Professional Documents

Culture Documents

FSA Analysis 3

FSA Analysis 3

Uploaded by

Tamo AndguladzeCopyright:

Available Formats

You might also like

- IREF V 6 Pager Brochure - X UnitsDocument6 pagesIREF V 6 Pager Brochure - X UnitsPushpa DeviNo ratings yet

- Litigating ReptilesDocument7 pagesLitigating Reptilesjacob600No ratings yet

- The United States Is Still A British ColonyDocument33 pagesThe United States Is Still A British Colonyfamousafguy100% (5)

- Manson FreepDocument120 pagesManson FreepCuervo86% (7)

- FSA Analysis 6Document1 pageFSA Analysis 6Tamo AndguladzeNo ratings yet

- FIN - 4746 - IBT3 - Final Exam Solution - May 2022Document9 pagesFIN - 4746 - IBT3 - Final Exam Solution - May 2022abdourahimdiallo0148No ratings yet

- PSA - Factsheet - Pioneer Peso Equity Fund - 4Q20Document1 pagePSA - Factsheet - Pioneer Peso Equity Fund - 4Q20Ron CatalanNo ratings yet

- Resource Sharing For An Intelligent Future: Interim Report 2021Document50 pagesResource Sharing For An Intelligent Future: Interim Report 2021mailimailiNo ratings yet

- Centrum Broking Intellect Design Arena Initiating CoverageDocument31 pagesCentrum Broking Intellect Design Arena Initiating CoveragekanadeceNo ratings yet

- UntitledDocument176 pagesUntitledPriya NairNo ratings yet

- Creating Value For ShareholdersDocument8 pagesCreating Value For Shareholders18ITR028 Janaranjan ENo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- AkzoNobel Report 2019 InteractiveDocument554 pagesAkzoNobel Report 2019 InteractiveApurvaDuaNo ratings yet

- Idfc First Bank: IndiaDocument35 pagesIdfc First Bank: IndiaPraveen PNo ratings yet

- En Randco 2021 Agm Slideshow 20210520Document65 pagesEn Randco 2021 Agm Slideshow 20210520Xolani Radebe RadebeNo ratings yet

- Ultratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityDocument10 pagesUltratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityRohan AgrawalNo ratings yet

- Enbridge Inc: Investment BriefDocument5 pagesEnbridge Inc: Investment BriefrickescherNo ratings yet

- KIC 2021 Annual ReportDocument87 pagesKIC 2021 Annual ReportSachin Tukaram SalianNo ratings yet

- CPP Investor Factsheet 2023Document2 pagesCPP Investor Factsheet 2023tdhNo ratings yet

- Kuwait Investment Sector: Kuwait Financial Centre "Markaz"Document23 pagesKuwait Investment Sector: Kuwait Financial Centre "Markaz"Jyoti PrakashNo ratings yet

- Societe Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021Document74 pagesSociete Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021EvgeniyNo ratings yet

- Indo Count Industries LTD (ICIL) : P: R .170 R: Buy T P: R .225 FY19E PE: 9.0Document19 pagesIndo Count Industries LTD (ICIL) : P: R .170 R: Buy T P: R .225 FY19E PE: 9.0V KeshavdevNo ratings yet

- Capitaland 2021 H1Document88 pagesCapitaland 2021 H1Kiva DangNo ratings yet

- Eclerx Research ReportDocument13 pagesEclerx Research ReportPragati ChaudharyNo ratings yet

- As at 29 February 2020: Invesco Enhanced Income LimitedDocument2 pagesAs at 29 February 2020: Invesco Enhanced Income LimitedRebeccaLangfordNo ratings yet

- ASTRO Financial PositionDocument4 pagesASTRO Financial PositionVISALI A/P MURUGAN STUDENTNo ratings yet

- Buy (From Hold) : Company ReportDocument13 pagesBuy (From Hold) : Company ReportGiova NicosiaNo ratings yet

- Dixon Technologies Q1FY22 Result UpdateDocument8 pagesDixon Technologies Q1FY22 Result UpdateAmos RiveraNo ratings yet

- IREF V 6 Pager Brochure - Regular UnitsDocument6 pagesIREF V 6 Pager Brochure - Regular UnitsPushpa DeviNo ratings yet

- Corporate Presentation Q2 - 2022pdfDocument24 pagesCorporate Presentation Q2 - 2022pdfgussalimNo ratings yet

- PT M Cash Integrasi TBK: Charting A Digital TransformationDocument7 pagesPT M Cash Integrasi TBK: Charting A Digital TransformationHamba AllahNo ratings yet

- Taaleri Commissioned Research 030522Document13 pagesTaaleri Commissioned Research 030522ar1234567No ratings yet

- Further Resource Sharing: Interim Report 2020Document50 pagesFurther Resource Sharing: Interim Report 2020mailimailiNo ratings yet

- Subh NiveshDocument3 pagesSubh NiveshhrplanetsparkindoreNo ratings yet

- ITC Limited: Ratings Reaffirmed: Summary of Rating ActionDocument6 pagesITC Limited: Ratings Reaffirmed: Summary of Rating ActionSatish RajNo ratings yet

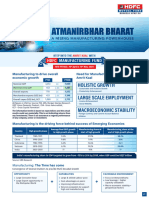

- HDFC Manufacturing Fund - NFO - Leaflet - HDFC BankDocument2 pagesHDFC Manufacturing Fund - NFO - Leaflet - HDFC Bankyeheji8177No ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- NFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358Document2 pagesNFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358bitsthechampNo ratings yet

- HFCL - Initiating Coverage - KSL 210521Document14 pagesHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNo ratings yet

- Building A Sustainable Future: Annual Report 2020Document177 pagesBuilding A Sustainable Future: Annual Report 2020AaNo ratings yet

- Building A Sustainable Future: Annual Report 2020Document177 pagesBuilding A Sustainable Future: Annual Report 2020AaNo ratings yet

- Coherence' 21 Case StudyDocument12 pagesCoherence' 21 Case Studyyashraj.nsscNo ratings yet

- Itc (Itc In) : Analyst Meet UpdateDocument18 pagesItc (Itc In) : Analyst Meet UpdateTatsam Vipul100% (1)

- Real Estate - Debt - Group 1Document3 pagesReal Estate - Debt - Group 1Vishant ChopraNo ratings yet

- Britannia Industries: IndiaDocument6 pagesBritannia Industries: Indiasps fetrNo ratings yet

- FSA Analysis 5Document1 pageFSA Analysis 5Tamo AndguladzeNo ratings yet

- Lse Adt 2021Document80 pagesLse Adt 2021hoangkhanhNo ratings yet

- IVRCL - Q4FY11 Result UpdateDocument3 pagesIVRCL - Q4FY11 Result UpdateSeema GusainNo ratings yet

- MAF603 - Group Case Study - AirAsia - GROUP 6 - 26.01.2022 - MarkedDocument8 pagesMAF603 - Group Case Study - AirAsia - GROUP 6 - 26.01.2022 - Markednurul syakirinNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- CCL Products India: Better Product Mix Flavours ProfitabilityDocument11 pagesCCL Products India: Better Product Mix Flavours ProfitabilityAshokNo ratings yet

- Ratio AnalysisDocument9 pagesRatio Analysislamvolamvo0912No ratings yet

- File 1686286056102Document14 pagesFile 1686286056102Tomar SahaabNo ratings yet

- The Power of Cummins USADocument37 pagesThe Power of Cummins USACASEEM INCNo ratings yet

- Qu Hưu Trí Na Uy - Gpfg-Annual-Report-2021-WebDocument140 pagesQu Hưu Trí Na Uy - Gpfg-Annual-Report-2021-WebhuynhtruonglyNo ratings yet

- CDSL TP: 750: in Its Own LeagueDocument10 pagesCDSL TP: 750: in Its Own LeagueSumangalNo ratings yet

- Bosch MdaDocument81 pagesBosch MdaAkansha priyaNo ratings yet

- Q1-2020 Financial ReportDocument13 pagesQ1-2020 Financial Reportvikasaggarwal01No ratings yet

- Silo 19apr21rev.19 04 2021 - 01 00 19 - QLA6BDocument13 pagesSilo 19apr21rev.19 04 2021 - 01 00 19 - QLA6BSaladin JaysiNo ratings yet

- Varun Beverages: Packed With FizzDocument46 pagesVarun Beverages: Packed With FizzDeepanshu GoswamiNo ratings yet

- Kino Indonesia: Equity ResearchDocument5 pagesKino Indonesia: Equity ResearchHot AsiNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- FSA Analysis 5Document1 pageFSA Analysis 5Tamo AndguladzeNo ratings yet

- FSA Analysis 2Document1 pageFSA Analysis 2Tamo AndguladzeNo ratings yet

- FSA Analysis 4Document1 pageFSA Analysis 4Tamo AndguladzeNo ratings yet

- FSA Analysis 1Document1 pageFSA Analysis 1Tamo AndguladzeNo ratings yet

- FSA Analysis 6Document1 pageFSA Analysis 6Tamo AndguladzeNo ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- ABELLO vs. CIRDocument4 pagesABELLO vs. CIRFrancise Mae Montilla MordenoNo ratings yet

- 42 PM MPC 16ps CsDocument8 pages42 PM MPC 16ps Csjose angel guzman lozanoNo ratings yet

- Presentation. e ProcurementDocument14 pagesPresentation. e ProcurementTrifan_DumitruNo ratings yet

- Pas 2Document7 pagesPas 2Justine VeralloNo ratings yet

- Plant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionDocument21 pagesPlant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionMehedi HasanNo ratings yet

- FM I Bond ValuationDocument16 pagesFM I Bond Valuationdanielnebeyat7No ratings yet

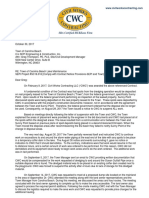

- Letter From CWCDocument3 pagesLetter From CWCMichael PraatsNo ratings yet

- DSCF Press ReleaseDocument2 pagesDSCF Press ReleaseGodwin IwekaNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- Evolution of Competition Law in IndiaDocument11 pagesEvolution of Competition Law in IndiaPreeminentPriyankaNo ratings yet

- Wedding Ceremony ScriptDocument4 pagesWedding Ceremony ScriptZenjamin007No ratings yet

- Capital Markets - EDHEC Risk InstituteDocument386 pagesCapital Markets - EDHEC Risk InstituteRicky Rick100% (1)

- General Accident: Comprehensive Personal LiabilityDocument1 pageGeneral Accident: Comprehensive Personal LiabilityJun FalconNo ratings yet

- The Unionist February 2014Document8 pagesThe Unionist February 2014novvotikNo ratings yet

- Different Kinds of Obligations 2Document49 pagesDifferent Kinds of Obligations 2Edrian BayotNo ratings yet

- TB ch01 9eDocument12 pagesTB ch01 9eRadizaJisiNo ratings yet

- Lesson 1. Rizal LawDocument3 pagesLesson 1. Rizal LawLucius LukeNo ratings yet

- Factories Act 1948Document9 pagesFactories Act 1948sid_narayanan4971No ratings yet

- Bangalore To Kolkata Flight Status Today, Flight Time & Tracker - IndiGoDocument1 pageBangalore To Kolkata Flight Status Today, Flight Time & Tracker - IndiGoPragati SarafNo ratings yet

- Digital Patterns: Designed by Steve GoodDocument29 pagesDigital Patterns: Designed by Steve GoodusuarioncilloNo ratings yet

- Class Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)Document4 pagesClass Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)P Janaki RamanNo ratings yet

- The Destruction of Records Act, 1917 - Arrangement of SectionsDocument3 pagesThe Destruction of Records Act, 1917 - Arrangement of SectionsKashishNo ratings yet

- I. Police Power CasesDocument127 pagesI. Police Power CasesAlvinson DayritNo ratings yet

- Request For Copy of Tax ReturnDocument2 pagesRequest For Copy of Tax ReturnAsjsjsjsNo ratings yet

- Teachers' Rights Mini-Guide: Provide Legal AdviceDocument2 pagesTeachers' Rights Mini-Guide: Provide Legal Adviceblackantelope_ericNo ratings yet

- Waterfront Cebu Vs LedesmaDocument5 pagesWaterfront Cebu Vs Ledesmaecinue guirreisaNo ratings yet

FSA Analysis 3

FSA Analysis 3

Uploaded by

Tamo AndguladzeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FSA Analysis 3

FSA Analysis 3

Uploaded by

Tamo AndguladzeCopyright:

Available Formats

Reckitt is outperforming Unilever in using its invested capital to generate NOPAT,

while Unilever seems more effective in generating sales

Dynamics Comments

ROIC Reckitt’s profitability metrics in 2021 were affected by the one-off loss of

EUR 3.8bn from the sale of IFCN China. On 5 June, Reckitt sold its IFCN

business in China (an implied enterprise value of EUR 2.3bn) for net cash

proceeds of around EUR 1.3bn to Primavera Capital Group, a Chinese

31.7% investment firm, while retaining an 8% stake in the business.

25.3%

21.7%

17.2% 16.4% 16.0%

IFCN China represented approximately 6% of revenues in 2020, and had, since

the beginning of 2020, been materially dilutive to the revenue growth and

2019 2020 2021 margins, reflecting increasingly difficult market conditions.

Unilever Reckitt

The transaction was strategically beneficial to Reckitt in that it allow

management to focus on its core operations and will help reduce

ICTO leverage. The proceeds were used to repay commercial paper when it fell due

and provided funds to partially cover the bond repayments due in June 2022.

Reckitt is outperforming Unilever in using its capital to generate NOPAT.

Reckitt’s ROIC has increased in 2021, as NOPAT was offset by lower average

1.3 1.3

invested capital, as a result of the disposal of IFCN China, which has been

1.2

removed from the invested capital from the date of disposal in September 2021.

0.6 0.6

0.5

Unilever’s ICTO is nearly twice the one for Reckitt, demonstrating that Unilever

2019 2020 2021 is more effective in generating sales by using its capital.

Unilever Reckitt

As both companies are based in the same country, effective tax rates are

almost identical.

You might also like

- IREF V 6 Pager Brochure - X UnitsDocument6 pagesIREF V 6 Pager Brochure - X UnitsPushpa DeviNo ratings yet

- Litigating ReptilesDocument7 pagesLitigating Reptilesjacob600No ratings yet

- The United States Is Still A British ColonyDocument33 pagesThe United States Is Still A British Colonyfamousafguy100% (5)

- Manson FreepDocument120 pagesManson FreepCuervo86% (7)

- FSA Analysis 6Document1 pageFSA Analysis 6Tamo AndguladzeNo ratings yet

- FIN - 4746 - IBT3 - Final Exam Solution - May 2022Document9 pagesFIN - 4746 - IBT3 - Final Exam Solution - May 2022abdourahimdiallo0148No ratings yet

- PSA - Factsheet - Pioneer Peso Equity Fund - 4Q20Document1 pagePSA - Factsheet - Pioneer Peso Equity Fund - 4Q20Ron CatalanNo ratings yet

- Resource Sharing For An Intelligent Future: Interim Report 2021Document50 pagesResource Sharing For An Intelligent Future: Interim Report 2021mailimailiNo ratings yet

- Centrum Broking Intellect Design Arena Initiating CoverageDocument31 pagesCentrum Broking Intellect Design Arena Initiating CoveragekanadeceNo ratings yet

- UntitledDocument176 pagesUntitledPriya NairNo ratings yet

- Creating Value For ShareholdersDocument8 pagesCreating Value For Shareholders18ITR028 Janaranjan ENo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- AkzoNobel Report 2019 InteractiveDocument554 pagesAkzoNobel Report 2019 InteractiveApurvaDuaNo ratings yet

- Idfc First Bank: IndiaDocument35 pagesIdfc First Bank: IndiaPraveen PNo ratings yet

- En Randco 2021 Agm Slideshow 20210520Document65 pagesEn Randco 2021 Agm Slideshow 20210520Xolani Radebe RadebeNo ratings yet

- Ultratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityDocument10 pagesUltratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityRohan AgrawalNo ratings yet

- Enbridge Inc: Investment BriefDocument5 pagesEnbridge Inc: Investment BriefrickescherNo ratings yet

- KIC 2021 Annual ReportDocument87 pagesKIC 2021 Annual ReportSachin Tukaram SalianNo ratings yet

- CPP Investor Factsheet 2023Document2 pagesCPP Investor Factsheet 2023tdhNo ratings yet

- Kuwait Investment Sector: Kuwait Financial Centre "Markaz"Document23 pagesKuwait Investment Sector: Kuwait Financial Centre "Markaz"Jyoti PrakashNo ratings yet

- Societe Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021Document74 pagesSociete Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021EvgeniyNo ratings yet

- Indo Count Industries LTD (ICIL) : P: R .170 R: Buy T P: R .225 FY19E PE: 9.0Document19 pagesIndo Count Industries LTD (ICIL) : P: R .170 R: Buy T P: R .225 FY19E PE: 9.0V KeshavdevNo ratings yet

- Capitaland 2021 H1Document88 pagesCapitaland 2021 H1Kiva DangNo ratings yet

- Eclerx Research ReportDocument13 pagesEclerx Research ReportPragati ChaudharyNo ratings yet

- As at 29 February 2020: Invesco Enhanced Income LimitedDocument2 pagesAs at 29 February 2020: Invesco Enhanced Income LimitedRebeccaLangfordNo ratings yet

- ASTRO Financial PositionDocument4 pagesASTRO Financial PositionVISALI A/P MURUGAN STUDENTNo ratings yet

- Buy (From Hold) : Company ReportDocument13 pagesBuy (From Hold) : Company ReportGiova NicosiaNo ratings yet

- Dixon Technologies Q1FY22 Result UpdateDocument8 pagesDixon Technologies Q1FY22 Result UpdateAmos RiveraNo ratings yet

- IREF V 6 Pager Brochure - Regular UnitsDocument6 pagesIREF V 6 Pager Brochure - Regular UnitsPushpa DeviNo ratings yet

- Corporate Presentation Q2 - 2022pdfDocument24 pagesCorporate Presentation Q2 - 2022pdfgussalimNo ratings yet

- PT M Cash Integrasi TBK: Charting A Digital TransformationDocument7 pagesPT M Cash Integrasi TBK: Charting A Digital TransformationHamba AllahNo ratings yet

- Taaleri Commissioned Research 030522Document13 pagesTaaleri Commissioned Research 030522ar1234567No ratings yet

- Further Resource Sharing: Interim Report 2020Document50 pagesFurther Resource Sharing: Interim Report 2020mailimailiNo ratings yet

- Subh NiveshDocument3 pagesSubh NiveshhrplanetsparkindoreNo ratings yet

- ITC Limited: Ratings Reaffirmed: Summary of Rating ActionDocument6 pagesITC Limited: Ratings Reaffirmed: Summary of Rating ActionSatish RajNo ratings yet

- HDFC Manufacturing Fund - NFO - Leaflet - HDFC BankDocument2 pagesHDFC Manufacturing Fund - NFO - Leaflet - HDFC Bankyeheji8177No ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- NFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358Document2 pagesNFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358bitsthechampNo ratings yet

- HFCL - Initiating Coverage - KSL 210521Document14 pagesHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNo ratings yet

- Building A Sustainable Future: Annual Report 2020Document177 pagesBuilding A Sustainable Future: Annual Report 2020AaNo ratings yet

- Building A Sustainable Future: Annual Report 2020Document177 pagesBuilding A Sustainable Future: Annual Report 2020AaNo ratings yet

- Coherence' 21 Case StudyDocument12 pagesCoherence' 21 Case Studyyashraj.nsscNo ratings yet

- Itc (Itc In) : Analyst Meet UpdateDocument18 pagesItc (Itc In) : Analyst Meet UpdateTatsam Vipul100% (1)

- Real Estate - Debt - Group 1Document3 pagesReal Estate - Debt - Group 1Vishant ChopraNo ratings yet

- Britannia Industries: IndiaDocument6 pagesBritannia Industries: Indiasps fetrNo ratings yet

- FSA Analysis 5Document1 pageFSA Analysis 5Tamo AndguladzeNo ratings yet

- Lse Adt 2021Document80 pagesLse Adt 2021hoangkhanhNo ratings yet

- IVRCL - Q4FY11 Result UpdateDocument3 pagesIVRCL - Q4FY11 Result UpdateSeema GusainNo ratings yet

- MAF603 - Group Case Study - AirAsia - GROUP 6 - 26.01.2022 - MarkedDocument8 pagesMAF603 - Group Case Study - AirAsia - GROUP 6 - 26.01.2022 - Markednurul syakirinNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- CCL Products India: Better Product Mix Flavours ProfitabilityDocument11 pagesCCL Products India: Better Product Mix Flavours ProfitabilityAshokNo ratings yet

- Ratio AnalysisDocument9 pagesRatio Analysislamvolamvo0912No ratings yet

- File 1686286056102Document14 pagesFile 1686286056102Tomar SahaabNo ratings yet

- The Power of Cummins USADocument37 pagesThe Power of Cummins USACASEEM INCNo ratings yet

- Qu Hưu Trí Na Uy - Gpfg-Annual-Report-2021-WebDocument140 pagesQu Hưu Trí Na Uy - Gpfg-Annual-Report-2021-WebhuynhtruonglyNo ratings yet

- CDSL TP: 750: in Its Own LeagueDocument10 pagesCDSL TP: 750: in Its Own LeagueSumangalNo ratings yet

- Bosch MdaDocument81 pagesBosch MdaAkansha priyaNo ratings yet

- Q1-2020 Financial ReportDocument13 pagesQ1-2020 Financial Reportvikasaggarwal01No ratings yet

- Silo 19apr21rev.19 04 2021 - 01 00 19 - QLA6BDocument13 pagesSilo 19apr21rev.19 04 2021 - 01 00 19 - QLA6BSaladin JaysiNo ratings yet

- Varun Beverages: Packed With FizzDocument46 pagesVarun Beverages: Packed With FizzDeepanshu GoswamiNo ratings yet

- Kino Indonesia: Equity ResearchDocument5 pagesKino Indonesia: Equity ResearchHot AsiNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- FSA Analysis 5Document1 pageFSA Analysis 5Tamo AndguladzeNo ratings yet

- FSA Analysis 2Document1 pageFSA Analysis 2Tamo AndguladzeNo ratings yet

- FSA Analysis 4Document1 pageFSA Analysis 4Tamo AndguladzeNo ratings yet

- FSA Analysis 1Document1 pageFSA Analysis 1Tamo AndguladzeNo ratings yet

- FSA Analysis 6Document1 pageFSA Analysis 6Tamo AndguladzeNo ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- ABELLO vs. CIRDocument4 pagesABELLO vs. CIRFrancise Mae Montilla MordenoNo ratings yet

- 42 PM MPC 16ps CsDocument8 pages42 PM MPC 16ps Csjose angel guzman lozanoNo ratings yet

- Presentation. e ProcurementDocument14 pagesPresentation. e ProcurementTrifan_DumitruNo ratings yet

- Pas 2Document7 pagesPas 2Justine VeralloNo ratings yet

- Plant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionDocument21 pagesPlant Assets, Natural Resources, and Intangible Assets: Accounting Principles, Ninth EditionMehedi HasanNo ratings yet

- FM I Bond ValuationDocument16 pagesFM I Bond Valuationdanielnebeyat7No ratings yet

- Letter From CWCDocument3 pagesLetter From CWCMichael PraatsNo ratings yet

- DSCF Press ReleaseDocument2 pagesDSCF Press ReleaseGodwin IwekaNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- Evolution of Competition Law in IndiaDocument11 pagesEvolution of Competition Law in IndiaPreeminentPriyankaNo ratings yet

- Wedding Ceremony ScriptDocument4 pagesWedding Ceremony ScriptZenjamin007No ratings yet

- Capital Markets - EDHEC Risk InstituteDocument386 pagesCapital Markets - EDHEC Risk InstituteRicky Rick100% (1)

- General Accident: Comprehensive Personal LiabilityDocument1 pageGeneral Accident: Comprehensive Personal LiabilityJun FalconNo ratings yet

- The Unionist February 2014Document8 pagesThe Unionist February 2014novvotikNo ratings yet

- Different Kinds of Obligations 2Document49 pagesDifferent Kinds of Obligations 2Edrian BayotNo ratings yet

- TB ch01 9eDocument12 pagesTB ch01 9eRadizaJisiNo ratings yet

- Lesson 1. Rizal LawDocument3 pagesLesson 1. Rizal LawLucius LukeNo ratings yet

- Factories Act 1948Document9 pagesFactories Act 1948sid_narayanan4971No ratings yet

- Bangalore To Kolkata Flight Status Today, Flight Time & Tracker - IndiGoDocument1 pageBangalore To Kolkata Flight Status Today, Flight Time & Tracker - IndiGoPragati SarafNo ratings yet

- Digital Patterns: Designed by Steve GoodDocument29 pagesDigital Patterns: Designed by Steve GoodusuarioncilloNo ratings yet

- Class Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)Document4 pagesClass Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)P Janaki RamanNo ratings yet

- The Destruction of Records Act, 1917 - Arrangement of SectionsDocument3 pagesThe Destruction of Records Act, 1917 - Arrangement of SectionsKashishNo ratings yet

- I. Police Power CasesDocument127 pagesI. Police Power CasesAlvinson DayritNo ratings yet

- Request For Copy of Tax ReturnDocument2 pagesRequest For Copy of Tax ReturnAsjsjsjsNo ratings yet

- Teachers' Rights Mini-Guide: Provide Legal AdviceDocument2 pagesTeachers' Rights Mini-Guide: Provide Legal Adviceblackantelope_ericNo ratings yet

- Waterfront Cebu Vs LedesmaDocument5 pagesWaterfront Cebu Vs Ledesmaecinue guirreisaNo ratings yet