Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsWhen A Loved One Passes Away

When A Loved One Passes Away

Uploaded by

Lucas GajewskiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Radi LpoDocument2 pagesRadi Lpomuhammadwahab1437No ratings yet

- IRCSL QuestionsDocument30 pagesIRCSL QuestionsUshan Wickramaratne100% (4)

- 4.1 Personal Budget ProjectDocument4 pages4.1 Personal Budget ProjectAmelia LivingstonNo ratings yet

- Technical Advisory Committee On Claims Processing Texas 2010Document33 pagesTechnical Advisory Committee On Claims Processing Texas 2010Texas WatchdogNo ratings yet

- Unified Forms - Property Financing-CIMB BANKDocument7 pagesUnified Forms - Property Financing-CIMB BANKNurul ShiedaNo ratings yet

- Banking & Finance 2022 - Jan To July - TopicWise PDF by AffairsCloud 7Document108 pagesBanking & Finance 2022 - Jan To July - TopicWise PDF by AffairsCloud 7rohit yadavNo ratings yet

- Train TicketDocument2 pagesTrain TicketSunil kumarNo ratings yet

- KCB Euro4&5 Sco 01022023Document3 pagesKCB Euro4&5 Sco 01022023Info Fer-OilNo ratings yet

- Bi Net PDFDocument1 pageBi Net PDFVinh DươngNo ratings yet

- DC Usage Guide TNC - 30.09.2022Document5 pagesDC Usage Guide TNC - 30.09.2022SowjanyaNo ratings yet

- Card Application Form (DONE)Document2 pagesCard Application Form (DONE)franklin nwaribeNo ratings yet

- TD29T2223-41786 DSCDocument4 pagesTD29T2223-41786 DSCBalaram SatapathyNo ratings yet

- Viaje 3Document5 pagesViaje 3Lodalp 123No ratings yet

- Mea Member BenefitsDocument14 pagesMea Member Benefitsapi-84334367No ratings yet

- Seema Chouhan: Account StatementDocument6 pagesSeema Chouhan: Account StatementKavya ShrmaNo ratings yet

- Assist Card Terms and ConditionsDocument54 pagesAssist Card Terms and Conditionsanil wadhwaniNo ratings yet

- 17 Col Website Oct 23Document18 pages17 Col Website Oct 23ramakrishna3333No ratings yet

- O Ravi KumarDocument2 pagesO Ravi KumarHari AmaNo ratings yet

- TicketDocument2 pagesTicketPrithvi05No ratings yet

- Tax Inv - 2043Document1 pageTax Inv - 2043Vidhi MehtaNo ratings yet

- Your Electronic Ticket Receipt-7Document2 pagesYour Electronic Ticket Receipt-7rynaldiandriansyaNo ratings yet

- NTPC Limited: (A Government of India Enterprise)Document5 pagesNTPC Limited: (A Government of India Enterprise)Amit VijayvargiNo ratings yet

- Reemployment Assistance Application EngDocument6 pagesReemployment Assistance Application EngMelissa RatliffNo ratings yet

- Online Banking AgreementDocument3 pagesOnline Banking AgreementLeomNo ratings yet

- Loan Agreement PDFPageDocument5 pagesLoan Agreement PDFPageRohit AhirwarNo ratings yet

- FCC - Royal Tiger NoticeDocument8 pagesFCC - Royal Tiger NoticeMidwest InformerNo ratings yet

- USN2023112552451568 ProposalDocument5 pagesUSN2023112552451568 ProposalGuru AssociateNo ratings yet

- Last Updated On: January 14, 2019Document12 pagesLast Updated On: January 14, 2019rahul sarmaNo ratings yet

- Tax Invoice: This Invoice Is Not A Valid Travel DocumentDocument2 pagesTax Invoice: This Invoice Is Not A Valid Travel DocumentAsim JenaNo ratings yet

- Tiket GarudaDocument2 pagesTiket GarudaKyle Adams100% (1)

- Acknowledgement Receipt 20190526 151008Document2 pagesAcknowledgement Receipt 20190526 151008Arman PenalosaNo ratings yet

- Loan Application Form MortgagesDocument3 pagesLoan Application Form MortgagesSuhail KhanNo ratings yet

- Account Opening FormDocument39 pagesAccount Opening FormArif ShaikhNo ratings yet

- Indusind Bank Iconia Visa Card Benefit Guide: Cover BackDocument12 pagesIndusind Bank Iconia Visa Card Benefit Guide: Cover BackSanjay Kumar KanaujiaNo ratings yet

- 33 Benefits and Perks of The American Express® Gold CardDocument38 pages33 Benefits and Perks of The American Express® Gold CardNadi Jothidan KLNo ratings yet

- EFT Detail Submission Form Word 97 Format0.1Document1 pageEFT Detail Submission Form Word 97 Format0.1nani3388No ratings yet

- Tickets Purchased Via Amex For Schneider To Fly From Phoenix To Denver On 06/24/2017Document3 pagesTickets Purchased Via Amex For Schneider To Fly From Phoenix To Denver On 06/24/2017larry-612445No ratings yet

- Cpi PDFDocument5 pagesCpi PDFmatchgemNo ratings yet

- 6905 Ruthette Court - NRHDocument3 pages6905 Ruthette Court - NRHTanner LeggettNo ratings yet

- Edit Print Train Ticket - PDF - Identity Document - DocumentDocument16 pagesEdit Print Train Ticket - PDF - Identity Document - Documentdibakar talapatraNo ratings yet

- TRAVEL POLICY CARLO URRIZA OLIVAR Standard Insurance Co. Inc - Travel Protect - Print CertificateDocument4 pagesTRAVEL POLICY CARLO URRIZA OLIVAR Standard Insurance Co. Inc - Travel Protect - Print CertificateCarlo OlivarNo ratings yet

- Icici Stack Report by Group 2Document14 pagesIcici Stack Report by Group 2Madhav KhuranaNo ratings yet

- E-Ticket For Order 653003226370700110 Trip 1: Hyderabad To Ranchi Fri, 27 Sep 2019Document3 pagesE-Ticket For Order 653003226370700110 Trip 1: Hyderabad To Ranchi Fri, 27 Sep 2019vivekNo ratings yet

- Direct Emigrant Registration FormDocument2 pagesDirect Emigrant Registration FormSyed Muhammad MohsinNo ratings yet

- Auto Repairshop License ApplicationDocument3 pagesAuto Repairshop License ApplicationfrankfmvNo ratings yet

- Rop PDFDocument4 pagesRop PDFelmyrNo ratings yet

- Calsia AccDocument12 pagesCalsia AccThabang MafiriNo ratings yet

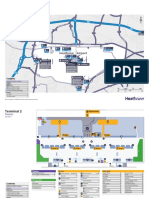

- Heathrow T2 MapDocument7 pagesHeathrow T2 MapPatel RonakNo ratings yet

- Gmail - Itinerary ReceiptDocument3 pagesGmail - Itinerary ReceiptIksan MustofaNo ratings yet

- Wa0009.Document8 pagesWa0009.Doctor AutoNo ratings yet

- HDFC BANK LTD - Delegate GST InvoiceDocument1 pageHDFC BANK LTD - Delegate GST InvoiceDevasyrucNo ratings yet

- Jelawat GreenDocument2 pagesJelawat GreenAzlan MuhammadNo ratings yet

- Invoice Template For Withdrawing Applyboard Commission: For Recruitment Partners in IndiaDocument2 pagesInvoice Template For Withdrawing Applyboard Commission: For Recruitment Partners in IndiadollarNo ratings yet

- ICICI Benefits For InfosysDocument10 pagesICICI Benefits For InfosysVaduNo ratings yet

- PRESCRIPTION A.M. No. 02-11-11-SCDocument7 pagesPRESCRIPTION A.M. No. 02-11-11-SCguilbert de guzmanNo ratings yet

- Flight Ticket New Delhi To Bangalore: Fare RulesDocument2 pagesFlight Ticket New Delhi To Bangalore: Fare RulesAnurag BasantNo ratings yet

- CRN6670907773Document3 pagesCRN6670907773Navin KumarNo ratings yet

- TicketDocument2 pagesTicketGaurav BhandariNo ratings yet

- Motor Insurance - Two Wheeler Comprehensive PolicyDocument3 pagesMotor Insurance - Two Wheeler Comprehensive PolicyOneandonly DevNo ratings yet

- INVOICE-1Document1 pageINVOICE-1socialfly06No ratings yet

- Summary of ChargesDocument6 pagesSummary of ChargesShailendra DwiwediNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsAnil kadamNo ratings yet

- When A Loved One Passes AwayDocument3 pagesWhen A Loved One Passes AwayLucas GajewskiNo ratings yet

- When A Loved One DiesDocument20 pagesWhen A Loved One Diesrates4termNo ratings yet

- Les Miserables MedleyDocument16 pagesLes Miserables MedleyLucas GajewskiNo ratings yet

- All I Ask of YouDocument7 pagesAll I Ask of YouLucas GajewskiNo ratings yet

- WI Prep Room Code 397Document1 pageWI Prep Room Code 397Lucas GajewskiNo ratings yet

- WDVA - 2800 - Military - Funeral - Honors - Request (Fillable For Printing)Document1 pageWDVA - 2800 - Military - Funeral - Honors - Request (Fillable For Printing)Lucas GajewskiNo ratings yet

- When A Loved One Passes AwayDocument3 pagesWhen A Loved One Passes AwayLucas GajewskiNo ratings yet

- KetanDocument60 pagesKetanKetan SagwekarNo ratings yet

- Adani Project SipDocument43 pagesAdani Project Sipkundan nishad50% (2)

- LIC's Jeevan Lakshya (Plan No. 933) : Benefit IllustrationDocument3 pagesLIC's Jeevan Lakshya (Plan No. 933) : Benefit IllustrationkrishnaNo ratings yet

- CGTMSE - Scheme Document CGS I - Updated As On December 2021Document25 pagesCGTMSE - Scheme Document CGS I - Updated As On December 2021prashantNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- By Gaurav Insurance Law 2021Document24 pagesBy Gaurav Insurance Law 2021Gaurav KumarNo ratings yet

- Seguro ColectivoDocument2 pagesSeguro Colectivoreinaldodesousa92No ratings yet

- JKR PWD Form 203A With Bills of QuantitiesDocument54 pagesJKR PWD Form 203A With Bills of QuantitiesGnabBang67% (3)

- Sunlife Assurance Vs CA, 245 SCRA 268Document1 pageSunlife Assurance Vs CA, 245 SCRA 268rengieNo ratings yet

- Profitability Determinants of Insurance Markets in Selected Central and Eastern European CountriesDocument24 pagesProfitability Determinants of Insurance Markets in Selected Central and Eastern European CountriesJorkosNo ratings yet

- Chapter 19 Testbank - StaticDocument67 pagesChapter 19 Testbank - Static李ANo ratings yet

- Everyday Banking Easy Read GuideDocument28 pagesEveryday Banking Easy Read Guidem.r.sathi1506No ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingVishwa KishorNo ratings yet

- Manufacturing FeasbilityDocument30 pagesManufacturing FeasbilitykarthikeyanNo ratings yet

- Fill-In - License Application FormDocument9 pagesFill-In - License Application FormWesley James ViejoNo ratings yet

- Lecture Notes - Econ B&F Lecture 3-12Document64 pagesLecture Notes - Econ B&F Lecture 3-12Qoirunisa AynaNo ratings yet

- Divorce Project - Oct2019Document20 pagesDivorce Project - Oct2019Rehmia ArshadNo ratings yet

- bookFlightConfirmation 2Document1 pagebookFlightConfirmation 2DerickNo ratings yet

- Partners For Progress Inc. 990 - 2017Document16 pagesPartners For Progress Inc. 990 - 2017Jessie BalmertNo ratings yet

- Application For Inspection Various 2018-2019Document4 pagesApplication For Inspection Various 2018-2019Tanmay VegadNo ratings yet

- Actuaries, Its Role and Function: Group Member Jyoti Gupta Disha Verma Kuldeep Hudda (Vitd)Document14 pagesActuaries, Its Role and Function: Group Member Jyoti Gupta Disha Verma Kuldeep Hudda (Vitd)Disha VermaNo ratings yet

- Prudential Regulation AuthorityDocument4 pagesPrudential Regulation AuthorityCassiane OgliariNo ratings yet

- Philhealth Identification Number (Pin) Important Reminders:: PurposeDocument3 pagesPhilhealth Identification Number (Pin) Important Reminders:: PurposeMhelaril AnneNo ratings yet

- Business Statistics Midterm Exam: Fall 2019: BUS41000Document16 pagesBusiness Statistics Midterm Exam: Fall 2019: BUS41000vinayak mishraNo ratings yet

- Date To Join: 15 December, 2021 Position: Pega Consultant Location: Hyderabad Visit Our WebsiteDocument4 pagesDate To Join: 15 December, 2021 Position: Pega Consultant Location: Hyderabad Visit Our WebsiteJillellamudi Murali KrishnaNo ratings yet

- ARCH100 Midterm 2Document5 pagesARCH100 Midterm 2No One Escapes DeathNo ratings yet

When A Loved One Passes Away

When A Loved One Passes Away

Uploaded by

Lucas Gajewski0 ratings0% found this document useful (0 votes)

12 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views3 pagesWhen A Loved One Passes Away

When A Loved One Passes Away

Uploaded by

Lucas GajewskiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

When A Loved One Passes Away…

Secure certified copies of death certificates

You’re going to need death certificates to close bank and brokerage accounts, file insurance claims

and register the death with government agencies, among other things. The funeral home you’re

working with can get copies on your behalf, or you can order them from the vital statistics office in the

state in which the person died.

Find the will and the executor

Your loved one’s survivors need to know where any money, property or belongings will go. Ideally,

you talked with your relative before she died and she told you where she kept her will. If not, look for

the document in a desk, a safe-deposit box or wherever she kept important papers. People usually

name an executor (the person who will manage the settling of the estate) in their will. The executor

needs to be involved in most of the steps going forward. If there isn’t a will, the probate court judge

will name an administrator in place of an executor.

Meet with a trusts and estates attorney

While you don’t need an attorney to settle an estate, having one makes things easier. If the estate is

worth more than $50,000, it is suggested that you hire a lawyer to help navigate the process and

distribute assets.

Contact a CPA

If your loved one had a CPA, contact them; if not, hire one. The estate may have to file a tax return,

and a final tax return will need to be filed on the deceased’s behalf. “Getting the taxes right is an

important part of this,”

Inquire About Probate

Probate is the legal process of executing a will. You’ll need to do this at a county or city probate court

office. Probate court makes sure that the person’s debts and liabilities are paid and that the remaining

assets are transferred to the beneficiaries.

Make an inventory of all assets

Laws vary by state, but the probate process usually starts with an inventory of all assets (bank

accounts, house, car, brokerage account, personal property, furniture, jewelry, etc.), which will need

to be filed in the court. For the physical items in the household, it is suggested that you hire an

appraiser.

Make a list of bills

Share the list with the executor so that important expenses like the mortgage, taxes and utilities are

taken care of while the estate is settled.

Cancel services no longer needed

These include cellphone, streaming services, cable and internet.

Notify the following of your loved one's death:

• The Social Security Administration: If the deceased was receiving Social Security benefits, you

need to stop the checks. Some family members may be eligible for death benefits from Social

Security. Generally, funeral directors report deaths to the Social Security Administration,

but, ultimately, it’s the survivors’ responsibility to tell the SSA. Contact your local SSA office to do so.

The agency will let Medicare know that your loved one died.

• Life insurance companies: You’ll need a death certificate and policy numbers to make claims on

any policies the deceased had.

• Banks, financial institutions: If you share a joint account with your deceased loved one, you’ll

need to notify the bank they’ve died. Most bank accounts carry automatic rights of survivorship, which

means if your name is on the account, you have full access to the funds when your loved one dies.

You become the sole owner on the date of your relative’s death. Most banks will require a death

certificate to remove the relative from the account.

If the deceased person was the sole owner of a bank account, the bank will release funds to the

person named beneficiary once it learns of the account holder’s death. Many banks let their

customers name a beneficiary or set the account as Payable on Death (POD) or Transferable on

Death (TOD) to another person. You’ll need to show the bank a death certificate to get the funds

released. If the owner of the account didn’t name a beneficiary or POD, things get more complicated.

The executor will be responsible for getting the funds to repay creditors, pay bills and divide funds

according to the dead person’s will.

• Financial advisers, stockbrokers: Determine the beneficiary listed on accounts. Depending on the

type of asset, the beneficiary may get access to the account or benefit simply by filling out appropriate

forms and providing a copy of the death certificate (no executor needed). While access to the money

is straightforward, there are tax consequences to keep in mind. You will be responsible for paying any

taxes earned by the account once your loved one dies. Keep in mind, the tax burden could be

significant on a well-funded investment account.

• Credit agencies: To prevent identity theft, send copies of the death certificate to one of the three

major credit bureaus: Equifax, Experian or TransUnion. You only need to tell one of them, and it will

tell the others.

Cancel driver's license

This removes the deceased’s name from the records of the department of motor vehicles and

prevents identity theft. Contact the agency for specific instructions, but you’ll need a copy of the death

certificate. Keep a copy of the canceled driver’s license in your records. You may need it to close or

access accounts that belonged to the deceased.

Close credit card accounts

Contact customer service and tell the representative that you’re closing the account on behalf of a

deceased relative who had a sole account. You’ll need a copy of the death certificate to do this, too.

Keep records of accounts you close and inform the executor of any outstanding balances on the

cards. Credit bureaus, as part of their regular reporting process, will also send card issuers an alert

that your relative has died. But if you want credit accounts notified faster, contact them directly. Be

sure to cut up your dead loved one’s credit cards so they aren’t lost or stolen.

If the credit card account is shared with another person who intends to keep using it, keep the

account open but notify the issuing bank your relative has died so the deceased’s name can be

removed from the account. Destroy any cards with their name on them to prevent theft and identity

fraud.

Terminate insurance policies

Contact providers to end coverage for the deceased on home, auto and health insurance policies,

and ask that any unused premium be returned.

Delete or memorialize social media accounts

You can delete social media accounts, but some survivors choose to turn them into a memorial for

their loved one instead. Twitter, Facebook and Instagram all allow a deceased person’s profile to

remain online, marked as a memorial account. On Facebook, a memorialized profile stays up with the

word “Remembering” in front of the deceased’s name. Friends will be able to post on the timeline.

Whether you choose to delete or memorialize, you’ll need to contact the companies with copies of the

death certificate. TikTok does not offer a memorial option for a deceased user’s account.

Close email accounts

To prevent identity theft and fraud, shut down the deceased’s email account. If the person set up a

funeral plan or a will, she may have included log-in information so you can do this yourself. If not,

you’ll need copies of the death certificate to cancel an email account. The specifics vary by email

provider, but most require a death certificate and verification that you are a relative or the estate

executor.

Update voter registration

Contact your state or county directly to find out how to remove your dead relative from the voting rolls.

Here’s a state-by-state contact list. The rules vary by state. Some states get notifications from state

and local agencies and will remove your dead relative from voter registration rolls automatically.

States will also remove voters if a relative notifies them of the death. Depending on where your loved

one was registered to vote, you may need to give notice of the death in writing, by affidavit or with a

death certificate

You might also like

- Radi LpoDocument2 pagesRadi Lpomuhammadwahab1437No ratings yet

- IRCSL QuestionsDocument30 pagesIRCSL QuestionsUshan Wickramaratne100% (4)

- 4.1 Personal Budget ProjectDocument4 pages4.1 Personal Budget ProjectAmelia LivingstonNo ratings yet

- Technical Advisory Committee On Claims Processing Texas 2010Document33 pagesTechnical Advisory Committee On Claims Processing Texas 2010Texas WatchdogNo ratings yet

- Unified Forms - Property Financing-CIMB BANKDocument7 pagesUnified Forms - Property Financing-CIMB BANKNurul ShiedaNo ratings yet

- Banking & Finance 2022 - Jan To July - TopicWise PDF by AffairsCloud 7Document108 pagesBanking & Finance 2022 - Jan To July - TopicWise PDF by AffairsCloud 7rohit yadavNo ratings yet

- Train TicketDocument2 pagesTrain TicketSunil kumarNo ratings yet

- KCB Euro4&5 Sco 01022023Document3 pagesKCB Euro4&5 Sco 01022023Info Fer-OilNo ratings yet

- Bi Net PDFDocument1 pageBi Net PDFVinh DươngNo ratings yet

- DC Usage Guide TNC - 30.09.2022Document5 pagesDC Usage Guide TNC - 30.09.2022SowjanyaNo ratings yet

- Card Application Form (DONE)Document2 pagesCard Application Form (DONE)franklin nwaribeNo ratings yet

- TD29T2223-41786 DSCDocument4 pagesTD29T2223-41786 DSCBalaram SatapathyNo ratings yet

- Viaje 3Document5 pagesViaje 3Lodalp 123No ratings yet

- Mea Member BenefitsDocument14 pagesMea Member Benefitsapi-84334367No ratings yet

- Seema Chouhan: Account StatementDocument6 pagesSeema Chouhan: Account StatementKavya ShrmaNo ratings yet

- Assist Card Terms and ConditionsDocument54 pagesAssist Card Terms and Conditionsanil wadhwaniNo ratings yet

- 17 Col Website Oct 23Document18 pages17 Col Website Oct 23ramakrishna3333No ratings yet

- O Ravi KumarDocument2 pagesO Ravi KumarHari AmaNo ratings yet

- TicketDocument2 pagesTicketPrithvi05No ratings yet

- Tax Inv - 2043Document1 pageTax Inv - 2043Vidhi MehtaNo ratings yet

- Your Electronic Ticket Receipt-7Document2 pagesYour Electronic Ticket Receipt-7rynaldiandriansyaNo ratings yet

- NTPC Limited: (A Government of India Enterprise)Document5 pagesNTPC Limited: (A Government of India Enterprise)Amit VijayvargiNo ratings yet

- Reemployment Assistance Application EngDocument6 pagesReemployment Assistance Application EngMelissa RatliffNo ratings yet

- Online Banking AgreementDocument3 pagesOnline Banking AgreementLeomNo ratings yet

- Loan Agreement PDFPageDocument5 pagesLoan Agreement PDFPageRohit AhirwarNo ratings yet

- FCC - Royal Tiger NoticeDocument8 pagesFCC - Royal Tiger NoticeMidwest InformerNo ratings yet

- USN2023112552451568 ProposalDocument5 pagesUSN2023112552451568 ProposalGuru AssociateNo ratings yet

- Last Updated On: January 14, 2019Document12 pagesLast Updated On: January 14, 2019rahul sarmaNo ratings yet

- Tax Invoice: This Invoice Is Not A Valid Travel DocumentDocument2 pagesTax Invoice: This Invoice Is Not A Valid Travel DocumentAsim JenaNo ratings yet

- Tiket GarudaDocument2 pagesTiket GarudaKyle Adams100% (1)

- Acknowledgement Receipt 20190526 151008Document2 pagesAcknowledgement Receipt 20190526 151008Arman PenalosaNo ratings yet

- Loan Application Form MortgagesDocument3 pagesLoan Application Form MortgagesSuhail KhanNo ratings yet

- Account Opening FormDocument39 pagesAccount Opening FormArif ShaikhNo ratings yet

- Indusind Bank Iconia Visa Card Benefit Guide: Cover BackDocument12 pagesIndusind Bank Iconia Visa Card Benefit Guide: Cover BackSanjay Kumar KanaujiaNo ratings yet

- 33 Benefits and Perks of The American Express® Gold CardDocument38 pages33 Benefits and Perks of The American Express® Gold CardNadi Jothidan KLNo ratings yet

- EFT Detail Submission Form Word 97 Format0.1Document1 pageEFT Detail Submission Form Word 97 Format0.1nani3388No ratings yet

- Tickets Purchased Via Amex For Schneider To Fly From Phoenix To Denver On 06/24/2017Document3 pagesTickets Purchased Via Amex For Schneider To Fly From Phoenix To Denver On 06/24/2017larry-612445No ratings yet

- Cpi PDFDocument5 pagesCpi PDFmatchgemNo ratings yet

- 6905 Ruthette Court - NRHDocument3 pages6905 Ruthette Court - NRHTanner LeggettNo ratings yet

- Edit Print Train Ticket - PDF - Identity Document - DocumentDocument16 pagesEdit Print Train Ticket - PDF - Identity Document - Documentdibakar talapatraNo ratings yet

- TRAVEL POLICY CARLO URRIZA OLIVAR Standard Insurance Co. Inc - Travel Protect - Print CertificateDocument4 pagesTRAVEL POLICY CARLO URRIZA OLIVAR Standard Insurance Co. Inc - Travel Protect - Print CertificateCarlo OlivarNo ratings yet

- Icici Stack Report by Group 2Document14 pagesIcici Stack Report by Group 2Madhav KhuranaNo ratings yet

- E-Ticket For Order 653003226370700110 Trip 1: Hyderabad To Ranchi Fri, 27 Sep 2019Document3 pagesE-Ticket For Order 653003226370700110 Trip 1: Hyderabad To Ranchi Fri, 27 Sep 2019vivekNo ratings yet

- Direct Emigrant Registration FormDocument2 pagesDirect Emigrant Registration FormSyed Muhammad MohsinNo ratings yet

- Auto Repairshop License ApplicationDocument3 pagesAuto Repairshop License ApplicationfrankfmvNo ratings yet

- Rop PDFDocument4 pagesRop PDFelmyrNo ratings yet

- Calsia AccDocument12 pagesCalsia AccThabang MafiriNo ratings yet

- Heathrow T2 MapDocument7 pagesHeathrow T2 MapPatel RonakNo ratings yet

- Gmail - Itinerary ReceiptDocument3 pagesGmail - Itinerary ReceiptIksan MustofaNo ratings yet

- Wa0009.Document8 pagesWa0009.Doctor AutoNo ratings yet

- HDFC BANK LTD - Delegate GST InvoiceDocument1 pageHDFC BANK LTD - Delegate GST InvoiceDevasyrucNo ratings yet

- Jelawat GreenDocument2 pagesJelawat GreenAzlan MuhammadNo ratings yet

- Invoice Template For Withdrawing Applyboard Commission: For Recruitment Partners in IndiaDocument2 pagesInvoice Template For Withdrawing Applyboard Commission: For Recruitment Partners in IndiadollarNo ratings yet

- ICICI Benefits For InfosysDocument10 pagesICICI Benefits For InfosysVaduNo ratings yet

- PRESCRIPTION A.M. No. 02-11-11-SCDocument7 pagesPRESCRIPTION A.M. No. 02-11-11-SCguilbert de guzmanNo ratings yet

- Flight Ticket New Delhi To Bangalore: Fare RulesDocument2 pagesFlight Ticket New Delhi To Bangalore: Fare RulesAnurag BasantNo ratings yet

- CRN6670907773Document3 pagesCRN6670907773Navin KumarNo ratings yet

- TicketDocument2 pagesTicketGaurav BhandariNo ratings yet

- Motor Insurance - Two Wheeler Comprehensive PolicyDocument3 pagesMotor Insurance - Two Wheeler Comprehensive PolicyOneandonly DevNo ratings yet

- INVOICE-1Document1 pageINVOICE-1socialfly06No ratings yet

- Summary of ChargesDocument6 pagesSummary of ChargesShailendra DwiwediNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsAnil kadamNo ratings yet

- When A Loved One Passes AwayDocument3 pagesWhen A Loved One Passes AwayLucas GajewskiNo ratings yet

- When A Loved One DiesDocument20 pagesWhen A Loved One Diesrates4termNo ratings yet

- Les Miserables MedleyDocument16 pagesLes Miserables MedleyLucas GajewskiNo ratings yet

- All I Ask of YouDocument7 pagesAll I Ask of YouLucas GajewskiNo ratings yet

- WI Prep Room Code 397Document1 pageWI Prep Room Code 397Lucas GajewskiNo ratings yet

- WDVA - 2800 - Military - Funeral - Honors - Request (Fillable For Printing)Document1 pageWDVA - 2800 - Military - Funeral - Honors - Request (Fillable For Printing)Lucas GajewskiNo ratings yet

- When A Loved One Passes AwayDocument3 pagesWhen A Loved One Passes AwayLucas GajewskiNo ratings yet

- KetanDocument60 pagesKetanKetan SagwekarNo ratings yet

- Adani Project SipDocument43 pagesAdani Project Sipkundan nishad50% (2)

- LIC's Jeevan Lakshya (Plan No. 933) : Benefit IllustrationDocument3 pagesLIC's Jeevan Lakshya (Plan No. 933) : Benefit IllustrationkrishnaNo ratings yet

- CGTMSE - Scheme Document CGS I - Updated As On December 2021Document25 pagesCGTMSE - Scheme Document CGS I - Updated As On December 2021prashantNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- By Gaurav Insurance Law 2021Document24 pagesBy Gaurav Insurance Law 2021Gaurav KumarNo ratings yet

- Seguro ColectivoDocument2 pagesSeguro Colectivoreinaldodesousa92No ratings yet

- JKR PWD Form 203A With Bills of QuantitiesDocument54 pagesJKR PWD Form 203A With Bills of QuantitiesGnabBang67% (3)

- Sunlife Assurance Vs CA, 245 SCRA 268Document1 pageSunlife Assurance Vs CA, 245 SCRA 268rengieNo ratings yet

- Profitability Determinants of Insurance Markets in Selected Central and Eastern European CountriesDocument24 pagesProfitability Determinants of Insurance Markets in Selected Central and Eastern European CountriesJorkosNo ratings yet

- Chapter 19 Testbank - StaticDocument67 pagesChapter 19 Testbank - Static李ANo ratings yet

- Everyday Banking Easy Read GuideDocument28 pagesEveryday Banking Easy Read Guidem.r.sathi1506No ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingVishwa KishorNo ratings yet

- Manufacturing FeasbilityDocument30 pagesManufacturing FeasbilitykarthikeyanNo ratings yet

- Fill-In - License Application FormDocument9 pagesFill-In - License Application FormWesley James ViejoNo ratings yet

- Lecture Notes - Econ B&F Lecture 3-12Document64 pagesLecture Notes - Econ B&F Lecture 3-12Qoirunisa AynaNo ratings yet

- Divorce Project - Oct2019Document20 pagesDivorce Project - Oct2019Rehmia ArshadNo ratings yet

- bookFlightConfirmation 2Document1 pagebookFlightConfirmation 2DerickNo ratings yet

- Partners For Progress Inc. 990 - 2017Document16 pagesPartners For Progress Inc. 990 - 2017Jessie BalmertNo ratings yet

- Application For Inspection Various 2018-2019Document4 pagesApplication For Inspection Various 2018-2019Tanmay VegadNo ratings yet

- Actuaries, Its Role and Function: Group Member Jyoti Gupta Disha Verma Kuldeep Hudda (Vitd)Document14 pagesActuaries, Its Role and Function: Group Member Jyoti Gupta Disha Verma Kuldeep Hudda (Vitd)Disha VermaNo ratings yet

- Prudential Regulation AuthorityDocument4 pagesPrudential Regulation AuthorityCassiane OgliariNo ratings yet

- Philhealth Identification Number (Pin) Important Reminders:: PurposeDocument3 pagesPhilhealth Identification Number (Pin) Important Reminders:: PurposeMhelaril AnneNo ratings yet

- Business Statistics Midterm Exam: Fall 2019: BUS41000Document16 pagesBusiness Statistics Midterm Exam: Fall 2019: BUS41000vinayak mishraNo ratings yet

- Date To Join: 15 December, 2021 Position: Pega Consultant Location: Hyderabad Visit Our WebsiteDocument4 pagesDate To Join: 15 December, 2021 Position: Pega Consultant Location: Hyderabad Visit Our WebsiteJillellamudi Murali KrishnaNo ratings yet

- ARCH100 Midterm 2Document5 pagesARCH100 Midterm 2No One Escapes DeathNo ratings yet