Professional Documents

Culture Documents

AFAR Preweek (B44) - HIGHLIGHTED

AFAR Preweek (B44) - HIGHLIGHTED

Uploaded by

MARIA VERNADETTE SHARISSE LEGASPIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR Preweek (B44) - HIGHLIGHTED

AFAR Preweek (B44) - HIGHLIGHTED

Uploaded by

MARIA VERNADETTE SHARISSE LEGASPICopyright:

Available Formats

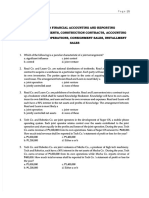

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 44 Oct 2022 CPALE Pre-Week Summary Lecture

ADVANCED FINANCIAL ACCOUNTING & REPORTING A. DAYAG G. CAIGA A. CRUZ

AFAR PREWEEK LECTURE

Revenue Recognition

Installment Sales METHOD – under the OLD Standard (IAS 18), IAS 18 was superseded by IFRS 15 effective

January 1, 2018 (for CPA Examination effective October 2018).

1. Since there is no reasonable basis for estimating the collectibility, the Pius Appliance Company uses

the installment method of recognizing revenue for the following sales:

20x4 20x5

Sales………………………………………… P 225,000 P 337,500

Collections from:

20x4 sales………………………… 75,000 37,500

20x5 sales………………………… -0- 112,500

Defaults:

20x4 sales………………………… 7,500 15,000

20x5 sales………………………… -0- 30,000

Accounts written-off:

20x4 sales………………………… 18,750 56,250

20x5 sales………………………… -0- 18,750

Gross profit percentage………………… 30% 40%

What amount should Pius Appliance Co. report as deferred gross profit, ending balance in its

December 31, 20x5 balance sheet?

a. P123,750 c. P75,000

b. P 93,750 d. P70,500

2. Sharron Company uses the installment sales method in accounting for its installment sales. On

January 1, 20x5, Sharron Company had an installment accounts receivable from Reyes Company

with a balance of P18,000. During 20x5, P4,000 was collected from Reyes. When no further collection

could be made, the merchandise sold to Reyes was repossessed. The merchandise had a fair

market value of P6,500 after the company spent for P600 for reconditioning of the merchandise. The

merchandise was originally sold with a gross profit rate of 40%. Determine the gain or loss on

repossession and cost of repossessed merchandise respectively:

A. P2,500 loss; P6,500 C. P2,500 gain; P5,900

B. P2,100 loss; P6,500 D. P2,100 gain; P5,900

Use the following information for questions 3 and 4:

Coaster manufactures and sells logging equipment. Due to the nature of its business, Coaster is unable

to reliably predict bad debts. During 20x4, Coaster sold equipment costing P2,400,000 for P3,600,000.

The terms of the sale were 20% down, with equal payments due quarterly over the next 3 years. All

payments for 20x4 were made on schedule. Round off answers to two decimal places.

3. Assuming that Coaster uses the installment method of accounting for its installment sales, what

amount of realized gross profit will Coaster report in its income statement for the year ended

December 31, 20x4?

a. P1,680,000 c. P560,000

b. P1,120,000 d. P369,600

4. Assuming that Coaster uses the cost-recovery method of accounting for its installment sales, what

amount of realized gross profit will Coaster report in its income statement for the year ended

December 31, 20x5?

a. P-0- c. P316,800

b. P240,000 d. P960,000

IFRS 15 [Construction Accounting almost the same with IAS 18 with a major difference on account

classification such as “Gross Amount Due from Customers” (IFRS 15 – Current Asset/Contract Asset);

“Gross Amount Due to Customers” (IFRS 15 – Current Liability/Contract Liability)

Use the following information for questions 5 - 8:

Seasons Construction is constructing an office building under contract for Cannon Cafe. The contract

calls for progress billings and payments of P620,000 each quarter. The total contract price is P7,440,000

and Seasons estimates total costs of P7,100,000. Seasons estimates that the building will take 3 years to

complete, and commences construction on January 2, 20x4.

5. At December 31, 20x4, Seasons estimates that it is 30% complete with the construction, based on

costs incurred. What is the total amount of Revenue from Long-Term Contracts recognized for 20x4

and what is the balance in the Accounts Receivable account assuming Cannon Cafe has not yet

made its last quarterly payment?

Page 1 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Accounts Accounts

Revenue Receivable Revenue Receivable

a. P2,480,000 P2,480,000 c. P2,232,000 P 620,000

b. P2,130,000 P 620,000 d. P2,130,000 P2,480,000

6. At December 31, 20x5, Seasons Construction estimates that it is 75% complete with the building;

however, the estimate of total costs to be incurred has risen to P7,200,000 due to unanticipated

price increases. At December 31, 20x4, Seasons estimated it was 30% complete. What is the total

amount of Construction Expenses that Seasons will recognize for the year ended December 31,

20x5?

a. P5,400,000 c. P3,195,000

b. P3,150,000 d. P3,270,000

7. At December 31, 20x5, Seasons Construction estimates that it is 75% complete with the building;

however, the estimate of total costs to be incurred has risen to P7,200,000 due to unanticipated

price increases. What is reported in the balance sheet at December 31, 20x5 for Seasons as the

difference between the Construction in Process and the Billings on Construction in Process

accounts, and is it a debit or a credit?

Difference between the accounts Debit/Credit

a. P1,690,000 Credit

b. P 620,000 Debit

c. P 440,000 Debit

d. P 620,000 Credit

8. Seasons Construction completes the remaining 25% of the building construction on December 31,

20x6, as scheduled. At that time the total costs of construction are P7,500,000. At December 31,

20x5, the estimates were 75% complete and total costs of P7,200,000. What is the total amount of

Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the

year ended December 31, 20x6?

Revenue Expenses Revenue Expenses

a. P7,440,000 P7,500,000 c. P1,860,000 P2,100,000

b. P1,860,000 P1,875,000 d. P1,875,000 P1,875,000

Revenue Recognition – (IFRS 15)

9. Ronella Ocampo sells hairstyling franchises. Ronella Ocampo receives P50,000 from a new franchisee

for providing initial training, equipment and furnishings that have a stand-alone selling price of

P50,000. Ronella Ocampo also receives P30,000 per year for use of the Ronella Ocampo name and

for ongoing consulting services (starting on the date the franchise is purchased). Carlos became a

Ronella Ocampo franchisee on July 1, 20x6, and on August 1, 20x6, had completed training and

was open for business. How much revenue in 20x6 will Ronella Ocampo recognize for its

arrangement with Carlos?

a. Zero c. P65,000

b. P10,000 d. P70,000

10. AA Computers licenses customer-relationship software to ABS Company. In addition to providing

the software itself, AA Computers promises to provide consulting services by extensively customizing

the software to ABS’s information technology environment, for a total consideration of P3,456,000.

In this case, AA Computers is providing a significant service by integrating the goods and services

(the license and the consulting service) into one combined item for which ABS has contracted. In

addition, the software is significantly customized by AA Computers in accordance with

specifications negotiated by ABS. How many performance obligations exist in the contract?

a. 0 c. 2

b. 1 d. 3

11. Fonesell Co enters into a contract on September 1, 20x5 to conduct telephone marketing activities

on behalf of a customer. The contract has a price of P8,000 and requires Fonesell Co to contact

10,000 households over a period of six months in order to enquire about buying habits and promote

its customer. The customer is invoiced equal amounts three months and six months after the

commencement of the contract. By Fonesell Co’s year-end of December 31, 20x5, it has contacted

3,500 of the 10,000 customers. What amounts does Fonesell Co recognise in its financial statements

in the year ended December 31, 20x5?

a. revenue of P4,000 and a receivable of P4,000

b. revenue of P4,000 and a contract liability of P4,000

c. revenue of P2,800, a receivable of P4,000 and a contract asset of P1,200

d. revenue of P2,800, a receivable of P4,000 and a contract liability of P1,200

Page 2 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

12. On July 31, O’Malley Company contracted to have two products built by Taylor Manufacturing for

a total of P185,000. The contract specifies that payment will only occur after both products have

been transferred to O’Malley Company. O’Malley determines that the standalone prices are

P100,000 for Product 1 and P85,000 for Product 2. On August 1, when Product 1 has been

transferred, the journal entry to record this event include a:

a. debit to Accounts Receivable for P100,000 c. debit to Contract Assets for P85,000

b. debit to Accounts Receivable for P85,000 d. debit to Contract Assets for P100,000

13. On November 1, 20x5, Green Valley Farm entered into a contract to buy a P75,000 harvester from

John Deere. The contract required Green Valley Farm to pay P75,000 in advance on November 1,

20x5. The harvester (cost of P55,000) was delivered on November 30, 20x5. The journal entry for John

Deere to record the contract on November 1, 20x5 includes a

a. credit to Accounts Receivable for P75,000.

b. credit to Sales Revenue for P75,000.

c. credit to Unearned Sales Revenue for P75,000.

d. debit to Unearned Sales Revenue for P75,000.

14. Same information with No. 13, the journal entry for John Deere to record the delivery of the

equipment includes a

a. debit to Unearned Sales Revenue for P75,000.

b. credit to Unearned Sales Revenue for P75,000.

c. credit to Cost of Goods Sold for P55,000.

d. debit to Inventory for P55,000.

15. On July 31, O’Malley Company contracted to have two products built by Taylor Manufacturing for

a total of P185,000. The contract specifies that payment will only occur after both products have

been transferred to O’Malley Company. O’Malley determines that the standalone prices are

P100,000 for Product 1 and P85,000 for Product 2. On August 1, when Product 1 has been

transferred, the journal entry to record this event include a:

a. debit to Accounts Receivable for P100,000 c. debit to Contract Assets for P85,000

b. debit to Accounts Receivable for P85,000 d. debit to Contract Assets for P100,000

16. OC signed a contract to provide office services to PQ for one year from 1 October 20x6 for P500 per

month. The contract required PQ to make a single payment to OC for all 12 months at the beginning

of the contract. OC received P6,000 on October 1, 20x6. What amount of revenue should OC

recognize in its statement of profit or loss for the year ended March 31, 20x7?

a. Nil c. P3,000 profit

b. P 300 d. P6,000 profit

Revenue Recognition – Other Issues (IFRS 15)

17. On 31 March DT received an order from a customer, XX, for products with a sales value of P900,000.

XX enclosed a deposit with the order of P90,000. On March 31, DT had not obtained credit

references of XX and has not determined if it will meet this order. According to PFRS 15 Revenue

from Contract with Customers, how should DT record this transaction in its financial statements for

the year ended March 31?

(1) Include P900,000 as revenue for the year

(2) Include P90,000 as revenue for the year

(3) Do not include anything as revenue for the year

(4) Create a trade receivable for P810,000

(5) Create a trade payable for P90,000

a. 1 and 4 c. 3 and 4

b. 2 and 5 d. 3 and 5

Quality Assurance Warranty and Extended Warranty

18. D and R Computer Inc. manufactures and sells computers that include a warranty to make good

on any defect in its computers for 120 days (often referred to as an assurance warranty). In addition,

it sells separately an extended warranty, which provides protection from defects for three years

beyond the 120 days (often referred to as a service warranty). How many performance obligations

exist in this contract?

a. None c. Two

b. One d. Three

Gift Cards

• Seller records a deferred revenue liability when the card is sold.

• Seller recognizes revenue when the card is used and at the point when it concludes there is only a

“remote likelihood” that customer will use the card.

Page 3 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

19. Bull’sEye sells gift cards redeemable for Bull’sEye products either in-store or online. During 20x6,

Bull’sEye sold P2,000,000 of gift cards, and P1,800,000 of the gift cards were redeemed for products.

As of December 31, 20x6, P150,000 of the remaining gift cards had passed the date at which

Bull’sEye concludes that the cards will never be redeemed. How much gift card revenue should

Bull’sEye recognize in 20x6?

a. P2,000,000 c. P1,850,000

b. P1,950,000 d. P1,800,000

Repurchase Agreement – Renewal Option

20. ABC Co., sells a subscription to its anti-virus software along with a subscription renewal option that

allows renewal at half the prevailing price for a new subscription. How many performance

obligations exist in this contract? How many performance obligations are in the contract?

a. 0 c. 2

b. 1 d. 3

21. When the bundle price is less than the sum of the standalone prices, the discount should be

allocated :

a. to the product (or products) associated with the discount.

b. to the entire bundle of products or services.

c. to the product cost, thereby increasing product margin.

d. to the selling price of product or services provided.

22. A company has satisfied its performance obligation when the

a. company has received payment for goods or services.

b. company has significant risks and rewards of ownership.

c. company has legal title to the asset.

d. company has transferred physical possession of the asset.

23. The most popular input measure used to determine the progress toward completion is

a. units-of-delivery method. c. labor hours worked.

b. cost-to-cost basis. d. tons produced.

24. A contract

a. must be in writing to be an enforceable contract.

b. is an agreement that creates enforceable rights and obligations.

c. is enforceable if each party can unilaterally terminate the contract.

d. does not need to have commercial substance.

25. The first step in the process for revenue recognition is to

a. determine the transaction price.

b. identify the contract with the customer.

c. allocate the transaction price to the separate performance obligations.

d. identify the separate performance obligations in the contract.

26. The second step in the process for revenue recognition is to

a. allocate transaction price to the separate performance obligations.

b. determine the transaction price.

c. identify the contract with customers.

d. identify the separate performance obligations in the contract.

27. The third step in the process for revenue recognition is to

a. determine the transaction price.

b. identify the separate performance obligations in the contract.

c. allocate transaction price to the separate performance obligations.

d. recognize revenue when each performance obligation is satisfied.

28. The fourth step in the process for revenue recognition is to

a. recognize revenue when each performance obligation is satisfied.

b. identify the separate performance obligations in the contract.

c. allocate transaction price to the separate performance obligations.

d. determine the transaction price.

29. The last step in the process for revenue recognition is to

a. allocate transaction price to the separate performance obligations.

b. recognize revenue when each performance obligation is satisfied.

c. determine the transaction price.

d. identify the contract with customers.

Page 4 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

30. A company must account for a contract modification as a new contract if

a. Goods or services are interdependent on each other.

b. The promised goods or services are distinct.

c. The company has the right to receive consideration equal to standalone price.

d. Goods or services are distinct and company has right to receive the standalone price.

31. The transaction price for multiple performance obligations should be allocated

a. based on selling price from the company’s competitors.

b. based on what the company could sell the goods for on a standalone basis.

c. based on forecasted cost of satisfying performance obligation.

d. based on total transaction price less residual value.

32. When the bundle price is less than the sum of the standalone prices, the discount should be

allocated :

a. to the product (or products) associated with the discount.

b. to the entire bundle of products or services.

c. to the product cost, thereby increasing product margin.

d. to the selling price of product or services provided.

33. Unconditional rights to receive consideration because a performance obligation has been satisfied

are

a. reported as a receivable on the statement of financial position.

b. reported as a contract asset on the statement of financial position.

c. reported as a contract liability on the statement of financial position.

d. are not reported on the balance sheet.

34. Partial satisfaction of a multiple performance obligation is reported on the statement of financial

position as

a. contract liability. c. contract asset.

b. receivable. d. unearned service revenue.

Business Combination

35. Corin, a private limited company, has acquired 100% of Coal, a private limited company, on

January 1, 2019. The fair value of the purchases consideration was 10 million ordinary shares of P1 of

Corin, and the fair value of the net assets acquired was P7 million. At the time of the acquisition, the

value of the ordinary shares of Corin and the net assets of Coal were only provisionally determined.

The value of the shares of Corin (P11 million) and the net assets of Coal (P7.5 million) on January 1,

2019, were finally determined on November 30, 2019. However, the directors of Corin have seen the

value of the company decline since January 1, 2019, and as of February 1, 2020, wish to change

the value of the purchase consideration to P9 million. What value should be placed on the purchase

consideration and assets of Coal as at the date of acquisition?

a. Purchase consideration P10 million, net asset value P7 million.

b. Purchase consideration P11 million, net asset value P7.5 million.

c. Purchase consideration P9 million, net asset value P7.5 million.

d. Purchase consideration P11 million, net asset value P7 million.

36. The balance sheet of San Jacinto Company as of December 31, 20x2 is as follows:

Assets Liabilities and Stockholders’ Equity

Cash…………………………………………P 175,000 Current liabilities……………… P 250,000

Accounts receivable… 250,000 Mortgage payable……………………… 450,000

Inventories……………………… 725,000 Common stock………………………………… 200,000

Property, plant and Additional paid-in capital 400,000

Equipment…………………… 950,000 Retained earnings…………………… 800,000

Total Assets………………… P2,100,000 Total Liabilities and SHE… P 2,100,000

On December 31, 20x2 the Sta. Clara, Inc. bought all of the outstanding stock of San Jacinto

Company for P1,800,000 cash. On the date of purchase, the fair market value of San Jacinto’s

inventories was P675,000, while the fair value of San Jacinto’s property, plant and equipment was

P1,100,000. The fair values of all other assets and liabilities of San Jacinto Company were equal to

their book values.

The consolidated balance sheet of Sta. Clara and San Jacinto, after the acquisition of San Jacinto

should reflect goodwill in the amount of –

a. P300,000 c. P500,000

b. P400,000 d. Zero

37. Using the same information in No. 36, the amount of goodwill recorded in the books of Sta. Clara

amounted to:

a. P300,000 c. P500,000

b. P400,000 d. Zero

Page 5 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Stock Acquisition/Consolidation

Use the following information for questions 38 and 39:

Pedro purchased 100% of the common stock of the Sanburn Company on January 1, 20x4, for P500,000.

On that date, the stockholders' equity of Sanburn Company was P380,000. On the purchase date,

inventory of Sanburn Company, which was sold during 20x4, was understated by P20,000. Any remaining

excess of cost over book value is attributable to building with a 20-year life. The reported income and

dividends paid by Sanburn Company were as follows:

20x4 20x5

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . P80,000 P90,000

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . 10,000 10,000

38. Using the cost model/method, which of the following amounts are correct?

Investment Income Investment Account Balance

20x4 December 31, 20x4

a. P10,000 P500,000

b. P70,000 P570,000

c. P70,000 P550,000

d. P10,000 P550,000

Solution/Answer:

38. a

20x4 Investment income: Dividend of P10,000 x 100%

20x4 Investment balance: P500,000

39. Using sophisticated (full) equity method, which of the following amounts are correct?

Investment Income Investment Account Balance

20x4 December 31, 20x4

a. P55,000 P555,000

b. P55,000 P545,000

c. P75,000 P565,000

d. P80,000 P570,000

Solution/Answer:

39. b: Investment (P500,000 + P80,000 – P10,000 – P20,000 – P5,000) = P545,000

Income: P80,000 – P20,000 – P5,000 = P55,000

40. On January 1, 2019, Gold Rush Company acquires 80 percent ownership in California Corporation

for P200,000. The fair value of the non-controlling interest at that time is determined to be P50,000.

It reports net assets with a book value of P200,000 and fair value of P230,000. Gold Rush Company

reports net assets with a book value of P600,000 and a fair value of P650,000 at that time, excluding

its investment in California. What will be the amount of goodwill that would be reported

immediately after the combination under current accounting practice if the option of full-goodwill

method is used?

a. P50,000 c. P30,000

b. P40,000 d. P20,000

Solution/Answer: Answer: d

(80%) Fair value of consideration given………………….. P 200,000

(20%) Fair value of non-controlling interest (given)……. 50,000

(100%) Fair value of Subsidiary……………………………… P 250,000

Less: Book value of Net Assets (Stockholders’

Equity of Subsidiary)….………............................... 200,000

Allocated Excess.……………………………………………… P 50,000

Less: Over/Undervaluation of net assets

(P230,000 – P200,000)…………………………………. 30,000

Goodwill (Full/Gross-up).….…………………………………… P 20,000

41. Lauren Corporation acquired Sarah, Inc. on January 1, 2019, by issuing 13,000 shares of common stock

with a P10 per share par value and a P23 market value. This transaction resulted in recording P62,000 of

goodwill. Lauren also agreed to compensate Sarah’s former owners for any difference if Lauren’s stock

is worth less than P23 on January 1, 2020. On January 1, 2020, Lauren issues an additional 3,000 shares to

Sarah’s former owners to honor the contingent consideration agreement. Under which of the following is

true?

a. The fair value of the expected number of shares to be issued for the contingency increases the

Goodwill account balance at the date of acquisition.

b. The Investment account balance is not affected, but the parent’s Additional Paid-In Capital is

reduced by the par value of the extra 3,000 shares when issued.

c. All of the subsidiary’s assets and liability accounts must be revalued for consolidation purposes

based on their fair values as of January 1, 2021.

d. The additional shares are assumed to have been issued on January 1, 2019, so that a retrospective

adjustment is required.

Page 6 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Consolidation: Subsequent to Date of Acquisition

42. On January 1, 2021, Turner, Inc. reports net assets of P480,000 although a building (with a 10-year life)

having a book value of P260,000 is now worth P300,000. Renrut Corporation pays P540,000 on that date

for a 90 percent ownership interest in Turner. On December 31, 2023, Turner reports a Building account

of P182,000 and Renrut reports a Building account of P510,000. What is theconsolidated balance of the

Building account?

a. P720,000 c. P780,000

b. P724,000 d. P810,000

Solution/Answer: Answer: A

Renrut building……………………………………... P510,000

Turner building 12/31/x3…………………………… P182,000

Excess acquisition-date fair value allocation

(P300,000 – P260,000)……………………… 40,000

Amortization of allocated excess for 3 years

[(P40,000 / 10 years) x 3 years]……………. (12,000) 210,000

Consolidated buildings, 20x3…………………………… P720,000

Or,

Renrut building………………………………….. P510,000

Turner building acquisition-date fair value… P 300,000

Amortization for 3 years (10-year life)…………( 90,000) 210,000

Consolidated buildings…………………………… P720,000

43. On January 1, 20x1, Harry, Inc. reports net assets of P880,000 although a patent (with a 10-year life) having a book

value of P330,000 is now worth P400,000. Newt Corporation pays P840,000 on that date for an 80 percent

ownership in Harry. On December 31, 20x2, Harry reports total expenses of P621,000 while Newt reports

expenses of P714,000. What is the consolidated total expense balance on December 31, 20x2?

a. P1,197,800 c. P1,342,000

b. P1,335,000 d. P1,349,000

Solution/Answer: Answer: C

Newt expense – 20x2……………………………………… P 714,000

Harry expenses – 20x2……………………………………... 621,000

Amortization of allocated excess

(P400,000 – P330,000) / 10 years………………… 7,000

Consolidated total expense for 20x2..…………………….. P1,342,000

44. At the end of 20x9, Paper Company’s stockholders’ equity includes common stock of P500,000 and

additional paid-in capital of P300,000. Paper purchased a 70 percent interest in Slick Company on

January 1, 20x9, when the non-controlling interest in Slick had a fair value of P90,000. No differential arose

from the business combination. During 20x9, Slick reports net income of P20,000 and declares dividend of

P5,000. The 20x9 consolidated balance sheet includes retained earnings of P630,000 (controlling interest

portion). Determine the consolidated equity on December 31, 20x9:

a. P1,430,000 c. P1,524,500

b. P1,457,000 d. P1,526,000

Solution/Answer: Answer: C

Consolidated Equity:

Attributable to Equity Holders’ of Parent / Controlling Interest:

Common stock………………………………… P 500,000

Additional paid-in capital.....…………………. 300,000

Retained earnings………………………………. 630,000

Equity Holders’ of Parent/Controlling Interest… P 1,430,000

Non-controlling interest:

[P90,000 + (P20,000 – P5,000) x 30%................. 94,500

Consolidated Equity………..…………………………….. P 1,524,500

45. Which of the following forms of business combination is not subject to laws specific to business

combinations?

a. Asset for asset acquisition

b. Statutory merger

c. Statutory consolidation

d. All three are subject to laws

46. Which of the following is not a true statement with regard to a statutory merger?

a. One entity continues to exist

b. One entity ceases to exist

c. The name of the new entity is not the same as either of the entities

d. All of the above are true statements with regard to a statutory merger

Page 7 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

47. Which of the following is not true with regard to the statutory consolidation form of business

combination?

a. A new corporation must be formed

b. Control of the net assets of the combining entities must be acquired by the new entity

c. The net assets of the combining entities must be acquired with assets of the new corporation

d. The combining entities both cease to exist after the combination

48. Following the completion of a business combination in the form of a statutory consolidation, whatis

the balance in the new corporation’s Retained Earnings account?

a. The acquirer Retained Earnings account balance

b. The acquiree Retained Earnings account balance

c. Zero

d. The sum of the acquirer and acquiree Retained Earnings account balances

49. Which of the following is not true with regard to a business combination accomplished in the form of

a stock acquisition?

a. Two companies remain in existence after the combination

b. A parent-subsidiary relationship is said to exist

c. Consolidated financial statements are normally required

d. All of the above statements are true

50. In a business combination accounted for as an acquisition, registration costs related to common

stock issued by the parent company are

a. expensed as incurred.

b. deducted from other contributed capital.

c. included in the investment cost.

d. deducted from the investment cost.

51. On the consolidated balance sheet, consolidated stockholders' equity is

a. equal to the sum of the parent and subsidiary stockholders' equity.

b. greater than the parent's stockholders' equity.

c. less than the parent's stockholders' equity.

d. equal to the parent's stockholders' equity.

52. Majority-owned subsidiaries should be excluded from the consolidated statements when

a. control does not rest with the majority owner.

b. the subsidiary operates under governmentally imposed uncertainty.

c. a foreign subsidiary is domiciled in a country with foreign exchangerestrictions or controls.

d. any of these circumstances exist.

53. Under the economic entity concept, consolidated financial statements are intended primarily for

the benefit of the

a. stockholders of the parent company.

b. creditors of the parent company.

c. minority stockholders.

d. all of the above.

54. Reasons a parent company may pay more than book value for the subsidiary company's stock

include all of the following except

a. the fair value of one of the subsidiary's assets may exceed its recorded value because of

appreciation.

b. the existence of unrecorded goodwill.

c. liabilities may be overvalued.

d. stockholders' equity may be undervalued.

55. What is the method of presentation required by PFRS 10 of “non-controlling interest” on a

consolidated balance sheet?

a. As a deduction from goodwill from consolidation.

b. As a separate item within the long-term liabilities section.

c. As a part of stockholders' equity.

d. As a separate item between liabilities and stockholders' equity.

56. A 70 percent owned subsidiary company declares and pays a cash dividend. What effect does

the dividend have on the retained earnings and non-controlling interest balances in the parent

company’s consolidated balance sheet?

a. No effect on either retained earnings or non-controlling interest.

b. No effect on retained earnings and a decrease in non-controlling interest

c. Decreases in both retained earnings and non-controlling interest.

d. A decrease in retained earnings and no effect on non-controlling interest.

57. In a business combination accounted for as an acquisition, how should the excess of fair value of

identifiable net assets acquired over implied value be treated?

a. Amortized as a credit to income over a period not to exceed forty years.

b. Amortized as a charge to expense over a period not to exceed forty years.

Page 8 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

c. Amortized directly to retained earnings over a period not to exceed forty years.

d. Recognized as an ordinary gain in the year of acquisition.

58. Goodwill represents the excess of the implied value of an acquired company over the

a. aggregate fair values of identifiable assets less liabilities assumed.

b. aggregate fair values of tangible assets less liabilities assumed.

c. aggregate fair values of intangible assets less liabilities assumed.

d. book value of an acquired company.

59. Which of the following accounts need not be eliminated in consolidation?

a. Intercompany Sales. d. Long-term Intercompany Receivables.

b. Intercompany Cost of Sales. e. None of the above.

c. Intercompany Interest expense.

60. Non-controlling interest in consolidated income is never affected by

a. upstream sales c. Non-controlling interest is affected by all sales

b. downstream sales d. None of the above

61. In reference to the downstream or upstream sale of depreciable assets, which of the following

statements is correct?

a. Upstream sales from the subsidiary to the parent company always result in unrealizedgains

or losses.

b. The initial effect of unrealized gains and losses from downstream sales of depreciable assets

is different from the sale of non-depreciable assets.

c. Gains, but not losses, appear in the parent-company accounts in the year of sale and

must be eliminated by the parent company in determining its investment incomeunder

the equity method of accounting.

d. Gains and losses appear in the parent-company accounts in the year of sale and must

be eliminated by the parent company determining its investment income under the equity

method of accounting.

62. In the year a subsidiary sells land to its parent company at a gain, a workpaper entry is made

debiting

1. Retained Earnings- P Co 2. Retained Earnings - S Co 3. Gain on Sale of Land.

a. 1 c. 3

b. 2 d. both 1 and 2.

63. In years subsequent to the year a 90% owned subsidiary sells equipment to its parent company at a

gain, the non-controlling interest in consolidated income is computed by multiplying the non-

controlling interest percentage by the subsidiary’s reported net income

a. minus the net amount of unrealized gain on the intercompany sale.

b. plus the net amount of unrealized gain on the intercompany sale.

c. minus intercompany gain considered realized in the current period.

d. plus intercompany gain considered realized in the current period.

64. Company S sells equipment to its parent company (P) at a gain. In years subsequent to the year of

the intercompany sale, a workpaper entry is made under the cost model debiting

a. Retained Earnings - P. c. Equipment.

b. Non-controlling interest. d. all of these.

Consolidation: Subsequent to Date of Acquisition - Intercompany Sales of Inventory

Items 65 through 68 are based on the following information:

The separate incomes (which do not include investment income) of Pell Corporation and Sell

Corporation, its 80% owned subsidiary, for 20x6 were determined as follows:

Pell Sell

Sales . . . . . . . . . . . . . . . . . . . . . . P400,000 P100,000

Less Cost of Sales. . . . . . . . . . . . 200,000 60,000

Gross profit . . . . . . . . . . . . . . . . P200,000 P40,000

Other expenses . . . . . . . . . . . . . 100,000 30,000

Separate incomes . . . . . . . . . . P100,000 P10,000

During 20x6 Pell Sold merchandise that cost P20,000 to Sell for P40,000, and at December 31, 20x6 half

of these inventory items remained unsold by Sell.

65. The Non –controlling interest in net income for 20x6:

a. P 0 c. P 8,000

b. 2,000 d. 10,000

66. The Consolidated sales for 20x6:

a. P500,000 c. P460,000

b. 480,000 d. 400,000

67. The Consolidated cost of sales for 20x6:

a. P230,000 c. P270,000

b. 248,000 d. 300,000

Page 9 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

68. The Profit attributable to Equity Holders of Parent or Controlling Interests in Consolidated Net Income

for 20x6:

a. P108,000 c. P 98,000

b. 100,000 d. 80,000

Solution/Answer:

65. (b)

Pell Sell

(CI-CNI) (NCI-CNI) CNI

Net Income from own operations:

Pell P100,000

Sell 8,000 P 2,000

RPBI of S (down) “solo” – Realized 0

RPBI of P (up) “hati” 0 0

UPEI of S (down) “solo” - Unrealized ( 10,000)

UPEI of P (up) “hati” ( 0) ( 0)

Amortization of allocated excess “hati” ( 0) ( 0)

Impairment of goodwill (if partial – “solo”;

if full –“hati” depending on the amount

or % allocated, if none use CI% and ( 0) ( 0)

NCI%

P 98,000 P 2,000 P100,000

*Equity in Subsidiary Loss (debit/reduction),

P2,000 loss

Profit Attributable to Equity NC Interest Consolidated

Holders of Parent/Controlling Interest in NI in Net Income Net Income

(CI-CNI) (NCI-CNI) (CNI)

66. (c)

Sales (Cr) Cost of Sales (Dr)

Parent – Pell P 400,000 P 200,000

Subsidiary – Sell 200,000 60,000

Intercompany sales – downstream ( 40,000) ( 40,000)

Intercompany sales - upstream ( 0) ( 0)

RPBI of S (downstream sales) ( 0)

RPBI of P (upstream sales) ( 0)

UPEI of S (downstream sales) 10,000

UPEI of P (upstream sales) _________ 0

Consolidated P 460,000 P 230,000

67. (a) – refer to No. 65

68. (c) – refer to No. 65

Reminder: To determine the Investment balance at the end of the current year under equity method, use this

approach:

Investment balance, beginning of the current year (equity method)…..P xxx

Add (deduct): ESI(L) – Equity in Subsidiary Income(*Loss).………………... xxx

Deduct: Dividend – S (Dividends declared/paid x % controlling interest) xxx

Investment balance, ending (equity method)………………………………..P xxx

Consolidation: Subsequent to Date of Acquisition - Intercompany Sales of Fixed Assets

69. Kestrel Company acquired an 80% interest in Reptile Corporation on January 1, 20x4. On January 1,

20x5, Reptile sold a building with a book value of P50,000 to Kestrel for P80,000. The building had a

remaining useful life of ten years and no salvage value. The separate balance sheets of Kestreland

Reptile on December 31, 20x5 included the following balances:

Kestrel Reptile

Buildings ........................................................................................

The consolidated amounts for Buildings and Accumulated Depreciation - Buildings that appeared,

respectively, on the balance sheet at December 31, 20x5, were

a. P620,000 and P192,000. c. P650,000 and P192,000.

b. P620,000 and P195,000. d. P650,000 and P195,000.

Items 70 through 73 are based on the following information:

Silver Corporation is a 90% owned subsidiary to Proto Corporation acquired several years ago at book

value equal to fair value. For the years 20x5 and 20x6, Proto and Silver report the following:

20x5 20x6

Proto’s separate income . . . . . . . P300,000 P400,000

Silver’s net income. . . . . . . . . . . . . 80,000 60,000

Page 10 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

The only intercompany transaction between Proto and Silver during 20x5 and 20x6 was the January 1, 20x5

of land. The land had a book value of P20,000 and was sold intercompany for P30,000, its appraised value at

the time of sale.

70. If the land was sold by proto to Silver (downstream sales) and that Silver still owns the land at December

31, 20x6, compute the Profit Attributable to Equity Holders of Parent or CNI Attributable to Controlling

Interests for 20x5 and 20x6:

20x5 20x6 20x5 20x6

a. P363,000 P454,000 c. P372,000 P460,000

b. 362,000 454,000 d. 362,000 460,000

71. The Consolidated/group net income for 20x5 and 20x6:

20x5 20x6 20x5 20x6

a. P362,000 P454,000 c. P370,000 P460,000

b. 380,000 460,000 d. 372,000 460,000

72. Except that the land was sold by Silver to Proto (upstream sales) and proto still owns the land at December

31, 20x6, compute the Profit Attributable to Equity Holders of parent or CNI Attributable to Controlling

Interests for 20x5 and 20x6:

20x5 20x6 20x5 20x6

a. P363,000 P454,000 c. P370,000 P460,000

b. 362,000 454,000 d. 363,000 460,000

73. Using the same information in No. 74, the Consolidated/group net income for 20x5 and 20x6:

20x5 20x6 20x5 20x6

a. P362,000 P454,000 c. P370,000 P460,000

b. 380,000 460,000 d. 372,000 460,000

Solution/Answer:

70. (b)

Downstream

20x5 20x6

Proto Silver Proto Silver

(CI-CNI) (NCI-CNI) CNI (CI-CNI) (NCI-CNI) CNI

NI from own operations:

P P300,000 P400,000

S 72,000 P 8,000 54,000 P 6,000

RG thru dep (down) 0 0 0 0

UG (downstream) ( 10,000) ( 0)

Amortization ( 0) ( 0) ( 0) ( 0)

Impairment of goodwill

(if partial – “solo”; if full

– “hati” depending on the

amount or % allocated,

if none use CI% and NCI ( 0) _( 0) ( 0) ( 0)

P362,000 P 8,000 P370,000 P454,000 P 6,000 P460,000

Note: Net income of parent is understood to be as Parent’s reported net income which includes dividend income from subsidiary.

CI-CNI NCI-CNI CNI CI-CNI NCI-CNI CNI

71. (c) – refer to No. 70

72. (a)

Upstream

20x5 20x6

Proto Silver Proto Silver

(CI-CNI) (NCI-CNI) CNI (CI-CNI) (NCI-CNI) CNI

NI from own operations:

P P300,000 P400,000

S 72,000 P 8,000 54,000 P 6,000

UG (Upstream) ( 9,000) ( 1,000) ( 0) ( 0)

RG thru dep (up) 0 0 0 0

Amortization ( 0) ( 0) ( 0) ( 0)

Impairment of goodwill

(if partial – “solo”; if full

– “hati” depending on the

amount or % allocated,

if none use CI% and NCI ( 0) _( 0) ( 0) ( 0)

P363,000 P 7,000 P370,000 P454,000 P 6,000 P460,000

Note: Net income of parent is understood to be as Parent’s reported net income which includes dividend income from subsidiary.

CI-CNI NCI-CNI CNI CI-CNI NCI-CNI CNI

73. (c) – refer to No. 72

Page 11 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Foreign Currency Transactions without Hedging

74. On October 1, 20x1, Mud Company a Philippine Company purchased parts from Terra, a Portuguese

Company with payment due on December 1, 20x1. If Mud’s 20x1 operating income included no

foreign exchange gain or loss, the transaction could have:

a. Resulted in an extraordinary gain

b. Been denominated in Philippine pesos

c. Generated a foreign exchange gain to be reported as a deferred charge on the balance

sheet

d. Generated a foreign exchange loss to be reported as a separate component of stockholders’

equity

Answer: B

(b) – “operating income included NO forex gain or loss” - the transaction is payable or denominated

in Philippines pesos, therefore it is not a Foreign Currency transaction it is simply an ordinary

transaction wherein no foreign currency involved.

75. A Philippine exporter has a Thai baht account receivable resulting from an export sale on April 1 to

a customer in Thailand. The exporter signed a forward contract on April 1 to sell Thai baht and

designated it as a cash flow hedge of a recognized Thai baht receivable. The spot rate was P0.022

on that date, and the forward rate was P0.023. Which of the following did the Philippine exporter

report in net income?

a. Discount expense c. Premium expense

b. Discount revenue d. Premium revenue

Answer: D

(d) if spot rate is lower than forward rate (Spot < Forward rate) it is a PREMIUM (buyer’s point of view

is a an expense; if seller’s point of view it is a revenue)

Items 76 to 78 are based on the following information:

On September 9, 20x8, Selma Inc. accepted a noncancellable merchandise sales order from a

Japanese firm. The contract price was 100,000 yens. The merchandise was delivered on December 14,

20x8. The invoice was dated December 11, 20x8, the shipping date (FOB shipping point). Full payment

was received on January 22, 20x9. The spot direct exchange rates for the Japanese yens on the

respective dates are as follows:

September 9, December 11, December 14 December 31 January 22,

20x8 20x8 20x8 20x8 20x9

P.75 P .78 P .77 P .73 P .725

76. What is the reportable sales amount in the 20x8 income statement?

a. P73,000 c. P77,000

b. 75,000 d. 78,000

77. What is the reportable foreign exchange gain or loss amount in the 20x8 income statement?

a. P2,000 gain c. P5,000 loss

b. 4,000 loss d. 5,000 gain

78. What is the reported value of the receivable from the customers at December 31, 20x8?

a. P73,000 c. P77,000

b. 75,000 d. 78,000

Solution/Answer:

76. (d) – Exposed Asset

Spot Rates

Date of Commitment: 9/9/x8 P.75

Date of Transaction (invoice): 12/11/x8 P.78 Asset – Accounts Receivable

Date of Delivery: 12/14/x8 P.77

B/S Date: 12/31/x8 P.73 P.05 XL

Date of settlement: 1/22/x9 P.725

Note:

• Reportable sales amount in 20x8 income statement: 100,000 yens x P.78 = P78,000 (d), the historical

rate on 12/31/20x8 or spot rate on the date of transaction, 12/11/20x8.

• Title passed on 12/11/20x8, the shipping date. A foreign currency transaction should be recorded

initially at the rate of exchange on the date of transaction (historical spot rate)

• In the absence of the invoice date (or shipping date - FOB shipping point), then the date of

delivery will be used.

Page 12 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Solution/Answer:

77. (c) – P.05 x 100,000 yens = P5,000 loss (refer to No. 71)

78. (a) – Exposed Asset, the reportable value of the receivable from the foreign customer at

12/31/20x8: 100,000 yens x P.73 = P73,000, the spot rate on 12/31/20x8 or current rate on

12/31/20x8.

Items 79 to 81 are based on the following information:

On September 3, 20x8, Connelly placed a noncancellable purchase order with a Japanese company

for a custom-built machine. The contract price was 1,000,000 yens. The machine was delivered on

December 23, 20x8. The invoice was dated November 13, 20x8, the shipping date (FOB shipping point).

The vendor was paid on January 7, 20x9. The spot direct exchange rates for the Japanese yens on the

respective dates are as follows:

September 3, November 13, December 23, December 31, January 7,

20x8 20x8 20x8 20x8 20x9

P.20 P .21 P .22 P .23 P .24

79. What amount is the capitalizable cost of the equipment?

a. P200,000 c. P220,000

b. 210,000 d. 230,000

80. What is the reportable foreign exchange gain or loss amount in Connelly’s 20x8 income statement?

a. P10,000 loss c. P30,000 loss

b. 20,000 gain d. 20,000 loss

81. What is the reported value of the payable to the vendor at December 31, 20x8?

a. P200,000 c. P220,000

b. 210,000 d. 230,000

Solution/Answer:

79. (b) – Exposed Liability

Spot Rates

Date of Commitment: 9/3/x8 P.20

Date of Transaction (invoice): 11/13/x8 P.21 Liability – Accounts Payable

Date of Delivery: 12/23/x8 P.22

B/S Date: 12/31/x8 P.23 P.02 XL

Date of settlement: 1/7/x9 P.24

Note:

• Capitalizable cost of the equipment: 1,000,000 yens x P.21 = P210,000, the historical rate on

12/31/20x8 or spot rate on the date of transaction (11/13/20x8).

• Title passed on 11/13/20x8, the shipping date. A foreign currency transaction should be recorded

initially at the rate of exchange on the date of transaction (historical spot rate)

• In the absence of the invoice date (or shipping date - FOB shipping point), then the date of

delivery will be used.

Answer:

80. (d) – P.02 x 1,000,000 yens = P20,000 loss (refer to No. 74)

81. (d) – Exposed Liability, the reportable value of the payable to the foreign vendor at 12/31/20x8:

1,000,000 yens x P.23 = P230,000, the spot rate on 12/31/20x8 or current rate on 12/31/20x8.

Foreign Currency Transactions with Hedging

Items 82 and 83 are based on the following information:

On September 1, 20x8, Ramus Company purchased machine parts from Jacky Chan Company for 6,000,000

Hong Kong dollars to be paid on January 1, 20x9. The exchange rate on September 1 is HK $7.7 = P1. On the

same date, Ramus enters into a forward contract and agrees to purchase HS $6,000,000 on January 1, 20x9,

at the rate of HK $7.7 = P1. On December 31, 20x8 and on January 1, 20x9, the exchange rate is HK $8.0 = P1.

82. What is the fair value of the forward contract on December 31, 20x8?

a. P 0 c. P750,000

b. P29,221 d. P779,221

Solution/Answer: B

Fair Value of Forward Contract:

September 1, 20x8 (no initial fair value – PFRS 9)……….. …… P 0

December 31, 20x8:

9/1/20x8: Current (Original) Forward Rate

(HK$6,000,000/HK$7.7)…..……………………...........P779,221

12/31/20x8: Spot rate (HK$6,000,000/HK$8.0)………………....... 750,000

Forex loss on forward contract.…………………………………………… 29,221

Fair value of forward contract, 12/31/20x8 (a payable)..……………….. P 29,221

Page 13 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

*Under the forward contract, Ramus must pay P779,221 to purchase HK$6,000,000 on January 1, 2019. Equivalently, Ramus

can make a settlement payment if the peso value of HK$6,000,000 on January 1, 20x9, is less than P779,221, and it can receive

a payment if the value is more. In this case, the value is P750,000 (HK$6,000,000/8.0), so Ramus must make a payment.

83. What is the notional value of the HK $ forward contrac?

a. P 0 c. P750,000

b. P29,221 d. P779,221

Solution/Answer: D

HK$6,000,000/HK$7.7 = P779,221. The notional amount is the total face amount of the asset or liability that

underlies the derivative contract. The notional amount can be misleading because the value of a derivative is

a function of changes in prices or interest rates and is normally equal to just a small fraction of the notional

amount of the underlying asset.

A notional amount may be expressed in the number of currency units, shares, bushels, pounds or other units

specified in the financial instrument.

Hyperinflationary Economy

84.The following equity relates to an entity operating in a hyperinflationary economy:

Before After

PAS 29 Restatement

Share capital………………………………………………… 100 170

Revaluation reserve………………………………….......... 20 -

Retained earnings……………………………………......… 30 -

150 270

What would be the balances on the revaluation reserve and retained earnings after the

restatement for PAS 29?

a. Revaluation reserve 0, retained earnings 100

b. Revaluation reserve 100, retained earnings 0

c. Revaluation reserve 20, retained earnings 80

d. Revaluation reserve 70, retained earnings 30

85. Property was purchased on December 31, 20x4 for 20 million baht. The general price index in the

country was 60.1 on that date. On December 31, 20x7, the general price index had risen to 240.4. If

the entity operates in a hyperinflationary economy, what would be the carrying amount in the

financial statements of the property after restatement?

a. 20 million baht c. 80 million baht

b. 1,200.2 million baht d. 4.808 million baht

Partnership

Use the following information for question 86 to 88:

OO and PP are partners sharing profits in this proportion – 60:40. A balance sheet prepared for the

partners on April 1, 20x4 shows the following:

Cash . . . . . . . . . . . . . . . . . . . . P48,000 Accounts payable . . . . . . . . . P 89,000

Accounts Receivable . . . . . . . 92,000 OO, capital . . . . . . . . . . . . . . 133,000

Inventories . . . . . . . . . . . . . . . . 165,000 PP, capital. . . . . . . . . . . . . . . 108,000

Equipment . . . . . . . . . . . . 70,000

Less: Accumulated

Depreciation . . . . . . . 45,000 25,000

Total Assets . . . . . . . . . . . . . . . . P330,000 Total Liabilities & Capital . . . . P 330,000

On this date, the partners agree to admit RR as a partner. The terms of the agreement are

summarized below.Assets and liabilities are to be restated as follows:

• An allowance for possible uncollectible of P4,500 is to be established.

• Inventories are to be restated at their present replacement value of P170,000.

• Accrued expenses of P4,000 are to be Recognized.

OO, PP and RR will divide profits in the ratio of 5:3:2. Capital balances of the partners after the formation

of the new partnership are to be in the aforementioned ratio, with OO and PP making cash settlement

between them outside of the partnership to adjust their capitals, and RR investing cash in the

partnership for his interest.

86. The cash to be invested by RR is:

a. P60,250 c. P50,000

b. P47,500 d. P59,375

87. The total capital of the partnership after the admission of RR is:

a. P296,875 c. P237,500

b. P301,250 d. P286,850

Page 14 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

88. Cash settlement between OO and PP is:

a. OO will pay PP P17,537.50 c. OO will invest P17,537.50

b. PP will pay OO P17,537.50 d. PP will withdraw P17,537.50

Solutions/Answers:

86. d

Total capital of the new partnership (see no. 20) P 296,875

Multiply by RR’s interest 20%

Cash to be invested by RR P 59,375

87. a OO PP Total

(60%) (40%)

Unadjusted capital balances P133,000 P108,000 P241,000

Adjustments:

Allowance for bad debts ( 2,700) ( 1,800) ( 4,500)

Inventories 3,000 2,000 5,000

Accrued expenses ( 2,400) ( 1,600) ( 4,000)

Adjusted capital balances P130,900 P106,600 P237,500

Total capital before the formation of the new partnership (see above) P 237,500

Divide by the total percentage share of OO and PP (50% + 30%) 80%

Total capital of the partnership after the admission of RR P 296,875

88. a

Agreed Capital Contributed Capital Settlement

OO P148,437.50 (50% x P296,875) P 130,900 P 17,537.50

PP 89,062.50 (30% x P296,875) 106,600 (17,537.50)

Therefore, OO will pay PP P17,537.50

Use the following information for questions 89 to 92:

A partnership began its first year of operations with the following capital balances:

Young, Capital . . . . . . . . . . . . . . . . . . . . . . . P 143,000

Eaton, Capital . . . . . . . . . . . . . . . . . . . . . . . 104,000

Thurman, Capital . . . . . . . . . . . . . . . . . . . . . 143,000

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young

was to be awarded an annual salary of P26,000 with P13,000 salary assigned to Thurman. Each partner

was to be attributed with interest equal to 10% of the capital balance as of the first day of the year. The

remainder was to be assigned on a 5:2:3 basis, respectively. Each partner was allowed to withdraw up

to P13,000 per year. Assume that the net loss for the first year of operations was P26,000 with net income

of P52,000 in the second year. Assume further that each partner withdrew the maximum amount from

the business each year.

89. What was Young’s share of loss for the first year?

a. P 3,900 loss d. P24,700 loss

b. P11,700 loss e. P111,500 loss

c. P10,400 loss

90. What was the balance in Eaton's Capital account at the end of the first year?

a. P120,900 d. P80,600

b. P118,300 e. P111,500

c. P126,100

91. What was Thurman's share of income or loss for the second year?

a. P17,160 income d. P17,290 income

b. P4,160 income e. P28,080 income

c. P19,760 income

92. What was the balance in Young's Capital account at the end of the second year?

a. P133,380 d. P132,860

b. P84,760 e. P71,760

c. P105,690

Solutions/Answers:

89. b

Y E T Total

Capital, 1/1/Year I 143,000 104,000 143,000 390,000

Net income (loss) (11,700) (10,400) (3,900) (26,000)

Withdrawals – personal (13,000) (13,000) (13,000) (39,000)

Capital, 12/31/ Year I 118,300 80,600 126,100 325,000

Page 15 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Year I Net loss

Salary 26,000 - 13,000 3,900

Interest – 10% x beginning capital 14,300 10,400 14,300 3,900

5:2:3 (52,000) (20,800) (31,200) (10,400)

Total (11,700) (10,400) (3,900) (2,600)

Capital, 1/1/Year 2 118,300 80,600 126,100 325,000

Net income (loss) 28,080 76,700 19,760 52,000

Withdrawals – personal (13,000) (13,000) (13,000) (3,900)

Capital, 12/31/ Year 2 133,380 144,300 132,860 338,000

Year 2 Net loss -

Salary 26,000 - 13,000 3,900

Interest – 10% x beginning capital 11,830 8,060 12,610 32,500

5:2:3 (9,750) (3,900) (5,850) (19,500)

28,080 76,700 19,760 52,000

90. d - refer to No. 89

91. c - refer to No. 89

92. a - refer to No. 89

93. The capital accounts of the partnership of Newton, Sharman, and Jackson on June 1, 20x4, are

presented, along with their respective profit and loss ratios:

Newton………………………………………………………………P139,200 1/2

Sharman…………………………………………………………….. 208,800 1/3

Jackson……………………………………………………………… 96,000 1/6

P444,000

On June 1, 20x4, Sidney was admitted to the partnership when he purchased, for P132,000, a

proportionate interest from Newton and Sharman in the net assets and profits of the partnership. As

a result of this transaction, Sidney acquired a one-fifth interest in the net assets and profits of the

firm. Assuming that implied goodwill is not to be recorded, what is the combined gain realized by

Newton and Sharman upon the sale of a portion of their interests in the partnership to Sidney?

a. P -0- c. P62,400

b. P43,200 d. P82,000

Solutions/Answers:

93. b

Amount paid P132,000

Less: Book value of interest acquired:

(P444,000 x 1/5) 88,800

Excess/Gain by Newton and Sharman P 43,200

Use the following information for questions 94 and 95:

A partnership has the following capital balances:

Partners Capital Balance

William (40% of gains and losses) . . . . . . . . . . . . . . . . . P 220,000

Jennings (40%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160,000

94. Darrow invests P270,000 in cash for a 30 percent ownership interest. The money goes to the original

partners. Goodwill is to be recorded. How much goodwill should be recognized, and what is

Darrow’s beginning capital balance?

a. P410,000 and P270,000 c. P140,000 and P189,000

b. P140,000 and P270,000 d. P410,000 and P189,000

Solutions/Answers:

94. a - Admission by purchase. The implied value of the company is P900,000 (P270,000/30%). Since the

money is going to the partners rather than into the business, the capital total is P490,000 before

realigning the balances. Hence, goodwill of P410,000 must be recognized based on the implied

value (P900,000 – P490,000). This goodwill is assumed to represent unrealized business gains and is

attributed to the original partners according to their profit and loss ratio. They will then each convey

30 percent ownership of the P900,000 partnership to Darrow for a capital balance of P270,000.

Formal presentation:

Amount paid ………………………….………….. P 270,000 / 30% P900,000 (100%)

Less: BV of interest acquired –

(P220,000 + P160,000 + P110,000) x 30%….... 147,000 490,000 (100%)

Excess……………………………………………….. P123,000

Divided by: Interest acquired………………….. 20%

Goodwill or revaluation of Asset …………….. P410,000 P410,000 (100%)

Page 16 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

The entry would be as follows;

Goodwill/Asset 410,000

Williams (40%) 164,000

Jennings (40%) 164,000

Bryan (20%) 82,000

Williams [P220,000 + (P410,000 x 40%)] x 30% 115,200

Jennings [P160,000 + (P410,000 x 40%)] x 30% 97,200

Bryan [P110,000 + (P410,000 x 20%)] x 30% 57,600

Darrow 270,000

95. Darrow invests P250,000 in cash for a 30 percent ownership interest. The money goes to the business.

No goodwill or other revaluation is to be recorded. After the transaction, what is Jennings’s capital

balance?

a. P160,000 c. P170,200

b. P168,000 d. P171,200

Solutions/Answers:

95. d - Admission by investment. Since the money goes into the business, total capital becomes

P740,000 (P490,000 + P250,000). Darrow is allotted 30 percent of this total or P222,000. Because

Darrow invested P250,000, the extra P28,000 is assumed to be a bonus to the original partners.

Jennings will be assigned 40 percent of this extra amount or P11,200. This bonus increases

Jennings’ capital from P160,000 to P171,200.

Formal presentation:

Total agreed capital* (same with total contributed capital)…... P 740,000

Less: Total contributed capital (P220,000 + P160,000 +

P110,000 + P250,000)..............…………………………....... 740,000

Difference .......................................………………..…………………... P 0

*since no goodwill or revaluation is allowed total agreed is the same with total

contributed capital.

The new partner’s contributed capital is equal to the agreed capital, the difference of P3,600

in (a) is attributable to revaluation (goodwill) to old partners:

Darrow’s contributed capital………………………………………… P 250,000

Darrow’s agreed capital: (P740,000 x 30%)……………………...... 222,000

Bonus to old partners ........................……………………………….. P 28,000

Jennings: [P160,000 + (P28,000 x 40%)] = P171,200

Use the following information for 96 and 97 :

Partners Dennis and Lilly have decided to liquidate their business. The following information is available:

Cash . . . . . . . . . . . . . P 100,000 Accounts Payable . . . P 100,000

Inventory . . . . . . . . . . 200,000 Dennis, Capital . . . . . 120,000

Lilly, Capital . . . . . . . . . __80,000

Total . . . . . . . . . . . . . . P 300,000 Total . . . . . . . . . . . . . . . P300,000

Dennis and Lilly share profits and losses in a 3:2 ratio. During the first month of liquidation, half the

inventory is sold for P60,000, and P60,000 of the accounts payable is paid. During the second month,

the rest of the inventory is sold for P45,000, and the remaining accounts payable are paid. Cash is

distributed at the end of each month, and the liquidation is completed at the end of the second month.

96. Using a safe payments schedule, how much cash will be distributed to Dennis at the end of the first

month?

a. P 64,000 c. P 24,000

b. P 60,000 d. P 36,000

Solutions/Answers:

96. d

Dennis Lily Total

Capital before realization 120,000 80,000 200,000

Reduction in capital (3:2) ( 84,000) ( 56,000) (140,000)

Payment to partners 36,000 24,000 60,000*

*Payment to partners:

Cash, beginning………………………………………………………………………………P100,000

Proceeds……………………………………………………………………………………….. 60,000

Payment of liabilities – to be conservative – it should be in full……………………..( 100,000)

Payment to partners…………………………………………………………………………..P 60,000

97. Assume instead that the remaining inventory was sold for P10,000 in the second month. What

payments will be made to Dennis and Lilly at the end of the second month?

Page 17 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

Dennis Lilly Dennis Lilly

a. P 0 P 0 c. P 5,000 P 5,000

b. P 10,000 P 0 d. P 6,000 P 4,000

Solutions/Answers:

97. d

Dennis Lily Total

Capital before realization – refer to no. 11 84,000 56,000 140,000

Reduction in capital (3:2) (78,000) ( 52,000) (130,000)

Payment to partners 6,000 4,000 10,000*

*since cash was fully distributed last month, only the proceeds of P10,000 for the second remains to

be distributed.

98. The condensed balance sheet of the partnership of China and Japan as of

December 31, 20x8 showed the following:

Total assets… ......................................... P200,000

Total liabilities……………………………. 40,000

China, capital…………………………… 80,000

Japan, capital………………………….. 80,000

On this date, the partnership was dissolved and its net assets were transferred to a newly-formed

corporation. The fair value of the assets was P24,000 more than the carrying value on the firm’s

books. Each of the partners was issued 10,000 shares of the corporation’s P1 par common stock.

Immediately after affecting the transfer of the net assets, and the issuance of stocks, the

corporation’s additional paid-in capital account would be credited for:

a. P136,000 c. P154,000

b. 140,000 d. 164,000

99. A partnership is formed by two individuals who were previously sole proprietors. Property other than

cash that is part of the initial investment in the partnership would be recorded for financial

reporting purposes at the

a. Proprietor’s book values or the fair value of the property at the date of the investment,

whichever is higher.

b. Proprietor’s book values or the fair value of the property at the date of the investment,

whichever is lower.

c. Proprietor’s book values of the property at the date of the investment.

d. Fair value of the property at the date of the investment.

e. None of the above.

100. How does partnership accounting differ from corporate accounting?

a. The matching principle is not considered appropriate for partnership accounting.

b. Revenues are recognized at a different time by a partnership than is appropriate for a

corporation.

c. Individual capital accounts replace the contributed capital and retained earnings

balances found in corporate accounting.

d. Partnerships report all assets at fair value as of the latest balance sheet date.

101. Which of the following statements is correct with regard to drawing accounts that may be used

bya partnership?

a. Drawing accounts are closed to the partners’ capital accounts at the end of the

accountingperiod

b. Drawing accounts establish the amount that may be taken from the partnership by a

partnerin a given time period

c. Drawing accounts are similar to Retained Earnings in a corporation

d. Drawing accounts appear on the balance sheet as a contra-equity account

102. Which of the following would be least likely to be used as a means of allocating profits among

partners who are active in the management of the partnership?

a. Salaries

b. Bonus as a percentage of net income before the bonus

c. Bonus as a percentage of sales in excess of a targeted amount

d. Interest on average capital balances

103. The dissolution of a partnership occurs

a. Only when the partnership sells its assets and permanently closes its books

b. Only when a partner leaves the partnership

c. At the end of each year, when income is allocated to the partners

d. Only when a new partner is admitted to the partnership

e. When there is any change in the individuals who make up the partnership

Page 18 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

104. Which of the following results in dissolution of a partnership?

a. contribution of additional assets to the partnership by an existing partner

b. receipt of a draw by an existing partner

c. winding up of the partnership and the distribution of remaining assets to the partners

d. withdrawal of a partner from a partnership

105. In a simple partnership liquidation, the last remaining cash distribution should be made according

to the ratio of

a. the individual partner’s profit and loss agreement.

b. the individual partner's capital accounts, increased by partner loans to thepartnership.

c. the individual partner’s capital accounts, increased by partnership loans to the

partners and decreased by partner loans to the partnership.

d. the individual partner’s capital accounts, decreased by partnership loans to the

partners and increased by partner loans to the partnership.

106. If a partner with a debit capital balance during liquidation is personally solvent, the

a. partner must invest additional assets in the partnership.

b. partner's debit balance will be allocated to the other partners.

c. other partners will give the partner enough cash to absorb the debit

balance.

d. partnership will loan the partner enough cash to absorb the debit balance.

Corporate Liquidation

Items 107 to 109 are based on the following information:

Orville Company recently petitioned for bankruptcy and is now in the process of preparing a statement

of affairs.

The carrying values and estimated fair values of the assets of Orville Company are as follows:

Carrying Value Fair Value

Cash . . . . . . . . . . . . . . . . . . . . . . . . P 20,000 P 20,000

Accounts Receivable . . . . . . . . . . 45,000 30,000

Inventory . . . . . . . . . . . . . . . . . . . . 60,000 35,000

Land . . . . . . . . . . . . . . . . . . . . . . . . 75,000 70,000

Building (net) . . . . . . . . . . . . . . . . . 180,000 100,000

Equipment (net) . . . . . . . . . . . . . . 170,000 80,000

Total . . . . . . . . . . . . . . . . . . . . . . . . P 550,000 P335,000

Debts of Orville are as follows:

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 60,000

Wages Payable(all have priority) . . . . . . . . . . . . . . . . . . . . . . . . 10,000

Taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000

Notes payable (secured by receivable and inventory). . . 120,000

Interest on Notes Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,000

Bonds Payable (secured by land and building) . . . . . . . . . . 150,000

Interest on bonds Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,000

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 363,000

107. What is the total amount of unsecured claims?

a. P 93,000 c. P121,000

b. P113,000 d. P126,000

108. What estimated amount will be available for general unsecured creditors upon liquidation?

a. P28,000 c. P113,000

b. P93,000 d. P121,000

109. What is the estimated dividend percentage?

a. 23% c. 77%

b. 93% d. 68%

Solutions/Answers:

107. c – P60,000 + [(P120,000 + P6,000) – (P30,000 + P35,000) = P121,000

108. b - P20,000 + P80,000 + [P170,000 – (P150,000 + P7,000)] = P113,000 – (P10,000 + P10,000)

= P93,000

Note: The lowest priority is given to claims by General Unsecured Creditors (i.e., without priority). These creditors

are paid only after secured creditors and unsecured creditors with priority are satisfied to the extent of any

legal limits. Often the general unsecured creditors receive less than the full amount of their claim. The amounts

to be paid to these creditors are usually stated as a percentage of total claim, such as 77 cents per peso (refer

to No. 29), or whatever the specific percentage is. The payment to general unsecured creditors is often termed

a “dividend”.

Page 19 of 31 0915-2303213/0908-6567516/02-82886922 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

Batch 44 – October 2022 CPA Licensure Examination

AFAR Preweek

109. c – P93,000/P121,000 = 77% rounded. Refer to “Note” in No. 102

110. When is a “statement of affairs” used?

a. Only in liquidations.

b. Only in reorganizations.

c. In both liquidations and reorganizations.

d. In preparing a statement of realization and liquidation.

e. None of the above.

111. In a “statement of affairs,”

a. Assets pledged with partially secured creditors are shown on the asset side of the

statement and as a deduction on the liability side of the statement.

b. Assets pledged with fully secured creditors are shown only on the liability side of the

statement.

c. Liabilities owed to fully secured creditors are shown only on the asset side of the

statement.

d. Liabilities owed to partially secured creditors are shown on the asset side of the

balance sheet and as a deduction on the liability side of the statement.

e. None of the above.

Home Office and Branch Accounting

112. Selected information from the trial balances for the home office and the branch of Gerty Company at

December 31, 20x4 is provided. These trial balances cover the period from December 1 to December 31,

20x4. The branch acquires some of its merchandise from the home office (the branch is billed at 20%

above the cost to the home office and some of it from outsiders. Differences in the shipments accounts

result entirely from the home office policy of billing the branch at 20% above cost.

Home Office Branch

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 60,000 P 30,000

Shipments to branch . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,000 -0-

Shipments to branch – loading / Unrealized profit

in branch inventory . . . . . . . . . . . . . . . . . . . . . . . . 3,600 -0-

Purchases (outsiders) . . . . . . . . . . . . . . . . . . . . . . . . 35,000 5,500

Shipments from home office . . . . . . . . . . . . . . . . . . -0- 9,600

Merchandise inventory, December 1, 20x4 . . . . . . . . 20,000 15,000

Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,000 6,000

Additional information:

Merchandise inventory, December 31, 20x4:

Home office……………………………………………………………P20,000

Branch………………………………………………………………… 10,000

How much of the December 1, 20x4 inventory of the branch represents purchases from outsiders