Professional Documents

Culture Documents

Accounting For Non - Current Assets

Accounting For Non - Current Assets

Uploaded by

RECALL JIRIVENGWAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Non - Current Assets

Accounting For Non - Current Assets

Uploaded by

RECALL JIRIVENGWACopyright:

Available Formats

ACCOUNTING FOR NON-CURRENT ASSETS

Non-current assets are purchased by a business in order to generate profits and are used for more than

one financial year e.g motor vehicle

A non-current asset (except land) has a limited useful life and hence should be depreciated.

The cost of a non-current asset includes:

a) The initial purchase price e) installation and assembly costs

b) Any import duties f) cost of testing the asset

c) Cost of site preparation g) professional fees or legal fees

d) Initial delivery and handling costs h) signwriting on a vehicle

Capital expenditure

It is expenditure which results in the acquisition of non-current assets or an improvement in their

earning capacity. Capital expenditure is not charged as an expense in the Income Statement.

It is money spent that has a long-term benefit to the business.

Revenue expenditure

Expenditure incurred in running a business on a day-to-day basis. It is also expenditure incurred to

maintain the earning capacity of non-current assets. E.g electricity , rates

It is money spent that has a short term benefit (less than one year) to the business.

Capital receipts

It is any money received that is not from normal trading e.g sale of noncurrent asset proceeds. They do

not appear on the income statement but are accounted for on the SFP.

Revenue receipts

They arise from the normal business activities. They are also incidental to the main business activity.

Revenue receipts are credited to the income statement e.g rent received, interest received

Recording the purchase of non-current asset

The purchase of a non-current asset that is paid immediately will be recorded in the cash book. The

purchase of a non-current asset on credit will be recorded in the general journal.

Non-Current Assets account

Balance b/d XXX Disposal XXX

Cash/bank XXX

Trade XXX Balance c/d XXX

exchange/Addition

XXX XXX

Balance b/d XXX

R Jirivengwa 0772772166 /0717779401

Depreciation

It is that part of the original cost of a non-current asset that is consumed during its period of use by the

business. Depreciation is a means of spreading the cost of a non-current asset over its useful life. It is the

loss in value of a non-current asset and is charged to the income statement.

It is a non-cash expense because it allocates costs to later years for a cash payment that has occurred

previously. It does not provide fund for the replacement of an asset when it is no longer in use.

Reasons why assets depreciate

Wear and tear. Assets become worn out through use.

Obsolescence. An asset becomes out of date through technological advances or a change in

tastes and fashion.

Passage of time. Passage of time reduces the value of an asset even if it is not used.

Exhaustion or using up. Mines, quarries, oil wells as the minerals are extracted from them.

Methods of depreciation

a) Straight line method

A fixed amount is charged per annum to the Income Statement over the life of the asset.

It is calculated as a fixed percentage on cost. The total depreciation is spread evenly over the

number of years of its expected life.

Annual depreciation charge = cost –residual value

Estimated useful life (years)

It is useful for assets which provide equal benefits each year e.g machinery , furniture

Example

1. Bought machinery $200,000 on 1 January 2000. It has an estimated useful life of $50,000

and an estimated useful life of 5 years.

Annual depreciation= 200,000-50,000 =150,000 = 30,000 per year

5 5

2. Bought motor vehicle $20,000 on 1 January 2000.Depreciation is 20% per annum using

straight line method.

Year 2000 Cost 20,000

Less depreciation (20% X20,000) (4000)

Net book value 16,000

Year 2001 less depreciation (20% X20,000) (4000)

Net book value 12,000

Year 2002 less depreciation (20% X20,000) (4000)

Net book value 8,000

b) Reducing balance / Diminishing balance method

Depreciation is calculated as a fixed percentage of the written down value of the asset each

year. The annual charge for depreciation is higher in the earlier years of the asset’s life and

lower in the later years.

A decreasing amount of depreciation is charged each year to the income statement and so

assumes that more benefit is consumed in earlier years.it is useful for assets which provide

more benefit in earlier years e.g motor vehicles , computers.

R Jirivengwa 0772772166 /0717779401

Example

3. Bought motor vehicle $20,000 on 1 January 2000.Depreciation is 20% per annum using

reducing balance method.

Year 2000 Cost 20,000

Less depreciation (20% X20,000) (4000)

Net book value 16,000

Year 2001 less depreciation (20% X16,000) (3200)

Net book value 12,800

Year 2002 less depreciation (20% X12,800) (2560)

Net book value 10,240

c) Revaluation method

Used where the assets are made up of small items e.g loose tools. Loose tools are small items of

non-current assets which may individually be of limited value but taken together their value may

become significant.

Calculation of depreciation

Opening valuation xxx

Add purchases during the year xxx

Xxx

Less closing valuation ( xxx)

Depreciation for the year xxx

Disposal of non-current assets

The accounting entries are:

(i) Transfer the cost price of the asset sold to an asset disposal account

Debit asset disposal account e.g Van disposal account

Credit Asset Account e.g van account

(ii) Transfer the depreciation already charged to the asset disposal account

Debit Provision for Depreciation:Asset account

Credit Asset disposal Account

( iii) The amount received on disposal

Debit Cash book

Credit Asset disposal account

(iv) Transfer the difference to the Income statement

a) If the disposal account shows a difference on the debit side ,there is a profit on sale

Debit asset disposal account

Credit Income statement

b) If the asset disposal account shows a difference on the credit side ,there is a loss on

sale Debit Income Statement

Credit asset disposal account

R Jirivengwa 0772772166 /0717779401

Asset disposal account

Asset XXX Depreciation XXX

Cash/bank XXX

Income statement XXX

XXX XXXX

Provision for depreciation : Asset Account

Disposal XXX Balance b/d XXX

Balance c/d XXX Income Statement XXX

XXX XXX

Part exchange

A business may purchase a non-current asset and part exchange another non-current asset that it

wishes to dispose of , as part of the purchase price. The part exchange value of the asset being disposed

of is debited to the non-current asset account and credited to the disposal account as the proceeds of

disposal.

Example

At 1 January 2017 , James owned an old vehicle costing $60,000 . The vehicle had been depreciated by

$24,000. On the same date he purchased a new motor vehicle for $120,000. He paid $82,000 by cheque

for the vehicle and part exchanged his old vehicle for the balance. It is the business policy to depreciate

all vehicles at 10% per annum on cost.

Required

a)Motor Vehicle Account

b) Provision for depreciation: motor vehicles Account

c) Motor Vehicle Disposal Account

Motor Vehicles Account

Balance b/d 60,000 Disposal 60,000

Bank 82,000

Disposal(part 38,000 Balance c/d 120,000

exchange)

180,000 180,000

Balance b/d 120,000

Provision for depreciation: Motor Vehicles Account

Disposal 24,000 Balance b/d 24,000

Balance c/d 12,000 Income statement 12,000

36,000 36,000

R Jirivengwa 0772772166 /0717779401

Motor vehicle Disposal Account

Motor vehicle 60,000 Accumulated 24,000

depreciation

Income 2,000 Motor vehicle(part 38,000

statement(profit on exchange)

disposal)

62,000 62,000

Choice of depreciation method

Straight line method

Should be used for assets that are expected to earn revenue evenly over their useful working lives. It is

also generally used where the pattern of an asset’s earning power is uncertain.

It should always be used to amortise the cost of assets with fixed lives eg leases

Reducing balance method

Should be used when it is considered that an asset’s earning power will diminish as the asset gets older.

It is also used when the asset loses more of its value in the early years of its life e.g motor car

Provisions for depreciation and the accounting concepts

Matching concept

The cost of using non-current assets to earn revenue should be matched in the Income Statement to the

revenue earned.

Prudence

If the cost of using non-current assets was not included in the income statement profit would be

overstated.

Journal entry for depreciation

Depreciation (income statement) XXX

Provision for depreciation: Asset XXX

Depreciation is not recorded in the asset account but in a separate Provision for Depreciation Account.

Balance Sheet extract

COST DEPRECIATION NET BOOK VALUE

NON-CURRENT ASSET

Motor vehicles XXX XXX XXX

R Jirivengwa 0772772166 /0717779401

Non-current asset schedule

Buildings Motor vehicles Total

COST

Opening balance XXX XXX XXX

Additions XXX XXX XXX

Disposal XXX XXX XXX

Closing balance XXX XXX XXX

DEPRECIATION

Opening Balance XXX XXX XXX

Charge for the year XXX XXX XXX

Disposals XXX XXX XXX

Closing balance XXX XXX XXX

NBV at opening XXX XXX XXX

NBV at closing XXX XXX XXX

ZIMSEC J2009 P2 Q3

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

R Jirivengwa 0772772166 /0717779401

c) Explain whether Intercity Limited can change its depreciation method from straight

line to reducing balance method(2)

Zimsec November 2010 P2

1 (a) (i) Motor vehicle Account (5) (ii) Provision for depreciation of motor van (11)

(iii) The Disposal Account (4)

b) The accountant of Tashinga Limited feels that the reducing balance is a better method of

depreciating motor vehicles.(i) State 2 advantages of the reducing balance method (2)

(ii) Explain whether it is permissible for Tashinga Limited to change from straight line method to

reducing balance method.

R Jirivengwa 0772772166 /0717779401

You might also like

- Tutorial Week 3 QuestionsDocument9 pagesTutorial Week 3 QuestionsShermaine WanNo ratings yet

- 01 - FS AnalysisDocument17 pages01 - FS AnalysisRyzel Borja0% (1)

- Income Statement TaskDocument5 pagesIncome Statement Taskiceman2167No ratings yet

- Chapter 10 Impairment of Assets (Pas 36)Document11 pagesChapter 10 Impairment of Assets (Pas 36)Krissa Mae Longos100% (1)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Document71 pagesCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNo ratings yet

- Consolidated Financial Statements: On Date of Business CombinationDocument53 pagesConsolidated Financial Statements: On Date of Business Combinationankursharma06No ratings yet

- Week 3 - Non-Current AssetsDocument55 pagesWeek 3 - Non-Current AssetsAishath Nisfa MohamedNo ratings yet

- NCERT Solutions For Class 11 Accountancy Chapter 10 Financial Statements - 2Document90 pagesNCERT Solutions For Class 11 Accountancy Chapter 10 Financial Statements - 2Badal singh ThakurNo ratings yet

- Impairment of AssetDocument10 pagesImpairment of AssetJerome_JadeNo ratings yet

- Depreciation O Level NotesDocument5 pagesDepreciation O Level NotesBijoy SalahuddinNo ratings yet

- Chapter 10 Impairment of Assets (Pas 36)Document11 pagesChapter 10 Impairment of Assets (Pas 36)Princess TaoinganNo ratings yet

- Chapter 7 To Chapter 9: CorrectDocument10 pagesChapter 7 To Chapter 9: CorrectChaiz MineNo ratings yet

- May 2017Document15 pagesMay 2017Cayden FavaNo ratings yet

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDocument4 pagesThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresNo ratings yet

- Exam 2Document19 pagesExam 2SHE50% (2)

- IFRS - Lecture Cash Flow (For Self-Srudy)Document77 pagesIFRS - Lecture Cash Flow (For Self-Srudy)KristenNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Exercises On Cash Flow Statement AnalysisDocument3 pagesExercises On Cash Flow Statement AnalysisBoa HancockNo ratings yet

- Multiple Choice On Cash Flow StatementDocument7 pagesMultiple Choice On Cash Flow StatementLongtan JingNo ratings yet

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocument19 pagesIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- PAS 36 Impairment of AssetsDocument8 pagesPAS 36 Impairment of AssetswalsondevNo ratings yet

- Quiz Chapter-6 7 - 8 9 10-11Document8 pagesQuiz Chapter-6 7 - 8 9 10-11Rizeth Ahne Marie GarayNo ratings yet

- Midterm Exam - LUNADocument22 pagesMidterm Exam - LUNAJoyce LunaNo ratings yet

- Acctg 11 Finals Q2 and Q3 AnswerkeyDocument17 pagesAcctg 11 Finals Q2 and Q3 AnswerkeyCrazy Solo67% (3)

- Acctg11finalsq2andq3answerkey PDF FreeDocument17 pagesAcctg11finalsq2andq3answerkey PDF FreeMichael Brian TorresNo ratings yet

- Final Revision Part 2 Language (2st)Document21 pagesFinal Revision Part 2 Language (2st)Magdy KamelNo ratings yet

- Lect 11a Depreciation (Part 1)Document18 pagesLect 11a Depreciation (Part 1)11Co sarahNo ratings yet

- LU3 Depreciation PresentationDocument45 pagesLU3 Depreciation PresentationShweta SinghNo ratings yet

- Chapter 23 - Impairment of AssetsDocument10 pagesChapter 23 - Impairment of AssetsXiena50% (2)

- Solution CMA December 2019 ExamDocument10 pagesSolution CMA December 2019 ExamF A Saffat RahmanNo ratings yet

- Bac 315Document11 pagesBac 315maisie laneNo ratings yet

- Ias 7 Cash Flow Statement ContinuedDocument8 pagesIas 7 Cash Flow Statement ContinuedMichael Bwire100% (1)

- +1 Acc Model Hly Ans (EM) 2022Document7 pages+1 Acc Model Hly Ans (EM) 2022BABA AssociatesNo ratings yet

- Depreciation Research WorkDocument7 pagesDepreciation Research Workgargbhavika875No ratings yet

- Accounting Treatment of DepreciationDocument5 pagesAccounting Treatment of Depreciationwebsurfer755100% (3)

- CH7 - DiscussionDocument8 pagesCH7 - DiscussionRichell ArtuzNo ratings yet

- Individual Assignment OneDocument3 pagesIndividual Assignment OnefeyselNo ratings yet

- CFAS-Reviewer PAS32.33.34.36Document7 pagesCFAS-Reviewer PAS32.33.34.36PotatoNo ratings yet

- Problem: 1Document8 pagesProblem: 1PRIYA SHARMA EPGDIB (On Campus) 2019-20No ratings yet

- ACC2010 Sample Final ExamDocument19 pagesACC2010 Sample Final ExamHarjot SinghNo ratings yet

- 18.2 - Notes WK 6 - Asset DisposalDocument8 pages18.2 - Notes WK 6 - Asset DisposalDenzel RasodiNo ratings yet

- Nov 2022 P13Document12 pagesNov 2022 P13Toshna RawoteeaNo ratings yet

- Adjusting Entry TypesDocument15 pagesAdjusting Entry TypesRaviSankarNo ratings yet

- Unit 5 - Depreciation - Chat Session 8 (Spring 2020)Document5 pagesUnit 5 - Depreciation - Chat Session 8 (Spring 2020)RealGenius (Carl)No ratings yet

- Lect 11c Depreciation-Disposals (Part 3)Document17 pagesLect 11c Depreciation-Disposals (Part 3)11Co sarahNo ratings yet

- Financial Analysis Test 2Document8 pagesFinancial Analysis Test 2Alaitz GNo ratings yet

- Cash FlowsDocument15 pagesCash FlowsAkshat DwivediNo ratings yet

- Practice Questions - Cash FlowDocument13 pagesPractice Questions - Cash FlowMariamNo ratings yet

- Drawing Financial Statements and ProjectionsDocument36 pagesDrawing Financial Statements and ProjectionsAaron MushunjeNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- Тasks for individual workDocument7 pagesТasks for individual workДарина БережнаяNo ratings yet

- Corporate Reporting Assignment 1 - GroupDocument18 pagesCorporate Reporting Assignment 1 - GroupangelaNo ratings yet

- Quiz - Chapter 23 - Impairment of AssetsDocument10 pagesQuiz - Chapter 23 - Impairment of Assetsjiachi.04212004No ratings yet

- Cash Flow StatementDocument55 pagesCash Flow StatementPanktiNo ratings yet

- AS Level MCQ - GroverDocument52 pagesAS Level MCQ - GroverVineet GroverNo ratings yet

- Accounting & Financial Systems (Lecture 7)Document20 pagesAccounting & Financial Systems (Lecture 7)Right Karl-Maccoy HattohNo ratings yet

- Self-Learning Kit: Region I Schools Division of Ilocos Sur Bantay, Ilocos SurDocument13 pagesSelf-Learning Kit: Region I Schools Division of Ilocos Sur Bantay, Ilocos SurLiam Aleccis Obrero CabanitNo ratings yet

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- INCOMPLETE RECORDS O LevelDocument5 pagesINCOMPLETE RECORDS O LevelRECALL JIRIVENGWA100% (1)

- Adjustments Income Statement and Balance Sheet ExercisesDocument2 pagesAdjustments Income Statement and Balance Sheet ExercisesRECALL JIRIVENGWANo ratings yet

- R2117455Q Dissertation Recall Jirivengwa FinalDocument77 pagesR2117455Q Dissertation Recall Jirivengwa FinalRECALL JIRIVENGWANo ratings yet

- Weather and Climate 2022Document41 pagesWeather and Climate 2022RECALL JIRIVENGWA100% (1)

- Maloba Dairy Farm Dep 600Document43 pagesMaloba Dairy Farm Dep 600Carol SoiNo ratings yet

- 01a CAPEX Overview - Basic (LH)Document25 pages01a CAPEX Overview - Basic (LH)herman rinaldiNo ratings yet

- Goat Fattening Rs. 0.85 MillionDocument18 pagesGoat Fattening Rs. 0.85 MillionZakir Ali100% (1)

- Satnam Overseas LimitedDocument12 pagesSatnam Overseas LimitedRavishankar ManthaNo ratings yet

- Principles of Accounting (Chapter-01) Lecture Sheet BBA VISIONDocument9 pagesPrinciples of Accounting (Chapter-01) Lecture Sheet BBA VISIONJareen Binte AsadNo ratings yet

- Infosys Annual Report 2018-19Document1 pageInfosys Annual Report 2018-19Prachi SharmaNo ratings yet

- SER Plagiarism ReportDocument5 pagesSER Plagiarism ReportmayankNo ratings yet

- Answers To The Overall Questions of Chapter SevenDocument3 pagesAnswers To The Overall Questions of Chapter SevenHamza MahmoudNo ratings yet

- The Expenditure Cycle: Payroll Processing and Fixed Asset ProceduresDocument19 pagesThe Expenditure Cycle: Payroll Processing and Fixed Asset ProceduresHassanNo ratings yet

- 2022 ALTEN Annual Results PresentationDocument39 pages2022 ALTEN Annual Results PresentationMed ElkotbiNo ratings yet

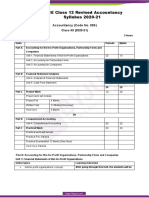

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- BUSINESS PLAN - Kids Clothing TradeDocument21 pagesBUSINESS PLAN - Kids Clothing TradeAbel GetachewNo ratings yet

- CH 09Document52 pagesCH 09mohammed faraazNo ratings yet

- Research Papers Related To Sri Lanka Software IndustryDocument7 pagesResearch Papers Related To Sri Lanka Software Industryefeq3hd0No ratings yet

- Paper - ABRCD - Putting The Asset in Rural Community DevelopmentDocument10 pagesPaper - ABRCD - Putting The Asset in Rural Community DevelopmentDr. Rhys Evans100% (2)

- Chapter 12 - Job-Order-Process and Hybrid Costing SystemsDocument52 pagesChapter 12 - Job-Order-Process and Hybrid Costing Systems朱潇妤100% (2)

- FM AssignmentDocument12 pagesFM AssignmentNurul Ariffah100% (1)

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Cup 1 - FARDocument8 pagesCup 1 - FARRojParconNo ratings yet

- Business Plan - MarecakesDocument53 pagesBusiness Plan - MarecakesJerome ManayanNo ratings yet

- Toa - Investment Property - AgricultureDocument7 pagesToa - Investment Property - AgricultureCookie143No ratings yet

- كيف تجتاز امتحانات البنوك PDFDocument60 pagesكيف تجتاز امتحانات البنوك PDFwhoamiNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

- Chapter 4 F7Document47 pagesChapter 4 F7Kelvin MasekoNo ratings yet

- Account For MaterialDocument25 pagesAccount For Materialshrestha.aryxnNo ratings yet

- Activity - Home Office, Branch Accounting & Business Combination (REVIEWER MIDTERM)Document11 pagesActivity - Home Office, Branch Accounting & Business Combination (REVIEWER MIDTERM)Paupau100% (1)

- SALN2012 (vs1994)Document10 pagesSALN2012 (vs1994)akalamoNo ratings yet

- 1199SEIU United Healthcare East 2021 FinancesDocument241 pages1199SEIU United Healthcare East 2021 FinancesLaborUnionNews.comNo ratings yet