Professional Documents

Culture Documents

Fin MGT Lesson 02 Financial Statements and Analysis ECA Handouts

Fin MGT Lesson 02 Financial Statements and Analysis ECA Handouts

Uploaded by

RanielMBarbosaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin MGT Lesson 02 Financial Statements and Analysis ECA Handouts

Fin MGT Lesson 02 Financial Statements and Analysis ECA Handouts

Uploaded by

RanielMBarbosaCopyright:

Available Formats

MANAGERIAL FINANCE

MANAGERIAL

FINANCE

Lesson 02

Financial Statements

MANAGERIAL FINANCE

and Analysis

Prof. Erich C. Acabado, CPA, REB

Prof. Erich C. Acabado, CPA, REB

Prof. Erich C. Acabado, CPA, REB Prof. Erich C. Acabado, CPA, REB

1 2

Learning Goals Learning Goals

1. Review the contents of the stockholders’ report 5. Use ratios to analyze a firm’s profitability

and the procedures for consolidating

international financial statements.

and market value.

2. Understand who uses financial ratios, 6. Use a summary of financial ratios and

and how. the DuPont system of analysis to

3. Use ratios to analyze a firm’s liquidity perform a complete ratio analysis.

and activity.

4. Discuss the relationship between debt and

financial leverage and the ratios used to

analyze a firm’s debt.

Prof. Erich C. Acabado, CPA, REB 2-3 Prof. Erich C. Acabado, CPA, REB 2-4

3 4

Prof. Erich C. Acabado CPA, REB Lesson 2 - 1

MANAGERIAL FINANCE

The Stockholders’ Report The Stockholders’ Report

• The guidelines used to prepare and maintain financial • The PCAOB is charged with protecting the

records and reports are known as generally accepted interests of investors and furthering the public

accounting principles (GAAP).

interest in the preparation of informative, fair,

• GAAP is authorized by the Financial Accounting and independent audit reports.

Standards Board (FASB).

• Public corporations with more than

• The Sarbanes-Oxley Act of 2002, passed to eliminate

the many disclosure and conflict of interest problems of

$5 million in assets and more than 500

corporations, established the Public Company stockholders are required by the SEC to

Accounting Oversight Board (PCAOB), which is a not- provide their stockholders with an annual

for-profit corporation that overseas auditors. stockholder's report.

Prof. Erich C. Acabado, CPA, REB 2-5 Prof. Erich C. Acabado, CPA, REB 2-6

5 6

The Four Key Financial Statements:

The Income Statement The Four Key

Financial

• The income statement provides a financial Statements

summary of a company’s operating results

during a specified period.

• Although they are prepared annually for

reporting purposes, they are generally

computed monthly by management and

quarterly for tax purposes.

Prof. Erich C. Acabado, CPA, REB 2-7 Prof. Erich C. Acabado, CPA, REB 2-8

7 8

Prof. Erich C. Acabado CPA, REB Lesson 2 - 2

MANAGERIAL FINANCE

The Four Key Financial Statements:

The Four Key Financial Statements

The Balance Sheet

• The balance sheet presents a summary of

a firm’s financial position at a given point

in time.

• Assets indicate what the firm owns,

equity represents the owners’ investment,

and liabilities indicate what the firm

has borrowed.

Prof. Erich C. Acabado, CPA, REB 2-9 Prof. Erich C. Acabado, CPA, REB 2-10

9 10

The Four Key The Four Key Financial Statements:

Financial Statements Statement of Retained Earnings

• The statement of retained earnings

reconciles the net income earned and

dividends paid during the year, with the

change in retained earnings.

Prof. Erich C. Acabado, CPA, REB 2-11 Prof. Erich C. Acabado, CPA, REB 2-12

11 12

Prof. Erich C. Acabado CPA, REB Lesson 2 - 3

MANAGERIAL FINANCE

The Four Key Financial Statements:

The Four Key Financial Statements

Statement of Cash Flows

• The statement of cash flows provides a

summary of the cash flows over the period

of concern, typically the year just ended.

• This statement not only provides insight

into a company’s investment, financing

and operating activities, but also ties

together the income statement and

previous and current balance sheets.

Prof. Erich C. Acabado, CPA, REB 2-13 Prof. Erich C. Acabado, CPA, REB 2-14

13 14

Consolidating International

The Four Key Financial Statements

Financial Statements

• FASB 52 mandated that U.S. based companies

translate their foreign-currency denominated assets

and liabilities into dollars using the current rate

(translation) method.

• Under the translation method, companies translate all

foreign-currency-denominated assets and liabilities into

dollars at the exchange rate prevailing at the fiscal year

ending date (the current rate).

• Income statement items are usually treated similarly.

Prof. Erich C. Acabado, CPA, REB 2-15 Prof. Erich C. Acabado, CPA, REB 2-16

15 16

Prof. Erich C. Acabado CPA, REB Lesson 2 - 4

MANAGERIAL FINANCE

Consolidating International Using Financial Ratios:

Financial Statements Interested Parties

• Equity accounts, on the other hand, are • Ratio analysis involves methods of

translated into dollars by using the calculating and interpreting financial ratios

exchange rate that prevailed when the to assess a firm’s financial condition

parent’s equity investment was made (the and performance.

historical rate).

• It is of interest to shareholders, creditors,

• Retained earnings are adjusted to reflect and the firm’s own management.

each year’s operating profits (or losses).

Prof. Erich C. Acabado, CPA, REB 2-17 Prof. Erich C. Acabado, CPA, REB 2-18

17 18

Using Financial Ratios: Using Financial Ratios:

Types of Ratio Comparisons Types of Ratio Comparisons

• Trend or time-series analysis • Trend or time-series analysis

– Used to evaluate a firm’s performance • Cross-sectional analysis

over time

– Used to compare different firms at the same

point in time

Prof. Erich C. Acabado, CPA, REB 2-19 Prof. Erich C. Acabado, CPA, REB 2-20

19 20

Prof. Erich C. Acabado CPA, REB Lesson 2 - 5

MANAGERIAL FINANCE

Using Financial Ratios: Using Financial Ratios:

Types of Ratio Comparisons Types of Ratio Comparisons

• Trend or time-series analysis • Trend or time-series analysis

• Cross-sectional analysis • Cross-sectional analysis

– Industry comparative analysis – Benchmarking

• One specific type of cross-sectional analysis. • A type of cross-sectional analysis in which the

Used to compare one firm’s financial performance firm’s ratio values are compared to those of a key

to the industry’s average performance competitor or group of competitors that it wishes

to emulate

Prof. Erich C. Acabado, CPA, REB 2-21 Prof. Erich C. Acabado, CPA, REB 2-22

21 22

Using Financial Ratios: Using Financial Ratios:

Types of Ratio Comparisons Types of Ratio Comparisons

• Trend or time-series analysis

• Cross-sectional analysis

• Combined Analysis

– Combined analysis simply uses a

combination of both time series analysis and

cross-sectional analysis

Prof. Erich C. Acabado, CPA, REB 2-23 Prof. Erich C. Acabado, CPA, REB 2-24

23 24

Prof. Erich C. Acabado CPA, REB Lesson 2 - 6

MANAGERIAL FINANCE

Using Financial Ratios: Using Financial Ratios:

Types of Ratio Comparisons Cautions for Doing Ratio Analysis

• Ratios must be considered together; a single

ratio by itself means relatively little.

• Financial statements that are being compared

should be dated at the same point in time.

• Use audited financial statements when possible.

• The financial data being compared should have

been developed in the same way.

• Be wary of inflation distortions.

Prof. Erich C. Acabado, CPA, REB 2-25 Prof. Erich C. Acabado, CPA, REB 2-26

25 26

Ratio Analysis Example Ratio Analysis

• We will illustrate the use of financial ratios • Liquidity Ratios

for analyzing financial statements using

– Current Ratio

the Bartlett Company Income Statements

and Balance Sheets presented earlier in Current ratio = total current assets

Tables 2.1 and 2.2. total current liabilities

Current ratio = ₱1,233,000 = 1.97

₱620,000

Prof. Erich C. Acabado, CPA, REB 2-27 Prof. Erich C. Acabado, CPA, REB 2-28

27 28

Prof. Erich C. Acabado CPA, REB Lesson 2 - 7

MANAGERIAL FINANCE

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

– Current Ratio • Activity Ratios

– Quick Ratio – Inventory Turnover

Quick ratio = Total Current Assets - Inventory Inventory Turnover = Cost of Goods Sold

total current liabilities Inventory

Quick ratio = ₱1,233,000 - ₱289,000 = 1.51 Inventory Turnover = ₱2,088,000 = 7.2

₱620,000 ₱289,000

Prof. Erich C. Acabado, CPA, REB 2-29 Prof. Erich C. Acabado, CPA, REB 2-30

29 30

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

• Activity Ratios • Activity Ratios

– Average Age of Inventory – Average Collection Period

Average Age of Inventory = 365 ACP = Accounts Receivable

Inventory Turnover Net Sales/365

Inventory Turnover = 365 = 50.7 days ACP = ₱503,000 = 59.7 days

7.2 ₱3,074,000/365

Prof. Erich C. Acabado, CPA, REB 2-31 Prof. Erich C. Acabado, CPA, REB 2-32

31 32

Prof. Erich C. Acabado CPA, REB Lesson 2 - 8

MANAGERIAL FINANCE

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

• Activity Ratios • Activity Ratios

– Average Payment Period – Total Asset Turnover

APP = Accounts Payable Total Asset Turnover = Net Sales

Annual Purchases/365 Total Assets

APP = ₱382,000 = 95.4 days Total Asset Turnover = ₱3,074,000 = .85

(.70 x ₱2,088,000)/365 ₱3,597,000

Prof. Erich C. Acabado, CPA, REB 2-33 Prof. Erich C. Acabado, CPA, REB 2-34

33 34

Ratio Analysis Ratio Analysis

• Liquidity Ratios

• Activity Ratios

• Financial Leverage Ratios

– Debt Ratio

Insert Table 2.6 here

Debt Ratio = Total Liabilities/Total Assets

Debt Ratio = ₱1,643,000/₱3,597,000 = 45.7%

Prof. Erich C. Acabado, CPA, REB 2-35 Prof. Erich C. Acabado, CPA, REB 2-36

35 36

Prof. Erich C. Acabado CPA, REB Lesson 2 - 9

MANAGERIAL FINANCE

Ratio Analysis Ratio Analysis

• Liquidity Ratios

• Liquidity Ratios

• Activity Ratios

• Activity Ratios

• Leverage Ratios

• Leverage Ratios

– Times Interest Earned Ratio

– Fixed-Payment coverage Ratio (FPCR)

FPCR = EBIT + Lease Payments

Times Interest Earned = EBIT/Interest Interest + Lease Pymts + {(Princ Pymts + PSD) x [1/(1-t)]}

Times Interest Earned = ₱418,000/₱93,000 = 4.5 FPCR = ₱418,000 + ₱35,000 = 1.9

₱93,000 + P35,000 + {(₱71,000 + ₱10,000) x [1/(1-.29)]}

Prof. Erich C. Acabado, CPA, REB 2-37 Prof. Erich C. Acabado, CPA, REB 2-38

37 38

Ratio Analysis Ratio Analysis

• Liquidity Ratios

• Activity Ratios

• Leverage Ratios

• Profitability Ratios

– Common-Size Income Statements

Prof. Erich C. Acabado, CPA, REB 2-39 Prof. Erich C. Acabado, CPA, REB 2-40

39 40

Prof. Erich C. Acabado CPA, REB Lesson 2 - 10

MANAGERIAL FINANCE

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

• Activity Ratios • Activity Ratios

• Leverage Ratios • Leverage Ratios

• Profitability Ratios • Profitability Ratios

– Gross Profit Margin – Operating Profit Margin (OPM)

GPM = Gross Profit/Net Sales OPM = EBIT/Net Sales

GPM = ₱986,000/₱3,074,000 = 32.1% OPM = ₱418,000/₱3,074,000 = 13.6%

Prof. Erich C. Acabado, CPA, REB 2-41 Prof. Erich C. Acabado, CPA, REB 2-42

41 42

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

• Activity Ratios

• Activity Ratios

• Leverage Ratios

• Leverage Ratios

• Profitability Ratios

• Profitability Ratios

– Net Profit Margin (NPM)

– Earnings Per Share (EPS)

NPM = Earnings Available to Common Stockholders EPS = Earnings Available to Common Stockholders

Sales Number of Shares Outstanding

NPM = ₱221,000/₱3,074,000 = 7.2%

EPS = ₱221,000/76,262 = ₱2.90

Prof. Erich C. Acabado, CPA, REB 2-43 Prof. Erich C. Acabado, CPA, REB 2-44

43 44

Prof. Erich C. Acabado CPA, REB Lesson 2 - 11

MANAGERIAL FINANCE

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

• Activity Ratios • Activity Ratios

• Leverage Ratios • Leverage Ratios

• Profitability Ratios • Profitability Ratios

– Return on Total Assets (ROA) – Return on Equity (ROE)

ROA = Earnings Available to Common Stockholders ROE = Earnings Available to Common Stockholders

Total Assets Total Equity

ROA = ₱221,000/₱3,597,000 = 6.1% ROE = ₱221,000/₱1,754,000 = 12.6%

Prof. Erich C. Acabado, CPA, REB 2-45 Prof. Erich C. Acabado, CPA, REB 2-46

45 46

Ratio Analysis Ratio Analysis

• Liquidity Ratios • Liquidity Ratios

• Activity Ratios • Activity Ratios

• Leverage Ratios • Leverage Ratios

• Profitability Ratios • Profitability Ratios

• Market Ratios • Market Ratios

– Price Earnings (P/E) Ratio – Market/Book (M/B) Ratio

P/E = Market Price Per Share of Common Stock BV/Share = Common Stock Equity

Earnings Per Share Number of Shares of Common Stock

P/E = ₱32.25/ ₱2.90 = 11.1 BV/Share = ₱1,754,000/72,262 = ₱23.00

Prof. Erich C. Acabado, CPA, REB 2-47 Prof. Erich C. Acabado, CPA, REB 2-48

47 48

Prof. Erich C. Acabado CPA, REB Lesson 2 - 12

MANAGERIAL FINANCE

Ratio Analysis Summarizing All Ratios

• Liquidity Ratios

• Activity Ratios

• Leverage Ratios

• Profitability Ratios

• Market Ratios

– Market/Book (M/B) Ratio

M/B Ratio = Market Price/Share of Common Stock

Book Value/Share of Common Stock

M/B Ratio = ₱32.25/₱23.00 = 1.40

Prof. Erich C. Acabado, CPA, REB 2-49 Prof. Erich C. Acabado, CPA, REB 2-50

49 50

Summarizing All Ratios Summarizing All Ratios

Prof. Erich C. Acabado, CPA, REB 2-51 Prof. Erich C. Acabado, CPA, REB 2-52

51 52

Prof. Erich C. Acabado CPA, REB Lesson 2 - 13

MANAGERIAL FINANCE

Summarizing All Ratios DuPont System of Analysis

• The DuPont system of analysis is used to dissect

the firm’s financial statements and to assess its

financial condition.

• It merges the income statement and balance sheet into

two summary measures of profitability: ROA and ROE

as shown in the equation below and in Figure 2.2 on the

following slide.

Prof. Erich C. Acabado, CPA, REB 2-53 Prof. Erich C. Acabado, CPA, REB 2-54

53 54

DuPont System Modified DuPont Formula

of Analysis

• The Modified DuPont Formula relates the firm’s

ROA to its ROE using the financial leverage

multiplier (FLM), which is the ratio of total assets

to common stock equity:

Prof. Erich C. Acabado, CPA, REB 2-55 Prof. Erich C. Acabado, CPA, REB 2-56

55 56

Prof. Erich C. Acabado CPA, REB Lesson 2 - 14

MANAGERIAL FINANCE

Modified DuPont Formula

• Use of the FLM to convert ROA into ROE

reflects the impact of financial leverage on the

owner’s return.

• Substituting the values for Bartlett Company’s End

ROA of 6.1 percent calculated earlier, and Thank you

Bartlett’s FLM of 2.06 (₱3,597,000 total assets ÷

₱1,754,000 common stock equity) into the

Modified DuPont formula yields:

ROE = 6.1% X 2.06 = 12.6%

Prof. Erich C. Acabado, CPA, REB 2-57 Prof. Erich C. Acabado, CPA, REB

57 58

Prof. Erich C. Acabado, CPA, REB 2-59

59

Prof. Erich C. Acabado CPA, REB Lesson 2 - 15

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- 3D Printed Houses List of Tables: Table Number Title Page NumberDocument22 pages3D Printed Houses List of Tables: Table Number Title Page NumberShain100% (2)

- F7 LectureDocument259 pagesF7 LectureĐạt LêNo ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- PropTech Book FINAL NP PDFDocument183 pagesPropTech Book FINAL NP PDFFares BetNo ratings yet

- Ethical Expectations: Employers & EmployeesDocument16 pagesEthical Expectations: Employers & EmployeesArpita Dhar TamaNo ratings yet

- Fin MGT Lesson 01 The Role and Environment of Managerial Finance ECA HandoutsDocument16 pagesFin MGT Lesson 01 The Role and Environment of Managerial Finance ECA HandoutsRanielMBarbosaNo ratings yet

- Financial Accounting Theory and Practice Vol 1Document1 pageFinancial Accounting Theory and Practice Vol 1Jessa BasarteNo ratings yet

- FMPR2 Module BookletDocument66 pagesFMPR2 Module BookletMarjorie Onggay MacheteNo ratings yet

- 1-Ch 1-IFRS-wDocument13 pages1-Ch 1-IFRS-wFAEETNo ratings yet

- IFA 1 & 2 - Textbook SlidesDocument429 pagesIFA 1 & 2 - Textbook SlidessaikrishnavnNo ratings yet

- CH 01Document62 pagesCH 01Inès AmaraNo ratings yet

- CH 02Document47 pagesCH 02nahid mushtaqNo ratings yet

- FMPR 2 - Lesson 2Document12 pagesFMPR 2 - Lesson 2jannypagalanNo ratings yet

- Final AccountsDocument91 pagesFinal AccountsKartikey swami0% (1)

- KTQTế 1Document21 pagesKTQTế 1Khiết DoanhNo ratings yet

- Lec3 - Statement of Financial PositionDocument8 pagesLec3 - Statement of Financial PositionThảo HảiNo ratings yet

- Lecture ONE Accounting For ManagerDocument30 pagesLecture ONE Accounting For Managermohamed elsabahiNo ratings yet

- Accounting in Action: Learning ObjectivesDocument57 pagesAccounting in Action: Learning ObjectivesAli ImranNo ratings yet

- Fabm 2 SG 12 Q1 0102Document20 pagesFabm 2 SG 12 Q1 0102Jasey Jeian CompocNo ratings yet

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDocument4 pagesPost Graduate Diploma in Management: Narsee Monjee Institute of Management Studiesharendra choudharyNo ratings yet

- BABE1 Reviewer 1Document13 pagesBABE1 Reviewer 1James Ryan AlzonaNo ratings yet

- Accounting For Managers: Syllabus and Learning OutcomesDocument3 pagesAccounting For Managers: Syllabus and Learning OutcomesNishant SinghNo ratings yet

- Learning Goals Contact Period 1 Contact Period 2 Contact Period 3 Contact Period 4Document4 pagesLearning Goals Contact Period 1 Contact Period 2 Contact Period 3 Contact Period 4Chai Samonte TejadaNo ratings yet

- Accounts Volume 1Document503 pagesAccounts Volume 1Utkarsh100% (1)

- FAR 001 Summary Notes - Financial Reporting Framework - 025259Document10 pagesFAR 001 Summary Notes - Financial Reporting Framework - 025259Sofia Mae AlbercaNo ratings yet

- Intermediate AccountingDocument47 pagesIntermediate AccountingYashna Tehjib MeghlaNo ratings yet

- Goal of The Firm PDFDocument4 pagesGoal of The Firm PDFSandyNo ratings yet

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDocument51 pagesIntermediate Accounting: Prepared by University of California, Santa BarbaraQamar AhmedNo ratings yet

- Completed ProjectDocument64 pagesCompleted ProjectPuneeth ArNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument56 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegemartinus linggoNo ratings yet

- Unit I Study GuideDocument5 pagesUnit I Study GuideVirginia TownzenNo ratings yet

- CH 01Document60 pagesCH 01intania larasatiNo ratings yet

- Lec 2Document35 pagesLec 2Ahmad FauzanNo ratings yet

- FA2A - Study GuideDocument67 pagesFA2A - Study GuideHasan EvansNo ratings yet

- Intermediate AccountingDocument60 pagesIntermediate AccountingSuwarno Noto JamanNo ratings yet

- CAF SyllabusDocument88 pagesCAF SyllabusTeen CharaghNo ratings yet

- Financial Statements and Analysis: Why This Chapter Matters To You Learning GoalsDocument55 pagesFinancial Statements and Analysis: Why This Chapter Matters To You Learning GoalsSana MohdNo ratings yet

- Introduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonDocument13 pagesIntroduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonPRACHI DASNo ratings yet

- Quick Learning Guide: Business in Action, 5th EditionDocument2 pagesQuick Learning Guide: Business in Action, 5th EditionNguyễn Hoàng Thanh NgânNo ratings yet

- Chapter 1 PowerPointDocument60 pagesChapter 1 PowerPointlamhocneuk64No ratings yet

- 2 Conceptual Framework For Financial ReportingDocument16 pages2 Conceptual Framework For Financial ReportingIman HaidarNo ratings yet

- Synopsis Accounting-Knowledge Level The Institute of Chartered Accountants of Bangladesh Coaching Class (Knowledge Level)Document12 pagesSynopsis Accounting-Knowledge Level The Institute of Chartered Accountants of Bangladesh Coaching Class (Knowledge Level)Mainul HasanNo ratings yet

- Individual Assignment 1A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 1A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- ABMA 106 - Module 2Document31 pagesABMA 106 - Module 2dendenramos767No ratings yet

- CH 01Document71 pagesCH 01hasibNo ratings yet

- Intermediate AccountingDocument60 pagesIntermediate AccountingResky Andika YuswantoNo ratings yet

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- Financial Manamegent Prelim ModuleDocument52 pagesFinancial Manamegent Prelim ModuleExequiel Adrada100% (1)

- FInancial Management1 - PrelimDocument52 pagesFInancial Management1 - PrelimEscalante, Alliah S.No ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingprachiNo ratings yet

- FAR 2 CF 01 - Overview of AccountingDocument2 pagesFAR 2 CF 01 - Overview of AccountingCatherine CaleroNo ratings yet

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- Chapter 1Document8 pagesChapter 1Nehal NabilNo ratings yet

- ACCA - Chapter 1-4Document5 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Ch 01 Accounting in Action (MTM)Document62 pagesCh 01 Accounting in Action (MTM)alifbupmbaNo ratings yet

- TESCO 2019 FindingsDocument4 pagesTESCO 2019 Findingssuraj lamaNo ratings yet

- Chapter No. 1 Nature & Scope of Financial ManagementDocument21 pagesChapter No. 1 Nature & Scope of Financial ManagementJuclyde Cespedes CababatNo ratings yet

- Chapter 1: Overview of Financial Reporting: Slide 1Document41 pagesChapter 1: Overview of Financial Reporting: Slide 1skystars0724No ratings yet

- ch01 - Managerial Accounting (3956)Document53 pagesch01 - Managerial Accounting (3956)Rania ChoucheneNo ratings yet

- CAF Syllabus PDFDocument88 pagesCAF Syllabus PDFAbdullah AbidNo ratings yet

- Summary Notes - Chapter 4 - 17th EditionDocument18 pagesSummary Notes - Chapter 4 - 17th EditionJosh ChakrabartyNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- DocumentDocument1 pageDocumentRanielMBarbosaNo ratings yet

- NJX Sites and LinksDocument5 pagesNJX Sites and LinksRanielMBarbosaNo ratings yet

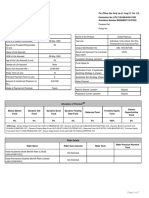

- Soa 1464602229761Document1 pageSoa 1464602229761RanielMBarbosaNo ratings yet

- Receipt ExpensesDocument2 pagesReceipt ExpensesRanielMBarbosaNo ratings yet

- Soa 1464602229761Document1 pageSoa 1464602229761RanielMBarbosaNo ratings yet

- Partnership by EstoppelDocument25 pagesPartnership by EstoppelRanielMBarbosaNo ratings yet

- Fin MGT Lesson 01 The Role and Environment of Managerial Finance ECA HandoutsDocument16 pagesFin MGT Lesson 01 The Role and Environment of Managerial Finance ECA HandoutsRanielMBarbosaNo ratings yet

- Lecture October 17Document20 pagesLecture October 17RanielMBarbosaNo ratings yet

- Kim G. PRDocument4 pagesKim G. PRRanielMBarbosaNo ratings yet

- Managerial Finance ECA LessonsDocument1 pageManagerial Finance ECA LessonsRanielMBarbosaNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsPersonal Finance GyanNo ratings yet

- Fastmig Ms Om en PDFDocument22 pagesFastmig Ms Om en PDFmariustudoracheNo ratings yet

- Method Statement 03g-Placing of CC BlockDocument5 pagesMethod Statement 03g-Placing of CC BlockAbdullah Al MarufNo ratings yet

- Rising Food Prices-"A Global Crisis: Action Needed Now To Avoid Poverty and Hunger" SummaryDocument4 pagesRising Food Prices-"A Global Crisis: Action Needed Now To Avoid Poverty and Hunger" Summarysong neeNo ratings yet

- Ratio Analysis 2022Document113 pagesRatio Analysis 2022Shiny JalliNo ratings yet

- Screening Process - Digital Marketing - 9thapril2020Document4 pagesScreening Process - Digital Marketing - 9thapril2020SAURABH SINGHNo ratings yet

- Leistritz Pump TechnologyDocument9 pagesLeistritz Pump Technologykexin behNo ratings yet

- Simon-Kucher SPI LCE SC2 DraftDocument68 pagesSimon-Kucher SPI LCE SC2 DraftHugo CaviedesNo ratings yet

- BB 260822115107935Document7 pagesBB 260822115107935Mahesh PatelNo ratings yet

- Petroleum Industry Act 2021Document253 pagesPetroleum Industry Act 2021multieniyanNo ratings yet

- Claims Arising Under A Construction ContractDocument5 pagesClaims Arising Under A Construction ContracthymerchmidtNo ratings yet

- Lien Form PDFDocument2 pagesLien Form PDFDanielleNo ratings yet

- Attorney's FeeDocument10 pagesAttorney's FeeNivla YacadadNo ratings yet

- ArthikDisha IT Cal FY 2023 24 AY 2024 25Document6 pagesArthikDisha IT Cal FY 2023 24 AY 2024 25SridharNo ratings yet

- Kinh tế quốc tếDocument11 pagesKinh tế quốc tếLy Nguyễn Thị HươngNo ratings yet

- Carrier Capacity and Commitment: Susan Beaver & Caleb Warner July 29, 2013Document20 pagesCarrier Capacity and Commitment: Susan Beaver & Caleb Warner July 29, 2013Jakkana PremNo ratings yet

- Jimma University College of Agriculture and Veterinary MedicineDocument2 pagesJimma University College of Agriculture and Veterinary MedicineÜm Yöñí Åvïd GödNo ratings yet

- File DelDocument280 pagesFile DelCreoNo ratings yet

- CQA Primer 2019 SampleDocument16 pagesCQA Primer 2019 SampleGee100% (1)

- Synopsis On Virtual Shopping MallDocument56 pagesSynopsis On Virtual Shopping MallSourav KumarNo ratings yet

- Do-It-Yourself (DIY)Document8 pagesDo-It-Yourself (DIY)Anas WaseemNo ratings yet

- MIS Reporting Analyst Job - Aegis BPO Malaysia SDN BHD - 3799124 - JobStreetDocument2 pagesMIS Reporting Analyst Job - Aegis BPO Malaysia SDN BHD - 3799124 - JobStreetNur NajihahNo ratings yet

- Executives PDFDocument49 pagesExecutives PDFdharmender singhNo ratings yet

- DN500 Mounting Flange Installation ManualDocument12 pagesDN500 Mounting Flange Installation ManualSreekanthNo ratings yet

- A Report On Organization StudyDocument63 pagesA Report On Organization StudyGowtham KSNo ratings yet

- Strategic Marketing Management MKT-522 Term Paper-Fall 2021 On Value Chain Model of "Shawpno Bangladesh"Document5 pagesStrategic Marketing Management MKT-522 Term Paper-Fall 2021 On Value Chain Model of "Shawpno Bangladesh"Tonmoy Dev PrithuNo ratings yet

- Calgary Cooperative Funeral Services - Business PlanDocument21 pagesCalgary Cooperative Funeral Services - Business PlanastuteNo ratings yet