Professional Documents

Culture Documents

Person 2 Individuals Slides

Person 2 Individuals Slides

Uploaded by

Shawn TayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Person 2 Individuals Slides

Person 2 Individuals Slides

Uploaded by

Shawn TayCopyright:

Available Formats

PERSON

How are different ‘persons’ taxed?

• Companies (done)

• Individuals (today)

01/03/2017 (C) POH 1

Income Tax Aspects Peculiar

to Individuals

01/03/2017 (C) POH 2

Outline

Employment income

Residence of individuals

Taxation of resident individuals

Personal reliefs (overview)

Tax rates

Tax rebates (overview)

Taxation of non-resident individuals

Tax rates

Section 13(6) exemption

Section 40B relief

01/03/2017 (C) POH 3

Income Tax Aspects Peculiar

to Individuals

Employment Income

01/03/2017 (C) POH 4

Employment Income - Outline

Source of employment income

Capital versus income

Inducement payment

Restrictive covenant payment

Compensation for the loss of the office

Salary in lieu of notice of termination

Gains or profits from employment

Section 10(2) ITA

Allowances

Benefits-in-kind

Timing of tax accrual

Bonus

Director’s fee

01/03/2017 (C) POH 5

Source of employment income

01/03/2017 (C) POH 6

Source of employment income

s12(4): source of employment income is

where the duties of the employment are

discharged or performed

01/03/2017 (C) POH 7

Duties performed in SGP

Employment income is SSI

01/03/2017 (C) POH 8

Duties performed overseas

Duties performed overseas

incidental to and part of a constitutes an

SGP employment overseas employment

employment income is employment income is

SSI FSI

See CAST 7.3.2.1 for some relevant factors to consider

01/03/2017 (C) POH 9

Capital v Income

01/03/2017 (C) POH 10

Capital versus income

Inducement payment

Restrictive covenant payment

Compensation for the loss of the office

Salary in lieu of notice of termination

Note: The true purpose for making the

payment is important; the label attached to

the payment is not

01/03/2017 (C) POH 11

Inducement payment

Payment received before commencement

of employment relationship; to induce or

persuade individual to take up employment

with the prospective employer

01/03/2017 (C) POH 12

Inducement payment

Compensation for loss of substantial personal

rights/advantages/status (i.e. loss of the PMA)

Capital; not taxable

OR (more likely)

Reward for future employment services

Income; taxable

How to decide between the two:

How substantial are the rights, etc. given up

Whether future services will be adequately remunerated

Whether payment is payable outright

01/03/2017 (C) POH 13

Restrictive covenant payment

Payment in consideration of employee’s

undertaking:

not to set up biz in competition with the employer

not to take up employment with a competitor

upon leaving employment

Consideration for undertaking not to compete

(i.e. to give up a future source of income /

PMA)

Capital; not taxable

01/03/2017 (C) POH 14

Compensation for the loss of the office

Payment to compensate for the premature

termination/curtailment of an expectation of

continued employment in the foreseeable future

Compensation for the loss of the source of the

income (i.e. the employment / PMA)

Capital; not taxable

01/03/2017 (C) POH 15

Salary in lieu of notice of termination

Direct substitution for the salary that

would have been earned by the

employee had proper notice of

termination been given by the employer

Taxable employment income

01/03/2017 (C) POH 16

Gains or profits from employment

What constitutes employment income?

01/03/2017 (C) POH 17

Gains or profits from employment

s10(2)

In subsection (1)(b), “gains or profits from any

employment” means —

(a) any wages, salary, leave pay, fee, commission,

bonus, gratuity, perquisite or allowance (other than a

subsistence, travelling, conveyance or entertainment

allowance which is proved to the satisfaction of the

Comptroller to have been expended for purposes

other than those in respect of which no deduction is

allowed under section 15) paid or granted in

respect of the employment whether in money or

otherwise;

…

01/03/2017 (C) POH 18

‘Paid or granted

in respect of employment’

Must be a reward for duties / services

rendered in the course of the

employment, whether in the past,

present or future

Need not be paid/borne by the employer

01/03/2017 (C) POH 19

Gains or profits from employment

Allowances paid to staff

01/03/2017 (C) POH 20

Allowances paid to staff

“gains or profits from any employment” means:

any wages, salary, … or allowance (other than

a subsistence, travelling, conveyance or

entertainment allowance which is proved to the

satisfaction of the Comptroller to have been

expended for purposes other than those in

respect of which no deduction is allowed under

section 15) paid or granted in respect of the

employment whether in money or otherwise.

01/03/2017 (C) POH 21

Allowances paid to staff

An allowance generally is taxable

employment income

However, any part (or the whole) of the

allowance that falls within the brackets is

NOT taxable employment income

(… a subsistence, travelling, conveyance or

entertainment allowance which is proved to the

satisfaction of the Comptroller to have been expended

for purposes for which deduction is allowed [to the

employee])

01/03/2017 (C) POH 22

Gains or profits from employment

Perquisites / Benefits-in-kind

01/03/2017 (C) POH 23

Perquisites / BIK

s10(2)(a): “ … perquisite … whether in money

or otherwise”

Valuation rules

(depending on type of BIK)

GENERAL RULE:

MV to employee (= Cost to employer)

ITA valuation rules

IRAS formulae / scale rates

IRAS administrative concessions

https://www.iras.gov.sg/IRASHome/Businesses/Employers/Tax-Treatment-of-Employee-

Remuneration/List-of-Benefits-in-Kind-Granted-Administrative-Concession-or-Exempt-from-Income-Tax/

01/03/2017 (C) POH 24

Interest-free/subsidised loans

(for employee’s personal use)

Interest subsidy

Market interest – Interest borne by employee

01/03/2017 (C) POH 25

Interest-free/subsidised loans

(for employee’s personal use)

01/03/2017 (C) POH 26

Interest-free/subsidised loans

(for employee’s personal use)

Scenario 1:

Interest subsidy generally taxable

Concession (i.e. not taxable):

Employee has no control or influence over

employer, or no substantial shareholding in

employer; OR

Loan scheme open to all staff on same terms

01/03/2017 (C) POH 27

Interest-free/subsidised loans

(for employee’s personal use)

01/03/2017 (C) POH 28

Interest-free/subsidised loans

(for employee’s personal use)

Scenario 2:

Interest subsidy taxable

01/03/2017 (C) POH 29

Employee’s income tax

borne by employer

Tax-on-tax computation applies*

*not examinable (See CAST 15.8 for examples)

01/03/2017 (C) POH 30

Premium paid by employer for

insurance on employee’s life

Who is the beneficiary?

Employee / Dependants

Taxable benefit

Employer (i.e. keyman insurance)

Not a reward to employee

Not taxable

01/03/2017 (C) POH 31

Club membership fees

paid by employer

Corporate membership

Individual membership held in trust for

employer

Entrance fees not taxable

Annual subscription fees taxable on

portion thereof attributable to private use

01/03/2017 (C) POH 32

Club membership fees

paid by employer

Individual membership beneficially

owned by employee

Entrance fees taxable

Annual subscription fees taxable on

portion thereof attributable to private use

01/03/2017 (C) POH 33

Employer’s CPF contributions

Statutory

Exempt in the hands of the employee

(Deductible for employer – see seminar on Deductions)

Excess

Taxable on the employee

(Not deductible for employer – see seminar on Deductions)

01/03/2017 (C) POH 34

Employer’s contributions to an overseas

pension/provident fund

General treatment*:

Taxable on the employee

(Deductible for the employer if contributions are obligatory under the

fund or under the employment contract – see seminar on Deductions)

* An IRAS administrative practice that deviates from this treatment may apply

in certain situations

01/03/2017 (C) POH 35

Home leave passage

provided by employer

Taxable on the employee based on the cost to

the employer

Concession for employees who are not

Singapore citizens or PRs:

Taxable benefit = 20% of cost

Limited per year to one return passage each for

employee and spouse, two return passages for

each child

This concession will be withdrawn from YA 2018.

01/03/2017 (C) POH 36

Housing benefit (rent-free/subsidised housing provided by

employer, other than in a hotel / serviced apartment)

w.e.f. YA 2015,

Taxable benefit =

Annual Value (AV) of the property

less

Rent contributed by employee (if any)

01/03/2017 (C) POH 37

Furniture and fittings (provided by the

employer) in a residential property

w.e.f. YA 2015,

Taxable benefit = X% of AV of the property

where:

• X% = 40% if partially furnished (i.e. only fittings, e.g.

lightings, air-conditioner / ceiling fan, or water-heater,

provided)

• X% = 50% if fully furnished (i.e. both fittings and

furniture / household appliances provided)

01/03/2017 (C) POH 38

Car benefit

(car provided by the employer for the employee’s private use)

Cost of petrol borne by employee

Taxable benefit

= 3/7 x [(Car cost – Residual value)/10]

+ $0.45/km x private km

Cost of petrol borne by employer

Taxable benefit

= 3/7 x [(Car cost – Residual value)/10]

+ $0.55/km x private km

01/03/2017 (C) POH 39

Employee stock options

Option to purchase shares granted in

respect of employment (i.e. reward for

employment services)

Taxable benefit from employment

quantified under s10(6)

01/03/2017 (C) POH 40

Employee stock options

Companies listed on SGX

Taxable benefit

= (Last done price on listing date

– Price paid by employee)

x No. of shares acquired under the option

Accrues for tax in the year of exercise

01/03/2017 (C) POH 41

Employee stock options

Other companies

Taxable benefit

= (MV on date of exercise

– Price paid by employee)

x No. of shares acquired under the option

Accrues for tax in the year of exercise

01/03/2017 (C) POH 42

Employee stock options

GRANT EXERCISE LISTING SALE

$1.10 $1.20 $1.30 $1.50

Option price: $1 per share

10,000 shares granted under the option

Option exercised for 8,000 shares

01/03/2017 (C) POH 43

Taxation of employment income

Question 1 – Allowances,

Reimbursements, BIK (housing and

related benefits, car benefit)

Question 2 – various other BIK

01/03/2017 (C) POH 44

Tax-Accrual of Bonus

and Director’s Fee

01/03/2017 (C) POH 45

Tax-accrual of bonus

Contractual bonus

Non-contractual bonus

Conditional bonus paid in advance

See CAST 11.3.1A for details

01/03/2017 (C) POH 46

Tax-accrual of director’s fee

Director’s fee approved in arrears

Director’s fee approved in advance

See CAST 11.3.1A for details

01/03/2017 (C) POH 47

Income Tax Aspects Peculiar

to Individuals

Residence of Individuals

01/03/2017 (C) POH 48

How to determine if an individual is a

resident or non-resident?

Statutory tests – s2(1)

Qualitative test

Quantitative tests

Physical presence

Employment

(to be a SGP resident, satisfy any one/more of the tests)

IRAS concessionary practices

2-year concession

3-year concession

01/03/2017 (C) POH 49

Qualitative test

‘normally residing’ in SGP in the PY?

factors to consider

absence(s) from SGP (if any) must be:

temporary

reasonable

not inconsistent with claim to be a resident

Consider:

period of absence?

purpose of absence?

intention to return?

01/03/2017 (C) POH 50

Quantitative tests

Physical presence

physically present in SGP for at least 183

days in the PY?

Employment

exercising an employment in SGP for at

least 183 days in the PY?

test is not applicable to non-executive

directorships

(see CAST 6.3.1.2, Illustration 4)

01/03/2017 (C) POH 51

Concessionary practice

2-year concession

exercising an employment in SGP or

physically present in SGP

for a continuous period of at least 183 days

straddling across 2 consecutive calendar

years

resident for both relevant Ys/A

01/03/2017 (C) POH 52

2-yr concession - Example

Senor Maccaroni Roma (normally lives

o/s SGP)

Arrives in SGP and commences SGP

employment: 1.9.2016

Leaves SGP after completing SGP

employment: 31.5.2017

Consider his SGP residence status for

YA 2017 and YA 2018

01/03/2017 (C) POH 53

2-yr concession - Example

SGP emp (or PP) ≥ 183 days

1.9.2016 31.5.2017

< 183 days < 183 days

CY 2016 2017

YA 2017 2018

01/03/2017 (C) POH 54

Concessionary practice

3-year concession

exercising an employment in SGP or

physically present in SGP

over a continuous period

straddling across at least 3 consecutive

calendar years

resident for all relevant Ys/A

01/03/2017 (C) POH 55

3-yr concession - Example

Senor Pizza Napolitano (normally lives

o/s SGP)

Arrives in SGP and commences SGP

employment: 1.10.2015

Leaves SGP after completing SGP

employment: 31.3.2017

Consider his SGP residence status for

YA 2016, YA 2017 and YA 2018

01/03/2017 (C) POH 56

3-yr concession - Example

SGP emp (or PP) ≥ 3 consecutive CYs

1.10.2015 31.3.2017

< 183 days < 183 days

CY 2015 2016 2017

YA 2016 2017 2018

01/03/2017 (C) POH 57

Income Tax Aspects Peculiar

to Individuals

Taxation of Resident Individuals

01/03/2017 (C) POH 58

Taxation of resident individuals –

Personal reliefs

Entitled to personal reliefs, based on

personal/family circumstances

Personal reliefs are deducted against AI

to arrive at CI

List of personal reliefs (s39) – next slide

01/03/2017 (C) POH 59

Taxation of resident individuals –

Personal reliefs

Earned income relief

Spouse relief

Handicapped spouse relief

Child relief

Qualifying child relief

Handicapped child relief

Working mother’s child relief

Grandparent caregiver relief

Relief for life insurance premiums

Relief for employee’s contributions to approved pension, provident fund or society

(e.g. CPF), including relief for CPF contributions by a self-employed person

Aged / Handicapped parent relief

Handicapped sibling relief

Relief for course fees

Relief for a National Serviceman, including relief for the wife/widow and parents of

a National Serviceman

Relief for contributions made to the Supplementary Retirement Scheme (SRS)

Relief for CPF top-ups

Foreign domestic worker levy relief

Note: Total personal reliefs capped at $80K per individual per YA from YA 2018

01/03/2017 (C) POH 60

Taxation of resident individuals –

Tax rates

Tax liability = CI x Tax rates

Graduated progressive tax rate structure

– see Part A, 2nd Schedule ITA

01/03/2017 (C) POH 61

Taxation of resident individuals –

Tax rates in Part A, 2nd Sch (YA 2012 to YA 2016)

01/03/2017 (C) POH 62

Taxation of resident individuals –

Tax rates in Part A, 2nd Sch (w.e.f. YA 2017)

01/03/2017 (C) POH 63

Taxation of resident individuals –

Tax rebates

Rebates are set off against tax liability

One-off rebate

For YA 2017, 20% rebate of the tax payable,

capped at $500

Parenthood rebates

01/03/2017 (C) POH 64

Income Tax Aspects Peculiar

to Individuals

Taxation of Non-Resident Individuals

01/03/2017 (C) POH 65

Taxation of

non-resident individuals

Tax rate

Generally, a flat 22% (w.e.f. YA 2017)

Reliefs for SGP employment income

Section 13(6) exemption

Section 40B relief

01/03/2017 (C) POH 66

s13(6) and s40B

Non-resident exercising

SGP employment

(Tax treatment of SGP

employment income?)

SGP employment SGP employment

60 days in PY > 60 days

but < 183 days in PY

Emp income exempt Emp income taxable

– s 13(6) – claim s40B relief

01/03/2017 (C) POH 67

s13(6) exemption

Exemption of SGP employment income

NR individual;

Employment in SGP ≤ 60 days in PY; AND

Employment is a short-term employment

(i.e. does not straddle across at least 3

consecutive calendar years – see CAST

20.3.3, Illustration 4)

01/03/2017 (C) POH 68

s40B relief

Tax SGP employment income based on:

flat rate of 15%; or

resident basis (i.e. with personal reliefs, and

applying graduated rates in Part A, 2nd Sch),

whichever is the higher liability

01/03/2017 (C) POH 69

Example –

SGP employment income of NR individual

Senora Spaghetti Venezia (a NR)

Commences SGP employment: 1.12.2016

Completes SGP employment: 31.3.2017

Advise on the taxability of her SGP

employment income

01/03/2017 (C) POH 70

Example –

SGP employment income of NR individual

SGP employment

1.12.2016 31.3.2017

> 60 days

≤ 60 days

< 183 days

CY 2016 2017

YA 2017 2018

01/03/2017 (C) POH 71

Residence of individual

and income tax implications

Question 3

01/03/2017 (C) POH 72

You might also like

- Jalen SDN BHDDocument18 pagesJalen SDN BHDsyakira kamarudinNo ratings yet

- Example - New HUD 1Document3 pagesExample - New HUD 151 Pegasi100% (2)

- Chap 016Document20 pagesChap 016Raj Naveen MaheshwariNo ratings yet

- Farm Business PlanDocument29 pagesFarm Business PlanMarija Beleska67% (3)

- Project Study (Sweety Kurup Bba019314)Document79 pagesProject Study (Sweety Kurup Bba019314)Hrithik BokdeNo ratings yet

- Salary-Chp 3Document38 pagesSalary-Chp 3Rozina TabassumNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- Income Tax Law and PracticesDocument26 pagesIncome Tax Law and Practicesremruata rascalralteNo ratings yet

- IAS 19 Employee Benefits (2021)Document6 pagesIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- Salary Income-Pg DTDocument11 pagesSalary Income-Pg DTOnkar BandichhodeNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Compliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Document57 pagesCompliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Himanshu ShahNo ratings yet

- ITLP (Unit 3) 09-11-2021Document86 pagesITLP (Unit 3) 09-11-2021anushkaNo ratings yet

- Fringe Benefits, de Minimis Benefits, Filing of Income Tax ReturnDocument5 pagesFringe Benefits, de Minimis Benefits, Filing of Income Tax ReturndgdeguzmanNo ratings yet

- Notes On Income From SalaryDocument5 pagesNotes On Income From SalaryNarendra KelkarNo ratings yet

- Income Tax PPT RutujaDocument9 pagesIncome Tax PPT RutujaRUTUJA RAJPUTNo ratings yet

- Provident FundDocument5 pagesProvident FundG MadhuriNo ratings yet

- Module 2 - Income From SalariesDocument22 pagesModule 2 - Income From SalariesAishwarya NNo ratings yet

- Tax Deducted at Source TDSDocument55 pagesTax Deducted at Source TDSDhruv SetiaNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Lecture Notes - IAS 19Document14 pagesLecture Notes - IAS 19Muhammed NaqiNo ratings yet

- Income From SalaryDocument22 pagesIncome From SalaryJatin DrallNo ratings yet

- IRBs Public Ruling No 5 of 2019 - Employee Buy Out Payments Taxable As Perquisites LHAG Update 20200221Document4 pagesIRBs Public Ruling No 5 of 2019 - Employee Buy Out Payments Taxable As Perquisites LHAG Update 20200221Ann YeoNo ratings yet

- Income Tax: Ca - Cma - Cs Inter / EPDocument55 pagesIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNo ratings yet

- SlaaDocument36 pagesSlaaGovind BharathwajNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- Chapter-9 Salary IncomeDocument21 pagesChapter-9 Salary IncomeDhrubo Chandro RoyNo ratings yet

- Final Indirect Tax ProjectDocument39 pagesFinal Indirect Tax Projectssg1015No ratings yet

- 02 - Taxation - Chapter-2 - Salary Part-1Document27 pages02 - Taxation - Chapter-2 - Salary Part-1apandeyproNo ratings yet

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresNo ratings yet

- Module 1 - Employee BenefitsDocument38 pagesModule 1 - Employee BenefitsMitchie Faustino100% (1)

- IAS 19 Employee BenefitsDocument56 pagesIAS 19 Employee BenefitsziyuNo ratings yet

- IJCRT1802005Document8 pagesIJCRT1802005preetha.r.kutty02No ratings yet

- 19 Employee Benefits s20 FinalDocument18 pages19 Employee Benefits s20 FinalMalcolmNo ratings yet

- Lecture Notes Employee Benefits: Page 1 of 16Document16 pagesLecture Notes Employee Benefits: Page 1 of 16fastslowerNo ratings yet

- Compliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Document57 pagesCompliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Pradee Srinivas GowdaNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- Income Under The Head Salary2Document142 pagesIncome Under The Head Salary2OnlineNo ratings yet

- Income From Salary MannualDocument26 pagesIncome From Salary Mannualmurshad000No ratings yet

- Handout 3.0 ACC 226 Sample Problems Employee BenefitsDocument12 pagesHandout 3.0 ACC 226 Sample Problems Employee BenefitsLyncee BallescasNo ratings yet

- Alphonse Irudayaraj Offer LetterDocument4 pagesAlphonse Irudayaraj Offer Letteralphonse INo ratings yet

- Offer Letter TaskusDocument9 pagesOffer Letter TaskusAkshay SharmaNo ratings yet

- Unit 2 Notes, Part 1Document19 pagesUnit 2 Notes, Part 1Sandip Kumar BhartiNo ratings yet

- Salary Income LawDocument25 pagesSalary Income Lawvishal singhNo ratings yet

- Taxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBDocument32 pagesTaxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBRupal DalalNo ratings yet

- Paper 7 New Book 83 152 SalaryDocument70 pagesPaper 7 New Book 83 152 SalaryHridya PrasadNo ratings yet

- Salary Tax CalculatorDocument7 pagesSalary Tax Calculatorbecito6195No ratings yet

- Lesson Six: Accounting For Employee BenefitsDocument27 pagesLesson Six: Accounting For Employee BenefitssamclerryNo ratings yet

- Offer Letter: Mr. Lalit SharmaDocument3 pagesOffer Letter: Mr. Lalit SharmaDr. Bhasker Pratap ChoudharyNo ratings yet

- IAS 19 NotesDocument16 pagesIAS 19 NotesArsalan AliNo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- IAS 19 Employee Benefits: Technical SummaryDocument3 pagesIAS 19 Employee Benefits: Technical SummaryHassan Iqbal PenkarNo ratings yet

- Heads of Income - Income From SalaryDocument10 pagesHeads of Income - Income From SalaryBhavesh KhillareNo ratings yet

- Practical Accounting 2: BSA51E1 &BSA51E2Document68 pagesPractical Accounting 2: BSA51E1 &BSA51E2Carmelyn GonzalesNo ratings yet

- Lecture 4to9 - SalaryDocument15 pagesLecture 4to9 - SalaryVandana VaidyaNo ratings yet

- Salary IncomeDocument83 pagesSalary IncomechitkarashellyNo ratings yet

- Income Tax 05Document17 pagesIncome Tax 05AMJAD ULLA RNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- Postemployment BenefitsDocument22 pagesPostemployment BenefitsChoco ButternutNo ratings yet

- Vignesh - DESIGNER CREATIVE - 0 - OfferletterDocument2 pagesVignesh - DESIGNER CREATIVE - 0 - OfferletterNavamani VigneshNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- 4.1 Salary Theory and Problems 1Document15 pages4.1 Salary Theory and Problems 1Krishna GuptaNo ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- Person 1 Companies SlidesDocument59 pagesPerson 1 Companies SlidesShawn TayNo ratings yet

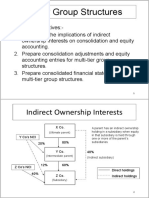

- AC3102 Jan2018 Seminar 6 Equity Accounting LKW 28dec2017Document19 pagesAC3102 Jan2018 Seminar 6 Equity Accounting LKW 28dec2017Shawn TayNo ratings yet

- GST - SlidesDocument74 pagesGST - SlidesShawn TayNo ratings yet

- AC3102 Seminar Outline S1toS15 Jan2018 May2018 13jan2018Document20 pagesAC3102 Seminar Outline S1toS15 Jan2018 May2018 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 1 Concepts Context LKW 8jan2018Document17 pagesAC3102 Jan2018 Seminar 1 Concepts Context LKW 8jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Document27 pagesAC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Document30 pagesAC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 4 Four Intra Group Elimination LKW 13jan2018Document26 pagesAC3102 Jan2018 Seminar 4 Four Intra Group Elimination LKW 13jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 9 Complex Group Structures LKW 8jan2018Document31 pagesAC3102 Jan2018 Seminar 9 Complex Group Structures LKW 8jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 16 Effects Foreign Exchange Rates LKW 14feb2018Document29 pagesAC3102 Jan2018 Seminar 16 Effects Foreign Exchange Rates LKW 14feb2018Shawn TayNo ratings yet

- Ac3102 Jan2018 Seminar 10 Change Ownership LKW 18jan2018Document15 pagesAc3102 Jan2018 Seminar 10 Change Ownership LKW 18jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13A Consolidated StCashFlow 10jan2018Document3 pagesAC3102 Jan2018 Seminar 13A Consolidated StCashFlow 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13C FRS 24 Related Party LKW 10jan2018Document5 pagesAC3102 Jan2018 Seminar 13C FRS 24 Related Party LKW 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 13B FRS112 Disclosure Interest InOtherEntity LKW 10jan2018Document9 pagesAC3102 Jan2018 Seminar 13B FRS112 Disclosure Interest InOtherEntity LKW 10jan2018Shawn TayNo ratings yet

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Document41 pagesAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNo ratings yet

- Aon - 2021 Global Risk Management Survey FindingsDocument142 pagesAon - 2021 Global Risk Management Survey FindingsIgnacio Alfredo A.F.No ratings yet

- Business Finance Q3 Module 5Document23 pagesBusiness Finance Q3 Module 5Jet Planes100% (6)

- RR 3-98Document13 pagesRR 3-98Althea Angela GarciaNo ratings yet

- Audit ReportDocument22 pagesAudit ReportTasya Febriani AdrianaNo ratings yet

- 9988 Contract Generator Maintenance e 354780 591769Document11 pages9988 Contract Generator Maintenance e 354780 591769Fosu DicksonNo ratings yet

- Andhra - Pradesh - Govt Rules For Epc ContractsDocument29 pagesAndhra - Pradesh - Govt Rules For Epc Contractsanon_740216180No ratings yet

- Proiect Crama 2Document57 pagesProiect Crama 2Anonymous gnGxwilWzNo ratings yet

- TATA AIG General Insurance Co. LTD.: Hi, Private Car Vehicle Policy QuoteDocument1 pageTATA AIG General Insurance Co. LTD.: Hi, Private Car Vehicle Policy QuotejibiteshNo ratings yet

- Double Insurance, Over-Insurance and ReinsuranceDocument2 pagesDouble Insurance, Over-Insurance and ReinsuranceJOBELLE VILLANUEVANo ratings yet

- JKH - BW Reports - Field AnalysisDocument51 pagesJKH - BW Reports - Field AnalysisSunitha GubbalaNo ratings yet

- 1637156823GAT General Linguistics F-2021Document15 pages1637156823GAT General Linguistics F-2021Noveera JaffarNo ratings yet

- Anaconda - Features 2019Document18 pagesAnaconda - Features 2019SergeNo ratings yet

- Public Policy Principles For Electronic Commerce and InsuranceDocument8 pagesPublic Policy Principles For Electronic Commerce and Insuranceb_1980b2148No ratings yet

- Hello AJAY JAISWAL, We Have Your Car Covered!: Insured Details Partner DetailsDocument8 pagesHello AJAY JAISWAL, We Have Your Car Covered!: Insured Details Partner Detailskunal.choudharyandromedaNo ratings yet

- Regulation of para Banking Activities of Commercial BanksDocument18 pagesRegulation of para Banking Activities of Commercial BanksEswar StarkNo ratings yet

- An Empirical Study of Life Insurance Product and Services in Rural AreasDocument16 pagesAn Empirical Study of Life Insurance Product and Services in Rural AreasPARTH PATELNo ratings yet

- HR Recruitment & Selection Project of BAJAJ ALLIANZDocument87 pagesHR Recruitment & Selection Project of BAJAJ ALLIANZKrishna Kinker86% (7)

- Ticketmaster v. PrestigeDocument46 pagesTicketmaster v. PrestigedanielrestoredNo ratings yet

- Wi 106Document22 pagesWi 106zatharisNo ratings yet

- Arqus Talent Scholarship Grant Agreement WebDocument5 pagesArqus Talent Scholarship Grant Agreement WebTerence DjomoNo ratings yet

- Synopsis 3, NCDRCDocument2 pagesSynopsis 3, NCDRCdevanshi jainNo ratings yet

- Psscoc For Design Build 2020Document78 pagesPsscoc For Design Build 2020王佳乐No ratings yet

- IC-38 - New Q.Set 2 - AnsDocument3 pagesIC-38 - New Q.Set 2 - AnsDhruv Shah100% (1)

- Standard Contract-Afia-2020Document23 pagesStandard Contract-Afia-2020BillNo ratings yet

- Street Hype Newspaper - July 1-18-July 19-31, 2020Document16 pagesStreet Hype Newspaper - July 1-18-July 19-31, 2020Patrick MaitlandNo ratings yet