Professional Documents

Culture Documents

Chapter 4 (Cont) Allowance For D. Debts

Chapter 4 (Cont) Allowance For D. Debts

Uploaded by

Deveender Kaur JudgeCopyright:

Available Formats

You might also like

- Setoff BondDocument1 pageSetoff BondMichael Kovach95% (42)

- Frankwood Question Bank DSEDocument19 pagesFrankwood Question Bank DSEAu Tsz Man50% (4)

- CH 14Document2 pagesCH 14tigger5191100% (1)

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Problems: Set B: InstructionsDocument4 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingDocument10 pagesACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaNo ratings yet

- Credit Report: Shannon CoxDocument60 pagesCredit Report: Shannon CoxShanNo ratings yet

- JPM - Abs-Cdo 2009-09-25Document95 pagesJPM - Abs-Cdo 2009-09-25Ryan JinNo ratings yet

- Pas 7 Cash Flow StatementsDocument7 pagesPas 7 Cash Flow StatementsRechelleNo ratings yet

- Purchaseworkshop PDFDocument44 pagesPurchaseworkshop PDFNikkie White100% (1)

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranRishab BuchaNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- Soal KuisDocument2 pagesSoal KuisSugeng FitriyonoNo ratings yet

- Chapter 14 Exercises - Set BDocument6 pagesChapter 14 Exercises - Set BHeather PaulsenNo ratings yet

- Bad Debts, Bad Debts Recovered & Provision For Bad DebtsDocument7 pagesBad Debts, Bad Debts Recovered & Provision For Bad Debtssnap100% (1)

- Book Keeping and Accounts Past Paper Series 4 2011Document7 pagesBook Keeping and Accounts Past Paper Series 4 2011i saiNo ratings yet

- Aber Corporation S Balance Sheet at December 31 2009 Is PresenDocument1 pageAber Corporation S Balance Sheet at December 31 2009 Is PresenM Bilal SaleemNo ratings yet

- Bus StudDocument74 pagesBus Studoby83.oooNo ratings yet

- Practice Paper Business, Accounting and Financial Studies Paper 2A Accounting ModuleDocument10 pagesPractice Paper Business, Accounting and Financial Studies Paper 2A Accounting Modulenw08042No ratings yet

- Bad Debts and Pfbd..Document6 pagesBad Debts and Pfbd..rizwan ul hassanNo ratings yet

- Latihan 7 PAK MaksiDocument3 pagesLatihan 7 PAK MaksiDwi HandariniNo ratings yet

- Fully Worked Questions: Bad Debts and Allowance For Doubtful DebtsDocument11 pagesFully Worked Questions: Bad Debts and Allowance For Doubtful DebtsCNPHIRINo ratings yet

- Financial Accounting 2012 Exam PaperDocument28 pagesFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- Soal ReceivableDocument1 pageSoal ReceivableMutia RiskaNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- Bad Debts QuestionsDocument13 pagesBad Debts QuestionsAejaz Mohamed100% (2)

- BCIT Exam Review Problem 9-D2Document2 pagesBCIT Exam Review Problem 9-D2Kim HangNo ratings yet

- December 11th 2013 (KB)Document4 pagesDecember 11th 2013 (KB)nic tNo ratings yet

- Book1Document2 pagesBook1Akthar BashaNo ratings yet

- ASE20050A Practice PaperDocument6 pagesASE20050A Practice PaperMyo NaingNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- December 10th 2009 (KB)Document4 pagesDecember 10th 2009 (KB)nic tNo ratings yet

- Practice Midterm Questions JAN 2022 Second With SOLUTIONS v7Document17 pagesPractice Midterm Questions JAN 2022 Second With SOLUTIONS v7Aryan JainNo ratings yet

- Pengantar Akuntansi 2Document3 pagesPengantar Akuntansi 2vi ngelsNo ratings yet

- CSEC POA June 2012 P2Document9 pagesCSEC POA June 2012 P2goseinvarunNo ratings yet

- 2011 Audited FsDocument75 pages2011 Audited FsJundi TNo ratings yet

- MIT Sloan School of Management: Saving 2Document4 pagesMIT Sloan School of Management: Saving 2junaid1626No ratings yet

- Pa 2Document3 pagesPa 2vi ngelsNo ratings yet

- At December 31 2010 The Trial Balance of Worcester Company PDFDocument1 pageAt December 31 2010 The Trial Balance of Worcester Company PDFAnbu jaromiaNo ratings yet

- B4 IfaDocument4 pagesB4 IfaadnanNo ratings yet

- This Study Resource Was: Use The Following Information For The Next Two QuestionsDocument2 pagesThis Study Resource Was: Use The Following Information For The Next Two QuestionsClaudette Clemente100% (1)

- PR 9 Piutang 2023pdfDocument2 pagesPR 9 Piutang 2023pdfAhah BsbNo ratings yet

- HBC 2208Document4 pagesHBC 2208hezronNo ratings yet

- Nov2010 Paper2 Q1 OlevelDocument3 pagesNov2010 Paper2 Q1 OlevelAbid faisal AhmedNo ratings yet

- CSEC POA January 2011 P2Document10 pagesCSEC POA January 2011 P2Jael BernardNo ratings yet

- Rrhttps:/doc 00 5g Prod 03 Apps Viewer - Googleusercontent.com/viewer2/prod 03Document14 pagesRrhttps:/doc 00 5g Prod 03 Apps Viewer - Googleusercontent.com/viewer2/prod 03mdparvez1340No ratings yet

- Bank Reconciliation PDFDocument12 pagesBank Reconciliation PDFKetan Thakkar100% (1)

- Introduction To Financial Accounting: T I C A PDocument5 pagesIntroduction To Financial Accounting: T I C A PadnanNo ratings yet

- CH 09Document4 pagesCH 09flrnciairnNo ratings yet

- Chapter 9Document7 pagesChapter 9Saharin Islam ShakibNo ratings yet

- On September 1 2011 Quick Lube Signed A 30 Year 1 080 000Document1 pageOn September 1 2011 Quick Lube Signed A 30 Year 1 080 000Amit PandeyNo ratings yet

- On September 1 2011 Quick Lube Signed A 30 Year 1 080 000Document1 pageOn September 1 2011 Quick Lube Signed A 30 Year 1 080 000Amit PandeyNo ratings yet

- On September 1 2011 Quick Lube Signed A 30 Year 1 080 000Document1 pageOn September 1 2011 Quick Lube Signed A 30 Year 1 080 000Amit PandeyNo ratings yet

- The University South Pacific: School of Accounting and FinanceDocument9 pagesThe University South Pacific: School of Accounting and FinanceTetzNo ratings yet

- Sample MCQDocument8 pagesSample MCQJacky LamNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualKellyMorenootdnj100% (88)

- May 2012Document17 pagesMay 2012Cayden FavaNo ratings yet

- On January 1 2010 Fair Company Issued 3 000 000 Face ValueDocument1 pageOn January 1 2010 Fair Company Issued 3 000 000 Face ValueM Bilal SaleemNo ratings yet

- Bad Debts and Provision For Bad Debts Practice Questions File 1Document4 pagesBad Debts and Provision For Bad Debts Practice Questions File 1Jahanzaib ButtNo ratings yet

- Revision AccountsDocument3 pagesRevision AccountsZaara AshfaqNo ratings yet

- FA1 Chapter 1 EngDocument21 pagesFA1 Chapter 1 EngYong ChanNo ratings yet

- Diploma in Accountancy December 2023 QaDocument240 pagesDiploma in Accountancy December 2023 QaKipson Drizo MuksNo ratings yet

- Statistics Assignment 3Document3 pagesStatistics Assignment 3Deveender Kaur JudgeNo ratings yet

- Chapter 6 Depreciation of Non-Current AssetsDocument2 pagesChapter 6 Depreciation of Non-Current AssetsDeveender Kaur JudgeNo ratings yet

- Chapter 5 Bank Reconciliation StatementDocument2 pagesChapter 5 Bank Reconciliation StatementDeveender Kaur JudgeNo ratings yet

- Chapter 4 Bad DebtsDocument5 pagesChapter 4 Bad DebtsDeveender Kaur JudgeNo ratings yet

- Chapter 1 Double Entry System-StockDocument2 pagesChapter 1 Double Entry System-StockDeveender Kaur JudgeNo ratings yet

- Chapter 1 Users of Accounting InformationDocument2 pagesChapter 1 Users of Accounting InformationDeveender Kaur JudgeNo ratings yet

- Chapter 1 Effect of Business Transactions On Accounting EquationDocument1 pageChapter 1 Effect of Business Transactions On Accounting EquationDeveender Kaur JudgeNo ratings yet

- Chapter 1 Double Entry System For Income & ExpensesDocument2 pagesChapter 1 Double Entry System For Income & ExpensesDeveender Kaur JudgeNo ratings yet

- Financial Statemnt AnalysisDocument39 pagesFinancial Statemnt AnalysisNor CahayaNo ratings yet

- Chapter 31: Financial Distress: Original Claim Distribution of Liquidating ValueDocument2 pagesChapter 31: Financial Distress: Original Claim Distribution of Liquidating ValueEhsan MohitiNo ratings yet

- Abk JPMDocument4 pagesAbk JPMZerohedgeNo ratings yet

- The Stony Brook Press - Volume 7, Issue 4Document12 pagesThe Stony Brook Press - Volume 7, Issue 4The Stony Brook PressNo ratings yet

- Loan Senction Letter IDFC FIRST BANK FOR A-98Document8 pagesLoan Senction Letter IDFC FIRST BANK FOR A-98smepaisalendingNo ratings yet

- COMMERCIAL SECURITY AGREEMENT: #CPM-05202006-RA 600 756 856 US Debtor: John Philip Doe©Document21 pagesCOMMERCIAL SECURITY AGREEMENT: #CPM-05202006-RA 600 756 856 US Debtor: John Philip Doe©Nadah8100% (1)

- Ideaflow SampleDocument31 pagesIdeaflow SamplePeter ChangNo ratings yet

- Corporate Finance Core Principles and Applications 3rd Edition Ross Test BankDocument65 pagesCorporate Finance Core Principles and Applications 3rd Edition Ross Test BankChristopherDyerkczqw100% (20)

- New Research PaperDocument6 pagesNew Research Paperbilal nagoriNo ratings yet

- BWBB3043 A182 Topic13.2 Prohibitory Order - EditedDocument7 pagesBWBB3043 A182 Topic13.2 Prohibitory Order - EditedWeihan KhorNo ratings yet

- Exp22 Excel ch02 ml2 - Vacation Property InstructionsDocument2 pagesExp22 Excel ch02 ml2 - Vacation Property Instructionsapi-572422586No ratings yet

- Wealth Management Module PDFDocument109 pagesWealth Management Module PDFAnujBhanot100% (1)

- Balance Sheet As On 1-4-2012: Liabilities RS Assets RSDocument2 pagesBalance Sheet As On 1-4-2012: Liabilities RS Assets RSL.D TECHNICAL POINTNo ratings yet

- Financial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomDocument74 pagesFinancial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomUmesh KathariyaNo ratings yet

- sd1 EngDocument4 pagessd1 EngGZMO GroupNo ratings yet

- CBSE Class XII 2024 Commerce Accountancy Sample Paper SolDocument11 pagesCBSE Class XII 2024 Commerce Accountancy Sample Paper Solrajputudbhav2429No ratings yet

- WEEK 1 (September 24) : - Contracts of Real Security - Contracts of Personal SecurityDocument11 pagesWEEK 1 (September 24) : - Contracts of Real Security - Contracts of Personal SecurityDANICA FLORESNo ratings yet

- Minor Project ReportDocument69 pagesMinor Project ReportrimpaNo ratings yet

- MOU - PadmalochanaDocument4 pagesMOU - PadmalochanaBoopathy RangasamyNo ratings yet

- FactoringDocument22 pagesFactoringRajinder Kaur100% (1)

- Fria LawDocument40 pagesFria LawSK San Isidro BombonNo ratings yet

- Be Free! By:mary Elizabeth CroftDocument90 pagesBe Free! By:mary Elizabeth Croft1 watchman100% (2)

- Ipsas 2 Notes 2021Document9 pagesIpsas 2 Notes 2021Wilson Mugenyi KasendwaNo ratings yet

Chapter 4 (Cont) Allowance For D. Debts

Chapter 4 (Cont) Allowance For D. Debts

Uploaded by

Deveender Kaur JudgeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 (Cont) Allowance For D. Debts

Chapter 4 (Cont) Allowance For D. Debts

Uploaded by

Deveender Kaur JudgeCopyright:

Available Formats

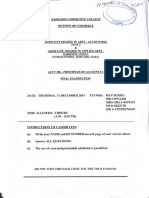

Allowance for doubtful debts

1. Sarah commenced her business on 1 January 2009. She had decided to adjust the

allowance for doubtful debts at the end of each accounting year. The following is the

related information extracted out from her accounts for three accounting years ended 31

December 2009, 2010 and 2011.

Year Bad Debts written off Debtors % of Allowance for

ended 31 ($) balance at 31 doubtful debts

Decembe December

r ($)

2009 328 11,000 5%

2010 900 20,000 6%

2011 1,900 30,000 3%

Required:

Prepare the following for the 3 years ended 31 December 2009, 2010 and 2011:

(a) Bad Debts Account.

(3 marks)

(b) Allowance for Doubtful Debts Account.

(3 marks)

(c) Balance sheet extracts as at 31 December 2009, 2010 & 20111.

(3 marks)

2. On 31October 2010, the sundry debtors of High Company stood at $10,000 and the

balance on the Allowance for Doubtful Debts account at 1 November 2009 was $200.

Of the debtors it was considered that $500 were irrecoverable and should be written off.

It was decided that the Allowance for Doubtful Debts should be made equal to 5% of the

outstanding accounts.

At 31 October 2011, the debtors balance had fallen to $8,000, of which $100 were

considered to be irrecoverable and should be written off. The Allowance for Doubtful

Debts was to be at the same rate as in 2010.

Required:

a) Show the Bad Debts account for the year ended 31 October 2010 and 2011.

(2 marks)

b) Show the Allowance for Doubtful Debts account for the year ended 31 October

2010 and 2011.

(3 marks)

c) Show the relevant figures in the Income Statement for the 2 years 2010 and 2011.

(2 marks)

e) Show the relevant figures in the Balance Sheet for the 2 years 2010 and 2011.

(2

marks)

3. Business often create an allowance for doubtful debts.

a) Of which concept is this an example? Explain your answer. (2 marks)

You might also like

- Setoff BondDocument1 pageSetoff BondMichael Kovach95% (42)

- Frankwood Question Bank DSEDocument19 pagesFrankwood Question Bank DSEAu Tsz Man50% (4)

- CH 14Document2 pagesCH 14tigger5191100% (1)

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Problems: Set B: InstructionsDocument4 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingDocument10 pagesACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaNo ratings yet

- Credit Report: Shannon CoxDocument60 pagesCredit Report: Shannon CoxShanNo ratings yet

- JPM - Abs-Cdo 2009-09-25Document95 pagesJPM - Abs-Cdo 2009-09-25Ryan JinNo ratings yet

- Pas 7 Cash Flow StatementsDocument7 pagesPas 7 Cash Flow StatementsRechelleNo ratings yet

- Purchaseworkshop PDFDocument44 pagesPurchaseworkshop PDFNikkie White100% (1)

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranRishab BuchaNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- Soal KuisDocument2 pagesSoal KuisSugeng FitriyonoNo ratings yet

- Chapter 14 Exercises - Set BDocument6 pagesChapter 14 Exercises - Set BHeather PaulsenNo ratings yet

- Bad Debts, Bad Debts Recovered & Provision For Bad DebtsDocument7 pagesBad Debts, Bad Debts Recovered & Provision For Bad Debtssnap100% (1)

- Book Keeping and Accounts Past Paper Series 4 2011Document7 pagesBook Keeping and Accounts Past Paper Series 4 2011i saiNo ratings yet

- Aber Corporation S Balance Sheet at December 31 2009 Is PresenDocument1 pageAber Corporation S Balance Sheet at December 31 2009 Is PresenM Bilal SaleemNo ratings yet

- Bus StudDocument74 pagesBus Studoby83.oooNo ratings yet

- Practice Paper Business, Accounting and Financial Studies Paper 2A Accounting ModuleDocument10 pagesPractice Paper Business, Accounting and Financial Studies Paper 2A Accounting Modulenw08042No ratings yet

- Bad Debts and Pfbd..Document6 pagesBad Debts and Pfbd..rizwan ul hassanNo ratings yet

- Latihan 7 PAK MaksiDocument3 pagesLatihan 7 PAK MaksiDwi HandariniNo ratings yet

- Fully Worked Questions: Bad Debts and Allowance For Doubtful DebtsDocument11 pagesFully Worked Questions: Bad Debts and Allowance For Doubtful DebtsCNPHIRINo ratings yet

- Financial Accounting 2012 Exam PaperDocument28 pagesFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- Soal ReceivableDocument1 pageSoal ReceivableMutia RiskaNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- Bad Debts QuestionsDocument13 pagesBad Debts QuestionsAejaz Mohamed100% (2)

- BCIT Exam Review Problem 9-D2Document2 pagesBCIT Exam Review Problem 9-D2Kim HangNo ratings yet

- December 11th 2013 (KB)Document4 pagesDecember 11th 2013 (KB)nic tNo ratings yet

- Book1Document2 pagesBook1Akthar BashaNo ratings yet

- ASE20050A Practice PaperDocument6 pagesASE20050A Practice PaperMyo NaingNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- December 10th 2009 (KB)Document4 pagesDecember 10th 2009 (KB)nic tNo ratings yet

- Practice Midterm Questions JAN 2022 Second With SOLUTIONS v7Document17 pagesPractice Midterm Questions JAN 2022 Second With SOLUTIONS v7Aryan JainNo ratings yet

- Pengantar Akuntansi 2Document3 pagesPengantar Akuntansi 2vi ngelsNo ratings yet

- CSEC POA June 2012 P2Document9 pagesCSEC POA June 2012 P2goseinvarunNo ratings yet

- 2011 Audited FsDocument75 pages2011 Audited FsJundi TNo ratings yet

- MIT Sloan School of Management: Saving 2Document4 pagesMIT Sloan School of Management: Saving 2junaid1626No ratings yet

- Pa 2Document3 pagesPa 2vi ngelsNo ratings yet

- At December 31 2010 The Trial Balance of Worcester Company PDFDocument1 pageAt December 31 2010 The Trial Balance of Worcester Company PDFAnbu jaromiaNo ratings yet

- B4 IfaDocument4 pagesB4 IfaadnanNo ratings yet

- This Study Resource Was: Use The Following Information For The Next Two QuestionsDocument2 pagesThis Study Resource Was: Use The Following Information For The Next Two QuestionsClaudette Clemente100% (1)

- PR 9 Piutang 2023pdfDocument2 pagesPR 9 Piutang 2023pdfAhah BsbNo ratings yet

- HBC 2208Document4 pagesHBC 2208hezronNo ratings yet

- Nov2010 Paper2 Q1 OlevelDocument3 pagesNov2010 Paper2 Q1 OlevelAbid faisal AhmedNo ratings yet

- CSEC POA January 2011 P2Document10 pagesCSEC POA January 2011 P2Jael BernardNo ratings yet

- Rrhttps:/doc 00 5g Prod 03 Apps Viewer - Googleusercontent.com/viewer2/prod 03Document14 pagesRrhttps:/doc 00 5g Prod 03 Apps Viewer - Googleusercontent.com/viewer2/prod 03mdparvez1340No ratings yet

- Bank Reconciliation PDFDocument12 pagesBank Reconciliation PDFKetan Thakkar100% (1)

- Introduction To Financial Accounting: T I C A PDocument5 pagesIntroduction To Financial Accounting: T I C A PadnanNo ratings yet

- CH 09Document4 pagesCH 09flrnciairnNo ratings yet

- Chapter 9Document7 pagesChapter 9Saharin Islam ShakibNo ratings yet

- On September 1 2011 Quick Lube Signed A 30 Year 1 080 000Document1 pageOn September 1 2011 Quick Lube Signed A 30 Year 1 080 000Amit PandeyNo ratings yet

- On September 1 2011 Quick Lube Signed A 30 Year 1 080 000Document1 pageOn September 1 2011 Quick Lube Signed A 30 Year 1 080 000Amit PandeyNo ratings yet

- On September 1 2011 Quick Lube Signed A 30 Year 1 080 000Document1 pageOn September 1 2011 Quick Lube Signed A 30 Year 1 080 000Amit PandeyNo ratings yet

- The University South Pacific: School of Accounting and FinanceDocument9 pagesThe University South Pacific: School of Accounting and FinanceTetzNo ratings yet

- Sample MCQDocument8 pagesSample MCQJacky LamNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualKellyMorenootdnj100% (88)

- May 2012Document17 pagesMay 2012Cayden FavaNo ratings yet

- On January 1 2010 Fair Company Issued 3 000 000 Face ValueDocument1 pageOn January 1 2010 Fair Company Issued 3 000 000 Face ValueM Bilal SaleemNo ratings yet

- Bad Debts and Provision For Bad Debts Practice Questions File 1Document4 pagesBad Debts and Provision For Bad Debts Practice Questions File 1Jahanzaib ButtNo ratings yet

- Revision AccountsDocument3 pagesRevision AccountsZaara AshfaqNo ratings yet

- FA1 Chapter 1 EngDocument21 pagesFA1 Chapter 1 EngYong ChanNo ratings yet

- Diploma in Accountancy December 2023 QaDocument240 pagesDiploma in Accountancy December 2023 QaKipson Drizo MuksNo ratings yet

- Statistics Assignment 3Document3 pagesStatistics Assignment 3Deveender Kaur JudgeNo ratings yet

- Chapter 6 Depreciation of Non-Current AssetsDocument2 pagesChapter 6 Depreciation of Non-Current AssetsDeveender Kaur JudgeNo ratings yet

- Chapter 5 Bank Reconciliation StatementDocument2 pagesChapter 5 Bank Reconciliation StatementDeveender Kaur JudgeNo ratings yet

- Chapter 4 Bad DebtsDocument5 pagesChapter 4 Bad DebtsDeveender Kaur JudgeNo ratings yet

- Chapter 1 Double Entry System-StockDocument2 pagesChapter 1 Double Entry System-StockDeveender Kaur JudgeNo ratings yet

- Chapter 1 Users of Accounting InformationDocument2 pagesChapter 1 Users of Accounting InformationDeveender Kaur JudgeNo ratings yet

- Chapter 1 Effect of Business Transactions On Accounting EquationDocument1 pageChapter 1 Effect of Business Transactions On Accounting EquationDeveender Kaur JudgeNo ratings yet

- Chapter 1 Double Entry System For Income & ExpensesDocument2 pagesChapter 1 Double Entry System For Income & ExpensesDeveender Kaur JudgeNo ratings yet

- Financial Statemnt AnalysisDocument39 pagesFinancial Statemnt AnalysisNor CahayaNo ratings yet

- Chapter 31: Financial Distress: Original Claim Distribution of Liquidating ValueDocument2 pagesChapter 31: Financial Distress: Original Claim Distribution of Liquidating ValueEhsan MohitiNo ratings yet

- Abk JPMDocument4 pagesAbk JPMZerohedgeNo ratings yet

- The Stony Brook Press - Volume 7, Issue 4Document12 pagesThe Stony Brook Press - Volume 7, Issue 4The Stony Brook PressNo ratings yet

- Loan Senction Letter IDFC FIRST BANK FOR A-98Document8 pagesLoan Senction Letter IDFC FIRST BANK FOR A-98smepaisalendingNo ratings yet

- COMMERCIAL SECURITY AGREEMENT: #CPM-05202006-RA 600 756 856 US Debtor: John Philip Doe©Document21 pagesCOMMERCIAL SECURITY AGREEMENT: #CPM-05202006-RA 600 756 856 US Debtor: John Philip Doe©Nadah8100% (1)

- Ideaflow SampleDocument31 pagesIdeaflow SamplePeter ChangNo ratings yet

- Corporate Finance Core Principles and Applications 3rd Edition Ross Test BankDocument65 pagesCorporate Finance Core Principles and Applications 3rd Edition Ross Test BankChristopherDyerkczqw100% (20)

- New Research PaperDocument6 pagesNew Research Paperbilal nagoriNo ratings yet

- BWBB3043 A182 Topic13.2 Prohibitory Order - EditedDocument7 pagesBWBB3043 A182 Topic13.2 Prohibitory Order - EditedWeihan KhorNo ratings yet

- Exp22 Excel ch02 ml2 - Vacation Property InstructionsDocument2 pagesExp22 Excel ch02 ml2 - Vacation Property Instructionsapi-572422586No ratings yet

- Wealth Management Module PDFDocument109 pagesWealth Management Module PDFAnujBhanot100% (1)

- Balance Sheet As On 1-4-2012: Liabilities RS Assets RSDocument2 pagesBalance Sheet As On 1-4-2012: Liabilities RS Assets RSL.D TECHNICAL POINTNo ratings yet

- Financial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomDocument74 pagesFinancial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomUmesh KathariyaNo ratings yet

- sd1 EngDocument4 pagessd1 EngGZMO GroupNo ratings yet

- CBSE Class XII 2024 Commerce Accountancy Sample Paper SolDocument11 pagesCBSE Class XII 2024 Commerce Accountancy Sample Paper Solrajputudbhav2429No ratings yet

- WEEK 1 (September 24) : - Contracts of Real Security - Contracts of Personal SecurityDocument11 pagesWEEK 1 (September 24) : - Contracts of Real Security - Contracts of Personal SecurityDANICA FLORESNo ratings yet

- Minor Project ReportDocument69 pagesMinor Project ReportrimpaNo ratings yet

- MOU - PadmalochanaDocument4 pagesMOU - PadmalochanaBoopathy RangasamyNo ratings yet

- FactoringDocument22 pagesFactoringRajinder Kaur100% (1)

- Fria LawDocument40 pagesFria LawSK San Isidro BombonNo ratings yet

- Be Free! By:mary Elizabeth CroftDocument90 pagesBe Free! By:mary Elizabeth Croft1 watchman100% (2)

- Ipsas 2 Notes 2021Document9 pagesIpsas 2 Notes 2021Wilson Mugenyi KasendwaNo ratings yet