Professional Documents

Culture Documents

(E2079) Ackn Wage Info

(E2079) Ackn Wage Info

Uploaded by

Jim TatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(E2079) Ackn Wage Info

(E2079) Ackn Wage Info

Uploaded by

Jim TatCopyright:

Available Formats

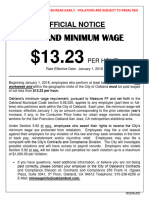

ACKNOWLEDGMENT OF WAGE INFORMATION

AK, CT, DE, HI, IL, IA, SC, and WV

In compliance with your state’s laws, you are hereby notified of the following information regarding your wages. If you have

any questions regarding any of these terms, please contact your Kelly representative.

1. Employee Printed Name: Joseph McDougall

2. Last Four Digits of Social Security Number: 7731

3. Wage Range: $20

Since your wage (and overtime wage, if applicable) may vary based on the responsibilities of each assignment, this

notice provides a range of rates earned by similarly qualified employees, who work assignments similar to those for

which you are eligible. Kelly Services will verbally notify you of the exact rate of pay for any assignment offered to

you. Should you accept and work the specific assignment offered to you, the exact rate of pay agreed to will also

be set forth on the pay stub (i.e., itemized wage statement) that you will receive each pay day following the date

the assignment commenced. Your assignment-specific overtime rates will be time-and-a-half and double your

hourly and/or differential rate and will be shown on your pay stub when you work overtime and double time.

4. Training Rate: You will be paid at the state or local minimum wage, whichever is higher. If you are unfamiliar

with your state or local minimum wage, contact your Kelly Representative.

5. Hours of Work: To be determined by customer per assignment. A Kelly representative will inform you for each

assignment. Hours typically conform to customer’s normal working hours for the position assigned.

6. Payment Schedule (Day/Hour): As long as you submit your time promptly and accurately at the end of your

work week, in accordance with Kelly Services’ policy, you will be paid within seven days from the end of the pay

period.

7. Place of Payment: For employees paid by Direct Deposit, your wages will be disbursed into the banking account

you provided. For employees paid by Wisely Pay, your wages will be disbursed via Wisely Pay (through the option

you selected, either Wisely Check or Wisely Pay Card).

8. Deductions from Wages: All required tax withholdings and, based on eligibility and/or election, other benefits,

such as 401(k) contributions, insurance, or spending accounts.

This Acknowledgment is not an employment contract. Kelly Services expressly reserves the right to alter, amend,

or delete any term set forth herein.

Prior to the commencement of each customer assignment, Kelly Services will verbally inform me of the actual

rate of pay for that assignment. I have the option to accept or reject any assignment. The agreed upon rate of

pay for the specific assignment I accept will be reflected on the paystub I receive each pay day following work on

the assignment. In the event that an inadvertent error is made regarding the pay rate range on this Notice, the

rate of pay verbally offered and accepted per assignment and reflected on the pay stub for the corresponding

pay period, will control.

My signature below acknowledges receipt of this document.

Employee Signature: _______________________________________ 09/06/2022

Date: __________________

2022 Kelly Services, Inc. An Equal Opportunity Employer e2079 Revised July 2022

You might also like

- Standard Job Contract With CashierDocument4 pagesStandard Job Contract With CashiertayyabtariqNo ratings yet

- What Unitedhealth Group Offers You: Automatic Enrollment Makes It SimpleDocument3 pagesWhat Unitedhealth Group Offers You: Automatic Enrollment Makes It SimpleHendrik SauterNo ratings yet

- Employment Agreement 2019 - Phaidon PDFDocument9 pagesEmployment Agreement 2019 - Phaidon PDFKhoa PhamNo ratings yet

- Student Loan Forbearance.Document2 pagesStudent Loan Forbearance.Brian John Mc100% (1)

- Same For Everyone.: WWW - Sba.govDocument4 pagesSame For Everyone.: WWW - Sba.govScott AtkinsonNo ratings yet

- Adobe Scan 26-Dec-2022Document1 pageAdobe Scan 26-Dec-2022Anant KumarNo ratings yet

- Next Steps After You File Your Own Unemployment ClaimDocument1 pageNext Steps After You File Your Own Unemployment ClaimTiffany BarnesNo ratings yet

- Va Terms of Business - Uk: InsuranceDocument10 pagesVa Terms of Business - Uk: InsuranceYasNo ratings yet

- Confirmation Page: Important - Print This PageDocument4 pagesConfirmation Page: Important - Print This Pagemozollis22No ratings yet

- Ca en Rca CCDDocument7 pagesCa en Rca CCDChris CutraraNo ratings yet

- National Credit Direct Terms ConditionsDocument14 pagesNational Credit Direct Terms ConditionsNoelNo ratings yet

- Consumer Account AgreementDocument20 pagesConsumer Account AgreementjeevankombanNo ratings yet

- Contract Librarian Appointment Template 06 21 08Document2 pagesContract Librarian Appointment Template 06 21 08Winniejanes nyabokeNo ratings yet

- Contract of Employment and GuidelinesDocument5 pagesContract of Employment and GuidelinesHBENo ratings yet

- GoldChargeCard FullTnCDocument16 pagesGoldChargeCard FullTnCDgusta2No ratings yet

- Sample Agreement TemplateDocument3 pagesSample Agreement TemplateSrikanth7482100% (1)

- Rewards Credit Card AgreementDocument10 pagesRewards Credit Card Agreementtonnymonttana012No ratings yet

- Loan Mod AgreementDocument4 pagesLoan Mod AgreementggavinreiterNo ratings yet

- Offer Letter: July 01, 2021 Norma Delgado 760-807-7021Document2 pagesOffer Letter: July 01, 2021 Norma Delgado 760-807-7021Norma DuenasNo ratings yet

- AssignmentDocument3 pagesAssignmentJevi RuiizNo ratings yet

- FORBDocument2 pagesFORBjotav11No ratings yet

- 1 - Application For InternshipDocument5 pages1 - Application For InternshipFreacking MadNo ratings yet

- 2146749Document14 pages2146749Frank CasaleNo ratings yet

- Expatriate Assignement LetterDocument4 pagesExpatriate Assignement LetterAvinash KumarNo ratings yet

- Microsoft Word - Vikas GargDocument6 pagesMicrosoft Word - Vikas Gargvikas_garg1986No ratings yet

- Engagement LetterDocument3 pagesEngagement LetterSharah Del T. TudeNo ratings yet

- Offer Letter - Saim - Sales Support - 17 May-2024Document4 pagesOffer Letter - Saim - Sales Support - 17 May-2024SAIM ALI RASHIDNo ratings yet

- User FileDocument29 pagesUser Filesantha kumarNo ratings yet

- Essential InformationDocument14 pagesEssential InformationdavemuncNo ratings yet

- 2023-07-17T10 22 47 LoanAgreement 691671Document9 pages2023-07-17T10 22 47 LoanAgreement 691671juantirado0777No ratings yet

- Stealth Canexpress Logistics - JOB Fraud - Https://stealthcanexpress - Ca - ScamerDocument2 pagesStealth Canexpress Logistics - JOB Fraud - Https://stealthcanexpress - Ca - ScamerLive Influences Digital Marketing AgencyNo ratings yet

- Personal Loan Pre-Approval LetterDocument3 pagesPersonal Loan Pre-Approval LetterJoeLuisAndradeNo ratings yet

- Letter of Appointment - Voluntary Demotion (With 6-Month Probation)Document2 pagesLetter of Appointment - Voluntary Demotion (With 6-Month Probation)Steph BalzNo ratings yet

- SJ&People Terms of Business 2014Document5 pagesSJ&People Terms of Business 2014Laurentiu CotetNo ratings yet

- Credit Card Statement DisclosureDocument1 pageCredit Card Statement DisclosureShahnaz NawazNo ratings yet

- Overdraft Request FormDocument1 pageOverdraft Request Formsam.whincup1No ratings yet

- Offer of Appointment Contract LetterDocument4 pagesOffer of Appointment Contract LetterPablo PazNo ratings yet

- SteelfixerDocument15 pagesSteelfixerJohn Albert BaltazarNo ratings yet

- Kikoff Credit Account Agreement 12292020Document9 pagesKikoff Credit Account Agreement 12292020H.I.M Dr. Lawiy ZodokNo ratings yet

- Pds BSN An Naim Home - BiDocument4 pagesPds BSN An Naim Home - BiMohd NizamuddinNo ratings yet

- Commercial Proposal - Hans HR - 05.12 (UAE)Document3 pagesCommercial Proposal - Hans HR - 05.12 (UAE)JOhnNo ratings yet

- Frequently Asked Questions FAQs For BancassuranceDocument7 pagesFrequently Asked Questions FAQs For BancassuranceAzeem AnwarNo ratings yet

- Offer of Appointment Contract LetterDocument4 pagesOffer of Appointment Contract LetterEduardo Carlos Timana LabrinNo ratings yet

- Kodego Memorandum of Agreement: TH THDocument16 pagesKodego Memorandum of Agreement: TH THMathew SalamatNo ratings yet

- Disclosure StatementDocument2 pagesDisclosure StatementCrystal DuplantisNo ratings yet

- Cardmember Agreement - Diners Club Card EliteDocument16 pagesCardmember Agreement - Diners Club Card EliteEric WeiNo ratings yet

- Employment ContractDocument7 pagesEmployment ContractShiela TiradorNo ratings yet

- Talentjolt: IncorporationDocument3 pagesTalentjolt: IncorporationKathrina CobolNo ratings yet

- New Personal Salary Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)Document2 pagesNew Personal Salary Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)En-en FrioNo ratings yet

- Consumer GeneralDocument28 pagesConsumer GeneralEe Yan neNo ratings yet

- Charter House Medical Terms & Conditions v2Document4 pagesCharter House Medical Terms & Conditions v2nathan7641No ratings yet

- Please DocuSign Retainer AgreementDocument7 pagesPlease DocuSign Retainer Agreementvimar teroNo ratings yet

- Welcome To Unemployment Insurance Benefits Online!Document3 pagesWelcome To Unemployment Insurance Benefits Online!tareqNo ratings yet

- Caoile EFT Authorization Form - EnglishDocument2 pagesCaoile EFT Authorization Form - EnglishSaki DacaraNo ratings yet

- Local Notices v8 9-20-2018Document13 pagesLocal Notices v8 9-20-2018Katherine EcheverriaNo ratings yet

- Childcare Vouchers Amendment FormDocument1 pageChildcare Vouchers Amendment FormmumarjuttNo ratings yet

- JobPlanDocument2 pagesJobPlanHarrison KerrNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Healthcare Staffing Payroll and Billing Process GuideFrom EverandHealthcare Staffing Payroll and Billing Process GuideNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Burs Final Tax Table PDFDocument81 pagesBurs Final Tax Table PDFMoabiNo ratings yet

- Tax Invoice: Recharge/Bill Payment For 7679431217Document1 pageTax Invoice: Recharge/Bill Payment For 7679431217Amita BiswasNo ratings yet

- Salary Slip NewDocument1 pageSalary Slip Newfakiv83032No ratings yet

- Inflation or Gold StandardDocument34 pagesInflation or Gold StandardHal Shurtleff100% (2)

- Malaysia 2H2022 Market Outlook 268447Document123 pagesMalaysia 2H2022 Market Outlook 268447Lim Chau LongNo ratings yet

- Finance Dept CircularsDocument490 pagesFinance Dept Circularssusanta_kumar50% (4)

- Guoiailon: Hino MetroDocument1 pageGuoiailon: Hino MetrojmNo ratings yet

- Hedge Funds. A Basic OverviewDocument41 pagesHedge Funds. A Basic OverviewBilal MalikNo ratings yet

- Alam Turnitin Originality ReportcxcDocument16 pagesAlam Turnitin Originality ReportcxcZaheer Ahmed SwatiNo ratings yet

- Textbook Engineering Economics Financial Decision Making For Engineers 5Th Edition Niall Fraser Ebook All Chapter PDFDocument33 pagesTextbook Engineering Economics Financial Decision Making For Engineers 5Th Edition Niall Fraser Ebook All Chapter PDFjennifer.bias411100% (13)

- Letter Reply To Unimasters (CTO)Document2 pagesLetter Reply To Unimasters (CTO)Ana Rose CincoNo ratings yet

- ECO403 MidTerm 2013 Solved BY MISHAL IQBALDocument25 pagesECO403 MidTerm 2013 Solved BY MISHAL IQBALmishal iqbalNo ratings yet

- CHEDROcc 2Document21 pagesCHEDROcc 2kmrosarioNo ratings yet

- Letter To 'Home' From Dusty RhodesDocument4 pagesLetter To 'Home' From Dusty Rhodeskbarrier214No ratings yet

- Korona Ecosystem White Paper FinalDocument32 pagesKorona Ecosystem White Paper FinalJózsef PataiNo ratings yet

- The Impact of Capital Structure On The Performance of Microfinance InstitutionsDocument17 pagesThe Impact of Capital Structure On The Performance of Microfinance InstitutionsMuhammadAzharFarooqNo ratings yet

- Elements of Crime Index CardsDocument142 pagesElements of Crime Index CardsJea Co100% (1)

- Bataan Shipyard and Engineering Company, Inc. vs. Atty. Anthony Jay B. Consunji, A.C. No. 11439 January 4, 2022Document16 pagesBataan Shipyard and Engineering Company, Inc. vs. Atty. Anthony Jay B. Consunji, A.C. No. 11439 January 4, 20221D OFFICIALDRIVENo ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- IB Economics SL Paper 1 Question Bank - TYCHRDocument25 pagesIB Economics SL Paper 1 Question Bank - TYCHRansirwayneNo ratings yet

- Course-Structure-Syllabi-BCom 1-101-140Document40 pagesCourse-Structure-Syllabi-BCom 1-101-140Ram YadavNo ratings yet

- The Scope of Corporate FinanceDocument11 pagesThe Scope of Corporate Financelinda zyongweNo ratings yet

- Business Plan: This Business Plan Was Prepared by XYZ To Apply For Turkish Businessperson VisaDocument19 pagesBusiness Plan: This Business Plan Was Prepared by XYZ To Apply For Turkish Businessperson VisaSenateriyaNo ratings yet

- Payroll Accounting 2018 28th Edition Bieg Test BankDocument15 pagesPayroll Accounting 2018 28th Edition Bieg Test Bankloanazura7k6bl100% (28)

- Markets Ethics and Business Ethics 2nd Edition Ebook PDFDocument57 pagesMarkets Ethics and Business Ethics 2nd Edition Ebook PDFwillie.kostyla455100% (52)

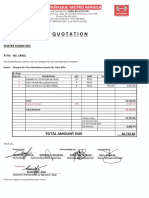

- A-00431 Quote FriendsDocument1 pageA-00431 Quote FriendsCamila TatisNo ratings yet

- Starkville Dispatch Eedition 9-15-19Document28 pagesStarkville Dispatch Eedition 9-15-19The DispatchNo ratings yet

- As 94Document7 pagesAs 94Kinga MochockaNo ratings yet

- Finals Conceptual Framework and Accounting Standards AnswerkeyDocument7 pagesFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesNo ratings yet