Professional Documents

Culture Documents

CBSE Class 12 Accountancy Question Paper 2017

CBSE Class 12 Accountancy Question Paper 2017

Uploaded by

gajendra kumarCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- BKP CBLM Core Journalize TransactionsDocument130 pagesBKP CBLM Core Journalize TransactionsEzekiel Lapitan100% (5)

- CBSE Class 12 Accountancy Important FormulasDocument3 pagesCBSE Class 12 Accountancy Important Formulasrio_harcan100% (2)

- CBSE Class 12 Accountancy Question Paper 2016Document42 pagesCBSE Class 12 Accountancy Question Paper 2016Ravi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2012 With SolutionsDocument38 pagesCBSE Class 12 Accountancy Question Paper 2012 With SolutionsRavi AgrawalNo ratings yet

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2014 With SolutionsDocument42 pagesCBSE Class 12 Accountancy Question Paper 2014 With SolutionsRavi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2015 With SolutionsDocument50 pagesCBSE Class 12 Accountancy Question Paper 2015 With SolutionsRavi AgrawalNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Blossom Senior Secondary School 1Document8 pagesBlossom Senior Secondary School 1raviNo ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Delhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Document3 pagesDelhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Lekhana WesleyNo ratings yet

- CBSE Accountancy 2017 Board QuestionsDocument10 pagesCBSE Accountancy 2017 Board QuestionsHeena Maqsood AhmadNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2018Document39 pagesCBSE Class 12 Accountancy Question Paper 2018vaishnavi coolNo ratings yet

- QP Xii Accs PB 1Document7 pagesQP Xii Accs PB 1ansabroxx02No ratings yet

- Accountancy 2018Document18 pagesAccountancy 2018MohamedZiaudeenNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- ABT - BK Question Bank22-23Document8 pagesABT - BK Question Bank22-23shrikantNo ratings yet

- CBSE Class 12 Accountancy Sample Paper 2019 Solved PDFDocument26 pagesCBSE Class 12 Accountancy Sample Paper 2019 Solved PDFMihir KhandelwalNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- AssingmentDocument4 pagesAssingmentGarima LohanNo ratings yet

- Asm1 25560Document12 pagesAsm1 25560shivanshu11o3o6No ratings yet

- 12 Acc SPR 2Document6 pages12 Acc SPR 2Yashasvi DhankharNo ratings yet

- Asm 25560Document9 pagesAsm 25560shivanshu11o3o6No ratings yet

- Class 12th Accountancy Set BDocument6 pagesClass 12th Accountancy Set BjashanjeetNo ratings yet

- Holiday Homework Accountancy Class 12Document15 pagesHoliday Homework Accountancy Class 12Sambhav GargNo ratings yet

- ACC 2024 Pre Board PDFDocument12 pagesACC 2024 Pre Board PDFKeshvi.No ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- CBSE 12 Accountancy 2019 SRDocument10 pagesCBSE 12 Accountancy 2019 SRmohit pandeyNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- 12th Accountancy Set - 1 QuestionsDocument9 pages12th Accountancy Set - 1 QuestionsKaran SinghNo ratings yet

- Adv Acc - BankingDocument13 pagesAdv Acc - Bankingrshyams165No ratings yet

- Term One Accountancy 12 QP & MSDocument13 pagesTerm One Accountancy 12 QP & MSVarun HurriaNo ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- 1234 WWWWDocument11 pages1234 WWWWbrainhub50No ratings yet

- ADJUSTING ENTRIES Part 3Document5 pagesADJUSTING ENTRIES Part 3MOCHI SSABELLENo ratings yet

- 12 Accounts ch6 tp1Document11 pages12 Accounts ch6 tp1Pawan TalrejaNo ratings yet

- ACCOUNTNCY QP Guugram RegionDocument12 pagesACCOUNTNCY QP Guugram Regionvivekdaiv55No ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- Worksheet On Dissolution of Partnership - Board Exam QuestionsDocument10 pagesWorksheet On Dissolution of Partnership - Board Exam QuestionsAhmedNo ratings yet

- CA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul AgrawalDocument8 pagesCA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul Agrawalharshveersingh480No ratings yet

- ULTIMATE Sample Paper 3Document22 pagesULTIMATE Sample Paper 3Vansh RanaNo ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- CBSE Sample Question Papers For Class 12 Accountancy 2020Document12 pagesCBSE Sample Question Papers For Class 12 Accountancy 2020Khan AkbarNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- XII Accountancy 2018-2019Document26 pagesXII Accountancy 2018-2019amanNo ratings yet

- Q.1 What Is Meant by Reconstitution of Partnership Firm?: New Ratio 11:7:6Document24 pagesQ.1 What Is Meant by Reconstitution of Partnership Firm?: New Ratio 11:7:6SUSHANTNo ratings yet

- 12 Accounts Half YearlyDocument5 pages12 Accounts Half YearlyRahul MajumdarNo ratings yet

- Retirement QuestionDocument2 pagesRetirement QuestionshubhamsundraniNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 01Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 01Rohan RughaniNo ratings yet

- PRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsDocument8 pagesPRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsKaustav DasNo ratings yet

- CBSE Sample Paper 2024 Class 12 Accountancy SQPDocument13 pagesCBSE Sample Paper 2024 Class 12 Accountancy SQPaninditaNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Term Paper On APEX FOODS LTD. Samina Sultana-8451Document45 pagesTerm Paper On APEX FOODS LTD. Samina Sultana-8451pranta senNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V06Document2 pagesSLF065 MultiPurposeLoanApplicationForm V06pen AbraNo ratings yet

- Clossme1 624580862Document16 pagesClossme1 624580862Surajit DoraNo ratings yet

- Financial Services: Finance Companies: True / False QuestionsDocument16 pagesFinancial Services: Finance Companies: True / False Questionslatifa hnNo ratings yet

- Finance Assignment 1Document10 pagesFinance Assignment 1khushbu mohanNo ratings yet

- ACCOUNTANCY Collectable Marks Question PapersDocument58 pagesACCOUNTANCY Collectable Marks Question PaperszanabunityNo ratings yet

- Sales Digest - Maceda LawDocument3 pagesSales Digest - Maceda LawKristine KristineeeNo ratings yet

- Chapter 11 Acc 113Document28 pagesChapter 11 Acc 113samaromsamar393No ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisShailyn AngcayNo ratings yet

- BOOK KEEPING AND BASIC ACCOUNTING - Dox AllenDocument11 pagesBOOK KEEPING AND BASIC ACCOUNTING - Dox AllenVipin MisraNo ratings yet

- Grade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305Document6 pagesGrade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305hobyanevisionNo ratings yet

- NHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PDocument30 pagesNHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PTrân LêNo ratings yet

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- FINMAR - Introduction To Financial Management and Financial MarketsDocument8 pagesFINMAR - Introduction To Financial Management and Financial MarketsLagcao Claire Ann M.No ratings yet

- International Academy of Management and Economics Incorporated vs. Litton and Co. IncDocument3 pagesInternational Academy of Management and Economics Incorporated vs. Litton and Co. IncOrlando DatangelNo ratings yet

- Test Bank For Financial Accounting An Integrated Approach 6th Edition by TrotmanDocument10 pagesTest Bank For Financial Accounting An Integrated Approach 6th Edition by TrotmanVivienne Lei BolosNo ratings yet

- "Azerbaijan Caspian Shipping" Closed Joint Stock CompanyDocument39 pages"Azerbaijan Caspian Shipping" Closed Joint Stock CompanyElik MəmmədovNo ratings yet

- Unit 8 Indian Contract Act Handwritten NotesDocument18 pagesUnit 8 Indian Contract Act Handwritten NotesDasharath RautNo ratings yet

- Lecture1 - Nov 2021 - IntroDocument30 pagesLecture1 - Nov 2021 - IntroJoanNo ratings yet

- Expenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Document6 pagesExpenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Srijan SaxenaNo ratings yet

- Feb 2022Document3 pagesFeb 20223aconsultancyNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- Money MattersDocument20 pagesMoney MattersGaurang PatelNo ratings yet

- B-MGAC203 Long QuizDocument6 pagesB-MGAC203 Long QuizMa. Yelena Italia TalabocNo ratings yet

- Fa1 Mock 3Document9 pagesFa1 Mock 3smartlearning1977No ratings yet

- Student Guide Lesson EightDocument9 pagesStudent Guide Lesson EightKhosrow KhazraeiNo ratings yet

- IX English II - QB - Final.1609738132Document8 pagesIX English II - QB - Final.1609738132Prashant PandeyNo ratings yet

- Assignment Comparative Ratio Analysis ofDocument16 pagesAssignment Comparative Ratio Analysis ofAbhishekDey162b BBANo ratings yet

CBSE Class 12 Accountancy Question Paper 2017

CBSE Class 12 Accountancy Question Paper 2017

Uploaded by

gajendra kumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBSE Class 12 Accountancy Question Paper 2017

CBSE Class 12 Accountancy Question Paper 2017

Uploaded by

gajendra kumarCopyright:

Available Formats

CBSE Class 12

Accountancy

Previous Year Question Paper 2017

Series: GBM Set-2

Code no. 67/2

• Please check that this paper contains 27 printed pages.

• Code number given on the right hand side of the question paper should be

written on the title page of the answer-book by the candidate.

• Please check that this question paper contains 32 questions.

• Please write down the Serial Number of the question in the answer-

book before attempting it.

• 15 minute time has been allotted to read this question paper. The question

paper will be distributed at 10.15 a.m. From 10.15 a.m. to 10.30 a.m., the

students will read the question paper only and will not write any answer on

the answer-book during this period.

ACCOUNTANCY

Time Allowed: 3 hours Maximum Marks: 80

General Instructions:

Read the following instructions very carefully and strictly follow them:

1. This question paper contains two Parts - A and B.

2. Part A is compulsory for all candidates.

Class XII Accountancy www.vedantu.com 1

3. Part B has two options i.e. (1) Analysis of Financial Statements and (2)

Computerized Accounting.

4. Attempt only one option of Part B.

5. All parts of a question should be attempted at one place.

PART - A

(Accounting for Not-for-Profit Organizations, Partnership Firms and

Companies)

1. Durga and Naresh were partners in a firm. They wanted to admit five more

members in the firm. List any two categories of individuals other than minors

who cannot be admitted by them. 1 Mark

Ans: Other than the minors the person cannot be admitted as a partner by a

partnership firm include:

(a) persons of unsound mind

(b) minors banned by law.

2. Z Ltd. forfeited 1,000 equity shares of Rs. 10 each for the nonpayment of the

first call of Rs. 2 per share. The final call of Rs. 3 per share was yet to be made.

Calculate the maximum amount of discount at which these shares can be

reissued. 1 Mark

Ans: The credit balance in the Share Forfeiture A/c, i.e. Rs.5000 (1000×5) , is the

maximum discount at which these shares can be re-issued.

3. X Ltd. invited applications for issuing 500, 12% debentures of Rs. 100 each

at a discount of 5%. These debentures were redeemable after three years at par.

Applications for 600 debentures were received. Pro-rata allotment was made to

all the applicants. Pass necessary journal entries for the issue of debentures

assuming that the whole amount was payable with application.

1 Mark

Class XII Accountancy www.vedantu.com 2

Ans: In the Books of X Ltd

Journal Entries

For the year ending……….

Dr. Cr.

Date Particulars L.F.

Rs Rs

i. Bank A/c Dr. 57,000

To 12% Debenture Application and Allotment A/c 57,000

(Being application and Allotment Money received

on 600 Debentures) 57,000

ii. 12% Debenture Application & Allotment A/c Dr. 2,500

Discount on Issue of Debentures A/c Dr.

To 12% Debentures A/c 50,000

To Bank A/c 9,500

(Being application and Allotment Money

transferred to Debentures Account)

4. P and Q were partners in a firm sharing profits and losses equally. Their

fixed capitals were Rs. 2,00,000 and Rs. 3,00,000 respectively. The partnership

deed provided for interest on capital @ 12% per annum. For the year ended

31st March, 2016, the profits of the firm were distributed without providing

interest on capital. Pass necessary adjustment entry to rectify the error.

1 Mark

Ans: Journal Adjustment Entries

Debit Credit

Particulars L.F.

Rs. Rs.

P’s Current A/c Dr. 6,000

To Q’s Current A/c 6,000

(Being adjustment of omission of interest on capital)

Working Note:

Statement Showing Adjustment

P Q Total

Class XII Accountancy www.vedantu.com 3

Interest on Capital @ 12% 24,000 36,000 60,000

Less: Profit wrongly distributed to the extent of interest (30,000) (30,000) (60,000)

amount

Net Effect (Profit Sharing) (6,000) 6,000 NIL

5. A and B were partners in a firm sharing profits and losses in the ratio of 5:3.

They admitted C as a new partner. The new profit sharing ratio between A, B

1

and C was 3:2:3. A surrendered th of his share in favour of C. Calculate B’s

5

sacrifice. 1 Mark

Ans: Calculation of B’s Sacrifice:

B's Sacrifice = Old share - New share

3 2 1

= − =

8 8 8

6. Distinguish between ‘Fixed Capital Account’ and ‘Fluctuating Capital

Account’ on the basis of credit balance. 1 Mark

Ans: The difference between ‘Fixed Capital Account’ and ‘Fluctuating Capital

Account’ on the basis of credit balance is:

Basis Fixed Capital Account Fluctuating Capital Account

Credit Balance Because all adjustments Because all adjustments of

pertaining to interest on capital, interest on capital, interest on

interest on withdrawals, salaries, withdrawals, salary, and so on

and other expenses are made are made through the same

through Partners' Current account, the fluctuating capital

Account, the Fixed Capital account can have both debit

Account always has a credit and credit balances.

balance.

Class XII Accountancy www.vedantu.com 4

7. Ganesh Ltd. is registered with an authorised capital of Rs. 10,00,00,000

divided into equity shares of Rs. 10 each. Subscribed and fully paid up capital

of the company was Rs. 6,00,00,000. For providing employment to the local

youth and for the development of the tribal areas of Arunachal Pradesh the

company decided to set up a hydro power plant there. The company also

decided to open skill development centres in Itanagar, Pasighat and Tawang.

To meet its new financial requirements, the company decided to issue 1,00,000

equity shares of Rs. 10 each and 1,00,000, 9% debentures of Rs. 100 each. The

debentures were redeemable after five years at par. The issue of shares and

debentures was fully subscribed. A shareholder holding 2,000 shares failed to

pay the final call of Rs. 2 per share. Show the share capital in the Balance Sheet

of the company as per the provisions of Schedule III of the Companies Act,

2013. Also identify any two values that the company wishes to propagate.

3 Marks

Ans: In the Books of Ganesh Ltd

Balance Sheet

For the year ending……….

Note

Particulars Rs.

No.

I. Equity and Liabilities

1. Shareholder’s funds

a. Share Capital 1 6,09,96,000

b. Reserve and Surplus

2. Non- Current Liabilities

Long-Term Borrowings 2 1,00,00,000

Total

Notes to Accounts:

Note

Particulars Rs.

No.

1 Share Capital

Authorised Share Capital

1,00,00,000 Equity Shares of Rs 10 each 1,00,00,000

Issued, Subscribed, Called-up and Paid-up Share Capital

Class XII Accountancy www.vedantu.com 5

61,00,000 Equity Shares of Rs 10 each fully called up

6,10,00,000

Less: Calls in Arrears (2,000 × Rs 2) (4,000)

2 Non-Current Liabilities:

6,09,96,000

Long Term Borrowings

1,00,00,000

Involved Values:

1. Regional Growth That Is Balanced

2. Creating Workplace Opportunities

8. Disha Ltd. purchased machinery from Nisha Ltd. and paid to Nisha Ltd. as

follows: 3 Marks

(i)By issuing 10,000, equity shares of Rs. 10 each at a premium of 10%.

(ii) By issuing 200, 9% debentures of Rs. 100 each at a discount of 10%.

(iii) Balance by accepting a bill of exchange of Rs. 50,000 payable after one

month.

Ans: In the Books of Disha Ltd

Journal Entries

For the year ending…...

Dr. Cr.

Date Particulars L.F.

Rs Rs

Machinery A/c Dr. 1,78,000

To Nisha Ltd. A/c (1,10,000+18,000+50,000) 1,78,000

(Being machinery Purchased from Nisha Ltd.)

Nisha Ltd. A/c (1,10,000+18,000+50,000) Dr 1,78,000

Discount on Issue of Debentures A/c (200 × 10) 2,000

To Equity Share Capital A/c (10,000 × Rs 10) 1,00,000

To Securities Premium A/c (10,000 × Rs 1) 10,000

To 9% Debentures A/c (200 × Rs 100) 20,000

Class XII Accountancy www.vedantu.com 6

To Bills Payable A/c 50,000

Being issued 10,000 equity share of Rs 10 each at a

premium of 10% issued 2,00 9% Debentures of Rs 100

at a discount of 10% and balance by issuing bills of

exchange account)

9. Kavi, Ravi, Kumar and Guru were partners in a firm sharing profits in the

ratio of 3:2:2:1. On 1.2.2017, Guru retired and the new profit sharing ratio

decided between Kavi, Ravi and Kumar was 3:1:1. On Guru’s retirement the

goodwill of the firm was valued at Rs. 3,60,000. Showing your working notes

clearly, pass necessary journal entry in the books of the firm for the treatment

of goodwill on Guru’s retirement. 3 Marks

Ans: Journal Entries

For the year ending…...

Dr. Cr.

Date Particulars L.F.

Rs Rs

Kavi’s Capital A/c Dr. 81,000

To Ravi’s Capital A/c 18,000

To Ravi’s Capital A/c 18,000

To Ravi’s Capital A/c 45,000

(Being new goodwill adjusted)

Working Note:

Gaining Ratio = New Ratio - Old Ratio

3 3

Kavi= −

5 8

24 − 15

=

40

9

=

40

Class XII Accountancy www.vedantu.com 7

1 2

Ravi= −

5 8

8 − 10

=

40

2

= − (Sacrificing)

40

1 2

Kumar= −

5 8

8 − 10

=

40

2

= − (Sacrificing)

40

Goodwill Valued = 360000

9

Kavi = Rs 360000 × Rs 81000

=

40

2

Ravi = Rs 360000 × Rs 18000

=

40

2

Kumar = Rs 360000 × Rs 18000

=

40

1

Guru = Rs 360000 × =Rs 45000

8

10. BPL Ltd. converted 500, 9% debentures of Rs. 100 each issued at a discount

of 6% into equity shares of Rs. 100 each issued at a premium of Rs. 25 per share.

Discount on issue of 9% debentures has not yet been written off. Showing your

working notes clearly, pass necessary journal entries for conversion of 9%

debentures into equity shares. 3 Marks

Ans: Journal Entries

Class XII Accountancy www.vedantu.com 8

For the year ending…...

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

9% Debentures A/c Dr. 50,000

To Debenture holders A/c 50,000

(500, 9% Debentures due to redemption)

Debenture holders A/c Dr. 50,000

To Equity Share Capital A/c (400 ×100) 40,000

To Securities Premium A/c (400 × 25) 10,000

(500, 9% Debentures redeemed by converting

into 400 equity shares of Rs 100 each issued at

a premium of Rs 25 per share)

Securities Premium A/c Dr. 3,000

To Discount on Issue of Debentures A/c 3,000

(Discount on issue of debentures written off

against balance in securities premium account)

Working Notes:

11. Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio

of 4:3:3. The firm closes its books on 31st March every year. On 31st December,

2016 Ashok died. The partnership deed provided that on the death of a partner

his executors will be entitled for the following: 4 Marks

i. Balance in his capital account. On 1.4.2016, there was a balance of Rs.

90,000 in Ashok’s Capital Account.

ii. Interest on capital @ 12% per annum.

Class XII Accountancy www.vedantu.com 9

iii. His share in the profits of the firm in the year of his death will be

calculated on the basis of rate of net profit on sales of the previous year,

which was 25%. The sales of the firm till 31st December, 2016 were Rs.

4,00,000.

iv. His share in the goodwill of the firm. The goodwill of the firm on Ashok’s

death was valued at Rs. 4,50,000.

The partnership deed also provided for the following deductions from the

amount payable to the executor of the deceased partner:

i. His drawings in the year of his death. Ashok’s drawings till 31.12.2016

were Rs. 15,000.

ii. Interest on drawings @ 12% per annum which was calculated as Rs.

1,500.

The accountant of the firm prepared Ashok’s Capital Account to be presented

to the executor of Ashok but in a hurry he left it incomplete. Ashok’s Capital

Account as prepared by the firm’s accountant is given below:

Ashoka’s Capital Account

Amount Amount

Date Particulars Date Particulars

₹ ₹

2016 2016

Dec 31 ……….. 15,000 April 1 ……….. 90,000

Dec 31 ……….. ……….. Dec 31 ……….. 8,100

Dec 31 ……….. ……….. Dec 31 ……….. 40,000

Dec 31 ……….. 90,000

Dec 31 ……….. 90,000

3,18,100 3,18,100

You are required to complete Ashoka’s Capital Account.

Ans: Ashoka’s Capital Account

Amount Amount

Date Particulars Date Particulars

₹ ₹

Class XII Accountancy www.vedantu.com 10

2016 2016

Dec 31 To Drawing A/c 15,000 April 1 By balance b/d 90,000

Dec 31 To Interest on 1,500 Dec 31 By Interest on Capital 8,100

Drawing A/c A/c

Dec 31 To Ashok 3,01,600 Dec 31 By Profit and Loss 40,000

Executor’s A/c Suspense A/c

Dec 31 By Babu’s Capital A/c 90,000

Dec 31 By Chetan’s Capital A/c 90,000

3,18,100 3,18,100

12. Madhu and Neha were partners in a firm sharing profits and losses in the

ratio of 3:5. Their fixed capitals were Rs. 4,00,000 and Rs. 6,00,000 respectively.

On 1.1.2016, Tina was admitted as a new partner for 1 4 th share in the profits.

Tina acquired her share of profit from Neha. Tina brought Rs. 4,00,000 as her

capital which was to be kept fixed like the capitals of Madhu and Neha.

Calculate the goodwill of the firm on Tina’s admission and the new profit

sharing ratio of Madhu, Neha and Tina. Also, pass necessary journal entry for

the treatment of goodwill on Tina’s admission considering that Tina did not

bring her share of goodwill premium in cash. 4 Marks

Ans: Journal Entries

For the year ending…...

Dr. Cr.

Date Particulars L.F.

Rs Rs

Cash A/c Dr. 4,00,000

To Tina’s Capital A/c 4,00,000

(Being capital Brought by Tina in cash)

Tina’s Current A/c Dr. 50,000

To Neha’s Current A/c 50,000

(Being hidden goodwill adjusted through the

Current account)

Working Note:

Calculation of Tina’s Share of Goodwill (Hidden)

Class XII Accountancy www.vedantu.com 11

4

Total Capital of the firm = 16,00,000 400000 ×

1

Net Worth = 4,00,000 + 6,00,000 + 4,00,000 =

14,00,000

Hidden Goodwill = Total Capital of the firm Net Worth

= 16,00,000 − 14,00,000

= 2,00,000

Tina’s Share in Goodwill

1

= 2,00,000

= × 50,000

4

Calculation of New PSR:

3

Madhu’s Share =

8

5 1 3

Neha’s Share = − =

8 4 8

1

Tina’s Share =

4

New Share = 3:3:2

13. Suresh, Ramesh, Mahesh and Ganesh were partners in a firm sharing

profits in the ratio of 2:2:3:3. On 1.4.2016 their Balance Sheet was as follows:

6 Marks

Balance Sheet of Suresh, Ramesh, Mahesh and Ganesh as on 1.4.2016

Amount Amount

Liabilities Assets

(₹) (₹)

Capitals: Fixed Assets 6,00,000

Suresh 1,00,000 Current Assets 3,45,000

Class XII Accountancy www.vedantu.com 12

Ramesh 1,50,000

Mahesh 2,00,000

Ganesh 2,50,000 7,00,000

Sundry Creditors 1,70,000

Workmen Compensation

Reserve 75,000

9,45,000 9,45,000

From the above date the partners decided to share the future profits equally.

For this purpose the goodwill of the firm was valued at Rs. 90,000. It was also

agreed that:

i. Claim against Workmen Compensation Reserve will be estimated at Rs.

1,00,000 and fixed assets will be depreciated by 10%.

ii. The capitals of the partners will be adjusted according to the new profit

sharing ratio. For this, necessary cash will be brought or paid by the

partners as the case may be.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance

Sheet of the reconstituted firm.

Ans: Revaluation Account

Dr. Cr.

Amount Amount

Particulars Particulars

(₹) (₹)

To Provision for WCF A/c 25,000 By Revaluation Loss:

To Depreciation on Fixed 60,000 Suresh Capital A/c 17,000

Assets Ramesh Capital A/c 17,000

Mahesh Capital A/c 25,500

Ganesh Capital A/c 25,500 85,000

85,000 85,000

Partner’s Capital Account

Dr. Cr.

Class XII Accountancy www.vedantu.com 13

Particulars Suresh Ramesh Mahesh Ganesh Particulars Suresh Ramesh Mahesh Ganesh

To Revaluation 17,000 17,000 25,500 25,500 By Balance 1,00,000 1,50,000 2,00,000 2,50,000

A/c (Loss) b/d

To Mahesh’s 2,250 2,250 By Suresh 2,250 2,250

Capital A/c - - Capital A/c - -

To Ganesh’s By Ramesh

Capital A/c 2,250 2,250 Capital A/c 2,250 2,250

- - - -

To Cash A/c By Cash - -

A/c

To Balance c/d - - 25,250 75,250 5,250

1,53,750 25,250

1,53,750 1,53,750 1,53,750

1,75,250 1,75,250 2,04,500 2,54,500 1,75,250 1,75,250 2,04,500 2,54,500

Balance Sheet

For the year ending…..

Liabilities Rs Assets Rs

Capital Fixed Assets 6,00,000

Suresh 1,53,750 Less: Depreciation (60,000) 5,40,000

Ramesh 1,53,750

Mahesh 1,53,750 Current Assets 3,45,000

Ganesh 1,53,750 6,15,000

Sundry Creditors 1,70,000

Claim against WCF 1,00,000

8,85,000 8,85,000

Working Notes:

WN 1: Calculation of Gaining Ratio/Sacrificing Ratio:

Old Ratio 2:2:3:3

New Ratio 1:1:1:1

Class XII Accountancy www.vedantu.com 14

2 1 1

Suresh = − =− (Gaining)

10 4 20

2 1 1

Ramesh = − =− (Gaining)

10 4 20

3 1 1

Mahesh = − = (Sacrificing)

10 4 20

3 1 1

Ganesh = − = (Sacrificing)

10 4 20

Suresh, Ramesh will compensate Mahesh, Ganesh

Journal Entry for Goodwill

L.F Dr. Cr.

Date Particulars

. Rs Rs

Suresh’s Capital A/c Dr 4,500

Ramesh’s Capital A/c Dr 4,500

To Mahesh’s Capital A/c 4,500

To Ganesh’s Capital A/c 4,500

(Being gaining partners compensate sacrificing

partners)

WN 2: Calculation of Adjusted Capital

Suresh = 1,00,000 − 21,500 =

Rs 78,500

Ramesh = 1,50,000 − 21,500 =

Rs 1,28,500

Mahesh = 2,04,500 − 25,500 =

Rs 1,79,000

Ganesh = 2,54,500 − 25,500 =

Rs 2,29,000

Total Combined Capital = 6,15,000

WN 3: Calculation of New Capital

1

Suresh = 615000 × 153750

=

4

Class XII Accountancy www.vedantu.com 15

1

Ramesh = 615000 × 153750

=

4

1

Mahesh = 615000 × 153750

=

4

1

Ganesh = 615000 × 153750

=

4

14. On 1.4.2015, KVK Ltd. issued 15,000, 9% debentures of Rs. 100 each at a

discount of 7%, redeemable at a premium of 10% after 10 years. The company

closes its books on 31st March every year. Interest on 9% debentures is payable

on 30th September and 31st March every year. The rate of tax deducted at

source is 10%. Pass necessary journal entries for the issue of 9% debentures

and debenture interest for the year ended 31st March, 2016. 6 Marks

Ans: Journal Entries

For the year ending…...

Dr. Cr.

Date Particulars LF

Rs Rs

2015 Bank A/c (15000 × Rs 93) Dr. 13,95,000

Apr 1 To 9% Debenture Application and Allotment A/c 13,95,000

(Being received application money on 15,000

Debentures.)

Apr 1 9% Debenture Application and Allotment A/c 13,95,000

Dr. 1,05,000

Discount on Issue of Debenture A/c Dr.

(15000 × Rs 7) 1,50,000

Loss on Issue of Debenture A/c Dr.

(15000 × Rs 10)

To 9% Debentures A/c (15000 × Rs 100) 15,00,000

1,50,000

To Premium on Redemption of Debenture

A/c

(15000 × Rs 10)

(Being application money transferred to

Debenture Account.)

Class XII Accountancy www.vedantu.com 16

Sep 30 6

Debenture Interest A/c (1500000 × 9% × ) Dr.

12

To Debentures holder’s A/c 67,500

To TDS Payable A/c 60,750

(Being interest due.) 6,750

Sep 30 Debenture holder’s A/c Dr. 60,750

TDS Payable A/c Dr. 6,750

6

To Bank A/c (1500000 × 9% × )

12 67,500

(Being interest Paid.)

2016 6 67,500

Debenture Interest A/c (1500000 × 9% × )

Mar 31 12

Dr.

To Debentures holder’s A/c 60,750

To TDS Payable A/c 6,750

(Being interest due.)

Mar 31 Debenture holder’s A/c Dr. 60,750

TDS Payable A/c Dr. 6,750

6 67,500

To Bank A/c (1500000 × 9% × )

12

(Being interest Paid.)

Mar 31 Statement of Profit & Loss A/c Dr. 1,35,000

To debenture interest A/c (1500000 × 9%) 1,35,000

(Being interest transferred to Profit & Loss

Account.)

15. Pass necessary journal entries on the dissolution of a partnership firm in

the following cases: 6 Marks

i. Expenses of dissolution were Rs. 9,000.

ii. Expenses of dissolution Rs. 3,400 were paid by a partner, Vishal.

iii. Shiv, a partner, agreed to do the work of dissolution for a commission of

Rs. 4,500. He also agreed to bear the dissolution expenses. Actual

dissolution expenses Rs. 3,900 were paid from the firm’s bank account.

iv. Naveen, a partner, agreed to look after the dissolution work for which he

was allowed a remuneration of Rs. 3,000. Naveen also agreed to bear the

Class XII Accountancy www.vedantu.com 17

dissolution expenses. Actual expenses on dissolution Rs. 2,700 were paid

by Naveen.

v. Vivek, a partner, was appointed to look after the dissolution work for a

remuneration of Rs. 7,000. He agreed to bear the dissolution expenses.

Actual dissolution expenses R. 6,500 were paid by Rishi, another partner,

on behalf of Vivek.

vi. Gaurav, a partner, was appointed to look after the work of dissolution

for a commission of Rs. 12,500. He agreed to bear the dissolution

expenses. Gaurav took over furniture of Rs. 12,500 as his commission.

The furniture had already been transferred to realisation account.

Ans: Journal Entries

For the year ending…

Date Debit Credit

Particulars L.F.

Rs Rs

1 Realisation A/c Dr 9,000

To Bank A/c 9,000

(Being expenses are borne and paid by the firm)

2 Realisation A/c Dr 3,400

To Vishal’s Capital A/c 3,400

(Being expenses paid by a partner on behalf of the firm)

3-A Realisation A/c Dr 4,500

To Shiv’s Capital A/c 4,500

(Being Remuneration paid)

3-B Shiv’s Capital A/c Dr 3,900

To Bank A/c 3,900

(Being expenses paid by the firm)

4 Realisation A/c Dr 3,000

To Naveen’s Capital A/c 3,000

(Being Remuneration paid)

5-A Realisation A/c Dr 7,000

To Vivek’s Capital A/c 7,000

Class XII Accountancy www.vedantu.com 18

(Being Remuneration paid)

5-B Vivek’s Capital A/c Dr 6,500

To Rishi’s Capital A/c 6,500

(Being expenses paid by one partner, borne by other)

6 No Entry

16. The issue was fully subscribed. Gopal, a shareholder holding 200 shares, did

not pay the allotment money and Madhav, a holder of 400 shares, paid his entire

share money along with the allotment money. Gopal’s shares were immediately

forfeited after allotment. Afterwards, the first call was made. Krishna, a holder

of 100 shares, failed to pay the first call money and Girdhar, a holder of 300

shares, paid the second call money also along with the first call. Krishna’s

shares were forfeited immediately after the first call. Second and final call was

made afterwards and was duly received. All the forfeited shares were reissued

at Rs. 9 per share fully paid up. Pass necessary journal entries for the above

transactions in the books of the company.

Ans: In the Books of VXN Ltd

Journal Entries

For the year ending…...

Debit Credit

Date Particulars L.F. Amount Amount

(₹) (₹)

Bank A/c (50,000 × 4) Dr. 2,00,000

To Equity Share Application A/c 2,00,000

(Received application money on 50,000 shares)

Equity Share Application A/c Dr.

To Equity Share Capital A/c 2,00,000

To Securities Premium Reserve A/c 1,00,000

1,00,000

(Transfer of application money to Share Capital)

Class XII Accountancy www.vedantu.com 19

Equity Share Allotment A/c (50,000 × 6) Dr.

To Equity Share Capital A/c 3,00,000

To Securities Premium Reserve A/c 1,50,000

(Allotment due on 50,000 shares) 1,50,000

Bank A/c (49,800 × 6) + (400 × 8) Dr.

To Equity Share Allotment A/c (49,800 × 5)

3,02,000

To Calls-in-Advance A/c (400 × 8)

2,98,800

(Allotment money received) 3,200

Equity Share Capital A/c (200 × 5) Dr.

Securities Premium Reserve A/c (200 × 3) Dr.

To Equity Share Allotment A/c (200 × 6) 1,000

To Equity Share Forfeiture A/c (200 × 2) 600

(Forfeiture of 200 shares for non-payment of

1,200

allotment money including premium of Rs 3)

400

Equity Share First Call A/c (49,800 × 5) Dr.

To Equity Share Capital A/c

To Securities Premium Reserve A/c

(Call money due on 49,800 shares) 2,49,000

Bank A/c (49,700 × 5) − 2,000 + 900 Dr. 1,99,200

Calls-in-Advance A/c (400 × 5) Dr. 49,800

To Calls-in-Advance A/c (300 × 3)

To Equity Share First Call A/c

(Received call money) 2,47,400

2,000

Equity Share First Call A/c (100 × 9) Dr. 900

2,48,500

Securities Premium Reserve A/c (100 × 1)

To Equity Share Allotment A/c (100 × 5)

To Equity Share Forfeiture A/c (100 × 5)

(Forfeiture of 100 shares for non-payment of call 900

money) 100

500

Equity Share Second and Final Call A/c Dr.

Class XII Accountancy www.vedantu.com 20

(49,700 × 3) 500

To Equity Share Capital A/c

To Securities Premium A/c

(Call money due on 49,700 shares)

1,49,100

Bank A/c Dr.

Calls-in-Advance A/c (1,200 + 900) 49,700

To Equity Share Second and Final Call A/c 99,400

(Received call money on shares)

Bank A/c (300 × 9) Dr.

1,47,000

Equity Share Forfeiture A/c

2,100

To Equity Share Capital A/c

1,49,100

(Reissue of 300 shares at Rs 9 per share)

Equity Share Forfeiture A/c (400 + 500 − 300) Dr.

2,700

To Capital Reserve A/c 300

(Profit on reissue transferred to Capital Reserve 3,000

Account)

600

600

Or

JJK Ltd. invited applications for issuing 50,000 equity shares of Rs. 10 each at

par. The amount was payable as follows:

On Application : Rs. 2 per share

On Allotment : Rs. 2 per share

On First and Final Call : Balance amount

The issue was oversubscribed three times. Applications for 30% shares were

rejected and money refunded. Allotment was made to the remaining applicants

as follows:

Class XII Accountancy www.vedantu.com 21

Category No. of Shares Applied No. of Shares Allotted

I 80,000 40,000

II 25,000 10,000

Excess money paid by the applicants who were allotted shares was adjusted

towards the sums due on allotment. Deepak, a shareholder belonging to

Category I, who had applied for 1,000 shares, failed to pay the allotment money.

Raju, a shareholder holding 100 shares, also failed to pay the allotment money.

Raju belonged to Category II. Shares of both Deepak and Raju were forfeited

immediately after allotment. Afterwards, first and final call was made and was

duly received. The forfeited shares of Deepak and Raju were reissued at Rs. 11

per share fully paid up. Pass necessary journal entries for the above

transactions in the books of the company.

Ans: Journal Entries

For the year ending…...

Debit Credit

Date Particulars L.F. Amount Amount

(₹) (₹)

Bank A/c (1,50,000 × 4) Dr. 3,00,000

To Share Application A/c 3,00,000

(Received application money on 1,50,000 shares)

Share Application A/c Dr. 3,00,000

To Share Capital A/c 1,00,000

To Share Allotment A/c 1,10,000

To Bank A/c 90,000

(Transfer of application money to Share Capital)

Share Allotment A/c (50,000 × 4) Dr.

2,00,000

To Share Capital A/c

2,00,000

(Allotment due on 50,000 shares)

Bank A/c Dr.

88,900

To Share Allotment A/c (WN2)

88,900

Class XII Accountancy www.vedantu.com 22

(Allotment money received)

Share Capital A/c (600 × 6) Dr. 3,600

To calls in arrear A/c (1000 + 100) 1,100

To forfeiture share A/c 2,500

(Being shares forfeiture on which allotment money

received)

Share First and Final Call A/c Dr.

To Share Capital A/c 1,97,600

(Call money due on 49,400 shares) 1,97,600

Bank A/c Dr.

1,97,600

To Share First and Final Call A/c

1,97,600

(Received call money)

Bank A/c (600 × 11) Dr.

6,600

To Share Capital A/c 6,000

To Security Premium Reserve A/c 600

(600 shares reissued at Rs.11 per share)

Share Forfeiture A/c Dr. 2,500 2,500

To Capital Reserve A/c

(Profit on reissue transferred to Capital Reserve

Account)

Working Notes:

WN1: Computation Table

Money Money

received transferre Amount

Excess

Shares Shares on d to Share adjusted Money

Categories Application

Applied Allotted Applicati Capital on refunded

Money

on @Rs.2 @Rs.2 Allotment

each each

I 80,000 40,000 1,60,000 80,000 80,000 80,000 -

II 25,000 10,000 50,000 20,000 30,000 30,000 -

III 45,000 - 90,000 - - - 90,000

1,50,000 50,000 3,00,000 1,00,000 1,10,000 1,10,000 90,000

Class XII Accountancy www.vedantu.com 23

WN2: Calculation of amount Received on allotment

Amount due on allotment 2,00,000

Less: Excess Received (1,10,000)

Balance to be Received 90,000

Less: Amount not paid by Deepak (1,000)

Less: Amount not paid by Raju (100)

Amount Received on allotment 88,900

40000

Shares Allotted to Deepak = 1000 × 500

=

80000

WN3: Calculation of Shares Applied/Allotted

25000

Shares Applied by Raju = × 100 =

250

10000

Amount not paid by Deepak on Allotment

Amount received on Application 2,000

Less: Transferred to Share Capital (1,000)

Excess received on Application 1,000

Amount due on allotment 2,000

Less: Excess adjustment (1,000)

Amount unpaid by Deepak 1,000

Amount not paid by Raju on Allotment

Amount received on Application 500

Less: Transferred to Share Capital (200)

Excess received on Application 300

Class XII Accountancy www.vedantu.com 24

Amount due on allotment 400

Less: Excess adjustment (300)

Amount unpaid by Raju 100

17. C and D are partners in a firm sharing profits in the ratio of 4:1. On

31.3.2016, their Balance Sheet was as follows:

Balance Sheet of C and D as on 31.3.2016

Amount Amount

Liabilities

(₹) Assets (₹)

Sundry Creditors 40,000 Cash 24,000

Provision for Bad Debts 4,000 Debtors 36,000

Outstanding Salary 6,000 Stock 40,000

General Reserve 10,000 Furniture 80,000

Capitals: Plant and Machinery 80,000

C 1,20,000

D 80,000 2,00,000

2,60,000 2,60,000

1

On the above date, E was admitted for th hare in the profits on the following

4

terms:

i. E will bring Rs. 1,00,000 as his capital and Rs. 20,000 for his share of

goodwill premium, half of which will be withdrawn by C and D.

ii. Debtors Rs. 2,000 will be written off as bad debts and a provision of 4%

will be created on debtors for bad and doubtful debts.

iii. Stock will be reduced by Rs. 2,000, furniture will be depreciated by Rs.

4,000 and 10% depreciation will be charged on plant and machinery.

iv. Investments of Rs. 7,000 not shown in the Balance Sheet will be taken into

account.

v. There was an outstanding repairs bill of Rs. 2,300 which will be recorded

Class XII Accountancy www.vedantu.com 25

in the books.

Pass necessary journal entries for the above transactions in the books of the

firm on E’s admission.

Ans: Journal Entries

For the year ending…...

Debit Credit

Date Particulars L.F. Amount Amount

(₹) (₹)

Cash A/c Dr. 30,000

To E’s Capital A/c 20,000

(Deceased partner’s share of goodwill transferred to 50,000

her capital A/c)

Profit and Loss Suspense A/c Dr. 28,000

To Aditi’s Capital A/c 28,000

(Aditi’s share of profit till the date of death credited to

Aditi’s Capital A/c)

Aditi’s Capital A/c Dr. 3,78,000

To Aditi’s Executors A/c 3,78,000

(Balance in Aditi’s capital A/c transferred to her

Executors A/c)

Aditi’s Executors A/c Dr. 1,89,000

To Cash A/c 1,89,000

(Aditi’s Executors were paid half of the amount due to

them)

Or

Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses

in the ratio of 4:3:3. On 31.3.2016, their Balance Sheet was as follows:

Balance Sheet of Sameer, Yasmin and Saloni as on 31.3.2016

Class XII Accountancy www.vedantu.com 26

Amount Amount

Liabilities

(₹) Assets (₹)

Creditors 1,10,000 Cash 80,000

General Reserve 60,000 Debtors 90,000

Capitals: Less: Provision 10,000 80,000

Sameer 3,00,000 Stock 1,00,000

Yasmin 2,50,000 Machinery 3,00,000

Saloni 1,50,000 7,00,000 Building 2,00,000

Patents 60,000

Profit and Loss Amount 50,000

8,70,000 8,70,000

On the above date, Sameer retired and it was agreed that:

i. Debtors of Rs. 4,000 will be written off as bad debts and a provision of

5% on debtors for bad and doubtful debts will be maintained.

ii. An unrecorded creditor of Rs. 20,000 will be recorded.

iii. Patents will be completely written off and 5% depreciation will be

charged on stock, machinery and building.

iv. Yasmin and Saloni will share future profits in the ratio of 3:2.

v. Goodwill of the firm on Sameer’s retirement was valued at Rs. 5,40,000.

Pass necessary journal entries for the above transactions in the books of the

firm on Sameer’s retirement.

PART – B

(Analysis of Financial Statements)

18. State whether the following will increase, decrease or have no effect on cash

flow from operating activities while preparing ‘Cash Flow Statement’:

i. Decrease in outstanding employees benefits expenses by Rs. 3,000

Class XII Accountancy www.vedantu.com 27

ii. Increase in prepaid insurance by Rs. 2,000 1 Marks

Ans: The following will increase, decrease or have no effect on cash flow from

operating activities while preparing ‘Cash Flow Statement’ are stated below:

i. If there is a drop in the current obligation of employee benefit expenses that

are due, it will be recognised as a change in working capital. As a result, a

decrease in current obligation is considered a cash outflow from operating

activities.

ii. A rise in prepaid insurance is viewed as an increase in current assets, resulting

in a drop in operating cash flow (or outflow).

19. Will ‘acquisition of machinery by issue of equity shares’ be considered while

preparing ‘Cash Flow Statement’? Give reason in support of your answer.

1 Marks

Ans: No, while generating a cash flow statement, the acquisition of machinery

through the issuance of equity shares is not taken into account. This is because there

is no cash flow in the example above, hence the Cash Flow Statement is unaffected.

20. State the objectives of ‘Analysis of Financial Statements’. 4 Marks

Ans: The following are the financial analysis' objectives:

i. It allows for the comparison of financial facts in a relevant way. It allows for a

clearer and more straightforward understanding of how financial data changes over

time.

ii. It enables control and checks over the use of financial resources, which aids in the

design of effective plans and improved execution of plans.

iii. Financial statement analysis aids in determining a company's earning capacity

and profitability. It also assesses the effectiveness of a company's activities.

iv. It also aids in determining the firm's solvency condition. This means that by

analyzing financial accounts, you can determine a company's ability to meet both

short- and long-term obligations (debts).

Class XII Accountancy www.vedantu.com 28

21. Financial statements are prepared following the consistent accounting

concepts, principles, procedures and also the legal environment in which the

business organizations operate. These statements are the sources of information

on the basis of which conclusions are drawn about the profitability and

financial position of a company so that their users can easily understand and

use them in their economic decisions in a meaningful way. From the above

statement identify any two values that a company should observe while

preparing its financial statements. Also, state under which major headings and

sub-headings the following items will be presented in the Balance Sheet of a

company as per Schedule III of the Companies Act, 2013.

i. Capital Reserve

ii. Calls-in-Advance

iii. Loose Tools

iv. Bank Overdraft 4 Marks

Ans: Values that must be followed by a corporation when generating financial

statements.

a) Accounting concepts, principles, and processes must be followed when

preparing financial statements.

b) Financial statements must be prepared in accordance with ethical and legal

guidelines.

Item Major Head Sub-Head

Capital Reserve Shareholders' Funds Reserves & Surplus

Calls-in-

Current Liabilities Other Current Liabilities

Advance

Loose Tools Current Assets Inventories

Bank Overdraft Current Liabilities Short Term Borrowings

22. The proprietary ratio of M. Ltd. is 0·80:1.

Class XII Accountancy www.vedantu.com 29

State with reasons whether the following transactions will increase, decrease or

not change the proprietary ratio:

i. Obtained a loan from bank Rs. 2,00,000 payable after five years.

ii. Purchased machinery for cash Rs. 75,000.

iii. Redeemed 5% redeemable preference shares Rs. 1,00,000.

iv. Issued equity shares to the vendors of machinery purchased for Rs.

4,00,000. 4 Marks

Ans:

Transaction Implication

Obtained a loan from bank Total assets are increasing by 2,00,000 (as cash is

Rs 2,00,000 payable after coming in) but shareholders' funds remain intact, so

five years. proprietary ratio will decrease.

Total assets are increasing and decreasing by 75,000

Purchased machinery for simultaneously (as cash is going out and machinery is

cash Rs 75,000. coming in), hence both numerator and denominator

remain intact, therefore proprietary ratio will not

change.

Redeemed 5%

Both shareholders' funds and total assets decrease by

redeemable preference

1,00,000 simultaneously and proprietary ratio decreases.

shares Rs 1,00,000.

Issued equity shares to the Both shareholders' funds and total assets increase by

vendors of machinery 4,00,000 simultaneously and proprietary ratio

purchased for Rs improves.

4,00,000.

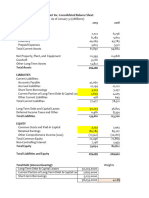

23. From the following Balance Sheet of SRS Ltd. and the additional

information as on 31.3.2016, prepare a Cash Flow Statement: 6 Marks

Balance Sheet of SRS Ltd. as on 31.3.2016

Class XII Accountancy www.vedantu.com 30

Notes to Accounts:

Additional Information:

i. Rs. 50,000, 12% debentures were issued on 31.3.2016.

ii. During the year a piece of machinery costing Rs. 40,000, on which

accumulated depreciation was Rs. 20,000, was sold at a loss of Rs. 5,000.

PART - B

(Computerised Accounting)

18. What is meant by a ‘Query’? 1 Mark

Ans: A query is a request for data or information from a table or set of tables in a

database.

19. What is meant by a ‘Database Report’? 1 Mark

Ans: A database report is a visual representation of queried data that can be used for

data discovery, analysis, and decision-making. Traditional BI systems and

embedded BI platforms can build database reports by making front-end requests to

a backend database.

20. Explain the steps involved in the installation of computerized accounting

software. 4 Marks

Ans: The steps involved in the installation of computerized accounting software are

as follows:

i. Organizational Manual Preparation:

Each executive's duties, powers, scope, and responsibilities are detailed in the

organisation handbook. It also shows the means and channels of communication

amongst the executives. This avoids functions from overlapping.

ii. Employee Appointment and Training:

Class XII Accountancy www.vedantu.com 31

Appointing the right individuals and providing them with appropriate training is

essential. If that's the case, they'll be able to do a great job on their own.

iii. Creating a variety of forms and reports:

According to the needs of managerial decision-making, top management can

develop various forms and decide on the contents of reports. Preparing multiple

forms and reports has the primary goal of preventing "bureaucratization."

iv. Accounts Codification and Classification:

For successful analysis and interpretation, financial accounting data is categorised

and codified. The accounts are categorised according to their nature. Accounts can

be easily identified thanks to the codification accounts.

v. Cost and financial data integration:

In management accounting, both cost accounting and financial accounting data are

employed. As a result, a system that can combine both cost and financial accounts

is required. It prevents data duplication. The integration system must be precise and

dependable.

vi. Establishing a System of Budgetary Control:

Budgets should be prepared by every organisation in order to fulfil its goals in a cost-

effective and efficient manner. As a result, management should put in place a proper

budgetary control mechanism. Furthermore, the proposed system should be

adaptable enough to accept future changes.

21. Explain ‘Flexibility’ and ‘Cost of installation’ as considerations before

opting for specific accounting software. 4 Marks

Ans: The ‘Flexibility’ and ‘Cost of installation’ as considerations before opting for

specific accounting software.

i. Flexibility: The most crucial element to consider when purchasing accounting

software is flexibility. The accounting software should be adaptable in terms of data

entry, data retrieval, and report design. The software should be able to run on a

variety of computers with various operating systems and configurations. It should

allow its users to be as flexible as possible.

Class XII Accountancy www.vedantu.com 32

ii. Cost of Installation and Maintenance: The cost of accounting software is a

major factor in making a decision. The cost of accounting software comprises the

cost of installing the necessary components and hardware, the cost of maintenance

and changes, the cost of staff training, and the cost of data recovery in the event of

data loss.

22. Explain any four sub-groups of the Account Group ‘Profit and Loss’ .

4 Marks

Ans:

i. Capital Account:

This is where the company's capital and reserves are kept. Share Capital, Partners'

Capital A/c, Proprietor's Capital A/c, and other Capital Account ledgers are

examples.

ii. Current Assets:

Current Assets are assets that do not belong to either the Bank Accounts or Cash-in-

Hand sub-groups in tally.

Bank Accounts include checking, savings, and short-term deposit accounts, among

others.

Tally has the cash in hand.

In this group, ERP 9 establishes a Cash A/c automatically. If necessary, you can

open multiple cash accounts.

iii. Current Liabilities

This category can be used to generate accounts such as Outstanding Obligations,

Statutory Liabilities, and other minor liabilities. The following are the sub-groups

under Current Liabilities.

a) Taxes and Duties: All tax accounts such as CGST, SGST, IGST, TDS, Income

Tax, and so on are included in Duties and Taxes.

b) Provisions: This category includes accounts such as Provision for Taxation,

Provision for Depreciation, and so on.

Class XII Accountancy www.vedantu.com 33

c) Sundry Creditors: For trade creditors, this term refers to the person who supplies

us with goods or to whom we owe money.

iv. Direct Expenses [Expenses Direct]

It has factory-related expenses, or more broadly, the factory's direct trade expenses,

such as wages given to workers, transportation, and electricity bills.

23. Explain the various elements of Charts/Graphs. 6 Marks

Ans: The following are the various elements of charts:

i. Chart area: This is where the chart will be placed.

ii. Data series: This refers to the many series that can be found in a chart, such as

the row and column of numbers.

iii. Axes: In a chart, there are two axes. They are the x- and y-axes, respectively.

iv. Plot area: The plot area is the most important part of the chart.

v. Grid lines: These lines serve as a point of reference for the chart.

Class XII Accountancy www.vedantu.com 34

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- BKP CBLM Core Journalize TransactionsDocument130 pagesBKP CBLM Core Journalize TransactionsEzekiel Lapitan100% (5)

- CBSE Class 12 Accountancy Important FormulasDocument3 pagesCBSE Class 12 Accountancy Important Formulasrio_harcan100% (2)

- CBSE Class 12 Accountancy Question Paper 2016Document42 pagesCBSE Class 12 Accountancy Question Paper 2016Ravi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2012 With SolutionsDocument38 pagesCBSE Class 12 Accountancy Question Paper 2012 With SolutionsRavi AgrawalNo ratings yet

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2014 With SolutionsDocument42 pagesCBSE Class 12 Accountancy Question Paper 2014 With SolutionsRavi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2015 With SolutionsDocument50 pagesCBSE Class 12 Accountancy Question Paper 2015 With SolutionsRavi AgrawalNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Blossom Senior Secondary School 1Document8 pagesBlossom Senior Secondary School 1raviNo ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Delhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Document3 pagesDelhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Lekhana WesleyNo ratings yet

- CBSE Accountancy 2017 Board QuestionsDocument10 pagesCBSE Accountancy 2017 Board QuestionsHeena Maqsood AhmadNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2018Document39 pagesCBSE Class 12 Accountancy Question Paper 2018vaishnavi coolNo ratings yet

- QP Xii Accs PB 1Document7 pagesQP Xii Accs PB 1ansabroxx02No ratings yet

- Accountancy 2018Document18 pagesAccountancy 2018MohamedZiaudeenNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- ABT - BK Question Bank22-23Document8 pagesABT - BK Question Bank22-23shrikantNo ratings yet

- CBSE Class 12 Accountancy Sample Paper 2019 Solved PDFDocument26 pagesCBSE Class 12 Accountancy Sample Paper 2019 Solved PDFMihir KhandelwalNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- AssingmentDocument4 pagesAssingmentGarima LohanNo ratings yet

- Asm1 25560Document12 pagesAsm1 25560shivanshu11o3o6No ratings yet

- 12 Acc SPR 2Document6 pages12 Acc SPR 2Yashasvi DhankharNo ratings yet

- Asm 25560Document9 pagesAsm 25560shivanshu11o3o6No ratings yet

- Class 12th Accountancy Set BDocument6 pagesClass 12th Accountancy Set BjashanjeetNo ratings yet

- Holiday Homework Accountancy Class 12Document15 pagesHoliday Homework Accountancy Class 12Sambhav GargNo ratings yet

- ACC 2024 Pre Board PDFDocument12 pagesACC 2024 Pre Board PDFKeshvi.No ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- CBSE 12 Accountancy 2019 SRDocument10 pagesCBSE 12 Accountancy 2019 SRmohit pandeyNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- 12th Accountancy Set - 1 QuestionsDocument9 pages12th Accountancy Set - 1 QuestionsKaran SinghNo ratings yet

- Adv Acc - BankingDocument13 pagesAdv Acc - Bankingrshyams165No ratings yet

- Term One Accountancy 12 QP & MSDocument13 pagesTerm One Accountancy 12 QP & MSVarun HurriaNo ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- 1234 WWWWDocument11 pages1234 WWWWbrainhub50No ratings yet

- ADJUSTING ENTRIES Part 3Document5 pagesADJUSTING ENTRIES Part 3MOCHI SSABELLENo ratings yet

- 12 Accounts ch6 tp1Document11 pages12 Accounts ch6 tp1Pawan TalrejaNo ratings yet

- ACCOUNTNCY QP Guugram RegionDocument12 pagesACCOUNTNCY QP Guugram Regionvivekdaiv55No ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- Worksheet On Dissolution of Partnership - Board Exam QuestionsDocument10 pagesWorksheet On Dissolution of Partnership - Board Exam QuestionsAhmedNo ratings yet

- CA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul AgrawalDocument8 pagesCA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul Agrawalharshveersingh480No ratings yet

- ULTIMATE Sample Paper 3Document22 pagesULTIMATE Sample Paper 3Vansh RanaNo ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- CBSE Sample Question Papers For Class 12 Accountancy 2020Document12 pagesCBSE Sample Question Papers For Class 12 Accountancy 2020Khan AkbarNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- XII Accountancy 2018-2019Document26 pagesXII Accountancy 2018-2019amanNo ratings yet

- Q.1 What Is Meant by Reconstitution of Partnership Firm?: New Ratio 11:7:6Document24 pagesQ.1 What Is Meant by Reconstitution of Partnership Firm?: New Ratio 11:7:6SUSHANTNo ratings yet

- 12 Accounts Half YearlyDocument5 pages12 Accounts Half YearlyRahul MajumdarNo ratings yet

- Retirement QuestionDocument2 pagesRetirement QuestionshubhamsundraniNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 01Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 01Rohan RughaniNo ratings yet

- PRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsDocument8 pagesPRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsKaustav DasNo ratings yet

- CBSE Sample Paper 2024 Class 12 Accountancy SQPDocument13 pagesCBSE Sample Paper 2024 Class 12 Accountancy SQPaninditaNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Term Paper On APEX FOODS LTD. Samina Sultana-8451Document45 pagesTerm Paper On APEX FOODS LTD. Samina Sultana-8451pranta senNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V06Document2 pagesSLF065 MultiPurposeLoanApplicationForm V06pen AbraNo ratings yet

- Clossme1 624580862Document16 pagesClossme1 624580862Surajit DoraNo ratings yet

- Financial Services: Finance Companies: True / False QuestionsDocument16 pagesFinancial Services: Finance Companies: True / False Questionslatifa hnNo ratings yet

- Finance Assignment 1Document10 pagesFinance Assignment 1khushbu mohanNo ratings yet

- ACCOUNTANCY Collectable Marks Question PapersDocument58 pagesACCOUNTANCY Collectable Marks Question PaperszanabunityNo ratings yet

- Sales Digest - Maceda LawDocument3 pagesSales Digest - Maceda LawKristine KristineeeNo ratings yet

- Chapter 11 Acc 113Document28 pagesChapter 11 Acc 113samaromsamar393No ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisShailyn AngcayNo ratings yet

- BOOK KEEPING AND BASIC ACCOUNTING - Dox AllenDocument11 pagesBOOK KEEPING AND BASIC ACCOUNTING - Dox AllenVipin MisraNo ratings yet

- Grade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305Document6 pagesGrade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305hobyanevisionNo ratings yet

- NHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PDocument30 pagesNHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PTrân LêNo ratings yet

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- FINMAR - Introduction To Financial Management and Financial MarketsDocument8 pagesFINMAR - Introduction To Financial Management and Financial MarketsLagcao Claire Ann M.No ratings yet

- International Academy of Management and Economics Incorporated vs. Litton and Co. IncDocument3 pagesInternational Academy of Management and Economics Incorporated vs. Litton and Co. IncOrlando DatangelNo ratings yet

- Test Bank For Financial Accounting An Integrated Approach 6th Edition by TrotmanDocument10 pagesTest Bank For Financial Accounting An Integrated Approach 6th Edition by TrotmanVivienne Lei BolosNo ratings yet

- "Azerbaijan Caspian Shipping" Closed Joint Stock CompanyDocument39 pages"Azerbaijan Caspian Shipping" Closed Joint Stock CompanyElik MəmmədovNo ratings yet

- Unit 8 Indian Contract Act Handwritten NotesDocument18 pagesUnit 8 Indian Contract Act Handwritten NotesDasharath RautNo ratings yet

- Lecture1 - Nov 2021 - IntroDocument30 pagesLecture1 - Nov 2021 - IntroJoanNo ratings yet

- Expenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Document6 pagesExpenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Srijan SaxenaNo ratings yet

- Feb 2022Document3 pagesFeb 20223aconsultancyNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- Money MattersDocument20 pagesMoney MattersGaurang PatelNo ratings yet

- B-MGAC203 Long QuizDocument6 pagesB-MGAC203 Long QuizMa. Yelena Italia TalabocNo ratings yet

- Fa1 Mock 3Document9 pagesFa1 Mock 3smartlearning1977No ratings yet

- Student Guide Lesson EightDocument9 pagesStudent Guide Lesson EightKhosrow KhazraeiNo ratings yet

- IX English II - QB - Final.1609738132Document8 pagesIX English II - QB - Final.1609738132Prashant PandeyNo ratings yet

- Assignment Comparative Ratio Analysis ofDocument16 pagesAssignment Comparative Ratio Analysis ofAbhishekDey162b BBANo ratings yet