Professional Documents

Culture Documents

Concepts and Conventions

Concepts and Conventions

Uploaded by

Manjeet KaurCopyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Coupon Money Order Letter (Cap1)Document3 pagesCoupon Money Order Letter (Cap1)OneNation100% (34)

- Ib Economics HL Revision NotesDocument160 pagesIb Economics HL Revision NotesMuras BaiyshevNo ratings yet

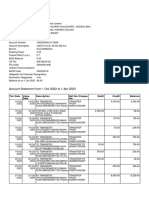

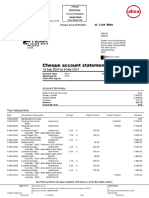

- Account Statement From 1 Oct 2022 To 1 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Oct 2022 To 1 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAman JaiswalNo ratings yet

- Principle of Accounting I Final ExamDocument3 pagesPrinciple of Accounting I Final ExamAbrha Giday100% (6)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- Acctg 105 QuizDocument5 pagesAcctg 105 Quizshin shinNo ratings yet

- AnswerDocument2 pagesAnswerNirmal K PradhanNo ratings yet

- Banking Law Project PDFDocument24 pagesBanking Law Project PDFDarpan MaganNo ratings yet

- Accounting Concepts MCQsDocument6 pagesAccounting Concepts MCQsUmar SulemanNo ratings yet

- FA MCQ On PrinciplesDocument9 pagesFA MCQ On Principlestiwariarad100% (1)

- MCQDocument17 pagesMCQMilan Subhashchandra ShahNo ratings yet

- Accountancy MCQDocument93 pagesAccountancy MCQabnadeemmalik111No ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument11 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionSherlock HolmesNo ratings yet

- Tutorial Chapter 1 & 2Document5 pagesTutorial Chapter 1 & 2nurfa061No ratings yet

- Generally Accepted Accounting PrinciplesDocument7 pagesGenerally Accepted Accounting Principlesb6tzw7xkd4No ratings yet

- Financial Accounting Canadian 6th Edition by Libby ISBN Test BankDocument39 pagesFinancial Accounting Canadian 6th Edition by Libby ISBN Test Banklauren100% (34)

- Sample Exam - Chapter 2Document11 pagesSample Exam - Chapter 2Harold Cedric Noleal OsorioNo ratings yet

- Financial Accounting Canadian 6th Edition Libby Test BankDocument6 pagesFinancial Accounting Canadian 6th Edition Libby Test Bankhopehigginslup31100% (26)

- Accounting For Management (MCQS)Document10 pagesAccounting For Management (MCQS)Dhruv GuptaNo ratings yet

- MCQs Cost and Financial AccountingDocument10 pagesMCQs Cost and Financial Accountingkhalida khanNo ratings yet

- Accounting Concepts MCQsDocument1 pageAccounting Concepts MCQsAdil IqbalNo ratings yet

- Exit Model (Fundamental of Accounting)Document6 pagesExit Model (Fundamental of Accounting)aronNo ratings yet

- Financial Accounting MCQs - Senior Auditor Bs-16Document34 pagesFinancial Accounting MCQs - Senior Auditor Bs-16Faizan Ch0% (1)

- Asynchronous Activity - April 12 - Key AnswerDocument6 pagesAsynchronous Activity - April 12 - Key AnswerAcads PurpsNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiArroNo ratings yet

- Corporate Financial Management 5th Edition Glen Arnold Test Bank 1Document683 pagesCorporate Financial Management 5th Edition Glen Arnold Test Bank 1monroe100% (49)

- BBA 407 GUIDE BOOK Smu 4rth SemDocument81 pagesBBA 407 GUIDE BOOK Smu 4rth SemlalsinghNo ratings yet

- MCQs of AccountsDocument23 pagesMCQs of AccountsShruti NaikNo ratings yet

- Review FINAL EXAM - Business FinanceDocument10 pagesReview FINAL EXAM - Business FinanceUynn LêNo ratings yet

- Set Question PaperDocument14 pagesSet Question PapercjkoshyNo ratings yet

- FAR - ReviewerDocument13 pagesFAR - ReviewerCharmel San AntonioNo ratings yet

- ACEFIAR Quiz No. 1Document3 pagesACEFIAR Quiz No. 1Marriel Fate CullanoNo ratings yet

- Correct Answers Are Marked in YellowDocument11 pagesCorrect Answers Are Marked in YellowAnonymous EtLWEJzpYCNo ratings yet

- Dwnload Full Financial Accounting Canadian 6th Edition Libby Test Bank PDFDocument35 pagesDwnload Full Financial Accounting Canadian 6th Edition Libby Test Bank PDFxatiaaumblask100% (13)

- Bai Tap CF 2018 Solution PDFDocument11 pagesBai Tap CF 2018 Solution PDFXuân Huỳnh100% (2)

- Fabm1 Exam1 QuestionnairesDocument4 pagesFabm1 Exam1 Questionnairesfennie ilinah molinaNo ratings yet

- B) Timing Concept: Commerce Accounting Financial ManagementDocument3 pagesB) Timing Concept: Commerce Accounting Financial ManagementYousaf JamalNo ratings yet

- Term 1 ReviewerDocument11 pagesTerm 1 ReviewerNieryl Mae RivasNo ratings yet

- First Comprehensive Exam PrintingDocument9 pagesFirst Comprehensive Exam Printinghasanah100% (1)

- Conceptual Framework and Accounting StandardsDocument4 pagesConceptual Framework and Accounting StandardsKrestyl Ann GabaldaNo ratings yet

- Accounting/Finance M.C.Qs PreparationDocument11 pagesAccounting/Finance M.C.Qs Preparationkarim mawazNo ratings yet

- 1 Pu Accountancy Theory Notes-2Document48 pages1 Pu Accountancy Theory Notes-2yashwanthnyashu00No ratings yet

- Financial Literacy: Assignment-1Document6 pagesFinancial Literacy: Assignment-1Varun NandaNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting Concepts032254044No ratings yet

- Financial Accounting Canadian 6th Edition Libby Test BankDocument36 pagesFinancial Accounting Canadian 6th Edition Libby Test Bankmeritot.wappatolhb0d2100% (42)

- 1Document42 pages1Magdy KamelNo ratings yet

- AccountingDocument290 pagesAccountingNibash KumuraNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- Accounting Concepts ExercisesDocument8 pagesAccounting Concepts ExercisesAriharan KumaranNo ratings yet

- Unit 2 MCQ Business FinanceDocument6 pagesUnit 2 MCQ Business FinancePrateek Yadav100% (1)

- Basic Accounting Multiple ChoiceDocument4 pagesBasic Accounting Multiple Choicenda04030% (1)

- Compre Sensive AnsDocument16 pagesCompre Sensive AnsyamijahanNo ratings yet

- IA Deptals 2019-2020Document10 pagesIA Deptals 2019-2020Joovs JoovhoNo ratings yet

- Business Finance Solved Mcqs For AllDocument10 pagesBusiness Finance Solved Mcqs For Alladityayaduvanshiii18No ratings yet

- FN 415 Fsa Final Exam Study Questions and Answers RZz2Document10 pagesFN 415 Fsa Final Exam Study Questions and Answers RZz2Chatlyn Kaye MediavilloNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Test 1 - Acc407 - Mar-Aug 2022 (Question)Document6 pagesTest 1 - Acc407 - Mar-Aug 2022 (Question)sabbyNo ratings yet

- Adjusting Quiz 2Document3 pagesAdjusting Quiz 2Jyasmine Aura V. AgustinNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- DonationS UNDE INCOME TAX ACTDocument2 pagesDonationS UNDE INCOME TAX ACTManjeet KaurNo ratings yet

- Company LawDocument1 pageCompany LawManjeet KaurNo ratings yet

- Current Affairs DigestDocument6 pagesCurrent Affairs DigestManjeet KaurNo ratings yet

- DeductionsDocument7 pagesDeductionsManjeet KaurNo ratings yet

- Business LawsDocument1 pageBusiness LawsManjeet KaurNo ratings yet

- Debtors and Bad DebDocument5 pagesDebtors and Bad DebManjeet KaurNo ratings yet

- A) B) C) D)Document5 pagesA) B) C) D)Manjeet KaurNo ratings yet

- Business EnvironmentDocument1 pageBusiness EnvironmentManjeet KaurNo ratings yet

- Busi OrgDocument1 pageBusi OrgManjeet KaurNo ratings yet

- Deprication and Fixed AssetsDocument7 pagesDeprication and Fixed AssetsManjeet KaurNo ratings yet

- Business EnvornmentDocument50 pagesBusiness EnvornmentManjeet KaurNo ratings yet

- Consumer Protection ActDocument4 pagesConsumer Protection ActManjeet KaurNo ratings yet

- ConsignmentDocument4 pagesConsignmentManjeet KaurNo ratings yet

- Concept of Retirement of A PartnerDocument3 pagesConcept of Retirement of A PartnerManjeet KaurNo ratings yet

- BSBM3-1 Group3Document5 pagesBSBM3-1 Group3Lyka FerrerNo ratings yet

- UntitledDocument19 pagesUntitledTejaas MageshNo ratings yet

- Trugo - Cab SeDocument7 pagesTrugo - Cab SemoreNo ratings yet

- Your Company Name: Income Statement For The Year Ending On: DD/MM/YYDocument4 pagesYour Company Name: Income Statement For The Year Ending On: DD/MM/YYBohdan KozarNo ratings yet

- Lecture 4 - WTODocument36 pagesLecture 4 - WTOVăn Trần Hoài PhươngNo ratings yet

- SSR250 - 450HP O&mDocument98 pagesSSR250 - 450HP O&mKamran IbadovNo ratings yet

- Solution Manual For International Business Competing in The Global Marketplace 12th Edition Charles W L Hill G Tomas M HultDocument14 pagesSolution Manual For International Business Competing in The Global Marketplace 12th Edition Charles W L Hill G Tomas M HultMargaret Knaebel100% (36)

- Chapter 17 - Financial Planning and ForecastingDocument7 pagesChapter 17 - Financial Planning and ForecastingAnaNo ratings yet

- Eco. Assignment1Document4 pagesEco. Assignment1shikshaNo ratings yet

- LH 9 - Final Accounts ProblemsDocument29 pagesLH 9 - Final Accounts ProblemsHarshavardhanNo ratings yet

- ECO 2115 Agricultural Production and Management 2021Document3 pagesECO 2115 Agricultural Production and Management 2021Waidembe YusufuNo ratings yet

- Accounting For Partnership Firm-FundamentalsDocument28 pagesAccounting For Partnership Firm-FundamentalsTushNo ratings yet

- IAPM Notes, Sem 5, BMS DUDocument95 pagesIAPM Notes, Sem 5, BMS DUHarshita DhamijaNo ratings yet

- Net Present Value and Other Investment CriteriaDocument72 pagesNet Present Value and Other Investment CriteriaAbdullah MujahidNo ratings yet

- Module 3 Buying and Selling For Students Copy 1Document35 pagesModule 3 Buying and Selling For Students Copy 1Alexander GuevarraNo ratings yet

- Notes1 - Bbmicrox - AgudaDocument2 pagesNotes1 - Bbmicrox - AgudaNina FrancineNo ratings yet

- Bac Reso (LCB)Document2 pagesBac Reso (LCB)tinaNo ratings yet

- Notice BoardDocument33 pagesNotice BoardEnduva SrinivasNo ratings yet

- Unit 4 RetailDocument9 pagesUnit 4 Retailsrkeditor1No ratings yet

- Goldman Sachs Hyrdrogen GasDocument14 pagesGoldman Sachs Hyrdrogen GasVivek AgNo ratings yet

- Francis ORGANIZATION STRUCTURE TRAINING NOT COMPLETEDDocument39 pagesFrancis ORGANIZATION STRUCTURE TRAINING NOT COMPLETEDFrancis kuruvila0% (1)

- Topic 5Document3 pagesTopic 5Shirley LiuNo ratings yet

- History of GoldDocument5 pagesHistory of GoldJoshua JNo ratings yet

- Commercials: Sr. No. TXN Mode Services Type Vle ShareDocument2 pagesCommercials: Sr. No. TXN Mode Services Type Vle ShareSHASHI KANTNo ratings yet

- KATLEGO JAMES BOIKANYO - aCsgOADN - ArchivedDocument4 pagesKATLEGO JAMES BOIKANYO - aCsgOADN - Archivedfarnaasadams801No ratings yet

- Auto Credit Arrangement Authorization Form - ReimbursementDocument4 pagesAuto Credit Arrangement Authorization Form - ReimbursementJohn HenryNo ratings yet

Concepts and Conventions

Concepts and Conventions

Uploaded by

Manjeet KaurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Concepts and Conventions

Concepts and Conventions

Uploaded by

Manjeet KaurCopyright:

Available Formats

MODERN EDUCATORS

1)Which of the following is not regarded as the fundamental concept that is identified by IAS-1

A) The going concern concept

B) The septate entity concept

C) The prudence concept

D) Correction concept

2)Using "lower of cost and net realisable value" for the purpose of inventory valuation is the

implementation of which of the following concepts?

A) The going concern concept

B) The septate entity concept

C) The prudence concept

D) Matching concept

3)The concept of separate entity is applicable to which of following types of businesses?

A) Sole proprietorship

B) Corporation

C) Partnership

D) All of them

4)Is Prudence concept allows a business to build substantially higher reserves or provisions than that

are actually required?

A) Yes B) No

C) To some extent D) It depends on the type of business

5)The revenue recognition principal dictates that all types of incomes should be recorded or recognized

when

A) Cash is received

B) At the end of accounting period

C) When they are earned

D) When interest is paid

6)The matching concept matches which of the following?

A) Asset with liabilities

B) Capital with income

C) Revenues with expenses

D) Expenses with capital

7)The allocation of owner's private expenses to his/her business violates which of the following?

A) Accrual concept

B) Matching concept

C) Separate business entity concept

D) Consistency concept

8)The going concern concept assumes that

A) The entity continue running for foreseeable future

B) The entity continue running until the end of accounting period

C) The entity will close its operating in 10 years

D) The entity can't be liquidated

9)American companies prepare their their financial statement in dollars whereas Japanese

companies produce financial statements in yens. Ths is an example of:

A) Stable monetary unit Concept

B) Unit of measurement Concept

C) Money value concept

D) Current swap concept

10)Which of the following is time span into which the total life of a business is divided for the purpose of

preparing financial statements?

A) Fiscal year

#249-A,SEWAK COLONY, NEAR GOVT BIKRAM COLLEGE, PATIALA. 9780574258, 9878636520

MODERN EDUCATORS

B) Calendar year

C) Accounting period

D) Accrual period

11)Showing purchased office equipments in financial statements is the application of which accounting

concept?

A) Historical cost convention B) Materiality

C) Prudence D) Matching concept

12)Assets can't be offset against liabilities. This the dictation of which of the following accounting

concepts?

A) Matching concept B) Accrual concept

C) Prudence concept D) Offsetting concept

13)Information about an item is ________ if its omission or misstatement might influence the financial

decision of the users taken on the basis of that information

A) Concrete B) Complete

C) Immaterial D) Material

14)Exercising a degree of caution in the case of judgments needed under the condition of uncertainty is

assumption of which of the following accounting concepts?

A) Matching concept B) Timeliness concept

C) Accrual concept D) Prudence concept

15)Which one of the following concepts states that the publication or presentation financial statements

should not be delayed?

A) Objectivity Concept B) Timing concept

C) Timeliness Concept D) Reliability Concept

16)land on lease should be shown in balance sheet contrary to fact that company doesn't own this piece

of land. This is the statement of what accounting concepts?

A) Matching concept

B) Accrual concept

C) Prudence concept

D) Substance over form Concept

17)"Financial information should be neutral and bias free" is the dictation of which one of the following?

A) Completeness concept

B) Faithful representation Concept

C) Objectivity Concept

D) Duality Concept

18)A business was commenced on 1st January and it purchased 5 vehicles, each costing $5000. During

the year the business managed to sell 2 vehicles at the price of $12000. How should the remaining 3

vehicles be valued if the business is going to continue its operations in the next year?

A) At the breakup value

B) On the basis of going concern

C) Liquidation value

D) More than market value

19)A company received cash $1000 in advance for auditing service. However, the company neither

earned this revenue nor made any adjusting entry in its books. Identify the effect of this omission?

A) Total liabilities to be understated

B) Total expenses to be overstated

C) Total income to be overstated

D) Total assets to be understated

20)Depreciation is charged on fixed asset to comply with which of the following accounting principles or

concepts?

#249-A,SEWAK COLONY, NEAR GOVT BIKRAM COLLEGE, PATIALA. 9780574258, 9878636520

MODERN EDUCATORS

A) Matching concept

B) Prudence concept

C) Timeliness concept

D) Reliability concept

#249-A,SEWAK COLONY, NEAR GOVT BIKRAM COLLEGE, PATIALA. 9780574258, 9878636520

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Coupon Money Order Letter (Cap1)Document3 pagesCoupon Money Order Letter (Cap1)OneNation100% (34)

- Ib Economics HL Revision NotesDocument160 pagesIb Economics HL Revision NotesMuras BaiyshevNo ratings yet

- Account Statement From 1 Oct 2022 To 1 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Oct 2022 To 1 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAman JaiswalNo ratings yet

- Principle of Accounting I Final ExamDocument3 pagesPrinciple of Accounting I Final ExamAbrha Giday100% (6)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- Acctg 105 QuizDocument5 pagesAcctg 105 Quizshin shinNo ratings yet

- AnswerDocument2 pagesAnswerNirmal K PradhanNo ratings yet

- Banking Law Project PDFDocument24 pagesBanking Law Project PDFDarpan MaganNo ratings yet

- Accounting Concepts MCQsDocument6 pagesAccounting Concepts MCQsUmar SulemanNo ratings yet

- FA MCQ On PrinciplesDocument9 pagesFA MCQ On Principlestiwariarad100% (1)

- MCQDocument17 pagesMCQMilan Subhashchandra ShahNo ratings yet

- Accountancy MCQDocument93 pagesAccountancy MCQabnadeemmalik111No ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument11 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionSherlock HolmesNo ratings yet

- Tutorial Chapter 1 & 2Document5 pagesTutorial Chapter 1 & 2nurfa061No ratings yet

- Generally Accepted Accounting PrinciplesDocument7 pagesGenerally Accepted Accounting Principlesb6tzw7xkd4No ratings yet

- Financial Accounting Canadian 6th Edition by Libby ISBN Test BankDocument39 pagesFinancial Accounting Canadian 6th Edition by Libby ISBN Test Banklauren100% (34)

- Sample Exam - Chapter 2Document11 pagesSample Exam - Chapter 2Harold Cedric Noleal OsorioNo ratings yet

- Financial Accounting Canadian 6th Edition Libby Test BankDocument6 pagesFinancial Accounting Canadian 6th Edition Libby Test Bankhopehigginslup31100% (26)

- Accounting For Management (MCQS)Document10 pagesAccounting For Management (MCQS)Dhruv GuptaNo ratings yet

- MCQs Cost and Financial AccountingDocument10 pagesMCQs Cost and Financial Accountingkhalida khanNo ratings yet

- Accounting Concepts MCQsDocument1 pageAccounting Concepts MCQsAdil IqbalNo ratings yet

- Exit Model (Fundamental of Accounting)Document6 pagesExit Model (Fundamental of Accounting)aronNo ratings yet

- Financial Accounting MCQs - Senior Auditor Bs-16Document34 pagesFinancial Accounting MCQs - Senior Auditor Bs-16Faizan Ch0% (1)

- Asynchronous Activity - April 12 - Key AnswerDocument6 pagesAsynchronous Activity - April 12 - Key AnswerAcads PurpsNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiArroNo ratings yet

- Corporate Financial Management 5th Edition Glen Arnold Test Bank 1Document683 pagesCorporate Financial Management 5th Edition Glen Arnold Test Bank 1monroe100% (49)

- BBA 407 GUIDE BOOK Smu 4rth SemDocument81 pagesBBA 407 GUIDE BOOK Smu 4rth SemlalsinghNo ratings yet

- MCQs of AccountsDocument23 pagesMCQs of AccountsShruti NaikNo ratings yet

- Review FINAL EXAM - Business FinanceDocument10 pagesReview FINAL EXAM - Business FinanceUynn LêNo ratings yet

- Set Question PaperDocument14 pagesSet Question PapercjkoshyNo ratings yet

- FAR - ReviewerDocument13 pagesFAR - ReviewerCharmel San AntonioNo ratings yet

- ACEFIAR Quiz No. 1Document3 pagesACEFIAR Quiz No. 1Marriel Fate CullanoNo ratings yet

- Correct Answers Are Marked in YellowDocument11 pagesCorrect Answers Are Marked in YellowAnonymous EtLWEJzpYCNo ratings yet

- Dwnload Full Financial Accounting Canadian 6th Edition Libby Test Bank PDFDocument35 pagesDwnload Full Financial Accounting Canadian 6th Edition Libby Test Bank PDFxatiaaumblask100% (13)

- Bai Tap CF 2018 Solution PDFDocument11 pagesBai Tap CF 2018 Solution PDFXuân Huỳnh100% (2)

- Fabm1 Exam1 QuestionnairesDocument4 pagesFabm1 Exam1 Questionnairesfennie ilinah molinaNo ratings yet

- B) Timing Concept: Commerce Accounting Financial ManagementDocument3 pagesB) Timing Concept: Commerce Accounting Financial ManagementYousaf JamalNo ratings yet

- Term 1 ReviewerDocument11 pagesTerm 1 ReviewerNieryl Mae RivasNo ratings yet

- First Comprehensive Exam PrintingDocument9 pagesFirst Comprehensive Exam Printinghasanah100% (1)

- Conceptual Framework and Accounting StandardsDocument4 pagesConceptual Framework and Accounting StandardsKrestyl Ann GabaldaNo ratings yet

- Accounting/Finance M.C.Qs PreparationDocument11 pagesAccounting/Finance M.C.Qs Preparationkarim mawazNo ratings yet

- 1 Pu Accountancy Theory Notes-2Document48 pages1 Pu Accountancy Theory Notes-2yashwanthnyashu00No ratings yet

- Financial Literacy: Assignment-1Document6 pagesFinancial Literacy: Assignment-1Varun NandaNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting Concepts032254044No ratings yet

- Financial Accounting Canadian 6th Edition Libby Test BankDocument36 pagesFinancial Accounting Canadian 6th Edition Libby Test Bankmeritot.wappatolhb0d2100% (42)

- 1Document42 pages1Magdy KamelNo ratings yet

- AccountingDocument290 pagesAccountingNibash KumuraNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- Accounting Concepts ExercisesDocument8 pagesAccounting Concepts ExercisesAriharan KumaranNo ratings yet

- Unit 2 MCQ Business FinanceDocument6 pagesUnit 2 MCQ Business FinancePrateek Yadav100% (1)

- Basic Accounting Multiple ChoiceDocument4 pagesBasic Accounting Multiple Choicenda04030% (1)

- Compre Sensive AnsDocument16 pagesCompre Sensive AnsyamijahanNo ratings yet

- IA Deptals 2019-2020Document10 pagesIA Deptals 2019-2020Joovs JoovhoNo ratings yet

- Business Finance Solved Mcqs For AllDocument10 pagesBusiness Finance Solved Mcqs For Alladityayaduvanshiii18No ratings yet

- FN 415 Fsa Final Exam Study Questions and Answers RZz2Document10 pagesFN 415 Fsa Final Exam Study Questions and Answers RZz2Chatlyn Kaye MediavilloNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Test 1 - Acc407 - Mar-Aug 2022 (Question)Document6 pagesTest 1 - Acc407 - Mar-Aug 2022 (Question)sabbyNo ratings yet

- Adjusting Quiz 2Document3 pagesAdjusting Quiz 2Jyasmine Aura V. AgustinNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- DonationS UNDE INCOME TAX ACTDocument2 pagesDonationS UNDE INCOME TAX ACTManjeet KaurNo ratings yet

- Company LawDocument1 pageCompany LawManjeet KaurNo ratings yet

- Current Affairs DigestDocument6 pagesCurrent Affairs DigestManjeet KaurNo ratings yet

- DeductionsDocument7 pagesDeductionsManjeet KaurNo ratings yet

- Business LawsDocument1 pageBusiness LawsManjeet KaurNo ratings yet

- Debtors and Bad DebDocument5 pagesDebtors and Bad DebManjeet KaurNo ratings yet

- A) B) C) D)Document5 pagesA) B) C) D)Manjeet KaurNo ratings yet

- Business EnvironmentDocument1 pageBusiness EnvironmentManjeet KaurNo ratings yet

- Busi OrgDocument1 pageBusi OrgManjeet KaurNo ratings yet

- Deprication and Fixed AssetsDocument7 pagesDeprication and Fixed AssetsManjeet KaurNo ratings yet

- Business EnvornmentDocument50 pagesBusiness EnvornmentManjeet KaurNo ratings yet

- Consumer Protection ActDocument4 pagesConsumer Protection ActManjeet KaurNo ratings yet

- ConsignmentDocument4 pagesConsignmentManjeet KaurNo ratings yet

- Concept of Retirement of A PartnerDocument3 pagesConcept of Retirement of A PartnerManjeet KaurNo ratings yet

- BSBM3-1 Group3Document5 pagesBSBM3-1 Group3Lyka FerrerNo ratings yet

- UntitledDocument19 pagesUntitledTejaas MageshNo ratings yet

- Trugo - Cab SeDocument7 pagesTrugo - Cab SemoreNo ratings yet

- Your Company Name: Income Statement For The Year Ending On: DD/MM/YYDocument4 pagesYour Company Name: Income Statement For The Year Ending On: DD/MM/YYBohdan KozarNo ratings yet

- Lecture 4 - WTODocument36 pagesLecture 4 - WTOVăn Trần Hoài PhươngNo ratings yet

- SSR250 - 450HP O&mDocument98 pagesSSR250 - 450HP O&mKamran IbadovNo ratings yet

- Solution Manual For International Business Competing in The Global Marketplace 12th Edition Charles W L Hill G Tomas M HultDocument14 pagesSolution Manual For International Business Competing in The Global Marketplace 12th Edition Charles W L Hill G Tomas M HultMargaret Knaebel100% (36)

- Chapter 17 - Financial Planning and ForecastingDocument7 pagesChapter 17 - Financial Planning and ForecastingAnaNo ratings yet

- Eco. Assignment1Document4 pagesEco. Assignment1shikshaNo ratings yet

- LH 9 - Final Accounts ProblemsDocument29 pagesLH 9 - Final Accounts ProblemsHarshavardhanNo ratings yet

- ECO 2115 Agricultural Production and Management 2021Document3 pagesECO 2115 Agricultural Production and Management 2021Waidembe YusufuNo ratings yet

- Accounting For Partnership Firm-FundamentalsDocument28 pagesAccounting For Partnership Firm-FundamentalsTushNo ratings yet

- IAPM Notes, Sem 5, BMS DUDocument95 pagesIAPM Notes, Sem 5, BMS DUHarshita DhamijaNo ratings yet

- Net Present Value and Other Investment CriteriaDocument72 pagesNet Present Value and Other Investment CriteriaAbdullah MujahidNo ratings yet

- Module 3 Buying and Selling For Students Copy 1Document35 pagesModule 3 Buying and Selling For Students Copy 1Alexander GuevarraNo ratings yet

- Notes1 - Bbmicrox - AgudaDocument2 pagesNotes1 - Bbmicrox - AgudaNina FrancineNo ratings yet

- Bac Reso (LCB)Document2 pagesBac Reso (LCB)tinaNo ratings yet

- Notice BoardDocument33 pagesNotice BoardEnduva SrinivasNo ratings yet

- Unit 4 RetailDocument9 pagesUnit 4 Retailsrkeditor1No ratings yet

- Goldman Sachs Hyrdrogen GasDocument14 pagesGoldman Sachs Hyrdrogen GasVivek AgNo ratings yet

- Francis ORGANIZATION STRUCTURE TRAINING NOT COMPLETEDDocument39 pagesFrancis ORGANIZATION STRUCTURE TRAINING NOT COMPLETEDFrancis kuruvila0% (1)

- Topic 5Document3 pagesTopic 5Shirley LiuNo ratings yet

- History of GoldDocument5 pagesHistory of GoldJoshua JNo ratings yet

- Commercials: Sr. No. TXN Mode Services Type Vle ShareDocument2 pagesCommercials: Sr. No. TXN Mode Services Type Vle ShareSHASHI KANTNo ratings yet

- KATLEGO JAMES BOIKANYO - aCsgOADN - ArchivedDocument4 pagesKATLEGO JAMES BOIKANYO - aCsgOADN - Archivedfarnaasadams801No ratings yet

- Auto Credit Arrangement Authorization Form - ReimbursementDocument4 pagesAuto Credit Arrangement Authorization Form - ReimbursementJohn HenryNo ratings yet