Professional Documents

Culture Documents

HVL7 1354 2011

HVL7 1354 2011

Uploaded by

BHARAT S0 ratings0% found this document useful (0 votes)

23 views20 pagesOriginal Title

HVL7-1354-2011

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

23 views20 pagesHVL7 1354 2011

HVL7 1354 2011

Uploaded by

BHARAT SCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 20

Rete

Shin war v.

afte a.

(a ita)

So1a39

Epo ©

so ¥

THIS DEED OF MORTGAGE IS MADE AND EXECUTED AT PUNE

ON THIS A® DAY OF FEBRUARY, IN THE YEAR 2010.

OF MORTGA

TOMAS MAOLA Samamamt same STVECY 94937 pseu

uw, reac, sotee ARTS

Sinan sene, BeAmcH, THATS FEB 10 2011

vaNesiaoaes wom an me an as 19:57

2-8/ST*( C8100 /01/05/427

oar

P R:0006000/-ras204

INDIA stamp cuTy saanarasuTna,

ae

ant For JMSB LYD., PUNE 14

sate ge

Saati nen: Ubale . - -

aoe er AUTHORISED SIGNATURE

BETWEEN

1) MR. SANJEEV CHANDRAKANT PATIL

Age about 37 Years, Occ. — Business,

2) MRS. SWATI SANJEEV PATIL

Age about 31 Years, Occ. ~ Housewife,

MR. CHANDRAKANT BABURAO PATIL

Age about 60 Years, Occ, — Service,

All RYAt - Flat Nos, 9 & 10, Atreya Society,

Kothrud, PUNE 411 029

(No.1 — Business Address —

C/O. Prompt IT Solutions

1549/A, Sadashiv Peth, Pune 411 030)

4) MRS: RADHABAI TUKARAM KADU

Age about 76 Years, Occ. ~ Housewiie,

RAL ~ Atreya Society, Kothrud,

PUNE 411 029

we

Who are the Borrowers of the First Part and hereinafter called

and referred to as “THE MORTGAGORS OF THE FIRST

PART”

AND

JIJAMATA MABILA SAHAKARI BANK LTD.

An Urban Co-Operative Bank,

Tegistered under the provisions of Meharashtra

Co-Operative Societies Act, 1960,

Having its Head Office - 1639-B, “Malati-Madhav’,

Sadashiv Peth, Tilak Road, PUNE 411 030.

and the Branch of this Bank at

Shivaji Nagar, Pune

__ Fa»

| 97a Ro

Tagistrabie | as Ragisemn:

CET OF ATENEO,

ad Person's full Signature &

Hereinafter called and referred to as “THE MORTGAGEE OF

THE SECOND PART”

WHEREAS the Mortgagors are Shareholders of the Bank

The Mortgagor No.2 is the wife of Martgagor No.! and the The

Mortgagor No.3 is the father of Mortgagor No.1 The

Mortgagor No.1 is running a business under the name & style

“Prompt IT Solutions”;

AND WHEREAS the Mertgagor No.4 is the full owner and

the Mortgagor Nos. 1 & 3 have acquired right to purchase the

residential premises bearing Flat No. 9A on the First Floor,

admeasuring about 691 Sq.Ft. i.e. 61.20 Sq.Mtrs., in the building

No. “A”, in the scheme/buiiding known as “Atreya No.2 Co-Op.

Housing Society Ltd”, which is constructed on the land bearing

Survey No. 88/8/A/2, situated at Village Kothrud, within the

registration Sub-District Taluka Haveli and registration District of

Pune and within the limits of Pune Municipal Corporation and

within the jurisdiction of Sub-Registrar Haveli, Pune, which is

more particularly described in the Schedule LA written

hereunder;

AND WHEREAS the Mortgagor Nos. 1 & 3, by a

tegistered Agreement of Assignment dt. 68/01/2002, acquired

Tight to purchase the Flat premises described in the Schedule [

from Morigagot No.4. The said Agreement of Assignment is

tegistered in the office of Sub-Registrar Haveli NoIV at Sr.No.

204/2002 dt. 09/01/2002. Thereafter the Mortgagor Nos. 1 & 3

have made complete payment of the agreed consideration of the

said Flet to Mortgagor No.4. The Mortgagor No.4 has received

& acknowledge the same.

The Title deeds of the mortgaged property are

the Second Schedule;

The Mortgagors have applied to the Mortgagee Bank for

Term Loan of Rs. 12,00,000/- (Rs. Twelve Lakh only) for the

purpose of expansion of Business, The said request of the

Mortgagors is sanctioned by the Mortgagee Bank by its Board of

Directors Resolution, against the security of property owned by

the Mortzagoss_ by executing Registered Mortgage of Rs

12,00,000/- (Rs. Twelve Lakh only) and by mortgaging the said

Mortgaged Property owned by the Mortgagors detailed in the

Schedule-1

The said property (which is more particularly described in

the Schedule-I written hereunder) 1s mortgaged by the

Mortgagors in favour of the Mortgagee, on the following terms,

for the Term loan amount of Rs 12,00,000/- (Rs. Twelve Lakh

only},

WHEREAS the Mortgagors have agreed to deposit the title

deeds of the said Property & the same are listed in the Schedule-

Il annexed hereto, with intent to create Security on that Property

for repayment of the amount of the Term Loan together with

further interest as hereinafter stated:

WHEREAS the Mortgages Bank has asked the Mortgagors

to execute these presents, with 2 view to record the terms and

conditions in respect thereof which the Mortgagors have agreed

todo

THUS NOW IT IS AGREED AND DECLARED BY THESE

MORITGAGORS AS FOLLOWS ~

1 In_ consideration of the Term loan of the sum of Rs.

12,00,000/- (Rs. Twelve Lakh only} advanced by the Mortgagee

Bank to the Mortgagors, by mortgaging the said Property (which

Fae — 9

Girt & 7 Ao

in

Sh fy

is more particularly desotibed in the ScheduloT~Agelaen

hereunder). The Mortgagors do covenant with the Mortgagee

Bank to make repayment of the said Loan in 60 Months with

interest @ 13% on the said amount, by Monthly Installment of

Rs. 20,000/- + Interest, as per their rules and also the amount of

penal interest at the rate of 2% per annum in case of defaults as

will be determined by the Mortgagee Bank.

If the Mortgagors fails to make tepayment of 3 regular

installments of the said loan, in that circumstances, the

Mortgagors have to pay 15% interest p.a. on the said Joan

amount, The said term is agreed & admitted by the Mortgagors.

It 1s agreed by the Mortgagors that if the Mortgagors fails

to make payment of 3 installments, then the Mortgagee has

complete right to demand the full outstanding amount from the

said loan from the Mortgagors.

2. That the Mortgagee shall at any time be entitled to charge

interest at a higher rate then the rate hereinbefore mentioned

3. The said rate of interest payable by the Mortgagors shal! be

subject to the changes in the rate of interest directed by Reserve

Bank of India.

4. That notwithstanding anything contained in above Clauses,

above or elsewhere or in any other document, the whole of the

loan shall if so desired by the Mortgagee, become forthwith due

and payable by the Mortgagors/Borrowers to the Mortgagee upon

the happending of any of the following events and the Mortgagee

shall be entitled to enforce the security ; IF

a) Any interest remaining unpaid and in arrears for

period of three months after the same have become due, whether

demanded of not or,

b) The Mortgagors committing any breach or default in

performance or observance of any of the covenants contained in

these presents and/or the proposal of Mortgagors and/or the

other security documents or of any other terms and conditions

relating to the loan or,

¢) The Mortgagors entering into any amangehuaicbels”

composition with the Mortgagors’s creditors or committing any

act of insolvency or,

d) Any execution or distress being enforced or levied

against the whole or any part of the Mortgagors Property or,

e) _ A Receiver being appointed in respect of the whole

Of any part of the Property of the Mortgagors or,

1) Non-observance or non-performance of the terms and

conditions imposed by the Mottgagee or,

g) The Mortgagors ceasing, or threatening to cease, to

carry on business or,

hy The occurance of any circumstances which is

prejudicial to or impeirs, imperils or depreciated which is likely

to prejudice, impair or imperils or depreciate any security given

to the Mortgagee and/or,

i} To the Mortgagors/Borrowers fails and/or neglects to

pay 3 monthly instaliments or an amount equal to 3 monthly

installments-or, .

J) The occurance of any event or circumstances which

is prejudicially or adversely affects or is likely to prejudicially or

adverseley affects in any manner, the capacity of the Mortgagors

to repay the loan,

k) On the question whether any of the above events, has

happened, the decision of the Mortgagee shall be conclusive and

binding on the Mortgagors / Borrower or,

1) Provided always that the Mortgagee may in iis own

discretion refrain from forthwith enforcing rights, under this

Mortgage inspite of the happening of any of the contingencies as

aforesaid,

5. Also the Mortgagors further covenants that the Mortgagors

shall be bound by the provision of the securitisation and

Reconstruction Financial Assets and Enforcement of Security

Interest Act. In case of default of any of the conditions mentioned

in this deed or the terms of the loan agreement, in the part of the

Mortgagors, the Mortgagee Bank is entitled to take over and/or

BNF ¢ fro

Ay,

acquired the possession of the mortgaged properties amet satl be

entitled to dispose it off as per its own wish and convenient. In

such a case the Mortgagors shall be debarred from call in

question in any civil court, the action taken by the Mortgagec

Bank under the provisions of the said Act.

6. The Mortgagors have received the amount on the execution

of this deed, as loan’ and the Mortgagors had agreed to deposit the

title-deeds of the said Property with Mortgagee Bank. Thus

Mortgagee Bank has given the loan against the security of the

Property detailed in Schedule-I hereto, by deposit of title deeds.

7 The Mortgagors further covenants that Mortgagors are

liable to repay all sorts of dues to which Mortgagee Bank is

entitled to recover in the names of the Mortgagors individually

and jeintly and for all these dues, to which Mortgagee Bank is

entitled to recover in the names of Mortgagors individually and.

jointly for ail these dues. The Property described in the

Schedule-I, will remain as security from which the Mortgagec

Bank will have right to satisfy its recovery, by effecting all sorts

of actions, These Property will remain as security with the

Mortgagee Bank, unti! the Mortgagors will made full repayment

or to make payment of the last installment of the said Loan

amount alongwith the Interest thereon, The Mortgagors

undertakes to repay the said loan amount with interest by

Scheduled Installments as will be determined by the Bank.

8. The Mortgagors further declares and confirms that the titie

deeds mentioned in the Schedule-LE hereunder written, relating to

the Property mentioned in the Schedule-I written hereunder and

agreed to be deposited with the Mortgagee Bank’s office

mentioned above, ate to be deposited with intent 10 create an

equitable security for payment of above referred Term Loan

amount and also for payment of other past and further loan

remain with the Mortgagee Bank, so long as, the debts of all sorts

or any other amounts in'respect thereof remain due and payable

by the Mortgagors to the Mortgagee Bank. As such the

Mortgagec Bank will have right to recover its dues from the sale

of the said Property if and when necessary,

9. The Mortgagors further covenants that, all costs, and

expenses incurted by the Mortgagee Bank for enforcement of the

security created hereby, by sale of these properties, shall be

payable by the Mortgagors and shall be deemed te form part of

the mortgage debt secured by the said depasit of title deeds.

10. The Mortgagors further agrees to execute in favour of

Mortgagee Bank all necessary documents and to abide all rules

Regarding Term loan facility with directives from Reserve Bank

of India, which are applicable to this loan.

tl. The Mortgagors hereby further declares and covenants that

during the subsistance of this oan, the Mortgagors will not assign

or alienate their interest in the mortgaged Property te anybody

without the permission of Mortgagee Bank,

12. Thus the Mortgagors further assures that the said

mortgaged Property (which is more particularly described in the

Schedule-T written hereunder) is free from any encumbrance or

charge and will remain unencumbered except this loan for all

along till the repayment of this loan. This Property is also not

subject to any litigation. The Mortgagors firther undertakes to

keep the-mortgaged Property in good and proper condition as

purdent manner, by paying ail sorts of taxes in respect of the

same

13. The Mortgagors further covenants that they will insure and

keep insured the Property, in the name of Mortgagee Bank and to

wo * RT Le

handover such policy to the Mortgagee. If the Morttgagars Tile “

to act accordingly, it shall be lawful and optional forthe

Mortgagee, to insure, keep insured the said premises and ail

moneys spent for such purpose together with interest at the rate

referred above shall be repaid by the Mortgagors to the

Mortgagee on demand and until such payment, the Morigagee

Bank shall be entitled to hold the said title deeds as security for

the repayment thereof,

|4, That in the event of the depreciation in value of the

tmortgaged premises, the Morigagors shall from time to time and

at all times at the Mortgagors’s own cost furnish such further

security as may be considered reasonable and adequate by the

Mortgagee PROVIDED that the decision of the Maortgagee on the

nature and extent of the depreciation shall be final

15. That the Mortgagors/Borrowers shall pay all costs, charges

and expenses between attorney and client in otherwise lawfully

incurred or paid by the Mortgagee and incidental or in connection

with these presents or its security and or paid by the Mortgagee

and incidental to or in connection with these present or its

security and incurred welt as for the assession or defence of the

tights of the Mortgagee as for the demand realisation and

recovery of the said principal sum interest and other moneys.

payable to the Mortgagee and the same shall be on demand be

paid by the Mortgagors with interest thereof at the rate aforesaid

from the time to time of the same having been so incurred and

until such payment, the same shall be a charge upon the

mortgaged premises,

16. The Mortgagors further covenants that in the event of the

Mortgagors’s failing to pay and discharge the amount due

hereunder the Mortgagee shall at its own option also be entitled

notwithstanding the power of sale, to file a suit/dispute against

the Mortgagors for the recovery of the amount due from

themortgaged Property described in the Schedule-I written

Fae -'9

g3yof 994 20

R088

hereunder, as well as from the Mortgagors

enforce all the remedies of the holder of a simple mo:

the Transfer of Property Act, 1882

17. All the obligations of Mortgagors and all the rights,

remedies and power of the Mortgagee under the law of the time,

being inforce except so far as they may be inconsistent with these

presents shall be deemed to be incorporated in these presents

provided that the provisions of section 62, 65-A and 67-A

respectively of Transfer of Property Act, 1988 shall not apply to

these presents or to the: Mortgagors or the Mortgagee’s interest

and this shall be deemed as a contract to the contrary for the

purpose of these section. .

18. The Morgaged security shall be a security for all money

from time to time due to the Mortgagee under a Term loan limit

to be granted to the Mortgagors in the name of the Mortgagors

and the Term loan is not the be considered to be closed for the

purpose of this security and is not to be considered or deemed to

be considered as satisfied or exhaused either by reason of the said

‘Term loan showing NIL balance or the said account is renewed

by executing fresh set of documents or has been brought into

credit any time from time to time or its being drawn upon to the

full extent if afterwards responded by payment to credit or by any

reason such account being and the other account being opened or

by reason of any demand for repayment made by the Mortgagee.

19. The Mortgagors hereby declares that they are absolute

owners of the said Praperty comprised in the deeds, evidence and

writings mentioned in Scheduie-II, The said Property is owned

and possessed by the Mortgagors as owners thereof and nobody

else has any right interest, claim to the same. The Mortgagors

further undertakes that they will keep this Property

unencumbered and if anybody proves any interest in the Property,

~

the Mortgagors will see that this Property will ret fs

their ownership or they shail make repayment from her other

properties. The Property to be mortgaged is owned by

Mortgagors.

20. Previously the Mortgagor Nos. 1 & 3, by a registered

Agreement of Assignment dt, 08/01/2002, purchased the Flat

premises described in the Schedule I from Consenting Party, The

said Agreement of Assignment is registered in the office of Sub-

Registrar Haveli No.IV at Sr.No. 204/2002 dt. 09/01/2002

Thereafter the Mortgagor Nos.1 & 3 have paid total agreed

consideration of the said Flat premises to Consenting Party. Thus

the Mortgagor Nos.1 & 3 became sole & exclusive owners of the

said Flat premises. The said fact is agreed and admitted by the

Consenting Party, Therefore not arise any technical mistake, the

Consenting Party has been admitted in the present Deed of

Mortgege and the Consenting Party has given her consent to the

present Deed of Mortgage.

21. The Mortgagors hereby assures that they will obtain prior

permission of the Mortgage for obtain any loan from any other

Bank / Financial Institution / Patsanstha, by mortgaging the said

properties described in the Schedule I.

22. The Mortgagors agrees that they will hang a Board on the

said property / business place i.e. “Financed by Jijamata Mahila

Sahakari Bank Ltd., Shivaji Negar Branch, Pune ”

23. The Mortgagors obtained the loan vide sanction letter dt.

05/10/2010 of the Mortgagee Bank and the Mortgagors hereby

agrees that ali the terms and conditions of the said loan sanction

letter of the Mortgagee are accepted and binding on the

Mortgagors.

24. The Mortgagors agrees to pay the stamp duty on this

presents as well as registered charge and all expenses, charges

INST 93, Lao

with the Sub-Registrar of Assurance at Pune and all &

Mortgagee (as between Attorney and Client) and other charges if

any, incurred, in connection with the stamping of these presents

or the registration thereof with the Sub-Registrar of Assurances,

and if any penalty or charges are paid by the Mortgagee the

amount thereof with interest as aforesaid.

SCHEDULE-1

DESCRIPTION OF THE PROPERTY MORTGAGED

All that piece and parcel of the residential premises bearing Flat

No. 9A on the First Floor, admeasuring about 691 Sq.Ft. Le.

61.20 Sq.Mtrs., in the building No. “A”, in the scheme/building

known as “Atreya No.2 Co-Op. Housing Society Lid.”, which is

constructed on the land bearing Survey No. 88/8/A/2, situated at

Village Kothrud, within the registration Sub-District Taluka

Haveli and rgistration District of Pune and within the limits of

Pune Municipal Corperation and within the jurisdiction of Sub-

Registrar Haveli, Pune, & total land bounded as under —

‘On or towards East Gujrat Colony

On or towards West Survey No. 88/7

On or towards South PMC Road

On or towards North PMC Road

SCHEDULE-I

DETAILS OF THE TITLE DEEDS DEPOSITED

1 Copy of Agreement of Assignment

2. Copy of statement of accounts

FANT 9T 1 B20

IN WITNESS WHERFOF THE PARTIES HERETO HAV!

SET & SUBSCRIBED THEIR RESPECTIVE HANDS THE DAY AND

YEAR FIRST HEREINABOVE WRITTEN,

WITNESS on

1) SIGN.

NAMB

ADDRESS. or .

fre- . MR SANEEV COPATIL

2) SIGN, T .

NAME _N

ADDRESS:

3)MR C. B, PATIL

giBiah’s HB

a

4)MRS, RADHABAI 7. KADU

MORTGAGORS

PART

@ fron after weet der Talia, git

SS

Bes Drea: wreeh-wrers 2688, u weft Ie, aa We Yit-30, B Weed, %

267 (10 /ceamt jeter

of,

eis aisha teat

‘a.uda werd eater

vam: —aise are étatheygra,

15ea,emafte t,feom 2a,

aso

trea,

prow feBer 14/08/2010 aaften sak seid etewte eferen was oka fers FATE Be

sans odfer ecb yg ama STAR sr

1. mbag eer ~~ &.12,00,000/-

2 eae aa ER

3 miu OMGE =~ 43 one

4 Tai Se oo era

5. aft = a9 oe

ate = %.20,000/~ azaeT +.

6. ao ani = ae wat weston wew ard asta,

ae ames aa Watehen Fe

4, Woe A SU after Matar, ferdhar 8a at ‘31,10,000/- —12,00,000/—

sate eftin ated fo xasraat ge Dats

Geran 691 dhe.

a 34,10,000/- __12,00,000/~

Bide Remaate eitece wal fe awa rach weet crates & atom Gement? sree TH

wad ama.

7. snfaerarenct ark:

4 toner Beare eT

8. age conte eres vant oat tera Ais.

nie aR TAT - w100/-

sofia can = BA00/-

‘fiat ste de site - .190/~

aia ain 3800/- +(10.20@0B)R.381/- =R. 3,61/~

dedimmer i = - ——20,000/-

9, weg wbeSar over ae a er rae Be ere .1,20,000/- te we Te Gas,

so. sched aemeict, wal oti, wars, tal vend, maar ed wae a wee

aon ornare age wah eek ETE eH TAA RETEST

grr Tad ear es tae ek lees en a ere RATT aT

PRR REE are gas EMT AEs,

ty

16

gue 19 ¢_/ 20

mead dona Aa,

‘wre, fer feo sec Phan ied eon wera ter ae emt oars AR,

arem fiemenciere ative dee / er aiewrey ee han Alter sre et ert Het

‘fraanfan sat ara wim tome witaes viemsr ceo TEA TERE Soa Bes.

THEN eer 7/12 gat —wreeA fapaaetion Romodine/ fd wT er—arae fatereret we

ten ehh atoga om cad dena ode ate 2s om re an Sfeoeit

fide wert,

‘merreren Rerfi/orts anizere “ Glave after ay. Aeret gh” sear es

‘cre FINE Mute BAe Grant eee ear BMRA wees

‘en amcor ae wear at wT oT cay ere ware Arata eecTeN artes aT

TET Qa OTT acta.

aot aor-ater ore rhage Get cat bere eT.

ular a

+. We waa wa aoa sta 2 cred Ce OO or TE.

2. wage asf am afer area oft he Rare wf UTE DET

a6 aed wom Ns eae emt we agt al ote oes ae

cored ecru sonra aE aS as GE 15 waeb amet TEs.

3. MOE mire oramad anid eer dae ere

anerreee taems w argcs aetna ena rar

ih Cor SE afte eral will at mane hoe ds a.

ayers fr aan Bae ED ater cher « aoate Het M,

eidt ag mba etter aot ema) cca aenerRETEEON

mamta a.

4, eid Zora ran peated aloe wer eT ait BB we tt

arrapt we sooth capt eso aera St ahs. ate wera Boa wet

a erm A

3. ahaa ssar ord dg mete wr one ates eka rae

wren a1 48 von def wash Bt wait ao.

8, tech axe ane ge or Bacar gah fer fi eat aT

ae aoe omen rt RAS ea TUE ToS TET stere T.

anand ggg det toa er Teme oe

ee a

9, Unig andes etree es Per ater eS ow ere sh

ree aha ge haere eran OR a Tm se area

ved Oe we meal) a ea etTaN wre A IT TE ATT TE

adh rae fe a ays aaa dor ite HB afta, aT

brordl sernd pier Qi diéae deren ue af.

fear rat fon ga fet

t

secon

&,

AV

afer fn ei df ore ane fe as done

2 fearon ar Trefet wearers FE.

hppatll_eanjeov.doc (25/09/2010 }

‘arf a1 TET (PERMANENT ACCOUNT NUMBER

ADAPTOS07H

PRANAY HARICHANDRA TARE,

Fim 3 parHERS MANE

HARICHADRA BUDHAJI TARE

; a 8M searcOr ORT

pB978

| rom aT

a comma

mn mn ear

1022011 gan Rete: aka WVART APT. | leet my 1354/2011

12:48:33 pm teh 7 ( arate 9020

‘ae wi: 1354/2011

RATA SPR: TeTETT

HTH. veo ara a TAT ‘WaraTTeN Wee

Se wae aa ela

Alam: wermtie #: - fg ore

a mo

Sra wa =

wertes oer So caren [Terrase] Teta wer Rew weer Gece.

a

[See weir (1984/2011)

_ _ i Aslan |

BRT, jese7-1964-2011] a TERT sredt m.1989 — featent1/02/2011

ara Tee 20 aah caw 1200000 wea yelay Yew : 6000 wade a

ean vain: she gic idle - -

ee GR eure APR 211/02/2017 12:43 PM —_—____

Presta feria: 10/02/2011 12000 steht

2S OR ea ae: 400 RH (3, 11), eT ser

: iar. 112),

“worard (Si. 12) 3 wren (SI, 19) ->

ein Ht

Teen Wee 40) ETAT

eet De wee: &) hear athaer ah awa FRET att fer Seer aT a 12400: we

ate ae

ra am. 1 a See: Garattaeny 11/02/2001 12:4

fram me. 2 dan: (ot) 11/02/2011 12:46 PM

Row w, sar aa fone sneer aes

from m4 ah tee atorey 11/02/2011 12:48

wether wera 8

dod eae wher | FANT AO wa.

a) wera ye at eee A

crest: ~

ene bv gem Pris ett. & get

Berean, ar Uta tree ge

= say tat ated

2) iowa tsb - weryete a: em . AB. BM.

aan gen Rie 99/2/2099

wee 7 { arte

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

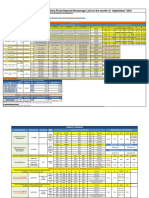

- Equity MF - Lumpsum & SIP - Brokerage Structure From May To June, 2021Document12 pagesEquity MF - Lumpsum & SIP - Brokerage Structure From May To June, 2021BHARAT SNo ratings yet

- IIFL Prime PortfoliosDocument25 pagesIIFL Prime PortfoliosBHARAT SNo ratings yet

- ELSS Mutual Fund - Net Brokerage Structure From May To June, 2021Document1 pageELSS Mutual Fund - Net Brokerage Structure From May To June, 2021BHARAT SNo ratings yet

- २४८८Document1 page२४८८BHARAT SNo ratings yet

- Billing Formate (Dsa)Document6 pagesBilling Formate (Dsa)BHARAT SNo ratings yet

- Debt MF - Brokerage Structure From May To June, 2021Document8 pagesDebt MF - Brokerage Structure From May To June, 2021BHARAT SNo ratings yet

- IIFL Associate FD List September'2021Document4 pagesIIFL Associate FD List September'2021BHARAT SNo ratings yet

- Society Noc - NDocument1 pageSociety Noc - NBHARAT SNo ratings yet

- Selve Company Profile Detailed LRDocument8 pagesSelve Company Profile Detailed LRBHARAT SNo ratings yet