Professional Documents

Culture Documents

Segment O and N

Segment O and N

Uploaded by

karina petersOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Segment O and N

Segment O and N

Uploaded by

karina petersCopyright:

Available Formats

Functional Specification

Segment O and N

BR Brasil

Date: 07.05.2018 pag 1 de 20

Index

1 Requirement....................................................................................................................3

2 Payment Methods strucutres......................................................................................4

2.1 Segment “O” Structure – Concessionaria...................................................................................4

2.2 Segment “N” Structure.....................................................................................................................6

2.2.1 Segment “N” – detail DARF...........................................................................................................6

2.2.2 Segment “N” – detail GPS.............................................................................................................9

2.2.3 Segment “N” – detail ICMS.........................................................................................................11

2.2.4 Segment “N” – detail FGTS.........................................................................................................13

3 Detailed Functional Requirements..........................................................................15

3.1 Segment “O” Functional Specification – Concessionaria....................................................15

3.2 Segment “O” and “N” upload program j_1bbr20....................................................................20

Date: 07.05.2018 pag 2 de 20

1 Requirement

The DME structure for Payment Methods Concessionária and Tax Payment will be copied as template

from Boleto Segment J. The template structure is defined in the include RFFORIY2 from report

RFFOBR_U.

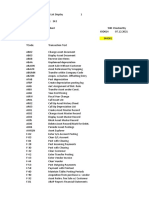

DME structures for Itau and Febraban

file header j_1bdmexh1

lot header j_1bdmexh2

details, segment J j_1bdmexj

lot trailer j_1bdmext2

file trailer j_1bdmext1

Date: 07.05.2018 pag 3 de 20

2 Payment Methods strucutres

2.1 Segment “O” Structure – Concessionaria

The DME file is created when payment method and barcode field met the following requirements:

If REGUH-UBNKL(3) = 341

Payment method = “O” (Field: REGUH-RZAWE)

Invoice Barcode = starts with “8” (Field: RF05L-BRCDE (1) = 8 (BRCDE = REGUP-ESRNR & REGUP-

ESRRE & REGUP-DMBTR)

The DME Concessionária structures are going to be created according following specifications:

File header

Same structure as j_1bdmexh1

Lot header

Same structure as J_1bdmexh2 with changes in following field:

H207 (DME position 014 to 016) = '030' *fixo.

Segment O

Same structure as j_1bdmexj with changes in following fields:

Segment_O Layout Entries from J_1BDMEXJ

Field Name Bank Description Position Segment_O fields Component Lenght Structure Description

Código Banco na first three digits for house bank

Compensação key, e.g. '341' for Itau

Código do Banco 001 003 =J01 J01 3

Lot control (for header '0000',

for trailer '9999')

Código do Lote Lote de Serviço 004 007 =J02 J02 4

Registro Detalhe de record type, e.g. '0' for the

Lote header

Tipo de Registro 008 008 =J03 J03 1

Número do Nº Sequencial Registro

Registro no Lote

009 013 =J04 J04 5 record number

Código Segmento Reg.

Detalhe

Segmento 014 014 Fixed = “O” J05 1 Segment type

Tipo de

Movimento

Tipo de Movimento 015 017 =J06 J06 3 Tipo de movimento

BRCDE = REGUP-ESRNR & REGUP-

ESRRE & REGUP-DMBTR

código de barras código de barras 018 065 Defined in Column F

Nome da

concessionária

concessionária 066 095 =J12 J12 30 Partner name

DATA DO VENCIMENTO

(NOMINAL)

DATA VENCTO 096 103 =J13 J13 8 Due date, format DDMMYYYY

Date: 07.05.2018 pag 4 de 20

Fixed value Defined in Column

F

moeda tipo de moeda 104 106 REA

quantidade Fixed value Defined in Column

moeda F

quantidade de moeda 107 121 “000000000000000”

VALOR previsto do

pagamento

valor a pagar 122 136 =J14 J14 15 Nominal value

DATA

PAGAMENTO

DATA DO PAGAMENTO 137 144 =J17 J17 8 Value date, format DDMMYYYY

VALOR de efetivação

DO PAGAMENTO

VALOR PAGo 145 159 “zeros” J18 15 Amount in Reais “zeros”

complemento de

registro

brancos 160 174 =J19 J19 15 Fines, always “Blanks”

nº docto ATRIBUÍDo

PELa empresa

seu número 175 194 =J20 J20 20 Seu Numero

complemento de

registro

brancos 195 215 =J21 J21 13 13 blanks

número atribuído pelo

banco

NOSSO Número 216 230 “Blanks” J22 15 Nosso Numero “Blanks”

CÓDIGO DE

OCORRÊNCIAS P/

Return code, blank when

RETORNO

sending “Blanks”

Lot trailer

Same structure as j_1bdmext2

File trailer

Same structure as j_1bdmext1 with changes in following Field:

j_1bdmext1-t107(6) = ' ' *6 positions = blank. (DME Position 30 to 35)

Date: 07.05.2018 pag 5 de 20

2.2 Segment “N” Structure

The DME file is created when payment method and barcode field met the following requirements:

If REGUH-UBNKL(3) = 341

Payment method = “N” (Field: REGUH-RZAWE)

The DME structures are going to be created according following specifications:

DARF

GPS

ICMS

FGTS

The above templates uses the following Invoice document fields to complement the DME creation:

XBLNR: Tax payment code (Código de pagamento)

BKTXT: Additional Infomation (Informações complementares)

ZUONR: Reference (Referência) – CNPJ of payer

KIDNO: Other entitites amount (Valor de outras entidades)

The additional tables:

Table ZTB00024:

Table to store interest GL account (687000).

Table to store fine GL account (750900).

Table ZTB00022:

Content for field XBLNR of DARF template details

Content for field XBLNR of GPS template details

2.2.1 Segment “N” – detail DARF

DME Structures - file header, lot header, segment N, lot trailer and file trailer:

File header

Same structure as j_1bdmexh1

Lot header

Date: 07.05.2018 pag 6 de 20

Same structure as J_1bdmexh2 with changes in following field:

H205 (DME position 010 to 011) = '22' *fixo.

H206 (DME position 012 to 013) = '16' *fixo.

Segment N

Same structure as j_1bdmexj with changes in following fields:

Segment_N Layout Entries from J_1BDMEXJ

Bank

Field Name Description Position Conteúdo Component Lenght Structure Description

Código Banco

Código do Banco na 001 003 =J01 J01 3 first three digits for house bank

Compensação key, e.g. '341' for Itau

Lot control (for header '0000', for

Código do Lote Lote de Serviço 004 007 =J02 J02 4 trailer '9999')

Registro Ctg.de registro, p.ex. '0' para

Tipo de Registro Detalhe de Lote 008 008 3 J03 1 cabeçalho

Nº Sequencial

Número do Registro no 009 013 =J04 J04 5 record number

Registro Lote

Código

Segmento Segmento Reg. 014 014 N J05 1 Tipo de segment

Detalhe

Tipo de Tipo de

Movimento Movimento 015 017 =J06 J06 3 Tipo de movimento

dados de

dados do tributo identificação do 018 195 Details (*)

tributo

nº docto

ATRIBUÍDo PELa

seu número empresa 196 215 =J21 J21 13 13 blanks

número

NOSSO Número atribuído pelo 216 230 =J22 J22 15 Nosso Numero

banco

CÓDIGO DE

OCORRÊNCIAS OCORRÊNCIAS 231 240 =J23 J23 10 Return code, blank when sending

P/ RETORNO

*Details (DARF)

Position in DME file:

018 to 019 = 02 (Darf)

020 to 023 = informação da (REGUP-XBLNR)

Date: 07.05.2018 pag 7 de 20

Entries available for REGUP-XBLNR = 0422, 0473, 0561, 0588, 1150, 1708, 2089, 2172, 2362,

2372, 2484, 3208, 3280, 3426, 5706, 5856, 5939, 5952, 5960, 5979, 5987, 6256, 6912, 8045, 8109

and 8741 (Stored in table Z_FI_CONTAS_DARF)

024 to 024 = 2 (fixed)

025 to 038 = Field from Structure (CNPJ contribuinte) J_1BDMEXH1- H106

039 to 046 = Calculation Period (Período de apuração) BKPF-BLDAT

047 to 063 = Refence from assignment field REGUP-ZUONR

064 to 077 = Net Amount (Valor do Principal) REGUP-WRBTR

078 to 091 = Fine amount (Valor da Multa) – Amount posted in accounts from table

Z_FI_CONTAS_MULTA (fields like HKONT)

092 to 105 = interest amount (Valor dos juros) – Amount posted in accounts from table

Z_FI_CONTAS_JUROS (fields like HKONT)

106 to 119 = Total amount – Sum of 3 previous fields (Net Amount + Fine Amount +

Interest amount)

120 to 127 = Net due date (Data de Vencimento) – E_FAEDT from FM:

NET_DUE_DATE_GET (Import I_ZFBDT, I_ZBD1T, I_ZBD2T, I_ZBD3T)

128 to 135 = Payment date (Data do pagamento) – BSAK-AUGDT

136 to 165 = Blank

166 to 195 = Company Code (Nome do Contribuinte) – T001-BUTXT

Lot trailer

Same structure as j_1bdmext2 with changes in following Fields:

024 to 037 = Sum of all records of Net Amount (Valor do Principal 064 to 077).

038 to 051 = Sum values from all documents with content populated in field BSEG-KIDNO.

052 to 065 = Sum all values in GL account in tables Z_FI_CONTAS_JUROS and

Z_FI_CONTAS_MULTA.

066 to 079 = Sum of values of REGUP-WRBTR from all BELNR

080 to 240 = Blank

File trailer

Same structure as j_1bdmext1 with changes in following Field:

j_1bdmext1-t107(6) = ' ' *6 positions = blank. (DME Position 30 to 35)

Date: 07.05.2018 pag 8 de 20

2.2.2 Segment “N” – detail GPS

DME Structures - file header, lot header, segment N, lot trailer and file trailer:

File header

Same structure as j_1bdmexh1

Lot header

Same structure as J_1bdmexh2 with changes in following field:

H205 (DME position 010 to 011) = '22' *fixo.

H206 (DME position 012 to 013) = '17' *fixo.

Segment N

Same structure as j_1bdmexj defined in topic: 2.2.1 Segment “N” DARF.

The details section from position 018 to 195 are described as follows:

*Details (GPS)

018 to 019 = ‘01’ (GPS)

020 to 023 = REGUP-XBLNR

Entries available for REGUP-XBLNR = 1406, 2100, 2119, 2208, 2216, 2631 and 2909 (Stored in

table Z_FI_CONTAS_INSS).

024 to 029 = mês e ano REGUP-BLDAT

030 to 043 = If position 020-023 (XBLNR) is 2631, this field is REGUP-ZUONR, else if it’s

the J_1BDMEXH1- H106 (CNPJ contribuinte).

044 to 057 = INSS Tax Amount REGUP-WRBTR minus amount in REGUP-KIDNO and

BSEG-WRBTR from accounts in tables: Z_FI_CONTAS_JUROS e

Z_FI_CONTAS_MULTA.

058 to 071 = Other entitites amount REGUP-KIDNO

072 to 085 = Evaluated Amount is the BSEG-WRBTR of GL accounts in table

Z_FI_CONTAS_JUROS.

086 to 099 = Amount REGUP-WRBTR

100 to 107 = Payment date (Data do pagamento) – BSAK-AUGDT

108 to 115 = Blank

116 to 165 = Enter information from field BKPF-BKTXT selected from BELNR

166 to 195 = Name of Payer. If position 020-023 (XBLNR) is 2631, get REGUP-ZUONR

and select LFA1-NAME1 with ZUONR=STCD1. Else if it’s the J_1BDMEXH1- H106

(CNPJ contribuinte)

Date: 07.05.2018 pag 9 de 20

166 to 195 = Company Code (Nome do Contribuinte) – T001-BUTXT

Lot trailer

Same structure as j_1bdmext2 with changes in following Fields:

024 to 037 = Sum of all records of Net Amount (Valor do Principal 044 to 057). If REGUP-

XBLNR is INSS (2100, 2119, 2208, 2216, 1406 or 2631) this amount must be deducted of

REGUP-KIDNO amount sum.

038 to 051 = Sum values from all documents with content populated in field BSEG-KIDNO.

052 to 065 = Sum all values in GL account in tables Z_FI_CONTAS_JUROS and

Z_FI_CONTAS_MULTA.

066 to 079 = Sum of all field 086 to 099 = Amount REGUP-WRBTR

080 to 240 = Blank

File trailer

Same structure as j_1bdmext1 with changes in following Field:

j_1bdmext1-t107(6) = ' ' *6 positions = blank. (DME Position 30 to 35)

Date: 07.05.2018 pag 10 de 20

2.2.3 Segment “N” – detail ICMS

DME Structures - file header, lot header, segment N, lot trailer and file trailer:

File header

Same structure as j_1bdmexh1

Lot header

Same structure as J_1bdmexh2 with changes in following field:

H205 (DME position 010 to 011) = '22' *fixo.

H206 (DME position 012 to 013) = '22' *fixo.

Segment N

Same structure as j_1bdmexj defined in topic: 2.2.1 Segment “N” DARF.

The details section from position 018 to 195 are described as follows:

*Details (ICMS)

018 to 019 = ‘05’ (ICMS)

020 to 023 = REGUP-XBLNR

Entries available for REGUP-XBLNR = 1200, 0462 and 1929 (Stored in table Z_FI_CONTAS_INSS).

024 to 024 = 1 (fixed)

025 to 038 = Field from Structure (CNPJ contribuinte) J_1BDMEXH1- H106

039 to 050 = State Tax Number (Inscrição Estadual) J_1BBRANCH-STATE_INSC)

051 to 063 = Número divida Ativa REGUP-ZUONR

064 to 069 = Month and year in format MMYYYY from REGUP-BLDAT

070 to 082 = Installment number (Número parcela/notificação) from BKPF-BXTXT

083 to 096 = ICMS Tax Amount REGUP-WRBTR minus amount BSEG-WRBTR from

accounts in tables: Z_FI_CONTAS_JUROS e Z_FI_CONTAS_MULTA

097 to 110 = interest amount (Valor dos juros) – Amount posted in accounts from table

Z_FI_CONTAS_JUROS (fields like HKONT)

111 to 124 = Fine amount (Valor da Multa) – Amount posted in accounts from table

Z_FI_CONTAS_MULTA (fields like HKONT)

125 to 138 = Payment Amount REGUP-WRBTR

139 to 146 = Net due date (Data de Vencimento) – E_FAEDT from FM:

NET_DUE_DATE_GET (Import I_ZFBDT, I_ZBD1T, I_ZBD2T, I_ZBD3T)

147 to 154 = Payment date (Data do pagamento) – BSAK-AUGDT

155 to 165 = Blank

Date: 07.05.2018 pag 11 de 20

166 to 195 = Company Code (Nome do Contribuinte) – T001-BUTXT

196 to 215 = Payment Document number REGUP-VBLNR

216 to 240 = Blank

Lot trailer

Same structure as j_1bdmext2 with changes in following Fields:

024 to 037 = Sum of all records of Net Amount (Valor do Principal 044 to 057). If REGUP-

XBLNR is INSS (2100, 2119, 2208, 2216, 1406 or 2631) this amount must be deducted of

REGUP-KIDNO amount sum.

038 to 051 = Sum values from all documents with content populated in field BSEG-KIDNO.

052 to 065 = Sum all values in GL account in tables Z_FI_CONTAS_JUROS and

Z_FI_CONTAS_MULTA.

066 to 079 = Sum of all field 125 to 138 = Amount REGUP-WRBTR

080 to 240 = Blank

File trailer

Same structure as j_1bdmext1 with changes in following Field:

j_1bdmext1-t107(6) = ' ' *6 positions = blank. (DME Position 30 to 35)

Date: 07.05.2018 pag 12 de 20

2.2.4 Segment “N” – detail FGTS

DME Structures - file header, lot header, segment N, lot trailer and file trailer:

File header

Same structure as j_1bdmexh1

Lot header

Same structure as J_1bdmexh2 with changes in following field:

H205 (DME position 010 to 011) = '22' *fixo.

H206 (DME position 012 to 013) = '35' *fixo.

Segment N

Same structure as j_1bdmexj defined in topic: 2.2.1 Segment “N” DARF.

The details section from position 018 to 195 are described as follows:

*Details (FGTS)

018 to 019 = ‘11’ (FGTS-GEFIP)

020 to 023 = REGUP-XBLNR

Entries available for REGUP-XBLNR = 150, 115 and 155 (Stored in table Z_FI_CONTAS_FGTS).

024 to 024 = 1 (fixed)

025 to 038 = Field from Structure (CNPJ contribuinte) J_1BDMEXH1- H106

039 to 086 = BarCode (RF05L-BRCDE) enter 44 positions

087 to 102 = FGTS identification REGUP-ZUONR

103 to 111 = Lacre da conectividade BKPF-BKTXT(9) (9 frist positions)

112 to 113 = Lacre da conectividade BKPF-BKTXT (2 last positions)

114 to 143 = Company Code (Nome do Contribuinte) – T001-BUTXT

144 to 151 = Payment date (Data do pagamento) – BSAK-AUGDT

152 to 165 = Payment Amount REGUP-WRBTR

166 to 195 = Blank

196 to 215 = Payment Document number REGUP-VBLNR

216 to 240 = Blank

Lot trailer

Date: 07.05.2018 pag 13 de 20

Same structure as j_1bdmext2 with changes in following Fields:

024 to 037 = Sum of all records of Net Amount (Valor do Principal 044 to 057). If REGUP-

XBLNR is INSS (2100, 2119, 2208, 2216, 1406 or 2631) this amount must be deducted of

REGUP-KIDNO amount sum.

038 to 051 = Sum values from all documents with content populated in field BSEG-KIDNO.

052 to 065 = Sum all values in GL account in tables Z_FI_CONTAS_JUROS and

Z_FI_CONTAS_MULTA.

066 to 079 = Sum of all field 125 to 138 = Amount REGUP-WRBTR

080 to 240 = Blank

File trailer

Same structure as j_1bdmext1 with changes in following Field:

j_1bdmext1-t107(6) = ' ' *6 positions = blank. (DME Position 30 to 35)

Date: 07.05.2018 pag 14 de 20

3 Detailed Functional Requirements

3.1 Segment “O” Functional Specification – Concessionaria

The payment method O Barcode starts with 8 and has 48 positions lengh. The field validation of

message 8B799, function module CONVERT_TO_BARCODE must be disable. The field have to free

for data entering.

Barcode function module:

CONVERT_BARCODE

Populate BSEG fields: ESRNR ESRRE

CONVERT_TO_BARCODE

Barcode numbering checking

ESRNR ISR Number

ESRRE ISR Reference Number

DMBTR Amount in LC

BARCODE = REGUP-ESRNR & REGUP-ESRRE & REGUP-DMBTR

Barcode template: 84660000007291510291100036152351009125121001

Date: 07.05.2018 pag 15 de 20

Badi updating: BOLETO_BARCODE_BR

In case barcode is written in 48 positions we have to convert into 44 to be written in DME file.

The conversion rule from 48 to 44 position is to remove the positions: 12, 24, 36 and 48:

Exemple:

Barcode 48 positions:

83630000017 8 05090053106 7 09216332900 3 20001537013 9

8 3 Digit

6 3 0 0 0 0 0 1 7 8 0 5 0 9 0 0 5 3 1 0 6 7 0 9 2 1 6 3 3 2 9 0 0 3 2 0 0 0 1 5 3 7 0 1 3 9

Position 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4

0 1 3 4 5 6 7 8 9 0 1 2 3 5 6 7 8 9 0 1 2 3 4 5 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 12 24 36 48

Result of barcode 44 positions:

83630000017050900531060921633290020001537013

Table BSEG for barcode storage:

ESRNR( ESRNR

4) DMBTR (11) + 4 (4) ESRRE (25)

8 3 6 3 0 0 0 0 0 1 7 0 5 0 9 0 0 5 3 1 0 6 0 9 2 1 6 3 3 2 9 0 0 2 0 0 0 1 5 3 7 0 1 3

1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4

0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9

ESRNR: 83630053

ESRRE: 1060921633290020001537013

DMBTR: 00000170509 (Campo da BSEG tem 13 posições 0000000170509. Eliminar dois zeros à

esquerda para escrever o código de barras)

Technical Details as example:

1. Copia implementação BAPI BOLETO_BARCODE_BR para ZBOLETO_BARCODE_BR.

Date: 07.05.2018 pag 16 de 20

Date: 07.05.2018 pag 17 de 20

Date: 07.05.2018 pag 18 de 20

2. Ativar nova implementação

3. Modifcar métodos IF_EX_BOLETO_BARCODE~REVERT. Insira o cõdigo abaixo na linha 67.

FIELD-SYMBOLS: <fs_ZLSCH> TYPE ANY.

ASSIGN ('(SAPMF05L)BSEG-ZLSCH') TO <fs_ZLSCH>.

IF <fs_ZLSCH> IS ASSIGNED.

IF <fs_ZLSCH> eq 'A' and

STRLEN( LV_BARCODE_CHAR ) EQ 47.

CONCATENATE LV_BARCODE_CHAR(11)

LV_BARCODE_CHAR+12(11)

LV_BARCODE_CHAR+24(11)

LV_BARCODE_CHAR+36(11)

into LV_BARCODE_CHAR.

ENDIF.

ENDIF.

4. Slution Test :

Enter FBL1N for company code 1820. Double click to select an item.

Date: 07.05.2018 pag 19 de 20

Date: 07.05.2018 pag 20 de 20

If the barcode is inserted with 48 positions then the numbering must be converted to 44 automatically:

83630000017050900531060921633290020001537013

Date: 07.05.2018 pag 21 de 20

After this point the standard automatic payment program must be run. Then we have DME fie creation.

3.2 Segment “O” and “N” upload program j_1bbr20

The report j_1bbr20 must be enhanced to upload file for Brazil in transaction FF.5 by report

RFEBKA00.

The below code must be updated for Segment ‘J’ and ‘O’ and ‘N’.

When ‘O’ the program will perform same logic as ‘J’.

When ‘N’ the program will perform same logic as ‘J’ and items_p_j-j18 = ‘zeros’

Date: 07.05.2018 pag 20 de 20

You might also like

- PROCESS DIRECTOR Import Guide 7.7.xDocument34 pagesPROCESS DIRECTOR Import Guide 7.7.xAshutosh MishraNo ratings yet

- Payments User Guide - English (2006)Document39 pagesPayments User Guide - English (2006)Gláucia CarvalhoNo ratings yet

- LayoutDocument2 pagesLayoutJohn KennedyNo ratings yet

- Aerospace Material Specification: Tolerances Nickel, Nickel Alloy, and Cobalt Alloy Sheet, Strip, and PlateDocument7 pagesAerospace Material Specification: Tolerances Nickel, Nickel Alloy, and Cobalt Alloy Sheet, Strip, and Platesunil karthickNo ratings yet

- CNAB 240 Standard (Santander Model)Document41 pagesCNAB 240 Standard (Santander Model)Eduardo Moreno NetoNo ratings yet

- Berger-Protective Coatings-S-Ravichandran - FEB 2019Document108 pagesBerger-Protective Coatings-S-Ravichandran - FEB 2019MOHD AZAMNo ratings yet

- SAP Community Network Wiki - ERP SCM - MM-IV-LIV-MRBR Invoice Release in LIV Transaction MRBRDocument5 pagesSAP Community Network Wiki - ERP SCM - MM-IV-LIV-MRBR Invoice Release in LIV Transaction MRBRMarsha LindsayNo ratings yet

- Overview On DMEE Tree With PMW Config StepsDocument33 pagesOverview On DMEE Tree With PMW Config StepsPallaviNo ratings yet

- Planday Restaurant KPIs Checklist Web FinalDocument4 pagesPlanday Restaurant KPIs Checklist Web FinalÓscar Correia100% (1)

- Segment O and NDocument20 pagesSegment O and Nkarina petersNo ratings yet

- T Code SAPDocument4 pagesT Code SAPGaparNo ratings yet

- DdaDocument3 pagesDdaregis0009No ratings yet

- Configuração Do SAP FSCM TRMDocument69 pagesConfiguração Do SAP FSCM TRMFelipeJonasNo ratings yet

- A) Introduction: Quick KDS InformationDocument11 pagesA) Introduction: Quick KDS InformationDillip Kumar mallickNo ratings yet

- FB01L Posting GL Document For Ledger GroupDocument5 pagesFB01L Posting GL Document For Ledger Grouplove_guy_1977No ratings yet

- SAPNOTE 3043409 - Brazilian Pix Payments in FinanceDocument9 pagesSAPNOTE 3043409 - Brazilian Pix Payments in FinanceAlmirFuncionalFINo ratings yet

- MB Roles Excel Sheet - 26042018Document150 pagesMB Roles Excel Sheet - 26042018Janmejaya SahooNo ratings yet

- Project TimelineDocument11 pagesProject TimelineNeetesh SoniNo ratings yet

- Advanced Foreign Currency Valuation - Public CloudDocument28 pagesAdvanced Foreign Currency Valuation - Public CloudBalajisriramNo ratings yet

- DMEE Configuration - Step by Step Part 2 - Sap 4 AllDocument5 pagesDMEE Configuration - Step by Step Part 2 - Sap 4 AllМаксим БуяновNo ratings yet

- AP322 FICO Special Purpose Ledger V0.8Document17 pagesAP322 FICO Special Purpose Ledger V0.8swainsatyaranjanNo ratings yet

- Automatic Clearing in SAP (Clear Open Items Automatically)Document23 pagesAutomatic Clearing in SAP (Clear Open Items Automatically)Shobhnath SinghNo ratings yet

- Al 11Document6 pagesAl 11jc_pedrazahNo ratings yet

- CL-9 SAP AuthorizationDocument13 pagesCL-9 SAP AuthorizationEVANo ratings yet

- Notas Localizacion ARg 1Document2 pagesNotas Localizacion ARg 1Viviana E. EstradaNo ratings yet

- S4HANA Document Status Uv1.0Document10 pagesS4HANA Document Status Uv1.0Priya Sangharsh NavadaNo ratings yet

- SAP System File UploadDocument6 pagesSAP System File UploadDeepak KumarNo ratings yet

- Best of SAP BI - Basic BI Configuration SettingsDocument19 pagesBest of SAP BI - Basic BI Configuration SettingsSharandeepNo ratings yet

- CJ88CapFinDepAsset PDFDocument15 pagesCJ88CapFinDepAsset PDFsrinivasNo ratings yet

- FI GL Create A Journal Entry and Initiate Workflow FV50 WIDocument12 pagesFI GL Create A Journal Entry and Initiate Workflow FV50 WIficosatyaNo ratings yet

- FS TTP Module Cheque PrintDocument9 pagesFS TTP Module Cheque PrintGhosh2No ratings yet

- T.code SAP FIDocument4 pagesT.code SAP FIanad12No ratings yet

- Sapnote 0000025709Document1 pageSapnote 0000025709Amit PaulNo ratings yet

- Dokumen - Tips Sap Jva Workshop Unit 2Document70 pagesDokumen - Tips Sap Jva Workshop Unit 2Jorge FOSNo ratings yet

- PRFI - Create Posting RunDocument6 pagesPRFI - Create Posting RunSenij Khan100% (1)

- Enable Liquidity PlanningDocument13 pagesEnable Liquidity PlanningUrandi MendesNo ratings yet

- Creating A LSMW Using Standard Batch or Direct Input RecordingDocument6 pagesCreating A LSMW Using Standard Batch or Direct Input RecordingRayreddyNo ratings yet

- MIRO User Exit During SAVE Read ItemsDocument3 pagesMIRO User Exit During SAVE Read ItemsspambartekzNo ratings yet

- PIS and COFINS ContributionsDocument2 pagesPIS and COFINS ContributionsRod Don PerinaNo ratings yet

- Simulado Sap Prova FI - TERP20Document1 pageSimulado Sap Prova FI - TERP20ijboNo ratings yet

- Sr. No. Business Scenario Transaction CodeDocument2 pagesSr. No. Business Scenario Transaction CodeAmit ShindeNo ratings yet

- FI Asset Accounting Configuration 1699127573Document142 pagesFI Asset Accounting Configuration 1699127573malickxdiallo100% (1)

- TCodes and Fiori AppsDocument40 pagesTCodes and Fiori Appspatrickbuchhorn21No ratings yet

- Credit Limit On Customer Level v2Document9 pagesCredit Limit On Customer Level v2Durga SNo ratings yet

- Transaction Code List S4HANADocument166 pagesTransaction Code List S4HANAAnonymous uxozDvwYNo ratings yet

- Sap Fi Ar DunningDocument18 pagesSap Fi Ar DunningAti Siti FathiahNo ratings yet

- FBCJ - Print Receipt: Community Topics Answers Blogs Events Programs Resources What's NewDocument5 pagesFBCJ - Print Receipt: Community Topics Answers Blogs Events Programs Resources What's NewMuhammad Azam SiddiquiNo ratings yet

- SAP Finance SAP Profit Center Tutorial 1674309483Document10 pagesSAP Finance SAP Profit Center Tutorial 1674309483Ramesh GNo ratings yet

- TDF SPED Register Coverage 2022-11-18Document11 pagesTDF SPED Register Coverage 2022-11-18PatriciaNo ratings yet

- SAP FI Config GuideDocument85 pagesSAP FI Config GuideSeyefe MenegestuNo ratings yet

- MR11 - GR / IR Clearing Account Maintenance: Cost Center AccountingDocument12 pagesMR11 - GR / IR Clearing Account Maintenance: Cost Center AccountingJyoti BugadeNo ratings yet

- Asset Class Company Code Asset DescriptionDocument13 pagesAsset Class Company Code Asset DescriptionJit GhoshNo ratings yet

- ABAP Proxy To File On SAP PI 731Document40 pagesABAP Proxy To File On SAP PI 731benk joviNo ratings yet

- S4 Hana Transaction CodesDocument18 pagesS4 Hana Transaction Codesshamshu zamanNo ratings yet

- Data Volume Management For SAP For RetailDocument65 pagesData Volume Management For SAP For RetailJose Humberto RestrepoNo ratings yet

- Ansi Micron X12 Invoice MRSDocument65 pagesAnsi Micron X12 Invoice MRSMichael Angelo SantosNo ratings yet

- Fisher Scientific Edi Specifications 810 Invoice Customer GuideDocument20 pagesFisher Scientific Edi Specifications 810 Invoice Customer Guidejeffa123No ratings yet

- System Configuration Template - AP Payment File - MalaysiaDocument20 pagesSystem Configuration Template - AP Payment File - MalaysiatunguitvnNo ratings yet

- REP-147-AR TW B0401 Credit Memo IssuedDocument164 pagesREP-147-AR TW B0401 Credit Memo IssuedRipendra KumarNo ratings yet

- 1 - UTS - Latihan 1Document24 pages1 - UTS - Latihan 1LusianaaNo ratings yet

- S No. T Code Name of Code Details GivenDocument17 pagesS No. T Code Name of Code Details GivenPravesh PangeniNo ratings yet

- k117 Zor MixandmatchdiscountDocument1 pagek117 Zor MixandmatchdiscountTim VanceNo ratings yet

- T-Code Descripion New T-CodeDocument15 pagesT-Code Descripion New T-CodeAarti GuptaNo ratings yet

- CHAPTER 3 - The Revised Chart of AccountsDocument16 pagesCHAPTER 3 - The Revised Chart of AccountsRafael VictoriaNo ratings yet

- 7 Principles of Creative Problem SolvingDocument2 pages7 Principles of Creative Problem SolvingDinh TranNo ratings yet

- SocialMediainthePublicSector Mergel 2016 EncyPAPS.1Document5 pagesSocialMediainthePublicSector Mergel 2016 EncyPAPS.1Kenio FilhoNo ratings yet

- Afa Ii Assignment IiDocument2 pagesAfa Ii Assignment Iiworkiemelkamu400100% (1)

- Board Resolution Format (Boom Pump)Document2 pagesBoard Resolution Format (Boom Pump)T YeshwathNo ratings yet

- Project Report ON Ornaments Manufacturing (Silver, Gold, Bronze and Other Metels) Under P.M.E.G.PDocument7 pagesProject Report ON Ornaments Manufacturing (Silver, Gold, Bronze and Other Metels) Under P.M.E.G.PGlobal Law FirmNo ratings yet

- Ty Baf Sem Vi Regular Exam Sample PapersDocument33 pagesTy Baf Sem Vi Regular Exam Sample PapersDurvasNo ratings yet

- Knjigapriča - Pitch DeckDocument13 pagesKnjigapriča - Pitch DeckNikola ObradovicNo ratings yet

- OmanAir Cargo Worldwide Contacts 2016Document32 pagesOmanAir Cargo Worldwide Contacts 2016Wasim Shah100% (1)

- Noosa Boathouse - Employee Handbook 2021Document42 pagesNoosa Boathouse - Employee Handbook 2021Raj GaneshNo ratings yet

- Dell CLNT Config Toolkit v2.1.1 User's Guide2 en UsDocument14 pagesDell CLNT Config Toolkit v2.1.1 User's Guide2 en Uskhopdi_number1No ratings yet

- Use The Following Information For The Next Two QuestionsDocument7 pagesUse The Following Information For The Next Two QuestionsJohn Carlo Aquino0% (1)

- Abdul GhaniDocument4 pagesAbdul Ghaniengrabdul ghaniNo ratings yet

- Hitting The Mark: Improving The Credibility of Industry Methane DataDocument39 pagesHitting The Mark: Improving The Credibility of Industry Methane DataMARIA LOZANONo ratings yet

- HBS 4110-Fall 19 2 0 002Document11 pagesHBS 4110-Fall 19 2 0 002Vinay JaddumahanthiNo ratings yet

- Level 6 Diploma in Business Management Leadership and Innovation - Delivered Online by LSBR, UKDocument19 pagesLevel 6 Diploma in Business Management Leadership and Innovation - Delivered Online by LSBR, UKLSBRNo ratings yet

- Controls and Process 2018Document66 pagesControls and Process 2018spandanNo ratings yet

- Balance SheetDocument1 pageBalance SheetPatriciaNo ratings yet

- Gantt Chart Example For ThesisDocument7 pagesGantt Chart Example For Thesisbsbbq7qp100% (2)

- SEC-Cover - Sheet-for-AFSDocument13 pagesSEC-Cover - Sheet-for-AFSArlene FelicianoNo ratings yet

- Advanced Income Tax Solutions PDFDocument214 pagesAdvanced Income Tax Solutions PDFelenaNo ratings yet

- Extracts From BS.4235:Pt 1: Metric KeywaysDocument2 pagesExtracts From BS.4235:Pt 1: Metric KeywaysAnonymous TG3lMENo ratings yet

- Additional Notes - Chapter 5 - Overview of Risk and ReturnDocument7 pagesAdditional Notes - Chapter 5 - Overview of Risk and ReturnPaupauNo ratings yet

- IT QuestionsDocument15 pagesIT QuestionsRajesh SaxenaNo ratings yet

- MAT Feb-2019 Registration Form: Personal ParticularsDocument2 pagesMAT Feb-2019 Registration Form: Personal ParticularsNikita ChandukaNo ratings yet

- SWOT AnalysisDocument13 pagesSWOT AnalysisEdchel EspeñaNo ratings yet

- ECM Calibration Download Instructions PDFDocument11 pagesECM Calibration Download Instructions PDFArtemio Garcia BarrientosNo ratings yet