Professional Documents

Culture Documents

What Is Managerial Accounting?: Assigning Costs

What Is Managerial Accounting?: Assigning Costs

Uploaded by

sabitibenja0 ratings0% found this document useful (0 votes)

20 views2 pagesOriginal Title

58519500bed8a87f8b3cf99cde60759fe92b3ca95b09413117d0d3b0de86adf6

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views2 pagesWhat Is Managerial Accounting?: Assigning Costs

What Is Managerial Accounting?: Assigning Costs

Uploaded by

sabitibenjaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

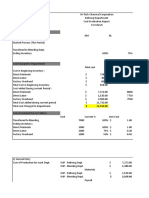

MANAGERIAL ACCOUNTING

ASSIGNING COSTS

What is Managerial Accounting?

Financial accounting: Focuses primarily on preparing the

Managerial Financial

balance sheet, income statement, and cash flow statement in Accounting Accounting

accordance with GAAP for use by internal team members as

well as external creditors and stakeholders. for internal use for internal and

external use

GAAP (Generally Accepted Accounting Principles): A set

of rules that standardizes the reporting and recording of does not follow follows GAAP

U.S. companies’ financial data. GAAP

Managerial accounting: Focuses on identifying, measuring, includes future contains mostly

analyzing, and interpreting the production, service, and other projections historical data

operating costs of a business.

often reports reports on the

Manufacturing costs: Costs related to the production of on individual company as a

divisions and whole

goods.

departments

Direct materials: Materials that are physically part of the

product being made that are easily identified as such.

Direct labor: The work required to assemble direct materials

into the finished products.

Manufacturing overhead: Consists of indirect material

costs, indirect labor costs, and other manufacturing costs.

Also called period costs, non-manufacturing costs are costs

that are unrelated to the manufacturing of goods. These

costs fit into two categories:

Selling costs: Costs associated with marketing, selling, and

delivering finished goods to customers.

General and administrative costs cover everything that is

not a direct cost, manufacturing overhead, or a selling cost,

such as executives’ salaries.

Manufacturing costs Non-manufacturing costs

direct manufacturing direct general &

selling

materials overhead labor administrative

indirect indirect other

materials labor manufacturing

costs

©2021 QUANTIC SCHOOL OF BUSINESS AND TECHNOLOGY

MANAGERIAL ACCOUNTING

Methods of Assigning Costs

Job order costing: Assigns costs to individual units of

inventory. Each piece of inventory may vary in cost.

Process costing: Averages costs over a large number of

inventory units over time, effectively creating a uniform,

predictable cost for each unit of inventory.

Cost driver: The resource that is the primary generator of

overhead costs for a company.

Cost object: The unit of inventory, service, department, etc.

that is being assigned a cost.

Cost pool: A collection of overhead costs.

Predetermined overhead rate: Estimated overhead costs

divided by the estimated total cost driver.

Plantwide costing (plantwide allocation): Assigns

manufacturing overhead using a single cost pool, cost driver,

and overhead rate.

Activity-based costing (ABC): Assigns manufacturing

overhead costs based on the actual resources required by

each production line using multiple cost pools, cost drivers,

and overhead rates.

Absorption costing: Manufacturing overhead is expensed

as, or absorbed by, cost of goods sold (COGS) when

inventory is sold to customers. Absorption costing is required

by GAAP.

Variable costing: Only variable overhead costs are

expensed through COGS. Fixed overhead costs are

expensed every period regardless of how many goods are

produced and sold.

Variable costs are dependent on production. The more

inventory produced, the higher the variable cost.

Fixed costs remain constant regardless of production.

©2021 QUANTIC SCHOOL OF BUSINESS AND TECHNOLOGY

You might also like

- Yakult and FriendsDocument83 pagesYakult and FriendsC S100% (1)

- At Its Sutter City Plant Yuba Machine Company Manufactures NutDocument2 pagesAt Its Sutter City Plant Yuba Machine Company Manufactures NutAmit PandeyNo ratings yet

- MAS-01 Management Accounting ConceptsDocument6 pagesMAS-01 Management Accounting ConceptsJohn Aries ReyesNo ratings yet

- Ca&c NotesDocument6 pagesCa&c NotesLourdes Sabuero TampusNo ratings yet

- Module 1-Intro To Management AccountingDocument48 pagesModule 1-Intro To Management AccountingAna ValenovaNo ratings yet

- Unit 3Document258 pagesUnit 3Raunak Maheshwari100% (1)

- MAF Notes Mid ExamDocument8 pagesMAF Notes Mid ExamPenguin Da Business GooseNo ratings yet

- Chapter 5Document13 pagesChapter 5abraha gebruNo ratings yet

- Managerial Accounting: Tool For Business Decision MakingDocument28 pagesManagerial Accounting: Tool For Business Decision MakingKeziah Eldene VilloraNo ratings yet

- Note of Cost Accounting IncomDocument5 pagesNote of Cost Accounting IncomAdam AbdullahiNo ratings yet

- Cost Cha 1Document39 pagesCost Cha 1Abreham AddNo ratings yet

- Part III-Managerial AccountingDocument91 pagesPart III-Managerial AccountingGebreNo ratings yet

- Cost Accounting Reviewer Chapter 1-4Document10 pagesCost Accounting Reviewer Chapter 1-4hanaNo ratings yet

- Intro To Managerial and Cost Accounting. CostsDocument19 pagesIntro To Managerial and Cost Accounting. Costsmehnaz kNo ratings yet

- DownloadfileDocument6 pagesDownloadfile2023311279No ratings yet

- MATERIALDocument24 pagesMATERIALsreekanthNo ratings yet

- Session 9 Introduction To Management AccountingDocument52 pagesSession 9 Introduction To Management Accounting靳雪娇No ratings yet

- Chapter No.01Document21 pagesChapter No.01Himat UllahNo ratings yet

- Unit 1 (Autosaved)Document23 pagesUnit 1 (Autosaved)Yuvnesh KumarNo ratings yet

- U03 Cost Management Terminology and ConceptsDocument15 pagesU03 Cost Management Terminology and ConceptsHamada Mahmoud100% (1)

- Unit 1Document23 pagesUnit 1Yuvnesh KumarNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingMariwin MacandiliNo ratings yet

- Managerial Accounting: Tool For Business Decision Making Third EditionDocument56 pagesManagerial Accounting: Tool For Business Decision Making Third Editionএ.বি.এস. আশিকNo ratings yet

- Intro To Management AcctgDocument46 pagesIntro To Management AcctgpotatookunNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingTofael MajumderNo ratings yet

- Cost and Managerial Accounting L Chap 1Document34 pagesCost and Managerial Accounting L Chap 1fekadegebretsadik478729No ratings yet

- Cost Accounting - Meaning and ScopeDocument27 pagesCost Accounting - Meaning and ScopemenakaNo ratings yet

- Cost: As A Resource Sacrificed or Forgone To Achieve A Specific Objective. It Is Usually MeasuredDocument19 pagesCost: As A Resource Sacrificed or Forgone To Achieve A Specific Objective. It Is Usually MeasuredTilahun GirmaNo ratings yet

- Managerial Accounting (1-3) - Fall 2022Document60 pagesManagerial Accounting (1-3) - Fall 2022Saahil KarnikNo ratings yet

- Basic Concepts of Cost AccountingDocument14 pagesBasic Concepts of Cost AccountinghellokittysaranghaeNo ratings yet

- An Introduction To Cost TermsDocument7 pagesAn Introduction To Cost TermsCheese ButterNo ratings yet

- Weygandt, Kieso, & Kimmel: Managerial AccountingDocument56 pagesWeygandt, Kieso, & Kimmel: Managerial AccountingJerome MogaNo ratings yet

- Budget Planning IntroductionDocument36 pagesBudget Planning IntroductionSUNNY BHUSHANNo ratings yet

- Lecture No. 1 - Cost Classification: Management AccountingDocument8 pagesLecture No. 1 - Cost Classification: Management AccountingAura MaghfiraNo ratings yet

- Lecture 3-4 Cost ConceptDocument32 pagesLecture 3-4 Cost ConceptAfzal AhmedNo ratings yet

- Introduction To Cost Accounting Module 1Document49 pagesIntroduction To Cost Accounting Module 1Godliving J LyimoNo ratings yet

- Notes CostDocument44 pagesNotes CostElla Blanca BuyaNo ratings yet

- Introduction To Managerial Accounting and Cost ConceptsDocument85 pagesIntroduction To Managerial Accounting and Cost Conceptsحسين عبدالرحمن100% (1)

- 110-W2-3-Cost concept-chp02-STDocument85 pages110-W2-3-Cost concept-chp02-STmargaret mariaNo ratings yet

- Chapter 2 Hilton 10th Instructor NotesDocument10 pagesChapter 2 Hilton 10th Instructor NotesKD MV100% (1)

- Differences Between Financial and Managerial AccountingDocument9 pagesDifferences Between Financial and Managerial AccountingChan LaguillesNo ratings yet

- Cost Accounting PresentationDocument30 pagesCost Accounting PresentationPhilimon YambaleNo ratings yet

- Project Accounting and FM ch2Document31 pagesProject Accounting and FM ch2Nesri YayaNo ratings yet

- Cost 1 Chapter 1 & 2Document34 pagesCost 1 Chapter 1 & 2Tesfaye Megiso BegajoNo ratings yet

- Managerial Accounting, 13 Edition, Garrison/ Noreen/ BrewerDocument25 pagesManagerial Accounting, 13 Edition, Garrison/ Noreen/ BrewerAhsan Sayeed Nabeel Depro100% (1)

- Fixed OverheadDocument2 pagesFixed OverheadElyza MarquilleroNo ratings yet

- MODULE 1 - Introduction To Cost SystemDocument31 pagesMODULE 1 - Introduction To Cost SystemMiks EnriquezNo ratings yet

- Management AccountingDocument7 pagesManagement AccountingKhushal SainiNo ratings yet

- Module 2 Basic Cost Management ConceptDocument12 pagesModule 2 Basic Cost Management ConceptWendryNo ratings yet

- Cost Accounting and Control (Cost 1) Module: Clariza C. GamboaDocument32 pagesCost Accounting and Control (Cost 1) Module: Clariza C. GamboaCatherine OrdoNo ratings yet

- Cost Accounting and Control (Cost 1) Module: Clariza C. GamboaDocument32 pagesCost Accounting and Control (Cost 1) Module: Clariza C. GamboaCatherine OrdoNo ratings yet

- Chapter 2 Managerial Accounting PowerPointDocument42 pagesChapter 2 Managerial Accounting PowerPointOmar Bani-KhalafNo ratings yet

- Throughput COSTINGDocument11 pagesThroughput COSTINGpiyush_127100% (1)

- Cost AccountingDocument22 pagesCost AccountingSiddharth KakaniNo ratings yet

- Week 5 621 NotesDocument5 pagesWeek 5 621 NotesAshish YadavNo ratings yet

- Activity BasedDocument50 pagesActivity BasedSandipan DawnNo ratings yet

- Cost Accounting: Schaum's Outline of Theory and Problems of Cost AccountingDocument56 pagesCost Accounting: Schaum's Outline of Theory and Problems of Cost AccountingAbdillahi Ibrahim Sh NorNo ratings yet

- Introduction To Cost AccountingDocument24 pagesIntroduction To Cost AccountingSherylLiquiganNo ratings yet

- Batch 2024 - Cost AccountingDocument42 pagesBatch 2024 - Cost AccountingZia NuestroNo ratings yet

- The Fundamentals of Costing: Afzal Ahmed, Aca Head of Accounts Lankabangla Finance LimitedDocument32 pagesThe Fundamentals of Costing: Afzal Ahmed, Aca Head of Accounts Lankabangla Finance LimitedsajedulNo ratings yet

- Cost Accounting: Swiss Business SchoolDocument149 pagesCost Accounting: Swiss Business SchoolMyriam Elaoun100% (1)

- Chap 022Document8 pagesChap 022Audrey TamNo ratings yet

- Cost Analysis & Elements of CostDocument15 pagesCost Analysis & Elements of CostAman BachhrajNo ratings yet

- Cost Paper M.COM Sem IIIDocument5 pagesCost Paper M.COM Sem IIIRahul KokareNo ratings yet

- qb09062019Document206 pagesqb09062019Nehasandhu SandhuNo ratings yet

- Chapter V: Relevant Information and Decision MakingDocument37 pagesChapter V: Relevant Information and Decision MakingBereket DesalegnNo ratings yet

- Marginal AbsorptionDocument4 pagesMarginal Absorptionbalachmalik100% (1)

- Standard Costing ExercisesDocument6 pagesStandard Costing ExercisesVatchdemonNo ratings yet

- Tcg017 PDF EngDocument3 pagesTcg017 PDF EngYu Him LumNo ratings yet

- Construction Equipment Management: Problem StatementDocument3 pagesConstruction Equipment Management: Problem Statementavant.07012024No ratings yet

- Purchasing-Related 120,000 Set-Up-Related 210,000 Total Overhead Cost P 440,000Document6 pagesPurchasing-Related 120,000 Set-Up-Related 210,000 Total Overhead Cost P 440,000Pamela Galang100% (3)

- Exercises Budgeting and Responsibility Problems W - Solutions 1Document10 pagesExercises Budgeting and Responsibility Problems W - Solutions 1Kristine NunagNo ratings yet

- Martens Inc Manufactures A Variety of Electronic Products ItDocument1 pageMartens Inc Manufactures A Variety of Electronic Products ItAmit PandeyNo ratings yet

- Cost Accounting Hilton 6Document3 pagesCost Accounting Hilton 6vkdocNo ratings yet

- Standard Cost and Components and Variance AnalysisDocument7 pagesStandard Cost and Components and Variance AnalysisNaveen RajputNo ratings yet

- Akuntansi BiayaDocument18 pagesAkuntansi Biayarani karinaNo ratings yet

- Assignment BBA 2008Document32 pagesAssignment BBA 2008ChaiNo ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Budgets and Budgetary Control: Learning ObjectivesDocument47 pagesBudgets and Budgetary Control: Learning ObjectivesmanoNo ratings yet

- Sybbi FM Working Capital SumsDocument2 pagesSybbi FM Working Capital Sumssameer_kiniNo ratings yet

- Bài tập chương 3Document12 pagesBài tập chương 3Hậu MinNgôNo ratings yet

- Finman4e Quiz Mod18 040615Document3 pagesFinman4e Quiz Mod18 040615Brian KangNo ratings yet

- What Is The Future of Setting Up ADocument58 pagesWhat Is The Future of Setting Up AR RanjanNo ratings yet

- Business Proposal For Towel PDFDocument13 pagesBusiness Proposal For Towel PDFSalman ArshadNo ratings yet

- Paper 05n Variance AnalyisisDocument14 pagesPaper 05n Variance AnalyisisHashan DasanayakaNo ratings yet

- Solartronics IncDocument5 pagesSolartronics Incraman2303100% (2)

- Chapter 2Document25 pagesChapter 2JOSEPH LEE ZE LOONG MoeNo ratings yet

- G.R. No. 147402 LWDDocument11 pagesG.R. No. 147402 LWDguadalou certificoNo ratings yet