Professional Documents

Culture Documents

Def in Ti On

Def in Ti On

Uploaded by

Bikas PatraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Def in Ti On

Def in Ti On

Uploaded by

Bikas PatraCopyright:

Available Formats

Air Waybill (AWB) or air consignment note refers to a receipt issued by an international airline for goods and an evidence

of the contract of carriage, but it is not a document of title to the goods. Hence, the AWB is non-negotiable. The Air Waybill (AWB) is the most important document issued by a carrier either directly or through its authorised agent. It is a non-negotiable transport document. It covers transport of cargo from airport to airport. By accepting a shipment an IATA cargo agent is acting on behalf of the carrier whose air waybill is issued. AWBs have eleven digit numbers which can be used to make bookings, check the status of delivery, and current position of the shipment. The number consists of:

1. The first three digits are the airline prefix. Each airline has been assigned a 3digit number by IATA, so from the prefix we know which airline has issued the document. 2. The next seven digits are the running number/s - one number for each consignment 3. The last digit is what is called the check digit. It is arrived at in the following manner:

The seven digit running numbers are divided by 7, by using a long division calculation. The remainder becomes the check digit. That is why no AWB number ends with a figure greater than 6. Air waybills are issued in sets of different colours. The first three copies are classified as originals. The first original, blue in colour, is the shippers copy. The second, coloured blue, is retained by the issuing carrier. The third, coloured orange, is the consignees copy. A yellow copy acts as the delivery receipt, or proof of delivery*. The other copies are all white.[1] There are several purposes that an air waybill serves, but its main functions are:

Contract of Carriage. Behind every original of the AWB are conditions of contract for carriage Evidence of Receipt of Goods

When the shipper delivers goods to be forwarded, he will get a receipt. The receipt is proof that the shipment was handed over in good order and condition and also that the shipping instructions, as contained in the Shipper's Letter of Instructions, are acceptable. After completion, an original copy of the air waybill is given to the shipper as evidence of the acceptance of goods and as proof of contract of carriage

Freight Bill

The air waybill may be used as a bill or invoice together with supporting documents since it may indicate charges to be paid by the consignee, charges due to the agent or the carrier. An original copy of the air waybill is used for the carrier's accounting

Certificate of Insurance

The air waybill may also serve as an evidence if the carrier is in a position to insure the shipment and is requested to do so by the shipper

Customs Declaration

Although customs authorities require various documents like a commercial invoice, packing list, etc. the air waybill too is proof of the freight amount billed for the goods carried and may be needed to be presented for customs clearance The format of the air waybill has been designed by IATA and these can be used for both domestic as well as international transportation. These are available in two forms, viz. the airline logo equipped air waybill and the neutral air waybill. Usually, airline air waybills are distributed to IATA cargo agents by IATA airlines. The air waybills show:

the carrier's name its head office address its logo the pre printed eleven digit air waybill number

It is also possible to complete an air waybill through a computerised system. Agents all over the world are now using their own in-house computer systems to issue airlines' and freight forwarders' own air waybills. IATA cargo agents usually hold air waybills of several carriers. However, it gradually became difficult to accommodate these prenumbered air waybills with the printed identification in the computer system. Therefore a neutral air waybill was created. Both types of air waybills have the same format and layout. However, the neutral air waybill does not bear any pre-printed individual name, head office address, logo and serial number.

Responsibility for Completion

The AWB as we have seen is a contract - an agreement between the shipper and the carrier. The agent only acts as an intermediary between the shipper and carrier. The air waybill is also a contract of good faith. This means that the shipper will be responsible for the accuracy and sufficiency of the details and/or statements relating to the goods listed. The shipper shall also be liable for all the damage suffered by the airline or any person due to irregularity, incorrectness or incompleteness of insertions on the air waybill, even if the air waybill has been completed by an agent or the carrier on his behalf. When the shipper signs the AWB or issues the letter of instructions he simultaneously confirms his agreement to the conditions of contract

Beneficiary's Certificate The beneficiary's certificate, sometimes referred to as the certificate of assurance, is a certification issued by the beneficiary of the letter of credit (L/C) showing, unless wording is specified in the L/C, the summary of a consignment and declaring (i.e., assuring the consignee) that the shipment in question conforms to the specifications in the sales contract. The exporter can issue a beneficiary's certificate using company letterhead. What Does Bill Of Exchange Mean? A non-interest-bearing written order used primarily in international trade that binds one party to pay a fixed sum of money to another party at a predetermined future date. Investopedia explains Bill Of Exchange Bills of exchange are similar to checks and promissory notes. They can be drawn by individuals or banks and are generally transferable by endorsements. The difference between a promissory note and a bill of exchange is that this product is transferable and can bind one party to pay a third party that was not involved in its creation. If these bills are issued by a bank, they can be referred to as bank drafts. If they are issued by individuals, they can be referred to as trade drafts

Bill of exchange

A bill of exchange or "draft" is a written order by the drawer to the drawee to pay money to the payee. A common type of bill of exchange is the cheque (check in American English), defined as a bill of exchange drawn on a banker and payable on demand. Bills of exchange are used primarily in international trade, and are written orders by one person to his bank to pay the bearer a specific sum on a specific date. Prior to the advent of paper currency, bills of exchange were a common means of exchange. They are not used as often today.

Bill of exchange, 1933 A bill of exchange is an unconditional order in writing addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at fixed or determinable future time a sum certain in money to order or to bearer. (Sec.126) It is essentially an order made by one person to another to pay money to a third person.

A bill of exchange requires in its inception three partiesthe drawer, the drawee, and the payee. The person who draws the bill is called the drawer. He gives the order to pay money to the third party. The party upon whom the bill is drawn is called the drawee. He is the person to whom the bill is addressed and who is ordered to pay. He becomes an acceptor when he indicates his willingness to pay the bill. (Sec.62) The party in whose favor the bill is drawn or is payable is called the payee. The parties need not all be distinct persons. Thus, the drawer may draw on himself payable to his own order. (see Sec. 8) A bill of exchange may be endorsed by the payee in favour of a third party, who may in turn endorse it to a fourth, and so on indefinitely. The "holder in due course" may claim the amount of the bill against the drawee and all previous endorsers, regardless of any counterclaims that may have disabled the previous payee or endorser from doing so. This is what is meant by saying that a bill is negotiable. In some cases a bill is marked "not negotiable" see crossing of cheques. In that case it can still be transferred to a third party, but the third party can have no better right than the transferor. Cerificate of Origin The Certificate of Origin is an instrument to establish evidence on the origin of goods imported into any country. The certificates are issued under the ambit of the Rules of Origin of any importing country that grants such concessions to tariffs or merely stipulates a non preferential certificate without granting any tariff concession. The Agreement on Rules of Origin within the framework of the World Trade Organisation ( WTO) is the foundation on which the Rules of Origin are framed by the respective countries. The basic principles enunciated in the WTO agreement on Rules of Origin are transparency, objectivity , impartiality, predictability, consistency and neutrality. The avowed objectives of these rules are to bring about further liberalization and expansion of world trade. It also desires to bring about the transparency of laws, regulations and practices regarding the Rules of Origin. It is on this basis that various countries have formulated their Rules of Origin which grant greater access to goods from the developing and the least developed countries under the preferential mode . There are two categories of Certificate of Origin viz. (1) Preferential and (2) Non preferential. Amongst the Preferential Certificate of Origin are the : 1. Generalised System of Preferences ( GSP) is a non contractual instrument by which

industrialised (developed) countries unilaterally and on the basis of non reciprocity extend tariff concessions to developing countries. The following countries extend tariff preferences under their GSP Scheme. United States, Japan European Union, Norway Canada, Switzerland Australia (only to LDCs) Bulgaria New Zealand Poland Hungary Belarus Slovakia Russia Czech Republic

GSP schemes of these countries details the sectors/ products and tariff lines under which these benefits are available, besides the conditions and the procedures governing the benefits. These schemes are renewed and modified from time to time. Normally the Customs of GSP offering countries require information in Form 'A' (prescribed for GSP Rules Of Origin) duly filled by the exporters of the beneficiary countries and certified by authorised agencies. The List of agencies authorised to issue GSP Certificate of Origin is given in Appendix-35 of the Exim Policy and is as under:

2. Global System of Trade Preference (GSTP): In the GSTP trade concessions are exchanged among developing countries, who have signed the agreement. Presently, there are 46 member countries of GSTP and India has exchanged tariff concessions with 12 countries on a limited number of products. Export Inspection Council (EIC) is the sole agency authorised to issue Certificate of Origin under GSTP. 3. The Agreement establishing SAPTA was signed by the seven SAARC countries namely India, Pakistan, Nepal, Bhutan, Bangladesh, Sri Lanka and Maldives. The list of agencies, which are authorised to issue Certificate of Origin under SAPTA are notified under Appendix - 35A of the Handbook of Procedures (Vol 1) . 4. The Bangkok agreement is a preferential trading arrangement designed to liberalise and expand trade in goods progressively in the Economic and Social Commission for Asia and Pacific (ESCAP) region through such measures as the relaxation of tariff and non tariff barriers and use of other negotiating techniques. The agencies authorised to issue Certificate of Origin under Bangkok agreement are listed in Appendix - 35A of the Handbook of Procedures (Vol 1) . 5. A Free Trade Agreement (FTA) between India and Sri Lanka was signed on 20th December, 1998. The agreement was operationalised in March, 2000 following notification of the required Customs tariff concessions by the Government of Sri Lanka and India in February, and March, 2000 respectively. Export Inspection Council is the sole agency to issue the Certificate of Origin under ISLFTA.

The non preferential certificate of origin merely evidences the origin of goods from a Particular country and does not bestow any tariff benefits for exports to the importing nations Nation. All the exporters who are required to submit Certificate of Origin (Non Preferential) would have to apply to any of the agencies enlisted in Appendix-35B with the following documents:

(a.)Details of quantum/origin of the inputs/ consumables used in the export product. (b.)Two copies of invoices. (c.)Packing list in duplicate for the concerned invoice. (d.)Fee not exceeding Rs.100 per certificate as may be prescribed by the concerned agency. The agency would ensure that the goods are of Indian origin as per the general principles governing the rules of origin before granting the Certificate of Origin(non preferential). The Certificate would be issued as per the Format of Certificate of Origin (Non Preferential) given in Annexure-II to Appendix-35B. It should be ensured that no correction/re-type is made on the certificate.

In the event of any agency desirous of being enlisted in Appendix-35-B, they shall submit the following documents to the office of the Director General of Foreign Trade: a) Details on the history, activities, membership, awards etc. of the agency. b) Notarised Declaration cum Undertaking as per Annexure I to Appendix 35 B on a stamp paper (Minimum Rupees two) A copy of the same may also be endorsed to the RMTR Division of the Department of Commerce .

Certificate of Origin

The ICC is authorized by the Directorate General of Foreign Trade and Ministry of Commerce, Govt. of India to issue Non-preferential Certificate of Origin to the exporters. ICC has been efficiently providing this service at a nominal cost. Special discounts are available for ICC members. The exporters seeking Certificate of Origin have to execute an indemnity bond in favour of the ICC before they can avail of this service for the first time. Thereafter preprinted certificate of origin forms can be obtained from the ICC office. Exporters can get the certificate of origin and allied documents duly attested and signed by one of the authorized signatories of ICC by paying the requisite service charges.

Form A in the GSP Program

Under the GSP (Generalised System of Preferences) program or the preferential tariff treatment, a free or reduced duty is granted by developed countries to certain manufactured goods from the least developed countries, in order to bolster their exports and economic growth. Most imports eligible under the GSP program are free of duty. There are over 20 industrialized countries---donor countries (country of destination)---which maintain GSP programs and over 100 least developed countries---beneficiary countries (country of origin)---which are eligible under the GSP program. Form A, which is often called the GSP Form A, is a certificate of origin. It is used under the GSP program for exportations to the donor countries from the beneficiary countries. Please see the sample Form A below. Some of the donor countries which accept Form A for the purposes of the GSP include:

Australia Austria Belgium Bulgaria Canada Denmark Finland France Germany Greece Hungary Ireland

Italy Japan Luxembourg Netherlands New Zealand Norway Poland Sweden Switzerland United Kingdom U.S.A.

General Conditions to Qualify for Preferences In order to meet the general conditions to qualify for preference, products must:

fall within a description of products eligible for preference in the country of destination. The description entered on the form must be sufficiently detailed to enable the products to be identified by the customs officer examining them;

comply with the rules of origin of the country of destination. Each article in a consignment must qualify separately in its own right; and,

comply with the consignment conditions specified by the country of destination. In general, products must be consigned direct from the country of exportation to the country of destination but most preferencegiving countries accept passage through intermediate countries subject to certain conditions. (For Australia, direct consignment is not necessary.)

Availability of the Form A The beneficiary countries are responsible for supplying the Form A. It is normally available at the government foreign trade office or the Chamber of Commerce of the beneficiary country.

" 8. Origin criterion (see Notes overleaf) " The entries to be made in Box 8 vary according to whether the products wholly owned or the products sufficiently worked or processed and the country of destination for such products. For export of products wholly owned to any of the listed countries of destination, enter the letter "P" in Box 8 (the 'Origin criterion' field). For Australia and New Zealand Box 8 may be left blank; it is sufficient that a declaration be properly made in Box 12 (the 'Declaration by the exporter' field). For export of products sufficiently worked or processed, the countries of destination have a different specific entry letter. For example:

shipments to the U.S.A. from recognized associations of countries such as ASEAN countries, enter the letter "Z" in Box 8 (the 'Origin

criterion' field), followed by the sum of the cost or value of the domestic materials and the direct cost of processing, expressed as a percentage of the ex-factory price of the exported products, for example "Z" 69.5% shipments to the U.S.A. from independent beneficiary countries--single country shipments---such as India, enter the letter "Y" in Box 8 (the 'Origin criterion' field), followed by the sum of the cost or value of the domestic materials and the direct cost of processing, expressed as a percentage of the ex-factory price of the exported products, for example "Y" 52%

" 11. Certification " and " 12. Declaration by the exporter " The Form A must be properly filled out and signed by the exporter. The designated certifying authority usually is the government foreign trade office or the Chamber of Commerce of the beneficiary country. The certification normally requires payment of a fee.

Sample Form: Form A (GSP Form A) Remarks: Fields or items in blue color contain links to the explanation.

Ocean (Marine) Bills of Lading Air Waybills

Inspection Certificate or Inspection Report

The inspection certificate---inspection report or report of findings---is required by some importers and/or importing countries. Please see the sample Inspection Report. The export-trader uses such a report in the inspection of goods purchased from a manufacturer. The export-manufacturer also uses such a report in the inspection of its own productions. In case an inspection certificate is required, the importer may stipulate in the letter of credit (L/C) to use a specific independent surveyor. In the case of a foreign government required pre-shipment inspection, which is stipulated in the L/C, the report of findings can be in the form of a security label attached on the invoice. The label bears the number and date of the corresponding report of findings issued by the foreign government engaged surveyor.

TOPIC

Certificate

of

Inspection

The Certificate of Inspection is a document certifying that the concerned merchandise (including perishable goods) was in good condition immediately prior to its shipment. The Certificate of Inspection is an inspection report or report of findings and is required by some importers or importing countries. The export or trader uses such a report in the inspection of goods purchased from a manufacturer. The export-manufacturer also uses such a report in the inspection of its own productions. In case a Certificate of Inspection is required, the importer may stipulate in the Letter of Credit (LC) to use a specific independent surveyor. In the case of a foreign government required pre-shipment inspection, which is stipulated in the LC, the report of findings can be in the form of a security label attached

with the invoice. The label bears the number and date of the corresponding report of findings issued by the foreign government engaged surveyor.

What is invoice? Answer #1

AR Invoice is a document raised by the sent to the customer with the details of items sold, price, tax and other details. Based on the customer will send the payment in case sales.

company and sold, qty this invoice, of credit

AP invoice is a document raised by the customer and sent to the company with the details of the items sent, qty sent, price and other details. The company will enter this invoice details in the Payables module and then pay the customer accoring to the credit terms. This invoice may come along with the consignment or may be sent to the company seperately.

An invoice or bill is a commercial document issued by a seller to the buyer, indicating the products, quantities, and agreed prices for products or services the seller has provided the buyer. An invoice indicates the buyer must pay the seller, according to the payment terms. The buyer has a maximum amount of days to pay these goods and are sometimes offered a discount if paid before. In the rental industry, an invoice must include a specific reference to the duration of the time being billed, so rather than quantity, price and discount the invoicing amount is based on quantity, price, discount and duration. Generally speaking each line of a rental invoice will refer to the actual hours, days, weeks, months, etc being billed. From the point of view of a seller, an invoice is a sales invoice. From the point of view of a buyer, an invoice is a purchase invoice. The document indicates the buyer and seller, but the term invoice indicates money is owed or owing. In English, the context of the term invoice is usually used to clarify its meaning, such as "We sent them an invoice" (they owe us money) or "We received an invoice from them" (we owe them money).

A typical invoice contains[1][2]

The word invoice (or Tax Invoice if in Australia and amounts include GST). A unique reference number (in case of correspondence about the invoice) Date of the invoice. Tax payments if relevant (e.g. GST and VAT) Name and contact details of the seller Tax or company registration details of seller (if relevant)[e.g. Australia Business Number (ABN) for Australian businesses.] Name and contact details of the buyer Date that the product was sent or delivered Purchase order number (or similar tracking numbers requested by the buyer to be mentioned on the invoice) Description of the product(s) Unit price(s) of the product(s) (if relevant) Total amount charged (optionally with breakdown of taxes, if relevant) Payment terms (including method of payment, date of payment, and details about charges for late payment)

In countries where wire transfer is the preferred method of settling debts the printed bill will contain the bank account number of the debtor and usually a reference code to be passed along the transaction identifying the payer. The US Defense Logistics Agency requires an employer identification number on invoices.[3] The European Union requires a VAT (value added tax) identification number. Recommendation about invoices used in international trade is also provided by the UNECE Committee on Trade, which involves more detailed description of logistics aspect of merchandise and therefore may be convenient for international logistics and customs procedures.[ Packing List

The packing list is an extension of the commercial invoice, as such it looks like a commercial invoice. Please see the sample Packing List below. The exporter or his/her agent---the customs broker or the freight forwarder---reserves the shipping space based on the gross weight or the measurement shown in the packing list.

Customs uses the packing list as a check-list to verify the outgoing cargo (in exporting) and the incoming cargo (in importing). The importer uses the packing list to inventory the incoming consignment. For the fields in the preamble of the packing list, please refer to the Explanations: Fields in the Preamble of the Commercial Invoice. For the purpose of explaining other fields in the packing list, it is assumed that the pneumatic tools in the sample L/C contain the following data: The catalogue or item number of the pneumatic tools is A380 Each set is in an inner box and there are two boxes in an export master carton, or a total of 50 cartons for the 100 sets Each master carton: Net Weight (N.W.) Gross Weight (G.W.) Measurement (Meas.) ..... ..... ..... 20 kgs. (44.1 lbs.) 23 kgs. (50.7 lbs.) 0.113 CBM (4 cft.) 61 cms. x 61 cms. x 30.5 cms. (2' x 2' x 1')

" Package No. " The entries preferably arranged in sequence from the lowest number to the highest, that is, from package No. 1 and up. From the sample L/C, enter "C/No. 150" or the like in the field (Package No.), provided it is not inconsistent with the marks and numbers on the master cartons.

" Item No. " and " Description of Goods " The description of the goods in the packing list can be in general terms, provided it is not inconsistent with the description in the L/C. From the sample L/C and data of the pneumatic tools above, entering "A380" and "'ABC' Brand Pneumatic Tools" in the fields will satisfy the requirements.

" Quantity " It shows the total quantity within a stated range of the package number and the breakdown in each package. The stated range is C/No. 1-50, enter: 100 Sets 2 Sets/Ctn. or 100 Sets 2 Sets @ Ctn. or the like in the field. The / and @ used here stands for per or each.

" Weight " It shows the total weight within a stated range of the package number and the weight of each package. The stated range is C/No. 1-50, enter: 1,150 Kgs. 23 Kgs./Ctn. or 1,150 Kgs. 23 Kgs. @ Ctn. or the like in the field and put a notation "Gross Weight". As far as the carrier is concerned, the gross weight or measurement of a consignment is needed to calculate the freight. In case the goods are assessed in

the importing country or exported on the net weight basis, it is necessary to show the net weight and gross weight in the packing list. The entry may appear as: N.W. 1,000 Kgs. G.W. 1,150 Kgs.

" Measurement " Ocean shipments are most often charged by the cubic meter (CBM or cbm). Enter: 5.65 CBM 0.113 CBM/Ctn. in the field (Measurement). Sometimes, it is necessary to include the size or dimensions (length-width-height) of the master package. The entry may appear as: 5.65 CBM 0.113 CBM/Ctn. @ 61 x 61 x 30.5 Cms. The @ stands for at or each. Some carriers may calculate the freight on a cubic feet (cft. or cu. ft.) basis. In the case of an irregular shaped cargo, take the three widest dimensions that describe the smallest cubic space enclosing the cargo to determine the measurement.

" signature and/or stamp " The packing list and commercial invoice need not be signed, unless otherwise stipulated in the letter of credit (L/C). In practice, the original and the copy of the packing list and commercial invoice are often signed.

Marks & Numbers Please see Shipping Marks and Numbers for detail information.

Corrections or Changes in the Packing List Any visible corrections or changes made in the packing list must be initialled, as in the commercial invoice and all other export documents, by their respective issuers. In practice, the initial usually is done using a rubber stamp bearing the word "CORRECTION".

Summary of Totals in a Consignment

Total Number of Packages For example a consignment where the range of the carton number is as follows: C/No. 1-8 C/No. 9-17 C/No. 18-23 C/No. 24-30 C/No. 31-42 C/No. 43-50 - Product A - Product B - Product C - Product D - Product E - Product F

put a summary "Total 50 Cartons" in a succeeding row after the "C/No. 43-50".

Total Quantity If a consignment consists of different units, preferably show all the units used in the summary of totals. For example, a shipment includes: - Product 100 dozen A 200 dozen - Product B 300 boxes - Product C 400 boxes - Product D as such the total shows "300 Dozen and 700 Boxes".

Total Weight and Total Measurement If the net weight and gross weight are used in the breakdown, the summary must show the total net weight and the total gross weight. If kgs., lbs., CBM and cft. are used in the breakdown, the summary must show the total of kgs., lbs., CBM and cft.. Under certain circumtances, such as in a consignment consisting of a few master cartons where each carton contains several small items of different sizes, it is necessary to show the breakdown of the quantity of each item. There is no need to show the breakdown of the weight and measurement of each carton. Simply entering the total weight and the total measurement of the consignment in the summary row would satisfy the export requirements.

Sample Document: Packing List Remarks: Fields or items in blue color contain links to the explanation.

Packing List For account and risk of Messrs.

UVW EXPORTS 88 Prosperity Street East, Suite 707 Export-City and Postal Code, ExportCountry Tel: (07) 1234-5678 Fax: (07) 1234-8888 E-mail: export@uvwexports.com.jp Commercial Invoice No. Letter of Credit No. Issuing Bank Date Date

Buyer's P.O. or Contract No. Buyer's Department / Store No. Carrier Voyage/Flight No. From (Port of Loading) Via (Tranship At) Package No. Item No.

Date

Import Permit/License No. Marks & Numbers

Date

Shipment on or about To (Port of Discharge) For Transhipment To Description of Goods Quantity Weight Measurement (Kgs./Lbs.) (CBM/Cft.)

UVW EXPORTS

(signature and/or stamp) E.&O.E.

Commercial Invoice Pro Forma Invoice Export-Import Quotations Product Inspection

You might also like

- mktg3007 - 20172 Retail Marketing and Distribution Final Exam Past Year QuestionsDocument4 pagesmktg3007 - 20172 Retail Marketing and Distribution Final Exam Past Year QuestionsKaylly Julius50% (2)

- Bill of ExchangeDocument4 pagesBill of ExchangeSara SanamNo ratings yet

- 15W-40 Engine Oil QuotationDocument2 pages15W-40 Engine Oil QuotationMarcial Jr. MilitanteNo ratings yet

- Transport Documents Used in International Trade PDFDocument5 pagesTransport Documents Used in International Trade PDFsatyaseerNo ratings yet

- Business Plan OutlineDocument4 pagesBusiness Plan OutlineGhulam HassanNo ratings yet

- Air Canada Booking Confirmation PAA4W5Document6 pagesAir Canada Booking Confirmation PAA4W5Waqar Alam KhanNo ratings yet

- Airway Bill NumberDocument10 pagesAirway Bill NumberVasant KothariNo ratings yet

- Air WaybillDocument5 pagesAir WaybillJasith Mundayat ValapilNo ratings yet

- Role of Foreign Exchange Department in Exports and ImportsDocument15 pagesRole of Foreign Exchange Department in Exports and ImportsniteshhgiriiNo ratings yet

- DocumentsDocument5 pagesDocumentsVimalanathan VimalNo ratings yet

- Export Trade Documents and Its PurposeDocument10 pagesExport Trade Documents and Its PurposeAdersh Saju ChackoNo ratings yet

- Lahore Office: 042-36610206, 36610260, 0345-3076375: "Import & Export Management"Document22 pagesLahore Office: 042-36610206, 36610260, 0345-3076375: "Import & Export Management"Muhammad Ali TurkmanNo ratings yet

- International Trade For MidtermDocument7 pagesInternational Trade For MidtermMoniruzzamanNo ratings yet

- Export DocumentationDocument8 pagesExport Documentationtranlamtuyen1911No ratings yet

- The Benefits of DocumentationDocument21 pagesThe Benefits of DocumentationFaisal HanifNo ratings yet

- Documents Usually Required For NegotiationDocument31 pagesDocuments Usually Required For NegotiationMd. Kaosar Ali 153-23-4468No ratings yet

- Trade TermsDocument17 pagesTrade Termslove_berri6303No ratings yet

- Assignment - 2 Q-2 IMDocument6 pagesAssignment - 2 Q-2 IMoishika boseNo ratings yet

- Documents of Import and Export TradeDocument22 pagesDocuments of Import and Export Tradederejefeye85No ratings yet

- International Banking: Department of MBLDocument7 pagesInternational Banking: Department of MBLnurulbibmNo ratings yet

- International Trade DocumentsDocument4 pagesInternational Trade DocumentsNazmul H. Palash100% (1)

- 09 - Negotiable Instruments ActDocument30 pages09 - Negotiable Instruments ActMani RajNo ratings yet

- ChetnaDocument20 pagesChetnaChetna VermaNo ratings yet

- Export and Import DocumentsDocument14 pagesExport and Import DocumentsGlobal Negotiator100% (2)

- Chapter 2Document25 pagesChapter 2SarahNo ratings yet

- Air Waybill (AWB) or Air Consignment Note Refers To A Receipt Issued by An InternationalDocument2 pagesAir Waybill (AWB) or Air Consignment Note Refers To A Receipt Issued by An InternationalMoinul IslamNo ratings yet

- Export ImportDocument10 pagesExport Importgopala_krishna_2No ratings yet

- Air FreightDocument2 pagesAir Freightradha krishna100% (1)

- Tenielle Appanna - The Two Important Doctrines Underlying Documentary Letters of Credit and The Fraud ExceptionDocument12 pagesTenielle Appanna - The Two Important Doctrines Underlying Documentary Letters of Credit and The Fraud ExceptionRoy BhardwajNo ratings yet

- ICL FieldDocument65 pagesICL FieldShivam DagaNo ratings yet

- International Transport DocumentDocument13 pagesInternational Transport DocumentGlobal Negotiator100% (1)

- Negotiable Instruments Paper1Document55 pagesNegotiable Instruments Paper1Anonymous iScW9lNo ratings yet

- Unit 3Document14 pagesUnit 3Guest OnlyNo ratings yet

- On Thi Cuoi Ki NVNTDocument17 pagesOn Thi Cuoi Ki NVNTandc20No ratings yet

- Chapter 4 - DocumentsDocument7 pagesChapter 4 - DocumentsMathew VargheseNo ratings yet

- 1646937227196_Foreign-Exchange-pdf (1)Document35 pages1646937227196_Foreign-Exchange-pdf (1)aurisha008No ratings yet

- Major Documents Needed in Connection With Export Transaction Documents Related To GoodsDocument5 pagesMajor Documents Needed in Connection With Export Transaction Documents Related To GoodsChåudhåry Åñeeq Žåfår Îqbål0% (1)

- Export DocsDocument13 pagesExport DocsPriya Kashyap100% (1)

- Law of Taxation AssignmnetDocument13 pagesLaw of Taxation Assignmnetsohan h m sohan h mNo ratings yet

- NIL - Interpretation and NegotiationDocument7 pagesNIL - Interpretation and NegotiationRem SerranoNo ratings yet

- NIL - Interpretation and NegotiationDocument14 pagesNIL - Interpretation and NegotiationRem SerranoNo ratings yet

- Import and Export ManualDocument103 pagesImport and Export ManualmeskendeshawNo ratings yet

- Cdocumentary Letter of Credit in Apparel IndustryDocument3 pagesCdocumentary Letter of Credit in Apparel Industrysuman_ishaNo ratings yet

- Collection GlossaryDocument51 pagesCollection GlossaryAK NgleNo ratings yet

- Business Law CDocument5 pagesBusiness Law CLiza kesiNo ratings yet

- Bankingtheorylawpracticeunitiiippt 240307181015 7e5977faDocument29 pagesBankingtheorylawpracticeunitiiippt 240307181015 7e5977fadharshan0425No ratings yet

- List of Documents Used in Garment Export ProcessDocument13 pagesList of Documents Used in Garment Export ProcessFaruk AhmedNo ratings yet

- What Is A Letter of Credit?: NegotiabilityDocument19 pagesWhat Is A Letter of Credit?: NegotiabilityYihunbelay AbebeNo ratings yet

- International Trade and FinanceDocument5 pagesInternational Trade and FinanceHamsa VahiniNo ratings yet

- Export Import DocumentationDocument159 pagesExport Import DocumentationMohak NihalaniNo ratings yet

- Negotiable InstrumentDocument7 pagesNegotiable InstrumentNathan NakibingeNo ratings yet

- Export DocumentationDocument54 pagesExport DocumentationmaninderwazirNo ratings yet

- Trade DocumentsDocument9 pagesTrade DocumentsJay KoliNo ratings yet

- Documents Used in International Trade: UNIT-1Document13 pagesDocuments Used in International Trade: UNIT-1Arjun RajputNo ratings yet

- Business Law AssignmentDocument7 pagesBusiness Law AssignmentRahul Kumar100% (1)

- LC - Common Mistakes'Document4 pagesLC - Common Mistakes'Kar WingNo ratings yet

- Bills of Exchange ProjectDocument7 pagesBills of Exchange ProjectNishaTambe100% (1)

- PN, BoE, Che and DistinguishDocument2 pagesPN, BoE, Che and DistinguishAdnan EfadNo ratings yet

- Document of Foreign TradeDocument11 pagesDocument of Foreign TradeAleena ShahNo ratings yet

- B.law Final .V Amanuel. ...... v123Document10 pagesB.law Final .V Amanuel. ...... v123kanegi5309No ratings yet

- 1.1 Identify TyDocument7 pages1.1 Identify TyTarekegn DemiseNo ratings yet

- Export ProceduresDocument10 pagesExport ProceduresGenious GeniousNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- HLL 2Document14 pagesHLL 2mugdha_567No ratings yet

- Vichy Loreal Sun Care Range Marketing PlanDocument134 pagesVichy Loreal Sun Care Range Marketing PlanShaili Desai100% (2)

- DAF HistoryDocument4 pagesDAF HistorysmeudenisaelenaNo ratings yet

- Behn Meyer vs. YangcoDocument3 pagesBehn Meyer vs. YangcoJenine QuiambaoNo ratings yet

- Final Report On LifebuoyDocument41 pagesFinal Report On LifebuoyNawaz TanvirNo ratings yet

- CadburryDocument8 pagesCadburryEunice FloresNo ratings yet

- Jumia Sales InvoiceDocument1 pageJumia Sales Invoiceisolaniyan2020No ratings yet

- Key Plan at Vasant Kunj Sports ComplexDocument24 pagesKey Plan at Vasant Kunj Sports ComplexMehboob Alam KhanNo ratings yet

- Volkswagen: Thanapat Naknouvatim Thanat Kerdmeungsamut Phanaphorn Singhara Na Ayudhaya Bei DongDocument11 pagesVolkswagen: Thanapat Naknouvatim Thanat Kerdmeungsamut Phanaphorn Singhara Na Ayudhaya Bei DongDũng NguyễnNo ratings yet

- Chapter 12 Strategy Balanced Scorecard A PDFDocument52 pagesChapter 12 Strategy Balanced Scorecard A PDFShing Ho TamNo ratings yet

- ITM Executive Education - Batch 22 - Nirdosh Case Study PDFDocument5 pagesITM Executive Education - Batch 22 - Nirdosh Case Study PDFAjay DasNo ratings yet

- VenkatDocument13 pagesVenkatGowtham ReddyNo ratings yet

- Rural Packaging StrategyDocument31 pagesRural Packaging StrategyRishi Shrivastava100% (2)

- 01 - Course Introduction and Food Packaging Functions Sept 2016Document34 pages01 - Course Introduction and Food Packaging Functions Sept 2016Hadi Yusuf FaturochmanNo ratings yet

- BSindividual Nykaa10506288Document19 pagesBSindividual Nykaa10506288Aadesh SinghNo ratings yet

- Case Study For CelineDocument3 pagesCase Study For CelineCelinedion DionisioNo ratings yet

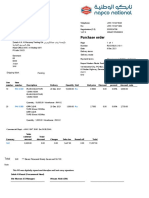

- Purchase Order: Napco Modern Plastic Products Co. - Sack DivisionDocument1 pagePurchase Order: Napco Modern Plastic Products Co. - Sack Divisionمحمد اصدNo ratings yet

- April NewsletterDocument8 pagesApril Newsletterapi-3830568No ratings yet

- Miss BYB Boot Camp Pageant EntryDocument7 pagesMiss BYB Boot Camp Pageant EntryLeah A'Lisa BrownNo ratings yet

- Sales and Distribution-Mm: Made By-Bhaibhab Nath Deepshikha Bansal Jignesh Joshi Mehak Oberoi Rashi Jain Sonal SmritiDocument22 pagesSales and Distribution-Mm: Made By-Bhaibhab Nath Deepshikha Bansal Jignesh Joshi Mehak Oberoi Rashi Jain Sonal Smritiapi-3757629No ratings yet

- A Guide To Diagnose A Business and Its ManagementDocument76 pagesA Guide To Diagnose A Business and Its ManagementSok HengNo ratings yet

- Straight Line (SL) Method: DepresiasiDocument2 pagesStraight Line (SL) Method: DepresiasiupiekupittNo ratings yet

- Finance For International BusinessDocument19 pagesFinance For International BusinessHuy NgoNo ratings yet

- Ford MondeoDocument42 pagesFord MondeoBry KaparangNo ratings yet

- Marketing Communications Exam SummaryDocument22 pagesMarketing Communications Exam SummaryAdeel Qurashi67% (3)

- 14 ConclusionDocument5 pages14 ConclusionAnurag KumarNo ratings yet