Professional Documents

Culture Documents

Corporate Cost of Debt: The Issue of Premium or Discount Bonds

Corporate Cost of Debt: The Issue of Premium or Discount Bonds

Uploaded by

Dipal KotakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Cost of Debt: The Issue of Premium or Discount Bonds

Corporate Cost of Debt: The Issue of Premium or Discount Bonds

Uploaded by

Dipal KotakCopyright:

Available Formats

Corporate cost of debt: the issue of premium or discount bonds

Thomas Secrest Coastal Carolina University Robert Burney Coastal Carolina University

ABSTRACT

INTRODUCTION

The corporate cost of debt is a simple matter of determining the yield to maturity that investors demand from the corporations outstanding bonds As a practical matter, the actual cost of debt also depends on several other factors which include: 1. Floatation costs that are paid by the corporation when the debt is issued (consisting of the underwriting spread, legal, regulatory, and other expenses), 2. The relationship between the yield to maturity demanded by new bondholders and the coupon rate of outstanding debt, 3. The timing of the coupon payments, 4. The corporations marginal tax rate after debt is issued, 5. Incentives or features that the bonds may carry (e.g. convertible, callable, sinking fund, warrants, etc.), and 6. The choice of accounting method used to record the coupon interest, the amortization of a premium or discount, and the expenses related to the bond issuance. The traditional bond pricing formula consists of discounting the future coupon payments and the lump sum maturity value to arrive at a fair market price for the bond. Formula 1

Where: FMP0 = Current fair market price of the bond if rd is known. PAR = Maturity or Par value to be returned to investor upon maturity. N = Total number of periods until the bond matures. t = Individual time periods until maturity. CI = Dollar amount of interest paid per coupon period. rd = The periodic before-tax cost of debt stated as a percentage (also the yield to maturity), if the current market price of the bond is known.

Effect of cost of debt on Coupon Rates The effect on the cost of debt of issuing bonds with coupon rates that are not equal to the yield demanded by investors. This condition causes the individual bonds to initially sell at a premium or a discount from par value. In the case of a discount bond, the coupon rate is insufficient to compensate investors, so additional compensation is sought by bidding less than the par value. The opposite occurs for premium bonds. The coupon rate is desirable because it is above investors required yield and the price is bid up with the understanding that the premium over par value will not be returned. Methods used to record the Actual Interest Expense Two methods exist that may be used to report the actual interest expense recorded for bonds that are issued at a premium or discount.

1. 2.

Straight Line Method Effective Interest Method

Each method carries different implications in terms of correctly identifying the cost of debt capital, since the time distribution of the dollar amounts to be amortized will affect the present value of the difference in deductible expenses. The time distribution of these expenses is critical to arrive at an appropriate percentage cost of capital.

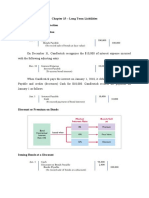

1. The straight-line method of bond amortization The straight-line method of amortizing the expenses of issuing the bond and the discount or premium assumes: 1. Total floatation costs are deducted in equal dollar amounts each coupon period over the life of the security. 2. If the funds received net of floatation costs are greater than the par value, the difference is deducted in equal dollar amounts each coupon payment period until maturity. 3. If the funds received net of flotation costs are less than the par value, the difference is added in equal dollar amounts each coupon payment period until

Formula

The introduction of a new term, which represents the constant dollar amount added to interest expense each coupon period, reduces Equation (4) to: Formula

The form of Equation (5) encompasses both discount and premium

bonds. For premium bonds,is negative as the amount received when the bonds are issued is larger than the commitment at maturity. Therefore, the cash flow recorded by the corporation for interest expense will be lower than the actual cash flow paid to bondholders. The difference takes into account the amortization of the premium associated with the original issue. In the case of bonds issued at a discount, interest expense recorded will be higher than the actual coupon payment to bondholders. The amortization of the bond as it moves toward maturity is recorded as additional interest expense each coupon period although the cash flow at maturity has yet to occur. When a corporation chooses to use the straight-line accounting method, the percentage cost of debt capital changes each period because the book value of the bond issuance changes while the interest expense recorded remains constant. Example A corporate coupon bond issued with the following characteristics will provide an investor an annual yield to maturity of 8.2619%. a. Maturity value of $1,000. b. Coupon rate of 6%. c. Annual interest payments. d. Term to maturity of 10 years. e. Corporation pays taxes at the marginal rate of 40%. f. The corporation receives $850 after floatation costs for each bond sold. Further assume that a total of 1,000 bonds are issued so the corporation receives $850,000 after all costs related to the issue are incorporated. Under the straight-line method of accounting for the $150,000 discount from par value, the discount is then equally distributed over the 10 payment periods and added to the $60,000 recorded as the coupon payment to bondholders. The corporation will record $75,000 as interest expense each coupon payment 2. The effective interest method of bond amortization The effective interest method of accounting for bond amortization is more consistent with finance theory than the straight-line method of accounting for interest expense and bond discount or premium amortization. This method assumes:

1. Floatation costs are deductible at each coupon period over the life of the security, 2. In addition to each coupon payment, the corporation records as interest expense the change in the amortized value of the bond each coupon period. Since the amortized value of the bond does change over time, the total dollar amount of interest expense for any given period will change as well. This method allocates the amortization of a discount or premium in such a way that the before-tax bond yield (cost) is a constant rate of interest, rather than a constant dollar amount, as in the straight-line method. Formula The average cost of debt from the straight-line method of accounting for floatation costs and amortization results in a lower estimate of the cost of debt for an original issue discount bond than the effective interest method. If the bond were originally issued at a premium, the strict average cost of debt from the straight-line method would be slightly higher than the effective interest method.

TIME VALUE OF MONEY CONSIDERATIONS WHEN CHOOSING A METHOD FOR FLOATATION COSTS AND AMORTIZATION OF A DISCOUNT OR PREMIUM OF A CORPORATE BOND ISSUE Due to the difference in the actual dollar interest expense recorded between the straightline and the effective interest methods, it is relevant in finance theory to consider which choice may benefit the corporation over time. Discount bond issues, when all costs are considered If the straight-line method is chosen, the difference in actual taxdeductible interest expense by the corporation that has issued a discount bond is positive in the early years and negative in later years. Finance theory pertaining to the timing of cash flows suggests that this is a desirable situation.

A corporation which nets less than par value from an issue of bonds after all costs and yields are considered would be wise to choose the straight-line method of accounting for coupon interest, amortizable expenses, and the bond discount. In doing so, the corporation receives a net benefit over the alternative accounting method. Premium bond issues, when all costs are considered Internet

CONCLUSION When coupon bonds are issued, the corporation has a choice of methods to account for the flotation costs and amortization of a premium or discount from par value. The straight-line method simply averages the costs and difference from par value over the life of the bond and deducts, or adds in the case of a premium, the same amount to actual coupon interest expense each period. Finally, the time value of money effect of the two choices of accounting methods is detailed. If a corporation receives less than par value after all costs and yields are considered, it is wise to choose the straight-line method of accounting for these factors when preparing financial statements. The choice of the straight-line method will provide more benefit than the alternative. If a corporation receives an amount greater than par value after all costs and yields are considered, it is best to choose the effective interest method to account for the amortization of the costs and bond premium. In following this strategy, the corporation will realize a positive net present value simply by making the correct choice of accounting methods.

You might also like

- CSA 8.6 UpdatedDocument25 pagesCSA 8.6 UpdatedMoksha Shetty100% (1)

- Chapter 7 External Economic Influences On Business ActivityDocument12 pagesChapter 7 External Economic Influences On Business ActivityHassaan UmerNo ratings yet

- Butler Lumber CaseDocument14 pagesButler Lumber CaseSamarth Mewada83% (6)

- Problems On Lease and Hire PurchaseDocument2 pagesProblems On Lease and Hire Purchase29_ramesh17050% (2)

- Socialism in Habonim Dror (Resource Book) PDFDocument37 pagesSocialism in Habonim Dror (Resource Book) PDFGeorge StevensNo ratings yet

- Chapter Four FMDocument7 pagesChapter Four FMHope GoNo ratings yet

- Yield To CallDocument16 pagesYield To CallSushma MallapurNo ratings yet

- Review of BondsDocument1 pageReview of BondsQueeny Mae Cantre ReutaNo ratings yet

- MB0045 - Financial Management Assignment Set-1 (60 Marks)Document8 pagesMB0045 - Financial Management Assignment Set-1 (60 Marks)Ahmed BarkaatiNo ratings yet

- What Is An 'Amortized Bond'Document11 pagesWhat Is An 'Amortized Bond'Christian Roi ElamparoNo ratings yet

- Chapter 14: Long Term LiabilitiesDocument29 pagesChapter 14: Long Term LiabilitiesVirginia FernandezNo ratings yet

- Advanced Bond ConceptsDocument8 pagesAdvanced Bond ConceptsEllaine OlimberioNo ratings yet

- Abdul Qadir Khan (Fixed Income Assignement No.5)Document10 pagesAbdul Qadir Khan (Fixed Income Assignement No.5)muhammadvaqasNo ratings yet

- Asset Valuation: Basic Bond Andstock Valuation ModelsDocument23 pagesAsset Valuation: Basic Bond Andstock Valuation ModelsMa Via Bordon SalemNo ratings yet

- Chapter 14: Financing Liabilities: Bonds and Long-Term Notes PayableDocument4 pagesChapter 14: Financing Liabilities: Bonds and Long-Term Notes PayableJason BrightNo ratings yet

- Chapter 13 OutlineDocument6 pagesChapter 13 OutlineShella FrankeraNo ratings yet

- Long Term Debt EditedDocument16 pagesLong Term Debt EditedAdugnaNo ratings yet

- Cost of Capital Compute The Cost of Debt Compute The Cost of Preferred StockDocument58 pagesCost of Capital Compute The Cost of Debt Compute The Cost of Preferred StockAerial DidaNo ratings yet

- BondDocument44 pagesBondSumit VaishNo ratings yet

- CH 14Document31 pagesCH 14mohamedhusseindableNo ratings yet

- Cost of Debt PMDocument12 pagesCost of Debt PManithamjohnyNo ratings yet

- CH 14Document8 pagesCH 14Lemon VeinNo ratings yet

- Introduction To Bonds PayableDocument2 pagesIntroduction To Bonds PayableMarko Zero FourNo ratings yet

- Bond Value - YieldDocument40 pagesBond Value - YieldSheeza AshrafNo ratings yet

- MBA - R. No - 511222964: T. Antony Joseph PrabakarDocument8 pagesMBA - R. No - 511222964: T. Antony Joseph PrabakarAntony Joseph PrabakarNo ratings yet

- Libby 4ce Solutions Manual - Ch11Document59 pagesLibby 4ce Solutions Manual - Ch117595522No ratings yet

- Cost of Capital ChapterDocument25 pagesCost of Capital ChapterHossain Belal100% (1)

- Understanding The True Cost of Issuing Convertible Debt and Other Equity Linked FinancingDocument5 pagesUnderstanding The True Cost of Issuing Convertible Debt and Other Equity Linked Financing_lucky_No ratings yet

- Interest CostDocument2 pagesInterest CostNiño Rey LopezNo ratings yet

- Bond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)Document9 pagesBond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)ammar123No ratings yet

- Reporting and Interpreting Bonds: Answers To QuestionsDocument43 pagesReporting and Interpreting Bonds: Answers To QuestionsceojiNo ratings yet

- Wealth MaximizationDocument9 pagesWealth MaximizationApplopediaNo ratings yet

- Unit II Eng Economics PresentDocument28 pagesUnit II Eng Economics PresentSudeep KumarNo ratings yet

- Fin Cost of CapitalDocument3 pagesFin Cost of CapitalMochiminNo ratings yet

- Short Term FinancingDocument16 pagesShort Term FinancingSaha SuprioNo ratings yet

- 2019 CIA P3 SIV 1E Capital Structure Capitl Budgeting Taxes and Transfer PricingDocument133 pages2019 CIA P3 SIV 1E Capital Structure Capitl Budgeting Taxes and Transfer PricingMarieJoiaNo ratings yet

- CH 14Document8 pagesCH 14antonydonNo ratings yet

- Chapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face ValueDocument11 pagesChapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face Valueowais khanNo ratings yet

- Unit 5 FA - IIDocument22 pagesUnit 5 FA - IIBlack boxNo ratings yet

- Chapter 14: Long Term LiabilitiesDocument30 pagesChapter 14: Long Term LiabilitiesMohammed Akhtab Ul HudaNo ratings yet

- Are Securities That Promise To Make Fixed Payments According ToDocument26 pagesAre Securities That Promise To Make Fixed Payments According Toaddisyawkal18No ratings yet

- Reporting and Analyzing Off-Balance Sheet FinancingDocument31 pagesReporting and Analyzing Off-Balance Sheet Financingaathiranair1310No ratings yet

- Chapter 10 Solutions Excluding HomeworkDocument31 pagesChapter 10 Solutions Excluding HomeworkMissing PersonNo ratings yet

- Advanced Bond ConceptsDocument32 pagesAdvanced Bond ConceptsJohn SmithNo ratings yet

- Reporting and Analyzing Off-Balance Sheet FinancingDocument31 pagesReporting and Analyzing Off-Balance Sheet FinancingmanoranjanpatraNo ratings yet

- Finance - Self Study Guide For Staff of Micro Finance InstitutionsDocument9 pagesFinance - Self Study Guide For Staff of Micro Finance InstitutionsmhussainNo ratings yet

- Unit 14Document23 pagesUnit 14amrutraj gNo ratings yet

- Fixed Income and Money MarketDocument43 pagesFixed Income and Money MarketHamza AsifNo ratings yet

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- OFF B S Financing Lease PensionDocument31 pagesOFF B S Financing Lease PensionGowri RamachandranNo ratings yet

- Business Finance 7Document25 pagesBusiness Finance 7Trisha ElecerioNo ratings yet

- Solución Mini Caso Cap. 8Document5 pagesSolución Mini Caso Cap. 8Anonymous 5qHvuEIVz0No ratings yet

- CFINDocument10 pagesCFINAnuj AgarwalNo ratings yet

- Bond Valuation JiteshDocument83 pagesBond Valuation Jiteshjitesh_talesaraNo ratings yet

- FM 15-17Document23 pagesFM 15-17HanaNo ratings yet

- Chapter 9Document65 pagesChapter 9Naeemullah baigNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalAhmad NaseerNo ratings yet

- Chapter 10Document33 pagesChapter 10Usman ShabbirNo ratings yet

- Bonds ValuationsDocument57 pagesBonds ValuationsarmailgmNo ratings yet

- CHAPTER 5 Effective Interest MethodDocument4 pagesCHAPTER 5 Effective Interest MethodbluemajaNo ratings yet

- Fa4e SM Ch09Document36 pagesFa4e SM Ch09michaelkwok1100% (1)

- Documentary Stamp TaxDocument7 pagesDocumentary Stamp TaxRyan Sabungan100% (1)

- FinMan 1 - Prelim Reviewer 2017Document17 pagesFinMan 1 - Prelim Reviewer 2017Rachel Dela CruzNo ratings yet

- Chapter 2 in Financial ManagementDocument117 pagesChapter 2 in Financial ManagementBSA3Tagum MariletNo ratings yet

- CRISIL Rating ScaleDocument5 pagesCRISIL Rating ScalecharlyNo ratings yet

- UntitledDocument2 pagesUntitledEdson NtodwaNo ratings yet

- Chapter 4 - FeasibilityDocument17 pagesChapter 4 - FeasibilityKim Nicole ReyesNo ratings yet

- The Sharpe Corporation S Projected Sales For The First 8 MonthsDocument1 pageThe Sharpe Corporation S Projected Sales For The First 8 MonthsAmit PandeyNo ratings yet

- Act of 1871,,the DeceptionDocument4 pagesAct of 1871,,the DeceptionPatrick Long100% (6)

- Smeda e LearningDocument22 pagesSmeda e LearningEduardo CanelaNo ratings yet

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument20 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument78 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The Questionaccountancyjef100% (1)

- Golden Harvest LTD and Fu-Wang Food Ltd.Document47 pagesGolden Harvest LTD and Fu-Wang Food Ltd.Rifat HossainNo ratings yet

- NBFC Crisis: Our Take - Could Have Been AvoidedDocument23 pagesNBFC Crisis: Our Take - Could Have Been AvoidedNishit RelanNo ratings yet

- Contingent Liab Bonds PayableDocument11 pagesContingent Liab Bonds PayableKristine Lirose Bordeos100% (1)

- FM (Actuary Exam) FormulasDocument15 pagesFM (Actuary Exam) Formulasmuffinslayers100% (1)

- Mathematics of Investment 2Document39 pagesMathematics of Investment 2John Luis Masangkay BantolinoNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- Financial Analysis of Tvs Motor Co. Ltd.Document21 pagesFinancial Analysis of Tvs Motor Co. Ltd.Piyush_jain004100% (3)

- Form A Public AnnouncementDocument2 pagesForm A Public Announcementjeevan.georgeNo ratings yet

- MidtermDocument11 pagesMidtermMAG MAGNo ratings yet

- Franchise Dossier enDocument58 pagesFranchise Dossier enKIRE CENTERNo ratings yet

- Hynes Speech at City ClubDocument5 pagesHynes Speech at City ClubCrains Chicago BusinessNo ratings yet

- A Study On Portfolio Management of Individual Investors in MumbaiDocument77 pagesA Study On Portfolio Management of Individual Investors in MumbaiTechno GuysNo ratings yet

- Financial Markets: Departmental Notes Business Department 0752818204Document12 pagesFinancial Markets: Departmental Notes Business Department 0752818204kimuli FreddieNo ratings yet

- Microfinance in Nepal PartDocument117 pagesMicrofinance in Nepal PartDipesh MagratiNo ratings yet