Professional Documents

Culture Documents

HDFC Business Cycle Fund NFO

HDFC Business Cycle Fund NFO

Uploaded by

leenagalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HDFC Business Cycle Fund NFO

HDFC Business Cycle Fund NFO

Uploaded by

leenagalaCopyright:

Available Formats

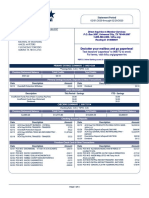

Choose a

better route.

Aim to stay ahead with

HDFC Business Cycle Fund

(An open ended equity scheme following business cycle based investing theme)

HDFC Business Cycle Fund aims to invest in businesses likely on the cusp / midst of a favourable business cycle.

What is a Business Cycle?

Peak

(Stable growth

at high levels)

Business Activity

Business cycle is the journey across four phases

Co (Delcowing

nt lining gro

s

of growth in business activity, observed in

ra / wth

ion

ct )

th)

acceleration / deceleration across factors such

io

row

ns

n

g

pa

g

as volume growth, pricing power, competitive

sin

Ex

(Ri

intensity, cost consciousness, capex intensity,

Slump ROCE and business sentiment.

(Phase of weak / no growth)

Time

Why does business cycle investing make sense?

Higher confidence Correlation with Investment Ahead of the curve: Agility:

on forecasts: valuations: strategy: Based on lead Investments across

Estimating positioning of When businesses are Invest in businesses indicators, domain companies and themes

various business cycles in upcycle, get dual likely on the cusp/midst expertise and recurring are not static in nature

and their trajectory can benefit of earnings of favorable business patterns in business and can be rotated

be done with higher growth and upcycle, avoid history, investing based on stages of

confidence vs the improvement in businesses about to opportunities can be business cycles.

general economic cycle valuation multiples enter/in a downcycle identified ahead of time

AMFI Registered Mutual Fund Distributor

Portfolio Strategy – HDFC Business Cycle Fund

Blend of top down and bottom up approach

Core of portfolio (>80%) would be companies likely on the cusp / midst of favourable business cycle, while

avoiding companies about to enter/in a business downcycle

Non-core (<20%) portfolio would consist of 1) growth stories relatively agnostic to the business cycle 2)

stocks relatively better positioned within their sector 3) tactical opportunities with favourable risk-reward

Risk management: Adequate diversification (across sectors / sub sectors / market cap) along with an active

approach towards business cycle selection

Large and experienced team with a rigorous investment process

Rahul Baijal, Senior Fund Manager, Equities, with experience spanning over 20 years in

Equity Research and Fund Management

Experienced team: 28 Investment professionals with average experience of 18 years

Experienced risk management team

Wide and deep stock coverage ~ 400 stocks in the core list covering ~85% of India market cap

HDFC Business Cycle Fund aims to leverage strengths in its research and fund

management team to manage the Fund based on outlook on business cycles

Who should consider investing?

This product may be suitable for investors who are looking for

Exposure to businesses likely on the cusp / midst of a favourable business cycle

A fund that is agile in rotation of investments based on assessment of stages of business cycles.

A product suitable for buy and hold / SIP for long periods of time

Investment horizon of 3 or more years

HDFC Business Cycle Fund is suitable for investors who are seeking*: Riskometer #

To generate long-term capital appreciation/ income

Investment predominantly in equity & equity related instruments of business

cycle based theme

*Investors should consult their financial advisers, if in doubt about whether the

product is suitable for them.

# For latest riskometer, investors may refer to the Monthly Portfolios disclosed

on the website of the Fund viz. www.hdfcfund.com

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS,

READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

You might also like

- Dxweb PDFDocument4 pagesDxweb PDFTSMSlippedNo ratings yet

- Retail Value Map - DeloitteDocument22 pagesRetail Value Map - DeloitteWilliam Poon100% (1)

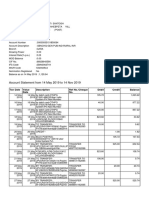

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Document2 pagesPenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)mainem izzanNo ratings yet

- HDFC Business Cycle Fund NFO - LeafletDocument2 pagesHDFC Business Cycle Fund NFO - LeafletdcpjimmyNo ratings yet

- Weekend Bytes - 19th Nov 221423287Document7 pagesWeekend Bytes - 19th Nov 221423287Jignesh Jagjivanbhai PatelNo ratings yet

- Impress PMS - Jan 24 - Anand Rathi PMSDocument19 pagesImpress PMS - Jan 24 - Anand Rathi PMSshivamsundaram794No ratings yet

- Impress PMS - Feb 24 - Anand Rathi PMSDocument19 pagesImpress PMS - Feb 24 - Anand Rathi PMSshivamsundaram794No ratings yet

- Investment Framework Chirag DagliDocument21 pagesInvestment Framework Chirag DagliTheMoneyMitraNo ratings yet

- Sanchit 505 Final AlignedDocument23 pagesSanchit 505 Final AlignedRohanNo ratings yet

- Company Profile: 9Kczr-Wlm - Bq7We-Mailchimp PasswordDocument6 pagesCompany Profile: 9Kczr-Wlm - Bq7We-Mailchimp PasswordChand KalraNo ratings yet

- Valuation Techniques: Presented byDocument32 pagesValuation Techniques: Presented byKeith NavalNo ratings yet

- Advantage, Returns, and Growth-In That OrderDocument4 pagesAdvantage, Returns, and Growth-In That OrderLuis Daniel Napa TorresNo ratings yet

- Tata Ethical Fund March 2021Document18 pagesTata Ethical Fund March 2021Capitus L. L. PNo ratings yet

- GLTU Value CreationDocument9 pagesGLTU Value CreationAnil GowdaNo ratings yet

- Sanchit 305Document19 pagesSanchit 305Ryan FirskyNo ratings yet

- ICAI Corporate ValuationDocument47 pagesICAI Corporate Valuationqamaraleem1_25038318No ratings yet

- Presentation - HDFC Business Cycle Fund NFODocument48 pagesPresentation - HDFC Business Cycle Fund NFOSahil AktarNo ratings yet

- Sampurna IA BrochureDocument6 pagesSampurna IA BrochurearkamitraNo ratings yet

- 017 Strategy Chapter 9 Strategy Evaluation SlidesDocument32 pages017 Strategy Chapter 9 Strategy Evaluation SlidesNash AsanaNo ratings yet

- MoF Issue 3Document24 pagesMoF Issue 3qweenNo ratings yet

- Corporatre ValuationDocument46 pagesCorporatre ValuationVipin MehtaNo ratings yet

- WH Tis ?: Fundamental Analysis A Fundamental AnalysisDocument7 pagesWH Tis ?: Fundamental Analysis A Fundamental AnalysisAbhinandan ChatterjeeNo ratings yet

- STMP10-3 Session 1Document14 pagesSTMP10-3 Session 1Gaurav JainNo ratings yet

- Tata Business Cycle Fund - NFO BrochureDocument4 pagesTata Business Cycle Fund - NFO BrochureawenewNo ratings yet

- BCG Ten Lessons From 20 Years of Value Creation Insights Nov 2018 Tcm21 208175Document8 pagesBCG Ten Lessons From 20 Years of Value Creation Insights Nov 2018 Tcm21 208175ram179No ratings yet

- MOSL WC Studies Notes 2018 PDFDocument257 pagesMOSL WC Studies Notes 2018 PDFAnkitNo ratings yet

- Fcffginzu - Xls Using The Valuation SpreadsheetDocument13 pagesFcffginzu - Xls Using The Valuation SpreadsheetMuhammad Zeeshan SaleemNo ratings yet

- Refreshing PurnarthaDocument13 pagesRefreshing PurnarthaRakesh RathodNo ratings yet

- How Much Is Your Startup WorthDocument4 pagesHow Much Is Your Startup WorthNano SamyurashviliNo ratings yet

- 74840bos60509 cp13Document64 pages74840bos60509 cp13ankitsethioneNo ratings yet

- Analysis & Interpretation: Prepared By: Sir Hamza Abdul HaqDocument10 pagesAnalysis & Interpretation: Prepared By: Sir Hamza Abdul HaqSrabon BaruaNo ratings yet

- AAA Digital India2Document19 pagesAAA Digital India2akamalapuriNo ratings yet

- Final CaDocument64 pagesFinal Cap Jhaveri100% (1)

- INTRODUCTIONDocument2 pagesINTRODUCTIONIffah IffahNo ratings yet

- 9th IBS Lecture - SAF-2022-23Document23 pages9th IBS Lecture - SAF-2022-23Nash AsanaNo ratings yet

- Introduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonDocument13 pagesIntroduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonPRACHI DASNo ratings yet

- Tudy The Impact of Growth, Firm Size, Capital Structure, and Pro Fitability On Enterprise Value: Evidence of Enterprises in VietnamDocument17 pagesTudy The Impact of Growth, Firm Size, Capital Structure, and Pro Fitability On Enterprise Value: Evidence of Enterprises in VietnamgemmyfoxNo ratings yet

- Advantage, Returns, and Growth-In That OrderDocument4 pagesAdvantage, Returns, and Growth-In That OrderLuis Daniel Napa TorresNo ratings yet

- Stock Market BrochureDocument9 pagesStock Market BrochureAkshay VermaNo ratings yet

- SBI ESG Portfolio Mar 2023Document21 pagesSBI ESG Portfolio Mar 2023SabSab MukNo ratings yet

- General Steps To Fundamental EvaluationDocument9 pagesGeneral Steps To Fundamental EvaluationkazminoNo ratings yet

- About Narnolia: 2nd Largest Registered Investment Advisor (RIA) of The Country, 2020-21Document4 pagesAbout Narnolia: 2nd Largest Registered Investment Advisor (RIA) of The Country, 2020-21Narnolia SecuritiesNo ratings yet

- Valuation - Discounted Cash Flow Method With Case Studies: Bengaluru Branch of SIRC of ICAIDocument33 pagesValuation - Discounted Cash Flow Method With Case Studies: Bengaluru Branch of SIRC of ICAIpre.meh21No ratings yet

- Resa Material Financial Statement AnalysisDocument12 pagesResa Material Financial Statement Analysispatrickjames.ravelaNo ratings yet

- Lecture 45 - FSADocument15 pagesLecture 45 - FSAPhúc Trần Võ MỹNo ratings yet

- (CFA) (2015) (L2) 20150314-15+20150321-22 - 权益和其他类投资分析 - 李斯克3Document135 pages(CFA) (2015) (L2) 20150314-15+20150321-22 - 权益和其他类投资分析 - 李斯克3Phyllis YenNo ratings yet

- IPO AnalyticsDocument31 pagesIPO AnalyticsPrajwal WakhareNo ratings yet

- 3 - IB Exam DCF DamodaranDocument5 pages3 - IB Exam DCF Damodaranmatthew erNo ratings yet

- Ahead of The Curve Future Proof Your Business in The CloudDocument17 pagesAhead of The Curve Future Proof Your Business in The CloudMichael de TocquevilleNo ratings yet

- Discounted Cash Flow DCF As A Measure of Startup FDocument24 pagesDiscounted Cash Flow DCF As A Measure of Startup FRavi SinghNo ratings yet

- Business ValuationsDocument29 pagesBusiness ValuationsRishabh singhNo ratings yet

- Formulate An Offer: Stephen Lawrence and Frank MoyesDocument13 pagesFormulate An Offer: Stephen Lawrence and Frank Moyesvkavtuashvili100% (2)

- Petroleum Economics Part 1 Oct 2009Document3 pagesPetroleum Economics Part 1 Oct 2009boisvertljNo ratings yet

- NDAQ Investor Presentation August 2023Document47 pagesNDAQ Investor Presentation August 2023aileenbanerjeeNo ratings yet

- What Drives Your Return On EquityDocument1 pageWhat Drives Your Return On Equitysilverjade03No ratings yet

- Business ModelDocument20 pagesBusiness ModelCurt Russell CagaoanNo ratings yet

- FABPro Specialities, Bangladesh 30th Sep, 2018Document52 pagesFABPro Specialities, Bangladesh 30th Sep, 2018ramsiva354No ratings yet

- Dynamic PMS BrochureDocument15 pagesDynamic PMS BrochurePradeep PrabhuNo ratings yet

- Sanchit 505 FinalDocument23 pagesSanchit 505 FinalRyan FirskyNo ratings yet

- BCG - Value Creation - More Than Commodity PriceDocument31 pagesBCG - Value Creation - More Than Commodity PricejrpranayNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- 09vwcma056 Naina LazarusDocument147 pages09vwcma056 Naina LazarusNitesh GarodiaNo ratings yet

- Ind AS 109 FI - Material 5 (Revisied) Compound Financial Instruments - With AnswersDocument2 pagesInd AS 109 FI - Material 5 (Revisied) Compound Financial Instruments - With AnswersjvbsdNo ratings yet

- Internal Audit PlanDocument1 pageInternal Audit Plannovita mujiNo ratings yet

- Cfas Notes (Pas and PFRS)Document3 pagesCfas Notes (Pas and PFRS)Gio BurburanNo ratings yet

- Assignment 2 FINANCEDocument2 pagesAssignment 2 FINANCEnaziaNo ratings yet

- Convexity and ImmunizationDocument8 pagesConvexity and Immunizationarjun guptaNo ratings yet

- Unit III Partnership LiquidationDocument20 pagesUnit III Partnership LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Journal Ledger & Trial BalanceDocument32 pagesJournal Ledger & Trial BalanceMr. Demon ExtraNo ratings yet

- Meaning of Export FinanceDocument2 pagesMeaning of Export Financeforamdoshi86% (7)

- Project ReportDocument59 pagesProject ReportAnuj YeleNo ratings yet

- Yes Bank Case FinalDocument5 pagesYes Bank Case FinalSourav JainNo ratings yet

- Insurance Abbreviations by Affairs CloudDocument30 pagesInsurance Abbreviations by Affairs CloudOm Singh IndaNo ratings yet

- DebenturesDocument7 pagesDebenturesHina KausarNo ratings yet

- Wolfsberg Credit Cards AML Guidance (2009)Document15 pagesWolfsberg Credit Cards AML Guidance (2009)harshscribd007No ratings yet

- Pepsico Inc 2019 Annual ReportDocument1 pagePepsico Inc 2019 Annual ReportToodley DooNo ratings yet

- Financial Reporting Thesis PDFDocument6 pagesFinancial Reporting Thesis PDFUK100% (2)

- T AccountDocument2 pagesT AccountSophia RamirezNo ratings yet

- Presented By: Sainbu Dutt Gupta Mukul Mansharamani Nikhil BhatiaDocument16 pagesPresented By: Sainbu Dutt Gupta Mukul Mansharamani Nikhil BhatiaSirohi JatNo ratings yet

- Audit Report of CYGNUS COR 2020Document20 pagesAudit Report of CYGNUS COR 2020Friends Law ChamberNo ratings yet

- Week 4 Balance OffDocument16 pagesWeek 4 Balance OffNor LailyNo ratings yet

- 1 Blockchain Babble FinalDocument3 pages1 Blockchain Babble Finalapi-610726438No ratings yet

- FLy Yrg 70 ZBQvde WRDocument15 pagesFLy Yrg 70 ZBQvde WRSantosh SpartanNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- Nominal and Effective Interest RateDocument4 pagesNominal and Effective Interest RateLarry NocesNo ratings yet

- Account Statement 301018 300119Document18 pagesAccount Statement 301018 300119cuttack cscndlmNo ratings yet

- ISYE 220 HW1 Q'sDocument1 pageISYE 220 HW1 Q'sAlex LopezNo ratings yet

- HBank Savings Account - Speciale Activ DeckDocument33 pagesHBank Savings Account - Speciale Activ DeckSrinivasan NarayananNo ratings yet

- In The Books of Virat Simple Cash Book DR. 2021Document13 pagesIn The Books of Virat Simple Cash Book DR. 2021S1626No ratings yet