Professional Documents

Culture Documents

12 Month P L Example

12 Month P L Example

Uploaded by

Kamera RightCopyright:

Available Formats

You might also like

- Bukalapak-Com Bilingual 31 Des 2017 ReleasedDocument59 pagesBukalapak-Com Bilingual 31 Des 2017 ReleasedjohnNo ratings yet

- KTM X-Bow Wiring PlanDocument65 pagesKTM X-Bow Wiring PlanSverker OttossonNo ratings yet

- Informecial App Analysis Question Test - AnsweredDocument4 pagesInformecial App Analysis Question Test - AnsweredMichael SatrioNo ratings yet

- No. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomDocument7 pagesNo. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomKimberlyNo ratings yet

- Profit and Loss Projection 1yr March 2018Document4 pagesProfit and Loss Projection 1yr March 2018Sebastian KiambaNo ratings yet

- Profit and Loss Projection 1yr March 2018Document1 pageProfit and Loss Projection 1yr March 2018Aqsa SajjadNo ratings yet

- Profit and Loss Projection 1yr 0Document1 pageProfit and Loss Projection 1yr 0Euros consultoriaNo ratings yet

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrhowieg43100% (2)

- Jsa Loding Material LongsoranDocument3 pagesJsa Loding Material LongsoranWin PutraNo ratings yet

- You Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDocument1 pageYou Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDAVIDLUNA8No ratings yet

- C O V Id - 1 9 C U Rren Tin Cid en Cer Ate in K en Tu CK Y: D Ateofr Eport: 1/3/2022 (4:28 PM)Document1 pageC O V Id - 1 9 C U Rren Tin Cid en Cer Ate in K en Tu CK Y: D Ateofr Eport: 1/3/2022 (4:28 PM)Debbie HarbsmeierNo ratings yet

- Inline ConveyorDocument1 pageInline ConveyorBarlian WidaryantoNo ratings yet

- 218014-G101RA - General Arrangement Plan - 109157410Document2 pages218014-G101RA - General Arrangement Plan - 109157410Them Bui XuanNo ratings yet

- JulyDocument3 pagesJulyneelshah23novNo ratings yet

- A B C D A B C D B B: Second Floor Plan Ground Floor PlanDocument1 pageA B C D A B C D B B: Second Floor Plan Ground Floor PlanIremedio, Nicole Allen S.No ratings yet

- Tangent Amp-50-Service-ManualDocument4 pagesTangent Amp-50-Service-ManualRaika ZamboniniNo ratings yet

- Incidence Map 01272022Document1 pageIncidence Map 01272022Debbie HarbsmeierNo ratings yet

- Incidence Map 01182022Document1 pageIncidence Map 01182022Debbie HarbsmeierNo ratings yet

- ITEM-9: Document StatusDocument1 pageITEM-9: Document StatusNitinNo ratings yet

- Incidence Map 01112022Document1 pageIncidence Map 01112022Debbie HarbsmeierNo ratings yet

- ART 400A, Page 1: ©2001 Mackie Designs Inc. All Rights Reserved ART Series Service Manual ART 400A CrossoverDocument7 pagesART 400A, Page 1: ©2001 Mackie Designs Inc. All Rights Reserved ART Series Service Manual ART 400A CrossoverrzvNo ratings yet

- Bhu Ba LLBDocument21 pagesBhu Ba LLBADITYA ABHISHEKNo ratings yet

- 600 Watt Power Amplifier PCB Schematics (821SCH - B)Document1 page600 Watt Power Amplifier PCB Schematics (821SCH - B)osman saraçNo ratings yet

- Content Mayank PDFDocument4 pagesContent Mayank PDFABC 123No ratings yet

- Red Zone Map: Nov. 1, 2021Document1 pageRed Zone Map: Nov. 1, 2021Bryce ShreveNo ratings yet

- Chemical Formulae and Equations Online Class NotesDocument2 pagesChemical Formulae and Equations Online Class Notesanas.asif2008No ratings yet

- Flying King Air ReprintDocument9 pagesFlying King Air ReprintVinicius AckermannNo ratings yet

- FFR vs. iFR vs. RFR vs. QFR: T. SantosoDocument30 pagesFFR vs. iFR vs. RFR vs. QFR: T. SantosoJosé Raúl Cascante AlpízarNo ratings yet

- Kentucky Red Zone COVID Transmission MapDocument1 pageKentucky Red Zone COVID Transmission MapBryce ShreveNo ratings yet

- Electrical Conduit Supports 01Document1 pageElectrical Conduit Supports 01Manoj JaiswalNo ratings yet

- Wiring Diagram Amal SR 30Document19 pagesWiring Diagram Amal SR 30aone satuNo ratings yet

- Gargallo Dibujos-IIDocument318 pagesGargallo Dibujos-IIMarisa Carreras AbeniaNo ratings yet

- BELT DRIVE 25 Jan 2024Document1 pageBELT DRIVE 25 Jan 2024bimaditya281No ratings yet

- Entertainment SysDocument1 pageEntertainment SysmisterminitcastleNo ratings yet

- BE6502 ClockDocument1 pageBE6502 ClockChandrasen Singh100% (2)

- Christian Ingo Lenz Dunker - Por Que Lacan - Coleção Grandes Psicanalistas-Zagodoni (2016) (Z-Lib - Io) - GiradoDocument135 pagesChristian Ingo Lenz Dunker - Por Que Lacan - Coleção Grandes Psicanalistas-Zagodoni (2016) (Z-Lib - Io) - GiradoresgatepraticoNo ratings yet

- Paper CuttingDocument1 pagePaper CuttingYogesh SonawaneNo ratings yet

- Incidence Map 01242022Document1 pageIncidence Map 01242022Debbie HarbsmeierNo ratings yet

- 13/01/2018 Goman Mihaila S. - : Designed By: DateDocument1 page13/01/2018 Goman Mihaila S. - : Designed By: DateSilviu ProdanNo ratings yet

- JD May 2018 KR Webpage 096b0dDocument32 pagesJD May 2018 KR Webpage 096b0dArun RaghavanNo ratings yet

- 61 651 B 23189 PDFDocument1 page61 651 B 23189 PDFfostbarrNo ratings yet

- 0BZ Bosa Britalia 10Document1 page0BZ Bosa Britalia 10genesisbarrockNo ratings yet

- Od-402 EsqDocument16 pagesOd-402 EsqEduardo AlvarezNo ratings yet

- Bv-Dao TienDocument1 pageBv-Dao TienTùng PhạmNo ratings yet

- Wholeearthcatalo00unse 8Document68 pagesWholeearthcatalo00unse 8Vincent WangNo ratings yet

- Mid STA.2+342.91Document1 pageMid STA.2+342.91Julian SandovalNo ratings yet

- Rfi PKG-1 06.07.2021Document1 pageRfi PKG-1 06.07.2021Ayan DuttaNo ratings yet

- Ba01001fen 2017 PDFDocument1 pageBa01001fen 2017 PDFVictor RojasNo ratings yet

- Mem TaconesDocument2 pagesMem Taconesmiller.castaneda.18No ratings yet

- Estate Planning HandbookDocument212 pagesEstate Planning Handbookjr7mondo7edoNo ratings yet

- Mackie Art500a SCHDocument7 pagesMackie Art500a SCHManuel TelloNo ratings yet

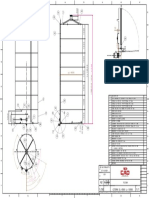

- CITERN Di 4500 LV 10500Document1 pageCITERN Di 4500 LV 10500mohamedNo ratings yet

- Atcpl - Ref - Wiring & Gadrawing - NN Traders - High Mast PanelDocument5 pagesAtcpl - Ref - Wiring & Gadrawing - NN Traders - High Mast PanelNawfel ArafathNo ratings yet

- RUS-04 RGB UltrasonicObstacleAvoidanceModuleDocument1 pageRUS-04 RGB UltrasonicObstacleAvoidanceModulelamine mhamedNo ratings yet

- EXHOSTODocument1 pageEXHOSTOasly españaNo ratings yet

- Img20210615 11124216Document72 pagesImg20210615 11124216Roxana Natali Ramirez MendozaNo ratings yet

- John Dee - Sigillum Dei Aemeth or Seal of The Truth of God English Version cd3 Id1753883643 Size175 PDFDocument2 pagesJohn Dee - Sigillum Dei Aemeth or Seal of The Truth of God English Version cd3 Id1753883643 Size175 PDFAnca MacaveiNo ratings yet

- Schéma Électrique 640 SGXDocument2 pagesSchéma Électrique 640 SGXEric SANCHEZNo ratings yet

- Draft SurveyDocument37 pagesDraft SurveyMehmet ArıkNo ratings yet

- NAMBURU PROP-ModelDocument1 pageNAMBURU PROP-ModelSreenivas KazaNo ratings yet

- Obnovi 10Document1 pageObnovi 10Edina ČirićNo ratings yet

- The Rough Guide to Beijing (Travel Guide eBook)From EverandThe Rough Guide to Beijing (Travel Guide eBook)Rating: 2 out of 5 stars2/5 (1)

- GEND3032 Outline24Document13 pagesGEND3032 Outline24Kamera RightNo ratings yet

- 4 GROUP 3 Reality of Trade - The WTO and DevelopingDocument11 pages4 GROUP 3 Reality of Trade - The WTO and DevelopingKamera RightNo ratings yet

- Govt2049 Tutorial Worksheet 2023 2024 FinDocument4 pagesGovt2049 Tutorial Worksheet 2023 2024 FinKamera RightNo ratings yet

- Kuratko 9 e CH 04Document33 pagesKuratko 9 e CH 04lobna_qassem7176No ratings yet

- 2023-2024 MoC Course OutlineDocument10 pages2023-2024 MoC Course OutlineKamera RightNo ratings yet

- Kuratko 9 e CH 06Document23 pagesKuratko 9 e CH 06Kamera RightNo ratings yet

- Direct and Indirect Object PronounsDocument2 pagesDirect and Indirect Object PronounsKamera RightNo ratings yet

- 2022 PHC Additional Information Form: Interview TranscriptDocument5 pages2022 PHC Additional Information Form: Interview TranscriptKamera RightNo ratings yet

- Coard - Unit 2 Workbook Becoming BilingualDocument22 pagesCoard - Unit 2 Workbook Becoming BilingualKamera RightNo ratings yet

- Protectionism and Trade A Country's Glory or Doom OriginalDocument10 pagesProtectionism and Trade A Country's Glory or Doom OriginalKamera RightNo ratings yet

- Govt 2048 Tutorial Sheet 2022Document8 pagesGovt 2048 Tutorial Sheet 2022Kamera RightNo ratings yet

- SEWING INSTRUCTIONS - Hela Cloth Menstrual Pads - Hela Cloth Pantyliners - Kulmine - ENDocument8 pagesSEWING INSTRUCTIONS - Hela Cloth Menstrual Pads - Hela Cloth Pantyliners - Kulmine - ENKamera RightNo ratings yet

- Breakeven - Analysis ExampleDocument1 pageBreakeven - Analysis ExampleKamera RightNo ratings yet

- 7 Jurisdictional Immunities - 2020-2021Document32 pages7 Jurisdictional Immunities - 2020-2021Kamera RightNo ratings yet

- Business Model Development WorksheetDocument16 pagesBusiness Model Development WorksheetKamera RightNo ratings yet

- Business ProposalDocument25 pagesBusiness ProposalKamera RightNo ratings yet

- BSC International Relations Major Checklist 2021-2022 0Document1 pageBSC International Relations Major Checklist 2021-2022 0Kamera RightNo ratings yet

- Racial Profiling and The War On Terror - Changing Trends and PerspDocument25 pagesRacial Profiling and The War On Terror - Changing Trends and PerspKamera RightNo ratings yet

- Comparative AnalysisDocument9 pagesComparative AnalysisKamera RightNo ratings yet

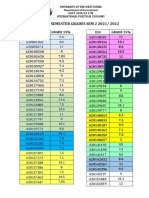

- Govt 2049 Mid Semester Grades 2022Document1 pageGovt 2049 Mid Semester Grades 2022Kamera RightNo ratings yet

- ABJam17-v18 0 3 2-Eng-170213 - WDocument41 pagesABJam17-v18 0 3 2-Eng-170213 - WKamera RightNo ratings yet

- Islam Is The New Black - Muslim Perceptions of Law EnforcementDocument11 pagesIslam Is The New Black - Muslim Perceptions of Law EnforcementKamera RightNo ratings yet

- 12 Professional House Cleaning Checklists JobberDocument5 pages12 Professional House Cleaning Checklists JobberKamera Right100% (2)

- Prob Set 1Document6 pagesProb Set 1Nikki BulanteNo ratings yet

- Answers Partnership ExercisesDocument15 pagesAnswers Partnership ExercisesAldrin ZolinaNo ratings yet

- Financial Statement Elements of Hotel DepartmentDocument4 pagesFinancial Statement Elements of Hotel DepartmentsarasatiwanamiNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument5 pagesModule 3 Chapter 15 DCF ModelAvinash GanesanNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- Tutorial 4 QuestionsDocument3 pagesTutorial 4 QuestionshrfjbjrfrfNo ratings yet

- 11th Accountancy EM 1st Mid Term Exam 2023 Model Question Paper English Medium PDF DownloadDocument4 pages11th Accountancy EM 1st Mid Term Exam 2023 Model Question Paper English Medium PDF Downloadsivachandirang6954No ratings yet

- Accounting Chapter 2Document4 pagesAccounting Chapter 2Ebony Ann delos SantosNo ratings yet

- AKM Annualreport18Document24 pagesAKM Annualreport18The Music TribeNo ratings yet

- B2Gold Corp. - TNM Marco PoloDocument4 pagesB2Gold Corp. - TNM Marco PoloBassirouNo ratings yet

- Cash Flow StatementDocument12 pagesCash Flow StatementChikwason Sarcozy MwanzaNo ratings yet

- Comprehensive Accounting Cycle Problem PDFDocument11 pagesComprehensive Accounting Cycle Problem PDFDin Rose Gonzales100% (1)

- DCF-Model - TemplateDocument5 pagesDCF-Model - TemplatebysqqqdxNo ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- ACCA F9 Financial Management Class NotesDocument185 pagesACCA F9 Financial Management Class NotesIt'z Pragmatic IbrahimNo ratings yet

- The Impact of Financial Leverage To Profitability Study of Vehicle Companies From PakistanDocument21 pagesThe Impact of Financial Leverage To Profitability Study of Vehicle Companies From PakistanAhmad Ali100% (1)

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- FAC1502 Study Unit 6 2021Document22 pagesFAC1502 Study Unit 6 2021edsonNo ratings yet

- Ar 2008 FinacialoverviewDocument78 pagesAr 2008 FinacialoverviewRiaz TreynoldsNo ratings yet

- Acct 505 - Course Project ADocument3 pagesAcct 505 - Course Project AShay Kay SamNo ratings yet

- T1 Exercises QuestDocument4 pagesT1 Exercises QuestXin XiuNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Exploration Assets and Depletion: TheoryDocument2 pagesExploration Assets and Depletion: TheoryNooroddenNo ratings yet

- F Capital Structure On Tesco PLC and Sainbury S PerformanceDocument13 pagesF Capital Structure On Tesco PLC and Sainbury S PerformanceFESTUS EFOSA EFOSANo ratings yet

- Financial ModelingDocument12 pagesFinancial ModelingHetviNo ratings yet

- Course-Outline A101ADocument1 pageCourse-Outline A101AGerald Niño ElardoNo ratings yet

- CFA Research Challenge Regional Final 2017 Dhaka - Team Fourth EchelonDocument24 pagesCFA Research Challenge Regional Final 2017 Dhaka - Team Fourth EchelonTarek MusannaNo ratings yet

- Ratio Analysis: Submitted To Shruti MamDocument48 pagesRatio Analysis: Submitted To Shruti MamMD Gulshan100% (1)

12 Month P L Example

12 Month P L Example

Uploaded by

Kamera RightOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Month P L Example

12 Month P L Example

Uploaded by

Kamera RightCopyright:

Available Formats

Profit and Loss Projection (12 Months)

Enter your Company Name here

Fiscal Year Begins

Jan-18

Y

8

RL

8

8

-18

8

8

8

8

18

8

y-1

g-1

v -1

c -1

n-1

b -1

r-1

n-1

r -1

l -1

A

t-

p

Ma

Ma

Ap

Au

No

YE

Oc

De

Se

Fe

Ju

Ju

Ja

Revenue (Sales)

Category 1 0 Notes on Preparation

Category 2 0

Category 3 300,000 ### You may want to print this information to use as reference later. To dele

Category 4 200,000 ### this text box and then press the DELETE key.

Category 5 0

Category 6 0 You should change "category 1, category 2", etc. labels to the actual names o

Category 7 0 category for each month. The spreadsheet will add up total annual sales.

Total Revenue (Sales) 500,000 0 0 0 0 0 0 0 0 0 0 0 ###

COST OF GOODS SOLD (also called Cost of Sales or COGS): COGS are th

Cost of Sales buying your products or services. For example, purchases of inventory or raw

Category 1 0 taxes) of employees directly involved in producing your products/services, are

Category 2 0 go up and down along with the volume of production or sales. Study your rec

Category 3 20,000 ### category. Control of COGS is the key to profitability for most businesses, so a

Category 4 30,000 ### care. For each category of product/service, analyze the elements of COGS: h

Category 5 0 for shipping, for sales commissions, etc.? Compare the Cost of Goods Sold a

Category 6 0 categories. Which are most profitable, and which are least - and why? Undere

Category 7 0 which can destroy your ability to earn a profit. Research carefully and be real

Total Cost of Sales 50,000 0 0 0 0 0 0 0 0 0 0 0 ### sales for each month. In the "%" columns, the spreadsheet will show the COG

Gross Profit 450,000 0 0 0 0 0 0 0 0 0 0 0 ### GROSS PROFIT: Gross Profit is Total Sales minus Total COGS.

OPERATING EXPENSES (also called Overhead): These are necessary expe

Expenses

to making or buying your products/services. Rent, utilities, telephone, interest

Salary expenses 0

and management employees are examples. Change the names of the Expen

Payroll expenses 0

your accounting system. You may need to combine some categories, howev

Outside services 0

spreadsheet. Most operating expenses remain reasonably fixed regardless o

Supplies (office and commissions, may vary with sales. Some, like utilities, may vary with the time

operating) 0 fluctuations. The only rule is that the projections should simulate your financia

Repairs and

maintenance 0 NET PROFIT: The spreadsheet will subtract Total Operating Expenses from G

Advertising 0

Car, delivery and travel 0 INDUSTRY AVERAGES: Industry average data is commonly available from in

Accounting and legal 0 are suppliers to your industry, and local colleges, Chambers of Commerce, an

Rent & Related Costs 0 book Statement Studies published annually by Robert Morris Associates. It ca

Telephone 0 almost surely has a copy. It is unlikely that your expenses will be exactly in lin

Utilities 0 helpful in areas in which expenses may be out of line.

Insurance 0

Taxes (real estate, etc.) 0

Interest 0

Depreciation 0

Other expenses (specify) 0

Other expenses (specify) 0

Other expenses (specify) 0

Misc. (unspecified) 0

Sub-total Expenses 0 0 0 0 0 0 0 0 0 0 0 0 0

Reserve for

Contingencies 0 0 0 0 0 0 0 0 0 0 0 0 0

Total Expenses 0 0 0 0 0 0 0 0 0 0 0 0 0

Net Profit Before Taxes 450,000 0 0 0 0 0 0 0 0 0 0 0 ###

Federal Income Taxes

State Income Taxes

Local Income Taxes

Net Operating Income 450,000 0 0 0 0 0 0 0 0 0 0 0 ###

You might also like

- Bukalapak-Com Bilingual 31 Des 2017 ReleasedDocument59 pagesBukalapak-Com Bilingual 31 Des 2017 ReleasedjohnNo ratings yet

- KTM X-Bow Wiring PlanDocument65 pagesKTM X-Bow Wiring PlanSverker OttossonNo ratings yet

- Informecial App Analysis Question Test - AnsweredDocument4 pagesInformecial App Analysis Question Test - AnsweredMichael SatrioNo ratings yet

- No. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomDocument7 pagesNo. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomKimberlyNo ratings yet

- Profit and Loss Projection 1yr March 2018Document4 pagesProfit and Loss Projection 1yr March 2018Sebastian KiambaNo ratings yet

- Profit and Loss Projection 1yr March 2018Document1 pageProfit and Loss Projection 1yr March 2018Aqsa SajjadNo ratings yet

- Profit and Loss Projection 1yr 0Document1 pageProfit and Loss Projection 1yr 0Euros consultoriaNo ratings yet

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrhowieg43100% (2)

- Jsa Loding Material LongsoranDocument3 pagesJsa Loding Material LongsoranWin PutraNo ratings yet

- You Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDocument1 pageYou Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDAVIDLUNA8No ratings yet

- C O V Id - 1 9 C U Rren Tin Cid en Cer Ate in K en Tu CK Y: D Ateofr Eport: 1/3/2022 (4:28 PM)Document1 pageC O V Id - 1 9 C U Rren Tin Cid en Cer Ate in K en Tu CK Y: D Ateofr Eport: 1/3/2022 (4:28 PM)Debbie HarbsmeierNo ratings yet

- Inline ConveyorDocument1 pageInline ConveyorBarlian WidaryantoNo ratings yet

- 218014-G101RA - General Arrangement Plan - 109157410Document2 pages218014-G101RA - General Arrangement Plan - 109157410Them Bui XuanNo ratings yet

- JulyDocument3 pagesJulyneelshah23novNo ratings yet

- A B C D A B C D B B: Second Floor Plan Ground Floor PlanDocument1 pageA B C D A B C D B B: Second Floor Plan Ground Floor PlanIremedio, Nicole Allen S.No ratings yet

- Tangent Amp-50-Service-ManualDocument4 pagesTangent Amp-50-Service-ManualRaika ZamboniniNo ratings yet

- Incidence Map 01272022Document1 pageIncidence Map 01272022Debbie HarbsmeierNo ratings yet

- Incidence Map 01182022Document1 pageIncidence Map 01182022Debbie HarbsmeierNo ratings yet

- ITEM-9: Document StatusDocument1 pageITEM-9: Document StatusNitinNo ratings yet

- Incidence Map 01112022Document1 pageIncidence Map 01112022Debbie HarbsmeierNo ratings yet

- ART 400A, Page 1: ©2001 Mackie Designs Inc. All Rights Reserved ART Series Service Manual ART 400A CrossoverDocument7 pagesART 400A, Page 1: ©2001 Mackie Designs Inc. All Rights Reserved ART Series Service Manual ART 400A CrossoverrzvNo ratings yet

- Bhu Ba LLBDocument21 pagesBhu Ba LLBADITYA ABHISHEKNo ratings yet

- 600 Watt Power Amplifier PCB Schematics (821SCH - B)Document1 page600 Watt Power Amplifier PCB Schematics (821SCH - B)osman saraçNo ratings yet

- Content Mayank PDFDocument4 pagesContent Mayank PDFABC 123No ratings yet

- Red Zone Map: Nov. 1, 2021Document1 pageRed Zone Map: Nov. 1, 2021Bryce ShreveNo ratings yet

- Chemical Formulae and Equations Online Class NotesDocument2 pagesChemical Formulae and Equations Online Class Notesanas.asif2008No ratings yet

- Flying King Air ReprintDocument9 pagesFlying King Air ReprintVinicius AckermannNo ratings yet

- FFR vs. iFR vs. RFR vs. QFR: T. SantosoDocument30 pagesFFR vs. iFR vs. RFR vs. QFR: T. SantosoJosé Raúl Cascante AlpízarNo ratings yet

- Kentucky Red Zone COVID Transmission MapDocument1 pageKentucky Red Zone COVID Transmission MapBryce ShreveNo ratings yet

- Electrical Conduit Supports 01Document1 pageElectrical Conduit Supports 01Manoj JaiswalNo ratings yet

- Wiring Diagram Amal SR 30Document19 pagesWiring Diagram Amal SR 30aone satuNo ratings yet

- Gargallo Dibujos-IIDocument318 pagesGargallo Dibujos-IIMarisa Carreras AbeniaNo ratings yet

- BELT DRIVE 25 Jan 2024Document1 pageBELT DRIVE 25 Jan 2024bimaditya281No ratings yet

- Entertainment SysDocument1 pageEntertainment SysmisterminitcastleNo ratings yet

- BE6502 ClockDocument1 pageBE6502 ClockChandrasen Singh100% (2)

- Christian Ingo Lenz Dunker - Por Que Lacan - Coleção Grandes Psicanalistas-Zagodoni (2016) (Z-Lib - Io) - GiradoDocument135 pagesChristian Ingo Lenz Dunker - Por Que Lacan - Coleção Grandes Psicanalistas-Zagodoni (2016) (Z-Lib - Io) - GiradoresgatepraticoNo ratings yet

- Paper CuttingDocument1 pagePaper CuttingYogesh SonawaneNo ratings yet

- Incidence Map 01242022Document1 pageIncidence Map 01242022Debbie HarbsmeierNo ratings yet

- 13/01/2018 Goman Mihaila S. - : Designed By: DateDocument1 page13/01/2018 Goman Mihaila S. - : Designed By: DateSilviu ProdanNo ratings yet

- JD May 2018 KR Webpage 096b0dDocument32 pagesJD May 2018 KR Webpage 096b0dArun RaghavanNo ratings yet

- 61 651 B 23189 PDFDocument1 page61 651 B 23189 PDFfostbarrNo ratings yet

- 0BZ Bosa Britalia 10Document1 page0BZ Bosa Britalia 10genesisbarrockNo ratings yet

- Od-402 EsqDocument16 pagesOd-402 EsqEduardo AlvarezNo ratings yet

- Bv-Dao TienDocument1 pageBv-Dao TienTùng PhạmNo ratings yet

- Wholeearthcatalo00unse 8Document68 pagesWholeearthcatalo00unse 8Vincent WangNo ratings yet

- Mid STA.2+342.91Document1 pageMid STA.2+342.91Julian SandovalNo ratings yet

- Rfi PKG-1 06.07.2021Document1 pageRfi PKG-1 06.07.2021Ayan DuttaNo ratings yet

- Ba01001fen 2017 PDFDocument1 pageBa01001fen 2017 PDFVictor RojasNo ratings yet

- Mem TaconesDocument2 pagesMem Taconesmiller.castaneda.18No ratings yet

- Estate Planning HandbookDocument212 pagesEstate Planning Handbookjr7mondo7edoNo ratings yet

- Mackie Art500a SCHDocument7 pagesMackie Art500a SCHManuel TelloNo ratings yet

- CITERN Di 4500 LV 10500Document1 pageCITERN Di 4500 LV 10500mohamedNo ratings yet

- Atcpl - Ref - Wiring & Gadrawing - NN Traders - High Mast PanelDocument5 pagesAtcpl - Ref - Wiring & Gadrawing - NN Traders - High Mast PanelNawfel ArafathNo ratings yet

- RUS-04 RGB UltrasonicObstacleAvoidanceModuleDocument1 pageRUS-04 RGB UltrasonicObstacleAvoidanceModulelamine mhamedNo ratings yet

- EXHOSTODocument1 pageEXHOSTOasly españaNo ratings yet

- Img20210615 11124216Document72 pagesImg20210615 11124216Roxana Natali Ramirez MendozaNo ratings yet

- John Dee - Sigillum Dei Aemeth or Seal of The Truth of God English Version cd3 Id1753883643 Size175 PDFDocument2 pagesJohn Dee - Sigillum Dei Aemeth or Seal of The Truth of God English Version cd3 Id1753883643 Size175 PDFAnca MacaveiNo ratings yet

- Schéma Électrique 640 SGXDocument2 pagesSchéma Électrique 640 SGXEric SANCHEZNo ratings yet

- Draft SurveyDocument37 pagesDraft SurveyMehmet ArıkNo ratings yet

- NAMBURU PROP-ModelDocument1 pageNAMBURU PROP-ModelSreenivas KazaNo ratings yet

- Obnovi 10Document1 pageObnovi 10Edina ČirićNo ratings yet

- The Rough Guide to Beijing (Travel Guide eBook)From EverandThe Rough Guide to Beijing (Travel Guide eBook)Rating: 2 out of 5 stars2/5 (1)

- GEND3032 Outline24Document13 pagesGEND3032 Outline24Kamera RightNo ratings yet

- 4 GROUP 3 Reality of Trade - The WTO and DevelopingDocument11 pages4 GROUP 3 Reality of Trade - The WTO and DevelopingKamera RightNo ratings yet

- Govt2049 Tutorial Worksheet 2023 2024 FinDocument4 pagesGovt2049 Tutorial Worksheet 2023 2024 FinKamera RightNo ratings yet

- Kuratko 9 e CH 04Document33 pagesKuratko 9 e CH 04lobna_qassem7176No ratings yet

- 2023-2024 MoC Course OutlineDocument10 pages2023-2024 MoC Course OutlineKamera RightNo ratings yet

- Kuratko 9 e CH 06Document23 pagesKuratko 9 e CH 06Kamera RightNo ratings yet

- Direct and Indirect Object PronounsDocument2 pagesDirect and Indirect Object PronounsKamera RightNo ratings yet

- 2022 PHC Additional Information Form: Interview TranscriptDocument5 pages2022 PHC Additional Information Form: Interview TranscriptKamera RightNo ratings yet

- Coard - Unit 2 Workbook Becoming BilingualDocument22 pagesCoard - Unit 2 Workbook Becoming BilingualKamera RightNo ratings yet

- Protectionism and Trade A Country's Glory or Doom OriginalDocument10 pagesProtectionism and Trade A Country's Glory or Doom OriginalKamera RightNo ratings yet

- Govt 2048 Tutorial Sheet 2022Document8 pagesGovt 2048 Tutorial Sheet 2022Kamera RightNo ratings yet

- SEWING INSTRUCTIONS - Hela Cloth Menstrual Pads - Hela Cloth Pantyliners - Kulmine - ENDocument8 pagesSEWING INSTRUCTIONS - Hela Cloth Menstrual Pads - Hela Cloth Pantyliners - Kulmine - ENKamera RightNo ratings yet

- Breakeven - Analysis ExampleDocument1 pageBreakeven - Analysis ExampleKamera RightNo ratings yet

- 7 Jurisdictional Immunities - 2020-2021Document32 pages7 Jurisdictional Immunities - 2020-2021Kamera RightNo ratings yet

- Business Model Development WorksheetDocument16 pagesBusiness Model Development WorksheetKamera RightNo ratings yet

- Business ProposalDocument25 pagesBusiness ProposalKamera RightNo ratings yet

- BSC International Relations Major Checklist 2021-2022 0Document1 pageBSC International Relations Major Checklist 2021-2022 0Kamera RightNo ratings yet

- Racial Profiling and The War On Terror - Changing Trends and PerspDocument25 pagesRacial Profiling and The War On Terror - Changing Trends and PerspKamera RightNo ratings yet

- Comparative AnalysisDocument9 pagesComparative AnalysisKamera RightNo ratings yet

- Govt 2049 Mid Semester Grades 2022Document1 pageGovt 2049 Mid Semester Grades 2022Kamera RightNo ratings yet

- ABJam17-v18 0 3 2-Eng-170213 - WDocument41 pagesABJam17-v18 0 3 2-Eng-170213 - WKamera RightNo ratings yet

- Islam Is The New Black - Muslim Perceptions of Law EnforcementDocument11 pagesIslam Is The New Black - Muslim Perceptions of Law EnforcementKamera RightNo ratings yet

- 12 Professional House Cleaning Checklists JobberDocument5 pages12 Professional House Cleaning Checklists JobberKamera Right100% (2)

- Prob Set 1Document6 pagesProb Set 1Nikki BulanteNo ratings yet

- Answers Partnership ExercisesDocument15 pagesAnswers Partnership ExercisesAldrin ZolinaNo ratings yet

- Financial Statement Elements of Hotel DepartmentDocument4 pagesFinancial Statement Elements of Hotel DepartmentsarasatiwanamiNo ratings yet

- Module 3 Chapter 15 DCF ModelDocument5 pagesModule 3 Chapter 15 DCF ModelAvinash GanesanNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- Tutorial 4 QuestionsDocument3 pagesTutorial 4 QuestionshrfjbjrfrfNo ratings yet

- 11th Accountancy EM 1st Mid Term Exam 2023 Model Question Paper English Medium PDF DownloadDocument4 pages11th Accountancy EM 1st Mid Term Exam 2023 Model Question Paper English Medium PDF Downloadsivachandirang6954No ratings yet

- Accounting Chapter 2Document4 pagesAccounting Chapter 2Ebony Ann delos SantosNo ratings yet

- AKM Annualreport18Document24 pagesAKM Annualreport18The Music TribeNo ratings yet

- B2Gold Corp. - TNM Marco PoloDocument4 pagesB2Gold Corp. - TNM Marco PoloBassirouNo ratings yet

- Cash Flow StatementDocument12 pagesCash Flow StatementChikwason Sarcozy MwanzaNo ratings yet

- Comprehensive Accounting Cycle Problem PDFDocument11 pagesComprehensive Accounting Cycle Problem PDFDin Rose Gonzales100% (1)

- DCF-Model - TemplateDocument5 pagesDCF-Model - TemplatebysqqqdxNo ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- ACCA F9 Financial Management Class NotesDocument185 pagesACCA F9 Financial Management Class NotesIt'z Pragmatic IbrahimNo ratings yet

- The Impact of Financial Leverage To Profitability Study of Vehicle Companies From PakistanDocument21 pagesThe Impact of Financial Leverage To Profitability Study of Vehicle Companies From PakistanAhmad Ali100% (1)

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- FAC1502 Study Unit 6 2021Document22 pagesFAC1502 Study Unit 6 2021edsonNo ratings yet

- Ar 2008 FinacialoverviewDocument78 pagesAr 2008 FinacialoverviewRiaz TreynoldsNo ratings yet

- Acct 505 - Course Project ADocument3 pagesAcct 505 - Course Project AShay Kay SamNo ratings yet

- T1 Exercises QuestDocument4 pagesT1 Exercises QuestXin XiuNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Exploration Assets and Depletion: TheoryDocument2 pagesExploration Assets and Depletion: TheoryNooroddenNo ratings yet

- F Capital Structure On Tesco PLC and Sainbury S PerformanceDocument13 pagesF Capital Structure On Tesco PLC and Sainbury S PerformanceFESTUS EFOSA EFOSANo ratings yet

- Financial ModelingDocument12 pagesFinancial ModelingHetviNo ratings yet

- Course-Outline A101ADocument1 pageCourse-Outline A101AGerald Niño ElardoNo ratings yet

- CFA Research Challenge Regional Final 2017 Dhaka - Team Fourth EchelonDocument24 pagesCFA Research Challenge Regional Final 2017 Dhaka - Team Fourth EchelonTarek MusannaNo ratings yet

- Ratio Analysis: Submitted To Shruti MamDocument48 pagesRatio Analysis: Submitted To Shruti MamMD Gulshan100% (1)