Professional Documents

Culture Documents

GST - Slides

GST - Slides

Uploaded by

Shawn TayCopyright:

Available Formats

You might also like

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Iec60383-1 (Ed4.0) en - D.img Insulators 80KNDocument62 pagesIec60383-1 (Ed4.0) en - D.img Insulators 80KNAdeel Zafar100% (2)

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- GST MDLDocument98 pagesGST MDLIndhuja MNo ratings yet

- Goods & Services Tax (GST) - ServicesDocument4 pagesGoods & Services Tax (GST) - ServicesItscrap ItscrapNo ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- Goods and Service Tax (GST)Document17 pagesGoods and Service Tax (GST)Manav SethiNo ratings yet

- Issues of Present TaxationDocument36 pagesIssues of Present TaxationvijayNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- RJR Weekly Bulletin #217Document6 pagesRJR Weekly Bulletin #217vivsubs18No ratings yet

- 4 - Input Tax Credit (ITC)Document25 pages4 - Input Tax Credit (ITC)ShrutiNo ratings yet

- GST MM Overview V3.1Document34 pagesGST MM Overview V3.1grc.coo.123No ratings yet

- Are You GST Ready WWW - SimpletaxindiaDocument140 pagesAre You GST Ready WWW - SimpletaxindiaJeethender Kummari KuntaNo ratings yet

- Sy Idt Obj U-3&4Document16 pagesSy Idt Obj U-3&4SNEH MEHTANo ratings yet

- Goods and Service TaxDocument35 pagesGoods and Service Taxaditya2110No ratings yet

- A Solution For Indian GST: Indirect Tax Central StateDocument17 pagesA Solution For Indian GST: Indirect Tax Central StateSrikanth MNo ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNDocument12 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNShane India RazaNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- Goods & Services Tax (GST) - RegistrationDocument2 pagesGoods & Services Tax (GST) - RegistrationSsubrat RrudraNo ratings yet

- Exam Practice ReviewDocument9 pagesExam Practice ReviewSafi NurulNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- BRD-Credit Note ProgramDocument3 pagesBRD-Credit Note ProgramVivek TripathiNo ratings yet

- GSTDocument10 pagesGSTmpsing1133No ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNDocument9 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNSai ParekhNo ratings yet

- GSTR4 06abops7789p1z8 2019-20Document3 pagesGSTR4 06abops7789p1z8 2019-20Suresh Kumar KumawatNo ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Gst-Act: Goods and Services Tax. One Nation-One TaxDocument63 pagesGst-Act: Goods and Services Tax. One Nation-One TaxKunal ChawlaNo ratings yet

- Inu 2216 Idt - Suggested AnswersDocument5 pagesInu 2216 Idt - Suggested AnswersVinil JainNo ratings yet

- Paper 11 New PDFDocument443 pagesPaper 11 New PDFAnand KumarNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- Journal Entries Receipt On Advance in GST - Accounting Entries in GSTDocument8 pagesJournal Entries Receipt On Advance in GST - Accounting Entries in GSTCAMSBABJI MAHNo ratings yet

- Monthly Value-Added Tax DeclarationDocument2 pagesMonthly Value-Added Tax DeclarationJa'maine ManguerraNo ratings yet

- Study Material of TaxationDocument4 pagesStudy Material of TaxationAishuNo ratings yet

- Role of CS in GSTDocument66 pagesRole of CS in GSThareshmsNo ratings yet

- GST ChangesDocument3 pagesGST ChangesPradeeP VNo ratings yet

- Goods and Services Tax - GST: Understanding The Supply Chain, Price Fixation, Tax Obligation & Union/States RevenueDocument14 pagesGoods and Services Tax - GST: Understanding The Supply Chain, Price Fixation, Tax Obligation & Union/States RevenuehampaiahNo ratings yet

- GSTR9 22aabcn2864p1z7 032018Document8 pagesGSTR9 22aabcn2864p1z7 032018Sumit K JhaNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Input Tax CreditDocument8 pagesInput Tax CreditPranjal AgrawalNo ratings yet

- CA - Inter GST Important Questions Answers Part 2 May2023Document12 pagesCA - Inter GST Important Questions Answers Part 2 May2023Vishal AgrawalNo ratings yet

- GST Revision - IndigoLearn - Nov 23 Exam - Day 1Document10 pagesGST Revision - IndigoLearn - Nov 23 Exam - Day 1311903736No ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- 2000 XHTMLDocument2 pages2000 XHTMLJanniza RoceroNo ratings yet

- GST Times - Vol.1, Issue-5Document24 pagesGST Times - Vol.1, Issue-5Milna JosephNo ratings yet

- Standardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument112 pagesStandardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiavsyamkumarNo ratings yet

- Chapter 1 Intro To GSTDocument3 pagesChapter 1 Intro To GSTkevin12345555No ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Goods and Services Tax (GST) : Simplified byDocument14 pagesGoods and Services Tax (GST) : Simplified bypushpendra singh sodhaNo ratings yet

- GST Alert 01 Decoding GST Presentation On Promises of GSTDocument73 pagesGST Alert 01 Decoding GST Presentation On Promises of GSTbibhugudu2002No ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Original 1692010361 Cs Project Report TemplateDocument12 pagesOriginal 1692010361 Cs Project Report TemplatedeepakasopaNo ratings yet

- GST Divyastra CH 7 Input Tax Credit R 1Document26 pagesGST Divyastra CH 7 Input Tax Credit R 1Sanskar SharmaNo ratings yet

- Goods & Services Tax (GST) - GSTR2B122Document2 pagesGoods & Services Tax (GST) - GSTR2B122rauniyar97No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Person 1 Companies SlidesDocument59 pagesPerson 1 Companies SlidesShawn TayNo ratings yet

- AC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Document30 pagesAC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 1 Concepts Context LKW 8jan2018Document17 pagesAC3102 Jan2018 Seminar 1 Concepts Context LKW 8jan2018Shawn TayNo ratings yet

- Ac3102 Jan2018 Seminar 10 Change Ownership LKW 18jan2018Document15 pagesAc3102 Jan2018 Seminar 10 Change Ownership LKW 18jan2018Shawn TayNo ratings yet

- Person 2 Individuals SlidesDocument72 pagesPerson 2 Individuals SlidesShawn TayNo ratings yet

- AC3102 Seminar Outline S1toS15 Jan2018 May2018 13jan2018Document20 pagesAC3102 Seminar Outline S1toS15 Jan2018 May2018 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 6 Equity Accounting LKW 28dec2017Document19 pagesAC3102 Jan2018 Seminar 6 Equity Accounting LKW 28dec2017Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Document27 pagesAC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 9 Complex Group Structures LKW 8jan2018Document31 pagesAC3102 Jan2018 Seminar 9 Complex Group Structures LKW 8jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 4 Four Intra Group Elimination LKW 13jan2018Document26 pagesAC3102 Jan2018 Seminar 4 Four Intra Group Elimination LKW 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13C FRS 24 Related Party LKW 10jan2018Document5 pagesAC3102 Jan2018 Seminar 13C FRS 24 Related Party LKW 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Document41 pagesAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 16 Effects Foreign Exchange Rates LKW 14feb2018Document29 pagesAC3102 Jan2018 Seminar 16 Effects Foreign Exchange Rates LKW 14feb2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13A Consolidated StCashFlow 10jan2018Document3 pagesAC3102 Jan2018 Seminar 13A Consolidated StCashFlow 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13B FRS112 Disclosure Interest InOtherEntity LKW 10jan2018Document9 pagesAC3102 Jan2018 Seminar 13B FRS112 Disclosure Interest InOtherEntity LKW 10jan2018Shawn TayNo ratings yet

- 00 - King Lear AnalysisDocument11 pages00 - King Lear AnalysisViki VankaNo ratings yet

- Revised E-Tickets With Seat NumberDocument1 pageRevised E-Tickets With Seat NumberMohiminul KhanNo ratings yet

- Nivel 2-Unit 4Document16 pagesNivel 2-Unit 4Jonathan Alberto Peñaranda PaezNo ratings yet

- T. Daryaee and Kh. Rezakhani The SasaniaDocument51 pagesT. Daryaee and Kh. Rezakhani The Sasaniaejc1717No ratings yet

- Supreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)Document17 pagesSupreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)muhammed iqbalNo ratings yet

- SHRM 475Document70 pagesSHRM 475Anil KumarNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Gas Spot Market: How Does It Work and Who Are The Players?Document16 pagesGas Spot Market: How Does It Work and Who Are The Players?lupoderi100% (1)

- Milhaus Park East ResponseDocument57 pagesMilhaus Park East ResponseMatthewTaubNo ratings yet

- Iso 565Document8 pagesIso 565André Carlos SilvaNo ratings yet

- Quieting of TitleDocument9 pagesQuieting of TitleLoNo ratings yet

- Files Example Darty PDFDocument12 pagesFiles Example Darty PDFMalick DiattaNo ratings yet

- 5 GRADE ENGLISH (2019-2020) : Examination Questions 1Document7 pages5 GRADE ENGLISH (2019-2020) : Examination Questions 1didarseyitjanowNo ratings yet

- 2 and Upto 3Document4 pages2 and Upto 3Sibin CherianNo ratings yet

- Belbin's Team Roles How Understanding Team Roles Can Improve Team PerformanceDocument5 pagesBelbin's Team Roles How Understanding Team Roles Can Improve Team PerformanceashishNo ratings yet

- Maguayo: Maguayo Is A Barrio in The Municipality of Dorado, PuertoDocument4 pagesMaguayo: Maguayo Is A Barrio in The Municipality of Dorado, PuertoChristopher ServantNo ratings yet

- Opportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatDocument8 pagesOpportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatUmbertoNo ratings yet

- How Mintoff Killed The NBMDocument4 pagesHow Mintoff Killed The NBMsevee2081No ratings yet

- Intertechnique: Within The Quality Aerospace EnvironmentDocument32 pagesIntertechnique: Within The Quality Aerospace EnvironmentwonchoiNo ratings yet

- Psychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah StringerDocument53 pagesPsychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah Stringermarsha.beaver589100% (5)

- Anders Grimstad INMANY23Document38 pagesAnders Grimstad INMANY23sachdevagNo ratings yet

- List of Law FirmsDocument18 pagesList of Law FirmsReena ShauNo ratings yet

- LF1SLD48B TechdataDocument2 pagesLF1SLD48B TechdataNitesh Kumar SinghNo ratings yet

- The Effect of Abuse Among Children in Conflict With The Law in Bahay Pag-AsaDocument13 pagesThe Effect of Abuse Among Children in Conflict With The Law in Bahay Pag-AsaMarlone Clint CamilonNo ratings yet

- Setup GuideDocument5 pagesSetup GuideBiwott MNo ratings yet

- Main - CDC Boys Growth Chart 2 To 20 Years Body Mass Index For Age Percentiles 5th 95th PercentileDocument1 pageMain - CDC Boys Growth Chart 2 To 20 Years Body Mass Index For Age Percentiles 5th 95th PercentileLuh Ayu Asri WijaniNo ratings yet

- Gregorio Araneta Vs RodasDocument2 pagesGregorio Araneta Vs RodasLeomar Despi LadongaNo ratings yet

- 07 Activity 1Document3 pages07 Activity 1Angel BinlayoNo ratings yet

- Trabajo Colaborativo Ingles IIDocument8 pagesTrabajo Colaborativo Ingles IIVivianaGaitanNo ratings yet

GST - Slides

GST - Slides

Uploaded by

Shawn TayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST - Slides

GST - Slides

Uploaded by

Shawn TayCopyright:

Available Formats

Goods and Services Tax (GST)

20/03/2017 (C) POH 1

Outline

What is GST and how it works

Scope of GST imposition

What is a supply

Types of supply

Place of supply

GST registration

Furtherance of business

Importation and imports relief

20/03/2017 (C) POH 2

Outline

Value of supply and imports

GST reporting period and time of supply

Claim of input tax credit

Administrative provisions

GST and income tax

20/03/2017 (C) POH 3

What is GST and how it works

20/03/2017 (C) POH 4

Basic terminology

biz input biz output

Supplier BIZ Customer

(GST-registered) (GST-registered)

[3] [1]

[4] [2]

IRAS

Output GST: charged on biz. outputs, [1] generally collected from

customers, and [2] payable to IRAS

Input GST: [3] paid/payable to GST-registered suppliers on biz.

inputs, but [4] recoverable from IRAS as input tax credit if certain

conditions are satisfied

20/03/2017 (C) POH 5

Basic terminology

imported biz input (goods) biz output

BIZ Customer

(GST-registered)

[3] [1]

[4] [2]

IRAS

SG Customs

Input GST: [3] paid/payable to SGP Customs

O Supplier on imported biz. inputs (goods), but [4]

recoverable from IRAS as input tax credit if

certain conditions are satisfied

20/03/2017 (C) POH 6

How GST works - example

Example

Production/distribution chain

SP (bef. GST) VA

RM supplier $100 $100

Manufacturer 180 80

Retailer 200 20

Consumer ____

$200

20/03/2017 (C) POH 7

How GST works - example

Some assumptions:

RM supplier has no inputs (SP = VA)

Product is standard-rated

All businesses are GST-registered

Full forward shifting of the tax

20/03/2017 (C) POH 8

How GST works - example

$100+$7.00 $180+$12.60 $200+$14.00

RM SUP MFR RET CONS

$7.00 $12.60

$7.00 $12.60 $14.00

IRAS

20/03/2017 (C) POH 9

What is GST?

multi-stage tax, collected at each stage of the

production/distribution chain

businesses act as collecting agents

tax on value added

e.g. for the manufacturer, the net GST payable is 7% x

$80 = $5.60

intended burden is on final consumers, hence

GST is a consumption tax

i.e. the total GST of $14 is borne by the consumer

20/03/2017 (C) POH 10

Scope of GST imposition

20/03/2017 (C) POH 11

Scope of GST imposition

– ss 7,8

SUPPLY IMPORTATION

a supply of goods

of goods/services into Singapore

which is a taxable supply

by any person

made in Singapore

by a taxable person

(GST-registered biz)

in the furtherance of biz.

Collected by: Collected by:

GST-registered biz. SGP Customs

20/03/2017 (C) POH 12

Scope of GST imposition – Supply

Meaning of supply

Deemed supplies

20/03/2017 (C) POH 13

What is a supply?

s10 – anything done for a consideration

anything done for free is not a supply

unless deemed so by the GSTA

e.g. 2nd Schedule deemed supplies

20/03/2017 (C) POH 14

2nd Schedule deemed supplies

business goods disposed of for free [para

5(1)], except [para 5(2)]:

biz. gift costing not more than $200

industrial/commercial sample … to actual/potential

customer … in a form not ordinarily available for

sale to the public

business goods diverted for free to non-

business uses [para 5(3)]

2nd Sch, para 5(4) exception:

para 5(1) and (3) apply only if the trader claims

input tax credit i.r.o. the goods

20/03/2017 (C) POH 15

2nd Schedule deemed supplies

3rd Sch, para 8 and 9:

generally, market value (or if not available,

cost) is taken as the value of the deemed

supply

20/03/2017 (C) POH 16

Question 1

biz. gift of vase

purchase of vase - deemed supply?

CTT BHPL Biz Assoc

(GST-reg) (GST-reg)

$70 i/p tax

$70 i/p tax o/p tax

credit accountable?

IRAS

20/03/2017 (C) POH 17

Question 1 (con’t)

biz. gift of vase

purchase of vase - deemed supply?

CTT BHPL Biz Assoc

(GST-reg) (GST-reg)

$70 i/p tax

forgo i/p tax o/p tax

credit accountable?

IRAS

20/03/2017 (C) POH 18

Question 2 (Scenario 2)

biz. gift of vase

purchase of vase - deemed supply?

STT BHPL Biz Assoc

(not GST-reg) (GST-reg)

no i/p tax

no i/p tax o/p tax

credit accountable?

IRAS

20/03/2017 (C) POH 19

Question 2 (Scenario 1)

purchase of vase biz. gift of vase

cost ≤ $200 - deemed supply?

CTT BHPL Biz Assoc

(GST-reg) (GST-reg)

$7 i/p tax

$7 i/p tax o/p tax

credit accountable?

IRAS

20/03/2017 (C) POH 20

Scope of GST imposition – Supply

Types of supply

20/03/2017 (C) POH 21

Types of supply

Supply made in SGP OUT-OF-SCOPE

(outside the scope of GST)

No supply or

Supply made outside SGP

TAXABLE EXEMPT

(excluded from scope of GST by s22 and 4th Sch)

Certain financial services

Sale and lease of residential properties

…

STD-RATED ZERO-RATED

7% o/p tax 0% o/p tax

Exports of goods

International services – s21(3)

20/03/2017 (C) POH 22

Exempt financial services – 4th Sch, Part I, para 1

Some examples

“(a) the operation of any current, deposit or savings

account”

“(e) the issue, allotment, transfer of ownership, drawing,

acceptance or endorsement of a debt security”

“(f) the issue, allotment or transfer of ownership of an

equity security”

“(g) the provision of any loan, advance or credit”

20/03/2017 (C) POH 23

Zero-rated international services – s21(3)

Some examples

(a) [international transport of goods and passengers]

“(e) … services supplied directly in connection with land

or any improvement thereto situated outside Singapore”

“(j) … services supplied – (i) under a contract with a

person who belongs in a country outside Singapore; and

(ii) which directly benefit a person who belongs in a

country other than Singapore and who is outside

Singapore at the time the services are performed”

20/03/2017 (C) POH 24

GST treatment

biz input biz output

Supplier BIZ Customer

(GST-registered) (GST-registered)

[2] [1]

SG Customs IRAS

[1] Is 7% output tax payable to IRAS in respect of the supply (of biz

output)?

[2] Is input tax credit recoverable from IRAS in respect of input tax

paid/payable on the purchase/importation of any biz input used in

the making of the supply (of biz output)?

20/03/2017 (C) POH 25

GST treatment – OOS v EX v SR v ZR

Type of supply (of biz output)

OOS EX T-SR T-ZR

[1] Is 7% output tax payable N N Y N

to IRAS on the supply?

[2] Is input tax credit

recoverable from IRAS in N* N* Y** Y**

respect of input tax on inputs

used in the making of the

supply?

* Some exceptions apply

** Provided that other relevant conditions are met

20/03/2017 (C) POH 26

SR at all stages of

production/distribution chain

$100+$7.00 $180+$12.60 $200+$14.00

RM SUP MFR RET CONS

$7.00 $12.60

$7.00 $12.60 $14.00

IRAS

20/03/2017 (C) POH 27

Effect of ZR at retail stage

$100+$7.00 $180+$12.60 $200+$0.00

RM SUP MFR RET CONS

$7.00 $12.60

$7.00 $12.60 $0.00

IRAS

20/03/2017 (C) POH 28

Effect of EX at retail stage

$100+$7.00 $180+$12.60 $212.60+$0.00

RM SUP MFR RET CONS

$7.00 $12.60

$7.00 $0.00 $0.00

IRAS

20/03/2017 (C) POH 29

Scope of GST imposition – Supply

Place of supply

20/03/2017 (C) POH 30

Place of supply - ss 13, 15

Supply of goods is made in Singapore if

the goods are physically located in

Singapore at the time of their

appropriation/removal for the supply

Supply of services is made in Singapore

if the supplier belongs in Singapore

20/03/2017 (C) POH 31

Country where supplier belongs

Supplier belongs in Singapore if:

the biz. or fixed establishment most directly

connected with the supply of the service is

in Singapore; or

the supplier’s usual place of residence is in

Singapore*

* applies only if the supplier does not have a biz. or

fixed establishment anywhere in the world

A company’s usual place of residence is where it is

incorporated

20/03/2017 (C) POH 32

Supply of goods ____ SGP:

____ supply

goods Japanese

customer

UK warehouse

SGP factory

sale

contract

SGP trader

20/03/2017 (C) POH 33

Supply of goods ____ SGP:

____ supply

UK warehouse

goods

SGP factory

SGP customer

SGP trader

sale

contract

20/03/2017 (C) POH 34

Supply of goods ____ SGP:

____ supply

goods Japanese

customer

UK warehouse

SGP factory

sale

contract

SGP trader

20/03/2017 (C) POH 35

Supply of goods ____ SGP:

____ supply

UK warehouse

goods

SGP factory

SGP customer

SGP trader

sale

contract

20/03/2017 (C) POH 36

Supply of goods ____ SGP:

____ supply

Japanese customer

UK warehouse sale Japan factory

contract

SGP factory

SGP factory

goods

SGP trader

20/03/2017 (C) POH 37

Supply of services ____ SGP:

____ supply

UK consultancy firm

UK office

SGP office

Consultancy contract

SGP traderConsultancy service

SGP customer

20/03/2017 (C) POH 38

Supply of services ____ SGP:

____ supply

UK consultancy firm

UK office

SGP office

Consultancy contract

SGP traderConsultancy service

SGP customer

20/03/2017 (C) POH 39

Supply of services

More scenarios in Question 3

20/03/2017 (C) POH 40

Scope of GST imposition – Supply

Taxable person

GST registration

20/03/2017 (C) POH 41

GST registration

Who has to register for GST?

Compulsory – s9 and 1st Sch, para 1

Retrospective test

Prospective test

Voluntary – 1st Sch, para 8 and 9

20/03/2017 (C) POH 42

Compulsory registration

Retrospective test

applies on 31/3, 30/6, 30/9 and 31/12 only

total value of taxable supplies* for the last 4

quarters > $1m?

if yes, must register

(unless IRAS is satisfied that total value of

taxable supplies* for the next 4 quarters

$1m)

20/03/2017 (C) POH 43

Compulsory registration

Prospective test

applies at any date

total value of taxable supplies* expected in

the next 12 months > $1m?

if yes, must register

For the purpose of ascertaining liability to

register ONLY, taxable supplies* exclude

sales of capital assets

20/03/2017 (C) POH 44

Compulsory registration

Aggregation of taxable supplies of all separate

businesses of a:

sole proprietor

partnership with the same composition of partners

If there is a liability to register, IRAS must be

notified within 30 days

Application for exemption from registration

where taxable supplies are wholly or

substantially zero-rated

20/03/2017 (C) POH 45

Timeline of prospective test

Let’s assume it is 11 Apr 2017 today

12 months*

11.4.2017 10.4.2018

* taxable supplies (excl. sales of CA) > $1m?

20/03/2017 (C) POH 46

Timeline of retrospective

and prospective tests

Let’s assume it is 31 Mar 2017 today

4 quarters* 4 quarters*

31.3.2016 31.3.2017 31.3.2018

12 months*

* taxable supplies (excl. sales of CA) > $1m?

20/03/2017 (C) POH 47

GST registration – Prospective test

Question 4

20/03/2017 (C) POH 48

Voluntary registration

2 situations:

trader with annual taxable supplies $1m

trader with a biz. establishment in

Singapore making only certain OOS

transactions

costs v benefits

20/03/2017 (C) POH 49

Scope of GST imposition – Supply

Furtherance of business

20/03/2017 (C) POH 50

Furtherance of business - s 3

Furtherance of business

≠ Ordinary course of business

Contrast with private transaction

20/03/2017 (C) POH 51

Scope of GST imposition

- Importation

20/03/2017 (C) POH 52

Importation and imports relief

7% GST payable to Customs at the point of

importation of goods into Singapore

Owner/consignee/importer liable to pay

regardless of whether GST-registered

Relief from GST payment at the point of

importation may apply under s24 and the GST

(Imports Relief) Order

20/03/2017 (C) POH 53

Imports relief - examples

temporary imports

re-importation of goods temporarily exported

imports under various import GST suspension

schemes

imports of used articles / personal belongings

and new goods (s.t. limits) by a bona fide

traveller

20/03/2017 (C) POH 54

Value of supply and

value of imported good

20/03/2017 (C) POH 55

Value of supply - s17, 3rd Sch

MC = VOS + GST

107% 100% 7%

100% 93.46% 6.54%

if GST is absorbed by the trader

GST = 7% x VOS

VOS = OMV if consideration is not wholly in money

20/03/2017 (C) POH 56

Value of import - s18, 3rd Sch

VOI = CIF price + customs duty (if any)

GST = 7% x VOI

20/03/2017 (C) POH 57

GST reporting period

Time of supply

20/03/2017 (C) POH 58

GST reporting period

- s 41, R 45

Prescribed (GST) accounting periods

generally, every quarter, as follows:

QE 31/1, 30/4, 31/7, 31/10; OR

QE 28/2, 31/5, 31/8, 30/11; OR

QE 31/3, 30/6, 30/9, 31/12,

whichever set fits in with the trader’s financial year

monthly and 6-monthly reporting periods

apply for certain traders

20/03/2017 (C) POH 59

GST reporting period

Submit a GST return for every quarter within

one month of the end of that quarter

In the GST return,

account for output tax payable to IRAS; and

claim input tax credits recoverable from IRAS.

if o/p tax > i/p tax cr, difference is payable within one

month of the end of the quarter

if i/p tax cr > o/p tax, difference is refundable within 3

months of filing the quarterly return

20/03/2017 (C) POH 60

Time of supply – ss 11, 12

When must output tax be charged / accounted

for on a std-rated supply?

General rule: time of a supply occurs on the:

(a) date on which any invoice or bill for payment is

issued in respect of the supply; or

(b) date on which payment is received in respect of

the supply,

whichever is the earlier

Other rules apply in exceptional situations

20/03/2017 (C) POH 61

Example – Time of supply

GST reporting periods: QE 31/3, 30/6, 30/9, 31/12

Date of removal of goods for sale 25/09/17

Date of issuance of invoice 05/10/17

Date payment is received 15/10/17

When to account for output GST?

05/10/17 a/c o/p tax in QE 31/12/17

20/03/2017 (C) POH 62

Time of supply

Question 5

20/03/2017 (C) POH 63

Claim of input tax credits

20/03/2017 (C) POH 64

Claim of input tax credits

(Recoverability of input tax)

Conditions for input tax credit claim

(ss 19, 20):

Trader is GST-registered

Input tax relates to a business input

Input is used in the making of taxable (or certain

out-of-scope) supplies, i.e. input tax is attributable

to the making of such supplies

Input tax attributable to the making of exempt

supplies is not recoverable, s.t. Reg. 28, 33, 34 and 35 GST

partial exemption rules

20/03/2017 (C) POH 65

Claim of input tax credits

(Recoverability of input tax)

Input tax relates to the GST reporting

period concerned and is properly

charged by the supplier

Documentary evidence in support of

input tax credit claim

Supplier’s tax invoice

Customs GST payment permit

Input tax is not blocked by Reg. 26 and

27

20/03/2017 (C) POH 66

Blocked input tax

Input tax on:

Sporting/recreational club fees

Medical and accident insurance premiums

Medical expenses

Employee’s “family benefits”

Transactions involving games of chance

Motor cars, as defined, incl. goods and

services used directly in connection therewith

20/03/2017 (C) POH 67

Administrative provisions

20/03/2017 (C) POH 68

Some administrative provisions

Issuance of tax invoice – Reg. 10

Contents of tax invoice – Reg. 11

Simplified tax invoice – Reg. 13

Issuance of serially printed receipt – s44

Maintenance of business/accounting

records and documentation – s46

20/03/2017 (C) POH 69

GST and income tax

20/03/2017 (C) POH 70

GST and income tax

Issue:

Since input tax is paid/payable by a person,

can the person obtain any income tax

benefit for it?

20/03/2017 (C) POH 71

Is there any income tax benefit for input

tax paid/payable?

Can the input tax be claimed as an input

tax credit in the GST return?

If yes, NO income tax benefit

If no (i.e. taxpayer is not GST-registered or the input

tax credit is blocked), the input tax is treated as

part of the underlying expense and the

income tax treatment follows that of the

underlying expense

20/03/2017 (C) POH 72

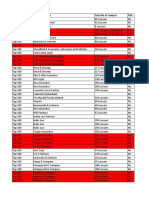

Examples to be discussed:

Income tax benefit for input tax?

Input tax Income tax

credit? benefit?

Taxpayer is GST-registered

Input tax on purchases of trading stock

Input tax on purchases of plant/machinery

Input tax on annual golf club subscription fee

Input tax on S-plate car expenses

20/03/2017 (C) POH 73

Examples to be discussed:

Income tax benefit for input tax?

Input tax Income tax

credit? benefit?

Taxpayer is not GST-registered

Input tax on purchases of trading stock

Input tax on purchases of plant/machinery

Input tax on annual golf club subscription fee

Input tax on S-plate car expenses

20/03/2017 (C) POH 74

You might also like

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Iec60383-1 (Ed4.0) en - D.img Insulators 80KNDocument62 pagesIec60383-1 (Ed4.0) en - D.img Insulators 80KNAdeel Zafar100% (2)

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- GST MDLDocument98 pagesGST MDLIndhuja MNo ratings yet

- Goods & Services Tax (GST) - ServicesDocument4 pagesGoods & Services Tax (GST) - ServicesItscrap ItscrapNo ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- Goods and Service Tax (GST)Document17 pagesGoods and Service Tax (GST)Manav SethiNo ratings yet

- Issues of Present TaxationDocument36 pagesIssues of Present TaxationvijayNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- RJR Weekly Bulletin #217Document6 pagesRJR Weekly Bulletin #217vivsubs18No ratings yet

- 4 - Input Tax Credit (ITC)Document25 pages4 - Input Tax Credit (ITC)ShrutiNo ratings yet

- GST MM Overview V3.1Document34 pagesGST MM Overview V3.1grc.coo.123No ratings yet

- Are You GST Ready WWW - SimpletaxindiaDocument140 pagesAre You GST Ready WWW - SimpletaxindiaJeethender Kummari KuntaNo ratings yet

- Sy Idt Obj U-3&4Document16 pagesSy Idt Obj U-3&4SNEH MEHTANo ratings yet

- Goods and Service TaxDocument35 pagesGoods and Service Taxaditya2110No ratings yet

- A Solution For Indian GST: Indirect Tax Central StateDocument17 pagesA Solution For Indian GST: Indirect Tax Central StateSrikanth MNo ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNDocument12 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNShane India RazaNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- Goods & Services Tax (GST) - RegistrationDocument2 pagesGoods & Services Tax (GST) - RegistrationSsubrat RrudraNo ratings yet

- Exam Practice ReviewDocument9 pagesExam Practice ReviewSafi NurulNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- BRD-Credit Note ProgramDocument3 pagesBRD-Credit Note ProgramVivek TripathiNo ratings yet

- GSTDocument10 pagesGSTmpsing1133No ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNDocument9 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNSai ParekhNo ratings yet

- GSTR4 06abops7789p1z8 2019-20Document3 pagesGSTR4 06abops7789p1z8 2019-20Suresh Kumar KumawatNo ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Gst-Act: Goods and Services Tax. One Nation-One TaxDocument63 pagesGst-Act: Goods and Services Tax. One Nation-One TaxKunal ChawlaNo ratings yet

- Inu 2216 Idt - Suggested AnswersDocument5 pagesInu 2216 Idt - Suggested AnswersVinil JainNo ratings yet

- Paper 11 New PDFDocument443 pagesPaper 11 New PDFAnand KumarNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- Journal Entries Receipt On Advance in GST - Accounting Entries in GSTDocument8 pagesJournal Entries Receipt On Advance in GST - Accounting Entries in GSTCAMSBABJI MAHNo ratings yet

- Monthly Value-Added Tax DeclarationDocument2 pagesMonthly Value-Added Tax DeclarationJa'maine ManguerraNo ratings yet

- Study Material of TaxationDocument4 pagesStudy Material of TaxationAishuNo ratings yet

- Role of CS in GSTDocument66 pagesRole of CS in GSThareshmsNo ratings yet

- GST ChangesDocument3 pagesGST ChangesPradeeP VNo ratings yet

- Goods and Services Tax - GST: Understanding The Supply Chain, Price Fixation, Tax Obligation & Union/States RevenueDocument14 pagesGoods and Services Tax - GST: Understanding The Supply Chain, Price Fixation, Tax Obligation & Union/States RevenuehampaiahNo ratings yet

- GSTR9 22aabcn2864p1z7 032018Document8 pagesGSTR9 22aabcn2864p1z7 032018Sumit K JhaNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Input Tax CreditDocument8 pagesInput Tax CreditPranjal AgrawalNo ratings yet

- CA - Inter GST Important Questions Answers Part 2 May2023Document12 pagesCA - Inter GST Important Questions Answers Part 2 May2023Vishal AgrawalNo ratings yet

- GST Revision - IndigoLearn - Nov 23 Exam - Day 1Document10 pagesGST Revision - IndigoLearn - Nov 23 Exam - Day 1311903736No ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- 2000 XHTMLDocument2 pages2000 XHTMLJanniza RoceroNo ratings yet

- GST Times - Vol.1, Issue-5Document24 pagesGST Times - Vol.1, Issue-5Milna JosephNo ratings yet

- Standardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument112 pagesStandardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiavsyamkumarNo ratings yet

- Chapter 1 Intro To GSTDocument3 pagesChapter 1 Intro To GSTkevin12345555No ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Goods and Services Tax (GST) : Simplified byDocument14 pagesGoods and Services Tax (GST) : Simplified bypushpendra singh sodhaNo ratings yet

- GST Alert 01 Decoding GST Presentation On Promises of GSTDocument73 pagesGST Alert 01 Decoding GST Presentation On Promises of GSTbibhugudu2002No ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Original 1692010361 Cs Project Report TemplateDocument12 pagesOriginal 1692010361 Cs Project Report TemplatedeepakasopaNo ratings yet

- GST Divyastra CH 7 Input Tax Credit R 1Document26 pagesGST Divyastra CH 7 Input Tax Credit R 1Sanskar SharmaNo ratings yet

- Goods & Services Tax (GST) - GSTR2B122Document2 pagesGoods & Services Tax (GST) - GSTR2B122rauniyar97No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Person 1 Companies SlidesDocument59 pagesPerson 1 Companies SlidesShawn TayNo ratings yet

- AC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Document30 pagesAC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 1 Concepts Context LKW 8jan2018Document17 pagesAC3102 Jan2018 Seminar 1 Concepts Context LKW 8jan2018Shawn TayNo ratings yet

- Ac3102 Jan2018 Seminar 10 Change Ownership LKW 18jan2018Document15 pagesAc3102 Jan2018 Seminar 10 Change Ownership LKW 18jan2018Shawn TayNo ratings yet

- Person 2 Individuals SlidesDocument72 pagesPerson 2 Individuals SlidesShawn TayNo ratings yet

- AC3102 Seminar Outline S1toS15 Jan2018 May2018 13jan2018Document20 pagesAC3102 Seminar Outline S1toS15 Jan2018 May2018 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 6 Equity Accounting LKW 28dec2017Document19 pagesAC3102 Jan2018 Seminar 6 Equity Accounting LKW 28dec2017Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Document27 pagesAC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 9 Complex Group Structures LKW 8jan2018Document31 pagesAC3102 Jan2018 Seminar 9 Complex Group Structures LKW 8jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 4 Four Intra Group Elimination LKW 13jan2018Document26 pagesAC3102 Jan2018 Seminar 4 Four Intra Group Elimination LKW 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13C FRS 24 Related Party LKW 10jan2018Document5 pagesAC3102 Jan2018 Seminar 13C FRS 24 Related Party LKW 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Document41 pagesAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 16 Effects Foreign Exchange Rates LKW 14feb2018Document29 pagesAC3102 Jan2018 Seminar 16 Effects Foreign Exchange Rates LKW 14feb2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13A Consolidated StCashFlow 10jan2018Document3 pagesAC3102 Jan2018 Seminar 13A Consolidated StCashFlow 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13B FRS112 Disclosure Interest InOtherEntity LKW 10jan2018Document9 pagesAC3102 Jan2018 Seminar 13B FRS112 Disclosure Interest InOtherEntity LKW 10jan2018Shawn TayNo ratings yet

- 00 - King Lear AnalysisDocument11 pages00 - King Lear AnalysisViki VankaNo ratings yet

- Revised E-Tickets With Seat NumberDocument1 pageRevised E-Tickets With Seat NumberMohiminul KhanNo ratings yet

- Nivel 2-Unit 4Document16 pagesNivel 2-Unit 4Jonathan Alberto Peñaranda PaezNo ratings yet

- T. Daryaee and Kh. Rezakhani The SasaniaDocument51 pagesT. Daryaee and Kh. Rezakhani The Sasaniaejc1717No ratings yet

- Supreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)Document17 pagesSupreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)muhammed iqbalNo ratings yet

- SHRM 475Document70 pagesSHRM 475Anil KumarNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Gas Spot Market: How Does It Work and Who Are The Players?Document16 pagesGas Spot Market: How Does It Work and Who Are The Players?lupoderi100% (1)

- Milhaus Park East ResponseDocument57 pagesMilhaus Park East ResponseMatthewTaubNo ratings yet

- Iso 565Document8 pagesIso 565André Carlos SilvaNo ratings yet

- Quieting of TitleDocument9 pagesQuieting of TitleLoNo ratings yet

- Files Example Darty PDFDocument12 pagesFiles Example Darty PDFMalick DiattaNo ratings yet

- 5 GRADE ENGLISH (2019-2020) : Examination Questions 1Document7 pages5 GRADE ENGLISH (2019-2020) : Examination Questions 1didarseyitjanowNo ratings yet

- 2 and Upto 3Document4 pages2 and Upto 3Sibin CherianNo ratings yet

- Belbin's Team Roles How Understanding Team Roles Can Improve Team PerformanceDocument5 pagesBelbin's Team Roles How Understanding Team Roles Can Improve Team PerformanceashishNo ratings yet

- Maguayo: Maguayo Is A Barrio in The Municipality of Dorado, PuertoDocument4 pagesMaguayo: Maguayo Is A Barrio in The Municipality of Dorado, PuertoChristopher ServantNo ratings yet

- Opportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatDocument8 pagesOpportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatUmbertoNo ratings yet

- How Mintoff Killed The NBMDocument4 pagesHow Mintoff Killed The NBMsevee2081No ratings yet

- Intertechnique: Within The Quality Aerospace EnvironmentDocument32 pagesIntertechnique: Within The Quality Aerospace EnvironmentwonchoiNo ratings yet

- Psychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah StringerDocument53 pagesPsychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah Stringermarsha.beaver589100% (5)

- Anders Grimstad INMANY23Document38 pagesAnders Grimstad INMANY23sachdevagNo ratings yet

- List of Law FirmsDocument18 pagesList of Law FirmsReena ShauNo ratings yet

- LF1SLD48B TechdataDocument2 pagesLF1SLD48B TechdataNitesh Kumar SinghNo ratings yet

- The Effect of Abuse Among Children in Conflict With The Law in Bahay Pag-AsaDocument13 pagesThe Effect of Abuse Among Children in Conflict With The Law in Bahay Pag-AsaMarlone Clint CamilonNo ratings yet

- Setup GuideDocument5 pagesSetup GuideBiwott MNo ratings yet

- Main - CDC Boys Growth Chart 2 To 20 Years Body Mass Index For Age Percentiles 5th 95th PercentileDocument1 pageMain - CDC Boys Growth Chart 2 To 20 Years Body Mass Index For Age Percentiles 5th 95th PercentileLuh Ayu Asri WijaniNo ratings yet

- Gregorio Araneta Vs RodasDocument2 pagesGregorio Araneta Vs RodasLeomar Despi LadongaNo ratings yet

- 07 Activity 1Document3 pages07 Activity 1Angel BinlayoNo ratings yet

- Trabajo Colaborativo Ingles IIDocument8 pagesTrabajo Colaborativo Ingles IIVivianaGaitanNo ratings yet