Professional Documents

Culture Documents

Nps Scheme - E (Tier-I)

Nps Scheme - E (Tier-I)

Uploaded by

SRIKANTA ROUTCopyright:

Available Formats

You might also like

- Study of Customer Satisfaction Towards HDFC BankDocument58 pagesStudy of Customer Satisfaction Towards HDFC BankNeeraj Verma69% (29)

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - E (Tier-Ii)Document1 pageNps Scheme - E (Tier-Ii)VenkateshMedidiNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)VenkateshMedidiNo ratings yet

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- Scheme E2 - 2Document1 pageScheme E2 - 2SanjayNo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)glorymatrixNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- Scheme A - 9Document1 pageScheme A - 94296tNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- Investment Approach Key Features & Portfolio AttributesDocument3 pagesInvestment Approach Key Features & Portfolio AttributesAkash JoshiNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- Scheme A 1 July 2021Document1 pageScheme A 1 July 2021amar srinivasNo ratings yet

- Nps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedshrikanhaiyyaNo ratings yet

- MO NTDOP One Pager Oct'22Document3 pagesMO NTDOP One Pager Oct'22Himanshu TamrakarNo ratings yet

- India's 3PL 2018 - Based On Service: Freight Forwarding 2.78Document20 pagesIndia's 3PL 2018 - Based On Service: Freight Forwarding 2.78Adithya PrabuNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- ACE - Fundtech LargeCap BA-FOTMDocument16 pagesACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNo ratings yet

- MO IOP-One-Pager Oct'22Document2 pagesMO IOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- MO BOP-One-Pager Oct'22Document3 pagesMO BOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- MO FMS One Pager Oct'22Document2 pagesMO FMS One Pager Oct'22Himanshu TamrakarNo ratings yet

- Bajaj Fin Serv NfoDocument26 pagesBajaj Fin Serv NfosonalNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Short Term Funds Comparision - Fund CompareDocument7 pagesShort Term Funds Comparision - Fund CompareANmolNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- Contact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniDocument17 pagesContact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniNarendran NareshNo ratings yet

- Bei 3Document25 pagesBei 3Anggih Nur HamidahNo ratings yet

- Cresent CottonDocument6 pagesCresent CottonIhsan danishNo ratings yet

- Finance Task-6Document2 pagesFinance Task-6Manish SharmaNo ratings yet

- Jupiter India Select Factsheet PA Retail LU0329071053 en GB PDFDocument4 pagesJupiter India Select Factsheet PA Retail LU0329071053 en GB PDFAlly Bin AssadNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Meezan Strategic Allocation Plan-III (Msap-Iii) : February, 2017Document17 pagesMeezan Strategic Allocation Plan-III (Msap-Iii) : February, 2017Zufa KanwalNo ratings yet

- 11 Chapter5Document122 pages11 Chapter5hareshNo ratings yet

- Strategy - Kotak - 12th OctDocument38 pagesStrategy - Kotak - 12th OctVasumathi SubramanianNo ratings yet

- Jupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFDocument4 pagesJupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFSaif MonajedNo ratings yet

- Strategy: Portfolio Perspectives: Safe and SelectiveDocument15 pagesStrategy: Portfolio Perspectives: Safe and SelectiveRecrea8 EntertainmentNo ratings yet

- Q1 Target Vs Ach FY 24-25 - TFPPLDocument8 pagesQ1 Target Vs Ach FY 24-25 - TFPPLMukul BansalNo ratings yet

- Microfinance PulseDocument24 pagesMicrofinance PulseNitin GuptaNo ratings yet

- Net Income Based Operating Income Based EBITDA Based Gross Income BasedDocument2 pagesNet Income Based Operating Income Based EBITDA Based Gross Income BasedAl-Quran DailyNo ratings yet

- Invesco India Infrastructure FundDocument17 pagesInvesco India Infrastructure FundArmstrong CapitalNo ratings yet

- Banking & Financials FundDocument23 pagesBanking & Financials FundArmstrong CapitalNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Organization - GROWTH ARROW: Mr. Megesh Prof. Arpan AnandDocument14 pagesOrganization - GROWTH ARROW: Mr. Megesh Prof. Arpan AnandZafar AlamNo ratings yet

- Collective Insights: Minutes From Our Morning MeetingDocument2 pagesCollective Insights: Minutes From Our Morning Meetingapi-63645244No ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- 10 1016@j Pacfin 2018 09 003Document18 pages10 1016@j Pacfin 2018 09 003gogayin869No ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- Manulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFDocument2 pagesManulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFHetanshNo ratings yet

- Time Series: Applications to Finance with R and S-PlusFrom EverandTime Series: Applications to Finance with R and S-PlusRating: 4 out of 5 stars4/5 (1)

- Delivery Service TNCDocument1 pageDelivery Service TNCSRIKANTA ROUTNo ratings yet

- Click Here: Covid Guidelines: Hotel DetailsDocument4 pagesClick Here: Covid Guidelines: Hotel DetailsSRIKANTA ROUTNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- CDF SPC All LOB Except HL LevelDocument2 pagesCDF SPC All LOB Except HL LevelSRIKANTA ROUTNo ratings yet

- 2023 New Resume - PubaliDocument6 pages2023 New Resume - PubaliSRIKANTA ROUTNo ratings yet

- Soro PuriDocument1 pageSoro PuriSRIKANTA ROUTNo ratings yet

- Consolidated Formcpdf 1288755 075734 SignedDocument4 pagesConsolidated Formcpdf 1288755 075734 SignedSRIKANTA ROUTNo ratings yet

- Pau Pnbe Exp Sleeper Class (SL)Document2 pagesPau Pnbe Exp Sleeper Class (SL)amit patel funny videosNo ratings yet

- Vacancies As OnDocument28 pagesVacancies As OnSRIKANTA ROUTNo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- Supreme Court Directs GSTN To Open Portal For Filing TRAN-1Document2 pagesSupreme Court Directs GSTN To Open Portal For Filing TRAN-1SRIKANTA ROUTNo ratings yet

- Tax Audit Under Section 44AB For AY 2022-23Document31 pagesTax Audit Under Section 44AB For AY 2022-23SRIKANTA ROUTNo ratings yet

- Medi-Caps University: IndoreDocument73 pagesMedi-Caps University: IndoreUJJWAL PATIDARNo ratings yet

- Banking & Economy PDF - March 2022 by AffairsCloud 1Document141 pagesBanking & Economy PDF - March 2022 by AffairsCloud 1ASHUTOSH KUMARNo ratings yet

- No Due CertificateDocument3 pagesNo Due Certificatemanoj khathumriaNo ratings yet

- Literature Review On HDFC Life InsuranceDocument8 pagesLiterature Review On HDFC Life Insurancec5rr5sqw100% (1)

- Chapter 2 Profile of The OrganisationDocument50 pagesChapter 2 Profile of The Organisationpmcmbharat264No ratings yet

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra67% (3)

- Financial Analysis HDFCDocument24 pagesFinancial Analysis HDFCbunnyNo ratings yet

- Comparative Study On Personal Banking of SBI and HDFCDocument14 pagesComparative Study On Personal Banking of SBI and HDFCsaurabhm707No ratings yet

- Banking and InsuranceDocument26 pagesBanking and InsuranceNitin ParasuramNo ratings yet

- Credit Advice: Reserve Bank of IndiaDocument3 pagesCredit Advice: Reserve Bank of IndiaVineet Gupta100% (1)

- Competitive Strategy For Bank - ProjDocument82 pagesCompetitive Strategy For Bank - ProjAnkush KriplaniNo ratings yet

- Swot Analysis of HDFC BankDocument1 pageSwot Analysis of HDFC BankRishabh KumarNo ratings yet

- Financial Service Offered HDFCDocument103 pagesFinancial Service Offered HDFCdeepak GuptaNo ratings yet

- HDFC BankDocument13 pagesHDFC Banknandini agrawalNo ratings yet

- Highest Safety: Recurring Deposits (RD) PlanDocument5 pagesHighest Safety: Recurring Deposits (RD) PlanNavya ShreeNo ratings yet

- Acct Statement - XX3940 - 09082023Document12 pagesAcct Statement - XX3940 - 09082023THE CAMBRIDGENo ratings yet

- Burgundy Private Hurun India 500Document37 pagesBurgundy Private Hurun India 500Bhurishrwa AbhishekNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument34 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancerakeshNo ratings yet

- HDFC Bank Statement Apr'21 - June'21Document208 pagesHDFC Bank Statement Apr'21 - June'21Malhar LakdawalaNo ratings yet

- 20-20 Ideas Summit 2023Document24 pages20-20 Ideas Summit 2023mdadnansyed2No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAyush kumarNo ratings yet

- HDFC Bank Statement 09-08-2022Document5 pagesHDFC Bank Statement 09-08-2022mahakaal digital point bhopalNo ratings yet

- Wa0039.Document50 pagesWa0039.shraddhaNo ratings yet

- Acct Statement XX9601 02022023Document46 pagesAcct Statement XX9601 02022023pgd22dc028No ratings yet

- Top Auto Finance Companies in IndiaDocument7 pagesTop Auto Finance Companies in IndiaplantpowerNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument57 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepra09031888No ratings yet

- KUU B.Com ProjectDocument18 pagesKUU B.Com Projectdiptimayeepatra944No ratings yet

- Acct Statement - XX8680 - 28032024Document56 pagesAcct Statement - XX8680 - 28032024crmfinance.tnNo ratings yet

- Headers DataDocument3,159 pagesHeaders DataZhong ElleNo ratings yet

Nps Scheme - E (Tier-I)

Nps Scheme - E (Tier-I)

Uploaded by

SRIKANTA ROUTOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nps Scheme - E (Tier-I)

Nps Scheme - E (Tier-I)

Uploaded by

SRIKANTA ROUTCopyright:

Available Formats

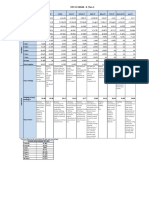

NPS SCHEME - E (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF TATA PF MAX LIFE PF Axis PF

Assets (Rs in crore ) 10,442.08 3,172.56 1,472.56 5,870.33 1,077.75 17,524.46 291.55 11.91 6.81 4.06

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17 19-Aug-22 12-Sep-22 21-Oct-22

30-Nov-22 41.1128 31.7617 48.4285 49.0048 45.5775 37.3665 20.0012 10.676 10.0255 10.3499

NAV

52 Week High 41.1128 31.7617 48.4285 49.0048 45.5775 37.3665 20.0012 10.7172 10.0255 10.3499

52 Week Low 33.4070 25.7882 39.5448 39.9622 37.0095 30.3948 16.3809 9.7677 9.1851 9.9791

3 Months 5.59% 5.65% 4.99% 4.56% 5.21% 5.26% 5.11% 7.63% NA NA

6 Months 13.74% 13.97% 13.27% 13.66% 14.08% 13.53% 13.07% NA NA NA

1 Year 11.02% 12.97% 11.53% 10.11% 11.79% 11.01% 11.23% NA NA NA

2 Years 20.58% 23.32% 21.34% 21.22% 21.48% 21.37% 20.08% NA NA NA

RETURNS

3 Years 15.99% 17.03% 16.31% 16.51% 16.83% 17.07% 15.98% NA NA NA

5 Years 12.33% 12.08% 12.42% 12.78% 12.03% 13.46% 12.48% NA NA NA

7 Years 13.23% 12.85% 13.53% 13.33% 13.62% 14.36% NA NA NA NA

10 Years 13.08% NA 13.46% 13.16% 13.26% NA NA NA NA NA

Since Inception 10.99% 13.14% 12.36% 12.45% 11.84% 15.16% 13.27% 6.76% 0.25% 3.50%

Reliance Reliance Icici Bank Equity, (1) ICICI Bank ICICI Bank Ltd. Reliance Industries Reliance 1) Adani Ports 1. Reliance 1) Reliance

Industry Industries Reliance Industries Limited HDFC Bank Ltd Ltd. Industries, And Special Industries Industries Ltd

Limited, Ltd., Equity, (2) Reliance Infosys ICICI Bank Ltd Icici Bank, Economic Limited 2) IDFC

Icici Equity, Icici Bank Hdfc Bank Equity, Industries Technologies Ltd. HDFC Bank Ltd Hdfc Bank, Zone Ltd 2. HDFC Bank Overnight

Hdfc Bank Ltd., Ltd., Infosys Tech Equity, Limited Reliance Infosys Ltd Infosys 2) Apollo Limited Fund - Direct

Infosys Hdfc Bank State Bank Of India (3) HDFC Bank Industries Ltd. State Bank of India Limited, Hospitals 3. ICICI Bank Plan - Growth

Technologies Limited, Equity Limited Axis Bank Ltd Tata Enterprise Ltd Limited 3) HDFC Bank

Infosys

Limited, (4) Infosys Consultancy 3) Asian Paints 4. Infosys Ltd

Top 5 Holdings Technologies

Axis Bank Limited Services Limited Limited 4) ICICI Bank

Ltd,

Equity (5) State Bank Of 4) Axis 5. Housing Ltd

Larsen And

India Overnight Development 5) Infosys Ltd

Toubro Ltd

Fund - Direct Finance Corp

Plan - Growth Limited

Option.

5) Bajaj

Finance

Limited

Weigtage of top 5

33.76 32.18 32.18 33.20 34.65 33.23 35.03 21.27 32.54 41.36

PORTFOLIO

Holdings,%

Monetary Banks, Monetary 1. Monetary Monetary 1)Monetary Oil & Gas, Financial 1. Banking 1) Monetary

Intermediation It - Software, Intermediation Of intermediation of Intermidiation Of intermediation of Bank & Services 2. FMCG Intermediation

Of Commercial Oil & Gas Commercial Banks, commercial Com Bank commercial banks, Finance, Healthcare 3. IT of Commercial

Banks, Saving Saving Banks. Postal banks, saving Manufacture Of saving banks. It Fast Moving Banks, Saving

Banks. Savings Bank, banks, postal Other Petroleum postal savings bank Consumer Banks. Postal

Postal,Writing , Writing , Modifying, savings. N.E.C. and discount Goods Savings Bank

Modifying, Testing Of Computer 2. Writing , Writing , houses and Discount

modifying, testing

Testing Of Program To Meet The Modifying, 2)Manufacture of Houses

of computer

Computer Needs Of A Particular Testing Of other petroleum 2) Writing ,

program.

Program To Client Excluding Web- Computer n.e.c. Modifying,

Top 3 Sectors 3. Manufacture of

Meet The Page Designing, Program To Meet 3)Writing , Testing of

other petroleum

Need,Manufact Manufacture Of The Needs Of A modifying, testing Computer

n.e.c.

Other Petroleum Particular Client of computer Program to

N.E.C. Excluding Web- program to meet Meet the

Page Designing the needs of a Needs of a

particular client Particular

excluding web- Client

page designing excluding Web-

Page Designing

3)

* Scheme Returns for more than 01 year are annualised

SCHEME BENCHMARK RETURN

3 month 4.32%

6 month 14.00%

1 year 11.80%

2 years 22.52%

3 years 17.81%

5 Years 13.81%

7 Years 14.28%

10 Years 13.49%

You might also like

- Study of Customer Satisfaction Towards HDFC BankDocument58 pagesStudy of Customer Satisfaction Towards HDFC BankNeeraj Verma69% (29)

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - E (Tier-Ii)Document1 pageNps Scheme - E (Tier-Ii)VenkateshMedidiNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)VenkateshMedidiNo ratings yet

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- Scheme E2 - 2Document1 pageScheme E2 - 2SanjayNo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)glorymatrixNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- Scheme A - 9Document1 pageScheme A - 94296tNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- Investment Approach Key Features & Portfolio AttributesDocument3 pagesInvestment Approach Key Features & Portfolio AttributesAkash JoshiNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- Scheme A 1 July 2021Document1 pageScheme A 1 July 2021amar srinivasNo ratings yet

- Nps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedshrikanhaiyyaNo ratings yet

- MO NTDOP One Pager Oct'22Document3 pagesMO NTDOP One Pager Oct'22Himanshu TamrakarNo ratings yet

- India's 3PL 2018 - Based On Service: Freight Forwarding 2.78Document20 pagesIndia's 3PL 2018 - Based On Service: Freight Forwarding 2.78Adithya PrabuNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- ACE - Fundtech LargeCap BA-FOTMDocument16 pagesACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNo ratings yet

- MO IOP-One-Pager Oct'22Document2 pagesMO IOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- MO BOP-One-Pager Oct'22Document3 pagesMO BOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- MO FMS One Pager Oct'22Document2 pagesMO FMS One Pager Oct'22Himanshu TamrakarNo ratings yet

- Bajaj Fin Serv NfoDocument26 pagesBajaj Fin Serv NfosonalNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Short Term Funds Comparision - Fund CompareDocument7 pagesShort Term Funds Comparision - Fund CompareANmolNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- Contact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniDocument17 pagesContact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniNarendran NareshNo ratings yet

- Bei 3Document25 pagesBei 3Anggih Nur HamidahNo ratings yet

- Cresent CottonDocument6 pagesCresent CottonIhsan danishNo ratings yet

- Finance Task-6Document2 pagesFinance Task-6Manish SharmaNo ratings yet

- Jupiter India Select Factsheet PA Retail LU0329071053 en GB PDFDocument4 pagesJupiter India Select Factsheet PA Retail LU0329071053 en GB PDFAlly Bin AssadNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Meezan Strategic Allocation Plan-III (Msap-Iii) : February, 2017Document17 pagesMeezan Strategic Allocation Plan-III (Msap-Iii) : February, 2017Zufa KanwalNo ratings yet

- 11 Chapter5Document122 pages11 Chapter5hareshNo ratings yet

- Strategy - Kotak - 12th OctDocument38 pagesStrategy - Kotak - 12th OctVasumathi SubramanianNo ratings yet

- Jupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFDocument4 pagesJupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFSaif MonajedNo ratings yet

- Strategy: Portfolio Perspectives: Safe and SelectiveDocument15 pagesStrategy: Portfolio Perspectives: Safe and SelectiveRecrea8 EntertainmentNo ratings yet

- Q1 Target Vs Ach FY 24-25 - TFPPLDocument8 pagesQ1 Target Vs Ach FY 24-25 - TFPPLMukul BansalNo ratings yet

- Microfinance PulseDocument24 pagesMicrofinance PulseNitin GuptaNo ratings yet

- Net Income Based Operating Income Based EBITDA Based Gross Income BasedDocument2 pagesNet Income Based Operating Income Based EBITDA Based Gross Income BasedAl-Quran DailyNo ratings yet

- Invesco India Infrastructure FundDocument17 pagesInvesco India Infrastructure FundArmstrong CapitalNo ratings yet

- Banking & Financials FundDocument23 pagesBanking & Financials FundArmstrong CapitalNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Organization - GROWTH ARROW: Mr. Megesh Prof. Arpan AnandDocument14 pagesOrganization - GROWTH ARROW: Mr. Megesh Prof. Arpan AnandZafar AlamNo ratings yet

- Collective Insights: Minutes From Our Morning MeetingDocument2 pagesCollective Insights: Minutes From Our Morning Meetingapi-63645244No ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- 10 1016@j Pacfin 2018 09 003Document18 pages10 1016@j Pacfin 2018 09 003gogayin869No ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- Manulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFDocument2 pagesManulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFHetanshNo ratings yet

- Time Series: Applications to Finance with R and S-PlusFrom EverandTime Series: Applications to Finance with R and S-PlusRating: 4 out of 5 stars4/5 (1)

- Delivery Service TNCDocument1 pageDelivery Service TNCSRIKANTA ROUTNo ratings yet

- Click Here: Covid Guidelines: Hotel DetailsDocument4 pagesClick Here: Covid Guidelines: Hotel DetailsSRIKANTA ROUTNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- CDF SPC All LOB Except HL LevelDocument2 pagesCDF SPC All LOB Except HL LevelSRIKANTA ROUTNo ratings yet

- 2023 New Resume - PubaliDocument6 pages2023 New Resume - PubaliSRIKANTA ROUTNo ratings yet

- Soro PuriDocument1 pageSoro PuriSRIKANTA ROUTNo ratings yet

- Consolidated Formcpdf 1288755 075734 SignedDocument4 pagesConsolidated Formcpdf 1288755 075734 SignedSRIKANTA ROUTNo ratings yet

- Pau Pnbe Exp Sleeper Class (SL)Document2 pagesPau Pnbe Exp Sleeper Class (SL)amit patel funny videosNo ratings yet

- Vacancies As OnDocument28 pagesVacancies As OnSRIKANTA ROUTNo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- Supreme Court Directs GSTN To Open Portal For Filing TRAN-1Document2 pagesSupreme Court Directs GSTN To Open Portal For Filing TRAN-1SRIKANTA ROUTNo ratings yet

- Tax Audit Under Section 44AB For AY 2022-23Document31 pagesTax Audit Under Section 44AB For AY 2022-23SRIKANTA ROUTNo ratings yet

- Medi-Caps University: IndoreDocument73 pagesMedi-Caps University: IndoreUJJWAL PATIDARNo ratings yet

- Banking & Economy PDF - March 2022 by AffairsCloud 1Document141 pagesBanking & Economy PDF - March 2022 by AffairsCloud 1ASHUTOSH KUMARNo ratings yet

- No Due CertificateDocument3 pagesNo Due Certificatemanoj khathumriaNo ratings yet

- Literature Review On HDFC Life InsuranceDocument8 pagesLiterature Review On HDFC Life Insurancec5rr5sqw100% (1)

- Chapter 2 Profile of The OrganisationDocument50 pagesChapter 2 Profile of The Organisationpmcmbharat264No ratings yet

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra67% (3)

- Financial Analysis HDFCDocument24 pagesFinancial Analysis HDFCbunnyNo ratings yet

- Comparative Study On Personal Banking of SBI and HDFCDocument14 pagesComparative Study On Personal Banking of SBI and HDFCsaurabhm707No ratings yet

- Banking and InsuranceDocument26 pagesBanking and InsuranceNitin ParasuramNo ratings yet

- Credit Advice: Reserve Bank of IndiaDocument3 pagesCredit Advice: Reserve Bank of IndiaVineet Gupta100% (1)

- Competitive Strategy For Bank - ProjDocument82 pagesCompetitive Strategy For Bank - ProjAnkush KriplaniNo ratings yet

- Swot Analysis of HDFC BankDocument1 pageSwot Analysis of HDFC BankRishabh KumarNo ratings yet

- Financial Service Offered HDFCDocument103 pagesFinancial Service Offered HDFCdeepak GuptaNo ratings yet

- HDFC BankDocument13 pagesHDFC Banknandini agrawalNo ratings yet

- Highest Safety: Recurring Deposits (RD) PlanDocument5 pagesHighest Safety: Recurring Deposits (RD) PlanNavya ShreeNo ratings yet

- Acct Statement - XX3940 - 09082023Document12 pagesAcct Statement - XX3940 - 09082023THE CAMBRIDGENo ratings yet

- Burgundy Private Hurun India 500Document37 pagesBurgundy Private Hurun India 500Bhurishrwa AbhishekNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument34 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancerakeshNo ratings yet

- HDFC Bank Statement Apr'21 - June'21Document208 pagesHDFC Bank Statement Apr'21 - June'21Malhar LakdawalaNo ratings yet

- 20-20 Ideas Summit 2023Document24 pages20-20 Ideas Summit 2023mdadnansyed2No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAyush kumarNo ratings yet

- HDFC Bank Statement 09-08-2022Document5 pagesHDFC Bank Statement 09-08-2022mahakaal digital point bhopalNo ratings yet

- Wa0039.Document50 pagesWa0039.shraddhaNo ratings yet

- Acct Statement XX9601 02022023Document46 pagesAcct Statement XX9601 02022023pgd22dc028No ratings yet

- Top Auto Finance Companies in IndiaDocument7 pagesTop Auto Finance Companies in IndiaplantpowerNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument57 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepra09031888No ratings yet

- KUU B.Com ProjectDocument18 pagesKUU B.Com Projectdiptimayeepatra944No ratings yet

- Acct Statement - XX8680 - 28032024Document56 pagesAcct Statement - XX8680 - 28032024crmfinance.tnNo ratings yet

- Headers DataDocument3,159 pagesHeaders DataZhong ElleNo ratings yet