Professional Documents

Culture Documents

NPS Fy23

NPS Fy23

Uploaded by

Sudhir Kumar SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Fy23

NPS Fy23

Uploaded by

Sudhir Kumar SinghCopyright:

Available Formats

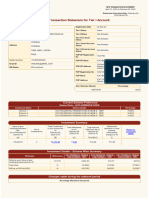

NPS TRANSACTION STATEMENT

April 01, 2022 to December 29, 2022

Statement Generation Date :December 29,

2022 11:17 AM

NPS Transaction Statement for Tier I Account

PRAN 110174386239 Registration Date 07-Feb-20

Subscriber Name SHRI SUDHIR KUMAR SINGH Tier I Status Active

57 MOHNPUR BHAVARAKH TEH-MIRZA Tier II Status Not Activated

PUR Tier II Tax Saver Not Activated

Status

DIST-MIRZAPUR MOHANAPUR BHAVRA

Tier I Virtual Account Not Activated

Address Status

BIJPUR

Tier II Virtual Account Not Aplicable

UTTAR PRADESH - 231001 Status

INDIA CBO Registration No 6500830

CBO Name KOTAK MAHINDRA BANK LTD.

Mobile Number +919530187340

CBO Address 36-38 A/227, NARIMAN BHAWAN

Email ID SUDHIR.SINGH@SJMSOM.IN NARIMAN POINT, MUMBAI, 400021

IRA Status IRA compliant CHO Registration No 5500854

CHO Name KOTAK MAHINDRA BANK LTD.

CHO Address 36-38 A,227, NARIMAN BHAWAN

NARIMAN POINT, MUMBAI, 400021

Tier I Nominee Name/s Percentage

CHANDRA KALA 100%

Current Scheme Preference

Scheme Choice - ACTIVE CHOICE

Investment Option Scheme Details Percentage

Scheme 1 ICICI PRUDENTIAL PENSION FUND SCHEME E - TIER I 75.00%

Scheme 2 ICICI PRUDENTIAL PENSION FUND SCHEME C - TIER I 10.00%

Scheme 3 ICICI PRUDENTIAL PENSION FUND SCHEME G - TIER I 10.00%

Scheme 4 ICICI PRUDENTIAL PENSION FUND SCHEME A - TIER I 5.00%

Investment Summary

Value of your Total Total Total Notional Withdrawal/

Holdings(Invest Contribution in Withdrawal as Gain/Loss as deduction in

ments) No of your account as on on units towards Return on

as on Contributions on December 29, December 29, intermediary Investment 14.74%

December 29, December 29, 2022 (in ₹) 2022 (in ₹) charges (in ₹) (XIRR)

2022 (in ₹) 2022 (in ₹)

(A) (B) (C) D=(A-B)+C E

₹ 4,80,753.66 33 ₹ 3,76,359.00 ₹ 0.00 ₹ 1,04,394.66 ₹ 92.03 Returns for the 6.67%

Financial Year

Investment Details - Scheme Wise Summary

ICICI PRUDENTIAL ICICI PRUDENTIAL ICICI PRUDENTIAL ICICI PRUDENTIAL

Particulars References PENSION FUND SCHEME PENSION FUND SCHEME PENSION FUND SCHEME PENSION FUND SCHEME

E - TIER I C - TIER I G - TIER I A - TIER I

Scheme wise Value of your E=U*N 3,68,621.91 44,966.26 45,102.23 22,063.26

Holdings(Investments) (in ₹)

Total Units U 7,741.9134 1,272.9195 1,495.7297 1,457.9763

NAV as on 28-Dec-2022 N 47.6138 35.3253 30.1540 15.1328

Changes made during the selected period

Date Tier Type Transaction Type

07-Jul-2022 Tier-1 Change in scheme preference

SUBSCRIBER SHIFT

20-Jul-2022 Tier-1 Subscriber Shifting From ::Corporate To :=>Corporate.

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

12-May- By Voluntary Contributions eNPS - Online (5000682), 50,000.00 0.00 50,000.00

2022

08-Aug- By Arrear - Regular Contribution for Kotak Mahindra Bank Limited (5000041), 0.00 7,760.60 7,760.60

2022 July

08-Sep- By Arrear - Regular Contribution For Kotak Mahindra Bank Limited (5000041), 0.00 7,760.60 7,760.60

2022 August

07-Oct-2022 By Arrear - Regular Contribution Kotak Mahindra Bank Limited (5000041), 0.00 7,500.60 7,500.60

September

10-Nov- By Arrear - Regular Contribution Kotak Mahindra Bank Limited (5000041), 0.00 8,020.60 8,020.60

2022 October

07-Dec- By Arrear - Regular Contribution for Kotak Mahindra Bank Limited (5000041), 0.00 7,760.60 7,760.60

2022 November

Transaction Details

ICICI PRUDENTIAL PENSION FUND ICICI PRUDENTIAL PENSION FUND

Withdrawal/ deduction in SCHEME E - TIER I SCHEME G - TIER I

units

Date Particulars

towards intermediary Amount (₹) Amount (₹)

charges(₹) Units Units

NAV (₹) NAV (₹)

01-Apr-2022 Opening balance 6,485.2147 2,592.8575

(23.28) (5.92)

09-Apr-2022 Billing for Q4, 2021-2022 (29.20) (0.5052) (0.2020)

46.0783 29.2949

37,500.00 12,500.00

12-May-2022 By Voluntary Contributions 909.0666 432.8809

41.2511 28.8763

(11,380.36) (48,287.17)

07-Jul-2022 To Withdrawal On Account of Subscriber (269.6207) (1,660.3172)

Initiated Scheme Preference Change 42.2088 29.0831

ICICI PRUDENTIAL ICICI PRUDENTIAL ICICI PRUDENTIAL ICICI PRUDENTIAL

PENSION FUND PENSION FUND SCHEME PENSION FUND PENSION FUND SCHEME

Withdrawal/ SCHEME E - TIER I C - TIER I SCHEME G - TIER I A - TIER I

deduction in units

Date Particulars towards intermediary Amount Amount Amount Amount

charges(₹) (₹) Units (₹) Units (₹) Units (₹) Units

NAV (₹) NAV (₹) NAV (₹) NAV (₹)

09-Jul- Billing for Q1, 2022- (21.88) (0.00) (2.90) (0.00)

(24.78) (0.5183) (0.0000) (0.0997) (0.0000)

2022 2023 42.2088 - 29.0831 -

By Contribution On 0.00 39,778.38 0.00 19,889.15

12-Jul- Account of Subscriber 0.0000 1,161.5448 0.0000 1,330.7250

2022 Initiated Scheme - 34.2461 - 14.9461

Preference Change

08-Aug- By Arrear - Regular 5,820.45 776.06 776.06 388.03

126.6614 22.5531 26.5179 25.4407

2022 Contribution for July 45.9528 34.4102 29.2655 15.2523

08- By Arrear - Regular 5,820.45 776.06 776.06 388.03

Sep- Contribution For August 123.5103 22.2468 26.0051 25.2037

2022 47.1252 34.8840 29.8425 15.3957

07-Oct- By Arrear - Regular 5,625.45 750.06 750.06 375.03

122.3370 21.6572 25.5129 24.5061

2022 Contribution September 45.9832 34.6332 29.3992 15.3035

08-Oct- Billing for Q2, 2022- (29.07) (3.58) (3.59) (1.81)

(38.05) (0.6321) (0.1033) (0.1221) (0.1182)

2022 2023 45.9832 34.6332 29.3992 15.3035

10-Nov- By Arrear - Regular 6,015.45 802.06 802.06 401.03

126.8354 22.9788 26.9433 26.6613

2022 Contribution October 47.4272 34.9043 29.7684 15.0416

07- By Arrear - Regular 5,820.45 776.06 776.06 388.03

Dec- Contribution for 119.5643 22.0421 25.7531 25.5577

2022 November 48.6805 35.2080 30.1346 15.1825

29-Dec- Closing Balance 7,741.9134 1,272.9195 1,495.7297 1,457.9763

2022

Notes

1. The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2. 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3. Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

4. 'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated.

5. The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account during the

period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account, the redemption

amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out (FIFO) basis. The details are

sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

6. 'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in subscribers'

account during the period for which the statement is generated. It also contains units debited from the account for redemption and rectification. The

details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

7. For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the Investment

Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

8. "Cost of Withdrawal", "Cost of GPF Withdrawal" and "Cost of One Way Switch", is the cost of units for the particular transaction and is calculated on a

First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual redemption value corresponding to the units redeemed has

been considered. Further, 'Total Withdrawal' in the Investment Summary section includes actual redemption value of Withdrawal and One Way

Switch transactions.

9. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

10. The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market basis

and are subject to change on NAV fluctuations. .

11. If you are an employee or if you are self-employed , you will be able to avail of deduction on contribution made from your taxable income to the extent

of (u/s 80 CCD (1) of income Tax Act, 1961)

- 10% of salary (Basic + DA ) - if you are salaried employee

- 20% of your gross income - if you are self-employed

However, please note that the maximum deduction from your taxable income is limited to RS.1.50 lac, as permitted under Sec 80 CCE of the

Income Tax Act.

Further, an additional deduction from your taxable income to the extent of Rs. 50,000/- is available only for contribution in NPS u/s Sec. 80 CCD (1B).

To give an example, your salary is Rs.15 lac per annum. On contribution of Rs. 2 lac, you can avail:

Deduction under Sec. 80 CCD (1) - ₹- Rs. 1.50 lac

Deduction under Sec. 80 CCD (1B)- ₹- Rs. 0.50 lac

Total deduction - ₹- Rs. 2.00 lac

Also note that your employer's contribution upto 10% of your salary is fully deductible from your taxable income.

This is applicable only for Tier-I account.

12. Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

13. This is computer generated statement and does not require any signature/stamp.

14. Kindly refer Table 1 for various charges applicable under NPS:

Table 1

Service Charges* (excluding taxes)

Intermediary Charge head Mode of Deduction

Private / Govt.

CRA charges for account opening if the CRA charges for account opening if the subscriber

subscriber opts for Physical PRAN card opts for ePRAN card (in Rs.)

Welcome kit sent in Welcome kit sent vide email Through Unit

PRA Opening charges (in Rs.)

physical only Deduction

Rs. 40 (also applicable to reissue of PRAN

CRA card)

Rs. 35 Rs. 18

Annual PRA Maintenance Through Unit

Rs. 69

cost per account Deduction

Charge per transaction Rs. 3.75 Through Unit

Deduction

- Private Govt. -

Initial subscriber registration Min Rs. 200 and Max Rs. 400

NA Collected by POP

and contribution upload (Negotiable within slab only)

0.50% of contribution

Any subsequent Min. Rs. 30 Max. Rs. 25,000

NA Collected by POP

transactions Non-Financial Rs. 30

(Negotiable within slab only)

Rs. 50 per annum for annual

POP contribution Rs. 1,000 to Rs. 2,999

Persistency Rs. 75 per annum for annual Through Unit

NA

> 6 months contribution Rs. 3,000 to Rs. 6,000 Deduction

Rs. 100 per annum for annual

contribution above Rs. 6,000

Upfront deduction

0.20% of contribution,

Contribution through eNPS Min. Rs.15 Max. Rs.10,000 NA from contribution

amount

Processing of Exit / @0.125% of Corpus with

Withdrawal Min. Rs. 125 and Max. Rs. 500 NA Collected by POP

Custodian Asset Servicing charges 0.0032% p.a for Electronic segment & Physical segment Through AUM

Slabs of AUM managed by the Pension Fund Maximum Investment

Management Fee (IMF)

Upto 10,000 Cr. 0.09%$

Investment Management

PF charges Through AUM

Fee# 10,001 - 50,000 Cr. 0.06%

50,001 - 1,50,000 Cr. 0.05%

Above 1,50,000 Cr. 0.03%

Reimbursement of

NPS Trust Expenses

0.005% p.a Through AUM

* In case of Government employees, CRA charges for Tier I account are being paid by the respective Government except for voluntary contribution, partial

withdrawal and scheme preference change.

# It includes brokerage fee up to 3 basis points.

$ UTI Retirement Solutions Ltd charges a fee of 0.07% under this slab.

The IMF to be charge by the Pension Fund on the slab structure would be on the aggregate AUM of the Pension Fund under all schemes managed by

Pension Funds.

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- Payment ReceiptDocument1 pagePayment ReceiptSkb VigneshNo ratings yet

- HDFC Ergo Policy Renewal 2023 SelfDocument5 pagesHDFC Ergo Policy Renewal 2023 SelfGopivishnu KanchiNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarNo ratings yet

- Self & Wife - Mediclaim PolicyDocument5 pagesSelf & Wife - Mediclaim PolicyShrikant Sahu100% (4)

- Premium ReceiptDocument2 pagesPremium ReceiptJaid RukadikarNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- Max Bupa Health Insurance Company LimitedDocument1 pageMax Bupa Health Insurance Company LimitedNiklesh ChandakNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- MediclaimDocument3 pagesMediclaimPrajwal ShettyNo ratings yet

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- Star Health PolicyDocument5 pagesStar Health PolicyTripathy RadhakrishnaNo ratings yet

- 2828100368063500002Document4 pages2828100368063500002sangama a0% (1)

- "Capstone Project": Philippine Christian University Graduate School of Business and ManagementDocument3 pages"Capstone Project": Philippine Christian University Graduate School of Business and Managementdaniela riveraNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument1 pageNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghNo ratings yet

- Medical Insurance Certificate Max BupaDocument1 pageMedical Insurance Certificate Max BupaBinod DashNo ratings yet

- 090003e88105430f SONIADocument3 pages090003e88105430f SONIAKoushik DuttaNo ratings yet

- Repay CertificateDocument1 pageRepay Certificateacrajesh50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- 80 D Religare Health Insurace Premium Receipt Rs.21347Document7 pages80 D Religare Health Insurace Premium Receipt Rs.21347Shree Sai Enterprise100% (1)

- Mediclaim ParentsDocument1 pageMediclaim ParentsCA Ashish MehtaNo ratings yet

- PolicyDocument56 pagesPolicyPoonam RathourNo ratings yet

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation Receiptqwert0% (1)

- Mediclaim ReceiptDocument1 pageMediclaim ReceiptParthiban KNo ratings yet

- Premium Paid Certificate For The Year 2020-2021Document1 pagePremium Paid Certificate For The Year 2020-2021Prince GoelNo ratings yet

- ParentHealthInsurance2023 2024Document1 pageParentHealthInsurance2023 2024Amarnath MalliahyagariNo ratings yet

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuKunal ShethNo ratings yet

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- CareHealth Policy 2020-21 Nihit FamilyDocument5 pagesCareHealth Policy 2020-21 Nihit FamilyJacob PruittNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDocument2 pagesBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- FHP H0225594Document2 pagesFHP H0225594Raghavendra KamathNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencevasumscrmNo ratings yet

- GuwahatiDocument4 pagesGuwahatiSudhir Kumar SinghNo ratings yet

- Invoice 2102612676Document1 pageInvoice 2102612676Sudhir Kumar SinghNo ratings yet

- Invoice1 MergedDocument2 pagesInvoice1 MergedSudhir Kumar SinghNo ratings yet

- Risks: Omnichannel Banking EconomyDocument11 pagesRisks: Omnichannel Banking EconomySudhir Kumar SinghNo ratings yet

- Avanti: Feeds LimitedDocument27 pagesAvanti: Feeds LimitedSudhir Kumar SinghNo ratings yet

- B School RankingsDocument1 pageB School RankingsSudhir Kumar SinghNo ratings yet

- Investor-Presentationv3 3 PDFDocument30 pagesInvestor-Presentationv3 3 PDFSudhir Kumar SinghNo ratings yet

- Investment Banks Contact1 Contact2Document3 pagesInvestment Banks Contact1 Contact2Sudhir Kumar SinghNo ratings yet

- Rohan Dhall: Career SummaryDocument5 pagesRohan Dhall: Career SummarySudhir Kumar SinghNo ratings yet

- 244 PGTRB Economics Study Material 3Document9 pages244 PGTRB Economics Study Material 3shareena ppNo ratings yet

- HHP - Indonesia Now Has A Specific E-Commerce RegulationDocument8 pagesHHP - Indonesia Now Has A Specific E-Commerce RegulationOsc GerhatNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Final Exam FinalDocument26 pagesFinal Exam FinalJoseph TusoyNo ratings yet

- MontgomeryBellAcademy MaTu Neg 5 - Michigan Round 6Document41 pagesMontgomeryBellAcademy MaTu Neg 5 - Michigan Round 6Owen ChenNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sreejesh SundaresanNo ratings yet

- Mrunal 6Document39 pagesMrunal 6archana bhartiNo ratings yet

- RFPDocument235 pagesRFPchanakyaNo ratings yet

- Pgcil Fpo NoteDocument4 pagesPgcil Fpo Notenature75No ratings yet

- GratuityDocument8 pagesGratuityManish KumarNo ratings yet

- Concept of Slump SaleDocument28 pagesConcept of Slump SaleParth SemwalNo ratings yet

- Microeconomics A Contemporary Introduction 11th Edition Mceachern Test Bank Full DownloadDocument57 pagesMicroeconomics A Contemporary Introduction 11th Edition Mceachern Test Bank Full Downloadterrysweeneymetfqgabxc100% (27)

- GSFM7514 - Accounting & Finance For Decision Making Reflective Quiz 1Document8 pagesGSFM7514 - Accounting & Finance For Decision Making Reflective Quiz 1Yaga KanggaNo ratings yet

- Unleashing The Potential of Pharmaceuticals in PakistanDocument121 pagesUnleashing The Potential of Pharmaceuticals in Pakistanjibran khanNo ratings yet

- RMC No 1-2018Document4 pagesRMC No 1-2018Dione GuevaraNo ratings yet

- The Evolution of Fiscal and Monetary Policy: John L. CampbellDocument25 pagesThe Evolution of Fiscal and Monetary Policy: John L. CampbellSettler RoozbehNo ratings yet

- Presentation 3 Real Property Gains TaxDocument29 pagesPresentation 3 Real Property Gains TaxAimi AzemiNo ratings yet

- RFP-AE NH-730-KmDocument120 pagesRFP-AE NH-730-KmLaxmipathi Rao LakkarajuNo ratings yet

- Legal Aspect of NGO 7.10Document14 pagesLegal Aspect of NGO 7.10Chandar SasmalNo ratings yet

- 8 Sale and LeasebackDocument10 pages8 Sale and Leasebackkoketso rahabNo ratings yet

- Greenfield v. Meer, 77 Phil. 394Document1 pageGreenfield v. Meer, 77 Phil. 394irene ibonNo ratings yet

- Answers For Some QuestionsDocument29 pagesAnswers For Some Questionsyogeshdhuri22No ratings yet

- Consti2casedigests From MonchieDocument407 pagesConsti2casedigests From MonchieRegine GumbocNo ratings yet

- Tally MCQ 1Document11 pagesTally MCQ 1rs0100100% (5)

- Taxation Thesis PDFDocument6 pagesTaxation Thesis PDFgbvexter100% (1)

- (A) 7.0 2. (D) Textile 3. (B) RiceDocument14 pages(A) 7.0 2. (D) Textile 3. (B) RiceSaif RandhawaNo ratings yet

- Standard & Poor's Dictionary of Financial TermsDocument227 pagesStandard & Poor's Dictionary of Financial TermsWill Alcmaeonid100% (3)

- Chapter - 1 Introduction and Research DesighDocument9 pagesChapter - 1 Introduction and Research DesighAli NadafNo ratings yet

- Form No. 15G: (See Rule 29C)Document1 pageForm No. 15G: (See Rule 29C)MKNo ratings yet