Professional Documents

Culture Documents

FOMC RedLine

FOMC RedLine

Uploaded by

Eduardo VinanteCopyright:

Available Formats

You might also like

- Transferwise Document 10 PDFDocument2 pagesTransferwise Document 10 PDFMai-linh Polero Dean0% (1)

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- SidebysidefedDocument1 pageSidebysidefedandrewbloggerNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- 2010-09-21 - Fed Side by Side StatementsDocument2 pages2010-09-21 - Fed Side by Side Statementsglerner133926No ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- Fed Statement June 2009Document2 pagesFed Statement June 2009andrewbloggerNo ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- Conférence de Presse BCE JanvierDocument2 pagesConférence de Presse BCE JanvierToroloNo ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- FOMCpresconf20240501Document26 pagesFOMCpresconf20240501David SimõesNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Transcript of Chair Powell's Press Conference May 4, 2022Document24 pagesTranscript of Chair Powell's Press Conference May 4, 2022Learning的生活No ratings yet

- Unconventional Wisdom. Original Thinking.: Bulletin BoardDocument12 pagesUnconventional Wisdom. Original Thinking.: Bulletin BoardCurve123No ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- Analysis Australia Monetary PolicyDocument3 pagesAnalysis Australia Monetary Policysong neeNo ratings yet

- Fomc Pres Conf 20160615Document21 pagesFomc Pres Conf 20160615petere056No ratings yet

- Fed Redline FebruaryDocument2 pagesFed Redline FebruaryPradeep SolankiNo ratings yet

- FOMCpresconf 20210922Document26 pagesFOMCpresconf 20210922marcoNo ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- FOMCpresconf 20220316Document26 pagesFOMCpresconf 20220316marchmtetNo ratings yet

- Powell 20180717 ADocument6 pagesPowell 20180717 AZerohedgeNo ratings yet

- FOMCpresconf 20220615Document27 pagesFOMCpresconf 20220615S CNo ratings yet

- FOMCpresconf20230503 PDFDocument4 pagesFOMCpresconf20230503 PDFJavierNo ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- Bernanke TestimonyDocument8 pagesBernanke TestimonyZerohedgeNo ratings yet

- Powell 20230621 ADocument5 pagesPowell 20230621 ADaily Caller News FoundationNo ratings yet

- FOMCpresconf 20230503Document25 pagesFOMCpresconf 20230503Edi SaputraNo ratings yet

- The Financial Stability Report Holistically AssessesDocument8 pagesThe Financial Stability Report Holistically AssessesKhushal PuriNo ratings yet

- March 22, 2023 - Fed Chair Prepared RemarksDocument5 pagesMarch 22, 2023 - Fed Chair Prepared RemarksRam AhluwaliaNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- Contentment: Neutral Stance Maintained: Economic InsightsDocument2 pagesContentment: Neutral Stance Maintained: Economic InsightsAnonymous hPUlIF6No ratings yet

- Comptabilité Tle G3 Et G2Document24 pagesComptabilité Tle G3 Et G2albertvalk2.0No ratings yet

- Statement by Philip Lowe, Governor: Monetary Policy Decision - Media Releases - RBADocument3 pagesStatement by Philip Lowe, Governor: Monetary Policy Decision - Media Releases - RBATraderNo ratings yet

- Bernanke Speech 20110203Document11 pagesBernanke Speech 20110203SarweinNo ratings yet

- Ben Bernanke - Frequently Asked QuestionsDocument9 pagesBen Bernanke - Frequently Asked QuestionsJohn SutherlandNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Bangalore Residential Market Report April 2012 PDFDocument44 pagesBangalore Residential Market Report April 2012 PDFPonchuNo ratings yet

- Make in IndiaDocument10 pagesMake in Indiamunna tiwariNo ratings yet

- ProgressDocument83 pagesProgressJohn Timothy VillacorteNo ratings yet

- Fasanara Capital 85% Spent PDFDocument11 pagesFasanara Capital 85% Spent PDFZerohedgeNo ratings yet

- Wasilwa - Challenges Posed by Common Market For Eastern and Southern Africa (Comesa) On Sugar Millers in KenyaDocument74 pagesWasilwa - Challenges Posed by Common Market For Eastern and Southern Africa (Comesa) On Sugar Millers in KenyakevinNo ratings yet

- Outstanding Entries As On 24 Jan 2023 998Document2 pagesOutstanding Entries As On 24 Jan 2023 998Hussain MerchantNo ratings yet

- About EthicsDocument21 pagesAbout EthicsJade MarkNo ratings yet

- PSPCL Bill 3002787835 Due On 2020-MAY-22Document1 pagePSPCL Bill 3002787835 Due On 2020-MAY-22Pallvi Nahar BhatiaNo ratings yet

- Assignment On MHRDocument21 pagesAssignment On MHRDiksha SinglaNo ratings yet

- Internal and External Analysis of The Automotive IndustryDocument9 pagesInternal and External Analysis of The Automotive IndustryRohit SoniNo ratings yet

- Factor-Factor RelationshipDocument28 pagesFactor-Factor RelationshipMohammad RizwanNo ratings yet

- Yayasan Mercusuar (BacePanel) - R4.1Document20 pagesYayasan Mercusuar (BacePanel) - R4.1Ahmad FaizalNo ratings yet

- List of Bir Forms: Form No. Form TitleDocument2 pagesList of Bir Forms: Form No. Form Titleabc360shelleNo ratings yet

- Bacc 121 Module OneDocument9 pagesBacc 121 Module OnehwoNo ratings yet

- SHS Micro Financing in NepalDocument24 pagesSHS Micro Financing in NepalparipranaNo ratings yet

- Ongoing Projects in DelhiDocument5 pagesOngoing Projects in Delhirahulchauhan7869No ratings yet

- Cbiresult Central Bank of IndiaDocument17 pagesCbiresult Central Bank of IndiaMohan GoyalNo ratings yet

- Application of Memebership Namrata DubeyDocument2 pagesApplication of Memebership Namrata DubeyBHOOMI REALTY AND CONSULTANCY - ADMINNo ratings yet

- 2019-2020 Pacing Guides - Ap World 3Document2 pages2019-2020 Pacing Guides - Ap World 3api-494149696No ratings yet

- Balance Between Human Rights and Intellectual Property LawsDocument3 pagesBalance Between Human Rights and Intellectual Property LawsEugenia PreethiNo ratings yet

- Self PracticeDocument1 pageSelf Practiceloislam12345No ratings yet

- EAManufacturersDirectorySSudan - 2020 - 副本Document16 pagesEAManufacturersDirectorySSudan - 2020 - 副本Leo SuNo ratings yet

- Master LOIDocument2 pagesMaster LOIKennethHarmon74No ratings yet

- Companies in MalaysiaDocument17 pagesCompanies in MalaysiaRRNo ratings yet

- A Case Study On Pension FundDocument4 pagesA Case Study On Pension FundJalalur RahmanNo ratings yet

- The Difference Between Macro and MicroeconomicsDocument3 pagesThe Difference Between Macro and MicroeconomicsMd Shahbub Alam SonyNo ratings yet

- I. Some General Observations: EconomicDocument12 pagesI. Some General Observations: EconomicJacob DavidNo ratings yet

- Forms of Tourism: Prepared By: Ma'am LDocument13 pagesForms of Tourism: Prepared By: Ma'am LShivam AggarwalNo ratings yet

FOMC RedLine

FOMC RedLine

Uploaded by

Eduardo VinanteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FOMC RedLine

FOMC RedLine

Uploaded by

Eduardo VinanteCopyright:

Available Formats

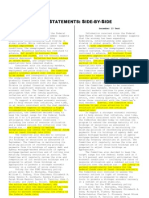

For immediate release

Information received since the Federal Open Market Committee met in AprilJune indicates that the economic recovery is continuing at a moderate pace, though somewhat more slowly growth so far this year has been considerably slower than the Committee had expected. Also, recent Indicators suggest a deterioration in overall labor market indicators have been weaker than anticipated. The slower pace ofconditions in recent months, and the unemployment rate has moved up. Household spending has flattened out, investment in nonresidential structures is still weak, and the recovery reflects in parthousing sector remains depressed. However, business investment in equipment and software continues to expand. Temporary factors that are likely to be temporary, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan. Household spending and business investment in equipment and software continue, appear to expand. However, investment in nonresidential structures is still weak, andaccount for only some of the housing sector continues to be depressed. recent weakness in economic activity. Inflation has picked up earlier in recent monthsthe year, mainly reflecting higher prices for some commodities and imported goods, as well as the recent supply chain disruptions. However, longer More recently, inflation has moderated as prices of energy and some commodities have declined from their earlier peaks. Longer-term inflation expectations have remained stable. Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The unemployment rate remains elevated; however, the Committee now expects the a somewhat slower pace of recovery to pick up over coming quarters than it did at the time of the previous meeting and anticipates that the unemployment rate to resume its gradualwill decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Inflation has moved up recently, but Moreover, downside risks to the economic outlook have increased. The Committee also anticipates that inflation will subside tosettle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate. further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations. To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipatecurrently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate for an extended period. at least through mid-2013. The Committee will complete its purchases of $600 billion of longer-term Treasury securities by the end of this month andalso will maintain its existing policy of reinvesting principal payments from its securities holdings. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate. The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will monitorcontinue to assess the economic outlook in

light of incoming information and financial developments and will actis prepared to employ these tools as needed to best foster maximum employment and price stability.appropriate. Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. PlosserEvans; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action were: Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser, who would have preferred to continue to describe economic conditions as likely to warrant exceptionally low levels for the federal funds rate for an extended period.

You might also like

- Transferwise Document 10 PDFDocument2 pagesTransferwise Document 10 PDFMai-linh Polero Dean0% (1)

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- SidebysidefedDocument1 pageSidebysidefedandrewbloggerNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- 2010-09-21 - Fed Side by Side StatementsDocument2 pages2010-09-21 - Fed Side by Side Statementsglerner133926No ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- Fed Statement June 2009Document2 pagesFed Statement June 2009andrewbloggerNo ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- Conférence de Presse BCE JanvierDocument2 pagesConférence de Presse BCE JanvierToroloNo ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- FOMCpresconf20240501Document26 pagesFOMCpresconf20240501David SimõesNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Transcript of Chair Powell's Press Conference May 4, 2022Document24 pagesTranscript of Chair Powell's Press Conference May 4, 2022Learning的生活No ratings yet

- Unconventional Wisdom. Original Thinking.: Bulletin BoardDocument12 pagesUnconventional Wisdom. Original Thinking.: Bulletin BoardCurve123No ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- Analysis Australia Monetary PolicyDocument3 pagesAnalysis Australia Monetary Policysong neeNo ratings yet

- Fomc Pres Conf 20160615Document21 pagesFomc Pres Conf 20160615petere056No ratings yet

- Fed Redline FebruaryDocument2 pagesFed Redline FebruaryPradeep SolankiNo ratings yet

- FOMCpresconf 20210922Document26 pagesFOMCpresconf 20210922marcoNo ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- FOMCpresconf 20220316Document26 pagesFOMCpresconf 20220316marchmtetNo ratings yet

- Powell 20180717 ADocument6 pagesPowell 20180717 AZerohedgeNo ratings yet

- FOMCpresconf 20220615Document27 pagesFOMCpresconf 20220615S CNo ratings yet

- FOMCpresconf20230503 PDFDocument4 pagesFOMCpresconf20230503 PDFJavierNo ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- Bernanke TestimonyDocument8 pagesBernanke TestimonyZerohedgeNo ratings yet

- Powell 20230621 ADocument5 pagesPowell 20230621 ADaily Caller News FoundationNo ratings yet

- FOMCpresconf 20230503Document25 pagesFOMCpresconf 20230503Edi SaputraNo ratings yet

- The Financial Stability Report Holistically AssessesDocument8 pagesThe Financial Stability Report Holistically AssessesKhushal PuriNo ratings yet

- March 22, 2023 - Fed Chair Prepared RemarksDocument5 pagesMarch 22, 2023 - Fed Chair Prepared RemarksRam AhluwaliaNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- Contentment: Neutral Stance Maintained: Economic InsightsDocument2 pagesContentment: Neutral Stance Maintained: Economic InsightsAnonymous hPUlIF6No ratings yet

- Comptabilité Tle G3 Et G2Document24 pagesComptabilité Tle G3 Et G2albertvalk2.0No ratings yet

- Statement by Philip Lowe, Governor: Monetary Policy Decision - Media Releases - RBADocument3 pagesStatement by Philip Lowe, Governor: Monetary Policy Decision - Media Releases - RBATraderNo ratings yet

- Bernanke Speech 20110203Document11 pagesBernanke Speech 20110203SarweinNo ratings yet

- Ben Bernanke - Frequently Asked QuestionsDocument9 pagesBen Bernanke - Frequently Asked QuestionsJohn SutherlandNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Bangalore Residential Market Report April 2012 PDFDocument44 pagesBangalore Residential Market Report April 2012 PDFPonchuNo ratings yet

- Make in IndiaDocument10 pagesMake in Indiamunna tiwariNo ratings yet

- ProgressDocument83 pagesProgressJohn Timothy VillacorteNo ratings yet

- Fasanara Capital 85% Spent PDFDocument11 pagesFasanara Capital 85% Spent PDFZerohedgeNo ratings yet

- Wasilwa - Challenges Posed by Common Market For Eastern and Southern Africa (Comesa) On Sugar Millers in KenyaDocument74 pagesWasilwa - Challenges Posed by Common Market For Eastern and Southern Africa (Comesa) On Sugar Millers in KenyakevinNo ratings yet

- Outstanding Entries As On 24 Jan 2023 998Document2 pagesOutstanding Entries As On 24 Jan 2023 998Hussain MerchantNo ratings yet

- About EthicsDocument21 pagesAbout EthicsJade MarkNo ratings yet

- PSPCL Bill 3002787835 Due On 2020-MAY-22Document1 pagePSPCL Bill 3002787835 Due On 2020-MAY-22Pallvi Nahar BhatiaNo ratings yet

- Assignment On MHRDocument21 pagesAssignment On MHRDiksha SinglaNo ratings yet

- Internal and External Analysis of The Automotive IndustryDocument9 pagesInternal and External Analysis of The Automotive IndustryRohit SoniNo ratings yet

- Factor-Factor RelationshipDocument28 pagesFactor-Factor RelationshipMohammad RizwanNo ratings yet

- Yayasan Mercusuar (BacePanel) - R4.1Document20 pagesYayasan Mercusuar (BacePanel) - R4.1Ahmad FaizalNo ratings yet

- List of Bir Forms: Form No. Form TitleDocument2 pagesList of Bir Forms: Form No. Form Titleabc360shelleNo ratings yet

- Bacc 121 Module OneDocument9 pagesBacc 121 Module OnehwoNo ratings yet

- SHS Micro Financing in NepalDocument24 pagesSHS Micro Financing in NepalparipranaNo ratings yet

- Ongoing Projects in DelhiDocument5 pagesOngoing Projects in Delhirahulchauhan7869No ratings yet

- Cbiresult Central Bank of IndiaDocument17 pagesCbiresult Central Bank of IndiaMohan GoyalNo ratings yet

- Application of Memebership Namrata DubeyDocument2 pagesApplication of Memebership Namrata DubeyBHOOMI REALTY AND CONSULTANCY - ADMINNo ratings yet

- 2019-2020 Pacing Guides - Ap World 3Document2 pages2019-2020 Pacing Guides - Ap World 3api-494149696No ratings yet

- Balance Between Human Rights and Intellectual Property LawsDocument3 pagesBalance Between Human Rights and Intellectual Property LawsEugenia PreethiNo ratings yet

- Self PracticeDocument1 pageSelf Practiceloislam12345No ratings yet

- EAManufacturersDirectorySSudan - 2020 - 副本Document16 pagesEAManufacturersDirectorySSudan - 2020 - 副本Leo SuNo ratings yet

- Master LOIDocument2 pagesMaster LOIKennethHarmon74No ratings yet

- Companies in MalaysiaDocument17 pagesCompanies in MalaysiaRRNo ratings yet

- A Case Study On Pension FundDocument4 pagesA Case Study On Pension FundJalalur RahmanNo ratings yet

- The Difference Between Macro and MicroeconomicsDocument3 pagesThe Difference Between Macro and MicroeconomicsMd Shahbub Alam SonyNo ratings yet

- I. Some General Observations: EconomicDocument12 pagesI. Some General Observations: EconomicJacob DavidNo ratings yet

- Forms of Tourism: Prepared By: Ma'am LDocument13 pagesForms of Tourism: Prepared By: Ma'am LShivam AggarwalNo ratings yet