Professional Documents

Culture Documents

The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2

The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2

Uploaded by

SR TGOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2

The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2

Uploaded by

SR TGCopyright:

Available Formats

CFAP04 - Business Finance Decisions | Page 2

Q2. FaceMask Limited (FML) operates a production unit which produces a chemical which is

commonly used in various industries. Following information has been collected to ascertain the

company’s working capital requirement:

(i) Designed capacity of the plant is 150 tons per hour. However, as in the past, it is expected that the

plant will operate at 70% of the designed capacity.

(ii) The variable cost per ton of finished product would be Rs. 2,500 made up as under:

Raw Materials 62.4%

Consumables and spares 12.0%

Other processing costs 25.6%

(iii) Raw material is imported on FOB basis. The supplier allows 45 days credit from the date of

shipment. However, overseas and inland transportation and port and customs formalities take 30

days.

(iv) Because of the nature of the cargo, only one ship is available in a month, for transporting the raw

material.

(v) Freight, transportation and other import related variable costs of purchases are estimated at 30%

of the FOB value and are paid at the time of receipt of goods at the plant.

(vi) One ton of finished goods requires 1.25 tons of raw materials. Fixed costs are estimated at Rs.

10.584 million per month.

(vii) Budgeted sales price is to be worked out so as to earn a gross profit of 20% over sales. The details

of sales forecast provided by the marketing department are as follows:

40% sales will be made to corporate clients on 10 days credit. The price would be 2% higher

than the budgeted price.

30% sales will be made to individual customers at budgeted price. The goods are delivered

after two days of receiving the required amount.

Remaining sales shall comprise of exports. The export documents are presented in the bank

within 2 days of shipment. The export proceeds are credited in the company’s bank account

after 3 days of the date of presenting the documents. The Federal government allows a rebate

of 5%on exports and it is credited to the company’s account on the date of realization of

export proceeds.

(viii) It is estimated that at any point of time the work in progress shall consist of 1,000 tons of raw

material which shall be 50% complete as regards consumables, spares and processing costs.

(ix) Average inventory of finished product is equal to fifteen days production. Till last year, the

company’s policy was to maintain average inventory of 30 days.

(x) Operational consumables and spares of Rs. 20 million are required to be maintained throughout

the year.

(xi) Production is evenly distributed throughout the year. Except for the facts given above, all other

costs are payable after 15 days of their incurrence.

(xii) FML follows marginal costing system.

Required:

Determine the working capital requirement for the year. (Assume 30 days in each month) (18)

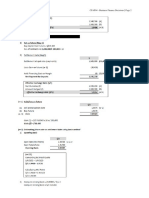

Q3. Sanitizers Limited (SL) is indulged in manufacturing and selling premium quality vehicles and

targets a niche market for its production line. As part of its strategic focus on creativity and innovation,

instead of establishing a Research & Development (R&D) Centre of its own to create innovative add-ons

for its vehicles, SL wishes to acquire Antiseptics Limited (AL) which is engaged in producing innovative

add-ons for over several years.

As part of transaction advisory project, you have been contacted and taken on board for performing

financial due diligence involved in the transaction. The following recent financial information is available

for both companies:

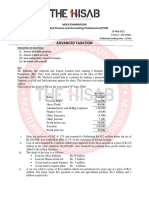

The HISAB School of Accountancy

You might also like

- Brand Plan - FinalDocument24 pagesBrand Plan - Finaljmhdeve60% (10)

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- The Body Shop Marketing Plan AnalysisDocument18 pagesThe Body Shop Marketing Plan AnalysisHepita0% (1)

- MGMT Acts PaperDocument27 pagesMGMT Acts PaperAbhishek JainNo ratings yet

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- Alaire Corporation Manufactures Several Different Circuit BoardsDocument2 pagesAlaire Corporation Manufactures Several Different Circuit BoardsAmit PandeyNo ratings yet

- Sample Ceo Resume 2 PDFDocument2 pagesSample Ceo Resume 2 PDFfahdlyNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingRamzan AliNo ratings yet

- CA Pakistan - MAC Past PapersDocument194 pagesCA Pakistan - MAC Past PapersAbdul Azeem100% (1)

- Caf 8 Cma Spring 2021Document5 pagesCaf 8 Cma Spring 2021Hassnain SardarNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingHooriaNo ratings yet

- Cost and Management AccountingDocument5 pagesCost and Management AccountingZaib Khan0% (1)

- Su - 018Document5 pagesSu - 018AbdulAzeemNo ratings yet

- F 17 - MacDocument4 pagesF 17 - MacIqra JawedNo ratings yet

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyDocument36 pagesGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTNo ratings yet

- ECON F315 - FIN F315 - Compre QP PDFDocument3 pagesECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationSyed Muhammad JawwadNo ratings yet

- FM Revision Q BankDocument10 pagesFM Revision Q BankOmkar VaigankarNo ratings yet

- Management Accounting: Final ExaminationsDocument4 pagesManagement Accounting: Final ExaminationsAbdulAzeemNo ratings yet

- Caf 8 Cma Autumn 2020Document5 pagesCaf 8 Cma Autumn 2020Hassnain SardarNo ratings yet

- Questions Ias 36Document6 pagesQuestions Ias 36kashan.ahmed1985No ratings yet

- Lecture # 14Document2 pagesLecture # 14bwcs1122No ratings yet

- Statement of Significant Accounting PoliciesDocument6 pagesStatement of Significant Accounting PoliciesthomasNo ratings yet

- IRR of The ProjectDocument9 pagesIRR of The Projectsamuel kebedeNo ratings yet

- Assignment Conceptual Framework of Finasncial ReportingDocument3 pagesAssignment Conceptual Framework of Finasncial ReportingmutasalinnNo ratings yet

- BACC 232 - 309-234 Assignment 1 (May-June 2024)Document8 pagesBACC 232 - 309-234 Assignment 1 (May-June 2024)melinencube2002No ratings yet

- Caf 8 Cma Spring 2019Document5 pagesCaf 8 Cma Spring 2019Jawad AzizNo ratings yet

- F9FM SQB Qs - d07Document40 pagesF9FM SQB Qs - d07Erclan50% (2)

- Sybbi FM Working Capital SumsDocument2 pagesSybbi FM Working Capital Sumssameer_kiniNo ratings yet

- CA Final FR Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Final FR Q MTP 2 May 2024 Castudynotes ComAudit UserNo ratings yet

- Lecture # 48Document3 pagesLecture # 48bwcs1122No ratings yet

- As 462Document6 pagesAs 462ziabuttNo ratings yet

- F-17 MacDocument4 pagesF-17 MacNadeem HanifNo ratings yet

- Financial Accounting and Reporting-IDocument6 pagesFinancial Accounting and Reporting-INafay Bin ZubairNo ratings yet

- Cost and Management AccountingDocument5 pagesCost and Management AccountingIbtehaj KayaniNo ratings yet

- Costing English Question-01.09.2022Document5 pagesCosting English Question-01.09.2022Planet ZoomNo ratings yet

- Working Capital Management - NumericalsDocument9 pagesWorking Capital Management - NumericalsAnjali JainNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Working Capital ManagementDocument7 pagesWorking Capital ManagementEduwiz Mänagemënt EdücatîonNo ratings yet

- Skans School of Accountancy Cost & Management AccountingDocument3 pagesSkans School of Accountancy Cost & Management AccountingmaryNo ratings yet

- Standard Costing and Variance Analysis: Icap Cost Accounting & Management Accounting - Spring 2020 Q 1Document8 pagesStandard Costing and Variance Analysis: Icap Cost Accounting & Management Accounting - Spring 2020 Q 1maryNo ratings yet

- MTP 10 16 Questions 1694017726Document7 pagesMTP 10 16 Questions 1694017726jiotv0050No ratings yet

- 6.III-TERMS-Tax June.2024 Exam Batch - 27Document7 pages6.III-TERMS-Tax June.2024 Exam Batch - 27y.yubaraj001No ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- Cost and Management AccountingDocument6 pagesCost and Management AccountingAli HaiderNo ratings yet

- Caf 8 Cma Autumn 2018Document4 pagesCaf 8 Cma Autumn 2018Hassnain SardarNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- CAF 8 CMA Autumn 2019 PDFDocument4 pagesCAF 8 CMA Autumn 2019 PDFbinuNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Assessment and Computation of Working Capital Requirements Numerical QuestionsDocument6 pagesAssessment and Computation of Working Capital Requirements Numerical QuestionsNazreena MukherjeeNo ratings yet

- Material Exam Type Practice Question M.Com 2ndDocument4 pagesMaterial Exam Type Practice Question M.Com 2ndJahanzaib ButtNo ratings yet

- 2230 RTP CA PCC - Paper 4 Cost Accounting and Financial ManagementDocument41 pages2230 RTP CA PCC - Paper 4 Cost Accounting and Financial ManagementNaveen R HegadeNo ratings yet

- MANAC QuestionsDocument4 pagesMANAC QuestionsPrakhar SethiNo ratings yet

- AFIN317 2016 Semester 1 Final ExamDocument7 pagesAFIN317 2016 Semester 1 Final ExamSandra K JereNo ratings yet

- 10 2004 Dec QDocument7 pages10 2004 Dec QMohd Bawa0% (1)

- 07 - Cash, Receivables, Inventory Managment ProblemsDocument6 pages07 - Cash, Receivables, Inventory Managment ProblemsMerr Fe PainaganNo ratings yet

- Case # 1: Institute of Cost and Management Accountants of PakistanDocument2 pagesCase # 1: Institute of Cost and Management Accountants of PakistanSajid AliNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- A.8 A) There Are Two Issues of Which Evaluation Is Below: InventoryDocument1 pageA.8 A) There Are Two Issues of Which Evaluation Is Below: InventorySR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- D) The Main Differences Between ML and TF AreDocument1 pageD) The Main Differences Between ML and TF AreSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- Gearing: CFAP04 - Business Finance Decisions - Page 12Document1 pageGearing: CFAP04 - Business Finance Decisions - Page 12SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- Accenture Building Omni Channel Commerce Platform FutureDocument16 pagesAccenture Building Omni Channel Commerce Platform Futurerahulp9999No ratings yet

- Strategic Selling Review 19991011Document52 pagesStrategic Selling Review 19991011jturner5520100% (2)

- Personal or Social Letters Applications Formal or Business Letters Personal or Social Letters: Informal LettersDocument16 pagesPersonal or Social Letters Applications Formal or Business Letters Personal or Social Letters: Informal LettersHarsimar NarulaNo ratings yet

- Prospectus Amazon Store Selling Survival and Sports Gear PDFDocument11 pagesProspectus Amazon Store Selling Survival and Sports Gear PDFAliciaNo ratings yet

- Advertising Agency PDFDocument34 pagesAdvertising Agency PDFNupur MaheshwariNo ratings yet

- Inventory (Stock Counts)Document22 pagesInventory (Stock Counts)Muhammad ArslanNo ratings yet

- Mangalore TilesDocument76 pagesMangalore TilesSubramanya Dg100% (1)

- In Trade or CommerceDocument7 pagesIn Trade or CommerceBo KamNo ratings yet

- Cosmetics DataDocument17 pagesCosmetics DataAmornrat Ting-Ting SriprajittichaiNo ratings yet

- Business Marketing Module 4 - Developing The Marketing MixDocument31 pagesBusiness Marketing Module 4 - Developing The Marketing MixMarisse Bagalay TejamoNo ratings yet

- Brand Building PPT ORSDocument14 pagesBrand Building PPT ORSDhruv JainNo ratings yet

- CEOFlow - Turn Your Employees Into Mini-CEO - Aaron RossDocument147 pagesCEOFlow - Turn Your Employees Into Mini-CEO - Aaron RossChristian ThybenNo ratings yet

- Truecaller Case StudyDocument4 pagesTruecaller Case StudyKevin JijuNo ratings yet

- MODULE#10 Product ConceptDocument14 pagesMODULE#10 Product ConceptRisavina Dorothy CondorNo ratings yet

- Monte Carlo (Oswal Woollen Mills LTD.) (Sales and Distribution Strategies)Document30 pagesMonte Carlo (Oswal Woollen Mills LTD.) (Sales and Distribution Strategies)Ankita KushwahaNo ratings yet

- Happy ManifestoDocument129 pagesHappy Manifestozsolt laszlo vagasiNo ratings yet

- Marketing Management Philosophies: Sunita SrivastavaDocument17 pagesMarketing Management Philosophies: Sunita SrivastavaImran MaknojiaNo ratings yet

- BPODocument68 pagesBPOSumit Suman50% (4)

- Haleeb Dairy Queen MilkDocument36 pagesHaleeb Dairy Queen MilkMuhammad QasimNo ratings yet

- Sonata WatchDocument14 pagesSonata WatchShikata RoyNo ratings yet

- International BusinessDocument40 pagesInternational Businesssuperrocker100% (1)

- Oyster MushroomDocument4 pagesOyster MushroomDeorene PulmanoNo ratings yet

- 3m India Ltd. ProjectDocument73 pages3m India Ltd. ProjectKavinder KanyalNo ratings yet

- Blue Nile Case NotesDocument18 pagesBlue Nile Case Notesenergizerabby100% (1)

- Company Unit 02-Sept - 2021Document12 pagesCompany Unit 02-Sept - 2021cubadesignstud0% (1)

- Theoretical Framework and Hypothesis DevelopmentDocument2 pagesTheoretical Framework and Hypothesis DevelopmentGrace MarasiganNo ratings yet