Professional Documents

Culture Documents

Accenture Capital Markets Technology 2022

Accenture Capital Markets Technology 2022

Uploaded by

deepakcool208Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accenture Capital Markets Technology 2022

Accenture Capital Markets Technology 2022

Uploaded by

deepakcool208Copyright:

Available Formats

CAPITAL

MARKETS

TECHNOLOGY

2022

Five Technology Design

Principles for Digital

Capital Markets

THE SPEED-READ

The information revolution is impacting every business, but

capital markets firms are really feeling the effects. The industry

is facing a perfect storm of negative publicity, ongoing fee

compression, value chain rebalancing, continued automation

and disintermediation, and increasingly challenging talent

acquisition—just to name a few of the forces at work. Add to that

an unyielding current of new regulations, and the picture is bleak—

especially for those that don’t engage in wholesale redesign.

To offset these negative fundamental By creating agile organizations or

trends, leading capital markets firms “living businesses,”—companies

should adopt five organizational design designed to achieve and maintain

principles: intelligent and automated, perpetual customer relevance—firms

data-led and client-centric, open could transform themselves. Doing so,

and accessible, agile and resilient, Accenture believes that investment

and simple and homogeneous. banks, for example, have the potential

to not only increase return on equity

(RoE) by up to an estimated three

to four percent, but they could also

drive cost-income (CI) ratios back to

lower and more acceptable levels.

2 CAPITAL MARKETS TECHNOLOGY 2022

THREE ELEMENTS

OF COMPRESSIVE

DISRUPTION

Shielded by large balance sheet In the capital markets industry, compressive

requirements, regulation and network disruption is evident in three key symptoms:

effects, global capital markets players stagnation in the overall revenue pool,

are unlikely to experience the kind increased competition for this shrinking

of big-bang disruption that Uber and pool of revenue, and weak financial returns

Netflix have wreaked in their respective even after significant cost-cutting.

industries. Nonetheless, the global capital

markets industry is facing a perfect STAGNATING REVENUE

storm of “compressive disruption”

that’s forcing change and reinvention. Following the global financial crisis,

This form of disruption is characterized top-tier investment banks and boutique

by a more gradual erosion of revenue advisory houses have seen their pool

and profit, compressing the amount of revenue stagnate or fall in real terms

of free capital available to invest in the (see Figure 1). While falling margins, low

new technologies and ways of working rates, low volatility, regulatory tightening,

required to keep pace with evolving the rise of passive investments and the

customer expectations and economics.1 plentiful supply of private equity have

created significant headwinds, two

additional trends are worth noting.

Figure 1: Revenue for global and European investment banks is flat-lining

$250bn 60%

$200bn 50%

$150bn 40%

$100bn 20%

$50bn 10%

$0bn 0%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Total industry Share of European majors

Source: Accenture Research

CAPITAL MARKETS TECHNOLOGY 2022 3

European investment banks FICC businesses

First, as Figure 1 shows, the revenue share Second, fixed-income, currencies and

of the leading European investment banks commodities (FICC) businesses, which

shrunk from nearly 40 percent to just once dominated the landscape, have seen

27 percent between 2007 and 2016. This nominal revenue fall sharply and their share

shift reflects not only deliberate business of the shrinking revenue pool dwindle

closures by certain leading players, but (see Figure 2). Interest rate rebounds and

also a reduction in the level of capital periods of increased volatility may provide

allocated to these businesses due to fear profitable relief for some players, but

around business model sustainability. global markets and investment banking

UBS is a key European example of such participants cannot rely on these events

restructuring. Yet, even in this environment alone to deliver sustainable profits.

of reduced competition, the industry’s

financial returns remain weak overall. Despite an uptick in volatility in early 2017,

the most recent Coalition IB Index pegs

global FICC revenue at $38.5 billion for the

first half of 2017, compared to $57.7 billion

for the same period five years ago.2

Figure 2: The FICC share of revenue is shrinking

Primary Primary

24% 29%

2011 FICC 2016 FICC

REVENUE

SHARES

51% REVENUE

SHARES

45%

Equities Equities

25% 27%

Source: Accenture Research

4 CAPITAL MARKETS TECHNOLOGY 2022

INCREASED This development of smaller firms is not

new; it’s a return to a market structure seen

COMPETITION more than 20 years ago. Nonetheless, it’s

Despite the anemic revenue backdrop a trend that’s exacerbating the pressure on

outlined above, capital markets returns in investment banking businesses.

players are still dealing with the rise

of non‑bank competitors in both Secondary businesses

primary and secondary businesses.

The effects of disintermediation are

also evident in the rise of non-bank

Primary businesses liquidity, particularly in mid-corporate

The most visible area is in the high-return and high‑growth segments, and

corporate advisory world, where boutique growing interest in all-to-all exchanges

firms have meaningfully changed the in traditionally dealer-led markets.

competitive landscape (see Figure 3). Forty‑eight percent of market participants

identified buy-side to buy-side trading as

Independent firms, such as Moelis & the most likely new source of liquidity in

Company, Greenhill and Evercore, have the next several years, with 22 percent

nearly doubled their revenue and more believing that non-bank market makers

than doubled their market share over will also play a key role.3 Increases in

the last decade. Considering that this both will be necessary to fill the liquidity

high-margin business tended to be the gap as banks scale back their capital

reason other products and services were commitments. Dealers will remain the

conducted at loss-leading prices, the core source of liquidity in these markets,

impact on shareholder returns is clear. but allowing digitally native providers

to gain a foothold may open the door

to wider competition if aggregation

or direct acquisition takes off.

Figure 3: Boutique advisory houses are on the rise

6,000 30%

5,000 25%

4,000 20%

3,000 15%

2,000 10%

1,000 5%

0 0%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Revenues (USDm) Market share

Source: Accenture Research

CAPITAL MARKETS TECHNOLOGY 2022 5

WEAK RETURNS Legacy infrastructure

Capital requirements for balance sheet-led The sheer size and scale of legacy

businesses (mainly secondary businesses) infrastructure is a particularly challenging

have increased so much that they have issue for the industry. Banks are struggling

destroyed shareholder value generation to achieve sustained profitability because

at even the purest of investment banks. the complex infrastructure established to

Attempts to reduce capital usage by support global and fixed-income markets

management teams has made pure is often vastly oversized and nearly always

advisory business an even larger share siloed. Many have restructured, ruthlessly

of the revenue stream. reduced costs and even exited businesses.

Looking at return on equity for the larger This legacy architecture is also

players in the sector, returns above the ill‑equipped to provide the insights

cost of capital have been inconsistent at required to improve customer service

best (see Figure 4).4 This is despite deep and drive growth in today’s digital world.

and prolonged cost reduction programs, New approaches are needed. Instead

many of which bear significant fruit. of redesigning its legacy stacks for

According to our research, one bank trading in the dealer-to‑dealer market

alone has cut more than $5 billion, or for treasuries, for example, JPMorgan

25 percent, from its non-asset-gathering is leveraging third‑party technology

cost base this decade.5 In real terms, from high‑frequency trading firm

that amounts to a near halving of the Virtu Financial.6

overall cost base.

Figure 4: Return on equity for top nine global investment banks

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Source: Accenture Research based on Capital IQN

6 CAPITAL MARKETS TECHNOLOGY 2022

Regulatory burden If nothing, MiFID2 and FRTB are

reminders that regulators have become

Two major pieces of regulation—the

important agents of change for global

second Markets in Financial Instruments

capital markets players and investment

Directive (MiFID2) and the fundamental

banks—over and above structural

review of the trading book (FRTB)—

changes in customer behavior, the

present both structural and technological

cyclical impact of low rates and low

challenges for investment banks.

volatility, and disruptive new entrants.

A wide-ranging update of the nearly

decade-old MiFID, MiFID2 aims to The rise of non-bank liquidity

increase trade transparency (including A recent Greenwich Associates study

trade costs) via best execution and put forward that one in five government

unbundling, drive liquidity toward more bond investors and one in four interest-

structured trade and reporting venues, rate derivative investors either trade

and improve monitoring of trading with or plan to gain access to non-bank

behavior. Because it applies to a wide liquidity providers.8 That’s because

range of asset classes, most investment non-bank liquidity providers are using

banks will be impacted. Though most technology to offer better pricing and

press coverage has focused on the tighter spreads than traditional dealers

future and economics of investment and ultimately gaining market share.

research, that’s far from the whole story.

MiFID2 will not only impact revenue This shift not only reduces investment

streams and necessitate new compliance banks’ ability to make flow margin as the

investments, but also facilitate the intermediary of choice, but also robs

digitization of customer engagement in those businesses of the information

ways that are likely to create threats and advantage they gain from interacting

opportunities for capital markets players. with both sides of these markets.

Although FRTB is not due for

implementation until the end of 2019,

The solution lies not in cost-

its impact could very well exceed

that of MiFID2. Not only will banks cutting, but rather strategically

have to redesign risk models, largely rethinking the exact shape

away from simple value-at-risk (VaR) of businesses—especially

techniques, but the data collection as regulations such as MiFID2

requirements will be far more onerous.

may begin to create an unlevel

Data currently presents a key barrier to

internal model use; in some areas, the global playing field.

required data simply does not exist.

The technological challenge of capturing

and interpreting this new data burden

comes at a cost. Even if a model passes

muster with regulators (no easy feat),

firms still face capital costs. The last

quantitative impact study of this new

rule set (QIS4) estimated a 40 percent

increase in capital costs for the industry—

a figure that will challenge already weak

returns and potentially drive marginal

players out of certain product lines.7

CAPITAL MARKETS TECHNOLOGY 2022 7

GLOBAL CAPITAL

MARKETS IN 2022

In five years from now, the capital markets industry will still

need to perform similar functions as it does today, but its

roles and activities may change. The nature of these shifts

will depend on regulation and economics, and will likely be

won or lost based on a firm’s ability to successfully combine

business and technology to address shifting expectations.

Between now and 2022, the industry will seeing their rivals accelerate beyond

be shaped by automation, self-service reach. Firms that choose to proactively

expectations, and the continued rise harness these technologies can use

in non-bank liquidity and execution various strategies to break the cycle

providers. In this context, technology of compressive disruption, but it will

offers a way for firms to get ahead. require significant change that goes

Yet global market players that choose far beyond the current portfolio of

to be “fast followers,” particularly technology-led, cost-cutting programs.

those in intermediary functions, risk

8 CAPITAL MARKETS TECHNOLOGY 2022

CAPITAL MARKETS TECHNOLOGY 2022 9

DIGITAL BANKING VERSUS

BANKING DONE DIGITALLY

To create value, capital markets players

must move beyond process replication,

and revisit the core design and architecture

of the firm and industry.

Many investment banks have attempted to update

their legacy systems in the past. By replicating

existing processes with newer technology, they have

been able to achieve incremental efficiencies and

cost savings. In this guise, “going digital” has often

taken the form of a technology or channel change.

Transformational change in other industries has not

been achieved by simply introducing new technologies

to the old stack, but rather through the re-evaluation

of long‑held and widely accepted assumptions about

what is possible. As one fintech industry commentator

said, “It takes NASA $300 million to put an asset

in space; it takes $30 million for SpaceX to do so…

but they also try to land the rocket.”9

Digital leaders have used combinations of new

technologies to create radically different business

and value propositions. They have used platforms,

created and/or contributed to ecosystems (both

shared and open), moved from a product-based

mindset to a customer-centric one, and maintained

consistent service across multiple touchpoints and

channels (both proprietary and shared). The global

capital markets industry has mirrored this with its

thinking around blockchain technology, evolving from

a cost‑mutualization play to collaboratively evaluating

ways to fundamentally alter the fabric of capital markets.

Ultimately, banking done digitally forms a strategy

that is dictated by technology. Becoming a digital bank

means forming strategies empowered by technology.

Achieving the latter requires investment banks

to understand the key organizational imperatives

required to win, and how to orchestrate business

and technology around those imperatives.

10 CAPITAL MARKETS TECHNOLOGY 2022

FIVE TECHNOLOGY DESIGN

PRINCIPLES FOR 2022

Accurately envisioning 2022 today is not possible. Growing

volatility means a small change in assumptions could have

profound impacts on projections. This industry dynamic—

often described as “volatile, uncertain, complex and

ambiguous”—makes it increasingly complicated

to project a future state and execute an appropriate strategy.

Indeed, regulatory and political regime • Second, they will have designed

changes, interest rate uncertainty, an organization that assumes

the rate of emerging technology uncertainty, anticipates change,

maturity and adoption, and firms’ and is capable of deploying

ability to unlock pan‑industry network resources with pace and purpose.

dynamics are among the factors that

will have a significant impact on To make that happen, they will depend

future markets. Gone are the days of on a set of five winning design principles.

multi‑year big bets and commitments,

if they ever truly existed before.

What’s important, however, is that

the leading global capital markets

organizations of 2022 will likely

have achieved two key objectives:

• First, they will have used technology

as a competitive advantage,

moving beyond simple adoption

and redesigning the end-to-end

operating model with customers at

the core (see the “Digital banking

versus banking done digitally”

sidebar on the previous page).

CAPITAL MARKETS TECHNOLOGY 2022 11

1. INTELLIGENT AND AUTOMATED

Deploying technology and organizational designs that use machine

intelligence to automate and amplify human creativity and intuition.

As a suite of technologies, intelligent Many investment banks and buy-

automated systems can provide an side firms are investing in artificial

effective method to reduce process intelligence to aid with pattern

costs. Robotic process automation recognition, with the goal of deriving

technologies are already being deployed alpha-generating insights (e.g., Goldman

and scaled across the back office. In Sachs’ investment in Kensho and UBS

some instances, self-learning systems and Deutsche Bank’s investment in

are also being used to handle exceptions Sqreem).10 This development follows

and optimize workflow productivity. a long history of algorithmic trading

Intelligent and automated organizations and experimentation with machine-

go even further, moving beyond process learning techniques among hedge

replication to redesign processes funds and large asset managers

for the new technological reality. (e.g., BlackRock’s Aladdin platform).11

As the technology advances, firms Thinking about intelligent systems as an

operating in the capital markets extension of the workforce instead of the

industry are quickly adopting more technology estate can help firms realize

intelligent automation technology. other benefits. Automated systems make

The explosion of available data has it possible to build workforces that are

fed a number of use cases that aim to sensitive to business needs and can be

help with the comprehension of more, rapidly retrained, redeployed and rescaled

and more complex, data. These include at speed. Both human and machine

content extraction from unstructured workforces leverage platforms and

data (e.g. videos, images) to support external marketplaces to augment specific

sales efficiency, anomaly detection skills or scale on demand, as dictated by

(as part of know your customer or anti- market and business strategies. Here firms

money laundering monitoring), and are embracing collaboration, running

broader sets of data analysis methods proof‑of-concepts with multiple start‑ups,

(prediction, tooling and classification). open-source technologies and university

data science labs in non‑sensitive areas

of the bank as a way to enlarge and

enrich their talent bases.

12 CAPITAL MARKETS TECHNOLOGY 2022

Artificial intelligence is also being scientists—many of whom work for other

deployed to augment human capabilities. funds or outside the industry—to generate

One organization is using the technology advanced machine-learning allocation

to de-silo functions and accelerate sharing algorithms. To align the distributed

of key operational and client information, workforce, the company has created

leveraging advanced search and discovery an Ethereum-based cryptographic

tools to create a smart data broker that can currency called Numeraire to encourage

funnel key information where it’s needed. participating scientists to collaborate

rather than compete.12

When artificial and human intelligence are

combined, a powerful set of capabilities

becomes available. Numerai, a hedge

fund, shares encrypted financial datasets

with a virtual workforce of 7,500 data

CAPITAL MARKETS TECHNOLOGY 2022 13

2. DATA-LED AND

CLIENT-CENTRIC

Expanding the catalogue of data that’s captured and analyzed

to create real-time views of client needs and behaviors,

and inform service design.

The capital markets industry is no Many of these technology capabilities

stranger to data, but the volume and could become commoditized by 2022—

diversity of data is changing rapidly. even when powered by the promise

Data lake architectures are allowing of advanced computing technology,

a combination of structured and such as quantum computing. Firms can

unstructured data types, sourced differentiate themselves by orienting

both internally and externally. “Exotic” this data-rich approach around a clear,

datasets, including the use of satellite detailed and specific understanding

imagery, direct-from-source transaction of client needs. Doing so means

information, Internet-of-things data, and complementing quantitative datasets

freight and customs data are increasingly with qualitative datasets to better

being used to gain an edge in today’s understand the context in which clients

advisory-focused and insight-led market. engage with services. That understanding

With the deployment of more Internet- needs to be de-siloed, shared and

of-things platforms and the publishing incorporated across the full range of

of more open APIs across industries services, channels and touchpoints.

(e.g., European banking, post-Payment

Services Directive 2), the race for data Using human-centric design principles

will intensify as firms look to find an turns individual customer profiles

edge or sell data to those who can. into a coherent set of services, built

around their objectives. Far from being

As the cost of storage continues to static, these “living services” learn and

drop, firms will be able to store almost evolve, using contextual awareness

everything. But making sense of all this data to adapt and intuitively learn user

will require a coherent data strategy and habits and preferences. That might

management framework, and analytical take the form of trading platforms that

tools to identify clear signals through the understand client intent, and orchestrate

noise. Smart systems can help by finding “next‑best-step” workflows and related

patterns in data and uncovering insights. data feeds in real time, to maximize

Intelligent agents can understand natural- execution speed and efficiency.

language questions, conduct analysis and

produce detailed reports. They can also

be proactive, using graph analytics and

machine-learning algorithms to identify

patterns in huge datasets, and alert sales

staff and relationship managers.

14 CAPITAL MARKETS TECHNOLOGY 2022

3. OPEN AND ACCESSIBLE

Providing the capability for customers and the ecosystem to engage

deeply and seamlessly with the organization, and extending your

reach and capabilities beyond the boundaries of the firm.

Digital leaders make it as easy as Participating and contributing to

possible for customers and partners open‑source projects can also provide

to do business with them, reducing a way to mutualize the costs of product

friction across the commercial journey. development and innovation. Some

New digital standards of integration firms are already working collaboratively

and interoperability, including open with peers on common technology

application programming interfaces and infrastructure challenges. Notable

(APIs), open-source software and shared examples include the Symphony

platforms, can help firms integrate Foundation’s messaging protocols,

seamlessly with customers and extend OpenGamma’s Strata repository of risk

the reach of their partner ecosystems. analytics, and core distributed ledger

protocols from R3CEV and Hyperledger.14

Firms have already begun to offer The invention of crypto‑tokens gives

API services, providing seamless contributors a more direct way to monetize

integrations that deliver beyond portal open protocols, incentivizing and aligning

functionality. More advanced firms a wider group of contributors beyond those

are offering direct access to a wide who will make direct use of the project.

range of internal systems and capabilities

via APIs, while simultaneously uniting

several siloed functions on one platform

As firms become more

(e.g., Goldman Sachs’ Marquee platform).13

transparent, opening services

Leading firms will also use APIs to to direct integration via portals

monetize proprietary datasets and and APIs, they will need to

assets (e.g., pricing, risk or clearing

strike a delicate balance

systems), providing new opportunities

to boost returns on internal investments. between a secure security

Accessible API platforms and developer posture, and easily accessible

portals can cultivate an active developer and usable services.

and partner community, leveraging open

innovation and the power of the crowd

to accelerate service innovation and new

product development. Many organizations

have begun this journey with hackathon

and incubator facilities, but providing

open access to core data and technical

components can accelerate partner

evaluation and ultimately deployment.

CAPITAL MARKETS TECHNOLOGY 2022 15

4. AGILE AND RESILIENT

Designing a “living business” that assumes uncertainty and can adapt

with pace and purpose to changing market and customer needs.

To remain competitive, agility must be built Implementing a zero-based organizational

into both business and IT organizations. design lens ensures each component of

Agility is an often-overused term with the business and IT architectures is aligned

vague aspirational characteristics. In with tactical and strategic imperatives.

contrast, organizational agility is a set This robust evaluation discipline of the

of practical architectural decisions that organization’s architecture provides

facilitates a change in the strategic flexibility to push component parts

direction of a business, either proactively outside the enterprise. Many capital

or reactively, and quickly brings capacity markets players are facing the challenge

and scale into the new direction. of sourcing and retaining specialized

talent to deliver big step-changes.

Microservice architectures reduce Investment banks in particular are

dependency between processes and losing top talent to tech companies and

systems, enabling the quick removal or start‑ups; in 2016, only seven percent of

adaptation of individual parts without US graduates saw banking and capital

significant (i.e., costly and timely) changes markets as a top industry to work for,

and service disruption. Well understood down from 12 percent in 2013.16

in technical contexts, similar structures

are appearing in organizational design. External workforce marketplaces can help

Companies like Amazon and Haier, a banks tap into key talent on demand. They

Chinese consumer electronics and home may take the form of formal marketplaces

appliances company, have adopted for freelance talent (e.g., Upwork, a

decentralized business architectures marketplace for technical freelancers)

comprising small semi‑autonomous or specialized crowdsourcing websites

and self‑organizing teams.15 That has (e.g., Kaggle, a platform that runs data

allowed both organizations to create science challenges).17 Another example is

entrepreneurial and responsive business an AML consortium, which uses advanced

units that can be deployed when analytics platforms to identify potential risk

required without significant upheaval. events before they occur, to address AML

monitoring and surveillance industry-wide.18

16 CAPITAL MARKETS TECHNOLOGY 2022

Resilience can no longer come from Global capital markets organizations can

high walls; it requires an immune tap into a growing ecosystem of vendors

system that can handle a blow and the and utilities, but they need to ensure

ability to adapt quickly to constant a coherent and holistic cyber defense.

change. A proactive and collaborative Interoperability among security products

cybersecurity stance built on intelligent across networking, computing, storage

technologies, crowd-based peer and end-user devices is available through

networks and “inside‑out” security providers such as TestWave and Tripwire,

design will help prepare organizations which scale distributed architectures.

for rapidly evolving threats.

According to Accenture’s 2015 Global

With this movement to the

Risk Management Study, 82 percent of

risk management executives in financial cloud, security becomes

services find that emerging risks in the a shared responsibility with

cyber realm account for more of their service providers. Making this

chief risk officer’s time than ever before. partnership work requires

With the cost of a breach expected to

a willingness and an ability

increase 100 percent per year for each

of the next four years, it’s not difficult to share information with

to see why.19 Advanced technologies third parties, governments

and threats—many readily available and industry groups, such

for purchase online—have created a as the Financial Services

hazardous digital environment. But

new technology can also be used to

Information Sharing and

combat these threats, including artificial Analysis Center (FS-ISAC).

intelligence for monitoring, detection

and first response, data visualization for

front-line staff support and behavioral

analytics, and biometric authentication

for insider threat reduction.

CAPITAL MARKETS TECHNOLOGY 2022 17

5. SIMPLE AND HOMOGENEOUS

Removing unnecessary complexity and friction across the

organization, outsourcing and leveraging utilities where possible.

De-duplication and simplification In the Cloud 100 vision developed

can reduce costs and help prepare by Accenture, non-differentiating

organizations for a more agile assets are transferred outside the

operating environment. Rationalization, traditional boundaries of the firm

replatforming and redesigning the (e.g., all infrastructure and most

backbone of an organization along platforms).20 Some standardized business

digital principles will enable faster processes are also executed, and the

evolution and adaptation to change. associated data is managed by external

Microservice-based business and providers encompassing big tech (e.g.,

technical architectures facilitate faster Microsoft, Google, Amazon, HP) and

adoption of emerging technologies and an ecosystem of industry utilities and

rapid reassembly of core components fintech businesses. Firms only retain

into new complex structures. DevOps- ownership of differentiating assets,

style shared services can be expanded including proprietary processes,

across other business functions to algorithms and data. They also manage

support efficient operations and the deployment, security and integration

shared centers of excellence. of those assets across the cloud and

their portfolio of service providers.

Achieving deep levels of simplification will

also require effort beyond organizational The degree to which public cloud

boundaries, working with peers across the solutions are used will vary depending on

ecosystem to create shared services and the type of capital markets firm and the

platforms that streamline and de-duplicate business model in use. Global markets

industry functions. Distributed ledger players and investment banks that focus

technologies offer the opportunity for on competing in trading markets will likely

capital markets firms to fundamentally alter leverage highly scalable public solutions,

the fabric of markets: the confirmation and while some asset and wealth managers

exchange of ownership of assets. However, may choose to develop hybrid solutions

adoption will require the rethinking and with a differentiating internal private cloud.

reworking of processes and technologies

far beyond the core stack. A fully digitized Beyond the cost benefits of moving

settlement process will feature distributed to consumption-based pricing,

ledger technologies at the core and global capital markets organizations

interoperable technologies around the will gain increased flexibility in the

periphery, including graph-based analytics technology stack and faster access

capabilities that can analyze patterns to new technologies (e.g., artificial

across the distributed network, digital intelligence software-as-a-service).

contract management systems (e.g.,

ClauseMatch), trusted data oracles and

safeguarded on-chain/off-chain exchanges.

18 CAPITAL MARKETS TECHNOLOGY 2022

CAPITAL MARKETS TECHNOLOGY 2022 19

THE HOW:

A DNA OF CONSTANT CHANGE

Global capital markets organizations in 2022 will operate in a state

of constant change, continually chasing the next state rather than

a static target state. To compete effectively, global capital markets

players will need to change their DNA to prepare themselves for

frequent and fast changes toward an ever-evolving future state.

Today’s digital leaders design strategies Leading companies aim to create

that assume constant change. Significant “living businesses”—organizations that

developments and disruptions now effectively mirror the characteristics

appear and scale well within traditional of living organisms by perpetually

three-to-five-year planning cycles (see adapting their strategies, services,

Figure 5). Adapting to these developments platforms and ecosystems to new

generally requires significant changes standards of customer relevance.21

in capital allocation and organizational

resource requirements. Much like an

oil tanker trying to abruptly change Adopting the five design

direction, it’s currently often a slow

principles highlighted in this

process that may cause internal

instability and halt forward progress. paper will surely help facilitate this

change, but an efficient process

To become truly agile, firms need to of continuous investment in

design their business and technical

innovation will also be necessary.

architectures to be able to constantly

evolve toward new business and

organizational models. True agility is

less about predicting the future and

more about designing an organization

that experiments and invests in innovation,

and can quickly deploy talent and

technology to scale the next state.

20 CAPITAL MARKETS TECHNOLOGY 2022

Figure 5: Significant change is occurring within traditional strategic planning timeframes

Average planning cycle 3 years Average planning cycle 5 years

5 years: Top 100 Fastest Unicorns achieve valuation within 5 yearsi

3 years 7 months: Lufax achieves a $10bn valuation (Sep 2011-April 2015)ii

3 years 5 months: Robinhood achieves a $1.3bn valuation

(Dec 2013-Apr 2017)iii

3 years 11 months: Y’ue Bao becomes the world's largest money market fund

(June 2013-May 2017)iv

1 year 2 months: Citadel achieves largest share of US Interest Rate Swap market by trade volume,

and third largest by dollar volume on Bloomberg SEF (Oct 2014-Dec 2015)v

3 years: Combined market share of top 5 global

FX dealers sinks from 53% to 44% (2013-2016)vi

3 years: VC-backed fintech investment increases

433% from $0.3bn to $1.6bn (2012-2015)vii

Approx. 2 years (based ICOs surpass venture funding as the primary funding

on mainstream adoption): for distributed ledger start-upsviii

New competitors emerge and scale Industry incumbents shift into new positions

Significant investment is allocated towards new technologies

Accenture research based on public sources:

i

https://fleximize.com/unicorns/

ii

https://www.wsj.com/articles/chinas-lufax-valued-at-nearly-10-billion-in-recent-funding-round-1429164241

iii

https://techcrunch.com/2017/03/31/now-whos-the-rich/, https://www.crunchbase.com/organization/analyst

iv

https://www.bloomberg.com/news/articles/2017-05-15/world-s-biggest-money-fund-said-to-face-pressure-to-slow-inflows

v

https://www.risk.net/awards/2442287/interest-rate-derivatives-house-year-citadel-securities,

https://www.wsj.com/articles/citadel-makes-inroads-into-swaps-arena-1434997210

vi

https://www.fnlondon.com/articles/fxs-new-breed-chips-away-at-dominant-banks-20170623

vii

https://www.cbinsights.com/research/report/fintech-trends-2016/

viii

https://www.cnbc.com/2017/08/09/initial-coin-offerings-surpass-early-stage-venture-capital-funding.html

CAPITAL MARKETS TECHNOLOGY 2022 21

INVESTMENT AND INNOVATION

The sheer pace of growth of investment in But the goal is not solely to maximize

new technologies and business models the total sum of investment dollars

means developing significant investment available. Firms need to ensure that they

capacity must be a priority (see Figure are getting the best possible return on

6). Building this capacity requires a their innovation investments by adopting

continuous process of unlocking free new execution tools and techniques.

cash flow from the core business, using That requires the creation of an innovation

zero-based organization methods and architecture—a set of capabilities and

leveraging the digital technologies clear governance principles to support

documented previously in this paper. the firm’s portfolio of innovation activities.

Figure 6: Capital markets investments in key digital and emerging technologies

EMERGING IT SPENDING 2017 GROWTH RATE

TECHNOLOGY (US$ BILLION) 2017–2018

Advanced analytics 2.4 15%

Big data 2.3 3%

Artificial intelligence 1.68 14%

Alternative data 1.4 18%

Cloud computing 1.2 19%

Robotic process automation 0.4 10%

Digitization 0.32 9%

Blockchain 0.17 11%

Visualization 0.12 7%

Note: Categories are not mutually exclusive.

Source: © Opimas LLC - used by permission

22 CAPITAL MARKETS TECHNOLOGY 2022

GOVERNANCE To maximize investment efficiency,

removing organizational silos within

Firms need to create an investment innovation groups is key. This facilitates

capability that is capable of bringing the pooling of resources for innovation,

scale and capacity to sudden changes encourages cross-pollination of ideas

in investment direction. You cannot and and ensures that investments align with

should not jump on board every business the top strategic priorities of the firm. But

or technology fad. Instead, you need to innovation groups must ensure that they

establish clear investment governance do not become administrative blockers

to assess opportunities as they arise. for new opportunities or over-centralized

command-and-control centers.

It starts with an innovation agenda.

Rather than a list of technology ideas

(supply‑led), an innovation agenda

should mirror the strategic imperatives

By positioning innovation groups

of the firm (demand-led). For “moonshot as platforms for the wider

divisions” (i.e., innovation capabilities enterprise, they can provide

working on brand-new industry talent and tools to support

paradigms), these agendas tend to be

employee ideas and ventures,

broad and question-led. For nearer-term

innovation teams, agendas should avoid and encourage the cultivation

lofty business aspirations and dig deep of an inclusive innovation

to find small, specific points of leverage culture across the organization.

that can deliver strategic step-changes.

Evaluating opportunities also requires

a new approach. Unlike traditional

methods, this does not necessarily

mean relying on pre-investment business

cases based on internal assumptions

and historical data. Instead, firms

should invest in as many opportunities

as possible, focusing initial seed

investments on creating business

cases based on validated learning

(e.g., end-user testing, evidence of

customer activity or workarounds,

technology feasibility assessments).

Firms should then continue to invest

in increments, evaluating the venture

at each stage with a “persevere,”

“pivot” or “park” decision.

CAPITAL MARKETS TECHNOLOGY 2022 23

INNOVATION EXECUTION

To maximize investment and execution Crucially, the architecture must not be

efficiency, firms need to adopt new ways built as a wholly removed entity. With

of working that are more conducive to the almost half of firms citing siloed business

experimental work of innovation. Start- lines and a lack of collaboration with

ups exemplify these new ways of working, innovation teams as the biggest blockers

borrowing from techniques found in to innovation, innovation groups must

design, agile software development and be careful to not insulate themselves

adapted lean production principles to from core business lines.22

quickly formulate high-impact, user-

centric solutions, even when operating

in resource-scarce environments. But Removing these silos unlocks

while there is much to learn from these

the ability to harvest valuable

start-up teams, global capital markets

players must be careful not to “throw end‑user feedback, and focuses

the baby out with the bath water.” the innovation group’s targets

Although traditionally less nimble and with key performance indicators

more risk averse, large corporations (KPIs) that will make a real

also hold a significant amount of assets

that can accelerate the scaling of new

difference in the organization.

innovations. An innovation architecture

should leverage the respective benefits

of start-ups and corporations, and work

to mitigate the negative constraints of

both. Figure 7 identifies some of the

key groups that should be involved.

Figure 7: Key groups and roles for building an innovation architecture

RESEARCH

STRATEGY FUNDING AND INSIGHT

Business and service design, Central innovation portfolio, Market snapshots, trends,

business canvas and business seed rounds and external operational analytics platforms,

plan, execution strategy financing management, lean analytics, KPI strategies,

overall finance admin advice, user testing and interview

business case modelling support, tester sourcing

GOVERNANCE

LEGAL AND COACHING ECOSYSTEM

Partner/vendor contracting, Innovation process Fintech and consortia

intellectual property protection, management, delivery leads, engagement, open-source

data protection, terms of scrum/agile coaches licensing and contribution,

service, patent filing open hackathons

Source: Accenture Research

24 CAPITAL MARKETS TECHNOLOGY 2022

Figure 8: The investment banking stack for 2022

TODAY 2022

EARLY POCS AND GREATER BREADTH AND

UNDER UTILIZATION DEPTH OF ADOPTION

OF TECHNOLOGIES ACROSS THE STACK

Portal based with some Opti-channel strategies

omni-channel service and embedded invisible

provisions across devices service provisions in place

Early adoption of utilities; Business Utilities and fintechs fulfill

fintech partnerships Functions some functions in full

supplement offerings

Ecosystem Intelligent systems deliver

Early use of robotic process complex decision-support

automation and artificial in collaboration with humans

Intelligent

intelligence systems

Automation Analytics on external,

Early client and operational “App Store” shared, and unstructured

analytics based mostly data drive customer

on internal, siloed data engagement and end-to-end

Digital operational excellence

Digital settlement PoCs, Settlement

focus on relatively simple Shared digital settlement

and Utilities

transaction flows platforms go-live; businesses

emerge built on-top

Early cloud engagement Cyber & Cloud of new infrastructure

with private and some Infrastructure

hybrid implementations Public cloud provides

IaaS and PaaS to majority

of functions

Source: Accenture Research

CAPITAL MARKETS TECHNOLOGY 2022 25

BRINGING IT TOGETHER:

GLOBAL CAPITAL MARKETS 2022

Adopting our five design principles will have a visible impact on

an organization’s structure and talent base. A componentized

form will make it possible to take advantage of shared services

and platforms across the enterprise, while preventing a return

to the siloed inefficiencies of the past. Internally, operational

decision-making will be pushed to lower levels, enabling

focused leaders on the ground to quickly change directions and

spur growth. That creates a more fluid structure, accelerating

the realization of a seamless “plug-and-play” ecosystem of

third-party providers that will deliver organizational agility.

Official headcounts are likely to decrease Firms seeking technical dominance

as firms carve out operational functions will knowingly pay a high premium for

to shared platforms and utilities, and advanced engineering and data science

automate the front office, switching skills as they compete with firms across

traders for engineers and algorithms. At industry sectors in an already crowded

the same time, unofficial headcounts will marketplace. Winning this talent war

increase as organizations take advantage will require a markedly different

of external workforces and communities approach than in previous decades,

to access niche talent on demand. thanks to changing attitudes toward

work, and new non-salary employment

Talent mixes will diverge as global expectations created by start-ups

capital markets players follow different and large technology companies.

strategies. While a technical base will

be common across all organizations,

the size of their footprints will differ.

26 CAPITAL MARKETS TECHNOLOGY 2022

Others will direct premiums toward

dealmakers, employing tools to measure

and augment employees’ emotional

intelligence and soft skills. Technology

skills will still be important, but these

firms will employ a new breed of data

science and engineering platforms that

make advanced technologies more

accessible to the wider, non-technical

workforce. User interface innovations

in voice interaction, and augmented

and virtual reality, are already simplifying

how we interact with technology,

making it possible to communicate in

more powerful ways with more powerful

outcomes. Many leading technology tools

can already be operated with minimal or

no technical skills (e.g., Blue Prism, Ayasdi).

CAPITAL MARKETS TECHNOLOGY 2022 27

FOUR STARTING

POINTS FOR TODAY

Change is not cheap, but the adoption of a small set of key trends

can not only begin to align the organization with the five technology

design principles, but also help unlock the capacity required to invest

purposefully in the new business. Based on Accenture’s analysis

from our project experience and realized benefits with clients,

we’ve seen significant value along the following key interventions:

Digital ecosystem: The emergence Client-centric analytics: Real-time

of digitally enabled ecosystems that analysis and visualization across vast

provide component services across datasets, enabling greater customer

technology, processes, skills and data. insight and responsiveness.

Accenture estimates that a broader use of In addition to smarter customer

industry utilities could deliver significant segmentation, and deeper awareness

savings. In an area such as post-trade of client profitability and cross-selling

processing, using a utility could deliver opportunities, a better understanding

up to 30 percent or more of savings of your customer profile could help

across the enterprise in a steady state. streamline and rationalize client support

On typical baseline profiles, that could operations. In selected cases, such

translate into more than $10 million of interventions could generate annual cost

savings per year. savings in the double-digit millions.

Intelligent enterprise: A virtual Digital settlement: Digitized assets that

workforce that independently leverage distributed ledgers to optimize

completes customer-facing and post-trade settlement, re-architect

operational tasks to provide increased processes and release trapped capital.

enterprise scalability and agility. Distributed ledger technologies could

Accenture’s experience in deploying drive $8 billion in savings on a cost

intelligent automation technologies base of $30 billion across eight of

across capital markets organizations the top 10 global investment banks.23

suggests that most firms could reduce For example, our research shows that

FTE costs by up to 30 percent from significant parts of the trade process—

defined back-office and corporate including reconciliation, confirmation

processes alone. and trade-break analysis—could be

reduced or completely eliminated,

leading to potential costs savings

of 50 percent across trade support

and middle-office functions.

28 CAPITAL MARKETS TECHNOLOGY 2022

Together, these interventions could

impact cost bases sufficiently to lead to When both regulators and

a return to sustainable double-digit RoE management appreciate the

and materially improved profitability—

not only taking a firm on the path to

power of modern data science

technology-driven transformation, but and analytics in these areas, then

also freeing up capital that could be the industry will be on course for

used for more ambitious investments. a potentially lower‑risk banking

There is, however, one area that could

system without simply choking

yield even greater improvements in credit from the economy.

returns than the four points mentioned

on the previous page: reducing

capital requirements. Regulators are

consistently pushing for greater capital

backing through global frameworks

like Basel 3, minimum requirements

for eligible liabilities and the FRTB.

The panacea would involve using

intelligent automation to monitor risks

much closer to real time, big data and

machine learning to identify forward

stress indicators far faster than humans,

and anonymized and centralized pooling

of balance sheet data (perhaps on a

blockchain) to see risks in areas that

aren’t even on your balance sheet.

CAPITAL MARKETS TECHNOLOGY 2022 29

CONCLUSION

The global capital markets of 2022 will deliver the same

outcomes and industry needs: they will help companies

and governments raise capital, they will help investors find

and access returns, and they will help manage financial

risks. But the way in which these outcomes are delivered is

likely to change dramatically, strongly influenced by new

technology paradigms and digitally-led operating models.

As we journey toward 2022, technology Following these five design technology

will be a way for firms operating in the principles and getting the technology

capital markets industry to get ahead and strategy right is imperative, but it’s

differentiate. The successful ones will only one side of the coin. The other

be able to point technology in the right is taking a view on where value is

direction, align it to their business needs migrating across the ecosystem, and

and execute seamlessly. Technology, realigning your business and operating

after all, is simply a tool that can provide models toward it—not just within today’s

scale and rapid access to insight buy-side, sell-side and infrastructure

and information—it rarely determines models, but also across them.

the service that needs to be scaled.

To lead, firms will need to move beyond

Many firms operating in the

purely thinking of digital in the pursuit

of cheaper operating costs, to rethinking capital markets industry have had

and repurposing the organization for a fully their ability to fully control their

digitized economy. That means learning own destiny reduced over the last

to be sensitive to the changing customer— decade. With the right network

encompassing the functional, emotional

of talent and technology, and a

and social needs that together drive their

expectations and experiences. It means commitment to bold change and

being more open and accessible—being innovation, the next decade will

able to use platforms, talent pools and give them the ability to find new

networks to orchestrate services around ground in which to thrive.

their clients, while extending their reach.

It means designing business and operating

models around constant change—

continuously unlocking investment

capacity to invest in innovation, and

building a simpler architecture that

supports resilience and agility.

30 CAPITAL MARKETS TECHNOLOGY 2022

REFERENCES

1. Accenture Research published in MIT Sloan Management Review: https://sloanreview.mit.edu/article/

the-big-squeeze-how-compression-threatens-old-industries

2. Coalition Investment Bank Index - 3Q17 YTD, November 2017. https://www.coalition.com/index_and_

league_tables.html

3. Greenwich Associates, “2016 Market Structure & Trading Technology Study”

4. Accenture research based on publicly available sources

5. Accenture research based on company financial statements

6. https://www.ft.com/content/04687116-5998-11e6-9f70-badea1b336d4

7. https://www.bis.org/bcbs/publ/d346.htm

8. https://www.greenwich.com/fixed-income-fx-cmds/technology-succeed-fixed-income-trading

9. https://soundcloud.com/tearsheet/moneynets-morgan-downey-2016-was-bloombergs-blackberry-moment

10. https://www.forbes.com/sites/antoinegara/2017/02/28/kensho-sp-500-million-valuation-jpmorgan-

morgan-stanley/#36b23d765cbf

https://www.americanbanker.com/news/beyond-robo-advisers-how-ai-could-rewire-wealth-management

11. https://www.nytimes.com/2017/03/28/business/dealbook/blackrock-actively-managed-funds-

computer-models.html

12. https://www.coindesk.com/no-ico-hedge-fund-numerai-releases-blockchain-token-without-funding/

13. http://www.businessinsider.com/goldman-sachs-is-making-its-trading-tech-open-source-2015-8

14. https://www.symphony.foundation/

https://github.com/OpenGamma/Strata

https://www.finextra.com/blogposting/13074/blockchain-and-hyperledger-project-beyond-the-hype

15. http://www.self-managementinstitute.org/haier-elevation

16. https://www.accenture.com/us-en/insight-investment-bank-challenge-05-digital-talent

17. https://www.upwork.com/

https://www.kaggle.com/

18. http://www.fatf-gafi.org/

19. https://www.juniperresearch.com/researchstore/innovation-disruption/cybercrime-security/

enterprise-threats-mitigation

20. https://www.accenture.com/us-en/insight-disruptive-technology-trends-2017

21. For more on achieving a living business in financial services, read: https://www.accenture.com/us-en/

insight-banking-living-business-customer-experience

22. https://www.aitegroup.com/report/innovation-capital-markets-not-just-dog-and-pony-show

23. https://www.accenture.com/us-en/insight-banking-on-blockchain

CAPITAL MARKETS TECHNOLOGY 2022 31

CONTACTS ABOUT ACCENTURE

Owen Jelf Accenture is a leading global professional

owen.jelf@accenture.com services company, providing a broad

range of services and solutions in

James Burrows strategy, consulting, digital, technology

james.e.burrows@accenture.com and operations. Combining unmatched

experience and specialized skills

Wynn Davies

across more than 40 industries and all

wynn.davies@accenture.com

business functions—underpinned by

Thomas Hollis the world’s largest delivery network—

thomas.hollis@accenture.com Accenture works at the intersection of

business and technology to help clients

Alexander Potter improve their performance and create

alexander.m.potter@accenture.com sustainable value for their stakeholders.

James Savidge With approximately 425,000 people

james.savidge@accenture.com serving clients in more than 120

countries, Accenture drives innovation

David Treat to improve the way the world works and

david.b.treat@accenture.com lives. Visit us at www.accenture.com.

This document is produced by consultants

FOLLOW US at Accenture as general guidance. It is not

intended to provide specific advice on your

Follow us on Twitter circumstances. If you require advice or further

details on any matters referred to, please

@AccentureCapMkt

contact your Accenture representative.

Follow us on LinkedIn

https://www.linkedin.com/showcase/ This document makes descriptive reference to

trademarks that may be owned by others. The

accenture_capital_markets/

use of such trademarks herein is not an assertion

Follow our Blog of ownership of such trademarks by Accenture

http://capitalmarketsblog. and is not intended to represent or imply the

existence of an association between Accenture

accenture.com/

and the lawful owners of such trademarks.

Copyright © 2018 Accenture

All rights reserved.

Accenture, its logo, and

High Performance Delivered

are trademarks of Accenture. 173998

You might also like

- Robert D. Blevins - Flow-Induced Vibration (2001, Krieger Pub Co) PDFDocument254 pagesRobert D. Blevins - Flow-Induced Vibration (2001, Krieger Pub Co) PDFDang Dinh DongNo ratings yet

- Lesson Plan in SwotDocument7 pagesLesson Plan in SwotFlorentina Visto100% (2)

- Accenture AI Industry Growth Full Report PDFDocument28 pagesAccenture AI Industry Growth Full Report PDFVictor HidalgoNo ratings yet

- Analysis and Interpretation of Financial Statement PDFDocument21 pagesAnalysis and Interpretation of Financial Statement PDFSaleh Abubakar100% (2)

- Whitepaper-Institutional-2020-Sqb-En Swiss QuoteDocument18 pagesWhitepaper-Institutional-2020-Sqb-En Swiss QuotemtimbangeNo ratings yet

- Capital Markets Event 17 12 20bDocument88 pagesCapital Markets Event 17 12 20bDaniela PohlNo ratings yet

- 30 Hour Day On Demand For Media and EntertainmentDocument16 pages30 Hour Day On Demand For Media and EntertainmentyiahNo ratings yet

- Investment Banking - Securities Dealing in The US Iexpert Report PDFDocument8 pagesInvestment Banking - Securities Dealing in The US Iexpert Report PDFJessyNo ratings yet

- ColombiaDocument67 pagesColombiaMarco MarksterNo ratings yet

- CR NBFC Survey Mar2024 FinalDocument19 pagesCR NBFC Survey Mar2024 FinalmadhavkumarNo ratings yet

- Mckinsey On Payments: October 2015 Volume 8, Number 22Document8 pagesMckinsey On Payments: October 2015 Volume 8, Number 22santosh hariharanNo ratings yet

- ControleDocument8 pagesControleMegane MatchioNo ratings yet

- BCG Global Wealth 2020 PDFDocument36 pagesBCG Global Wealth 2020 PDFArpit CooldudeNo ratings yet

- Employment - Recruiting Agencies in The US iExpertRisk ReportDocument11 pagesEmployment - Recruiting Agencies in The US iExpertRisk ReportOozax OozaxNo ratings yet

- Chapter 11 and 17 - Quality of Financial ReportsDocument12 pagesChapter 11 and 17 - Quality of Financial ReportsTanzeem MahamudNo ratings yet

- BCG Global PaymentsDocument36 pagesBCG Global PaymentsAdityaMahajanNo ratings yet

- Credit Analysis of Premier Foods PLC - Sample 1Document14 pagesCredit Analysis of Premier Foods PLC - Sample 1BethelNo ratings yet

- Swift Banks Whitepaper Transactionbankingadvantage2012Document27 pagesSwift Banks Whitepaper Transactionbankingadvantage2012nghia tranNo ratings yet

- L8 - Analysis and Interpretation of Financial Statements (Part 1)Document17 pagesL8 - Analysis and Interpretation of Financial Statements (Part 1)mishabmoomin1524No ratings yet

- FSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideDocument25 pagesFSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideSandeep WandreNo ratings yet

- دليل المستثمر في التقنية العميقة- إنجليزيDocument20 pagesدليل المستثمر في التقنية العميقة- إنجليزيwadaq.factoryNo ratings yet

- BCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFDocument27 pagesBCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFLawrence HNo ratings yet

- QuarterlyUpdateReport AngelOneLtd Q4FY23Document9 pagesQuarterlyUpdateReport AngelOneLtd Q4FY23Abhishek TondeNo ratings yet

- Australia Investment Banking Review First Quarter 2021: Refinitiv Deals IntelligenceDocument15 pagesAustralia Investment Banking Review First Quarter 2021: Refinitiv Deals IntelligenceYohei John MikawaNo ratings yet

- DH-09-0469 Mine - Year-End Review FINALDocument52 pagesDH-09-0469 Mine - Year-End Review FINALOwm Close CorporationNo ratings yet

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- Distrab SAS LBO: Marc Harik David Brandao Jimmy Moreau Avaidh Sudhakaran Jean-Victor ChambardDocument15 pagesDistrab SAS LBO: Marc Harik David Brandao Jimmy Moreau Avaidh Sudhakaran Jean-Victor ChambardchambardNo ratings yet

- ADV DTS Middle-Market-DTS Retail Web FinalDocument32 pagesADV DTS Middle-Market-DTS Retail Web FinalXuanlaNo ratings yet

- Impact of Q1FY21 Results On Equity Market: Ason1 July' 20Document4 pagesImpact of Q1FY21 Results On Equity Market: Ason1 July' 20YasahNo ratings yet

- RBSA Advisors Industry Valuation Multiples Series 4th Edition Dec2020Document52 pagesRBSA Advisors Industry Valuation Multiples Series 4th Edition Dec2020Sudhir SalianNo ratings yet

- FinTechnicolor The New Picture in Finance PDFDocument84 pagesFinTechnicolor The New Picture in Finance PDFalex.kestner384No ratings yet

- BCG Global Asset Management 2021 Jul 2021Document28 pagesBCG Global Asset Management 2021 Jul 2021hehevNo ratings yet

- 2021 Banking and Capital Markets Outlook Strengthening Resilience Accelerating Transformation7429Document40 pages2021 Banking and Capital Markets Outlook Strengthening Resilience Accelerating Transformation7429abkhanNo ratings yet

- Covid 19 and Monetary Policy Speech by Michael SaundersDocument16 pagesCovid 19 and Monetary Policy Speech by Michael SaundersHao WangNo ratings yet

- MBB 19 - The Case For Pricing TransparencyDocument7 pagesMBB 19 - The Case For Pricing TransparencyHuber NavaNo ratings yet

- Q2 2022 LLIN CommentaryDocument6 pagesQ2 2022 LLIN CommentaryTay YisiongNo ratings yet

- Rics Economy and Property Update February 2022Document7 pagesRics Economy and Property Update February 2022Alex jonesNo ratings yet

- Malik Pims An Essential Part of Good Business ManagementDocument7 pagesMalik Pims An Essential Part of Good Business ManagementManisha NagpalNo ratings yet

- Affle InvestmentAnalysis V2Document14 pagesAffle InvestmentAnalysis V2Soham BansalNo ratings yet

- Requirement 3 Group 47Document3 pagesRequirement 3 Group 47lucia VallsNo ratings yet

- 2021 Tech CFO Outlook Webinar - Intl FinalDocument50 pages2021 Tech CFO Outlook Webinar - Intl FinalSalil RavindranNo ratings yet

- The Superincumbent'S Dilemma: 2019 Value Creators ReportDocument6 pagesThe Superincumbent'S Dilemma: 2019 Value Creators ReportTrip KrantNo ratings yet

- M&a BpoDocument7 pagesM&a BpoVishal MehtaNo ratings yet

- 2021 Banking and Capital Markets Outlook Strengthening Resilience Accelerating Transformation5393Document37 pages2021 Banking and Capital Markets Outlook Strengthening Resilience Accelerating Transformation5393Pankaj SankholiaNo ratings yet

- The Impact of COVID 19 On Capital Markets One Year in PDFDocument8 pagesThe Impact of COVID 19 On Capital Markets One Year in PDFRhenyAANo ratings yet

- ImportantDocument25 pagesImportantHossein SassaniNo ratings yet

- Q1 2022 Fintech Report 1130Document30 pagesQ1 2022 Fintech Report 1130fakeid fakeidNo ratings yet

- Investment Banking - Securities Dealing in The US Industry ReportDocument42 pagesInvestment Banking - Securities Dealing in The US Industry ReportEldar Sedaghatparast SalehNo ratings yet

- The Australian Financial System in The 1990s: 180 Marianne Gizycki and Philip LoweDocument36 pagesThe Australian Financial System in The 1990s: 180 Marianne Gizycki and Philip Loweaftab20No ratings yet

- CFM AssignmentDocument6 pagesCFM AssignmentNikhil ChhabraNo ratings yet

- Valiant Organics LTD.: Eureka in The LabDocument11 pagesValiant Organics LTD.: Eureka in The LabAJNo ratings yet

- 4Q 2020 - Analyst Meeting (LONG FORM)Document80 pages4Q 2020 - Analyst Meeting (LONG FORM)Giang NguyenNo ratings yet

- Evaluation of Digital Realty Trust IncDocument18 pagesEvaluation of Digital Realty Trust Incwafula stanNo ratings yet

- Shape F5 - The New Business Imperative - WhitepaperDocument8 pagesShape F5 - The New Business Imperative - WhitepaperAnteGrNo ratings yet

- 7 Step SalesForce CRM March 13 2024Document19 pages7 Step SalesForce CRM March 13 2024resourcesficNo ratings yet

- Market Outlook - Jan 2022Document138 pagesMarket Outlook - Jan 2022sigdelkumudNo ratings yet

- Financial Ration Analysis: 2. Trend Analysis: 3. Comparative Analysis: VNM - Summary of Financial Ratios in 2020Document4 pagesFinancial Ration Analysis: 2. Trend Analysis: 3. Comparative Analysis: VNM - Summary of Financial Ratios in 2020Nguyễn Hoàng ĐiệpNo ratings yet

- India Diagnostics Sector 01 Mar 2023Document32 pagesIndia Diagnostics Sector 01 Mar 2023RJNo ratings yet

- Corporate ReportDocument26 pagesCorporate ReportMuhammad AhmedNo ratings yet

- Article StockbasedcompensationDocument29 pagesArticle StockbasedcompensationКостя КомаровNo ratings yet

- Mark Leonard PL 2015Document14 pagesMark Leonard PL 2015Sugar RayNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Top25Web3Innovations 1650517664262Document80 pagesTop25Web3Innovations 1650517664262deepakcool208No ratings yet

- Integration Hackathon - DetailsDocument11 pagesIntegration Hackathon - Detailsdeepakcool208No ratings yet

- Web3 StorageDocument1 pageWeb3 Storagedeepakcool208No ratings yet

- Web3 Reading List - Crypto Canon - Andreessen HorowitzDocument32 pagesWeb3 Reading List - Crypto Canon - Andreessen Horowitzdeepakcool208No ratings yet

- Knit RoadmapDocument1 pageKnit Roadmapdeepakcool208No ratings yet

- I3 SigcommDocument14 pagesI3 Sigcommdeepakcool208No ratings yet

- CHILL PANDA Business CardDocument2 pagesCHILL PANDA Business Carddeepakcool208No ratings yet

- Maple BlockDocument10 pagesMaple Blockdeepakcool208No ratings yet

- Ambit - IIM Calcutta Job Description FormDocument2 pagesAmbit - IIM Calcutta Job Description Formdeepakcool208No ratings yet

- Vpsa O2 Systems Brochure ML IND0032Document8 pagesVpsa O2 Systems Brochure ML IND0032kalaiNo ratings yet

- Yea Kaeps800000042k SGDV Ac APDocument24 pagesYea Kaeps800000042k SGDV Ac APthanh_cdt01No ratings yet

- Himax HX8347Document170 pagesHimax HX8347whistle-blowerNo ratings yet

- Sci Grade 9Document5 pagesSci Grade 9Emmam LucanasNo ratings yet

- Achievement Report PDFDocument4 pagesAchievement Report PDFAnonymous IpBC61ZNo ratings yet

- Week 4 Assignment PDFDocument5 pagesWeek 4 Assignment PDFTilakLNRangaNo ratings yet

- (Computer Science Project) To Generate Electricity Bill For Computer Science ProjectDocument33 pages(Computer Science Project) To Generate Electricity Bill For Computer Science ProjectHargur BediNo ratings yet

- KB00194 - DCOM Settings For The OPC Interface That Cause The Following Errors - Advise Returns Error 8004020 - or PIPCDocument1 pageKB00194 - DCOM Settings For The OPC Interface That Cause The Following Errors - Advise Returns Error 8004020 - or PIPCJunior PassosNo ratings yet

- M1-8 Version 6 Error Code Door LabelDocument1 pageM1-8 Version 6 Error Code Door Labeljonatan toledoNo ratings yet

- Ethiopian Construction LawDocument128 pagesEthiopian Construction LawFreedom Love Nabal100% (4)

- Lesson Plan Template - Social EmotionalDocument2 pagesLesson Plan Template - Social Emotionalapi-573540610No ratings yet

- Matrix Infinity 2Document2 pagesMatrix Infinity 2marianotavaresNo ratings yet

- Mother Tongue DLPDocument10 pagesMother Tongue DLPmaricrispigangNo ratings yet

- A Study On Marketing Strategies of LIC Agents With Special Reference To Branches in Madurai DivisionDocument14 pagesA Study On Marketing Strategies of LIC Agents With Special Reference To Branches in Madurai DivisionAjanta BearingNo ratings yet

- LOR ProfessorDocument1 pageLOR Professorapi-3845889100% (4)

- TarangMini ST13SMxxDocument1 pageTarangMini ST13SMxxPrasad ChabbiNo ratings yet

- Drone Spraying BeanDocument4 pagesDrone Spraying BeanFitri AudiaNo ratings yet

- Chapter 8 Thermal LoadsDocument2 pagesChapter 8 Thermal LoadsCarlo DizonNo ratings yet

- PlagiarismDocument4 pagesPlagiarismMary Grace PilarNo ratings yet

- DESTINATIONS 1 WebDocument38 pagesDESTINATIONS 1 WebRodrigo MartinezNo ratings yet

- Phoenix Contact PT 2-PES-230AC-STDocument6 pagesPhoenix Contact PT 2-PES-230AC-STblitz301No ratings yet

- Mental HealthDocument24 pagesMental Healthnitin pareekNo ratings yet

- Understanding Feyerabend On GalileoDocument5 pagesUnderstanding Feyerabend On Galileorustycarmelina108No ratings yet

- Introduction To Tech Communication & Project Management: Arthur C.M. Chen 617 253-7312, RM 38-460 Acmchen@alum - Mit.eduDocument21 pagesIntroduction To Tech Communication & Project Management: Arthur C.M. Chen 617 253-7312, RM 38-460 Acmchen@alum - Mit.eduTejal1212No ratings yet

- Lecture 2 Graphs of Some Standard Functions, Shifting of GraphsDocument12 pagesLecture 2 Graphs of Some Standard Functions, Shifting of Graphsghazi membersNo ratings yet

- Grade 6 - Q1 - W3 - BDocument2 pagesGrade 6 - Q1 - W3 - BMary Joy G TornoNo ratings yet

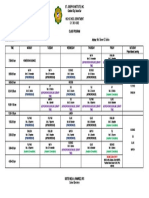

- 9 St. Catherine Class ScheduleDocument1 page9 St. Catherine Class ScheduleAleah TungbabanNo ratings yet