Professional Documents

Culture Documents

Cash Declaration

Cash Declaration

Uploaded by

Willem DienaarCopyright:

Available Formats

You might also like

- Fabm2: Quarter 1 Week 5 Module 5Document18 pagesFabm2: Quarter 1 Week 5 Module 5Jose John Vocal89% (19)

- Form Eu1: Application For A Residence CardDocument8 pagesForm Eu1: Application For A Residence CardasilvaronaldoNo ratings yet

- AkkiDocument18 pagesAkkiJoe Dedsinfo100% (1)

- Mod 3040Document2 pagesMod 3040luisNo ratings yet

- Declaration Form enDocument3 pagesDeclaration Form enHet Hongarije NieuwsbladNo ratings yet

- Z894 GEPF Estate LateDocument1 pageZ894 GEPF Estate LatelienalexidelangeNo ratings yet

- 3 Self Declaration Form All International Passengers Arriving Into India 6Document1 page3 Self Declaration Form All International Passengers Arriving Into India 6Ankit SharmaNo ratings yet

- DT-1001 Ind RegDocument4 pagesDT-1001 Ind RegMugabi EltonbenNo ratings yet

- Requirements For UK Tourist VisaDocument3 pagesRequirements For UK Tourist VisaAnonymous ku7POqvKNo ratings yet

- Application For A UK Discharge Book and / or A British Seaman's CardDocument11 pagesApplication For A UK Discharge Book and / or A British Seaman's CardFBNo ratings yet

- Form Visa Maritime - UKDocument10 pagesForm Visa Maritime - UKBudi ProNo ratings yet

- BIR Form No. 1948finalDocument1 pageBIR Form No. 1948finaldave torredaNo ratings yet

- Commoditites Account Opening FormDocument22 pagesCommoditites Account Opening Formabdulrehman akhtarNo ratings yet

- Cross Border Movement Physical Currency 4657566Document2 pagesCross Border Movement Physical Currency 4657566lunwenNo ratings yet

- TirCarnet TemplateDocument13 pagesTirCarnet TemplategavgabiNo ratings yet

- Form C DennyDocument2 pagesForm C DennybambangNo ratings yet

- Application For Shipping Guarantee (SG) / Endorsement of Transport Document (Etd)Document2 pagesApplication For Shipping Guarantee (SG) / Endorsement of Transport Document (Etd)BAHRAT A/L MURALITHARAN MoeNo ratings yet

- New 2019 Passport Renewal Form AdultDocument2 pagesNew 2019 Passport Renewal Form AdultTopal FerhatNo ratings yet

- Borang Import Plastik (Plastic Import Form)Document4 pagesBorang Import Plastik (Plastic Import Form)Archipelago Travel ToursNo ratings yet

- US Internal Revenue Service: F3520a - 1999Document4 pagesUS Internal Revenue Service: F3520a - 1999IRSNo ratings yet

- Form c1Document4 pagesForm c1Petrus PeuNo ratings yet

- EPP1 OLT2KM7M Passport Application FormDocument5 pagesEPP1 OLT2KM7M Passport Application Formeliteprinters2018No ratings yet

- EPP1 5OTYY6A9 Passport Application FormDocument5 pagesEPP1 5OTYY6A9 Passport Application Formamunabibedan2No ratings yet

- B957 PDFDocument2 pagesB957 PDFKhang Chu MạnhNo ratings yet

- Residence Work Permit FormDocument14 pagesResidence Work Permit Formramzi MoussaNo ratings yet

- Chapter 3 - Payment in International TradeDocument142 pagesChapter 3 - Payment in International TradeHuy Hoàng PhanNo ratings yet

- BIR Form No. 1948finalDocument2 pagesBIR Form No. 1948finalauditornicole968No ratings yet

- European Commission Industry Intelligence Submission Form: Red AlertDocument1 pageEuropean Commission Industry Intelligence Submission Form: Red AlertluisNo ratings yet

- V COP8Document15 pagesV COP8Hameed arghandewalNo ratings yet

- Cash Declaration Form: Y Y Y M Y M D DDocument2 pagesCash Declaration Form: Y Y Y M Y M D DluisNo ratings yet

- Form SELF REPORTING FORM FOR TRAVELLERS Revised 26feb 2020Document1 pageForm SELF REPORTING FORM FOR TRAVELLERS Revised 26feb 2020Danish KhanNo ratings yet

- UK Home Office: FLR (HSMP) FormDocument18 pagesUK Home Office: FLR (HSMP) FormUK_HomeOffice100% (1)

- M FRMDocument5 pagesM FRMkennkelvin123No ratings yet

- Application For United Kingdom Entry ClearanceDocument3 pagesApplication For United Kingdom Entry Clearancejob.cnd0% (1)

- Temporary Passport Application FormDocument4 pagesTemporary Passport Application FormHenqNo ratings yet

- Application For Aerodrome Licence - Initial: Particulars Regarding The Applicant/HolderDocument3 pagesApplication For Aerodrome Licence - Initial: Particulars Regarding The Applicant/HolderDavid TomaNo ratings yet

- Form 15 CA and 15 CBDocument6 pagesForm 15 CA and 15 CBscrana7480No ratings yet

- UK Home Office: Td112rev12 FormDocument11 pagesUK Home Office: Td112rev12 FormUK_HomeOffice100% (2)

- Form No. 27ADocument1 pageForm No. 27Akaturi3689No ratings yet

- 5LI For Non Surrender of BLDocument2 pages5LI For Non Surrender of BLBAHRAT A/L MURALITHARAN MoeNo ratings yet

- UK Home Office: Form rn2Document4 pagesUK Home Office: Form rn2UK_HomeOfficeNo ratings yet

- Application For Visa: For Official Use Only Approved / Not Approved Single / Multiple EntryDocument2 pagesApplication For Visa: For Official Use Only Approved / Not Approved Single / Multiple EntryMaciejWiczarski100% (1)

- Export Declaration - Australia604715120210721Document1 pageExport Declaration - Australia604715120210721Лена КиселеваNo ratings yet

- Carnetir VacioDocument11 pagesCarnetir VacioJorge Sarabia HernandoNo ratings yet

- Din 4Document2 pagesDin 4subbu152No ratings yet

- EPP1-QPTQWOBJ-Passport Application FormDocument5 pagesEPP1-QPTQWOBJ-Passport Application Formrolandamuh2023No ratings yet

- Part I: Multiple - Choise Questions Choose The Only One Right Answer For Each QuestionDocument7 pagesPart I: Multiple - Choise Questions Choose The Only One Right Answer For Each QuestionHa TranNo ratings yet

- Passport Application 022024Document5 pagesPassport Application 022024keithnorthover1994No ratings yet

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsDocument1 pageAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaNo ratings yet

- Requirements of Italian Consulate in Mumbai For Issue of VisasDocument1 pageRequirements of Italian Consulate in Mumbai For Issue of VisasSrivastavaVineetNo ratings yet

- BBBBDocument5 pagesBBBBkennkelvin123No ratings yet

- Self Reporting FormDocument1 pageSelf Reporting FormprahladNo ratings yet

- Cash Declaration Form: Use Capital Letters / Tick As AppropriateDocument4 pagesCash Declaration Form: Use Capital Letters / Tick As Appropriateamirmohammad KhaliliNo ratings yet

- Self Reporting Form For All Travellers Arriving From 2019-Ncov Affected CountriesDocument1 pageSelf Reporting Form For All Travellers Arriving From 2019-Ncov Affected CountriesDeepak SrohaNo ratings yet

- CNI Application Pack - OPPOSITE SexDocument9 pagesCNI Application Pack - OPPOSITE Sexgulrosekhan5No ratings yet

- EPP1 YLT6QOWP Passport Application FormDocument5 pagesEPP1 YLT6QOWP Passport Application Formwebnet printersNo ratings yet

- Individual: Know Your Customer (Kyc) Application FormDocument5 pagesIndividual: Know Your Customer (Kyc) Application FormMuhammad HaseebNo ratings yet

- Exchange of Damaged Euro Banknotes PDFDocument3 pagesExchange of Damaged Euro Banknotes PDFBlessing KatukaNo ratings yet

- A. Travel Information:: Passenger Locator FormDocument11 pagesA. Travel Information:: Passenger Locator FormEduard AdelinNo ratings yet

- Planning for London: The Indispensable Companion To Your GuidebookFrom EverandPlanning for London: The Indispensable Companion To Your GuidebookNo ratings yet

- Lets Talk About MoneyDocument1 pageLets Talk About MoneyMarta RuizNo ratings yet

- Berjamin, Eric Brian - BSA - IA - Act (Journal)Document3 pagesBerjamin, Eric Brian - BSA - IA - Act (Journal)Eric BerjaminNo ratings yet

- Wa0002.Document51 pagesWa0002.Abdelnasir HaiderNo ratings yet

- ch09Document44 pagesch09Balach MalikNo ratings yet

- AS Business Paper October 2019Document4 pagesAS Business Paper October 2019Ved “Veko” KodothNo ratings yet

- Country Report Part One of South AfricaDocument21 pagesCountry Report Part One of South AfricaSachin DowarkasingNo ratings yet

- Homework TimothyDocument4 pagesHomework TimothyLe Thi Luyen QP1138No ratings yet

- Account StatementDocument83 pagesAccount StatementAshwani KumarNo ratings yet

- Dygnonise of FusionDocument17 pagesDygnonise of Fusionyramesh77No ratings yet

- Bullet Review On Cash and Cash Equivalents, Receivables and InventoriesDocument15 pagesBullet Review On Cash and Cash Equivalents, Receivables and InventoriesCrystal PanolNo ratings yet

- Required Forms For SCSSDocument16 pagesRequired Forms For SCSSmurugeshlpNo ratings yet

- Notes in Cash Receivables Inventory MGTDocument7 pagesNotes in Cash Receivables Inventory MGTLiana Monica LopezNo ratings yet

- Intermediate Accounting 1 Cash and Cash EquivalentsDocument3 pagesIntermediate Accounting 1 Cash and Cash EquivalentsMark Navida AgunaNo ratings yet

- Chapter 4 - Management of Current Assets - Student's Copy v1Document32 pagesChapter 4 - Management of Current Assets - Student's Copy v1Julie Mae Caling Malit100% (1)

- 4hana 1909Document60 pages4hana 1909ddharNo ratings yet

- Mekdes MekonnenDocument102 pagesMekdes MekonnenWolassa WosharaNo ratings yet

- Chap 004Document18 pagesChap 004Hoài Anh VõNo ratings yet

- 20230831090153633Document1 page20230831090153633kamoto kabumbuNo ratings yet

- Yukon National Bank Deposit Slip - Free Printable Template - CheckDeposit - IoDocument1 pageYukon National Bank Deposit Slip - Free Printable Template - CheckDeposit - Ioboomy2064No ratings yet

- Chapter 4 - Cash ControlDocument16 pagesChapter 4 - Cash ControlNigussie BerhanuNo ratings yet

- Challan 12a Form10 Form5 203Document10 pagesChallan 12a Form10 Form5 203Karthik XoticventuresNo ratings yet

- Marketing Concierge Program For ISVsDocument24 pagesMarketing Concierge Program For ISVsLara FURINI ROSITONo ratings yet

- Role of Central Bank-SabaDocument11 pagesRole of Central Bank-Sabas shaikhNo ratings yet

- Measuring Exposure To Exchange Rate Fluctuations: 1. Transaction Exposure 2. Economic Exposure 3. Translation ExposureDocument25 pagesMeasuring Exposure To Exchange Rate Fluctuations: 1. Transaction Exposure 2. Economic Exposure 3. Translation ExposureTuyền Mai PhươngNo ratings yet

- Cash App April 2023 Account StatementDocument14 pagesCash App April 2023 Account StatementAnselinamarieNo ratings yet

- Statement 1617736254355Document13 pagesStatement 1617736254355Sunny Paul ChanduNo ratings yet

- 09.a-Balasan2022 Part2-Observations and RecommendationsDocument39 pages09.a-Balasan2022 Part2-Observations and RecommendationsEi Mi SanNo ratings yet

- Week 9: Merchandise Inventory Adjustments and Special JournalsDocument10 pagesWeek 9: Merchandise Inventory Adjustments and Special JournalsFrance Delos SantosNo ratings yet

Cash Declaration

Cash Declaration

Uploaded by

Willem DienaarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Declaration

Cash Declaration

Uploaded by

Willem DienaarCopyright:

Available Formats

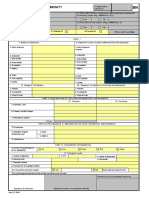

Cash declaration

(for amounts of 10,000 Euros or more entering or leaving the European Union)

You must read the notes on the reverse before completing this form. Complete all boxes using black ink and capital letters

A Transport details

5. Port or airport where journey ends (see note A5)

1. Are you entering EU? Or exiting EU?

(see note A1) (see note A1)

6. Via (see note A6)

2. By air? Or by sea?

a. Port or airport

D D M M Y Y Y Y b. Port or airport

3. Date of EU entry/EU exit

4. Port or airport where journey starts (see note A4) 7. Port or airport where this declaration is made

B Details of cash

a. Type of cash (see note B) b. Currency c. Amount

1

2

3

C Origin and intended use of cash

1. Do you own the cash? 3. Origins of cash, where and how obtained (see note C3)

Yes If ‘Yes’ go to box 3

4. Details of intended use of cash

No If ‘No’ go to box 2

2. Details of owner (see note C2)

5. Details of intended recipient of cash (see note C5)

D Declaration and your personal details

1. Surname 5. Place of birth (city and country)

6. Full address (including house number)

2. First name(s)

Country

D D M M Y Y Y Y

3. Date of birth 7. Postcode

4. Passport number and nationality

a. Passport number 8. Occupation

b. Nationality

I have read the notes and warning (note 5) on the reverse of this form and declare that all the details entered above are

complete and correct to the best of my knowledge and belief. Sign this (Copy 1) and post in HM Revenue & Customs drop box

provided. Keep carbon copy (Copy 2) for your own use and in case it is requested by HMRC officers.

For official use only

Signature

PID

9. Date Penalty

D D M M Y Y Y Y POCA

C9011 (Copy 1) Original Page 1 HMRC 04/07

Cash declaration

(for amounts of 10,000 Euros or more entering or leaving the European Union)

You must read the notes on the reverse before completing this form. Complete all boxes using black ink and capital letters.

A Transport details

5. Port or airport where journey ends (see note A5)

1. Are you entering EU? Or exiting EU?

(see note A1) (see note A1)

6. via (see note A6)

2. By air? Or by sea?

a. Port or airport

D D M M Y Y Y Y b. Port or airport

3. Date of EU entry/EU exit

4. Port or airport where journey starts (see note A4) 7. Port or airport where this declaration is made

B Details of cash

a. Type of cash (see note B) b. Currency c. Amount

1

2

3

C Origin and intended use of cash

1. Do you own the cash? 3. Origins of cash, where and how obtained (see note C3)

Yes If ‘Yes’ go to box 3

4. Details of intended use of cash

No If ‘No’ go to box 2

2. Details of owner (see note C2)

5. Details of intended recipient of cash (see note C5)

D Declaration and your personal details

1. Surname 5. Place of birth (city and country)

6. Full address (including house number)

2. First name(s)

Country

D D M M Y Y Y Y

3. Date of birth 7. Postcode

4. Passport number and nationality

a. Passport number 8. Occupation

b. Nationality

I have read the notes and warning (note 5) on the reverse of this form and declare that all the details entered above are

complete and correct to the best of my knowledge and belief. Sign this (Copy 1) and post in HM Revenue & Customs drop box

provided. Keep carbon copy (Copy 2) for your own use and in case it is requested by HMRC officers.

For official use only

Signature

PID

9. Date Penalty

D D M M Y Y Y Y POCA

C9011 (Copy 2) Page 2

Notes on completing this form

You do not need to complete this form if you are travelling to or arriving from another EU country or are

carrying less than 10,000 Euros.

General information Notes on completion of individual boxes

1 You must complete this form if you are entering or leaving A1 Entering the EU means arriving directly from a non-EU

the European Union (EU) (see 3. below) and are carrying country and includes journeys where your final

cash of a value of 10,000 Euros or more or the equivalent destination is a port, airport or train station elsewhere

in other currencies. This law is to help combat money in the EU.

laundering and it applies in all EU countries. Exiting the EU means travelling directly to a non-EU

2 Cash not only means currency notes and coins but also country and includes journeys where your original place

of departure was a port, airport or train station elsewhere

bankers’ drafts and cheques of any kind (including

in the EU.

travellers’ cheques).

3 For the purposes of this declaration, the countries of the A4 Enter name of first port or airport on your journey and

EU are Austria, Belgium, Bulgaria, Cyprus, the Czech the country in which it is located.

Republic, Denmark, Estonia, Finland, France, Germany, A5 Enter name of final port or airport on your journey and

Gibraltar, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, the country in which it is located.

Luxembourg, Malta, the Netherlands, Poland, Portugal, A6 Enter names of intermediate ports and airports on

Romania, Slovakia, Slovenia, Spain (including the Canary your journey and the country in which each is located.

Islands), Sweden and the United Kingdom (not including B Enter the type of cash carried (for example currency

the Isle of Man and the Channel Islands). notes, currency coins, travellers’ cheques). See also

4 The declaration must be signed and dated. note 2. opposite.

5 You will be liable to financial penalties if you fail to comply C2 Enter name, address and business of person or company.

with the obligation to declare, or provide incomplete or If there is more than one owner, enter details of the one

incorrect information. You must answer any questions who owns the greatest amount of the cash.

HM Revenue & Customs officers may ask you about the C3 Enter what the cash represents (for example proceeds of

cash, and they may seize it (whether declared or not) if sale of house or car, business takings, personal savings)

they have reasonable grounds to suspect that it is and the country in which it was obtained.

associated with criminal activity.

C5 Enter name, address and business of intended recipient.

If there is more than one intended recipient, enter

details of the one most likely to receive the greatest

amount of cash.

Page 3

You might also like

- Fabm2: Quarter 1 Week 5 Module 5Document18 pagesFabm2: Quarter 1 Week 5 Module 5Jose John Vocal89% (19)

- Form Eu1: Application For A Residence CardDocument8 pagesForm Eu1: Application For A Residence CardasilvaronaldoNo ratings yet

- AkkiDocument18 pagesAkkiJoe Dedsinfo100% (1)

- Mod 3040Document2 pagesMod 3040luisNo ratings yet

- Declaration Form enDocument3 pagesDeclaration Form enHet Hongarije NieuwsbladNo ratings yet

- Z894 GEPF Estate LateDocument1 pageZ894 GEPF Estate LatelienalexidelangeNo ratings yet

- 3 Self Declaration Form All International Passengers Arriving Into India 6Document1 page3 Self Declaration Form All International Passengers Arriving Into India 6Ankit SharmaNo ratings yet

- DT-1001 Ind RegDocument4 pagesDT-1001 Ind RegMugabi EltonbenNo ratings yet

- Requirements For UK Tourist VisaDocument3 pagesRequirements For UK Tourist VisaAnonymous ku7POqvKNo ratings yet

- Application For A UK Discharge Book and / or A British Seaman's CardDocument11 pagesApplication For A UK Discharge Book and / or A British Seaman's CardFBNo ratings yet

- Form Visa Maritime - UKDocument10 pagesForm Visa Maritime - UKBudi ProNo ratings yet

- BIR Form No. 1948finalDocument1 pageBIR Form No. 1948finaldave torredaNo ratings yet

- Commoditites Account Opening FormDocument22 pagesCommoditites Account Opening Formabdulrehman akhtarNo ratings yet

- Cross Border Movement Physical Currency 4657566Document2 pagesCross Border Movement Physical Currency 4657566lunwenNo ratings yet

- TirCarnet TemplateDocument13 pagesTirCarnet TemplategavgabiNo ratings yet

- Form C DennyDocument2 pagesForm C DennybambangNo ratings yet

- Application For Shipping Guarantee (SG) / Endorsement of Transport Document (Etd)Document2 pagesApplication For Shipping Guarantee (SG) / Endorsement of Transport Document (Etd)BAHRAT A/L MURALITHARAN MoeNo ratings yet

- New 2019 Passport Renewal Form AdultDocument2 pagesNew 2019 Passport Renewal Form AdultTopal FerhatNo ratings yet

- Borang Import Plastik (Plastic Import Form)Document4 pagesBorang Import Plastik (Plastic Import Form)Archipelago Travel ToursNo ratings yet

- US Internal Revenue Service: F3520a - 1999Document4 pagesUS Internal Revenue Service: F3520a - 1999IRSNo ratings yet

- Form c1Document4 pagesForm c1Petrus PeuNo ratings yet

- EPP1 OLT2KM7M Passport Application FormDocument5 pagesEPP1 OLT2KM7M Passport Application Formeliteprinters2018No ratings yet

- EPP1 5OTYY6A9 Passport Application FormDocument5 pagesEPP1 5OTYY6A9 Passport Application Formamunabibedan2No ratings yet

- B957 PDFDocument2 pagesB957 PDFKhang Chu MạnhNo ratings yet

- Residence Work Permit FormDocument14 pagesResidence Work Permit Formramzi MoussaNo ratings yet

- Chapter 3 - Payment in International TradeDocument142 pagesChapter 3 - Payment in International TradeHuy Hoàng PhanNo ratings yet

- BIR Form No. 1948finalDocument2 pagesBIR Form No. 1948finalauditornicole968No ratings yet

- European Commission Industry Intelligence Submission Form: Red AlertDocument1 pageEuropean Commission Industry Intelligence Submission Form: Red AlertluisNo ratings yet

- V COP8Document15 pagesV COP8Hameed arghandewalNo ratings yet

- Cash Declaration Form: Y Y Y M Y M D DDocument2 pagesCash Declaration Form: Y Y Y M Y M D DluisNo ratings yet

- Form SELF REPORTING FORM FOR TRAVELLERS Revised 26feb 2020Document1 pageForm SELF REPORTING FORM FOR TRAVELLERS Revised 26feb 2020Danish KhanNo ratings yet

- UK Home Office: FLR (HSMP) FormDocument18 pagesUK Home Office: FLR (HSMP) FormUK_HomeOffice100% (1)

- M FRMDocument5 pagesM FRMkennkelvin123No ratings yet

- Application For United Kingdom Entry ClearanceDocument3 pagesApplication For United Kingdom Entry Clearancejob.cnd0% (1)

- Temporary Passport Application FormDocument4 pagesTemporary Passport Application FormHenqNo ratings yet

- Application For Aerodrome Licence - Initial: Particulars Regarding The Applicant/HolderDocument3 pagesApplication For Aerodrome Licence - Initial: Particulars Regarding The Applicant/HolderDavid TomaNo ratings yet

- Form 15 CA and 15 CBDocument6 pagesForm 15 CA and 15 CBscrana7480No ratings yet

- UK Home Office: Td112rev12 FormDocument11 pagesUK Home Office: Td112rev12 FormUK_HomeOffice100% (2)

- Form No. 27ADocument1 pageForm No. 27Akaturi3689No ratings yet

- 5LI For Non Surrender of BLDocument2 pages5LI For Non Surrender of BLBAHRAT A/L MURALITHARAN MoeNo ratings yet

- UK Home Office: Form rn2Document4 pagesUK Home Office: Form rn2UK_HomeOfficeNo ratings yet

- Application For Visa: For Official Use Only Approved / Not Approved Single / Multiple EntryDocument2 pagesApplication For Visa: For Official Use Only Approved / Not Approved Single / Multiple EntryMaciejWiczarski100% (1)

- Export Declaration - Australia604715120210721Document1 pageExport Declaration - Australia604715120210721Лена КиселеваNo ratings yet

- Carnetir VacioDocument11 pagesCarnetir VacioJorge Sarabia HernandoNo ratings yet

- Din 4Document2 pagesDin 4subbu152No ratings yet

- EPP1-QPTQWOBJ-Passport Application FormDocument5 pagesEPP1-QPTQWOBJ-Passport Application Formrolandamuh2023No ratings yet

- Part I: Multiple - Choise Questions Choose The Only One Right Answer For Each QuestionDocument7 pagesPart I: Multiple - Choise Questions Choose The Only One Right Answer For Each QuestionHa TranNo ratings yet

- Passport Application 022024Document5 pagesPassport Application 022024keithnorthover1994No ratings yet

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsDocument1 pageAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaNo ratings yet

- Requirements of Italian Consulate in Mumbai For Issue of VisasDocument1 pageRequirements of Italian Consulate in Mumbai For Issue of VisasSrivastavaVineetNo ratings yet

- BBBBDocument5 pagesBBBBkennkelvin123No ratings yet

- Self Reporting FormDocument1 pageSelf Reporting FormprahladNo ratings yet

- Cash Declaration Form: Use Capital Letters / Tick As AppropriateDocument4 pagesCash Declaration Form: Use Capital Letters / Tick As Appropriateamirmohammad KhaliliNo ratings yet

- Self Reporting Form For All Travellers Arriving From 2019-Ncov Affected CountriesDocument1 pageSelf Reporting Form For All Travellers Arriving From 2019-Ncov Affected CountriesDeepak SrohaNo ratings yet

- CNI Application Pack - OPPOSITE SexDocument9 pagesCNI Application Pack - OPPOSITE Sexgulrosekhan5No ratings yet

- EPP1 YLT6QOWP Passport Application FormDocument5 pagesEPP1 YLT6QOWP Passport Application Formwebnet printersNo ratings yet

- Individual: Know Your Customer (Kyc) Application FormDocument5 pagesIndividual: Know Your Customer (Kyc) Application FormMuhammad HaseebNo ratings yet

- Exchange of Damaged Euro Banknotes PDFDocument3 pagesExchange of Damaged Euro Banknotes PDFBlessing KatukaNo ratings yet

- A. Travel Information:: Passenger Locator FormDocument11 pagesA. Travel Information:: Passenger Locator FormEduard AdelinNo ratings yet

- Planning for London: The Indispensable Companion To Your GuidebookFrom EverandPlanning for London: The Indispensable Companion To Your GuidebookNo ratings yet

- Lets Talk About MoneyDocument1 pageLets Talk About MoneyMarta RuizNo ratings yet

- Berjamin, Eric Brian - BSA - IA - Act (Journal)Document3 pagesBerjamin, Eric Brian - BSA - IA - Act (Journal)Eric BerjaminNo ratings yet

- Wa0002.Document51 pagesWa0002.Abdelnasir HaiderNo ratings yet

- ch09Document44 pagesch09Balach MalikNo ratings yet

- AS Business Paper October 2019Document4 pagesAS Business Paper October 2019Ved “Veko” KodothNo ratings yet

- Country Report Part One of South AfricaDocument21 pagesCountry Report Part One of South AfricaSachin DowarkasingNo ratings yet

- Homework TimothyDocument4 pagesHomework TimothyLe Thi Luyen QP1138No ratings yet

- Account StatementDocument83 pagesAccount StatementAshwani KumarNo ratings yet

- Dygnonise of FusionDocument17 pagesDygnonise of Fusionyramesh77No ratings yet

- Bullet Review On Cash and Cash Equivalents, Receivables and InventoriesDocument15 pagesBullet Review On Cash and Cash Equivalents, Receivables and InventoriesCrystal PanolNo ratings yet

- Required Forms For SCSSDocument16 pagesRequired Forms For SCSSmurugeshlpNo ratings yet

- Notes in Cash Receivables Inventory MGTDocument7 pagesNotes in Cash Receivables Inventory MGTLiana Monica LopezNo ratings yet

- Intermediate Accounting 1 Cash and Cash EquivalentsDocument3 pagesIntermediate Accounting 1 Cash and Cash EquivalentsMark Navida AgunaNo ratings yet

- Chapter 4 - Management of Current Assets - Student's Copy v1Document32 pagesChapter 4 - Management of Current Assets - Student's Copy v1Julie Mae Caling Malit100% (1)

- 4hana 1909Document60 pages4hana 1909ddharNo ratings yet

- Mekdes MekonnenDocument102 pagesMekdes MekonnenWolassa WosharaNo ratings yet

- Chap 004Document18 pagesChap 004Hoài Anh VõNo ratings yet

- 20230831090153633Document1 page20230831090153633kamoto kabumbuNo ratings yet

- Yukon National Bank Deposit Slip - Free Printable Template - CheckDeposit - IoDocument1 pageYukon National Bank Deposit Slip - Free Printable Template - CheckDeposit - Ioboomy2064No ratings yet

- Chapter 4 - Cash ControlDocument16 pagesChapter 4 - Cash ControlNigussie BerhanuNo ratings yet

- Challan 12a Form10 Form5 203Document10 pagesChallan 12a Form10 Form5 203Karthik XoticventuresNo ratings yet

- Marketing Concierge Program For ISVsDocument24 pagesMarketing Concierge Program For ISVsLara FURINI ROSITONo ratings yet

- Role of Central Bank-SabaDocument11 pagesRole of Central Bank-Sabas shaikhNo ratings yet

- Measuring Exposure To Exchange Rate Fluctuations: 1. Transaction Exposure 2. Economic Exposure 3. Translation ExposureDocument25 pagesMeasuring Exposure To Exchange Rate Fluctuations: 1. Transaction Exposure 2. Economic Exposure 3. Translation ExposureTuyền Mai PhươngNo ratings yet

- Cash App April 2023 Account StatementDocument14 pagesCash App April 2023 Account StatementAnselinamarieNo ratings yet

- Statement 1617736254355Document13 pagesStatement 1617736254355Sunny Paul ChanduNo ratings yet

- 09.a-Balasan2022 Part2-Observations and RecommendationsDocument39 pages09.a-Balasan2022 Part2-Observations and RecommendationsEi Mi SanNo ratings yet

- Week 9: Merchandise Inventory Adjustments and Special JournalsDocument10 pagesWeek 9: Merchandise Inventory Adjustments and Special JournalsFrance Delos SantosNo ratings yet