Professional Documents

Culture Documents

Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5

Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5

Uploaded by

YOHANNES WIBOWOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5

Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5

Uploaded by

YOHANNES WIBOWOCopyright:

Available Formats

Ownership percentage :

Aquired by Pep 13,500

Syn's Stockholder equity 15,000

90%

Investment cost 202,500

Implied fair value of Syn 225,000

Book value of Syn 165,000

Excess fair value over book value 60,000

Excess allocated to :

Land 20,000

Patents 40,000

Excess fair value over book value 60,000

Income from Syn :

Syn's reported net income 24,000

Less : Patent amortization - 4,000

Syn's adjusted income 20,000

Pen's share of Syn's income (90%) 18,000

Noncontrolling interest rate (10%) 2,000

Investment in Syn December 31, 2012

Cost January 1, 2011 202,500

Pen's share of the change in Syn's retained earnings 24,300

Less : Patent amortization for 2 years - 7,200

Investment in Syn December 31 219,600

Journal

Income 18,000

Dividends 14,400

Investment 3,600

Noncontrolling interest share 2,000

Dividend 1,600

Noncontrolling interest 400

Capital Stock 150,000

Retained earnings 34,000

Patents 36,000

Land 20,000

Investment 216,000

Noncontrolling interest 24,000

Amortization Expense 4,000

Patents 4,000

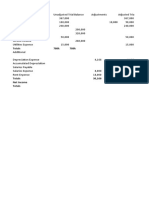

Pen Corporation and Subsidiary

Consolidation Workpapers

For the year ended December 31, 2012

Pen Syn (90%)

Income Statement

Sales 400,000 100,000

Income from Syn 18,000

Cost of sales - 250,000 - 50,000

Other expenses - 100,600 - 26,000

Consolidated Noncontrolling Interest

Noncontrolling share

Controlling share of NI 67,400 24,000

Retained Earnings

Retained earnings - Pen 177,000

Retained earnings - Syn 34,000

Net income 67,400 24,000

Dividends - 50,000 - 16,000

Retained earnigns - Dec 31 194,400 42,000

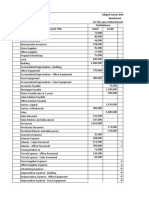

Balance Sheet

Cash 18,000 15,000

Accounts receivable 80,000 20,000

Dividends receivable 7,200

Inventories 95,000 10,000

Note receivable - Pen 5,000

Investment in Syn 219,600

Land 65,000 30,000

Buildings - net 170,000 80,000

Equipment - net 130,000 50,000

Patents

784,800 210,000

Accounts payable 85,400 10,000

Note payable to Syn 5,000

Dividends payable 8,000

Capital Stock 500,000 150,000

Retained earnings 194,400 42,000

784,800 210,000

Noncontroling interest January 1

Noncontrolling Interest December 31

n and Subsidiary

Workpapers

December 31, 2012

Adjustments and Eliminations Conosolidated

Statements

500,000

18,000 -

- 300,000

- 4,000 - 130,600

69,400

- 2,000 - 2,000

67,400

177,000

34,000 -

67,400

- 14,400

- 1,600 - 50,000

194,400

33,000

5,000 95,000

7,200 -

105,000

5,000 -

3,600

216,000 -

20,000 115,000

250,000

180,000

36,000 4,000 32,000

810,000

5,000 90,400

5,000 -

7,200 800

150,000 500,000

194,400

24,000

400 24,400

810,000

You might also like

- List of Corporate Clients With ContactDocument212 pagesList of Corporate Clients With ContactKrishan Kakkar56% (18)

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONReymark Baldo100% (1)

- Duracell's Acquisition by Berkshire Hathaway - A Case Study FinalDocument12 pagesDuracell's Acquisition by Berkshire Hathaway - A Case Study Finaltanya batraNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- CH 09Document43 pagesCH 09Nabae AsfarNo ratings yet

- Problem 1: 105,000 - Correct AnswerDocument1 pageProblem 1: 105,000 - Correct AnswerSophia MilletNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 9Document10 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 9YOHANNES WIBOWONo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Akl 11Document1 pageAkl 11Via jyNo ratings yet

- Mahusay, Bsa 315 - Module 2-CaseletsDocument10 pagesMahusay, Bsa 315 - Module 2-CaseletsJeth MahusayNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Alomia - Ae 112 Midterm Sa1 SolutionDocument9 pagesAlomia - Ae 112 Midterm Sa1 SolutionRica Ann RoxasNo ratings yet

- Bus ComDocument14 pagesBus ComSITTIE AINNAH SHIREEHN DIDAAGUNNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- Trial Balance3Document3 pagesTrial Balance3Marcos DmitriNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Assignment 5Document17 pagesAssignment 5Beenish JafriNo ratings yet

- FV Differential: Amortization TableDocument17 pagesFV Differential: Amortization TableBeenish JafriNo ratings yet

- Assignment No. 6Document14 pagesAssignment No. 6Angela MacailaoNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Seatwork Ratio AnalysisDocument2 pagesSeatwork Ratio AnalysisMARIBEL SANTOSNo ratings yet

- Accounting For Business Combinations Pre7 - MidtermDocument1 pageAccounting For Business Combinations Pre7 - MidtermJalyn Jalando-onNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Quiz 1Document2 pagesQuiz 1Leonie Jhoy Concepcion MillanesNo ratings yet

- Asset 2017 2018: Total 313.000 295.000Document1 pageAsset 2017 2018: Total 313.000 295.000Agung KartikasariNo ratings yet

- Accounting CycleDocument3 pagesAccounting CycleSelahNo ratings yet

- Conso FS LessonDocument54 pagesConso FS Lessondbpcastro8No ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- BTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsDocument21 pagesBTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsgatotkaNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Comprehensive ProblemDocument14 pagesComprehensive ProblemMarian Augelio PolancoNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- FAR Prob 9 FinalDocument17 pagesFAR Prob 9 FinalRayno Chiu CimafrancaNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- AKL 2 - Tugas 3 Marselinus A H T (A31113316)Document3 pagesAKL 2 - Tugas 3 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- Rayhan Dewangga Saputra - Tugas AKL TM 4Document6 pagesRayhan Dewangga Saputra - Tugas AKL TM 4Rayhan Dewangga SaputraNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Name: Jeth A. Mahusay Course: BSA-3 Schedule: TTH-4:00-5:30 PM Subject: Accounting For Business Combinations Instructor: Ms. Ana Mae Magbanua, CPADocument2 pagesName: Jeth A. Mahusay Course: BSA-3 Schedule: TTH-4:00-5:30 PM Subject: Accounting For Business Combinations Instructor: Ms. Ana Mae Magbanua, CPAJeth MahusayNo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- DONE BA 118.3 Module 2 Quiz 1answer KeyDocument8 pagesDONE BA 118.3 Module 2 Quiz 1answer KeyRed Ashley De LeonNo ratings yet

- Assets AmountsDocument6 pagesAssets Amountsaashir chNo ratings yet

- Additional Consolidation Reporting IssuesDocument61 pagesAdditional Consolidation Reporting IssuesDifaNo ratings yet

- Law of Association (Company Laws)Document80 pagesLaw of Association (Company Laws)Akmal MarizaleeNo ratings yet

- Roll No. Name MajorDocument19 pagesRoll No. Name MajorSakshi ShahNo ratings yet

- Forms of Ownership: A Micro Project Report OnDocument21 pagesForms of Ownership: A Micro Project Report OnAishwarya BandgarNo ratings yet

- Retained EarningsDocument18 pagesRetained EarningsAngelie Bancale100% (1)

- Tugas Accounting and Finance Bab 2 Setelah UtsDocument6 pagesTugas Accounting and Finance Bab 2 Setelah UtsbogitugasNo ratings yet

- Modes of International Business in BangladeshDocument3 pagesModes of International Business in BangladeshObydulRana67% (3)

- A Study On Acquisition of Aditya Birla Company and Columbian Chemicals CompanyDocument42 pagesA Study On Acquisition of Aditya Birla Company and Columbian Chemicals Companysneha91210% (1)

- VP HR IT Mum - Pune 1st March 2019Document8 pagesVP HR IT Mum - Pune 1st March 2019PriyaNo ratings yet

- What Is An IPO?Document9 pagesWhat Is An IPO?Gabriella PopovaNo ratings yet

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDocument32 pagesQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeNo ratings yet

- Accounting 2 - FinalDocument4 pagesAccounting 2 - FinalJon Dumagil Inocentes, CPANo ratings yet

- Honeywell - Garrett Motion - Plan Support Deal in Chapter 11Document97 pagesHoneywell - Garrett Motion - Plan Support Deal in Chapter 11Kirk HartleyNo ratings yet

- EmpasmontookmlDocument4 pagesEmpasmontookmlthe kriboeeNo ratings yet

- HW 1Document17 pagesHW 1api-468551425No ratings yet

- Hull War, Strikes, Terrorism and Related Perils Notice of Cancellation Administration ClauseDocument3 pagesHull War, Strikes, Terrorism and Related Perils Notice of Cancellation Administration ClauseDannn GNo ratings yet

- Hollinger IncDocument2 pagesHollinger Incjohn_k7408No ratings yet

- C U R R e N T E M P L o y e R C T C E D U C A T I o N P e R S o N N A M eDocument16 pagesC U R R e N T E M P L o y e R C T C E D U C A T I o N P e R S o N N A M eRicha MohiniNo ratings yet

- What Is Forfeiture of ShareDocument3 pagesWhat Is Forfeiture of ShareSathish SmartNo ratings yet

- 2 PFRS For SMEs Business CombinationDocument1 page2 PFRS For SMEs Business CombinationRay Allen UyNo ratings yet

- Access Bank PLC and SubsidiariesDocument2 pagesAccess Bank PLC and SubsidiariesRizzleNo ratings yet

- Salomon V A SalomonDocument2 pagesSalomon V A SalomonSudhanshu Kumar SinghNo ratings yet

- Spotify Free Accounts by BabyPremiumDocument8 pagesSpotify Free Accounts by BabyPremiumMateo CarderNo ratings yet

- Consolidated Statement of Profit or Loss and Other Comprehensive IncomeDocument40 pagesConsolidated Statement of Profit or Loss and Other Comprehensive IncomeSing YeeNo ratings yet

- CRISIL Unit Linked Insurance Plan (ULIP) Ranking: As On March 2021Document45 pagesCRISIL Unit Linked Insurance Plan (ULIP) Ranking: As On March 2021chriscolmanNo ratings yet