Professional Documents

Culture Documents

Schroder OKTOBER 2021

Schroder OKTOBER 2021

Uploaded by

Dhanik JayantiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schroder OKTOBER 2021

Schroder OKTOBER 2021

Uploaded by

Dhanik JayantiCopyright:

Available Formats

Fund Factsheet

Schroder Dana Mantap Plus II

All data expressed as of 29 October 2021 Fund Category: Fixed Income

Effective Date About Schroders

25 January 2007 PT. Schroder Investment Management Indonesia (''PT. SIMI'') is a 99% owned subsidiary of Schroders Plc. headquartered in

Effective Statement the United Kingdom. Schroders started its investment management business in 1926 and managed funds approximately USD

S-336/BL/2007 967.5 billion (as of June 2021) for its clients worldwide. PT. SIMI manages funds aggregating IDR 67.77 trillion (as of October

2021) for its retail and institutional clients in Indonesia including pension funds, insurance companies and social foundations.

Launch Date PTSIMI is licensed and supervised by the Financial Services Authority (OJK) based on decree no. KEP-04/PM/MI/1997.

29 January 2007

Currency Investment Objective

Rupiah The investment objective of Schroder Dana Mantap Plus II is to provide an attractive investment return with emphasis on

Unit Price (NAV per Unit) capital stability.

IDR 3,078.42

Fund Size Asset Allocation Top Holdings

IDR 2.2 trillion Debt securities: 80% - 100% (In Alphabetical Order)

Minimum Initial Investment Cash: 0% - 20% FR0056 (Bond) FR0082 (Bond)

IDR 10.000 * Investment in fixed income securities with less than 1 FR0059 (Bond) FR0086 (Bond)

Number of Offered Units year of maturity and cash, will not exceed 95%. FR0074 (Bond) FR0087 (Bond)

10 Billion Units FR0078 (Bond) FR0092 (Bond)

Valuation Period Portfolio Breakdown FR0080 (Bond) PBS012 (Sukuk)

Daily Debt securities: 97.88%

Subscription Fee Cash: 2.12%

Max. 1.00%

Redemption Fee

Max. 1.00% Performance

Performance 1 Month 3 Month 6 Month YTD 1 Year 3 Year 5 Year Since Inception

Switching Fee Schroder Dana Mantap Plus II 0.73% 1.60% 4.37% 2.78% 6.51% 31.88% 37.75% 207.84%

Max. 1.00% Benchmark ^ 0.74% 1.78% 4.72% 4.23% 8.78% 40.17% 47.79% 144.19%

Management Fee Best Monthly Return: 14.69% (Dec-08)

Max. 1.25% per annum Worst Monthly Return: -12.02% (Oct-08)

Custodian Bank

Deutsche Bank AG, Jakarta Branch Monthly Return during the Last 5 years Unit Price Movement since Inception

Custodian Fee

7% 3,200

Max. 0.25% per annum

6% 3,000 Schroder Dana Mantap Plus II

ISIN Code 5% 2,800 Benchmark ^

4%

IDN000044609 2,600

3%

2% 2,400

Main Risk Factors 1% 2,200

0% 2,000

Risk of Deteriorating Economic and

-1% 1,800

Political Conditions. -2% 1,600

-3% 1,400

Risk of Decrease in Investment -4%

1,200

Value. -5%

-6% 1,000

Risk of Liquidity. -7% 800

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-16

Jul-17

Jul-18

Jul-20

Jul-21

Jul-15

Jul-19

Jan-07

Jan-08

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

Jan-18

Jan-19

Jan-21

Jan-09

Jan-20

Nov-16

Nov-17

Nov-18

Nov-20

May-17

May-18

May-19

Nov-19

May-20

May-21

Sep-17

Sep-19

Sep-20

Sep-21

Mar-18

Sep-18

Mar-19

Mar-21

Mar-17

Jul-17

Jul-19

Mar-20

Jul-20

Jan-17

Jan-18

Jul-18

Jan-19

Jan-20

Jan-21

Jul-21

Risk of Dissolution and Liquidation.

Low Risk High Risk

Potentially Potentially Source: Schroders.

Lower Return Higher Return

Risk Level

Custodian Bank

Low Medium High Deutsche Bank AG, Jakarta Branch (“DB“) is a branch office of Deutsche Bank AG, a banking institution domiciled and having its headquarter

in Germany. DB has a license from the OJK to operate as a custodian in the capital market based on Bapepam Chairman Decision No. Kep-

1 2 3 4

07/PM/1994 dated 19 January 1994. DB is registered and supervised by the OJK.

MORE INFORMATION IS AVAILABLE IN THE FUND'S PROSPECTUS, WHICH IS AVAILABLE AT WWW.SCHRODERS.CO.ID

* not applicable if transaction is made through distribution agent.

^ Prior to Jan-13, the benchmark was Government Money Market Rate (SBI/SPN). From Jan-13 until Apr-16, the benchmark used was [

Income

Market

Money

Equity

Mixed

Asset

Fixed

80% HSBC Bond Index + 20% 1 Month JIBOR ]. From May-16 until Dec-17, the benchmark was [ 80% IBPA Bond Index + 20% 1 Month

JIBOR ]. Starting Jan-18 the benchmark is 100% IBPA Bond Index.

BASED ON THE PREVAILING OJK REGULATION, SUBSCRIPTION, SWITCHING AND REDEMPTION CONFIRMATION LETTERS ARE VALID PROOF OF MUTUAL FUND

UNITS OWNERSHIP, WHICH ARE ISSUED AND DELIVERED BY THE CUSTODIAN BANK.

INVESTMENT IN MUTUAL FUND CONTAINS RISKS. PRIOR TO INVESTING IN MUTUAL FUND, INVESTOR MUST READ AND UNDERSTAND THE FUND PROSPECTUS.

PAST PERFORMANCE DOES NOT INDICATE FUTURE PERFORMANCE.

PT Schroder Investment Management Indonesia (PT SIMI) had received an investment manager license from, and is supervised by, the Indonesian Financial Services Authority (OJK).

This document is prepared by PT SIMI for information purpose only and is prepared in accordance to provisions stipulated in Bapepam & LK regulation number V.B.4 article b and

Bapepam & LK regulation number IV.D.1. It should not be considered as an offer to sell, or a solicitation of an offer to buy. All reasonable care has been taken to ensure that the

information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this

document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if any) and its employees may have an interest in any transaction, securities

or investments mentioned in this document. Similarly, PT SIMI or its affiliated companies (if any), may perform services, for, or solicit business from, any company referred to in this

document. The value of investments can go down as well as up and is not guaranteed. OJK does not provide a statement of approval or disapproval of this mutual fund, nor does it

state the truth or adequacy of the contents of this Mutual Fund’s prospectus. Any statement that contradicts these matters is a violation of the law.

Schroders Indonesia Schroders Indonesia

You might also like

- Econ 203 S16 Final Exam Version 1Document15 pagesEcon 203 S16 Final Exam Version 1givemeNo ratings yet

- 20 Year Intrinsic ValueDocument27 pages20 Year Intrinsic ValueCaleb100% (2)

- Philbin Financial Group: To Provide A Graphical Summary of The Portfolio Prospectus For The Sunrise FundDocument13 pagesPhilbin Financial Group: To Provide A Graphical Summary of The Portfolio Prospectus For The Sunrise FundSALIL SHANKARNo ratings yet

- Mutual Fund Account Statement: ICICI Securities LimitedDocument4 pagesMutual Fund Account Statement: ICICI Securities LimitedSourabh PunshiNo ratings yet

- Factsheets Schroder Dana Mantap Plus II SEPTEMBER 2021Document1 pageFactsheets Schroder Dana Mantap Plus II SEPTEMBER 2021Dhanik JayantiNo ratings yet

- Schroder APRIL 2022Document1 pageSchroder APRIL 2022Dhanik JayantiNo ratings yet

- Schroder - OKTOBER 20222Document1 pageSchroder - OKTOBER 20222Dhanik JayantiNo ratings yet

- Schroder Dana Andalan II: Fund FactsheetDocument1 pageSchroder Dana Andalan II: Fund Factsheetainun endarwatiNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- Schroder 90 Plus Equity Fund AllDocument1 pageSchroder 90 Plus Equity Fund AllDadang SuhermanNo ratings yet

- Schroder Dana IstimewaDocument1 pageSchroder Dana IstimewaDadang SuhermanNo ratings yet

- Schroder Dana Likuid OKTOBER 2022-1Document1 pageSchroder Dana Likuid OKTOBER 2022-1Dhanik JayantiNo ratings yet

- Schroder Dana Likuid: Fund FactsheetDocument1 pageSchroder Dana Likuid: Fund FactsheetTuPandeNo ratings yet

- FFS Jambaf Feb22Document2 pagesFFS Jambaf Feb22Alvarian AdnanNo ratings yet

- 8807ab12870db0d41e3aa9472d8321ce_3db5e9121eb49dfa9aa1d2a95cb7a65eDocument1 page8807ab12870db0d41e3aa9472d8321ce_3db5e9121eb49dfa9aa1d2a95cb7a65eAldian LokariaNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetDodi AriyantoroNo ratings yet

- Jarvis Balanced Fund Desember 2022Document4 pagesJarvis Balanced Fund Desember 2022Rachmat SubektiNo ratings yet

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaNo ratings yet

- FFS Jambaf Aug2021Document2 pagesFFS Jambaf Aug2021royescspchiitymmuaNo ratings yet

- Performance Overview: As of Sep 13, 2023Document2 pagesPerformance Overview: As of Sep 13, 2023Tirthkumar PatelNo ratings yet

- Jarvis Balance Fund - FFS-JUN21Document2 pagesJarvis Balance Fund - FFS-JUN21Triwibowo B NugrohoNo ratings yet

- Ffs Jambaf Sept21Document2 pagesFfs Jambaf Sept21Ainsley SantosoNo ratings yet

- FFS Jambaf Apr22Document2 pagesFFS Jambaf Apr22agcpzdeqpyeaeypxifNo ratings yet

- 2020 12 December PublicDocument2 pages2020 12 December Publicsumit.bitsNo ratings yet

- Performance Overview: As of Sep 14, 2023Document3 pagesPerformance Overview: As of Sep 14, 2023Tirthkumar PatelNo ratings yet

- Syailendra Balanced Opportunity Fund (SBOF) : Investment ObjectiveDocument1 pageSyailendra Balanced Opportunity Fund (SBOF) : Investment ObjectiveYoanna WidyantiNo ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- ALFM Peso Bond Fund Inc. - 202205 1Document2 pagesALFM Peso Bond Fund Inc. - 202205 1C KNo ratings yet

- Ffs-Jambaf Jan2021Document2 pagesFfs-Jambaf Jan2021Johan CahyantoNo ratings yet

- Jarvis Money Market Fund NOVEMBER 2022Document2 pagesJarvis Money Market Fund NOVEMBER 2022Dhanik JayantiNo ratings yet

- FFS Jambaf Okt23Document4 pagesFFS Jambaf Okt23Fri Wardara van HoutenNo ratings yet

- FactsheetDocument2 pagesFactsheetMighfari ArlianzaNo ratings yet

- Reksa Dana Syariah Syailendra Ovo Bareksa Tunai Likuid (Sobatl)Document1 pageReksa Dana Syariah Syailendra Ovo Bareksa Tunai Likuid (Sobatl)Windy Nur MalasariNo ratings yet

- Jarvis Balanced Fund Desember 2020Document2 pagesJarvis Balanced Fund Desember 2020rinasiahaanNo ratings yet

- Factsheet - Mandiri Investa Dana SyariahDocument1 pageFactsheet - Mandiri Investa Dana SyariahFitria MeylinaNo ratings yet

- SFM Q MTP 1 Final May22Document5 pagesSFM Q MTP 1 Final May22Divya AggarwalNo ratings yet

- Performance Overview: As of Sep 14, 2023Document3 pagesPerformance Overview: As of Sep 14, 2023Tirthkumar PatelNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)HIRA -No ratings yet

- Syailendra Pendapatan Tetap Premium - DESEMBER - 2022Document1 pageSyailendra Pendapatan Tetap Premium - DESEMBER - 2022Hendra GuntoroNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answeradarsh agrawalNo ratings yet

- ALFM Peso Bond Fund Inc. - 202208Document2 pagesALFM Peso Bond Fund Inc. - 202208Megan CastilloNo ratings yet

- Jarvis Money Market Fund DESEMBER 2022Document4 pagesJarvis Money Market Fund DESEMBER 2022Dhanik JayantiNo ratings yet

- REL Fact Sheet 03-18Document2 pagesREL Fact Sheet 03-18Hannes Sternbeck FryxellNo ratings yet

- Government Guarantee Management ReportDocument2 pagesGovernment Guarantee Management ReportIntanNo ratings yet

- Syailendra Fixed Income Fund (SFIF) : Monthly Report January 2018Document1 pageSyailendra Fixed Income Fund (SFIF) : Monthly Report January 2018Khadafi DafiNo ratings yet

- Franklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchDocument1 pageFranklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchAbhishek GinodiaNo ratings yet

- Syailendra Sharia Money Market Fund - Mei - 2022Document1 pageSyailendra Sharia Money Market Fund - Mei - 2022Moslem CompanyNo ratings yet

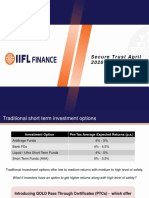

- Secure Trust April 2020 - PTC Series ADocument17 pagesSecure Trust April 2020 - PTC Series ARohan RautelaNo ratings yet

- NMMF May 2022Document1 pageNMMF May 2022chqaiserNo ratings yet

- Ifm PPT Saida PartDocument14 pagesIfm PPT Saida PartbayezidNo ratings yet

- NBP Income Opportunity Fund (Niof)Document1 pageNBP Income Opportunity Fund (Niof)HIRA -No ratings yet

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- BRS Morning Shout 27.02.2019Document2 pagesBRS Morning Shout 27.02.2019Sudheera IndrajithNo ratings yet

- 6.1 Stress Test - Sparkassen: RC NotesDocument21 pages6.1 Stress Test - Sparkassen: RC NoteserteNo ratings yet

- Risk To SharekhanDocument8 pagesRisk To SharekhanprakashinduNo ratings yet

- ACRMSMS FactsheetDocument1 pageACRMSMS FactsheetJoni NizartNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- FFS Jambaf Mar2021Document2 pagesFFS Jambaf Mar2021Johan CahyantoNo ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- Syailendra Balanced Opportunity Fund (SBOF) : Investment ObjectiveDocument1 pageSyailendra Balanced Opportunity Fund (SBOF) : Investment ObjectiveHeny FitrianaNo ratings yet

- Shinhan Balance Fund Factsheet PDFDocument1 pageShinhan Balance Fund Factsheet PDFjoecool87No ratings yet

- Jarvis Money Market Fund DESEMBER 2022Document4 pagesJarvis Money Market Fund DESEMBER 2022Dhanik JayantiNo ratings yet

- Jarvis Money Market Fund NOVEMBER 2022Document2 pagesJarvis Money Market Fund NOVEMBER 2022Dhanik JayantiNo ratings yet

- Schroder Dana Likuid OKTOBER 2022-1Document1 pageSchroder Dana Likuid OKTOBER 2022-1Dhanik JayantiNo ratings yet

- Factsheets Schroder Dana Mantap Plus II SEPTEMBER 2021Document1 pageFactsheets Schroder Dana Mantap Plus II SEPTEMBER 2021Dhanik JayantiNo ratings yet

- Schroder APRIL 2022Document1 pageSchroder APRIL 2022Dhanik JayantiNo ratings yet

- Schroder - OKTOBER 20222Document1 pageSchroder - OKTOBER 20222Dhanik JayantiNo ratings yet

- Guide To The Markets Q3 2023 1688397991Document100 pagesGuide To The Markets Q3 2023 1688397991nicholasNo ratings yet

- 1.fundamentals of Strategic ManagementDocument40 pages1.fundamentals of Strategic Managementryson100% (1)

- Forecasting Default With The KMV-Merton ModelDocument35 pagesForecasting Default With The KMV-Merton ModelEdgardo Garcia MartinezNo ratings yet

- Container TerminalsDocument5 pagesContainer TerminalsPRmani RamalingamNo ratings yet

- NBCC GovtDocument40 pagesNBCC GovtDr. Anamika JhaNo ratings yet

- Final Project On Fdi in IndiaDocument75 pagesFinal Project On Fdi in Indiadeepakgautam_00786% (28)

- Ethiopia - Butajira-Hossaina-Sodo Road Project - Appraisal ReportDocument63 pagesEthiopia - Butajira-Hossaina-Sodo Road Project - Appraisal ReportTewodros AbateNo ratings yet

- Wallstreetjournal 20151230 The Wall Street JournalDocument43 pagesWallstreetjournal 20151230 The Wall Street JournalstefanoNo ratings yet

- REM - The Grand Pan Jan Drum and Its Monopoly (Jim Coke)Document2 pagesREM - The Grand Pan Jan Drum and Its Monopoly (Jim Coke)Jim CokeNo ratings yet

- IMD 2011 Class ProfileDocument12 pagesIMD 2011 Class ProfileDavid LewkowitzNo ratings yet

- Chapter 1Document27 pagesChapter 1Catherine RiveraNo ratings yet

- Personal Financial Planning PDFDocument272 pagesPersonal Financial Planning PDFrakesh dhiman100% (2)

- Topic 3 - Foreign Currency Translation and Financial Reporting and Price ChangesDocument89 pagesTopic 3 - Foreign Currency Translation and Financial Reporting and Price ChangesEMELDA MatthewNo ratings yet

- Cape Work Sheet Module OneDocument4 pagesCape Work Sheet Module OneNIS TTNo ratings yet

- Chanakya National Law UniversityDocument31 pagesChanakya National Law UniversityHarshit GuptaNo ratings yet

- Jackson-Pettigrew Presentation - 10-16-2017Document24 pagesJackson-Pettigrew Presentation - 10-16-2017SarahNo ratings yet

- Module: Basic AccountingDocument17 pagesModule: Basic AccountingAzim OthmanNo ratings yet

- Tilson Funds Annual Report 2005Document28 pagesTilson Funds Annual Report 2005josepmcdalena6542No ratings yet

- HumanResourceAccountingACaseStudyWithSpecialReferenceToVisakhapatnamPortTrust (72 77)Document6 pagesHumanResourceAccountingACaseStudyWithSpecialReferenceToVisakhapatnamPortTrust (72 77)bablooNo ratings yet

- Mid MCQDocument7 pagesMid MCQtrinh tranNo ratings yet

- Financial Management Term PaperDocument6 pagesFinancial Management Term Paperc5h71zzc100% (1)

- MSQ-03 - Working Capital FinanceDocument11 pagesMSQ-03 - Working Capital FinanceJade RamosNo ratings yet

- Akgun (2021) - How Company Size Bias in ESG Scores Impacts The Small Cap InvestorDocument16 pagesAkgun (2021) - How Company Size Bias in ESG Scores Impacts The Small Cap Investor謝文良No ratings yet

- NIB BankDocument19 pagesNIB BankSohail KhanNo ratings yet

- Marcellus MeritorQ RIA BASL 4thoctDocument27 pagesMarcellus MeritorQ RIA BASL 4thoctPratik HingeNo ratings yet

- Conell - Business Plan - Vancouver Luxury Hotel Residences - 2009 - StaigerDocument76 pagesConell - Business Plan - Vancouver Luxury Hotel Residences - 2009 - StaigeraschalewNo ratings yet

- Lecture 3 - Financial Markets and InstitutionsDocument36 pagesLecture 3 - Financial Markets and InstitutionsNithiyaa VijayanNo ratings yet

- Housing Industry RoadmapDocument8 pagesHousing Industry RoadmapmjfprgcNo ratings yet