Professional Documents

Culture Documents

Assignment 12 Ekotek

Assignment 12 Ekotek

Uploaded by

iam ahoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 12 Ekotek

Assignment 12 Ekotek

Uploaded by

iam ahoCopyright:

Available Formats

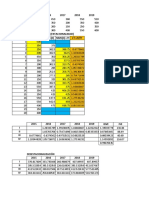

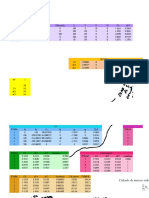

P 39000 6 YEARS

S 3900

U1 50000

U2 55000

U3 65000

U4 75000

U5 60000

U6 55000

SL METHOD

YEAR DEPREC VALUE

I 5850 33150

II 5850 27300

III 5850 21450

IV 5850 15600

V 5850 9750

VI 5850 3900

PU METHOD

0.0975

YEAR DEPREC VALUE

I 4875 34125

II 5362.5 28762.5

III 6337.5 22425

IV 7312.5 15112.5

V 5850 9262.5

VI 5362.5 3900

SUM YEARS METHOD

21

YEAR DEPREC VALUE D-S

I 10028.57 28971.43 6 35100

II 8357.14 20614.29 5 35100

III 6685.71 13928.57 4 35100

IV 5014.29 8914.29 3 35100

V 3342.86 5571.43 2 35100

VI 1671.43 3900 1 35100

DECLINING BALANCE METHOD

0.3333333333333

YEAR DEPREC VALUE

I 13000 26000

II 8666.67 17333.33

III 5777.78 11555.56

IV 3851.85 7703.70

V 2567.90 5135.80

VI 1711.93 3423.87

SINKING FUND METHOD

YEAR DEPREC VALUE D-S A/F F/P

I 4008.42 34991.58 35100 0.1142 1

II 4609.68 30381.90 35100 0.1142 1.15

III 5303.14 25078.76 35100 0.1142 1.323

IV 6096.81 18981.95 35100 0.1142 1.521

V 7010.73 11971.22 35100 0.1142 1.749

VI 8060.93 3910.29 35100 0.1142 2.011

You might also like

- Simple & CompuestoDocument5 pagesSimple & CompuestocompaniadiamontNo ratings yet

- Pregunta 1Document4 pagesPregunta 1MAYCKOL SCOOTT MORALES CARHUACHINNo ratings yet

- Tugas EyiiiDocument11 pagesTugas EyiiiFADLAN MALONo ratings yet

- Informe Etareos Por Comuna CantidadDocument52 pagesInforme Etareos Por Comuna CantidadAlberto Ignacio Riquelme ArriagadaNo ratings yet

- Antony Isaac Vargas Hercules HerramientasDocument9 pagesAntony Isaac Vargas Hercules HerramientasAntony VargasNo ratings yet

- Topografia P4Document6 pagesTopografia P4ac4288326No ratings yet

- Deber de Economía 19 OctDocument4 pagesDeber de Economía 19 OctMateo José Cobos ToralNo ratings yet

- Tugas3.1 Jordan Putra Cahyono 1033446Document2 pagesTugas3.1 Jordan Putra Cahyono 1033446Aditya IqbalNo ratings yet

- Practica de Sistemas EconometricosDocument7 pagesPractica de Sistemas EconometricosE Manuel CondoriNo ratings yet

- M.fikri Audi Tugas1 HidrologiDocument4 pagesM.fikri Audi Tugas1 HidrologiCandra IrawanNo ratings yet

- El Sonido Moreno CalderónDocument37 pagesEl Sonido Moreno CalderónRenato Moreno CalderonNo ratings yet

- Minimos Cuadrados AguaDocument2 pagesMinimos Cuadrados AguaJesus DvalaosNo ratings yet

- Practica de EvaluacionDocument4 pagesPractica de EvaluacionSaul SantinNo ratings yet

- Base Demanda Carnes - UNALM EI 23IIDocument2 pagesBase Demanda Carnes - UNALM EI 23IIJanina Soriano MachacuayNo ratings yet

- Base Demanda Carnes - UNALM EI 23IIDocument2 pagesBase Demanda Carnes - UNALM EI 23IIYelsin CamargoNo ratings yet

- Restaurante Huaraz MBC 192 20abr24Document17 pagesRestaurante Huaraz MBC 192 20abr24Anonymous sD861qTS9vNo ratings yet

- Copia de Copia de Funcion PagoDocument8 pagesCopia de Copia de Funcion PagoJosue PazNo ratings yet

- Calculo de Coordenadas Del Trazo DefinitivoDocument2 pagesCalculo de Coordenadas Del Trazo DefinitivoJesus MartinezNo ratings yet

- TugasDocument1 pageTugasAriya ArifaNo ratings yet

- Met Medias Moviles, Met de La TendenciaDocument37 pagesMet Medias Moviles, Met de La TendenciaRosario GonzalesNo ratings yet

- Kadar Abu No Kode Cawan Sampel 2 Jam 30 Menit Cawan KosongDocument32 pagesKadar Abu No Kode Cawan Sampel 2 Jam 30 Menit Cawan KosongAriq DhiaNo ratings yet

- Elementos Originales (Solo para Una Mayor Comprension Del Lisp)Document2 pagesElementos Originales (Solo para Una Mayor Comprension Del Lisp)ERICK ESAU RODRIGUEZ QUINCHONo ratings yet

- Burbuja Este SiDocument18 pagesBurbuja Este SiTyhtNo ratings yet

- HM Juli 2022Document11 pagesHM Juli 2022fakri husainiNo ratings yet

- Perhitungan TDDocument7 pagesPerhitungan TDraihansalombasalombaNo ratings yet

- Tabela IrrradiaçãoDocument7 pagesTabela IrrradiaçãoGuilherme FerreiraNo ratings yet

- Taquimetria PUNTO A (Estacion Total) 2Document9 pagesTaquimetria PUNTO A (Estacion Total) 2Yahir Mijail Juli GonzalesNo ratings yet

- P.taquimetrica Topografia SabadoDocument5 pagesP.taquimetrica Topografia SabadoKevin Cruz BendezuNo ratings yet

- Ingeniería Economica - Semana 7Document17 pagesIngeniería Economica - Semana 7RULLIERD GUILMAR SOTOMAYOR TERRONESNo ratings yet

- CORRECIONDocument5 pagesCORRECIONjose maria loango chamorroNo ratings yet

- Perhitungan TD Field TripDocument4 pagesPerhitungan TD Field TripraihansalombasalombaNo ratings yet

- Pengolahan - Data - Modul - 2Document14 pagesPengolahan - Data - Modul - 2andirawpsNo ratings yet

- Calculo Curva Circular DefinitivoDocument13 pagesCalculo Curva Circular Definitivogatocat29No ratings yet

- Pares de Apriete PDFDocument1 pagePares de Apriete PDFalexletNo ratings yet

- Clase Topo3Document3 pagesClase Topo3carlosNo ratings yet

- Sổ Làm Việc2Document4 pagesSổ Làm Việc2van quyetNo ratings yet

- Analisis SismicoDocument30 pagesAnalisis SismicoGian Carlos Ramos OrtegaNo ratings yet

- Practica ImdaDocument3 pagesPractica ImdaWilmer Nuñez AyalaNo ratings yet

- Peraltes Via 1 y 2Document25 pagesPeraltes Via 1 y 2Karen VidarteNo ratings yet

- Capacitor Trafo A VazioDocument2 pagesCapacitor Trafo A VazioGuilhermeEmerickAndreottiNo ratings yet

- Curva Equiadherencia Quimbiamba Quito G1Document9 pagesCurva Equiadherencia Quimbiamba Quito G1Leandro Illeskas CardenasNo ratings yet

- Modelos Lineales 1Document5 pagesModelos Lineales 1Jason Eduardo Orozco picadoNo ratings yet

- Series de TiempoDocument80 pagesSeries de TiempoIsrrael SaraguroNo ratings yet

- Tabla A.6 - Agua SobrecalentadaDocument4 pagesTabla A.6 - Agua SobrecalentadaJuan Luis De la cruzNo ratings yet

- AREASPORSECCIONESDocument5 pagesAREASPORSECCIONESRafael Fortunato Escalante AuccaisiNo ratings yet

- Cálculo Curva NTCDocument5 pagesCálculo Curva NTCAndré ReisNo ratings yet

- Apendice C Lineas de FanoDocument6 pagesApendice C Lineas de FanoAndres NarvaezNo ratings yet

- TEODOLITODocument1 pageTEODOLITOMichael Angel Huanca QuispeNo ratings yet

- Sesion 5Document2 pagesSesion 5OMAR LOPEZ FELIXNo ratings yet

- Proyecto Cantagallo AngeliaDocument30 pagesProyecto Cantagallo AngeliaBeimarNo ratings yet

- Tail Water Rating Curve - 18.01.22Document4 pagesTail Water Rating Curve - 18.01.22Madhu KurmiNo ratings yet

- T2 TopografiaDocument2 pagesT2 TopografiaFernando Escalante DiazNo ratings yet

- Ejercicio Con DesplazamientoDocument8 pagesEjercicio Con DesplazamientoMaria Alejandra IzaguirreNo ratings yet

- Deva StatistikaDocument6 pagesDeva StatistikaGEDE MEGA ADI PRADWITYANo ratings yet

- Excel CalculoDocument4 pagesExcel Calculoangel caNo ratings yet

- Korelasi RegressiDocument6 pagesKorelasi RegressiArthur Kusuma Atmaja ManurungNo ratings yet

- Trab HidrologiaDocument2 pagesTrab HidrologiaCondori Esteba Yaneth YolandaNo ratings yet

- Gumbel-Ardianto Runtu JadiDocument4 pagesGumbel-Ardianto Runtu JadiArdianto RuntuNo ratings yet

- Tarea 2 Frecuencias y Histograma Medidasd e TendenciaDocument5 pagesTarea 2 Frecuencias y Histograma Medidasd e TendenciaJHON LUIS ANGEL YAMPARA PACHAURINo ratings yet