Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsBasket of Products

Basket of Products

Uploaded by

RAJAT CREATORSThe document provides interest rates for various housing and non-housing loan products offered by a bank. It lists interest rates based on the loan amount, CIBIL score of the borrower, and whether the borrower is salaried or non-salaried. Rates range from 8.65% to 12.60% depending on the product and borrower profile. Products include home loans, plot and construction loans, top up loans, and loans for commercial purposes. Interest rates are floating and linked to the bank's benchmark lending rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Sheryl Nieves Santillan: East West Banking CorporationDocument7 pagesSheryl Nieves Santillan: East West Banking CorporationAngela Cajurao ArenoNo ratings yet

- Basket of ProductsDocument3 pagesBasket of ProductsJayasree DevulapalliNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI OnretaillendingschemesSaran ManiNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesHarish MauryaNo ratings yet

- Retail Rate of Interest Updated 15.05.23Document10 pagesRetail Rate of Interest Updated 15.05.23Mahammad sadik shaikNo ratings yet

- Retail Rate of Interest Updated 07 09 2023Document9 pagesRetail Rate of Interest Updated 07 09 2023vikaspabuwalNo ratings yet

- Campaign OfferDocument3 pagesCampaign OfferNeos EonsNo ratings yet

- Retail Rate of Interest Updated 15122022Document10 pagesRetail Rate of Interest Updated 15122022srikarNo ratings yet

- Retail Rate of Interest Updated 10012023Document10 pagesRetail Rate of Interest Updated 10012023monty chikNo ratings yet

- Campaign OfferDocument2 pagesCampaign OfferAkhilNo ratings yet

- BASKET OF PRODUCTS As On 21.11.19Document3 pagesBASKET OF PRODUCTS As On 21.11.19Virendra K VermaNo ratings yet

- Festive Campaign OfferDocument2 pagesFestive Campaign OfferShubhaNo ratings yet

- Retail Rate of Interest Updated 12112022Document10 pagesRetail Rate of Interest Updated 12112022Sravan Sneha TchaduvulaNo ratings yet

- Sbi Loan DataDocument1 pageSbi Loan DataWHITE DEVILNo ratings yet

- RBI ROI FormatDocument8 pagesRBI ROI Formatsrinivas.rmbaNo ratings yet

- 061022-Festive Campaign OfferDocument2 pages061022-Festive Campaign OfferDhanush ENo ratings yet

- Roi OnretaillendingschemesDocument10 pagesRoi OnretaillendingschemesKarthik MestaNo ratings yet

- The Rate of Interest On Home Loans and Vehicle Loans Will Be Based On CIBIL ScoreDocument5 pagesThe Rate of Interest On Home Loans and Vehicle Loans Will Be Based On CIBIL ScorenitinNo ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesFayaz ShaikNo ratings yet

- Interest Rates - Deposit: Saving Account Interest Rates: 4.0 % P.A. (W.e.f. 3rd May 2011)Document14 pagesInterest Rates - Deposit: Saving Account Interest Rates: 4.0 % P.A. (W.e.f. 3rd May 2011)rajat_sethiNo ratings yet

- Bidvest Investment AccountsDocument1 pageBidvest Investment Accountsshaunvdm777No ratings yet

- 250123-Festive Campaign Offer Wef 26.01.2023Document2 pages250123-Festive Campaign Offer Wef 26.01.2023CyrilRithikaNo ratings yet

- MRP May 2023Document3 pagesMRP May 2023princeNo ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- Rate of InterestDocument9 pagesRate of InterestUdaydeep SinghNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Updated Roi 15.05.2024 To 30.06.2024Document1 pageUpdated Roi 15.05.2024 To 30.06.2024Divya MaheshNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI Onretaillendingschemespassword123resetNo ratings yet

- About LichflDocument17 pagesAbout LichflHyma KavyaNo ratings yet

- Oct To Dec: Running Collection (Net) With Above 65% Strike Including BlsDocument3 pagesOct To Dec: Running Collection (Net) With Above 65% Strike Including BlsSanket MargajNo ratings yet

- Roi OnretaillendingschemesDocument9 pagesRoi OnretaillendingschemesRajdeep ChaudhariNo ratings yet

- P Seg Int Rate As On 15.06.2022Document2 pagesP Seg Int Rate As On 15.06.2022Devanathan HbkNo ratings yet

- Rbi Format Roi PCDocument11 pagesRbi Format Roi PCSumeet TripathiNo ratings yet

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Old Fee StructureDocument5 pagesOld Fee Structureab505450No ratings yet

- Licence Fee Chart: Schedule "A"Document1 pageLicence Fee Chart: Schedule "A"environment GSNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatDevender RajuNo ratings yet

- UntitledDocument5 pagesUntitledRwings JeansNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- Financial Planning: Alqaab Arshad Amish Bhalla ShawezDocument6 pagesFinancial Planning: Alqaab Arshad Amish Bhalla ShawezAlqaab ArshadNo ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- PK Actual Rates For October 2019Document3 pagesPK Actual Rates For October 2019Awais KhalidNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatSandeep SandyNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesAnirudh SharmaNo ratings yet

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- EBLR As On 01.04.2020 Is 7.20 % I.E. RBI Repo Rate (4.40%) + Spread (2.80%)Document6 pagesEBLR As On 01.04.2020 Is 7.20 % I.E. RBI Repo Rate (4.40%) + Spread (2.80%)Atul GuptaNo ratings yet

- ROI Schemes DetailingDocument7 pagesROI Schemes DetailingVenkat Deepak SarmaNo ratings yet

- Rate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorDocument2 pagesRate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorAjoydeep DasNo ratings yet

- APC Incentive StructureDocument17 pagesAPC Incentive StructureMohd NaimNo ratings yet

- FHO, CHI, WC, ASSURE, Coparison One PagerDocument1 pageFHO, CHI, WC, ASSURE, Coparison One PagerLakshmikanth SNo ratings yet

- Plastic MoneyDocument70 pagesPlastic MoneyBhagyashri GaikwadNo ratings yet

- Money Transmit ListDocument9 pagesMoney Transmit ListCoin FireNo ratings yet

- Cash Surrender - Termination RequestDocument4 pagesCash Surrender - Termination RequesterdemNo ratings yet

- Module 4 Adjusting EntriesDocument41 pagesModule 4 Adjusting EntriesXiavNo ratings yet

- RBI Role in Foreign Exchange MarketDocument6 pagesRBI Role in Foreign Exchange MarketKirti ParkNo ratings yet

- ST Marys Primary School Fee Schedule 2021Document2 pagesST Marys Primary School Fee Schedule 2021jenny smithNo ratings yet

- Week 3 in Class Case FG 1Document1 pageWeek 3 in Class Case FG 1xsnoweyxNo ratings yet

- TIPS FOR HANDING OVER & TAKING OVER Booklet 03-06-17Document32 pagesTIPS FOR HANDING OVER & TAKING OVER Booklet 03-06-17sahilNo ratings yet

- Conception ManaloDocument6 pagesConception ManaloBarcelona, Tricia Mae F.No ratings yet

- Group 2 - Jollibee Foods Corporation 2019 Financial ReportDocument15 pagesGroup 2 - Jollibee Foods Corporation 2019 Financial ReportVenziel Pedrosa0% (1)

- HST NotesDocument4 pagesHST NotesDrippy SnowflakeNo ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument18 pagesChapter 02 - How To Calculate Present ValuesTrinh VũNo ratings yet

- Financial Markets and Institutions: ReadingsDocument10 pagesFinancial Markets and Institutions: ReadingsQuang NguyenNo ratings yet

- Full Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFDocument41 pagesFull Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFshirley.sur179100% (34)

- XII - Accounts - Sample Paper-1Document27 pagesXII - Accounts - Sample Paper-1zainab.xf77No ratings yet

- Enclosed Destefano Pre Approval Items Needed PDFDocument7 pagesEnclosed Destefano Pre Approval Items Needed PDFGiuseppe DestefanoNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument70 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeEnsy QuNo ratings yet

- Central Bank of India (Eco Project)Document2 pagesCentral Bank of India (Eco Project)Shivam TanejaNo ratings yet

- Module 6 Property, Plant, and EquipmentDocument31 pagesModule 6 Property, Plant, and EquipmentNicole ConcepcionNo ratings yet

- Accounting Past Paper 2Document2 pagesAccounting Past Paper 2Noshair AliNo ratings yet

- Assignment 1 StudentDocument3 pagesAssignment 1 StudentAssagNo ratings yet

- Foreign Exchange Management (Overseas Investment) Rules, 2022 - Taxguru - inDocument15 pagesForeign Exchange Management (Overseas Investment) Rules, 2022 - Taxguru - inHimanshu DhanukaNo ratings yet

- Application Form For SBM ATM CardsDocument1 pageApplication Form For SBM ATM Cardsneedsmsspl0% (1)

- FAB SMS Banking User GuideDocument3 pagesFAB SMS Banking User GuideVladimir RyzhkovNo ratings yet

- Chapter 18Document12 pagesChapter 18ks1043210No ratings yet

- Appointment, Rights, Dismissal and Auditor's ResignationDocument17 pagesAppointment, Rights, Dismissal and Auditor's ResignationcleophacerevivalNo ratings yet

- Introduction of Insurance of LICDocument7 pagesIntroduction of Insurance of LICKanishk Gupta100% (1)

- Payment Details Form 1440Document2 pagesPayment Details Form 1440Јован ЈосифоскиNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet

Basket of Products

Basket of Products

Uploaded by

RAJAT CREATORS0 ratings0% found this document useful (0 votes)

10 views3 pagesThe document provides interest rates for various housing and non-housing loan products offered by a bank. It lists interest rates based on the loan amount, CIBIL score of the borrower, and whether the borrower is salaried or non-salaried. Rates range from 8.65% to 12.60% depending on the product and borrower profile. Products include home loans, plot and construction loans, top up loans, and loans for commercial purposes. Interest rates are floating and linked to the bank's benchmark lending rates.

Original Description:

Hi

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides interest rates for various housing and non-housing loan products offered by a bank. It lists interest rates based on the loan amount, CIBIL score of the borrower, and whether the borrower is salaried or non-salaried. Rates range from 8.65% to 12.60% depending on the product and borrower profile. Products include home loans, plot and construction loans, top up loans, and loans for commercial purposes. Interest rates are floating and linked to the bank's benchmark lending rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views3 pagesBasket of Products

Basket of Products

Uploaded by

RAJAT CREATORSThe document provides interest rates for various housing and non-housing loan products offered by a bank. It lists interest rates based on the loan amount, CIBIL score of the borrower, and whether the borrower is salaried or non-salaried. Rates range from 8.65% to 12.60% depending on the product and borrower profile. Products include home loans, plot and construction loans, top up loans, and loans for commercial purposes. Interest rates are floating and linked to the bank's benchmark lending rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

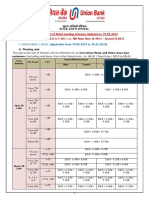

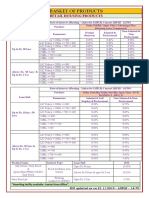

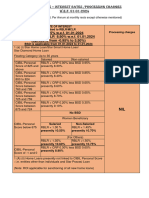

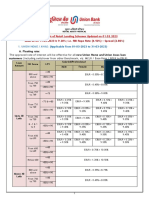

BASKET OF PRODUCTS

RETAIL HOUSING PRODUCTS

Rate of Interests (Floating - Linked to LHPLR) Current LHPLR – 16.80%

Home Loan

Salaried &

CIBIL score Loan slab Non-Salaried

Professional

CIBIL≥ 800 Up to 15 crs 8.65% 8.75%

Up to 5 crs 8.75% 8.85%

CIBIL 750-799

More than 5 crs & up to 15 crs 8.95% 9.05%

Up to 5 crs 9.05% 9.15%

CIBIL 700-749

More than 5 crs & up to 15 crs 9.25% 9.35%

Up to 50 Lakhs 9.30% 9.40%

CIBIL 600-699 More than 50 Lakhs & up to 2 crs 9.50% 9.60%

More than 2 crs & up to 15 crs 9.65% 9.75%

Up to 50 Lakhs 9.75% 9.85%

CIBIL <600 More than 50 Lakhs & up to 2 crs 9.95% 10.05%

More than 2 crs & up to 5 crs 10.15% 10.25%

Up to 50 Lakhs 9.05% 9.15%

150≤CIBIL≤200

More than 50 Lakhs & up to 2 crs 9.25% 9.35%

Up to 50 Lakhs 9.30% 9.40%

101≤CIBIL<150

More than 50 Lakhs & up to 2 crs 9.50% 9.60%

Advantage plus Scheme (Housing Loan Component)

CIBIL ≥ 800 8.65%

HL component should be Greater

CIBIL 750-799 8.75%

than or Equal to 10 Lakhs

CIBIL 700-749 9.05%

Sure Fixed Scheme

CIBIL≥750 Up to 15 crs 9.75%(fixed for entire term)

CIBIL<750 Up to 15 crs 10.00%(fixed for entire term)

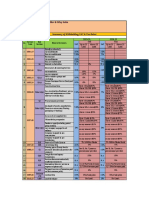

Loan Towards Purchase of Residential Plots / Residential Plots and Construction

Salaried &

CIBIL Score Loan Slab Non-Salaried

Professional

CIBIL≥ 800 Up to 15 crs 8.85% 8.95%

Up to 5 crs 8.95% 9.05%

CIBIL 750-799

More than 5 crs & up to 15 crs 9.15% 9.25%

Up to 5 crs 9.25% 9.35%

CIBIL 700-749

More than 5 crs & up to 15 crs 9.45% 9.55%

Up to 50 Lakhs 9.50% 9.60%

CIBIL 650-699 More than 50 Lakhs & up to 2 cr 9.70% 9.80%

More than 2 cr & up to 15 crs 9.85% 9.95%

150≤CIBIL≤200 Up to 50 Lakhs 9.25% 9.35%

(only P+C) More than 50 Lakhs & up to 2 crs 9.45% 9.55%

101≤CIBIL<150 Up to 50 Lakhs 9.50% 9.60%

(only P+C) More than 50 Lakhs & up to 2 crs 9.70% 9.80%

ROI updated as on 26.12.2022

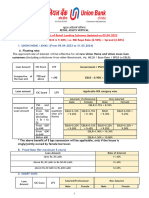

Griha Suvidha

Salaried &

CIBIL SCORE Loan slab Non-Salaried

Professional

CIBIL≥ 800 More than 10 lakhs & up to 3 crs 8.90% 9.00%

CIBIL 750-799 More than 10 lakhs & up to 3 crs 9.00% 9.10%

CIBIL 700-749 More than 10 lakhs & up to 3 crs 9.30% 9.40%

More than 10 lakhs & up to 50 Lakhs 9.55% 9.65%

CIBIL 600-699 More than 50 Lakhs & up to 2 crs 9.75% 9.85%

More than 2 cr & up to 3 crs 9.90% 10.00%

More than 10 lakhs & up to 50 Lakhs 10.00% 10.10%

CIBIL< 600 More than 50 Lakhs & up to 2 crs 10.20% 10.30%

More than 2 cr & up to 3 crs 10.40% 10.50%

More than 10 Lakhs & up to 50 Lakhs 9.30% 9.40%

150 ≤CIBIL≤200

More than 50 Lakhs & up to 2 crs 9.50% 9.60%

More than 10 Lakhs & up to 50 Lakhs 9.55% 9.65%

101 ≤CIBIL<150

More than 50 Lakhs & up to 2 crs 9.75% 9.85%

Griha Suvidha Asha (2 year ITR Self Employed or Class IV Salaried)

CIBIL≥ 800 More than 10 lakhs & up to 3 crs 9.15% 9.25%

CIBIL 750-799 More than 10 lakhs & up to 3 crs 9.25% 9.35%

CIBIL 700-749 More than 10 lakhs & up to 3 crs 9.55% 9.65%

More than 10 lakhs & up to 50 Lakhs 9.80% 9.90%

CIBIL 650-699 More than 50 Lakhs & up to 2 cr 10.00% 10.10%

More than 2 cr & up to 3 crs 10.15% 10.25%

More than 10 lakhs & up to 50 Lakhs 9.55% 9.65%

150 ≤CIBIL≤200

More than 50 Lakhs & up to 2 crs 9.75% 9.85%

More than 10 Lakhs & up to 50 Lakhs 9.80% 9.90%

101 ≤CIBIL<150

More than 50 Lakhs & up to 2 crs 10.00% 10.10%

*Other conditions will be same as applicable to Griha Siddhi Product

** For P+C cases under Griha Suvidha, applicable ROI is 25 bps more than Griha Bhoomi & under Griha Suvidha

Asha(only for self Employed Borrowers), applicable ROI is 50 bps more than Griha Bhoomi.

Product Name Cibil Score Loan Slab ROI

700 & above 9.35%

New face Lift Up to Rs. 15 Crs

Below 700 10.10%

ROI updated as on 26.12.2022

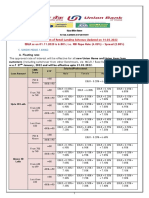

RETAIL NON HOUSING PRODUCTS

Rate of Interests (Floating - Linked to LHPLRNH) Current LHPLRNH – 16.90%

Product Name Interest Type/slab CIBIL score Rate of Interest

CIBIL ≥ 800 9.10%

Advantage Plus 800>CIBIL ≥ 750 9.20%

Floating

(Top up Component)

750>CIBIL ≥ 700 9.50%

CIBIL ≥ 750 9.45%

Griha Vikas/Griha

Floating

Vikas (Topup)/ New 750>CIBIL ≥ 700 10.05%

Up to Rs 15 crs

Griha Vikas (Facelift)

700>CIBIL ≥ 600 11.30%

CIBIL ≥ 800 11.10%

Floating CIBIL ≥ 700 11.60%

Up to Rs 5 crs

CIBIL ≥ 600 12.10%

LRD /

LAP – Commercial CIBIL ≥ 800 11.60%

Above Rs. 5 crs and CIBIL ≥ 700 12.10%

Up to Rs. 15 crs

CIBIL ≥ 600 12.60%

CIBIL ≥ 750 10.10%

Rs. 10 Lakhs & Upto

Rs. 5 Crs

750>CIBIL ≥ 700 10.60%

MY Office

(For Individuals)

CIBIL ≥ 750 10.30%

Above Rs. 5 crs &

Upto Rs. 15 Crs

750>CIBIL ≥ 700 10.85%

Rs. 10 Lakhs & Upto

11.10%

MY Office Rs. 5 Crs

NA

(For Non-Individuals) Above Rs. 5 crs &

11.85%

Upto Rs. 15 Crs

ROI updated as on 26.12.2022

Rewriting facility available for Housing & Non Housing individual loans. Contact Area Office.

* 1) In case of joints applicants, CIBIL score of applicant having highest score will be considered.

* 2) Total loan exposure should not exceed 10 crs. under under Advantage Plus Scheme

***********

You might also like

- Sheryl Nieves Santillan: East West Banking CorporationDocument7 pagesSheryl Nieves Santillan: East West Banking CorporationAngela Cajurao ArenoNo ratings yet

- Basket of ProductsDocument3 pagesBasket of ProductsJayasree DevulapalliNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI OnretaillendingschemesSaran ManiNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesHarish MauryaNo ratings yet

- Retail Rate of Interest Updated 15.05.23Document10 pagesRetail Rate of Interest Updated 15.05.23Mahammad sadik shaikNo ratings yet

- Retail Rate of Interest Updated 07 09 2023Document9 pagesRetail Rate of Interest Updated 07 09 2023vikaspabuwalNo ratings yet

- Campaign OfferDocument3 pagesCampaign OfferNeos EonsNo ratings yet

- Retail Rate of Interest Updated 15122022Document10 pagesRetail Rate of Interest Updated 15122022srikarNo ratings yet

- Retail Rate of Interest Updated 10012023Document10 pagesRetail Rate of Interest Updated 10012023monty chikNo ratings yet

- Campaign OfferDocument2 pagesCampaign OfferAkhilNo ratings yet

- BASKET OF PRODUCTS As On 21.11.19Document3 pagesBASKET OF PRODUCTS As On 21.11.19Virendra K VermaNo ratings yet

- Festive Campaign OfferDocument2 pagesFestive Campaign OfferShubhaNo ratings yet

- Retail Rate of Interest Updated 12112022Document10 pagesRetail Rate of Interest Updated 12112022Sravan Sneha TchaduvulaNo ratings yet

- Sbi Loan DataDocument1 pageSbi Loan DataWHITE DEVILNo ratings yet

- RBI ROI FormatDocument8 pagesRBI ROI Formatsrinivas.rmbaNo ratings yet

- 061022-Festive Campaign OfferDocument2 pages061022-Festive Campaign OfferDhanush ENo ratings yet

- Roi OnretaillendingschemesDocument10 pagesRoi OnretaillendingschemesKarthik MestaNo ratings yet

- The Rate of Interest On Home Loans and Vehicle Loans Will Be Based On CIBIL ScoreDocument5 pagesThe Rate of Interest On Home Loans and Vehicle Loans Will Be Based On CIBIL ScorenitinNo ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesFayaz ShaikNo ratings yet

- Interest Rates - Deposit: Saving Account Interest Rates: 4.0 % P.A. (W.e.f. 3rd May 2011)Document14 pagesInterest Rates - Deposit: Saving Account Interest Rates: 4.0 % P.A. (W.e.f. 3rd May 2011)rajat_sethiNo ratings yet

- Bidvest Investment AccountsDocument1 pageBidvest Investment Accountsshaunvdm777No ratings yet

- 250123-Festive Campaign Offer Wef 26.01.2023Document2 pages250123-Festive Campaign Offer Wef 26.01.2023CyrilRithikaNo ratings yet

- MRP May 2023Document3 pagesMRP May 2023princeNo ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- Rate of InterestDocument9 pagesRate of InterestUdaydeep SinghNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Updated Roi 15.05.2024 To 30.06.2024Document1 pageUpdated Roi 15.05.2024 To 30.06.2024Divya MaheshNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI Onretaillendingschemespassword123resetNo ratings yet

- About LichflDocument17 pagesAbout LichflHyma KavyaNo ratings yet

- Oct To Dec: Running Collection (Net) With Above 65% Strike Including BlsDocument3 pagesOct To Dec: Running Collection (Net) With Above 65% Strike Including BlsSanket MargajNo ratings yet

- Roi OnretaillendingschemesDocument9 pagesRoi OnretaillendingschemesRajdeep ChaudhariNo ratings yet

- P Seg Int Rate As On 15.06.2022Document2 pagesP Seg Int Rate As On 15.06.2022Devanathan HbkNo ratings yet

- Rbi Format Roi PCDocument11 pagesRbi Format Roi PCSumeet TripathiNo ratings yet

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Old Fee StructureDocument5 pagesOld Fee Structureab505450No ratings yet

- Licence Fee Chart: Schedule "A"Document1 pageLicence Fee Chart: Schedule "A"environment GSNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatDevender RajuNo ratings yet

- UntitledDocument5 pagesUntitledRwings JeansNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- Financial Planning: Alqaab Arshad Amish Bhalla ShawezDocument6 pagesFinancial Planning: Alqaab Arshad Amish Bhalla ShawezAlqaab ArshadNo ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- PK Actual Rates For October 2019Document3 pagesPK Actual Rates For October 2019Awais KhalidNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatSandeep SandyNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesAnirudh SharmaNo ratings yet

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- EBLR As On 01.04.2020 Is 7.20 % I.E. RBI Repo Rate (4.40%) + Spread (2.80%)Document6 pagesEBLR As On 01.04.2020 Is 7.20 % I.E. RBI Repo Rate (4.40%) + Spread (2.80%)Atul GuptaNo ratings yet

- ROI Schemes DetailingDocument7 pagesROI Schemes DetailingVenkat Deepak SarmaNo ratings yet

- Rate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorDocument2 pagesRate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorAjoydeep DasNo ratings yet

- APC Incentive StructureDocument17 pagesAPC Incentive StructureMohd NaimNo ratings yet

- FHO, CHI, WC, ASSURE, Coparison One PagerDocument1 pageFHO, CHI, WC, ASSURE, Coparison One PagerLakshmikanth SNo ratings yet

- Plastic MoneyDocument70 pagesPlastic MoneyBhagyashri GaikwadNo ratings yet

- Money Transmit ListDocument9 pagesMoney Transmit ListCoin FireNo ratings yet

- Cash Surrender - Termination RequestDocument4 pagesCash Surrender - Termination RequesterdemNo ratings yet

- Module 4 Adjusting EntriesDocument41 pagesModule 4 Adjusting EntriesXiavNo ratings yet

- RBI Role in Foreign Exchange MarketDocument6 pagesRBI Role in Foreign Exchange MarketKirti ParkNo ratings yet

- ST Marys Primary School Fee Schedule 2021Document2 pagesST Marys Primary School Fee Schedule 2021jenny smithNo ratings yet

- Week 3 in Class Case FG 1Document1 pageWeek 3 in Class Case FG 1xsnoweyxNo ratings yet

- TIPS FOR HANDING OVER & TAKING OVER Booklet 03-06-17Document32 pagesTIPS FOR HANDING OVER & TAKING OVER Booklet 03-06-17sahilNo ratings yet

- Conception ManaloDocument6 pagesConception ManaloBarcelona, Tricia Mae F.No ratings yet

- Group 2 - Jollibee Foods Corporation 2019 Financial ReportDocument15 pagesGroup 2 - Jollibee Foods Corporation 2019 Financial ReportVenziel Pedrosa0% (1)

- HST NotesDocument4 pagesHST NotesDrippy SnowflakeNo ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument18 pagesChapter 02 - How To Calculate Present ValuesTrinh VũNo ratings yet

- Financial Markets and Institutions: ReadingsDocument10 pagesFinancial Markets and Institutions: ReadingsQuang NguyenNo ratings yet

- Full Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFDocument41 pagesFull Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFshirley.sur179100% (34)

- XII - Accounts - Sample Paper-1Document27 pagesXII - Accounts - Sample Paper-1zainab.xf77No ratings yet

- Enclosed Destefano Pre Approval Items Needed PDFDocument7 pagesEnclosed Destefano Pre Approval Items Needed PDFGiuseppe DestefanoNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument70 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeEnsy QuNo ratings yet

- Central Bank of India (Eco Project)Document2 pagesCentral Bank of India (Eco Project)Shivam TanejaNo ratings yet

- Module 6 Property, Plant, and EquipmentDocument31 pagesModule 6 Property, Plant, and EquipmentNicole ConcepcionNo ratings yet

- Accounting Past Paper 2Document2 pagesAccounting Past Paper 2Noshair AliNo ratings yet

- Assignment 1 StudentDocument3 pagesAssignment 1 StudentAssagNo ratings yet

- Foreign Exchange Management (Overseas Investment) Rules, 2022 - Taxguru - inDocument15 pagesForeign Exchange Management (Overseas Investment) Rules, 2022 - Taxguru - inHimanshu DhanukaNo ratings yet

- Application Form For SBM ATM CardsDocument1 pageApplication Form For SBM ATM Cardsneedsmsspl0% (1)

- FAB SMS Banking User GuideDocument3 pagesFAB SMS Banking User GuideVladimir RyzhkovNo ratings yet

- Chapter 18Document12 pagesChapter 18ks1043210No ratings yet

- Appointment, Rights, Dismissal and Auditor's ResignationDocument17 pagesAppointment, Rights, Dismissal and Auditor's ResignationcleophacerevivalNo ratings yet

- Introduction of Insurance of LICDocument7 pagesIntroduction of Insurance of LICKanishk Gupta100% (1)

- Payment Details Form 1440Document2 pagesPayment Details Form 1440Јован ЈосифоскиNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet