017 31S Balagopal SivaprakasamNo ratings yet

- Tender Document OTM Double Cabin Pick Up Microbus1Document75 pagesTender Document OTM Double Cabin Pick Up Microbus1Rawnakul Islam OpuNo ratings yet

- Quality Management System ISO 9001:2015 22.07.2022Document1 pageQuality Management System ISO 9001:2015 22.07.2022FIRST CHILDREN'S EMBASSY IN THE WORLD MEGJASHI MACEDONIANo ratings yet

- JVD Catalogue 2018 - Low ResolutionDocument68 pagesJVD Catalogue 2018 - Low ResolutionRahul KumarNo ratings yet

- Unilever & Diversification StrategyDocument22 pagesUnilever & Diversification StrategyHa My50% (2)

- IATF 16949 2016 Checklist Sample PDFDocument3 pagesIATF 16949 2016 Checklist Sample PDFMichael Nguyen0% (1)

- Rasgas Proposal 310105Document25 pagesRasgas Proposal 310105api-3708285No ratings yet

- Analysis of Cost Benchmarking at JCBDocument76 pagesAnalysis of Cost Benchmarking at JCBAbhishek Kumar100% (1)

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet

GEAR371 - CT3 Scenario Final

GEAR371 - CT3 Scenario Final

Uploaded by

akeeraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GEAR371 - CT3 Scenario Final

GEAR371 - CT3 Scenario Final

Uploaded by

akeeraCopyright:

Available Formats

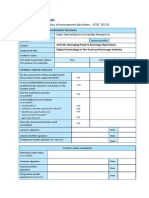

Sakrekenaars/Calculators: Ja/Yes

Benodigdhede vir hierdie vraestel/Requirements for this paper: Ander hulpmiddels/Other resources:

Antwoordskrifte/ Multikeusekaarte (A5)/

X

Answer scripts: Multi-choice cards (A5):

Presensiestrokies (Invulvraestel)/ Multikeusekaarte (A4)/

X

Attendance slips (Fill-in paper): Multi-choice cards (A4):

Rofwerkpapier/ Grafiekpapier/

Scrap paper: Graph paper:

c

Tipe Assessering/ Test 3 Kwalifikasie/ B Com Chartered &

Type of Assessment: Qualification: Forensic

Accountancy

Modulekode/ GEAR371 Tydsduur/ 90 minutes

Module code: Duration:

Module beskrywing/ Auditing Maks/ 50 marks

Module description: Max:

Eksaminator(e)/ Mr R M Brink Datum/Date: 31 August 2022

Examiner(s): Ms M du Plessis Tyd/Time: 9:00

Internal/Interne Prof A Nel

moderator(s):

Instructions

1. You are reminded that answers may NOT be written in pencil or erasable pen.

2. The marks shown against the requirement(s) for each question should be taken as an indication of the

expected length and the required depth of the answer.

3. Answer the questions using:

Appropriate arrangement and presentation;

Clarity of explanation;

Logical argument; and

Clear and concise language.

Marks will be awarded for the above.

4. Non-programmable calculators are allowed.

5. Prescribed technical books may be used.

6. All books must be handed in.

7. This paper is subject to the approved NWU open-book policy and the following are highlighted:

You are allowed to highlight, underline, side-line and flag permitted texts.

You may NOT make any notes anywhere in the prescribed texts.

You MAY NOT supplement texts with ANY loose papers (whether or not affixed to the permitted

texts).

8. Clearly show all calculations.

9. Assume that all amounts are material except where the contrary is stated.

10. Your answer must adhere to the provisions of ISA.

11. Reading time of 15 minutes is allowed and thereafter writing will commence for the remainder of time.

GEAR371: Class test 3 1/8

QUESTION 1 50 MARKS

Background information

You are an audit manager at Serious & Young Incorporated (hereafter “SY”). SY is a medium sized

audit firm which has branches in all major cities throughout South Africa. SY provides auditing,

taxation, and advisory services. SY is currently tendering to provide auditing services to Mrs Price

Clothing Stores Limited (hereafter “Price”) for the financial year ending 31 December 2022.

Price began in Durban South Africa where one idea by two visionaries quickly grew to multiple

stores around the country. Fast forward more than twenty years later and Price is now providing

fashionable clothing across ladies, men and kids lines at unbelievable prices to stores across

Africa and worldwide through Mrs-Price-app (hereafter “app”). Price worked very hard, since 2015

when their online shopping journey began, to bring to customers the most convenient way to shop

“hot” fashion from the tips of their fingers. Although, the Covid-19 pandemic severely impacted

sales at Price as lockdown regulations restricted sales from all stores not providing essential

goods, the app reaped the necessary rewards post Covid as customers felt much more inclined to

use the app as they perceived it as a safer way to shop. The app makes shopping much easier as

customers can now shop in one convenient place, where the app provides a visual search option

and a super safe contactless scan to pay option. Not only does the digital receipt save kilometres

of paper each year, but utilising the app, as opposed to visiting the physical store, also saves the

customers essential time which could be utilised for other more important things. Price’s

warehouses that are situated across Africa are fully stocked and their latest product offerings

include beauty products, school gear baby wear, as well as technological gadgets.

Pride utilizes a comprehensive computerised accounting system for all their reporting

requirements. SY’s auditing software is compatible with Price’s system.

The following documents and working papers are available to you:

Reference Description

Email: 1 Results of the year-end inventory count of Mrs Price Clothing Stores

Limited

Working paper M1 Overview of Debtors

Working paper N1 Overview of Creditors

To: Auditpartner@Serious&Young.co.za

EMAIL:1

From: Auditmanager@Serious&Young.co.za

Date: 08/01/2023

Subject: Results of the year-end inventory count of Price

GEAR371: Class test 3 2/8

Good day Mr Audit partner

I am glad to announce that the year-end inventory count was a success! There were a few

hiccups here and there, but all in all it went well.

As requested, please find the feedback pertaining to the inventory count that was done.

Prior to the count

The audit team was informed of the date, time, and location of the inventory count. The inventory

controller phoned me before the count, where he confirmed all locations where inventory is kept

and gave me a quick update of key matters addressed in the inventory count instructions. To

streamline the communication between all members of the audit team allocated to the inventory

count, we all agreed to create a Chatsup group. On the morning of the inventory count I

personally provided a message on the Chatsup group the responsibilities of each audit staff

member allocated to the inventory count of Price.

During the count

After picking up my morning cappuccino, I walked through Price’s warehouse where the count

was taking place and was impressed at how fast the counting team of Price was counting and

sticking the inventory tags on all inventory counted – they clearly knew what they were doing. It

was easy for me to identify everything that was counted by just checking the inventory tags

sticked on every item counted and additionally I observed that no movement were taking place.

Thereafter, the audit team allocated to the count, also performed some test counts to ensure that

at least some of the physical inventory agrees with the inventory count sheets. If we identified

any discrepancies, it was resolved by recounting it with the counters of Price and making the

necessary adjustments to the inventory count sheets.

The count team and I made good progress by finishing the inventory count before 13:00. I

decided to reward the audit team that assisted with the inventory count with a meal at a local

restaurant, using the company card of course. While at the restaurant I remembered that I

should have confirmed how many inventory count sheets were issued to Price’s counters and

how many were handed back at the end of the count to Price’s inventory controller. Luckily, I

remembered that I did count them with the inventory controller of Price, before the inventory

count was conducted, so that shouldn’t be an issue.

Conclusion of the count

After we got back from the restaurant, I inspected all the inventory count sheets returned to

make sure they were signed by the counters of Price responsible for the inventory count. I did

notice a few alterations on the inventory count sheets and were happy that the counters did a

proper job. I then created audit records by making copies of all the inventory count sheets,

recording observations of Price’s inventory count procedures, and lastly, I obtained a list of

goods received notes unmatched to the supplier invoices.

Let me know if you have any questions.

Greetings

Mr S Doubt (Audit manager in charge of inventory count at Mrs Price Clothing Stores Limited)

Client: Mrs Price Clothing Stores Limited Year-end: 31 December 2022

M1

Prepared by: Second year trainee accountant Date: 16 January 2023

1 of 2

Reviewed by: B Peckish Date: 22 January 2023

GEAR371: Class test 3 3/8

Subject: Overview of Debtors

1. Overview of Debtors

Price sells goods on credit and cash to the public. All debtors buying on credit must complete a

credit application form before they can purchase goods on credit. The credit terms are 30 days

from the invoice date.

If Price’s debtors’ list and debtors control account contain reconciling items, a monthly

reconciliation is performed by the credit controller to identify the reason for the differences.

Thereafter, the Chief Financial Officer (CFO), Mrs Right, reviews the reconciliation to ensure it is

done correctly and signs if off as proof of authorisation.

2. Debtors’ Masterfile

The credit controller has indicated that a text file, can be extracted from the debtor’s

masterfile, to assist with the audit of debtors.

An example of the fields contained in the debtors’ Masterfile are as follows:

Field Example

Account Number 12425206

Name Corporate Clothing (Pty) Ltd.

Address P.O. Box 2145, Vereeniging, Gauteng, South

Africa, 2001

Total amount owed R225 625

Credit limit R300 000

Credit terms 30 days

Discount percentage (%) if paid within 30 2.5%

days

Ageing of total amount owed 30 days, 60 days, 90 and over

Status of account Letter “h” – if handed over to the attorneys for

collection

3. Allowance for credit losses

An allowance for credit losses is made by Price, using the following criteria:

60 days and over – 10%

Client: Mrs Price Clothing Stores Limited Year-end: 31 December 2022

M1

Prepared by: First year trainee accountant Date: 16 January 2023

GEAR371: Class test 3 4/8

Reviewed by: B Peckish Date: 22 January 2023 2 of 2

Subject: Overview of Debtors

4. Audit procedures already performed

By using CAATs, casted individual balances on the debtors list and compared it to the

debtors’ control account

Scrutinised the debtors control account in the general ledger for any unusual entries e.g.

credit balances

Performed necessary audit procedures on any reconciliation items identified during the

debtors’ reconciliation

Reviewed and followed up on the debtors’ circulation responses obtained for evidence of

debtor valuation problems e.g., debtors arguing that they have been charged twice

By using CAATs, re-performed the debtors’ age analysis, by selecting a sample of debtors

from the debtors’ masterfile and tracing it back to supporting documentation (e.g. delivery

notes) to determine that amounts owed have been allocated to the correct time period in the

age-analysis

Inspected debtors’ correspondence and legal files to identify debtors who have been handed

over to attorneys for collection

Enquired from management about any specific factors e.g. relaxing of credit terms, which

may affect the allowance for credit losses

Client: Mrs Price Clothing Stores Limited Year-end: 31 December 2022

N1

Prepared by: First year trainee accountant Date: 10 February 2023

1 of 2

Reviewed by: V Clever Date: 22 February 2023

Subject: Overview of Creditors

1. Creditor’s reconciliation

Twenty-five (25) creditors were selected from the creditors’ list on which to perform audit

procedures to obtain audit evidence regarding the accuracy, valuation, and allocation of

creditors.

The following creditor’s reconciliation pertaining to Funcky Clothing (Pty) Ltd (hereafter

“Funcky Clothing”) was selected as part of the sample:

Note R

Balance as per Funcky Clothing’s statement dated 31 December 1 425 094

2022

Less:

Electronic Fund Transfer (EFT) made on 31 December 2022, not 1 (85 000)

yet reflected

Delivery of goods pre-invoiced 2 (152 800)

Add:

GEAR371: Class test 3 5/8

Vat error on invoice 190 3 (1 500)

Balance as per creditor’s ledger as at 31 December 2022 1 185 794

Note 1

The amount of R85 000 was directly deposited into Funcky Clothing’s bank account via an

Electronic Funds Transfer (EFT) on 31 December 2022 but doesn’t show on the 31 December

2022 creditors’ statement.

Note 2

The goods valued at R152 800 was delivered by Funcky Clothing on 1 January 2023, where

ownership was taken by Price’s goods receiving clerk when he signed the Goods received note

(GRN150). The invoice (INV198) for R152 800 was made out on 31 December 2022 to which

GRN150 relates to does however already appear on the 31 December 2022 creditors’

statement.

Note 3

This overcharge resulted from Funcky Clothing including the total invoiced amount including

VAT for invoice (INV190). The invoice amount excluding VAT was R10 000 and was made out to

Price on 23 December 2022.

GEAR371: Class test 3 6/8

Client: Mrs Price Clothing Stores Limited Year-end: 31 December 2022

N1

Prepared by: First year trainee accountant Date: 10 February 2023

2 of 2

Reviewed by: V Clever Date: 22 February 2023

Subject: Creditors

2. Further audit procedures on creditors

As you were busy auditing the creditor’s accounts of Funcky Clothing you obtained important

supporting documentation from the accountant to assist you further with the auditing of creditors.

(Refer to Annexure A: Supporting documentation):

Annexure A: Supporting documentation

List of creditors as at 31 December 2022

Account Creditor name 2022 2021

number R R

SUP00024 Happy Logistics Ltd 1 842 727 1 419 853

SUP00089 Redfox Supplier Ltd 328 752 1 175 289

SUP00095 Proton Logistics (Pty) Ltd 1 937 573 1 274 526

SUP00061 Supplier Harbour Ltd 1 874 896 1 481 744

SUP00048 Logistics Fever (Pty) Ltd - 1 147 109

5 983 948 6 498 521

List of unmatched goods received notes (GRNs) unmatched to supplier

invoices as at 31 December 2022

GRN Creditor name Date 2022

number R

GRN00881 Happy Logistics Ltd 31/12/2022 56 478

GRN00882 Redfox Supplier Ltd 31/12/2022 38 528

GRN00883 Supplier Harbour Ltd 31/12/2022 79 251

174 257

GEAR371: Class test 3 7/8

SUB-

QUESTION 1 – REQUIRED

TOTAL TOTAL

1.1 With specific reference to E-mail 1:

Discuss any concerns evident in the audit procedures documented 11 x 1

and performed by the audit team of Serious & Young Incorporated

prior, during and at the conclusion of the inventory count of Mrs

Price Clothing Stores Limited at year-end.

Communication skills: Clarity of expression 1x1 12

1.2 Describe three (3) substantive audit procedures that you will

perform, to obtain audit evidence for the rights assertion of 3x1

inventory for the 2022 year-end. 3

1.3 With specific reference to working paper M1 - Overview of

Debtors:

Describe the additional substantive audit procedures, including 15 x 1

CAATs (Computer assisted audit techniques), that you will perform,

to obtain audit evidence for the accuracy, valuation and allocation

assertion of debtors for the 2022 year-end. 15

1.4 With reference to working paper N1 - Overview of Creditors: - 1. 14 x 1 15

Creditors reconciliation

Describe the substantive audit procedures that you will perform on

the creditor’s reconciliation of Funcky Clothing (Proprietary) Limited

for the 2022 year-end.

1.5 With reference to Working paper – N1 – Overview of Creditors – 5x1 5

2. Further audit procedures on creditors and Annexure A:

Formulate the detail substantive audit procedures that you would

perform on Mrs Price Clothing Stores Limited’s list of creditors and

list of unmatched goods received notes to supplier invoices to obtain

audit evidence for the completeness assertion of creditors for the 31

December 2022 year-end.

Note: Please provide examples relevant to the information

provided under annexure A, where possible.

TOTAL MARKS FOR QUESTION 1 50 50

GEAR371: Class test 3 8/8

You might also like

- BSBWOR203 Learner Assessment Tool V1.3Document27 pagesBSBWOR203 Learner Assessment Tool V1.3Ambika SuwalNo ratings yet

- Jennifer Li FEP 107086 S1Document23 pagesJennifer Li FEP 107086 S1Niraj ThapaNo ratings yet

- Platinum Partnership Member Success Guide OFFICIAL 2016Document16 pagesPlatinum Partnership Member Success Guide OFFICIAL 2016JB Ravishankar50% (2)

- BSBMGT517 Task 3 Project 2020Document7 pagesBSBMGT517 Task 3 Project 2020Hoàng My50% (2)

- BSBMGT517 Assessment 3 - Operational Plan: Assessment Tasks and InstructionsDocument7 pagesBSBMGT517 Assessment 3 - Operational Plan: Assessment Tasks and InstructionsArmughan Bukhari0% (1)

- Information Asset Management Part 1Document7 pagesInformation Asset Management Part 1Steve SimpsonNo ratings yet

- GSPP 805 Teaching Notes Factor MarketsDocument5 pagesGSPP 805 Teaching Notes Factor MarketsKushal GuptaNo ratings yet

- CT3 - Gear371 - 2023 - Final - V4Document6 pagesCT3 - Gear371 - 2023 - Final - V4wonderfulmabNo ratings yet

- CT1 - GEAR371 - 2023 - FINAL Question For PrintingDocument5 pagesCT1 - GEAR371 - 2023 - FINAL Question For PrintingwonderfulmabNo ratings yet

- 2022+ACCF+111+Class+test+3 FinalDocument6 pages2022+ACCF+111+Class+test+3 Finalndzalo050822No ratings yet

- r06 January 2023 Eg v2Document33 pagesr06 January 2023 Eg v2Dion AngoveNo ratings yet

- 21-4-TM1 Pts-Institutional AssessmentDocument18 pages21-4-TM1 Pts-Institutional Assessmentbob guintoNo ratings yet

- Assignment Brief BA (Hons.) International Business & Finance Academic Year 2019-20Document6 pagesAssignment Brief BA (Hons.) International Business & Finance Academic Year 2019-20Aiswarya AshaNo ratings yet

- The 34 Most Common Outsourcing Questions Asked by A Potential Client DAS SolutionsDocument8 pagesThe 34 Most Common Outsourcing Questions Asked by A Potential Client DAS SolutionscolzmasterNo ratings yet

- 2022+ACCF+111+Class+test+2 Moderated+versionDocument8 pages2022+ACCF+111+Class+test+2 Moderated+versionLucas LuluNo ratings yet

- Quantity Surveyor Interview Questions Part-2Document7 pagesQuantity Surveyor Interview Questions Part-2Ravi KumarNo ratings yet

- Important Tips For Interview For SAP SDDocument86 pagesImportant Tips For Interview For SAP SDPradeep SelokarNo ratings yet

- R06 2022-23 Practice Test 3 (October 2018 EG)Document23 pagesR06 2022-23 Practice Test 3 (October 2018 EG)Dion AngoveNo ratings yet

- Quality Auditor Case StudyDocument3 pagesQuality Auditor Case Studyminiom19No ratings yet

- SAQA - 12891 - Summative AssessmentsDocument21 pagesSAQA - 12891 - Summative AssessmentsjabuNo ratings yet

- Specific Instructions For The CandidateDocument7 pagesSpecific Instructions For The CandidateKenneth Dela Cruz AcasioNo ratings yet

- MFR Assignment 3 Front SheetdDocument8 pagesMFR Assignment 3 Front SheetdSyed Imam BakharNo ratings yet

- Assignment 2Document9 pagesAssignment 2sajaniNo ratings yet

- SAQA - 115367 - Summative AssessmentsDocument18 pagesSAQA - 115367 - Summative AssessmentsjabuNo ratings yet

- SAQA - 10153 - Summative AssessmentsDocument49 pagesSAQA - 10153 - Summative AssessmentsTalent100% (1)

- G8 Mar 2Document67 pagesG8 Mar 2Kaicie Dian BaldozNo ratings yet

- SAQA 8964 - Summative AssessmentsDocument24 pagesSAQA 8964 - Summative AssessmentsTapiwa Glen Dube MdangweNo ratings yet

- Best Practices For Testing Process: By, Poorna MuthukumarDocument27 pagesBest Practices For Testing Process: By, Poorna MuthukumarshilpakhaireNo ratings yet

- SAQA - 11241 - Summative AssessmentsDocument15 pagesSAQA - 11241 - Summative Assessmentsnkosinathisellobobo7944No ratings yet

- Assessment ICTSUS601 3 of 3 V2Document9 pagesAssessment ICTSUS601 3 of 3 V2sammy0% (1)

- Posting To LedgerDocument34 pagesPosting To LedgerBridgett Florence CaldaNo ratings yet

- Estimator Interview QuestionsDocument24 pagesEstimator Interview QuestionsMustapha SamuelNo ratings yet

- 04 Institutional Assessment ToolsDocument11 pages04 Institutional Assessment ToolsJerson Mejares ViagedorNo ratings yet

- AssignmentDocument25 pagesAssignmentPrashan Shaalin FernandoNo ratings yet

- Assignment Cover Sheet Lecturer's Comments Form: Section A: To Be Completed by StudentDocument10 pagesAssignment Cover Sheet Lecturer's Comments Form: Section A: To Be Completed by StudentPeter ChngNo ratings yet

- 6HO740 Financial Accounting - Assessment Brief-Winter 2024Document10 pages6HO740 Financial Accounting - Assessment Brief-Winter 2024JosephNo ratings yet

- 1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021Document38 pages1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021Hasantha IndrajithNo ratings yet

- 1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021Document16 pages1154-1619623260919-Unit 11 - Maths For Computing - Reworded - 2021rivindu ranasinghe0% (1)

- SAQA 8964 - Summative MemoDocument16 pagesSAQA 8964 - Summative MemoTapiwa Glen Dube MdangweNo ratings yet

- BSBMKG417 Assessment Task 3Document7 pagesBSBMKG417 Assessment Task 3Nguyễn Thu HàNo ratings yet

- Course - Guide - Quantity SurveyDocument7 pagesCourse - Guide - Quantity SurveyUtsav ThakrarNo ratings yet

- Oli - SITXFIN004 Assessment 1 - Short Answers (1) 2Document13 pagesOli - SITXFIN004 Assessment 1 - Short Answers (1) 2dipakoli127No ratings yet

- RICS CQSP Course-GuideDocument9 pagesRICS CQSP Course-Guidemuhammadanas70No ratings yet

- Auditing and Investigations R.K 05 - 05 - 2006 DR MaunguDocument506 pagesAuditing and Investigations R.K 05 - 05 - 2006 DR MaunguJasiz Philipe Ombugu100% (1)

- Unit 01 ProgrammingDocument174 pagesUnit 01 Programmingmohammed shalmanNo ratings yet

- Research Paper Exam QuestionsDocument4 pagesResearch Paper Exam Questionsgz8reqdc100% (1)

- 1150-1619622396900-Unit-01 Programming Assignment Reworded 2021Document46 pages1150-1619622396900-Unit-01 Programming Assignment Reworded 2021Rodrick FernandoNo ratings yet

- Coordinate SITHKOP005Document27 pagesCoordinate SITHKOP005v6vdj9xc79No ratings yet

- 3001 AssessmentsDocument52 pages3001 Assessmentsadnanarif929No ratings yet

- Sajani - Unit 11 - Maths For Computing - Reworded - 2021Document74 pagesSajani - Unit 11 - Maths For Computing - Reworded - 2021Charles RodrigoNo ratings yet

- Reassessment Coursework F28SD Software Development Done1Document15 pagesReassessment Coursework F28SD Software Development Done1TESLAENo ratings yet

- R06 2022-23 Practice Test 1 (October 2017 EG)Document25 pagesR06 2022-23 Practice Test 1 (October 2017 EG)Dion AngoveNo ratings yet

- SAQA 8964 - Summative AssessmentsDocument23 pagesSAQA 8964 - Summative AssessmentsNomsa ZunguNo ratings yet

- Summative Assessment MemorandumDocument25 pagesSummative Assessment MemorandumForbetNo ratings yet

- Tletechdrafting-Grade7-8-Qtr1-Module2part2 (Without Edits) PDFDocument16 pagesTletechdrafting-Grade7-8-Qtr1-Module2part2 (Without Edits) PDFAnna Navalta100% (1)

- BSBMGT517 Assessment 1 - Short AnswerDocument10 pagesBSBMGT517 Assessment 1 - Short Answerozdiploma assignmentsNo ratings yet

- BSBCRT401 Task 1 1Document20 pagesBSBCRT401 Task 1 1uchralsaruul2222No ratings yet

- EX02527 CMA304 2F 2015 PartBDocument8 pagesEX02527 CMA304 2F 2015 PartBLance NgNo ratings yet

- Zolbayar and Ochir BSBPMG531 Assessment TasksDocument47 pagesZolbayar and Ochir BSBPMG531 Assessment TasksAniqa ZafiraNo ratings yet

- Muhammad Atta Ur Rehman Bscs 5B S.E (Software Engineering) Final Assignment 1 8-ARID-5198Document7 pagesMuhammad Atta Ur Rehman Bscs 5B S.E (Software Engineering) Final Assignment 1 8-ARID-5198Atta RandhawaNo ratings yet

- Certificate in Quantity Surveying Practice Course Guide 2023Document8 pagesCertificate in Quantity Surveying Practice Course Guide 2023Rey MichaelNo ratings yet

- Kertas Soalan Ini Mengandungi 3 Soalan Dalam 6 Halaman Yang DicetakDocument10 pagesKertas Soalan Ini Mengandungi 3 Soalan Dalam 6 Halaman Yang DicetakThiya. TtNo ratings yet

- ABC Context and TheoryDocument10 pagesABC Context and TheoryakeeraNo ratings yet

- ABC MethodologyDocument17 pagesABC MethodologyakeeraNo ratings yet

- TAXC+371+ +Second+Opportunity+ +paper+2Document6 pagesTAXC+371+ +Second+Opportunity+ +paper+2akeeraNo ratings yet

- BSCI BSST 371 Integrated Session 2Document1 pageBSCI BSST 371 Integrated Session 2akeeraNo ratings yet

- Question+10+ +optimeyes+ +Suggested+SolutionDocument2 pagesQuestion+10+ +optimeyes+ +Suggested+SolutionakeeraNo ratings yet

- TAXC371+-+Second+Opportunity+2019+Solution+ UpdatedDocument18 pagesTAXC371+-+Second+Opportunity+2019+Solution+ UpdatedakeeraNo ratings yet

- BSCI BSST+321+SU+E6+Strategy,+Trust+and+Corporate+Governance+ NotesDocument11 pagesBSCI BSST+321+SU+E6+Strategy,+Trust+and+Corporate+Governance+ NotesakeeraNo ratings yet

- F&F ATS - SellerDocument1 pageF&F ATS - SellerAdarsh PandeyNo ratings yet

- Itil V3 - at A Glance: Service DesignDocument1 pageItil V3 - at A Glance: Service DesignAleksandr TsirkunovNo ratings yet

- W12-Module 010 Contracting For Catering ServiceDocument12 pagesW12-Module 010 Contracting For Catering ServiceRonalyn C. CariasNo ratings yet

- Rationale of CRMDocument41 pagesRationale of CRMMuniza Maknojiya0% (1)

- Anti-Money Laundering and Combating The Financing of TerrorismDocument124 pagesAnti-Money Laundering and Combating The Financing of TerrorismLaurette M. BackerNo ratings yet

- Likuidasi PersekutuanDocument33 pagesLikuidasi Persekutuansilmi sofyanNo ratings yet

- Entrepreneursh IP AAT: Presented By: Diwakar R Shubhra DebnathDocument20 pagesEntrepreneursh IP AAT: Presented By: Diwakar R Shubhra DebnathDiwakar RajNo ratings yet

- A Paradigm For Developing Better Measures of Marketing ConstructsDocument19 pagesA Paradigm For Developing Better Measures of Marketing ConstructsRavi ShankarNo ratings yet

- Art 1956-1957Document6 pagesArt 1956-1957Kathleen Rose TaninasNo ratings yet

- KAPE'T KWENTUHAN FINAL PAPER (Revised)Document7 pagesKAPE'T KWENTUHAN FINAL PAPER (Revised)Csiemon RiveroNo ratings yet

- AcumaticaERP AccountsPayable PDFDocument334 pagesAcumaticaERP AccountsPayable PDFpaulinoemersonpNo ratings yet

- Nature and CharacteristicsDocument6 pagesNature and CharacteristicsrajendrakumarNo ratings yet

- Iso 37001:2016 Abms Documentation Toolkit Contents and Iso 37001:2016 Requirement MappingDocument3 pagesIso 37001:2016 Abms Documentation Toolkit Contents and Iso 37001:2016 Requirement Mappinggeorge50% (2)

- Intended, Emergent, Deliberate and Realised StrategyDocument3 pagesIntended, Emergent, Deliberate and Realised StrategyChami100% (1)

- Afar 3603 Franchise-AccountingDocument3 pagesAfar 3603 Franchise-AccountingDenise RamilNo ratings yet

- Case Analysis An Irate Distribtor Group 6Document5 pagesCase Analysis An Irate Distribtor Group 6Manish Kumar83% (6)

- Unified Proposal UpdatedDocument14 pagesUnified Proposal UpdatedBhattarai PrashantNo ratings yet

- Crush Wine Trademark ComplaintDocument14 pagesCrush Wine Trademark ComplaintMark JaffeNo ratings yet

- Uttar Pradesh Minimum Wages October 2017 March Up MW Wef 01-10-2017 31Document1 pageUttar Pradesh Minimum Wages October 2017 March Up MW Wef 01-10-2017 31S Balagopal SivaprakasamNo ratings yet

- Tender Document OTM Double Cabin Pick Up Microbus1Document75 pagesTender Document OTM Double Cabin Pick Up Microbus1Rawnakul Islam OpuNo ratings yet

- Quality Management System ISO 9001:2015 22.07.2022Document1 pageQuality Management System ISO 9001:2015 22.07.2022FIRST CHILDREN'S EMBASSY IN THE WORLD MEGJASHI MACEDONIANo ratings yet

- JVD Catalogue 2018 - Low ResolutionDocument68 pagesJVD Catalogue 2018 - Low ResolutionRahul KumarNo ratings yet

- Unilever & Diversification StrategyDocument22 pagesUnilever & Diversification StrategyHa My50% (2)

- IATF 16949 2016 Checklist Sample PDFDocument3 pagesIATF 16949 2016 Checklist Sample PDFMichael Nguyen0% (1)

- Rasgas Proposal 310105Document25 pagesRasgas Proposal 310105api-3708285No ratings yet

- Analysis of Cost Benchmarking at JCBDocument76 pagesAnalysis of Cost Benchmarking at JCBAbhishek Kumar100% (1)

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet