Professional Documents

Culture Documents

IA2-Income Tax

IA2-Income Tax

Uploaded by

CJ Riano0 ratings0% found this document useful (0 votes)

39 views2 pagesThe document shows accounting income and adjustments to arrive at taxable income of $7,000,000 for West Company. It then provides requirements to calculate current tax expense, deferred tax asset, deferred tax liability, and total income tax expense. Requirement 6 shows the statement of comprehensive income, reporting net income of $6,750,000 after deducting total income tax expense of $2,250,000 from income before tax.

Original Description:

Intermediate Accounting 2 Valix

Original Title

IA2-Income tax

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows accounting income and adjustments to arrive at taxable income of $7,000,000 for West Company. It then provides requirements to calculate current tax expense, deferred tax asset, deferred tax liability, and total income tax expense. Requirement 6 shows the statement of comprehensive income, reporting net income of $6,750,000 after deducting total income tax expense of $2,250,000 from income before tax.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

39 views2 pagesIA2-Income Tax

IA2-Income Tax

Uploaded by

CJ RianoThe document shows accounting income and adjustments to arrive at taxable income of $7,000,000 for West Company. It then provides requirements to calculate current tax expense, deferred tax asset, deferred tax liability, and total income tax expense. Requirement 6 shows the statement of comprehensive income, reporting net income of $6,750,000 after deducting total income tax expense of $2,250,000 from income before tax.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

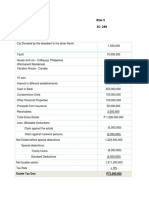

Problem 16-10

Accounting Income 9,000,000

Land (3,000,000) DTL

Machinery and Equipment (1,000,000) DTL

Inventory 1,500,000 DTA

Accounts Receivable 500,000 DTA

Taxable Income 7,000,000

Req 1

Income tax expense 1,750,000

Income tax payable 1,750,000

Req 2 Deferred tax asset 500,000

Income tax expense 500,000

Req 3 Income tax expense 1,000,000

Deferred tax liability 1,000,000

req 4 Land (3,000,000)

Machinery and Equipment (1,000,000)

Future taxable amount (4,000,000)

25%

DTL (1,000,000)

Req 5 Income tax expense 1,750,000

Deferred tax asset (500,000)

Deferred tax liability 1,000,000

TOTAL INCOME TAX EXPENSE 2,250,000

Req 6 West Company

Statement of Comprehensive Income

for the period Dec 31

Income before tax 9,000,000

Less: Income tax expense

Current tax expense 1,750,000

Deferred tax Asset (500,000)

Deferred tax liability 1,000,000 (2,250,000)

Net Income 6,750,000

Inventory 1,500,000

Accounts Receivable 500,000

Future deductible amount 2,000,000

25%

DTA 500,000

You might also like

- Financial Accounting and Reporting Test BankDocument30 pagesFinancial Accounting and Reporting Test BankMiku Lendio78% (9)

- PPEDocument30 pagesPPEJohn Kenneth AlicawayNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Far Quiz 2 Final W AnswersDocument4 pagesFar Quiz 2 Final W AnswersMarriz Bustaliño Tan78% (9)

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- ACT150 Assignment DIMAAMPAODocument4 pagesACT150 Assignment DIMAAMPAOJeromeNo ratings yet

- 10Document1 page10Bryan KenNo ratings yet

- BAFACR16 01 Problem IllustrationsDocument2 pagesBAFACR16 01 Problem Illustrationsmisssunshine112No ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- Tidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxDocument7 pagesTidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxAlfatih 1453No ratings yet

- Chapter 21 - Review Acct 343Document19 pagesChapter 21 - Review Acct 343Alisia LeNo ratings yet

- Tutorial 12 (Answer)Document6 pagesTutorial 12 (Answer)Vidya IntaniNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- Solvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionDocument9 pagesSolvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionlolaNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Laboratory Exercise 2 - Intermediate Accounting 3Document2 pagesLaboratory Exercise 2 - Intermediate Accounting 3Zeniah LouiseNo ratings yet

- Financial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionDocument29 pagesFinancial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionBernadette PalermoNo ratings yet

- 2019 IntAcc Vol 3 CH 4 AnswersDocument9 pages2019 IntAcc Vol 3 CH 4 AnswersRizalito SisonNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- AFA Class 11 Income Taxes Answers AllDocument18 pagesAFA Class 11 Income Taxes Answers AllaniaNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- FAR Test BankDocument24 pagesFAR Test BankMaryjel17No ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- 2019 IntAcc Vol 3 CH 4 Answers-Excel-SheetDocument15 pages2019 IntAcc Vol 3 CH 4 Answers-Excel-SheetRizalito SisonNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

- Reviewer TAXDocument3 pagesReviewer TAXAnnabel MendozaNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Midterm Q&a Ca2 Question Tri 2, 2016.17Document6 pagesMidterm Q&a Ca2 Question Tri 2, 2016.17GautamNo ratings yet

- Exercise 4Document17 pagesExercise 4LoyalNamanAko LLNo ratings yet

- Tax Cases Corp FTG Sy22-23Document8 pagesTax Cases Corp FTG Sy22-23charmaineenriquez24No ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Fav2chp4 9Document122 pagesFav2chp4 9Emey CalbayNo ratings yet

- FAC 3701 Exam PackDocument52 pagesFAC 3701 Exam Packartwell MagiyaNo ratings yet

- Sole Trader - Final Accounts: The Following Trial Balance Was Extracted From The Books of K. Kelly On 31/12/2005Document8 pagesSole Trader - Final Accounts: The Following Trial Balance Was Extracted From The Books of K. Kelly On 31/12/2005MahmozNo ratings yet

- CPAR B94 TAX Final PB Exam - Answers - SolutionsDocument12 pagesCPAR B94 TAX Final PB Exam - Answers - SolutionsSilver LilyNo ratings yet

- John Paul - Ia2 She QuizDocument2 pagesJohn Paul - Ia2 She QuizTomas JMNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- BUSITAX (Final Output)Document5 pagesBUSITAX (Final Output)Ivan AnaboNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Unit 12-Question 12-A Sol (2023)Document3 pagesUnit 12-Question 12-A Sol (2023)shirleygebenga020829No ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)