Professional Documents

Culture Documents

Reviewer in Banking

Reviewer in Banking

Uploaded by

Baby Lyca ManaloCopyright:

Available Formats

You might also like

- Reason For The Application: Payment by Credit Card ConfidentialDocument1 pageReason For The Application: Payment by Credit Card ConfidentialdtoxidNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaMohamed Tousif82% (22)

- 3.06&3.07 - Limcoma V Republic & Lacamen V LaruanDocument1 page3.06&3.07 - Limcoma V Republic & Lacamen V LaruanKate GaroNo ratings yet

- Bfs - Unit II Short NotesDocument12 pagesBfs - Unit II Short NotesvelmuruganbNo ratings yet

- DJ WorkDocument49 pagesDJ WorkPratik GhadeNo ratings yet

- Banking ReviewerDocument5 pagesBanking ReviewerBianca MalinabNo ratings yet

- Suraj Main BodyDocument44 pagesSuraj Main BodySuraj SinghNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaSuryaNo ratings yet

- Pre 04 ReviewerDocument4 pagesPre 04 ReviewerCamila Gail GumbanNo ratings yet

- Management of Non-Performing Assets (Npas) in The Urban Cooperative Banks (Ucbs)Document5 pagesManagement of Non-Performing Assets (Npas) in The Urban Cooperative Banks (Ucbs)Neeraj GuptaNo ratings yet

- Product Development EDUCATIONDocument11 pagesProduct Development EDUCATIONGuy MoroNo ratings yet

- LAS BF Q3 Week 5 IGLDocument2 pagesLAS BF Q3 Week 5 IGLdaisymae.buenaventuraNo ratings yet

- 08 Chapter-02Document35 pages08 Chapter-02Manoj ValaNo ratings yet

- Module IIIDocument18 pagesModule IIISumit KumarNo ratings yet

- W9 Managing Receivables & Payables - 240307 - 174301Document44 pagesW9 Managing Receivables & Payables - 240307 - 174301Chi NguyễnNo ratings yet

- Based On The Purpose of The CreditDocument5 pagesBased On The Purpose of The CreditAn DoNo ratings yet

- F1 Part D Topic 1-8Document7 pagesF1 Part D Topic 1-8S RaihanNo ratings yet

- Revised Working Capital ManagementDocument37 pagesRevised Working Capital ManagementTanaka MbotoNo ratings yet

- "The Impact of NPA On The Net Profit of SBI and Axis BankDocument9 pages"The Impact of NPA On The Net Profit of SBI and Axis BankJayesh SonawaneNo ratings yet

- 02 Guide Questions - AUDIT OF THE FINANCIAL STATEMENTS OF BANKS (Part 1)Document4 pages02 Guide Questions - AUDIT OF THE FINANCIAL STATEMENTS OF BANKS (Part 1)Jhoanne Marie TederaNo ratings yet

- X1 Managing ReceivablesPayables - 2023Document43 pagesX1 Managing ReceivablesPayables - 2023Nguyễn HồngNo ratings yet

- Report TTDocument24 pagesReport TTvaibhavagrawal04102003No ratings yet

- Credit Appraisal ProcessDocument12 pagesCredit Appraisal ProcessmithilNo ratings yet

- Arief Taufiqqurrakhman (C1B018115) Cash and Marketable Securities Management and Working Capital and Short-Term Financing PDFDocument6 pagesArief Taufiqqurrakhman (C1B018115) Cash and Marketable Securities Management and Working Capital and Short-Term Financing PDFBikin RelaxNo ratings yet

- Short Term Sources of FinanceDocument18 pagesShort Term Sources of FinanceJithin Krishnan100% (1)

- Lecture 09Document17 pagesLecture 09simraNo ratings yet

- Functions of Banks PDFDocument10 pagesFunctions of Banks PDFSumit K SankhlaNo ratings yet

- Product Development HEALTHDocument11 pagesProduct Development HEALTHGuy MoroNo ratings yet

- Module 14 - Receivable and Inventory ManagementDocument10 pagesModule 14 - Receivable and Inventory ManagementGRACE ANN BERGONIONo ratings yet

- Project On Recovery Management of BanksDocument71 pagesProject On Recovery Management of Banksmandar_1380% (10)

- Assignment 1Document4 pagesAssignment 1Sanjida Ashrafi AnanyaNo ratings yet

- Managing NPAsDocument58 pagesManaging NPAsSuranga FernandoNo ratings yet

- Name: Dharshini S College: Sri Krishna College of Technology Topic: BankingDocument25 pagesName: Dharshini S College: Sri Krishna College of Technology Topic: BankingDharshini SelvarajNo ratings yet

- M.A. S3 Module 2 - Part 2Document5 pagesM.A. S3 Module 2 - Part 242 Abhishek Paul M ssNo ratings yet

- Cash ReceivablesDocument31 pagesCash ReceivablesRyou ShinodaNo ratings yet

- Chapter 13 Financial Management by CabreraDocument25 pagesChapter 13 Financial Management by CabreraLars FriasNo ratings yet

- Finance PresentationDocument11 pagesFinance PresentationRahul KapurNo ratings yet

- Glasanay BF Q3W3Document4 pagesGlasanay BF Q3W3Whyljyne Mary GlasanayNo ratings yet

- Audit of Receivables Lecture NotesDocument10 pagesAudit of Receivables Lecture NotesDebs Fanoga100% (1)

- Banking Products and FacilitiesDocument36 pagesBanking Products and FacilitiesMadihah JamianNo ratings yet

- Credit Analysis and Distress PredictionDocument57 pagesCredit Analysis and Distress Predictionrizki nurNo ratings yet

- Non-Performing AssetsDocument38 pagesNon-Performing Assetssuriraghav2003No ratings yet

- A R I M: Ccounts Eceivable AND Nventory AnagementDocument33 pagesA R I M: Ccounts Eceivable AND Nventory AnagementtennimNo ratings yet

- W1f FINS3650 Essential Readings SummaryDocument6 pagesW1f FINS3650 Essential Readings SummaryShruti IyengarNo ratings yet

- Finance Department, Tashkent Institute of Finance, UzbekistanDocument3 pagesFinance Department, Tashkent Institute of Finance, UzbekistanMULU TEMESGENNo ratings yet

- Non Performing Assets (Npa)Document16 pagesNon Performing Assets (Npa)Avin P RNo ratings yet

- Chapter 08 Loans & Advances (Law & Practice of Banking)Document9 pagesChapter 08 Loans & Advances (Law & Practice of Banking)Rayyah AminNo ratings yet

- Auditing Problems: Audit of ReceivablesDocument4 pagesAuditing Problems: Audit of ReceivablesMa. Trixcy De VeraNo ratings yet

- AssignmentDocument2 pagesAssignmentHarish YvsNo ratings yet

- Chapter VII-Credit Administration, Monitoring and ReviewDocument9 pagesChapter VII-Credit Administration, Monitoring and ReviewPradeep GautamNo ratings yet

- Credit FinalsDocument4 pagesCredit FinalsJane Alyssa SevillaNo ratings yet

- Agri Lending Learning 23656 - Managing - Late - RepaymDocument10 pagesAgri Lending Learning 23656 - Managing - Late - Repaymapi-3833893No ratings yet

- Funded & Non-Funded FacilitiesDocument3 pagesFunded & Non-Funded Facilitiesbhavin shahNo ratings yet

- Chapter 15 Audit of Other Items of Statement of Financial PositionDocument13 pagesChapter 15 Audit of Other Items of Statement of Financial PositionMiaNo ratings yet

- Money and BankingpptDocument19 pagesMoney and BankingpptSania ZaheerNo ratings yet

- Risk ManagementDocument14 pagesRisk ManagementMichelle TNo ratings yet

- Credit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsFrom EverandCredit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsNo ratings yet

- BS en Iso 13916-1997Document11 pagesBS en Iso 13916-1997Jithu KareemNo ratings yet

- Letter To Postmaster General Louis DeJoyDocument2 pagesLetter To Postmaster General Louis DeJoyHonolulu Star-AdvertiserNo ratings yet

- Phil Intro Resources - 0Document6 pagesPhil Intro Resources - 0Mitakun UlfahNo ratings yet

- ) Daily Times - Site Edition (Printer Friendly Version)Document6 pages) Daily Times - Site Edition (Printer Friendly Version)Rameez_AhmedNo ratings yet

- Descriptions of Ike and FranklinDocument1 pageDescriptions of Ike and FranklinPeace BridgesNo ratings yet

- CIVREVcases 1Document509 pagesCIVREVcases 1Jayson AbabaNo ratings yet

- MyTiCon Screws Design Guide VU 1.2Document52 pagesMyTiCon Screws Design Guide VU 1.2TomNo ratings yet

- Corporate Split-Off: by Veronika KovácsDocument49 pagesCorporate Split-Off: by Veronika KovácsSammy Dalie Soto BernaolaNo ratings yet

- BMC Act 1888Document346 pagesBMC Act 1888Akshay Ramade100% (1)

- This Deed of Gift Is Made by Kotha Konda Madhavi On 22/nov/2019 Day ofDocument1 pageThis Deed of Gift Is Made by Kotha Konda Madhavi On 22/nov/2019 Day ofShaikriyaz PashaNo ratings yet

- Orange - Equity Research ReportDocument6 pagesOrange - Equity Research Reportosama aboualamNo ratings yet

- Finance Module 1 Intro To FinanceDocument8 pagesFinance Module 1 Intro To FinanceJOHN PAUL LAGAONo ratings yet

- A Plot Seemingly Hatched in HellDocument4 pagesA Plot Seemingly Hatched in HellAlvin MercaderoNo ratings yet

- ZTWD ELt Ne USogw FDocument10 pagesZTWD ELt Ne USogw FSouravDeyNo ratings yet

- Province of Camarines Sur v. CADocument3 pagesProvince of Camarines Sur v. CAAira Marie M. AndalNo ratings yet

- Corporation Law OutlineDocument131 pagesCorporation Law OutlineNora LupebaNo ratings yet

- VpCI-649 BDDocument2 pagesVpCI-649 BDChaitanya Sai TNo ratings yet

- CLAT 2013 PG Provisional ListDocument13 pagesCLAT 2013 PG Provisional ListBar & BenchNo ratings yet

- APUNTES DerechoDocument41 pagesAPUNTES DerechoVerónica Rueda PuyanaNo ratings yet

- On The Jews and Their Lies - Martin LutherDocument172 pagesOn The Jews and Their Lies - Martin LutherOrdinaryD100% (3)

- LRD Term Sheet - Priyami CommentsDocument11 pagesLRD Term Sheet - Priyami Commentslaxmikanth.goturNo ratings yet

- Adjusting Entries Discussion ProblemsDocument2 pagesAdjusting Entries Discussion Problemsmicadeguzman.1313No ratings yet

- 2019123000574Document105 pages2019123000574in resNo ratings yet

- Residential Rent AgreementDocument2 pagesResidential Rent AgreementShashi KumarNo ratings yet

- The Virtual Battlefield in 2022:: Russia-Ukraine War & Its Policy ImplicationsDocument26 pagesThe Virtual Battlefield in 2022:: Russia-Ukraine War & Its Policy ImplicationsOliver HidalgoNo ratings yet

- The Practical Guide To Humanitarian Law: Calling Things by The Wrong Name Adds To The A IctionDocument23 pagesThe Practical Guide To Humanitarian Law: Calling Things by The Wrong Name Adds To The A Ictionfati maaNo ratings yet

- REKO DIQ Case (Write-Up)Document1 pageREKO DIQ Case (Write-Up)Adnan SiddiqiNo ratings yet

- SparkNotes Much Ado About Nothing Full Book Quiz PDFDocument1 pageSparkNotes Much Ado About Nothing Full Book Quiz PDFEvan SandovalNo ratings yet

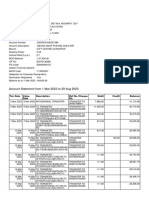

Reviewer in Banking

Reviewer in Banking

Uploaded by

Baby Lyca ManaloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reviewer in Banking

Reviewer in Banking

Uploaded by

Baby Lyca ManaloCopyright:

Available Formats

Banking and Financial Institution • Financial warning signal - default in repayment, falling

profits, rising level of bad debts, declining sales.

A nonperforming asset (NPA) refers to a classification for loans • Operational warning signal - underutilization of capacity,

or advances that are in default or in arrears. frequent labour problems, over stocking

• Banking warning signals - frequent requests for further loans,

NPA is an asset which ceases to generate income for the bank. It delay in payment of interest or instalment due, reduction in

means an advance or credit facility in respect of which the transactions, dishonour of cheques, opening account with other

interest or instalment of principal remain overdue for a period of banks, etc.

more than 90 days with effect from 31st march 2004. • Managerial warning signal - poor financial control, frequent

change in ownership, undertaking of undo risks, window

Nonperforming assets (NPAs) are recorded on a bank's dressing.

balance sheet after a prolonged period of non-payment by the • External warning signal - economic recession, change in

borrower. government policies, new competition.

Factors Responsible for NPA

Note: NPAs place financial burden on the lender; a significant 1. Internal Factors

number of NPAs over a period of time may indicate to

Diversion of funds by the borrowers

regulators that the financial health of the bank is in jeopardy.

Delay and consequent increase in cost of the

project

NPAs can be classified as a substandard asset, doubtful asset,

or loss asset, (types of NPA) depending on the length of time Business failure

overdue and probability of repayment. 2. External Factors

Recession

Note: Lenders have options to recover their losses, including Shortage of input/ power

taking possession of any collateral or selling off the loan at a Rise in prices of inputs

significant discount to a collection agency. Techniques for Managing NPA

Ensure that loans are diversified across sectors

Note: A loan is in arrears when principal or interest payments Loans are granted to credit worthy borrowers

are late or missed. A loan is in default when the lender Improving its monitoring system

considers the loan agreement to be broken and the debtor is React to early warning signals

unable to meet his obligations.

Knowing clients profile thoroughly

Adapting credit rating system

Note: After a prolonged period of non-payment, the lender will

force the borrower to liquidate any assets that were pledged as

Banking Legislations in India

part of the debt agreement. If no assets were pledged, the lender

might write-off the asset as a bad debt and then sell it at a The negotiable instruments Act 1881

discount to a collection agency. In most cases, debt is classified The banking regulation Act 1949

as nonperforming when loan payments have not been made for The reserve bank of India Act 1934

a period of 90 days. While 90 days is the standard, the amount

of elapsed time may be shorter or longer depending on the Banking Ombudsman Scheme

terms and conditions of each individual loan. A loan can be A banking ombudsman is a person appointed by the

classified as a nonperforming asset at any point during the term reserve bank of India to redress customer complaints

of the loan or at its maturity. against certain deficiencies in banking services.

It is to solve and settle complaints relating to the

Types of Non-Performing Assets (NPA) provisions of barking services.

Overdraft and cash credit (OD/CC) accounts left out-

of-order for more than 90 days Online banking allows a user to conduct financial transactions

Agricultural advances whose interest or principal via the Internet. Online banking is also known as Internet

installment payments remain overdue for two banking or web banking.

crop/harvest seasons for short duration crops or Online banking offers customers almost every service

overdue one crop season for long duration crops. traditionally available through a local including deposits,

Expected payment on any other type of account is transfers, and online bill payments.

overdue for more than 90 days.

Recording Non-Performing Assets (NPA) Note: Virtually every banking institution has some form of

Note: Banks are required to classify nonperforming assets into online banking, available both on desktop versions and through

one of three categories according to how long the asset has mobile apps.

been non-performing: sub-standard assets, doubtful assets, and

loss assets. Importance of e-banking

Banks

A sub-standard asset is an asset classified as an NPA for less

1. Lesser transaction costs - electronic transactions are

than 12 months. A doubtful asset is an asset that has been non-

the cheapest modes of transaction

performing for more than 12 months.

2. A reduced margin for human error - since the

Loss assets are loans with losses identified by the bank, auditor,

information is relayed electronically, there is no room

or inspector that need to be fully written off. They typically have

for human error

an extended period of non-payment, and it can be reasonably

3. Lesser paperwork - digital records reduce paperwork

assumed that it will not be repaid.

and make the process easier to handle. Also, it is

Impact of NPA environment-friendly.

They do not generate income 4. Reduced fixed costs- A lesser need for branches which

They enhance the administrative, legal and recovery translates into a lower fixed cost

costs of loans 5. More loyal customers - since e-banking services are

They reduce profitability of the lending bank customer-friendly, banks experience higher loyalty

They effect banks credibility and image from its customers.

They adversely affect decision making for fresh loans Customers

1. Convenience - a customer can access his account and

transact from anywhere 24x7x366.

Early Indicators of NPA

2. Lower cost per transaction - since the customer does simple retail account balance inquiry to a large

not have to visit the branch for every transaction, it business-to-business funds transfer. The following table

saves him both time and money. lists some common retail and wholesale e-banking

3. No geographical barriers - In traditional banking services offered by banks and financial institutions.

systems, geographical distances could hamper certain

banking transactions. However, with e-banking, Common E-Banking Services

geographical barriers are reduced.

Businesses Retail Services

1. Account reviews - Business owners and designated Account management

staff members can access the accounts quickly using an Bill payment

online banking interface. This allows them to review New account opening

the account activity and also ensure the smooth Consumer wire transfers

functioning of the account. Investment/Brokerage services

2. Better productivity - Electronic banking improves Loan application and approval

productivity. It allows the automation of regular Account aggregation

monthly payments and a host of other features to

enhance the productivity of the business. Wholesale Services

3. Lower costs - Usually, costs in banking relationships Account management

are based on the resources utilized. If a certain business Cash management

requires more assistance with wire transfers, deposits, Small business loan applications, approvals, or

etc., then the bank charges it higher fees. With online advances

banking, these expenses are minimized. Commercial wire transfers

4. Lesser errors - Electronic banking helps reduce errors Business-to-business payments

in regular banking transactions. Bad handwriting, Employee benefits/ pension administration

mistaken information, etc. can cause errors which can

prove costly. Also, easy review of the account activity

enhances the accuracy of financial transactions. A financial instruments is any contract that gives rise to a

5. Reduced fraud - Electronic banking provides a digital financial asset of one entity and a financial liability or equity

footprint for all employees who have the right to instrument of another entity.

modify banking activities. Therefore, the business has

better visibility into its transactions making it difficult Contract refers to an agreement between two or more parties

for any fraudsters to play mischief. that has clear economic consequences that the parties have little,

Electronic banking is a form of banking in which funds are if any, discretion to avoid, usually because the agreement is

transferred through an exchange of electronic signals rather than enforceable by law.

through an exchange of cash, checks, or other types of paper

documents. Financial instruments include primary instruments and

Note: Transfers of funds occur between financial institutions derivative financial instruments. Based on the definition,

such as banks and credit unions. They also occur between financial instruments include financial assets, financial

financial institutions and commercial institutions such as stores. liabilities, equity instruments and derivatives. Derivatives

Whenever someone withdraws cash from an automated teller include financial options, futures and forwards, interest rate

machine (ATM) or pays for groceries using a debit card (which swaps and currency swaps.

draws the amount owed to the store from a savings or checking Financial Assets

account), the funds are transferred via electronic banking. A financial asset is any asset that is:

Forms of E Banking Cash

Internet banking Equity instruments of another entity

Mobile banking Receivable

Telephone banking Some of the most commonly encountered financial instruments

Home banking representing financial assets are the following:

1. Cash on hand and in banks

Credit card

a) Petty cash - refers to cash balances kept on

A credit card is an instrument which provides instantaneous

hand at various locations to pay for minor

credit facilities to its holder to purchase goods or services from

expenditures such as postage and other small

business establishments enrolled as members of the credit card

out-of-pocket expenditures.

system.

b) Demand, savings and time deposits -

Debit card represent amounts on deposit in checking,

It also payment card. It is used to obtain cash, goods or services savings and time deposit accounts

automatically deviating the payments to the card holder's bank respectively. Time deposits are placements

account instantly up to the credit balance which exists in the covering a relatively long period of time.

customer's bank account. c) Undeposited checks - are checks payable to

Electronic Fund Transfer the enterprise or bearer but not yet presented

It is scheme of RBI introduced in 1996 to the bank for payment.

It helps banks to offer their customers money transfer service d) Foreign currencies - may not be used to buy

from one account to another of a bank branch both intercity and goods and services in any country other than

intercity and also from one account of one bank to another the one in which it is printed, unless the

account of another bank in the same city or different cities. government of that country agrees to use it.

e) Money orders - are financial instruments

similar to bank drafts but are drawn generally

Two Types of Banking Websites from authorized post offices or other financial

1. Informational Websites - These websites offer general institutions.

information about the bank and its products and f) Bank drafts - are commitment by banking

services to customers. institutions to advance funds on demand by

2. Transactional Websites - These websites allow the party to whom the draft was directed.

customers to conduct transactions on the bank's

website. Further, these transactions can range from a

2. Accounts, notes and loans receivable and investment 2. Forward Contracts - is a customized contract between

in bonds and other debt instruments issued by other two parties to buy or sell an asset at a specified price on

entities: a future date. A forward contract can be used for

a) Trade-receivables (signed delivery receipts hedging or speculation, although its non-standardized

and sales invoice) nature makes it particularly apt for hedging.

b) Promissory notes

c) Bond certificates A forward contract is similar to a future

3. Interest in shares or other equity instruments issued contract but differ in three ways:

by other entities a) A forward contract calls for delivery on a specific

a) Stock certificates date, whereas a future contract permits the seller to

b) Publicly listed securities decide later which specific day within the specified

month will be the delivery date (if it gets as far as

4. Derivative Financial Assets actual delivery before it is closed out).

a) Future contracts b) Unlike a future contract, a forward usually is not

b) Forward contracts traded on a market exchange.

c) Call options c) Unlike a future contract, forward contracts does

d) Foreign currency futures not call for a daily cash settlement for price

e) Interest rate swaps changes in the underlying contract. Gains and

losses on forward contracts are paid only when

Financial Liabilities they are closed out.

A financial liability is any liability that is

1. A contractual obligation 3. Call options - are financial contracts that give the

a) To deliver cash or another financial asset option buyer the right, but not the obligation, to buy a

to another entity; or stock, bond, commodity or other asset or instrument at

b) To exchange financial assets or financial a specified price within a specific time period.

liabilities with another entity under

conditions that are potentially 4. Foreign Currency Futures - foreign currency

unfavourable to the entity; or frequently is denominated in the currency of the lender.

2. A contract that will or may settled in the entity's 5. Interest Rate Swaps - is a forward contract in which

own equity instruments and is: one stream of future interest payments is exchanged for

a) A non- derivative for which the entity is another based on a specified principal amount. It

or may be obligated to deliver a variable usually involves the exchange of a fixed interest rate

number of the entity's own instruments; or for a floating rate, or vice versa, to reduce or increase

b) A derivative that will or may be settled exposure to fluctuations in interest rates or to obtain a

other than by the exchange of a fixed marginally lower interest rate than would have been

amount of cash or another financial asset possible without the swap. A swap can also involve the

for a fixed number of the entity's own exchange of one type of floating rate for another, which

equity instruments. is called a basis swap.

Examples of Financial Liabilities are the following:

Accounts and notes payable, loans from other entities

and bonds and other debt instruments issued by the

entity

Derivative financial liabilities

Obligations to deliver own shares worth a fixed amount

of cash

Some derivatives on own equity instruments.

Equity Instruments

An equity instrument is any contract that evidence a

residual interest in the assets of an entity after deducting all

of its liabilities.

Examples of Equity Instruments are:

Ordinary shares

Preference shares

Warrants or written call option that allow the holder to

subscribe or purchase ordinary shares in exchange for a

fixed amount of each or another financial asset.

Derivative Financial Instruments

Derivatives are financial instruments that "derive" their

value on contractually required cash flows from some other

security or index.

Five Major Types of Financial Derivatives

1. Future Contracts - is an agreement between a seller

and a buyer that requires that seller to deliver a

particular commodity at a designated future date, at a

predetermined price. These contracts are actively

treated on regulated future exchanges and are generally

referred to as "commodity future contract".

You might also like

- Reason For The Application: Payment by Credit Card ConfidentialDocument1 pageReason For The Application: Payment by Credit Card ConfidentialdtoxidNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaMohamed Tousif82% (22)

- 3.06&3.07 - Limcoma V Republic & Lacamen V LaruanDocument1 page3.06&3.07 - Limcoma V Republic & Lacamen V LaruanKate GaroNo ratings yet

- Bfs - Unit II Short NotesDocument12 pagesBfs - Unit II Short NotesvelmuruganbNo ratings yet

- DJ WorkDocument49 pagesDJ WorkPratik GhadeNo ratings yet

- Banking ReviewerDocument5 pagesBanking ReviewerBianca MalinabNo ratings yet

- Suraj Main BodyDocument44 pagesSuraj Main BodySuraj SinghNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaSuryaNo ratings yet

- Pre 04 ReviewerDocument4 pagesPre 04 ReviewerCamila Gail GumbanNo ratings yet

- Management of Non-Performing Assets (Npas) in The Urban Cooperative Banks (Ucbs)Document5 pagesManagement of Non-Performing Assets (Npas) in The Urban Cooperative Banks (Ucbs)Neeraj GuptaNo ratings yet

- Product Development EDUCATIONDocument11 pagesProduct Development EDUCATIONGuy MoroNo ratings yet

- LAS BF Q3 Week 5 IGLDocument2 pagesLAS BF Q3 Week 5 IGLdaisymae.buenaventuraNo ratings yet

- 08 Chapter-02Document35 pages08 Chapter-02Manoj ValaNo ratings yet

- Module IIIDocument18 pagesModule IIISumit KumarNo ratings yet

- W9 Managing Receivables & Payables - 240307 - 174301Document44 pagesW9 Managing Receivables & Payables - 240307 - 174301Chi NguyễnNo ratings yet

- Based On The Purpose of The CreditDocument5 pagesBased On The Purpose of The CreditAn DoNo ratings yet

- F1 Part D Topic 1-8Document7 pagesF1 Part D Topic 1-8S RaihanNo ratings yet

- Revised Working Capital ManagementDocument37 pagesRevised Working Capital ManagementTanaka MbotoNo ratings yet

- "The Impact of NPA On The Net Profit of SBI and Axis BankDocument9 pages"The Impact of NPA On The Net Profit of SBI and Axis BankJayesh SonawaneNo ratings yet

- 02 Guide Questions - AUDIT OF THE FINANCIAL STATEMENTS OF BANKS (Part 1)Document4 pages02 Guide Questions - AUDIT OF THE FINANCIAL STATEMENTS OF BANKS (Part 1)Jhoanne Marie TederaNo ratings yet

- X1 Managing ReceivablesPayables - 2023Document43 pagesX1 Managing ReceivablesPayables - 2023Nguyễn HồngNo ratings yet

- Report TTDocument24 pagesReport TTvaibhavagrawal04102003No ratings yet

- Credit Appraisal ProcessDocument12 pagesCredit Appraisal ProcessmithilNo ratings yet

- Arief Taufiqqurrakhman (C1B018115) Cash and Marketable Securities Management and Working Capital and Short-Term Financing PDFDocument6 pagesArief Taufiqqurrakhman (C1B018115) Cash and Marketable Securities Management and Working Capital and Short-Term Financing PDFBikin RelaxNo ratings yet

- Short Term Sources of FinanceDocument18 pagesShort Term Sources of FinanceJithin Krishnan100% (1)

- Lecture 09Document17 pagesLecture 09simraNo ratings yet

- Functions of Banks PDFDocument10 pagesFunctions of Banks PDFSumit K SankhlaNo ratings yet

- Product Development HEALTHDocument11 pagesProduct Development HEALTHGuy MoroNo ratings yet

- Module 14 - Receivable and Inventory ManagementDocument10 pagesModule 14 - Receivable and Inventory ManagementGRACE ANN BERGONIONo ratings yet

- Project On Recovery Management of BanksDocument71 pagesProject On Recovery Management of Banksmandar_1380% (10)

- Assignment 1Document4 pagesAssignment 1Sanjida Ashrafi AnanyaNo ratings yet

- Managing NPAsDocument58 pagesManaging NPAsSuranga FernandoNo ratings yet

- Name: Dharshini S College: Sri Krishna College of Technology Topic: BankingDocument25 pagesName: Dharshini S College: Sri Krishna College of Technology Topic: BankingDharshini SelvarajNo ratings yet

- M.A. S3 Module 2 - Part 2Document5 pagesM.A. S3 Module 2 - Part 242 Abhishek Paul M ssNo ratings yet

- Cash ReceivablesDocument31 pagesCash ReceivablesRyou ShinodaNo ratings yet

- Chapter 13 Financial Management by CabreraDocument25 pagesChapter 13 Financial Management by CabreraLars FriasNo ratings yet

- Finance PresentationDocument11 pagesFinance PresentationRahul KapurNo ratings yet

- Glasanay BF Q3W3Document4 pagesGlasanay BF Q3W3Whyljyne Mary GlasanayNo ratings yet

- Audit of Receivables Lecture NotesDocument10 pagesAudit of Receivables Lecture NotesDebs Fanoga100% (1)

- Banking Products and FacilitiesDocument36 pagesBanking Products and FacilitiesMadihah JamianNo ratings yet

- Credit Analysis and Distress PredictionDocument57 pagesCredit Analysis and Distress Predictionrizki nurNo ratings yet

- Non-Performing AssetsDocument38 pagesNon-Performing Assetssuriraghav2003No ratings yet

- A R I M: Ccounts Eceivable AND Nventory AnagementDocument33 pagesA R I M: Ccounts Eceivable AND Nventory AnagementtennimNo ratings yet

- W1f FINS3650 Essential Readings SummaryDocument6 pagesW1f FINS3650 Essential Readings SummaryShruti IyengarNo ratings yet

- Finance Department, Tashkent Institute of Finance, UzbekistanDocument3 pagesFinance Department, Tashkent Institute of Finance, UzbekistanMULU TEMESGENNo ratings yet

- Non Performing Assets (Npa)Document16 pagesNon Performing Assets (Npa)Avin P RNo ratings yet

- Chapter 08 Loans & Advances (Law & Practice of Banking)Document9 pagesChapter 08 Loans & Advances (Law & Practice of Banking)Rayyah AminNo ratings yet

- Auditing Problems: Audit of ReceivablesDocument4 pagesAuditing Problems: Audit of ReceivablesMa. Trixcy De VeraNo ratings yet

- AssignmentDocument2 pagesAssignmentHarish YvsNo ratings yet

- Chapter VII-Credit Administration, Monitoring and ReviewDocument9 pagesChapter VII-Credit Administration, Monitoring and ReviewPradeep GautamNo ratings yet

- Credit FinalsDocument4 pagesCredit FinalsJane Alyssa SevillaNo ratings yet

- Agri Lending Learning 23656 - Managing - Late - RepaymDocument10 pagesAgri Lending Learning 23656 - Managing - Late - Repaymapi-3833893No ratings yet

- Funded & Non-Funded FacilitiesDocument3 pagesFunded & Non-Funded Facilitiesbhavin shahNo ratings yet

- Chapter 15 Audit of Other Items of Statement of Financial PositionDocument13 pagesChapter 15 Audit of Other Items of Statement of Financial PositionMiaNo ratings yet

- Money and BankingpptDocument19 pagesMoney and BankingpptSania ZaheerNo ratings yet

- Risk ManagementDocument14 pagesRisk ManagementMichelle TNo ratings yet

- Credit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsFrom EverandCredit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsNo ratings yet

- BS en Iso 13916-1997Document11 pagesBS en Iso 13916-1997Jithu KareemNo ratings yet

- Letter To Postmaster General Louis DeJoyDocument2 pagesLetter To Postmaster General Louis DeJoyHonolulu Star-AdvertiserNo ratings yet

- Phil Intro Resources - 0Document6 pagesPhil Intro Resources - 0Mitakun UlfahNo ratings yet

- ) Daily Times - Site Edition (Printer Friendly Version)Document6 pages) Daily Times - Site Edition (Printer Friendly Version)Rameez_AhmedNo ratings yet

- Descriptions of Ike and FranklinDocument1 pageDescriptions of Ike and FranklinPeace BridgesNo ratings yet

- CIVREVcases 1Document509 pagesCIVREVcases 1Jayson AbabaNo ratings yet

- MyTiCon Screws Design Guide VU 1.2Document52 pagesMyTiCon Screws Design Guide VU 1.2TomNo ratings yet

- Corporate Split-Off: by Veronika KovácsDocument49 pagesCorporate Split-Off: by Veronika KovácsSammy Dalie Soto BernaolaNo ratings yet

- BMC Act 1888Document346 pagesBMC Act 1888Akshay Ramade100% (1)

- This Deed of Gift Is Made by Kotha Konda Madhavi On 22/nov/2019 Day ofDocument1 pageThis Deed of Gift Is Made by Kotha Konda Madhavi On 22/nov/2019 Day ofShaikriyaz PashaNo ratings yet

- Orange - Equity Research ReportDocument6 pagesOrange - Equity Research Reportosama aboualamNo ratings yet

- Finance Module 1 Intro To FinanceDocument8 pagesFinance Module 1 Intro To FinanceJOHN PAUL LAGAONo ratings yet

- A Plot Seemingly Hatched in HellDocument4 pagesA Plot Seemingly Hatched in HellAlvin MercaderoNo ratings yet

- ZTWD ELt Ne USogw FDocument10 pagesZTWD ELt Ne USogw FSouravDeyNo ratings yet

- Province of Camarines Sur v. CADocument3 pagesProvince of Camarines Sur v. CAAira Marie M. AndalNo ratings yet

- Corporation Law OutlineDocument131 pagesCorporation Law OutlineNora LupebaNo ratings yet

- VpCI-649 BDDocument2 pagesVpCI-649 BDChaitanya Sai TNo ratings yet

- CLAT 2013 PG Provisional ListDocument13 pagesCLAT 2013 PG Provisional ListBar & BenchNo ratings yet

- APUNTES DerechoDocument41 pagesAPUNTES DerechoVerónica Rueda PuyanaNo ratings yet

- On The Jews and Their Lies - Martin LutherDocument172 pagesOn The Jews and Their Lies - Martin LutherOrdinaryD100% (3)

- LRD Term Sheet - Priyami CommentsDocument11 pagesLRD Term Sheet - Priyami Commentslaxmikanth.goturNo ratings yet

- Adjusting Entries Discussion ProblemsDocument2 pagesAdjusting Entries Discussion Problemsmicadeguzman.1313No ratings yet

- 2019123000574Document105 pages2019123000574in resNo ratings yet

- Residential Rent AgreementDocument2 pagesResidential Rent AgreementShashi KumarNo ratings yet

- The Virtual Battlefield in 2022:: Russia-Ukraine War & Its Policy ImplicationsDocument26 pagesThe Virtual Battlefield in 2022:: Russia-Ukraine War & Its Policy ImplicationsOliver HidalgoNo ratings yet

- The Practical Guide To Humanitarian Law: Calling Things by The Wrong Name Adds To The A IctionDocument23 pagesThe Practical Guide To Humanitarian Law: Calling Things by The Wrong Name Adds To The A Ictionfati maaNo ratings yet

- REKO DIQ Case (Write-Up)Document1 pageREKO DIQ Case (Write-Up)Adnan SiddiqiNo ratings yet

- SparkNotes Much Ado About Nothing Full Book Quiz PDFDocument1 pageSparkNotes Much Ado About Nothing Full Book Quiz PDFEvan SandovalNo ratings yet