Professional Documents

Culture Documents

Case Study Crystal Ball Proforma and Forecasts Statements

Case Study Crystal Ball Proforma and Forecasts Statements

Uploaded by

Tingstene 13Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study Crystal Ball Proforma and Forecasts Statements

Case Study Crystal Ball Proforma and Forecasts Statements

Uploaded by

Tingstene 13Copyright:

Available Formats

Analyse comptable - Philippe Giraudon, CIIA Octobre 2020

CRYSTAL BALL Case Study: Preparation of pro-forma statements and forecasts

You have to analyse CB company, midcap 100% family-owned business held by its manager

Jean Marthet and his family, whose accounts are shown below:

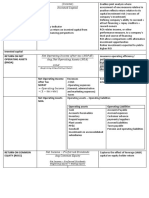

CB P&L 2013

Accounts

Potential restatements

Pro-forma 2014e 2015e 2016e

(Data in EUR)

Revenues 8’030’000

Purchases used -2’150’000

Other revenues 1’200’000

(licences)

Other suppliers -650’000

and external

charges

Wages -2’000’000

EBITDA 4'430’000

Depreciation -1’480’000

EBIT 2’950’000

Financial result -150’000

PBT 2'800’000

Employees profit- -304’000

sharing cost

(“Participations

des salaries”)

Taxes -748,800

Net Profit 1'747’200

CB Balance Sheet for 2013 (data in EUR)

Potential Potential

Assets Liabilities

restatements Pro- Accounts restatements Pro-

Accounts

forma forma

PPE 6'000’000 Equity 6'500’000

Inventories 4'000’000

Accounts 2'500'000 MLT Financial 4'500’000

receivable Debt

Other current 1'500’000 ST Financial 500’000

assets Debt

Cash & Cash 2'500’000 Accounts 1'000’000

equivalent payable

Other current 4'000’000

liabilities

Total Assets 16'500’000 Total 16'500’000

Liabilities

©Philippe Giraudon, PHG Finance

Analyse comptable - Philippe Giraudon, CIIA Octobre 2020

1) You want to show CB economic P&L and Balance Sheet.

When discussing with the owner-manager, you obtain the following information:

- The owner-manager pays himself EUR 500’000 (including social charges) per annum (the usual

wage of a company of such size is EUR 250’000 including social charges)

- The company has factored EUR 2’000’000 of accounts receivables

- Other supplies and external charges include EUR 240’000 of financial lease instalments on

production tools that the company intends to use over their expected life (10 years) with a total

financial lease commitment of EUR 1'680'000 as of end 2013 (= 7 years of yearly instalments)

Please specify any potential restatements you are undertaking if any.

2) The owner-manager provides you with his main forecasts for 2014e to 2016e; you

want to prepare a forecast P&L to have a clear idea of CB profitability prospects:

- Sales volumes are expected to grow by 5% per annum with a selling price per unit growing by 2%

per annum as it has been the case for the last 5 years since the products have been created

- Purchases used will remain stable as a proportion of sales and other supplies and external charges

(excluding financial lease instalments) will grow by 0.25% per annum

- Wages will grow by 1.5% per annum

- Net yearly investments will remain stable as a proportion of sales (do you think that their level is

adequate?)

- Working Capital will remain stable as a proportion of sales in the coming years

- Dividends represent from 2012 included 75% of net result (restated net result) of CB

3) What level of net financial debt (on a restated basis upon need) will the company have in 3

years considering that its ST and MLT financial debt is “bullet” with a maturity in 5 years?

4) Can you summarise on a table the 4 major assumptions of the forecasts for each year?

What about returns then for each year? Do you think then a forecast P&L is enough? You

may prepare any other forecast table you consider relevant.

5) Is the growth level of the company realistic? Can it be increased with this level of dividend

payout?

6) What list of questions would you like to ask to CB company manager, Jean Marthet, to

ensure that your financial forecasts are realistic and robust?

©Philippe Giraudon, PHG Finance

You might also like

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- FIP FIN701-1905-1 - Team 4 - 1Document10 pagesFIP FIN701-1905-1 - Team 4 - 1Jay Prakash SoniNo ratings yet

- UOPX Real Estate Brokerage Business PlanDocument24 pagesUOPX Real Estate Brokerage Business PlanEvonia Hogan100% (2)

- Rebath International PDFDocument13 pagesRebath International PDFGlobal FranchiseNo ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Chapter 14Document13 pagesChapter 14VanessaFaithBiscaynoCalunodNo ratings yet

- 5 Financial Statements of CompaniesDocument11 pages5 Financial Statements of Companiessunil.h68 SunilNo ratings yet

- Bus. Finance W3-4 - C5 (Answer)Document5 pagesBus. Finance W3-4 - C5 (Answer)Rory GdLNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Topic 2 - Af09101 - Financial StatementsDocument42 pagesTopic 2 - Af09101 - Financial Statementsarusha afroNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Written Assignment Unit 1 BUS 5110Document7 pagesWritten Assignment Unit 1 BUS 5110Joseph KamaraNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- Financial Statements - II: 360 AccountancyDocument65 pagesFinancial Statements - II: 360 AccountancyshantX100% (1)

- PC 2 QuestionnaireDocument3 pagesPC 2 QuestionnaireLuWiz DiazNo ratings yet

- 助教課講義 Ch.3 (A4雙面)Document10 pages助教課講義 Ch.3 (A4雙面)5213adamNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- Preparation of Financial StatementsDocument5 pagesPreparation of Financial StatementsOji ArashibaNo ratings yet

- Basic Accounting Lesson 7: Worksheet and Financial StatementsDocument33 pagesBasic Accounting Lesson 7: Worksheet and Financial StatementsGutierrez Ronalyn Y.No ratings yet

- Intermediate 1 Ch5 Ø Ù Ø Ø Ø Ø Ù Ø Ø Ø ØDocument12 pagesIntermediate 1 Ch5 Ø Ù Ø Ø Ø Ø Ù Ø Ø Ø Ømobilhamdan318No ratings yet

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- (Ust-Jpia) Acc5115 Ifr Sce and SCF ReviewerDocument5 pages(Ust-Jpia) Acc5115 Ifr Sce and SCF Revieweraly kayleNo ratings yet

- What Is The Worksheet?: Fabm Week 6: Accounting Cycle of A Service Business (Part II-B)Document10 pagesWhat Is The Worksheet?: Fabm Week 6: Accounting Cycle of A Service Business (Part II-B)Tumamudtamud, JenaNo ratings yet

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDocument3 pagesInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNo ratings yet

- Financial Statements - II: 372 AccountancyDocument65 pagesFinancial Statements - II: 372 AccountancyBhartiNo ratings yet

- Chap 2Document16 pagesChap 2RABBINo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Handouts 1 Partnership AccountingDocument5 pagesHandouts 1 Partnership AccountingRozel MontevirgenNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- Management Development Institute, GurgaonDocument7 pagesManagement Development Institute, Gurgaonrishav jhaNo ratings yet

- F2 Sept 2014 QP Final Version For PrintDocument20 pagesF2 Sept 2014 QP Final Version For PrintFahadNo ratings yet

- SCALP Handout 038 PDFDocument2 pagesSCALP Handout 038 PDFAine Arie HNo ratings yet

- Fina 470 Project Two - Check PointDocument9 pagesFina 470 Project Two - Check PointMitchell ParrottNo ratings yet

- Exercises On Projected Financial StatementsDocument2 pagesExercises On Projected Financial StatementsSharmaine LiasosNo ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Homework ch4 11-4-2020Document5 pagesHomework ch4 11-4-2020Qasim MansiNo ratings yet

- Capital University of Science and Technology: Honor StatementDocument7 pagesCapital University of Science and Technology: Honor StatementPak KhNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- 2016-01-08 Exame enDocument6 pages2016-01-08 Exame enbarbaraNo ratings yet

- Tut 8 Submission QuestionsDocument6 pagesTut 8 Submission Questionsxabaandiswa8No ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Cbea FAR 01 Lecture 02Document16 pagesCbea FAR 01 Lecture 02Osirisheen Aizle CubacubNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Chapter Vii & ViiiDocument3 pagesChapter Vii & ViiiJP GargantaNo ratings yet

- 2611 Balancesheet 061cab728ef57e7 96134910Document60 pages2611 Balancesheet 061cab728ef57e7 96134910AdarshNo ratings yet

- Partnership Formation (Problems) : Group 2 (Buruelo, Castro)Document5 pagesPartnership Formation (Problems) : Group 2 (Buruelo, Castro)Celine Marie AntonioNo ratings yet

- Statement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Document13 pagesStatement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Fiza Xiena100% (1)

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Financial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsDocument22 pagesFinancial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsMOVIEZ FUNDANo ratings yet

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- I. Distribution of Profits: RequiredDocument3 pagesI. Distribution of Profits: RequiredJennette ToNo ratings yet

- Commerce Syllabus Degree Part 3Document21 pagesCommerce Syllabus Degree Part 3मनोज गुप्ता उपाध्यक्षNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- 1 RevaluationDocument38 pages1 RevaluationAbdul RaufNo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 1Document18 pages2076 - Varias, Aizel Ann B - Module 1Aizel Ann VariasNo ratings yet

- Bakery Business PlanDocument39 pagesBakery Business Plantanmay_ch100% (10)

- Warren Buffett Squawk Box Transcript, October 24, 2012Document52 pagesWarren Buffett Squawk Box Transcript, October 24, 2012CNBCNo ratings yet

- Illustrative LBO AnalysisDocument21 pagesIllustrative LBO AnalysisBrian DongNo ratings yet

- Multiplan DF 3T07 EngDocument43 pagesMultiplan DF 3T07 EngMultiplan RINo ratings yet

- Cgu ProblemsDocument2 pagesCgu ProblemsAlizeyyNo ratings yet

- CPM Construction Company AccountingDocument6 pagesCPM Construction Company AccountingPrita HerdiantiNo ratings yet

- For Editing Las Malikhaing Pagsulat FinalDocument13 pagesFor Editing Las Malikhaing Pagsulat FinalMARICEL MAGDATONo ratings yet

- Final Publik Muh - Ferial Ferniawan A031191156Document13 pagesFinal Publik Muh - Ferial Ferniawan A031191156andi TenriNo ratings yet

- SFM Module 1Document132 pagesSFM Module 19832155922No ratings yet

- AIS Second HalfDocument12 pagesAIS Second HalfSheena CariñoNo ratings yet

- CMA Inter - FM MCQ BookletDocument58 pagesCMA Inter - FM MCQ BookletDREAM SLAYERNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- Professional Qualifying Examination PQE SyllabusDocument101 pagesProfessional Qualifying Examination PQE Syllabuskarandeep89No ratings yet

- 12th ACCOUNTS One MarksDocument3 pages12th ACCOUNTS One Markssujithrasuji773No ratings yet

- CA Inter Accounts (New) Suggested Answer Dec2021Document24 pagesCA Inter Accounts (New) Suggested Answer Dec2021omaisNo ratings yet

- Business Purchase AgreementDocument11 pagesBusiness Purchase AgreementVũ Ngọc TrâmNo ratings yet

- Excel 2Document8 pagesExcel 2Vignesh BalachandarNo ratings yet

- 8, Problems #7-11Document7 pages8, Problems #7-11jowdpugsNo ratings yet

- Hodik Limited - Audited Financial StatementsDocument32 pagesHodik Limited - Audited Financial Statementsdemrey21No ratings yet

- SRC Rule 68Document15 pagesSRC Rule 68chua_arlene256189No ratings yet

- DONE BA 118.3 Module 2 Quiz 1answer KeyDocument8 pagesDONE BA 118.3 Module 2 Quiz 1answer KeyRed Ashley De LeonNo ratings yet

- Ch10 DepreciationDocument18 pagesCh10 DepreciationRama KrishnaNo ratings yet

- In Their Words: History and Society in Gilbertese Oral TraditionDocument226 pagesIn Their Words: History and Society in Gilbertese Oral TraditionkemalNo ratings yet

- Values and Ethics From Inception To PracticeDocument30 pagesValues and Ethics From Inception To PracticeSam SumoNo ratings yet

- 5 Published Company AccountsDocument27 pages5 Published Company Accountsking brothersNo ratings yet

- McKeown, Adam - Global Migration 1846-1940Document35 pagesMcKeown, Adam - Global Migration 1846-1940Bernat BertomeuNo ratings yet