Professional Documents

Culture Documents

CH - 10 - Company Audit

CH - 10 - Company Audit

Uploaded by

Ekansh AgarwalCopyright:

Available Formats

You might also like

- Full Download Principles of Corporate Finance 10th Edition Brealey Solutions ManualDocument14 pagesFull Download Principles of Corporate Finance 10th Edition Brealey Solutions Manualdrockadeobaq96% (24)

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Commonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiDocument37 pagesCommonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiCIBIL CHURUNo ratings yet

- Audit Rev. 3Document4 pagesAudit Rev. 3Charles PolidoNo ratings yet

- G.R. No. L-12582Document8 pagesG.R. No. L-12582Inter_vivosNo ratings yet

- CH - 3 - Audit Documentation and Audit EvidenceDocument38 pagesCH - 3 - Audit Documentation and Audit EvidenceEkansh AgarwalNo ratings yet

- Peer Review (P.R.) : DefinitionDocument8 pagesPeer Review (P.R.) : DefinitionDinesh MaheshwariNo ratings yet

- 04 - Peer Review and Quality ReviewDocument18 pages04 - Peer Review and Quality ReviewRavi RothiNo ratings yet

- Chapter 9 AIFS Complete Notes With QuestionsDocument71 pagesChapter 9 AIFS Complete Notes With Questionschananakartik1No ratings yet

- Who Is An Auditor?Document15 pagesWho Is An Auditor?Aman ChauhanNo ratings yet

- Caro - Companies (Auditor's Report) Order, 2020Document16 pagesCaro - Companies (Auditor's Report) Order, 2020Ekansh AgarwalNo ratings yet

- TOR - BAI ISO CertificationDocument5 pagesTOR - BAI ISO CertificationDM BertisNo ratings yet

- CH - 0 - Audit - BasicsDocument21 pagesCH - 0 - Audit - BasicsEkansh AgarwalNo ratings yet

- FAQ Peer ReviewDocument9 pagesFAQ Peer ReviewNaresh BudhaairNo ratings yet

- Training Regulations Training in Practice 2015 PDFDocument51 pagesTraining Regulations Training in Practice 2015 PDFIFRS LabNo ratings yet

- SA220Document22 pagesSA220Laura D'souza0% (1)

- Training Regulations and Guidelines 2015: Directive 1.03Document10 pagesTraining Regulations and Guidelines 2015: Directive 1.03IFRS LabNo ratings yet

- Audit and Assurance: The Regulatory FrameworkDocument21 pagesAudit and Assurance: The Regulatory FrameworkNatalia NaveedNo ratings yet

- CA Ipcc Audit m21 Book FVDocument405 pagesCA Ipcc Audit m21 Book FVKC XitizNo ratings yet

- The Project Report On The Topic: University Institute of Legal Studies Panjab University, ChandigarhDocument10 pagesThe Project Report On The Topic: University Institute of Legal Studies Panjab University, ChandigarhÅPEX々 N33JÜNo ratings yet

- Training Regulations and Guidelines 2015: Directive 1.03Document5 pagesTraining Regulations and Guidelines 2015: Directive 1.03IFRS LabNo ratings yet

- Audit of Different Types of EntitiesDocument47 pagesAudit of Different Types of Entitieschananakartik1No ratings yet

- Sample TOR For CBDocument5 pagesSample TOR For CBAntonio P. Santos100% (1)

- Audit Committee CharterDocument17 pagesAudit Committee CharterJaja JijiNo ratings yet

- CA Inter Auditing RTP Nov22Document30 pagesCA Inter Auditing RTP Nov22tholkappiyanjk14No ratings yet

- Training Regulations and Guidelines Training in Practice 2015Document4 pagesTraining Regulations and Guidelines Training in Practice 2015IFRS LabNo ratings yet

- SEBI Grade A 2020 Companies Act Chapter XDocument8 pagesSEBI Grade A 2020 Companies Act Chapter Xnit07No ratings yet

- The Institute of Chartered Accountants of Bangladesh Professional Stage: Knowledge Level Additional Sheet - Concept of and Need For AssuranceDocument4 pagesThe Institute of Chartered Accountants of Bangladesh Professional Stage: Knowledge Level Additional Sheet - Concept of and Need For AssuranceShahid MahmudNo ratings yet

- Chapter 12 of Companies Act 2013Document57 pagesChapter 12 of Companies Act 2013piyush parasharNo ratings yet

- Guidelines ApprenticeshipDocument15 pagesGuidelines ApprenticeshipkapsicumadNo ratings yet

- Corporate Law IIDocument19 pagesCorporate Law IIIMRAN ALAMNo ratings yet

- AUDITORDocument7 pagesAUDITORAKSHAY SHINGADENo ratings yet

- SOP 11-Conflict of Interest Rev 1Document3 pagesSOP 11-Conflict of Interest Rev 1Bang CacihNo ratings yet

- Audit Program Licensing TermsDocument21 pagesAudit Program Licensing TermsLê Đình ChinhNo ratings yet

- Companies (Audit and Auditors) Rules, 2014 - MCA - 31-03-2014Document10 pagesCompanies (Audit and Auditors) Rules, 2014 - MCA - 31-03-2014dhuvadpratikNo ratings yet

- Quality ReviewDocument34 pagesQuality Reviewenila upretiNo ratings yet

- Corporate Governance Report - Confederation of Indian IndustryDocument6 pagesCorporate Governance Report - Confederation of Indian IndustryNeha GuptaNo ratings yet

- 5b. QUALITY CONTROL POLICIES AND PROCEDURESDocument6 pages5b. QUALITY CONTROL POLICIES AND PROCEDURESSumbul SammoNo ratings yet

- Module 3 - The Professional StandardsDocument8 pagesModule 3 - The Professional StandardsMAG MAGNo ratings yet

- Peer Review Print Version M23 OnwardsDocument13 pagesPeer Review Print Version M23 Onwardsmdasifraza3196No ratings yet

- Company Law AssignmentDocument9 pagesCompany Law Assignmentrohanjaiswal290301No ratings yet

- Chapter-7. Peer ReviewDocument16 pagesChapter-7. Peer ReviewAARCHI JAIN100% (1)

- Bhubaneswar 24012016 Session IDocument49 pagesBhubaneswar 24012016 Session ILovely LeninNo ratings yet

- SQC 1Document34 pagesSQC 1Sourabh SinghNo ratings yet

- Basics Audit Neeraj AroraDocument22 pagesBasics Audit Neeraj Aroradaniya manojNo ratings yet

- Audit and Auditors PresentationDocument14 pagesAudit and Auditors PresentationGeo P BNo ratings yet

- 01 Audit of Different Types of EntitiesDocument5 pages01 Audit of Different Types of Entitiesvishal mishraNo ratings yet

- Tuev Nord Cert Amfori Bsci Service DescriptionDocument4 pagesTuev Nord Cert Amfori Bsci Service DescriptionMohamed HafezNo ratings yet

- NB 371Document7 pagesNB 371NISAR DEENNo ratings yet

- 1.Name:Humayun Raheel 2.CLASS:SP18-BBA-5D 3.subject: Corporate Law 4.registration No.152Document2 pages1.Name:Humayun Raheel 2.CLASS:SP18-BBA-5D 3.subject: Corporate Law 4.registration No.152Humayun raheelNo ratings yet

- Guide To OPITO ApprovalDocument28 pagesGuide To OPITO ApprovalMalek SammoudiNo ratings yet

- G65 BRC Checklist (1aug10)Document15 pagesG65 BRC Checklist (1aug10)almasofia3No ratings yet

- SIRE Inspector Accreditation Guidelines August 2011Document66 pagesSIRE Inspector Accreditation Guidelines August 2011lostnfndNo ratings yet

- AI 2 Part 6 QADocument39 pagesAI 2 Part 6 QAJobby JaranillaNo ratings yet

- Audit Guidance Effective From 1 January 2014Document58 pagesAudit Guidance Effective From 1 January 2014Nasir ArifNo ratings yet

- Final Draft of Amendments To Rules and Regulations On The QAR ProgramDocument12 pagesFinal Draft of Amendments To Rules and Regulations On The QAR ProgramLen AlairNo ratings yet

- Appointment of Auditors in PakistanDocument21 pagesAppointment of Auditors in PakistanSunaina ZakiNo ratings yet

- 34.peer ReveiwDocument7 pages34.peer ReveiwmercatuzNo ratings yet

- Iso 17020Document7 pagesIso 17020Abusaada2012No ratings yet

- Sa 220Document20 pagesSa 220Ankush DhawanNo ratings yet

- Peer Review ScannerDocument7 pagesPeer Review Scannersairad1999No ratings yet

- The Concise Calibration & Test Equipment Management Guide: The Concise Collection, #1From EverandThe Concise Calibration & Test Equipment Management Guide: The Concise Collection, #1Rating: 4.5 out of 5 stars4.5/5 (2)

- Series 10 Exam Study Guide 2022 + Test BankFrom EverandSeries 10 Exam Study Guide 2022 + Test BankNo ratings yet

- CH - 3 - Question BankDocument22 pagesCH - 3 - Question BankEkansh AgarwalNo ratings yet

- Caro - Companies (Auditor's Report) Order, 2020Document16 pagesCaro - Companies (Auditor's Report) Order, 2020Ekansh AgarwalNo ratings yet

- CH - 8 - Analytical Procedure (Sa 520)Document10 pagesCH - 8 - Analytical Procedure (Sa 520)Ekansh AgarwalNo ratings yet

- CH - 4 - Risk Assessment and Internal ControlDocument46 pagesCH - 4 - Risk Assessment and Internal ControlEkansh AgarwalNo ratings yet

- CH - 3 - Audit Documentation and Audit EvidenceDocument38 pagesCH - 3 - Audit Documentation and Audit EvidenceEkansh AgarwalNo ratings yet

- CH - 0 - Audit - BasicsDocument21 pagesCH - 0 - Audit - BasicsEkansh AgarwalNo ratings yet

- CH - 2 - Audit Strategy, Audit Planning, & Audit ProgrammeDocument29 pagesCH - 2 - Audit Strategy, Audit Planning, & Audit ProgrammeEkansh AgarwalNo ratings yet

- CH - 0 - Question BankDocument12 pagesCH - 0 - Question BankEkansh AgarwalNo ratings yet

- CH - 2 - Question BankDocument30 pagesCH - 2 - Question BankEkansh AgarwalNo ratings yet

- CH - 1 - Question BankDocument45 pagesCH - 1 - Question BankEkansh AgarwalNo ratings yet

- CH - 1 - Sa 200 - Overall Objectives of An Independent Auditor and Conduct of The Audit in Accordance With Standard On AuditingDocument49 pagesCH - 1 - Sa 200 - Overall Objectives of An Independent Auditor and Conduct of The Audit in Accordance With Standard On AuditingEkansh AgarwalNo ratings yet

- The Concept of Business OrganisationDocument4 pagesThe Concept of Business OrganisationSanveer Krishna100% (2)

- Trust - Not A Separate Legal EntityDocument2 pagesTrust - Not A Separate Legal EntityNeha ShahNo ratings yet

- Donation Political PartiesDocument4 pagesDonation Political Partiessockalingam.mNo ratings yet

- H.j.heinz M & A Kel848-PDF-Eng - UnlockedDocument25 pagesH.j.heinz M & A Kel848-PDF-Eng - UnlockedHasanNo ratings yet

- Real Life CaseDocument2 pagesReal Life CaseFahim Shahriar MozumderNo ratings yet

- Terms of Employment - DCT - V3Document6 pagesTerms of Employment - DCT - V3Sahil AnejaNo ratings yet

- Sentiment Analysis of Restaurant CustomerDocument6 pagesSentiment Analysis of Restaurant CustomerAC CahuloganNo ratings yet

- 18PM0044 - 1.0 ML Clear White Ring Snap Off & Yellow Ring On Neck Glass AmpouleDocument2 pages18PM0044 - 1.0 ML Clear White Ring Snap Off & Yellow Ring On Neck Glass Ampoulesystacare remediesNo ratings yet

- Printers AbbreviationsDocument8 pagesPrinters AbbreviationsGustavo MazaNo ratings yet

- Part A Warehouse ReceiptsDocument20 pagesPart A Warehouse ReceiptsRhev Xandra AcuñaNo ratings yet

- Standard Chartered BankDocument41 pagesStandard Chartered BankGovind Tyagi100% (1)

- Estatement - 01 Feb 2024 - 1708262406490Document8 pagesEstatement - 01 Feb 2024 - 1708262406490Hammad KhanNo ratings yet

- Week 3 Case AnalysisDocument3 pagesWeek 3 Case AnalysisGarrett ToddNo ratings yet

- Chapter 5 - Teori AkuntansiDocument34 pagesChapter 5 - Teori AkuntansiCut Riezka SakinahNo ratings yet

- Doctrine of Indoor ManagementDocument5 pagesDoctrine of Indoor ManagementBeejal AhujaNo ratings yet

- Griffiths CaseDocument13 pagesGriffiths CaseMERCY LAWNo ratings yet

- Aptitude Assessment Preparation Program Trainee HandbookDocument148 pagesAptitude Assessment Preparation Program Trainee HandbookMustafa ShabanNo ratings yet

- English A (2009) May Paper 2Document6 pagesEnglish A (2009) May Paper 2Jewelle100% (1)

- 11A. HDFC Estatement FEB 2018Document6 pages11A. HDFC Estatement FEB 2018Nanu PatelNo ratings yet

- Business Level Strategy: Reference: Henry "Understanding Strategic Management", Chapter 7Document25 pagesBusiness Level Strategy: Reference: Henry "Understanding Strategic Management", Chapter 7sarmithaNo ratings yet

- An Aasis Training Guide Accounts Payable Basics Logistics InvoicingDocument53 pagesAn Aasis Training Guide Accounts Payable Basics Logistics Invoicingrajkishoresharma_554No ratings yet

- Issai: Quality Control For SaisDocument24 pagesIssai: Quality Control For SaisishtiaqNo ratings yet

- Teaching Hours: 5 Hours Per WeekDocument47 pagesTeaching Hours: 5 Hours Per WeekChandana CharaNo ratings yet

- w9 Request JeffCo District Court 3-22-2022Document2 pagesw9 Request JeffCo District Court 3-22-2022otis tolbertNo ratings yet

- Miscellaneous Provisions: After Studying This Chapter, You Would Be Able ToDocument40 pagesMiscellaneous Provisions: After Studying This Chapter, You Would Be Able ToYASH PATILNo ratings yet

- CREW Most Corrupt Report 2011Document135 pagesCREW Most Corrupt Report 2011CREW100% (1)

- Invoice 207Document1 pageInvoice 207morerahul5889No ratings yet

CH - 10 - Company Audit

CH - 10 - Company Audit

Uploaded by

Ekansh AgarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH - 10 - Company Audit

CH - 10 - Company Audit

Uploaded by

Ekansh AgarwalCopyright:

Available Formats

These notes are incomplete without our videos. We keep on updating our books, notes and videos.

You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Chapter 10 Company Audit

CHAPTER X

AUDIT AND AUDITORS

Appointment of auditors - 139

Subsequent auditor of a company other than government company

139. (1) Subject to the provisions of this Chapter,

● every company

● shall,

● at the first annual general meeting,

● appoint an individual or a firm as an auditor

● who shall hold office

○ from the conclusion of that meeting till the conclusion of its sixth annual general meeting

○ And the manner and procedure of selection of auditors by the members of the company at such

meetings shall be such as may be prescribed.

First Proviso Deleted

Provided further that

● before such appointment is made,

● the written consent of the auditor to such appointment, and

● a certificate from him or it

○ that the appointment,

○ if made,

○ shall be in accordance with the conditions as may be prescribed, shall be obtained from the

auditor:

Provided also that the certificate shall also indicate whether the auditor satisfies the criteria provided in section

141

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 1

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Provided also that the company shall inform the auditor concerned of his or its appointment, and also file a

notice of such appointment with the Registrar within fifteen days of the meeting in which the auditor is

appointed.

Role of Audit Committee in Appointment of Auditor

139 (11) Where a company is required to constitute an Audit Committee under section 177, all appointments,

including the filling of a casual vacancy of an auditor under this section shall be made after taking into account

the recommendations of such committee.

Manner and procedure of selection and appointment of auditors - Rule 3 Companies (Audit and

Auditors) Rules, 2014

3. (1) In case of a company that is required to constitute an Audit Committee under section 177, the committee,

and, in cases where such a committee is not required to be constituted, the Board, shall take into consideration

the qualifications and experience of the individual or the firm proposed to be considered for appointment as

auditor and whether such qualifications and experience are commensurate with the size and requirements of

the company:

Provided that while considering the appointment, the Audit Committee or the Board, as the case may be, shall

have regard to any order or pending proceeding relating to professional matters of conduct against the

proposed auditor before the Institute of Chartered Accountants of India or any competent authority or any

Court.

(2) The Audit Committee or the Board, as the case may be, may call for such other information from the

proposed auditor as it may deem fit.

(3) Subject to the provisions of sub-rule (1), where a company is required to constitute the Audit Committee, the

committee shall recommend the name of an individual or a firm as auditor to the Board for consideration and

in other cases, the Board shall consider and recommend an individual or a firm as auditor to the members in

the annual general meeting for appointment.

(4) If the Board agrees with the recommendation of the Audit Committee, it shall further recommend the

appointment of an individual or a firm as auditor to the members in the annual general meeting.

(5) If the Board disagrees with the recommendation of the Audit Committee, it shall refer back the

recommendation to the committee for reconsideration citing reasons for such disagreement.

(6) If the Audit Committee, after considering the reasons given by the Board, decides not to reconsider its

original recommendation, the Board shall record reasons for its disagreement with the committee and send its

own recommendation for consideration of the members in the annual general meeting; and if the Board

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 2

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

agrees with the recommendations of the Audit Committee, it shall place the matter for consideration by

members in the annual general meeting.

(7) The auditor appointed in the annual general meeting shall hold office from the conclusion of that meeting

till the conclusion of the sixth annual general meeting, with the meeting wherein such appointment has been

made being counted as the first meeting.

Conditions for appointment and notice to Registrar - Rule 4

4. (1) The auditor appointed under rule 3 shall submit a certificate that -

a. the individual or the firm, as the case may be, is eligible for appointment and is not disqualified for

appointment under the Act, the Chartered Accountants Act, 1949 and the rules or regulations made

thereunder;

b. the proposed appointment is as per the term provided under the Act;

c. the proposed appointment is within the limits laid down by or under the authority of the Act;

d. the list of proceedings against the auditor or audit firm or any partner of the audit firm pending with

respect to professional matters of conduct, as disclosed in the certificate, is true and correct.

(2) The notice to Registrar about appointment of auditor under fourth proviso to sub-section (1) of section 139

shall be in Form ADT- 1

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 3

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 4

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

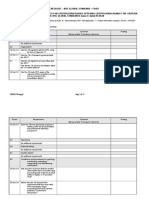

Rule 3 Charts

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 5

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 6

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Subsequent Auditor of Government Company

(5) Notwithstanding anything contained in sub-section (1), in the case of a Government company or any other

company owned or controlled, directly or indirectly, by the Central Government, or by any State

Government or Governments, or partly by the Central Government and partly by one or more State

Governments, the Comptroller and Auditor-General of India shall, in respect of a financial year, appoint an

auditor duly qualified to be appointed as an auditor of companies under this Act, within a period of one

hundred and eighty days from the commencement of the financial year, who shall hold office till the

conclusion of the annual general meeting.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 7

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

First Auditor other than government company

(6) Notwithstanding anything contained in sub-section (1), the first auditor of a company, other than a

Government company, shall be appointed by the Board of Directors within thirty days from the date of

registration of the company and in the case of failure of the Board to appoint such auditor, it shall inform the

members of the company, who shall within ninety days at an extraordinary general meeting appoint such

auditor and such auditor shall hold office till the conclusion of the first annual general meeting.

First auditor Government Company

(7) Notwithstanding anything contained in sub-section (1) or sub-section (5), in the case of a Government

company or any other company owned or controlled, directly or indirectly, by the Central Government, or by

any State Government, or Governments, or partly by the Central Government and partly by one or more State

Governments, the first auditor shall be appointed by the Comptroller and Auditor-General of India within sixty

days from the date of registration of the company and in case the Comptroller and Auditor-General of India

does not appoint such auditor within the said period, the Board of Directors of the company shall appoint

such auditor within the next thirty days; and in the case of failure of the Board to appoint such auditor within

the next thirty days, it shall inform the members of the company who shall appoint such auditor within the

sixty days at an extraordinary general meeting, who shall hold office till the conclusion of the first annual

general meeting.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 8

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 9

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

139(2) - Rotation

No listed company or a company belonging to such class or classes of companies as may be prescribed, shall

appoint or re-appoint—

a. an individual as auditor for more than one term of five consecutive years; and

b. an audit firm as auditor for more than two terms of five consecutive years

Cooling period

Provided that—

● an individual auditor who has completed his term under clause (a) shall not be eligible for

re-appointment as auditor in the same company for five years from the completion of his term;

● an audit firm which has completed its term under clause (b), shall not be eligible for re-appointment as

auditor in the same company for five years from the completion of such term:

Firms having a common partner or partners also have to serve the cooling period.

Provided further that as on the date of appointment no audit firm having a common partner or partners to the

other audit firm, whose tenure has expired in a company immediately preceding the financial year, shall be

appointed as auditor of the same company for a period of five years

Provided also that, nothing contained in this sub-section shall prejudice

● the right of the company to remove an auditor or

● the right of the auditor to resign from such office of the company.

139(3)

Subject to the provisions of this Act, members of a company may resolve to provide that—

a. in the audit firm appointed by it, the auditing partner and his team shall be rotated at such intervals as

may be resolved by members; or

b. the audit shall be conducted by more than one auditor

139(4)

The Central Government may, by rules, prescribe the manner in which the companies shall rotate their

auditors in pursuance of sub-section (2).

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 10

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Section 139(2) - Super Summary For Understanding

For listed and prescribed companies

● Individuals cannot be appointed as auditor for more than one term of 5 consecutive years.

● Firm cannot be appointed as auditor for more than 2 terms of 5 consecutive years.

Individual or firm as the case may be once completed the term (1 term of 5 CY or 2 term of 5CY) as

mentioned above will not be eligible to be reappointed as auditor in the same company for 5 years from the

completion of such term.

Not only individual or the firm the following will also be not eligible to be appointed as the auditor of such a

company

● Partner of the outgoing firm

● Firm having common partner as on the date of appointment.

● the incoming auditor or audit firm shall not be eligible if such auditor or audit firm is associated with

the outgoing auditor or audit firm under the same network of audit firms.

○ For the purposes of these rules the term 'same network" includes the firms operating or

functioning, hitherto or in future, under the same brand name, trade name or common

control.

● Firm joined by partner who certified the financial statements.

Any break in 1 term of 5CY or 2 terms of 5CY will be considered as break only if it is of 5 years or more.

Example - Individual is auditor in a company specified under Section 139(2), the auditor resigned after 4

years. The same auditor was reappointed after 1 year for another 5 years. Discuss

Discussion in classes or videos

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 11

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 12

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 13

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Question

Clue Ltd. is a Public unlisted company having paid-up share capital of Rs. 9 crores and public borrowings

from the financial institutions of Rs. 51 crores. They appointed M/s Pray and Co., A Chartered Accountant firm

as the statutory auditor in its annual general meeting for 11 years.

● Is the manner of rotation of the auditor applicable in the case of Clue Ltd.?

● Whether the appointment of M/s Pray and Co. is valid?

November 2020 - 4 Marks

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 14

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

139(8) - Casual Vacancy

Any casual vacancy in the office of an auditor shall—

● in the case of a company other than a company whose accounts are subject to audit by an auditor

appointed by the Comptroller and Auditor-General of India, be filled by the Board of Directors within

thirty days, but if such casual vacancy is as a result of the resignation of an auditor, such appointment

shall also be approved by the company at a general meeting convened within three months of the

recommendation of the Board and he shall hold the office till the conclusion of the next annual general

meeting;

● in the case of a company whose accounts are subject to audit by an auditor appointed by the

Comptroller and Auditor-General of India, be filled by the Comptroller and Auditor-General of India

within thirty days:

Provided that in case the Comptroller and Auditor-General of India does not fill the vacancy within the said

period, the Board of Directors shall fill the vacancy within the next thirty days.

Question - Correct / Incorrect Marks 2 January 2021 Exam Question

As per Section 139(8) of the Companies Act, 2013, any casual vacancy in the office of an auditor shall in case of

a company other than a company whose accounts are subject to audit by an auditor appointed by

Comptroller and Auditor General of India, be filled by the Shareholders at an Annual General Meeting within

60 days.

139(9) Reappointment of retiring auditor

Subject to the provisions of sub-section (1) and the rules made thereunder, a retiring auditor may be

re-appointed at an annual general meeting, if—

a. he is not disqualified for re-appointment;

b. he has not given the company a notice in writing of his unwillingness to be re-appointed; and

c. a special resolution has not been passed at that meeting appointing some other auditor or providing

expressly that he shall not be re-appointed.

139(10) - No auditor is appointed or reappointed

Where at any annual general meeting, no auditor is appointed or reappointed, the existing auditor shall

continue to be the auditor of the company.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 15

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Section 140- Removal, resignation of auditor and giving of special notice

Removal before expiry of term

140. (1) The auditor appointed under section 139 may be removed from his office before the expiry of his term

only by a special resolution of the company, after obtaining the previous approval of the Central Government in

that behalf in the prescribed manner:

Provided that before taking any action under this sub-section, the auditor concerned shall be given a

reasonable opportunity of being heard.

Removal of the auditor before expiry of his term

7. (1) The application to the Central Government for removal of auditor shall be made in Form ADT-2 and shall

be accompanied with fees as provided for this purpose under the Companies (Registration Offices and Fees)

Rules, 2014.

(2) The application shall be made to the Central Government within thirty days of the resolution passed by

the Board.

(3) The company shall hold the general meeting within sixty days of receipt of approval of the Central

Government for passing the special resolution.

Statement of Reasons

(2) The auditor who has resigned from the company shall file within a period of thirty days from the date of

resignation, a statement in the prescribed form with the company and the Registrar, and in case of companies

referred to in sub-section (5) of section 139, the auditor shall also file such statement with the Comptroller and

Auditor-General of India, indicating the reasons and other facts as may be relevant with regard to his

resignation.

(3) If the auditor does not comply with the provisions of sub-section (2), he or it shall be liable to a penalty of

fifty thousand rupees or an amount equal to the remuneration of the auditor, whichever is less, and in case of

continuing failure, with further penalty of five hundred rupees for each day after the first during which such

failure continues, subject to a maximum of two lakh rupees.

(4)

i. Special notice shall be required for a resolution at an annual general meeting appointing as auditor a

person other than a retiring auditor, or providing expressly that a retiring auditor shall not be

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 16

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

re-appointed, except where the retiring auditor has completed a consecutive tenure of five years or, as

the case may be, ten years, as provided under sub-section (2) of section 139.

ii. On receipt of notice of such a resolution, the company shall forthwith send a copy thereof to the retiring

auditor.

iii. Where notice is given of such a resolution and the retiring auditor makes with respect thereto

representation in writing to the company (not exceeding a reasonable length) and requests its

notification to members of the company, the company shall, unless the representation is received by it

too late for it to do so,—

a. in any notice of the resolution given to members of the company, state the fact of the

representation having been made; and

b. send a copy of the representation to every member of the company to whom notice of the

meeting is sent, whether before or after the receipt of the representation by the company, and if

a copy of the representation is not sent as aforesaid because it was received too late or because

of the company's default, the auditor may (without prejudice to his right to be heard orally)

require that the representation shall be read out at the meeting:

Provided that if a copy of representation is not sent as aforesaid, a copy thereof shall be filed with the Registrar:

Provided further that if the Tribunal is satisfied on an application either of the company or of any other

aggrieved person that the rights conferred by this sub-section are being abused by the auditor, then, the copy

of the representation may not be sent and the representation need not be read out at the meeting.

(5) Without prejudice to any action under the provisions of this Act or any other law for the time being in force,

the Tribunal either suo motu or on an application made to it by the Central Government or by any person

concerned, if it is satisfied that the auditor of a company has, whether directly or indirectly, acted in a

fraudulent manner or abetted or colluded in any fraud by, or in relation to, the company or its directors or

officers, it may, by order, direct the company to change its auditors:

Provided that if the application is made by the Central Government and the Tribunal is satisfied that any

change of the auditor is required, it shall within fifteen days of receipt of such application, make an order that

he shall not function as an auditor and the Central Government may appoint another auditor in his place:

Provided further that an auditor, whether individual or firm, against whom final order has been passed by the

Tribunal under this section shall not be eligible to be appointed as an auditor of any company for a period of

five years from the date of passing of the order and the auditor shall also be liable for action under section 447.

Explanation I.—It is hereby clarified that in the case of a firm, the liability shall be of the firm and that of every

partner or partners who acted in a fraudulent manner or abetted or colluded in any fraud by, or in relation to,

the company or its directors or officers.

Explanation II.—For the purposes of this Chapter the word "auditor" includes a firm of auditors.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 17

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 18

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 19

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 20

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 21

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 22

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Section 141- eligibility, qualifications and disqualifications of auditors

141. (1) A person shall be eligible for appointment as an auditor of a company

● only if he is a chartered accountant

● Provided that a firm whereof

○ majority of partners practising in India are qualified for appointment as aforesaid

○ may be appointed by its firm name to be auditor of a company.

2(17) "chartered accountant" means a chartered accountant as defined in clause (b) of subsection (1) of section

2 of the Chartered Accountants Act, 1949 (38 of 1949) who holds a valid certificate of practice under subsection

(1) of section 6 of that Act

2(1)(b) of The Chartered Accountants Act, 1949- chartered accountant” means a person who is a member of the

Institute

(2) Where a firm including a limited liability partnership is appointed as an auditor of a company,

● only the partners who are chartered accountants shall be authorised to act and sign on behalf of the

firm.

(3) The following persons shall not be eligible for appointment as an auditor of a company, namely:—

(a) a body corporate other than a limited liability partnership registered under the Limited Liability

Partnership Act, 2008 (6 of 2009);

(b) an officer or employee of the company;

(c) a person who is a partner, or who is in the employment, of an officer or employee of the company;

(d) a person who, or his relative or partner—

(i) is holding any security of or interest in the company or its subsidiary, or of its holding or

associate company or a subsidiary of such holding company:

Provided that the relative may hold security or interest in the company of face value not exceeding one

thousand rupees or such sum as may be prescribed (Not exceeding Rs. 1 lakh)

In the event of acquiring any security or interest by a relative, above the threshold prescribed (Rs. 1,00,000), the

corrective action to maintain the limits as specified above shall be taken by the auditor within 60 days of such

acquisition or interest.

(ii) is indebted to the company, or its subsidiary, or its holding or associate company or a subsidiary

of such holding company, in excess of such amount as may be prescribed (Not exceeding Rs. 5

lakh) ; or

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 23

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

(iii) has given a guarantee or provided any security in connection with the indebtedness of any third

person to the company, or its subsidiary, or its holding or associate company or a subsidiary of

such holding company, for such amount as may be prescribed; (Not exceeding Rs. 1 lakh.)

(e) a person or a firm who, whether directly or indirectly, has business relationship with the company, or

its subsidiary, or its holding or associate company or subsidiary of such holding company or associate

company of such nature as may be prescribed;

For the purpose of clause (e) of sub-section (3) of section 141, the term "business relationship" shall be

construed as any transaction entered into for a commercial purpose, except -

i. commercial transactions which are in the nature of professional services permitted to be

rendered by an auditor or audit firm under the Act and the Chartered Accountants Act, 1949

and the rules or the regulations made under those Acts;

ii. commercial transactions which are in the ordinary course of business of the company at

arm's length price -like sale of products or services to the auditor, as customer, in the ordinary

course of business, by companies engaged in the business of telecommunications, airlines,

hospitals, hotels and such other similar businesses.

(f) - a person whose relative

- is a director or

- is in the employment of the company as a

- director or key managerial personnel;

(g) - a person who is in full time employment elsewhere or

- a person or a partner of a firm holding appointment as its auditor, if such persons or partner is at the

date of such appointment or reappointment holding appointment as auditor of more than twenty

companies other than one-person Company, dormant companies , small companies and private

Companies having paid up capital less than 100 Crores which has not committed default in filing it’s

financial statements u/s 137 or annual return u/s 92 of companies act with the registrar.

(h) a person who has been convicted by a court of an offence involving fraud and a period of ten years has

not elapsed from the date of such conviction.

(i) a person who, directly or indirectly, renders any service referred to in section 144 to the company or its

holding company or its subsidiary company.

Explanation.—For the purposes of this clause, the term "directly or indirectly" shall have the meaning assigned

to it in the Explanation to section 144.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 24

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

(4) Where a person appointed as an auditor of a company incurs any of the disqualifications mentioned in

141(3) after his appointment, he shall vacate his office as such auditor and such vacation shall be deemed to be

a casual vacancy in the office of the auditor.

Meaning of Relative : The term “relative” as defined under the Companies Act, 2013, means anyone who is

related to another as members of a HUF; husband and wife; Father (including step-father), mother (including

stepmother), Son (including step-son), Son’s wife, Daughter, Daughter’s husband, Brother (including

step-brother), sister (including step-sister).

Ceiling on Tax Audit Assignments: The specified number of tax audit assignments that an auditor, as an individual or

as a partner of a firm, can accept is 60 numbers.

A chartered accountant in practice as well as firm of chartered accountants in practice shall maintain a record of the

audit assignments accepted by him or by the firm of chartered accountants, or by any of the partner of the firm in

his individual name or as a partner of any other firm as far as possible, in the prescribed manner.

In exercise of the powers conferred by the Chartered Accountants Act, 1949, the Council of the Institute of

Chartered Accountants of India specifies that a member of the Institute in practice shall be deemed to be

guilty of professional misconduct, if he holds at any time appointment of more than the “specified number

of audit assignments of the companies under Section 141(3)(g) of the Companies Act, 2013).

Explain the provisions prescribed under Companies Act, 2013 in respect of ceiling on number of audits in a

company to be accepted by an auditor.

ICAI RTP May 2021.

144 - Auditor not to render certain services.

An auditor appointed under this Act shall provide to the company only such other services as are approved by

the Board of Directors or the audit committee, as the case may be, but which shall not include any of the

following services (whether such services are rendered directly or indirectly to the company or its holding

company or subsidiary company), namely

(a) accounting and book keeping services;

(b) internal audit;

(c) design and implementation of any financial information system;

(d) actuarial services;

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 25

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

(e) investment advisory services;

(f) investment banking services;

(g) rendering of outsourced financial services;

(h) management services; and

(i) any other kind of services as may be prescribed :

Explanation.—For the purposes of this subsection, the term "directly or indirectly" shall include rendering of

services by the auditor

i. in case of auditor being an individual,

○ either himself or

○ through his relative or

○ any other person connected or associated with such individual or

○ through any other entity, whatsoever, in which such individual has significant influence or

control,

○ or whose name or trade mark or brand is used by such individual;

ii. in case of auditor being a firm,

○ either itself or

○ through any of its partners or

○ through its parent, subsidiary or associate entity or

○ through any other entity, whatsoever, in which the firm or any partner of the firm has

significant influence or control, or

○ whose name or trademark or brand is used by the firm or any of its partners.

AB & Co. is an audit firm having partners Mr. A and Mr. B. Mr. C, the relative of Mr. B, is holding

securities having face value of ₹ 2,00,000 in XYZ Ltd. AB & Co. is qualified for being appointed as an

auditor of XYZ Ltd.

Incorrect: As per the provisions of the Companies Act, 2013, a person is disqualified to be appointed as an

auditor of a company if his relative is holding any security of or interest in the company of face value

exceeding ₹1 lakh.

Therefore, AB & Co. shall be disqualified for being appointed as an auditor of XYZ Ltd. as Mr. C, the relative of

Mr. B who is a partner in AB & Co., is holding securities in XYZ Ltd. having face value of ₹2 lakh.

A Chartered Accountant holding securities of S Ltd. having face value of ₹950 is qualified for

appointment as an auditor of S Ltd.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 26

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Incorrect: As per the provisions of the Companies Act, 2013, a person is disqualified to be appointed as an

auditor of a company if he is holding any security of or interest in the company.

As the chartered accountant is holding securities of S Ltd. having face value of ₹950, he is not eligible for

appointment as an auditor of S Ltd.

Mr. N, a member of the Institute of Chartered Accountants of England and Wales, is qualified to be

appointed as auditor of Indian Companies.

Incorrect: A person shall be eligible for appointment as an auditor of a company only if he is a chartered

accountant.

It may be noted that a firm whereof majority of partners practicing in India are qualified for appointment as

aforesaid may be appointed by its firm name to be auditor of a company.

Thus, Mr. N is disqualified to be appointed as an auditor of Indian Companies.

M/s R & Co., a firm of Chartered Accountants, was appointed as statutory auditors of Ramesh Company

Ltd. Ramesh Company Ltd. holds 51% shares in Suresh Company Ltd. Mr. R, one of the partners of M/s R

& Co., owed ₹1,500 as on the date of appointment to Suresh Company Ltd. for goods purchased in

normal course of business. Comment.

Indebtedness to the Subsidiary Company: As per Section 141(3)(d)(ii) of the Companies Act, 2013, a person

who, or his relative or partner is indebted to the company, or its subsidiary, or its holding or associate

company, or a subsidiary of its holding company, for an amount exceeding ₹5,00,000, then he is not

qualified for appointment as an auditor of a company.

Where an auditor purchases goods or services from a company audited by him or its subsidiary, or its

holding or associate company, or a subsidiary of its holding company, whether in normal course of business,

he is definitely indebted to the company and if the amount outstanding exceeds ₹5,00,000, he is disqualified

for appointment as an auditor of the company. In such a case, he becomes indebted to the company and

consequently he has deemed to have vacated his office.

In the given case, M/s R & Co., a firm of Chartered Accountants, was appointed as statutory auditors of

Ramesh Company Ltd. where the company holds 51% shares in Suresh Company Ltd. Mr. R, one of the

partners of M/s R & Co. owed ₹ 1,500 as on the date of appointment to Suresh Company Ltd. for goods

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 27

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

purchased.

Accordingly, the partner, Mr. R, is not disqualified to be appointed as auditor of the company as he is

indebted to the company for an amount not exceeding ₹ 5,00,000.

Due to this, M/s R & Co. is not disqualified to be appointed as an auditor of Ramesh Company Ltd.

ABC Ltd. appointed CA Prem as an auditor of the company for the current financial year. Further the

company offered him the services of investment banking, rendering of outsourced financial services and

management services which was also approved by the Board of Directors. State the services which the

auditor is restrained from rendering and then advise accordingly. (For Answer Please refer Section 144)

An auditor purchased goods worth ₹ 510,200 on credit from a company being audited by him. The

company allowed him one month's credit, which it normally allowed to all known customers.

Purchase of Goods on Credit by the Auditor: Section 141(3)(d)(ii) of the Companies Act, 2013 specifies that a

person shall be disqualified to act as an auditor if he is indebted to the company for an amount exceeding

five lakh rupees.

Where an auditor purchases goods or services from a company audited by him on credit, he is definitely

indebted to the company and if the amount outstanding exceeds rupees five lakh, he is disqualified for

appointment as an auditor of the company.

It will not make any difference if the company allows him the same period of credit as it allows to

other customers on the normal terms and conditions of the business.

The auditor cannot argue that he is enjoying only the normal credit period allowed to other customers. In

fact, in such a case he has become indebted to the company and consequently he has deemed to have

vacated his office.

Mr. A, a chartered accountant has been appointed as auditor of Laxman Ltd. in the Annual General Meeting

of the company held in September, 2018. Subsequently in January, 2019 he joined Mr. B, another chartered

accountant, who is the Manager Finance of Laxman Ltd., as partner.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 28

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Disqualifications of an Auditor: Section 141 (3)(c) of the Companies Act, 2013 prescribes that any person who is

a partner or in employment of an officer or employee of the company will be disqualified to act as an auditor

of a company. Sub-section (4) of Section 141 provides that an auditor who incurs any of the disqualifications

mentioned in sub-section (3) after his appointment, he shall vacate his office as such auditor.

In the present case, Mr. A, an auditor of Laxman Ltd., joined as partner with Mr. B, who is Manager Finance of

Laxman Limited, has attracted sub-section (3)(c) of Section 141 and, therefore, he shall be deemed to have

vacated office of the auditor of Laxman Limited.

If an LLP (Limited Liability Partnership Firm) is appointed as an auditor of a company, every partner of a

firm shall be authorized to act as an auditor.

Incorrect: As per section 141(2) of the Companies Act, 2013, where a firm including a limited liability

partnership (LLP) is appointed as an auditor of a company, only the partners who are Chartered Accountants

shall be authorized to act and sign on behalf of the firm.

KBC & Co. a firm of Chartered Accountants has three partners, namely, Mr. K, Mr. B & Mr. C. Mr. K is also

in whole time employment elsewhere. The firm is offered the audit of ABC Ltd. and is already holding

audits of 40 companies.

Ceiling on Number of Company Audits: Section 141 (3)(g) of the Companies Act, 2013 states that the following

persons shall not be eligible for appointment as an auditor of a company i.e. a person who is in full time

employment elsewhere; or a person, or a partner of a firm holding appointment as its auditor, if such person,

or partner is at the date of such appointment, or reappointment holding appointment as auditor of more

than twenty companies.

In the given case, Mr. K, a partner in the firm KBC & Co., is in whole-time employment elsewhere, therefore,

he will be excluded in determining the number of company audits that the firm can hold. If Mr. B and Mr. C

do not hold any audits in their personal capacity or as partners of other firms, the total number of company

audits that can be accepted by KBC & Co., is 40, and in the given case company is already holding 40 audits,

therefore, KBC & Co. can't accept the offer for audit of ABC Ltd.

Ram and Hanuman Associates, Chartered Accountants in practice have been appointed as Statutory

Auditor of Krishna Ltd. for the accounting year 2014-2015. Mr. Hanuman holds 100 equity shares of Shiva

Ltd., a subsidiary company of Krishna Ltd.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 29

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Auditor Holding Securities of a Company: As per sub-section (3)(d)(i) of Section 141 of the Companies Act,

2013 along with Rule 10 of the Companies (Audit and Auditors) Rule, 2014, a person shall not be eligible for

appointment as an auditor of a company, who, or his relative or partner is holding any security of or interest

in the company or its subsidiary, or of its holding or associate company or a subsidiary of such holding

company. Provided that the relative may hold security or interest in the company of face value not exceeding

₹ 1 lakh.

Also, as per sub-section 4 of Section 141 of the Companies Act, 2013, where a person appointed as an auditor

of a company incurs any of the disqualifications mentioned in sub-section (3) after his appointment, he shall

vacate his office as such auditor and such vacation shall be deemed to be a casual vacancy in the office of

the auditor.

In the present case, Mr. Hanuman, Chartered Accountant, a partner of M/s Ram and Hanuman Associates,

holds 100 equity shares of Shiva Ltd. which is a subsidiary of Krishna Ltd.

Therefore, the firm, M/s Ram and Hanuman Associates would be disqualified to be appointed as statutory

auditor of Krishna Ltd., which is the holding company of Shiva Ltd., because one of the partners Mr.

Hanuman is holding equity shares of its subsidiary.

Preksha, a member of the ICAI, does not hold a Certificate of practice. Is her appointment as an auditor

valid?

Qualifications of an Auditor: A person shall be qualified for appointment as an auditor of a company, only if

one is a Chartered Accountant within the meaning of the Chartered Accountants Act, 1949. Under the

Chartered Accountants Act, 1949, only a Chartered Accountant holding the certificate of practice can engage

in public practice. Preksha does not hold a certificate of practice and hence cannot be appointed as an

auditor of a company.

'B' owes ₹ 5,01,000 to 'C' Ltd., of which he is an auditor. Is his appointment valid? Will it make any

difference, if the advance is taken for meeting-out travelling expenses?

Indebtedness to the Company: As per Section 141(3)(d)(ii) of the Companies Act, 2013, a person who, or his

relative or partner is indebted to the company, or its subsidiary, or its holding or associate company, or a

subsidiary of its holding company, for an amount exceeding ₹ 5,00,000/- then he is not qualified for

appointment as an auditor of a company. Accordingly, B's appointment is not valid and he is disqualified as

the amount of debt exceeds ₹ 5,00,000.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 30

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Even if the advance was taken for meeting out travelling expenses particularly before commencement of

audit work, his appointment is not valid because in such a case also the auditor shall be indebted to the

company. The auditor is entitled to recover fees on a progressive basis only.

Mr. Aditya, a practicing chartered accountant is appointed as a "Tax Consultant" of ABC Ltd., in which

his father Mr. Singhvi is the Managing Director.

Appointment of a Practicing CA as 'Tax Consultant': A chartered accountant appointed as an auditor of a

company, should ensure the independence in respect of his appointment as an auditor, else it would

amount to "misconduct" under the Chartered Accountants Act, 1949 read with Guidance Note on

Independence of Auditors.

In this case, Mr. Aditya is a "Tax Consultant" and not a "Statutory Auditor" or "Tax Auditor" of ABC Ltd., hence

he is not subject to the above requirements.

PBS & Associates, a firm of Chartered Accountants, has three partners P, B and S. The firm is already

having audit of 45 companies. The firm is offered 20 company audits. Decide and advise whether PBS &

Associates will exceed the ceiling prescribed under Section 141(3)(g) of the Companies Act, 2013 by

accepting the above audit assignments?

Ceiling on Number of Audits: Before appointment is given to any auditor, the company must obtain a

certificate from him to the effect that the appointment, if made, will not result in an excess holding of

company audit by the auditor concerned over the limit laid down in section 141 (3)(g) of the Act which

prescribes that a person who is in full time employment elsewhere or a person or a partner of a firm holding

appointment as its auditor, if such person or partner is at the date of such appointment or reappointment

holding appointment as auditor of more than 20 companies.

In the case of a firm of auditors, it has been further provided that 'specified number of companies' shall be

construed as the number of companies specified for every partner of the firm who is not in full time

employment elsewhere.

If Mr. P, B and S do not hold any audits in their personal capacity or as partners of other firms, the total

number of company audits that can be accepted by M/s PBS & Associates is 60. But, the firm is already

having audit of 45 companies. So the firm can accept the audit of 15 companies only, which is well within the

limit, specified by Section 141(3)(g) of the Companies Act, 2013.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 31

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Mr. Fat, auditor of Thin Ltd., has his office and residence in the building owned by Thin Ltd. Mr. Fat has

been given 10% concession in rent by the company as compared to other tenants.

Independence of Auditor: As per SA 200, "Overall Objectives of the Independent Auditor and the conduct of

an audit in accordance with standards on auditing", In the case of an audit engagement it is in the public

interest and, therefore, required by the Code of Ethics, that the auditor be independent of the entity subject

to the audit.

The Code describes independence as comprising both independence of mind and independence in

appearance. The auditor's independence from the entity safeguards the auditor's ability to form an audit

opinion without being affected by influences that might compromise that opinion. Independence enhances

the auditor's ability to act with integrity, to be objective and to maintain an attitude of professional

skepticism.

In the instant case, Mr. Fat has his office and residence in the building owned by Thin Ltd. who are subject to

audit by Mr. Fat. Giving 10% concession in rent may be due to some other reasons other than holding the

auditor ship of Thin Ltd. It may be due to being a very old tenant or due to office and residence in the same

building or Mr. Fat might have carried out major renovations and so on.

Thus in the instant case unless and until there is direct proof, giving 10% concession in rent does not affect

independence of the auditor in expressing his opinion on the audit of Thin Ltd.

Under what circumstances the retiring Auditor cannot be reappointed? (झकास)

Answer Circumstances where Retiring Auditor Cannot be Reappointed: In the following circumstances, the

retiring auditor cannot be reappointed-

1. A specific resolution has not been passed to reappoint the retiring auditor.

2. A resolution has been passed in AGM appointing somebody else or providing expressly that the

retiring auditor shall not be reappointed.

3. The proposed auditor suffers from the disqualifications under section 141(3), 141(4) and 144 of the

Companies Act, 2013.

4. He has given the company a notice in writing of his unwillingness to be reappointed.

5. The auditor proposed to be reappointed does not possess the qualification prescribed under section

141 of the Companies Act, 2013.

6. A written certificate has not been obtained from the proposed auditor to the effect that the

appointment or reappointment, if made, will be in accordance within the limits specified under

section 141 (3)(g) of the Companies Act, 2013.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 32

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Mr. Amar, a Chartered Accountant, bought a car financed at ₹ 7,00,000 by Chaudhary Finance Ltd.,

which is a holding company of Charan Ltd. and Das Ltd. He has been the statutory auditor of Das Ltd.

and continues to be to even after taking the loan.

Indebtedness to the Holding Company: According to section 141(3)(d)(ii) of the Companies Act, 2013, a person

is not eligible for appointment as auditor of any company, If he is indebted to the company, or its subsidiary,

or its holding or associate company or a subsidiary of such holding company, in excess of ₹ 5 lakh.

In the given case Mr. Amar is disqualified to act as an auditor under section 141 (3)(d) (ii)) as he is indebted to

M/s Chaudhary Finance Ltd. for more than ₹ 5'00'000. Also according to Section 141(3)(d)(ii), he cannot act as

an auditor of any subsidiary of Chaudhary Finance Ltd. i.e. he is also disqualified to work in Charan Ltd. & Das

Ltd. Therefore, he has to vacate his office in Das Ltd. Even though it is a subsidiary of Chaudhary Finance Ltd.

Hence audit work performed by Mr. Amar as an auditor is invalid, he should vacate his office immediately

and Das Ltd must have to appoint any other CA as an auditor of the company.

Question (Imp Question) Mr. Y was appointed as an auditor of PQR Ltd. for the year ended 31.3.20 _ _ at

the Annual General Meeting held on 16.08.20 _ _ . Mr. Y has been indebted to the company for sum of

Rs. 5,10,000 as on 01.04.20 _ _ , the opening date of accounting year which has been subject to his audit.

However, Mr. Y having come to know that he might be appointed as auditor, he repaid the amount on

10.8.20 _ _ . One of the shareholders, complains that the appointment of Mr. Y as an auditor was invalid

because he incurred disqualification u/s 141 of the Companies Act, 2013. Comment.

Indebtedness to the Company: According to the section 141(3)(d)(ii) of the Companies Act, 2013, a person who

is indebted to the company for an amount exceeding ₹ 5,00,000 shall be disqualified to act as an auditor of

such company and he should vacate his office of auditor when he incurs this disqualification subsequent to

his appointment.

However, where the person has liquidated his debt before the appointment date, there is no disqualification

to be construed for such appointment.

In the given case, Mr. Y was appointment as an auditor of PQR Ltd. for the year ended 31.03.20 _ _ at the

Annual General Meeting held on 16.08.2014. He repaid the loan amount fully to the company on 10.8.20 _ _

i.e. before the date of his appointment.

Hence, the appointment of Mr. Y as an auditor is valid and the shareholder's complaint is not acceptable.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 33

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Section 143 Powers and duties of auditors and auditing standards

143(1) Right To Access, Information and Explanation and Inquiries

143. (1) Every auditor of a company shall have a

● right of access

○ at all times

○ to the books of account and vouchers of the company,

○ whether kept at the registered office of the company or at any other place and

● shall be entitled to require

○ from the officers of the company

○ such information and explanation as he may consider necessary for the performance of his

duties as auditor and

NOTE: - The right of access is not limited to those books and records maintained at the registered or head

office so that in the case of a company with branches, the right also extends to the branch records, if the

auditor considers it necessary to have access thereto as per Section 143(8).

● amongst other matters inquire into the following matters, namely:—

a. whether loans and advances made by the company on the basis of security have been properly

secured and whether the terms on which they have been made are prejudicial to the interests of

the company or its members;

b. whether transactions of the company which are represented merely by book entries are prejudicial

to the interests of the company;

c. where the company not being an investment company or a banking company, whether so much

of the assets of the company as consist of shares, debentures and other securities have been sold

at a price less than that at which they were purchased by the company;

d. whether loans and advances made by the company have been shown as deposits;

e. whether personal expenses have been charged to revenue account;

f. where it is stated in the books and documents of the company that any shares have been allotted

for cash, whether cash has actually been received in respect of such allotment, and if no cash has

actually been so received, whether the position as stated in the account books and the balance

sheet is correct, regular and not misleading:

Provided that the auditor of a company which is a holding company shall also have the right of access to the

records of all its subsidiaries and associate companies insofar as it relates to the consolidation of its financial

statements with that of its subsidiaries and associate companies.

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 34

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

Question

During the audit of PQR Ltd. you as an auditor requested officers of the company to have access to secretarial

records and correspondence which they refused to provide. Comment. - ICAI RTP May 2021

Question

The auditor has to make inquiries on certain matters under section 143(1) of Companies Act, 2013.Discuss those

matters. - MTP 1 May 2021

Question

RJ Limited is in the business of trading cycles having Head Office at Delhi and branch at Mumbai. Statutory audit

of Head Office was to be done by CA D and statutory audit of branch at Mumbai was to be done by CA M. During

the course of audit by CA D at head office, CA D Wanted to visit branch at Mumbai and verify the inventory records

at Mumbai. The management of RJ Limited did not allow CA D to visit Mumbai office and verify the inventory

records as the branch audit of Mumbai was already being undertaken by another CA M.

In the above situation, discuss the rights available with CA D in terms of the Companies Act, 2013. - November 2020

- 4 Marks

Answer - As per ICAI’S SUGGESTED ANSWERS -

Section 143(1) of the Act provides that the auditor of a company, at all times, shall have a

● right of access to the books of account and vouchers of the company, whether kept at the registered office of the

company or at any other place and

Join Us on YouTube www.youtube.com/neerajarora Chapter 10 Company Audit | 35

Join Us on Telegram https://t.me/neerajaroraclasses

These notes are incomplete without our videos. We keep on updating our books, notes and videos. You should always study from updated notes with our videos. To get

the most out of these notes please study from our audit classes and attend our mock tests. Visit www.edu91.org

● He is entitled to require from the officers of the company such information and explanation as he may consider

necessary for the performance of his duties as auditor.