Professional Documents

Culture Documents

Module 15

Module 15

Uploaded by

Jhon Ferdlee Bahandi BenitezCopyright:

Available Formats

You might also like

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Tuning Guide Peug. 206 2.0L HDI EDC15C2 90cv - 120HP by J-SkyDocument6 pagesTuning Guide Peug. 206 2.0L HDI EDC15C2 90cv - 120HP by J-Skyzo68No ratings yet

- Sol. Man. Chapter 4 Partnership Liquidation 2020 EditionDocument30 pagesSol. Man. Chapter 4 Partnership Liquidation 2020 EditionJennifer RelosoNo ratings yet

- Assign 4 Answer Partnership Liquidation Millan 2021Document12 pagesAssign 4 Answer Partnership Liquidation Millan 2021mhikeedelantar100% (1)

- Wiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Partnership Liquidation: Problem MDocument8 pagesPartnership Liquidation: Problem MMiko ArniñoNo ratings yet

- Assignment 1Document8 pagesAssignment 1Bianca LizardoNo ratings yet

- Module 5: Accounting For Special Transactions Partnership Dissolution Part 1Document3 pagesModule 5: Accounting For Special Transactions Partnership Dissolution Part 1Angel AlforqueNo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2021 EditionDocument7 pagesQuiz - Chapter 4 - Partnership Liquidation - 2021 EditionYam SondayNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- Cristal Kaye Gallo BSA-1ADocument1 pageCristal Kaye Gallo BSA-1ACristal KayeNo ratings yet

- CPA - Practical Accounting IIDocument43 pagesCPA - Practical Accounting IIJayChrome de la TorreNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- Red, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Document7 pagesRed, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Vivienne Rozenn LaytoNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Chapter 2 Partnership Operations 2021 EditionDocument17 pagesChapter 2 Partnership Operations 2021 Editionregine bacabagNo ratings yet

- Sol. Man. - Chapter 11 - She (Part 2) - 2021Document26 pagesSol. Man. - Chapter 11 - She (Part 2) - 2021Crystal Rose TenerifeNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 4 SolutionDocument13 pagesFAC 2602 - 2023 - S1 - Assessment 4 SolutionlennoxhaniNo ratings yet

- AFAR - PARTNERSHIPS - PPTX UM Digos Competency AppraisalDocument34 pagesAFAR - PARTNERSHIPS - PPTX UM Digos Competency AppraisalDiana Faye CaduadaNo ratings yet

- Assignment 1.2: Partneship Dissolution and Liquidation AnswerDocument17 pagesAssignment 1.2: Partneship Dissolution and Liquidation AnswerTricia Nicole DimaanoNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressDump DumpNo ratings yet

- Installment LiquidationDocument4 pagesInstallment LiquidationVivienne Rozenn LaytoNo ratings yet

- Solution To Prob. 4 On PP 151-153Document4 pagesSolution To Prob. 4 On PP 151-153mhikeedelantarNo ratings yet

- "Knowledge Is Superior To Marks",: PrefaceDocument12 pages"Knowledge Is Superior To Marks",: PrefaceTapan BarikNo ratings yet

- Adv Acc Chapter4Document13 pagesAdv Acc Chapter4Reanne Claudine LagunaNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressWynne RamosNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- Solutions To Problems AFAR2 Chap2Document33 pagesSolutions To Problems AFAR2 Chap2Sassy GirlNo ratings yet

- Tugas 5 8 Denila Wahyu Kelompok 7Document4 pagesTugas 5 8 Denila Wahyu Kelompok 7awangNo ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- Quiz in Safe Payment and Cash Priority Program With Answer Keys Part 2Document4 pagesQuiz in Safe Payment and Cash Priority Program With Answer Keys Part 2caraaatbongNo ratings yet

- Solution 18preparation of Financial Statements Company Final AccDocument2 pagesSolution 18preparation of Financial Statements Company Final AccKajal BindalNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- Assignment 9/17/2020: Use The Following Information For The Next Two QuestionsDocument6 pagesAssignment 9/17/2020: Use The Following Information For The Next Two QuestionsRosmar AbanerraNo ratings yet

- CH 16Document8 pagesCH 16Lex HerzhelNo ratings yet

- Conso Subsequent 1Document17 pagesConso Subsequent 1Winnie LaraNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Problems Partnership Dissolution and LiquidationDocument5 pagesProblems Partnership Dissolution and LiquidationNick ivan AlvaresNo ratings yet

- Taxation of Income of Partnership-1 - 034114Document6 pagesTaxation of Income of Partnership-1 - 034114temiladeadeyemi11No ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- 09 Treasury & Cash Management 7CDocument7 pages09 Treasury & Cash Management 7CChartered Accountant YASHNo ratings yet

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoNo ratings yet

- Chapter 3 Problem 1, 2 and 5 SolutionsDocument30 pagesChapter 3 Problem 1, 2 and 5 SolutionseiaNo ratings yet

- Solutions To Problems AFAR2 Chap3Document39 pagesSolutions To Problems AFAR2 Chap3Jane DizonNo ratings yet

- Example - Tax ComputationDocument10 pagesExample - Tax ComputationAminul Islam RubelNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- Partnership Dissolution DiscussionDocument13 pagesPartnership Dissolution DiscussionYazieeNo ratings yet

- Advance Acctg. Dayag 2013Document12 pagesAdvance Acctg. Dayag 2013Clarize R. Mabiog100% (2)

- p1 Quiz With TheoryDocument15 pagesp1 Quiz With TheoryGrace CorpoNo ratings yet

- Chapter 2 Partnership OperationsDocument27 pagesChapter 2 Partnership OperationsKenaniah SanchezNo ratings yet

- Chap 3: Problem 4: Multiple Choice-ComputationalDocument30 pagesChap 3: Problem 4: Multiple Choice-ComputationalAlarich CatayocNo ratings yet

- StewpeedDocument10 pagesStewpeedau4seventeenNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- SAS 1 and 2 Modules AnswerDocument3 pagesSAS 1 and 2 Modules AnswerJhon Ferdlee Bahandi BenitezNo ratings yet

- Sas 7Document1 pageSas 7Jhon Ferdlee Bahandi BenitezNo ratings yet

- SAS 2 Activity 3Document1 pageSAS 2 Activity 3Jhon Ferdlee Bahandi BenitezNo ratings yet

- Sas 6Document2 pagesSas 6Jhon Ferdlee Bahandi BenitezNo ratings yet

- Module 14Document1 pageModule 14Jhon Ferdlee Bahandi BenitezNo ratings yet

- Alere G1 Glucose Meter ManualDocument55 pagesAlere G1 Glucose Meter ManualSundar Rajan33% (6)

- Laboratorium Pengujian Teknik Sipil Universitas Bandar LampungDocument1 pageLaboratorium Pengujian Teknik Sipil Universitas Bandar LampungPanji OctaWirawanNo ratings yet

- Suhas S R: Email-ID: Mobile: 9535610175 / 7019470710Document2 pagesSuhas S R: Email-ID: Mobile: 9535610175 / 7019470710Sachin S KukkalliNo ratings yet

- Soc TB 25 May 2017Document37 pagesSoc TB 25 May 2017Ipie BsaNo ratings yet

- (Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Document355 pages(Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Carlos Roberto JúniorNo ratings yet

- WRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkDocument2 pagesWRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkFatmah El WardagyNo ratings yet

- Basic First Aid Handbook v2Document47 pagesBasic First Aid Handbook v2maeveley9dayne9chuaNo ratings yet

- City Center Unifier Deployment PDFDocument35 pagesCity Center Unifier Deployment PDFSachin PatilNo ratings yet

- Urushi ArtDocument24 pagesUrushi ArtGuadalupeCaravajalNo ratings yet

- Technical Drawings of PlasticwareDocument69 pagesTechnical Drawings of PlasticwareGuldu KhanNo ratings yet

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Gen Studs and Engg AptiDocument1 pageGen Studs and Engg AptiasishNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Dwnload Full Cost Accounting A Managerial Emphasis 14th Edition Horngren Test Bank PDFDocument35 pagesDwnload Full Cost Accounting A Managerial Emphasis 14th Edition Horngren Test Bank PDFcurguulusul100% (18)

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- 8DIO Claire Oboe Virtuoso ManualDocument10 pages8DIO Claire Oboe Virtuoso ManualNiskaNo ratings yet

- Jyotish - Hindu Panchangam & MuhurtasDocument40 pagesJyotish - Hindu Panchangam & MuhurtasSamir Kadiya100% (1)

- Murphy'S Laws: Anything That Can Go Wrong Will Go WrongDocument2 pagesMurphy'S Laws: Anything That Can Go Wrong Will Go WrongAshwin ReddyNo ratings yet

- Ozone Therapy Is Safest Known TherapyDocument35 pagesOzone Therapy Is Safest Known Therapyherdin2008100% (1)

- Getting Started With Nuvoton NUC140 32-Bit ARM Cortex-M0 Microcontroller PDFDocument7 pagesGetting Started With Nuvoton NUC140 32-Bit ARM Cortex-M0 Microcontroller PDFoktaNo ratings yet

- 12feb Quickref Views enDocument148 pages12feb Quickref Views enprakash2709No ratings yet

- Health The Basics 11th Edition Donatelle Test BankDocument19 pagesHealth The Basics 11th Edition Donatelle Test BankJosephWilliamsinaom100% (6)

- Solution Techniques For Models Yielding Ordinary Differential Equations (ODE)Document67 pagesSolution Techniques For Models Yielding Ordinary Differential Equations (ODE)Nikhil DewalkarNo ratings yet

- Unit Iv Secondary and Auxilary Motions 12Document3 pagesUnit Iv Secondary and Auxilary Motions 129043785763No ratings yet

Module 15

Module 15

Uploaded by

Jhon Ferdlee Bahandi BenitezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 15

Module 15

Uploaded by

Jhon Ferdlee Bahandi BenitezCopyright:

Available Formats

Activity 2: Skill-building Activities (with answer key) (18 mins + 2 mins checking)

Directions: Determine the partners’ share in profit or loss for each of the following situation:

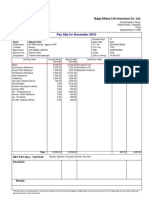

On January 1, 20x1, A and B decided to liquidate their partnership. As of this date, their capital

balances were ₱400,000 and ₱800,000, respectively. The partners share profits and losses on

a

60:40 ratio. Before liquidation, the partnership had ₱80,000 cash and ₱120,000 liabilities. The

partnership incurred loss of ₱480,000 on the sale of non-cash assets. A is solvent but B is

insolvent.

A (60%)

B (40%)

Totals

1,200.00

Capital balances before liquidation

400,000 (288,00

800,000 (192,00 (480,00

Allocation of lon [480Kx (60% & 40%)

Amounts received by parmers

112,000 50,000 720.000

3) Activity 3: Check for Understanding (5 mins)

Direction: Determine the answers to the following questions.

The following condensed statement of financial position is presented for the partnership of AA,

BB and CC, who share profits and losses in the ratio of 4:4:2, respectively:

Cash P 160,000

Other Assets 320,000

Total Assets P 480,000

Liabilities P 180,000

AA, Capital 48,000

BB, Capital 216,000

CC, Capital 36,000

Total Liabilities and Capital P 480,000

The partners agreed to dissolve the partnership after selling the other assets for P200,000.

Requirement:

1. How much should each partner receive upon liquidation?

2. Assume instead that the other assets were sold for P10,000 and that deficient partners, if

any, are solvent. How much should each partner receive upon liquidation?

3. Assume instead that the other assets were sold for P50,000 and that deficient partners, if

any, are insolvent. How much should each partner receive upon liquidation?

AA:4 BB:4 CC:2 Total

Capital / Interest 48,000 216,000 36,000 300,000

+/- Gains & (48,000) (48,000) (24,000) (120,000)

Losses

Realization

(200,000-

320,000)

Remaining 0 168,000 12,000 180,000

Interest

AA:4 BB:4 CC:2 Total

Capital/ Interest, 48,000 216,000 36,000 300,000

+/- Gain & (124,000) (124,000) [62,000) (310,000)

Losses

(10,000)

Realization

10,000 -320,000

Remaining (76,000) 92,000 (26,000) (10,000)

interest

Investment 76,000 26,000 102,000

Distribution to 0 92,000 0 92,000

partners

AA BB CC Total

Capital/Interest 48,000 216,000 36,000 300,000

+/- Gains & (108,000) (108,000) (54,000) (270,000)

Losses

50,000-320,000

Remaining (60,000) 108,000 (18,000) 30,000

Interest

Absorption of 60,000 (78,000) 18,000 0

loss

Distribution to 0 30,000 0 30,000

Partners

You might also like

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Tuning Guide Peug. 206 2.0L HDI EDC15C2 90cv - 120HP by J-SkyDocument6 pagesTuning Guide Peug. 206 2.0L HDI EDC15C2 90cv - 120HP by J-Skyzo68No ratings yet

- Sol. Man. Chapter 4 Partnership Liquidation 2020 EditionDocument30 pagesSol. Man. Chapter 4 Partnership Liquidation 2020 EditionJennifer RelosoNo ratings yet

- Assign 4 Answer Partnership Liquidation Millan 2021Document12 pagesAssign 4 Answer Partnership Liquidation Millan 2021mhikeedelantar100% (1)

- Wiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Partnership Liquidation: Problem MDocument8 pagesPartnership Liquidation: Problem MMiko ArniñoNo ratings yet

- Assignment 1Document8 pagesAssignment 1Bianca LizardoNo ratings yet

- Module 5: Accounting For Special Transactions Partnership Dissolution Part 1Document3 pagesModule 5: Accounting For Special Transactions Partnership Dissolution Part 1Angel AlforqueNo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2021 EditionDocument7 pagesQuiz - Chapter 4 - Partnership Liquidation - 2021 EditionYam SondayNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- Cristal Kaye Gallo BSA-1ADocument1 pageCristal Kaye Gallo BSA-1ACristal KayeNo ratings yet

- CPA - Practical Accounting IIDocument43 pagesCPA - Practical Accounting IIJayChrome de la TorreNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- Red, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Document7 pagesRed, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Vivienne Rozenn LaytoNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Chapter 2 Partnership Operations 2021 EditionDocument17 pagesChapter 2 Partnership Operations 2021 Editionregine bacabagNo ratings yet

- Sol. Man. - Chapter 11 - She (Part 2) - 2021Document26 pagesSol. Man. - Chapter 11 - She (Part 2) - 2021Crystal Rose TenerifeNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 4 SolutionDocument13 pagesFAC 2602 - 2023 - S1 - Assessment 4 SolutionlennoxhaniNo ratings yet

- AFAR - PARTNERSHIPS - PPTX UM Digos Competency AppraisalDocument34 pagesAFAR - PARTNERSHIPS - PPTX UM Digos Competency AppraisalDiana Faye CaduadaNo ratings yet

- Assignment 1.2: Partneship Dissolution and Liquidation AnswerDocument17 pagesAssignment 1.2: Partneship Dissolution and Liquidation AnswerTricia Nicole DimaanoNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressDump DumpNo ratings yet

- Installment LiquidationDocument4 pagesInstallment LiquidationVivienne Rozenn LaytoNo ratings yet

- Solution To Prob. 4 On PP 151-153Document4 pagesSolution To Prob. 4 On PP 151-153mhikeedelantarNo ratings yet

- "Knowledge Is Superior To Marks",: PrefaceDocument12 pages"Knowledge Is Superior To Marks",: PrefaceTapan BarikNo ratings yet

- Adv Acc Chapter4Document13 pagesAdv Acc Chapter4Reanne Claudine LagunaNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressWynne RamosNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- Solutions To Problems AFAR2 Chap2Document33 pagesSolutions To Problems AFAR2 Chap2Sassy GirlNo ratings yet

- Tugas 5 8 Denila Wahyu Kelompok 7Document4 pagesTugas 5 8 Denila Wahyu Kelompok 7awangNo ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- Quiz in Safe Payment and Cash Priority Program With Answer Keys Part 2Document4 pagesQuiz in Safe Payment and Cash Priority Program With Answer Keys Part 2caraaatbongNo ratings yet

- Solution 18preparation of Financial Statements Company Final AccDocument2 pagesSolution 18preparation of Financial Statements Company Final AccKajal BindalNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- Assignment 9/17/2020: Use The Following Information For The Next Two QuestionsDocument6 pagesAssignment 9/17/2020: Use The Following Information For The Next Two QuestionsRosmar AbanerraNo ratings yet

- CH 16Document8 pagesCH 16Lex HerzhelNo ratings yet

- Conso Subsequent 1Document17 pagesConso Subsequent 1Winnie LaraNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Problems Partnership Dissolution and LiquidationDocument5 pagesProblems Partnership Dissolution and LiquidationNick ivan AlvaresNo ratings yet

- Taxation of Income of Partnership-1 - 034114Document6 pagesTaxation of Income of Partnership-1 - 034114temiladeadeyemi11No ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- 09 Treasury & Cash Management 7CDocument7 pages09 Treasury & Cash Management 7CChartered Accountant YASHNo ratings yet

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoNo ratings yet

- Chapter 3 Problem 1, 2 and 5 SolutionsDocument30 pagesChapter 3 Problem 1, 2 and 5 SolutionseiaNo ratings yet

- Solutions To Problems AFAR2 Chap3Document39 pagesSolutions To Problems AFAR2 Chap3Jane DizonNo ratings yet

- Example - Tax ComputationDocument10 pagesExample - Tax ComputationAminul Islam RubelNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- Partnership Dissolution DiscussionDocument13 pagesPartnership Dissolution DiscussionYazieeNo ratings yet

- Advance Acctg. Dayag 2013Document12 pagesAdvance Acctg. Dayag 2013Clarize R. Mabiog100% (2)

- p1 Quiz With TheoryDocument15 pagesp1 Quiz With TheoryGrace CorpoNo ratings yet

- Chapter 2 Partnership OperationsDocument27 pagesChapter 2 Partnership OperationsKenaniah SanchezNo ratings yet

- Chap 3: Problem 4: Multiple Choice-ComputationalDocument30 pagesChap 3: Problem 4: Multiple Choice-ComputationalAlarich CatayocNo ratings yet

- StewpeedDocument10 pagesStewpeedau4seventeenNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- SAS 1 and 2 Modules AnswerDocument3 pagesSAS 1 and 2 Modules AnswerJhon Ferdlee Bahandi BenitezNo ratings yet

- Sas 7Document1 pageSas 7Jhon Ferdlee Bahandi BenitezNo ratings yet

- SAS 2 Activity 3Document1 pageSAS 2 Activity 3Jhon Ferdlee Bahandi BenitezNo ratings yet

- Sas 6Document2 pagesSas 6Jhon Ferdlee Bahandi BenitezNo ratings yet

- Module 14Document1 pageModule 14Jhon Ferdlee Bahandi BenitezNo ratings yet

- Alere G1 Glucose Meter ManualDocument55 pagesAlere G1 Glucose Meter ManualSundar Rajan33% (6)

- Laboratorium Pengujian Teknik Sipil Universitas Bandar LampungDocument1 pageLaboratorium Pengujian Teknik Sipil Universitas Bandar LampungPanji OctaWirawanNo ratings yet

- Suhas S R: Email-ID: Mobile: 9535610175 / 7019470710Document2 pagesSuhas S R: Email-ID: Mobile: 9535610175 / 7019470710Sachin S KukkalliNo ratings yet

- Soc TB 25 May 2017Document37 pagesSoc TB 25 May 2017Ipie BsaNo ratings yet

- (Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Document355 pages(Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Carlos Roberto JúniorNo ratings yet

- WRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkDocument2 pagesWRAP - Case Study - Aggregates - The Channel Tunnel Rail LinkFatmah El WardagyNo ratings yet

- Basic First Aid Handbook v2Document47 pagesBasic First Aid Handbook v2maeveley9dayne9chuaNo ratings yet

- City Center Unifier Deployment PDFDocument35 pagesCity Center Unifier Deployment PDFSachin PatilNo ratings yet

- Urushi ArtDocument24 pagesUrushi ArtGuadalupeCaravajalNo ratings yet

- Technical Drawings of PlasticwareDocument69 pagesTechnical Drawings of PlasticwareGuldu KhanNo ratings yet

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Gen Studs and Engg AptiDocument1 pageGen Studs and Engg AptiasishNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Dwnload Full Cost Accounting A Managerial Emphasis 14th Edition Horngren Test Bank PDFDocument35 pagesDwnload Full Cost Accounting A Managerial Emphasis 14th Edition Horngren Test Bank PDFcurguulusul100% (18)

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- 8DIO Claire Oboe Virtuoso ManualDocument10 pages8DIO Claire Oboe Virtuoso ManualNiskaNo ratings yet

- Jyotish - Hindu Panchangam & MuhurtasDocument40 pagesJyotish - Hindu Panchangam & MuhurtasSamir Kadiya100% (1)

- Murphy'S Laws: Anything That Can Go Wrong Will Go WrongDocument2 pagesMurphy'S Laws: Anything That Can Go Wrong Will Go WrongAshwin ReddyNo ratings yet

- Ozone Therapy Is Safest Known TherapyDocument35 pagesOzone Therapy Is Safest Known Therapyherdin2008100% (1)

- Getting Started With Nuvoton NUC140 32-Bit ARM Cortex-M0 Microcontroller PDFDocument7 pagesGetting Started With Nuvoton NUC140 32-Bit ARM Cortex-M0 Microcontroller PDFoktaNo ratings yet

- 12feb Quickref Views enDocument148 pages12feb Quickref Views enprakash2709No ratings yet

- Health The Basics 11th Edition Donatelle Test BankDocument19 pagesHealth The Basics 11th Edition Donatelle Test BankJosephWilliamsinaom100% (6)

- Solution Techniques For Models Yielding Ordinary Differential Equations (ODE)Document67 pagesSolution Techniques For Models Yielding Ordinary Differential Equations (ODE)Nikhil DewalkarNo ratings yet

- Unit Iv Secondary and Auxilary Motions 12Document3 pagesUnit Iv Secondary and Auxilary Motions 129043785763No ratings yet