Professional Documents

Culture Documents

01 PF Declaration Form 11

01 PF Declaration Form 11

Uploaded by

Vijayavelu AdiyapathamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 PF Declaration Form 11

01 PF Declaration Form 11

Uploaded by

Vijayavelu AdiyapathamCopyright:

Available Formats

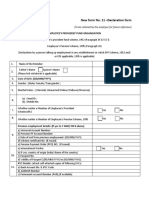

New Form No.

11 – Declaration Form

(To be retained by the employer for future reference)

EMPLOYEES' PROVIDENT FUND ORGANASATION

The Employees' Provident Funds Scheme, 1952 (Paragraph 34 & 57) &

The Employees’ Pension Scheme, 1995 (Paragraph 24)

(Declaration by a person taking up employment in any establishment on which EPF Scheme, 1952 and/or EPS, 1995 is applicable)

1 Name of the member

Father's Name Spouse Name

2 (Please tick whichever is applicable)

3 Date of Birth : (DD / MM / YYYY)

4 Gender : (Male / Female / Transgender)

5 Marital Status : (Married/Unmarried/Widow/Widower/Divorcee)

(a) Email ID :

6

(b) Mobile No. :

7 Whether earlier a member of Employees' Provident Funds Scheme, 1952 Yes / No

8 Whether earlier a member of Employees’ Pension Scheme, 1995 Yes / No

Previous employment details : [ if Yes to 7 AND/OR 8 above ]

a) Universal Account Number :

b) Previous PF Account Number :

9

c) Date of exit from previous employment : (DD / MM / YYYY)

d) Scheme Certificate No. (if issued)

e) Pension Payment Order (PPO) No. (if issued)

a) International Worker : Yes / No

b) If Yes, State country origin (India / Name of the other country)

10

c) Passport No. :

d) Validity of Passport [(DD/MM/YYYY) to (DD/MM/YYYY)]

KYC Details : (attach self attested copies of following KYCs)

a) Bank Account No. & IFC Code :

11

b) AADHAR Number : LEAVE BLANK – DO NOT MENTION

c) Permanent Account Number : (PAN), if available

UNDERTAKING

1) Certified that the particulars are true to the best of my knowledge.

2) I authorize EPFO to use my Aadhar for verification/authentication/eKYC purpose for service delivery.

3) Kindly transfer the funds and service details, if applicable, from the previous PF account as declared above to the present P.F.

Account. (The transfer would be possible only if the identified KYC detail approved by previous employer has been verified by

The present employer using his Digital Signature Certificate)

4) In case of changes in above details, the same will be intimated to the employer at the earliest.

Date :

Place : Signature of member

DECLARATION BY PRESENT EMPLOYER

A. The member Mr./Ms./Mrs. …....................................................... has joined on …........................ and has been allotted PF Number

…............................................

B. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995 :

• (Post allotment of UAN) The UAN allotted for the member is …......................................

• Please Tick the appropriate option:

The KYC details of the above member in the UAN database

□ Have not been uploaded

□ Have been uploaded but not approved

□ Have been uploaded and approved with DSC

C. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995 :

• The above PF Account number/UAN of the member as mentioned in (A) above has been tagged with his/her UAN/Previous Member ID as declared

by member.

• Please Tick the appropriate option:

□ The KYC details of the above member in the UAN database have been approved with Digital Signature Certificate and

transfer request has been generated on portal.

□ As the DSC of establishment are not register with EPFO, the member has been informed to file physical claim (Form-13)

for transfer of funds from his/her previous establishment.

Date : Signature of employer with Seal of Establishment

You might also like

- Final Assignment CRMDocument24 pagesFinal Assignment CRMDumidu Chathurange Dassanayake0% (1)

- Marketing in A Global Context. Assignment 2Document14 pagesMarketing in A Global Context. Assignment 2Jack SniperNo ratings yet

- AKS-Institute of Management Excellence: Internal Assessment-1 MBA - 3 Semester (BU Batch 2011-2013)Document1 pageAKS-Institute of Management Excellence: Internal Assessment-1 MBA - 3 Semester (BU Batch 2011-2013)Manish SethiNo ratings yet

- Child Protection and Welfare Bureau Form ADocument4 pagesChild Protection and Welfare Bureau Form AKashif WaqasNo ratings yet

- Allworld CorporationDocument3 pagesAllworld CorporationAltaf KhanNo ratings yet

- IBM Assignment No 03 Pizza HutDocument7 pagesIBM Assignment No 03 Pizza HutNisitha Tharushan DarmarathnaNo ratings yet

- Turning Robotic Process Automation Into Commercial Success - Case OpuscapitaDocument18 pagesTurning Robotic Process Automation Into Commercial Success - Case OpuscapitaDiego QuevedoNo ratings yet

- Nokia Information SystemDocument3 pagesNokia Information SystemRia Singh67% (3)

- 2009 Annual ReportDocument264 pages2009 Annual ReportasangasdNo ratings yet

- Tutorial 1 Topic: Strategic Management and Strategic Competitiveness (Introduction To Strategic Management)Document7 pagesTutorial 1 Topic: Strategic Management and Strategic Competitiveness (Introduction To Strategic Management)Krishneel Anand PrasadNo ratings yet

- Quiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsDocument2 pagesQuiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsArjun LalwaniNo ratings yet

- Sample TOEIC Test (Reading Section)Document56 pagesSample TOEIC Test (Reading Section)Kenneth Madrigal100% (9)

- SME ReportDocument81 pagesSME ReportBridgetNo ratings yet

- Application Form of Tourist Guide LicenceDocument1 pageApplication Form of Tourist Guide Licencetayyab_mir_4No ratings yet

- Job Application FormDocument3 pagesJob Application FormSchakema Mohamad100% (1)

- SCM - Strategic Change ManagementDocument24 pagesSCM - Strategic Change ManagementvuquyhaiNo ratings yet

- AFDS Circular To Shareholders - Dec 16Document1 pageAFDS Circular To Shareholders - Dec 16Business Daily ZimbabweNo ratings yet

- Intro F&NDocument9 pagesIntro F&NImam FatihahNo ratings yet

- Porter's Five Force Model MASDocument6 pagesPorter's Five Force Model MASDaeng BireleyNo ratings yet

- The Campus Wedding Case: Submitted byDocument5 pagesThe Campus Wedding Case: Submitted byPallavi SinghNo ratings yet

- Principles of Finance Assignment 02Document7 pagesPrinciples of Finance Assignment 02RakibImtiazNo ratings yet

- Vision and Mission of National SavingsDocument1 pageVision and Mission of National SavingszumurdNo ratings yet

- Final Assessment - Suggested Solution & Marking Scheme Paper 1Document3 pagesFinal Assessment - Suggested Solution & Marking Scheme Paper 1Deidree Elsa100% (1)

- ABRY Scheme GuidelinesDocument12 pagesABRY Scheme GuidelinesreenaNo ratings yet

- SWOT Analysis Grameen PhoneDocument20 pagesSWOT Analysis Grameen Phonesifat21100% (1)

- HRM CaseDocument20 pagesHRM CasePriyam ChakrabortyNo ratings yet

- Walmart ScandalDocument6 pagesWalmart ScandalWaseem AhmadNo ratings yet

- PBL Case 2 - Ais 630Document36 pagesPBL Case 2 - Ais 630Normala HamzahNo ratings yet

- SSLG 102Document2 pagesSSLG 102Dang Trung Hieu (FGW HN)100% (2)

- EB 2 Petition Letter 1Document20 pagesEB 2 Petition Letter 1oluwabusayoforsuccessNo ratings yet

- Junior Staff Collective Agreement 2003-2007Document82 pagesJunior Staff Collective Agreement 2003-2007Andre Benny JohnsonNo ratings yet

- Change Management During Downsizing 1Document25 pagesChange Management During Downsizing 1ghulamkibrya0% (1)

- QARZ E Hasana FormDocument6 pagesQARZ E Hasana FormtoobaNo ratings yet

- CMI Group AssignmentDocument2 pagesCMI Group AssignmentDesmond Chan0% (1)

- Entrepreneurship ENT 300 KBA 111 5B Business PlanDocument53 pagesEntrepreneurship ENT 300 KBA 111 5B Business PlanBavani SaravanaNo ratings yet

- AP Cars SDN BHD - QuestionsDocument1 pageAP Cars SDN BHD - Questionsnadia0% (1)

- Capstone Project For ETypes PDFDocument3 pagesCapstone Project For ETypes PDFLuis Felipe ArenasNo ratings yet

- Set 1Document2 pagesSet 1Jephthah Bansah0% (1)

- Group Project Paper and Ink: Riasat AmirDocument16 pagesGroup Project Paper and Ink: Riasat AmirTasnim Mahmud Rana 1921142630No ratings yet

- Transfer and Transmission of SharesDocument2 pagesTransfer and Transmission of SharesLina KhalidaNo ratings yet

- Chapter 4.determinants of National Advantage, CompetitivenesDocument78 pagesChapter 4.determinants of National Advantage, CompetitivenesMarlon BoucaudNo ratings yet

- Logbook Aisyah Athirah Abdul RazabDocument28 pagesLogbook Aisyah Athirah Abdul Razabauni fildzahNo ratings yet

- Implementation of BCG Matrix in Malaysia CompanyDocument20 pagesImplementation of BCG Matrix in Malaysia CompanybubbleteaNo ratings yet

- Case StudyDocument17 pagesCase StudyMinesh PatelNo ratings yet

- Organisational Change &developmentDocument29 pagesOrganisational Change &developmentRamesh HiragappanavarNo ratings yet

- Service Quality and Customer Satisfaction in Banking Sector During COVID-19 - An Empirical Analysis of Sri LankaDocument8 pagesService Quality and Customer Satisfaction in Banking Sector During COVID-19 - An Empirical Analysis of Sri LankaDharma RaoNo ratings yet

- Instructor: Professor M Palley April 24, 2007: Case AnalysisDocument11 pagesInstructor: Professor M Palley April 24, 2007: Case AnalysisJay_Prakash_6747No ratings yet

- Dta Wtax Qna MicpaDocument3 pagesDta Wtax Qna MicpaHafiz MusannefNo ratings yet

- Ufone PresentationDocument31 pagesUfone PresentationWajiha Ali100% (1)

- IBMC Competition Booklet 2013Document40 pagesIBMC Competition Booklet 2013Rollins Center at BYUNo ratings yet

- Tutorial Chapter 1,2 & 3Document31 pagesTutorial Chapter 1,2 & 3Nur Nabilah Kamaruddin0% (1)

- Income BuilderDocument3 pagesIncome BuilderFarrahAbdullahNo ratings yet

- Financial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Document70 pagesFinancial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Tấn Lộc LouisNo ratings yet

- ITB Mcqs BankDocument78 pagesITB Mcqs Banksalwa asifNo ratings yet

- Bbap2103 - Management Accounting 2016Document16 pagesBbap2103 - Management Accounting 2016yooheechulNo ratings yet

- JD-COM - General Banking Officer - Clearing & Collection PDFDocument3 pagesJD-COM - General Banking Officer - Clearing & Collection PDFfaexasultanaNo ratings yet

- DataNerds BI Assessment 2Document23 pagesDataNerds BI Assessment 2ujjwalkachhwahNo ratings yet

- Twitter CaseDocument8 pagesTwitter CaseNa Tacha JosephNo ratings yet

- SWOTDocument3 pagesSWOTSajid Ali0% (1)

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- Form 11 - PF Declaration1Document2 pagesForm 11 - PF Declaration1ADITYA R P 1937302No ratings yet

- PMWeb Training Manual Version 2 1a3okzaDocument299 pagesPMWeb Training Manual Version 2 1a3okzaVijayavelu AdiyapathamNo ratings yet

- B1-Funds Single Platform Multifonds - Original.1463592611Document15 pagesB1-Funds Single Platform Multifonds - Original.1463592611Vijayavelu AdiyapathamNo ratings yet

- IDC Financial Insights FinTech Rankings-2015Document1 pageIDC Financial Insights FinTech Rankings-2015Vijayavelu AdiyapathamNo ratings yet

- Lu Uk Value Creation Through MaDocument24 pagesLu Uk Value Creation Through MaVijayavelu AdiyapathamNo ratings yet

- Aite Matrix Evaluation Investment and Fund Accounting Systems ReportDocument25 pagesAite Matrix Evaluation Investment and Fund Accounting Systems ReportVijayavelu AdiyapathamNo ratings yet

- 03 PF Nomination FormDocument2 pages03 PF Nomination FormVijayavelu AdiyapathamNo ratings yet

- 04 Gratuity Nomination Form TrustDocument3 pages04 Gratuity Nomination Form TrustVijayavelu AdiyapathamNo ratings yet

- 05 Life Insurance and Personal Accident InsuranceDocument2 pages05 Life Insurance and Personal Accident InsuranceVijayavelu AdiyapathamNo ratings yet

- 02 PF Joint Declaration FormDocument1 page02 PF Joint Declaration FormVijayavelu AdiyapathamNo ratings yet

- English Pedagogical Module 6: CareersDocument24 pagesEnglish Pedagogical Module 6: CareersFanny Vera100% (1)

- Least Learned Competencies Learning Area: Mapeh: Grade Level Competency Code Probable Causes Proposed InterventionDocument2 pagesLeast Learned Competencies Learning Area: Mapeh: Grade Level Competency Code Probable Causes Proposed Interventionkuya-maNo ratings yet

- Career Planning and Development: T. Sanjeev Kumar, G.K.Sushma, G.RamyaDocument8 pagesCareer Planning and Development: T. Sanjeev Kumar, G.K.Sushma, G.RamyaCantusephonenoNo ratings yet

- Case Analysis: Chapter: OneDocument14 pagesCase Analysis: Chapter: OneSai Teja AnnalaNo ratings yet

- Tutorial 8 Production: ST ND RDDocument1 pageTutorial 8 Production: ST ND RDShivang Agarwal0% (1)

- Organizational Behavior Lecture Notes Week 2 Attitudes and Job SatisfactionDocument12 pagesOrganizational Behavior Lecture Notes Week 2 Attitudes and Job SatisfactionABDUL KARIM ASLAMINo ratings yet

- TP 1Document3 pagesTP 1Mitch Bea Tonogbanua93% (15)

- Pagadian Elementary LETDocument242 pagesPagadian Elementary LETTheSummitExpress67% (3)

- Department of Mechanical Engineering Gannon University Project Management (GENG 624) Project 4 Due Date: TBADocument10 pagesDepartment of Mechanical Engineering Gannon University Project Management (GENG 624) Project 4 Due Date: TBASalehNo ratings yet

- Stakeholders: 9707/1,2 - Business Studies Unit 1: Business & Environment A LevelsDocument2 pagesStakeholders: 9707/1,2 - Business Studies Unit 1: Business & Environment A LevelsLejla Eminovic NiksicNo ratings yet

- Pillai's Institute of Management Studies & ResearchDocument27 pagesPillai's Institute of Management Studies & ResearchniranjanaNo ratings yet

- Dole RegulationsDocument5 pagesDole Regulationsjuncos0729No ratings yet

- Hindustan Lever Limited Vs Hindustam Lever Employees UnionDocument23 pagesHindustan Lever Limited Vs Hindustam Lever Employees UnionRadhika GargNo ratings yet

- Functional and Work Capacity Evaluation IssuesDocument5 pagesFunctional and Work Capacity Evaluation IssuesOanaNo ratings yet

- Pakistan Studies Geography 2059 Class 10Document13 pagesPakistan Studies Geography 2059 Class 10Laleen AkhunzadaNo ratings yet

- Municipal Ordinance No.04Document4 pagesMunicipal Ordinance No.04joseph jandaNo ratings yet

- Manojkumar.m (Final)Document36 pagesManojkumar.m (Final)ManojkumarNo ratings yet

- Minimum Wages Act, 1948Document20 pagesMinimum Wages Act, 1948Manish KumarNo ratings yet

- Accom Rep 161 217Document65 pagesAccom Rep 161 217Sajja SrinivasNo ratings yet

- Political and Media Officer Vacancy 2023Document2 pagesPolitical and Media Officer Vacancy 2023Mina TharwatNo ratings yet

- MFE Module 1 .Document15 pagesMFE Module 1 .Adarsh KNo ratings yet

- NR Germany Needs 750 Pinoy Nurses Under Triple Win ProjectDocument1 pageNR Germany Needs 750 Pinoy Nurses Under Triple Win ProjectEmmz rdNo ratings yet

- MDF PDFDocument2 pagesMDF PDFglecydimaano100% (1)

- Colegio Del Santisimo Rosario vs. RojoDocument5 pagesColegio Del Santisimo Rosario vs. RojoDeric MacalinaoNo ratings yet

- Maintenance Planner Role ResponsibilitiesDocument2 pagesMaintenance Planner Role ResponsibilitiesAnonymous OuY6oAMggxNo ratings yet

- Marine Engineering IndustryDocument259 pagesMarine Engineering IndustryAnonymous 45z6m4eE7pNo ratings yet

- People V SadiosaDocument9 pagesPeople V SadiosaDNAANo ratings yet

- Apollo 13Document6 pagesApollo 13Chitrini ChalmelaNo ratings yet

- Topic 8 HRMDocument49 pagesTopic 8 HRMKay YeoNo ratings yet