Professional Documents

Culture Documents

Citizen Charter of City of Manila Treasury

Citizen Charter of City of Manila Treasury

Uploaded by

Johnny CruzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Citizen Charter of City of Manila Treasury

Citizen Charter of City of Manila Treasury

Uploaded by

Johnny CruzCopyright:

Available Formats

CITY TREASURER’S OFFICE

CITIZEN’S CHARTER

2019 (1st Edition)

Manila Citizen’s Charter 120 | P a g e

I. Mandate:

Republic Act No. 409 Section 52 entitled “An Act to Revise the Charter of the City of

Manila and for other purposes:”, states that:

The City Treasurer shall act as chief fiscal officer and financial adviser of the city and

custodian of its funds. He shall exercise the functions of municipal collector of taxes; shall

collect all taxes and assessments due the city, all licenses authorized by law or ordinance,

and all rents due for lands, markets, and other property owned by the city; shall administer

markets and slaughterhouses and shall receive and receipt for all costs, fees, fines, and

forfeitures imposed by the municipal court, from the clerks thereof, and fees collected by

the sheriff or his deputies, or by the justice of the peace. He shall collect all miscellaneous

charges made by the department of engineering and public works and by other

departments of the city government, and all charges made by the city engineer for

inspections, permits, licenses, and the installation, maintenance, and services rendered in

the operation of the private privy system. He shall collect, as deputy of the Collector of

Internal Revenue, by himself or deputies, all taxes and charges imposed by the National

Government, upon property or persons in the City of Manila, depositing daily such

collections in the National Treasury. He shall be accountable for all funds and property of

the city and shall render such accounts in connection therewith as may be prescribed by

the Auditor General. He shall deposit daily all municipal funds and collections in the

National Treasury or in a Government depository.

II. Vision:

The City Treasurer’s Office of Manila aims to be a leading local treasury office in the

country.

III. Mission:

To be a vital partner in sustaining the delivery of basic services to the community through

Manila’s program by generating the much-needed revenues and at the same time

providing reliable, honest, transparent and excellent service that assures full customer

satisfaction towards good governance.

IV. Service Pledge:

a. We are committed to providing excellent service to our taxpayers and stakeholders.

b. We strive to address all clients’ concerns well within the given processing periods

with utmost courtesy and competence.

c. We shall continually improve methods and procedures for prudent fiscal

management and responsive treasury operations.

Manila Citizen’s Charter 121 | P a g e

V. List of Services

Page Number

a. Administrative Division

Receive Incoming/Outgoing Communications 123

Release of Accountable Forms with Money Value 124

Payment of Landed Estate 125

Issuance of Certified True Copies of

Accountable forms issued by bonded officers 126

b. License Division

Generate Statement of Account for Business Tax Due

New Business 127

Renewal of Business 128

Retirement of Permit to Operate Business 129

Computation of Contractor’s for Gen. Building Construction 131

Issuance of Certified True Copy of Business Tax Payment 132

Issuance of Certification (Business) 133

c. Real Estate Division

Real Property Tax Payment 134

Issuance of Certificate of Payment 135

Issuance of Transfer Tax Bill 137

Issuance of Certificate of Payment for

Transfer of Ownership (TCT) 139

Issuance of Tax Credit for Business and Real Property Tax 140

d. Cash Division

Collection of Taxes, Fees and Chargers 141

Payment of Salaries, Wages, allowances and

Other benefits 142

Deposit of Collection 143

Transmittal of supporting documents 144

Manila Citizen’s Charter 122 | P a g e

1. Receive Incoming/Outgoing Communication and Correspondence

Office or Division CTO Administrative Division - Records Section

Classification: Simple

Type of Transaction G2G / G2C

Who may avail Different Government and Private Office / Public

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Communication and Correspondence attachment, if

Requesting Party

any

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

1.Submit letter request

with 1. Record, assign None 10 mins

complete address and control number and

contact number refer to the Division

Chief for classification.

1.1 Refer to concern 10 mins

CTO division/services

for evaluation and

immediate action

1.2. Prepare reply on 6 hours

the action taken by

the division/services

1.3. Record/ Release 5 mins

of communication and

correspondence

1.3. Deliver/mail to the 1 hour

concerned Taxpayer/

Office Division /Dept.

TOTAL None 1 day

Manila Citizen’s Charter 123 | P a g e

2. Release of Accountable Forms with Money Value

Office or Division Administrative Division - Accountable Forms Section

Classification: Simple

Type of Transaction G2G

Who may avail Bonded Accountable Officers

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Requisition and Issue Slip Administrative Division - Accountable Forms Section

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Present duly approved Record and Release None 5 Mins

Requisition Slip Accountable Forms

to Accountable Officer

TOTAL None 5 mins

Manila Citizen’s Charter 124 | P a g e

3. Payment of City Landed Estate (CLE)

Office or Division Administrative Division - Rental Section

Classification: Simple

Type of Transaction G2C

Who may avail Awardees of City Landed Estate (CLE)

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Indorsement from Urban Settlement Office Urban Settlement Office

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Present Indorsement 1.Verify record of Ord. No. 4 mins

from Urban Settlement payment and Issue 8331

Office Order of Payment as amended

2. Proceed to Taxpayers' 2. Accept payment 1 min

Lounge for Payment based on the Order of

Payment & issue OR

3. Return to Rental Section 3. Post payment on 1 min

for posting of payment CLE Awardee index

card

TOTAL 6 mins

Manila Citizen’s Charter 125 | P a g e

4. Issuance of Certified True Copies of Accountable forms issued by bonded Officers

Office or Division Administrative - Records And Accountable Forms Section

Classification: Simple

Type of Transaction G2G / G2C

Who may avail Different Government and Private Office / Public

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Letter Request Taxpaying Public

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Present Letter Request 1. Recd.Letter request Ord. No. 2 mins

and forward to AFS 8331

for issuance of as amended

Order of Payment

2. Proceed to Taxpayers' 2. Accept payment 1 min.

Lounge for Payment based on the Order of

Payment and issue

Official Receipt (OR)

3. Return to Accountable 3.Verify the requested 6 mins and/or

Form Section then present Accountable Forms depending on

OR if available, request the availability

taxpayer to wait. of the requested

if unavailable, issue Accountable

claim slip stating time Forms (i.e.

and date of release (Date Issued/

Date returned)

4. Claim Certified True 4. Released requested 1 min.

Copy of Accountable Form Certified True Copy of

Accountable Forms

10 mins

TOTAL

Manila Citizen’s Charter 126 | P a g e

5. Generate Statement of Account for Business Tax Due (New Business)

Office or Division License Division - Business One Stop Shop (BOSS)

Classification: Simple

Type of Transaction G2B

Who may avail Manila Business Taxpayers

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Application for New Business Bureau of Permits, Manila City Hall

Barangay Certificate Barangay within its territorial jurisdiction.

DTI for single prop/ SEC Registration for Corp DTI or Security and Exchange Commission

Contract of Lease with Lessors Permit Manila Business Taxpayer

Tax Declaration (if owned) Department of Assessment

Real Property Tax updated City Treasurer's Office

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Present Application 1. Received approved Ord. No. 10 mins.

Form for new business application fr Bureau 8331

of Permits and verify as amended

Business Record. If

no previous record of

business, process &

evaluate application

form and issue

Statement of Account

for business Tax and

Order of Payment from

other regulatory fees.

Otherwise, taxpayer is

requested to proceed

to Retirement Section

2. Proceed to Business 2. Accept payment 1 min.

Teller Window based on the State-

ment of Account and

issue Official Receipt

TOTAL

Manila Citizen’s Charter 127 | P a g e

6. Generate Statement of Account for Business Tax Due (Renewal of Business)

Office or Division License Division - Business One Stop Shop (BOSS)

Classification: Simple

Type of Transaction G2B

Who may avail Manila Business Taxpayers

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Application for Renewal of Business Bureau of Permits, Manila City Hall

Barangay Clearance Barangay within its territorial jurisdiction.

VAT Returns Bureau of Internal Revenue / Taxpayer

Schedule of Gross Sales Manila Business Taxpayer

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Present Application 1. Received approved Ord. No. 19 mins.

Form for Renewal of application of Renewal 8331

Business Permit of Business Permit as amended

fr Bureau of Permits

1.1. SOA Preparation-

Evaluation/assessment

and computation

2. Proceed to Business 2. Accept payment 1 min.

Teller Window based on the State-

ment of Account and

issue Official Receipt

TOTAL 20 mins

Manila Citizen’s Charter 128 | P a g e

7. Retirement of Permit to Operate Business

Office or Division License Division - Retirement Unit

Classification: Complex

Type of Transaction G2B

Who may avail Manila Business Taxpayers

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

SINGLE PROPRIETOR

Application for Business Retirement License Division, Retirement Unit

Notarized Application form Notary Public

Current/latest original copy of Mayor's Permit Owner of Business / Bureau of Permits

Current/latest original copy of Official Receipts Owner of Business / CTO-License Div.

Barangay Certificate on the date of closure Barangay within its territorial jurisdiction.

Schedule of Gross Sales/Receipts and Owner of Business

Breakdown of Sales duly certified by

Accountant (2 years)

Photocopy of Audited Financial Statement, Owner of Business / BIR

VAT and Percentage Tax Receipts

Photocopy of Certificate of Registration Owner of Business / DTI

Special Power of Attorney, if representative Owner of Business

FOR CORPORATION/PARTNERSHIP (Addl docs)

Board Resolution for Business Closure Owner of Business / SEC

Copy of Articles of Incorporation / General Owner of Business / SEC

Information Sheet

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

1. Present Application 1. Recd accomplished Ord. No. 10 mins

for Business Retirement Retirement application 8331

together with complete form and check for as amended

documents the completeness of

required documents

submitted. If complete,

issue claim slip

stating date and time

of release of Order of

Payment

1.1 Assign to 3-4 days

inspector for evaluation

Manila Citizen’s Charter 129 | P a g e

computation/verification

(LTOM & IRR of LGC)

1.2 If verified closed,

compute & generate

Statement of Account

If still operational,

business retirement

is DENIED

2. Claim Statement of 2. Accept payment 5 mins

Account and proceed to of Business Retire-

Taxpayers' Lounge for ment Fee and Certi-

Payment fication Fee and

issue Official Receipt

3. Present Original copy 3.1 Preparation of

Official Receipts to Certification and other

Business Retirement Fee pertinent documents.

and Certification Fee 3.2 For signature and 1 day

approval of Business

Retirement by the

OIC License Division

and City Treasurer

4. Claim Certification of 4. Release approved 10 mins

Business Retirement Business Retirement

and Certification with

Control Number

TOTAL 1-7 days

Manila Citizen’s Charter 130 | P a g e

8. Computation of Contractor's Tax for General Building Construction

Office or Division License Division - Miscellaneous Inspection Section

Classification: Simple

Type of Transaction G2B

Who may avail Manila Business Taxpayers

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Reference Slip CEO - Office of the City Building Official

Application Form CEO - Office of the City Building Official

Certified True Copy of Title Register of Deeds

Tax Declaration of Land and Building Department of Assessment

Real Estate Tax Receipts Owner of property/CTO-Real Estate Div.

Deed of Sale / Contract of Lease (if not owned) Owner of Property

Floor Plan Owner of Property

Bill of Materials Owner of Property

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

1. Present accomplished 1. Receive accom- Ord. No. 10 mins.

Reference Slip plished Reference 8331

Slip for the complete- as amended

ness of documents

submitted.

1.1 Evaluate the 3 hours

documents submitted

1.2 Compute assess- 30 mins

ment for Contractors

Tax

1.3 Chief of License 4 hours

Division - recommen-

dation for approval

1.4 City Treasurer 4 hours

approved and signed

computation of

Contractor's Tax

1.5 Generate State- 10 mins

ment of Account

2. Claim Statement of 2. Accept payment 2 mins.

Account and proceed to based on the State-

Taxpayers' Lounge for ment of Account and

Payment issue Official Receipt

TOTAL 3 days

Manila Citizen’s Charter 131 | P a g e

9. Issuance of Certified True Copy of Business Tax Payment

Office or Division License Division - Business Tax Registry (BTR)

Classification: Simple

Type of Transaction G2B / G2G

Who may avail Manila Business Taxpayers and Ombudsman

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

SPA/Authorization from the owner of company, Owner of Company

if representative

Xerox Copy of I.D. of Taxpayer and/or Owner of Company

authorized representative

General Information Sheet and SEC Reg (for corp) Owner of Company / SEC

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Fill-up Application Form 1. Check Application Ord. No. 2 mins

and submit requirements Form, documents 8331

to officer on duty. submitted and issue as amended

Order of Payment

2. Proceed to Taxpayers' 2. Accept payment 1 min.

Lounge for Payment based on the State-

ment of Account and

issue Official Receipt

3. Present original copy 3. Releasing of 2 mins

of Official Receipt to BTR requested documents

TOTAL 5 mins

Manila Citizen’s Charter 132 | P a g e

10. Issuance of Certification (Business)

Office or Division License Division - Business Tax Registry (BTR)

Classification: Simple

Type of Transaction G2B / G2G

Who may avail Taxpaying Public / Bureau of Internal Revenue for no business

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

FOR MEDICAL CERTIFICATE

Medical Certification Hospital of confinement

FOR NO BUSINESS

Letter Request from requesting party Taxpayer

Subpoena Ombudsman

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Fill-up Request Form 1. Check Request Ord. No. 2 mins

and submit requirements Form, documents 8331

to officer on duty. submitted and issue as amended

Order of Payment

2. Proceed to Taxpayers' 2. Accept payment 1 min.

Lounge for Payment based on the State-

ment of Account and

issue Official Receipt

3. Present original copy 3. Releasing of 2 mins

of Official Receipt to BTR requested documents

TOTAL 5 mins

Manila Citizen’s Charter 133 | P a g e

11. Real Property Tax Payments

Real Estate Division (RED) - Billing and Miscellaneous

Office or Division

Section

Classification: Simple

Type of Transaction G2B / G2G

Who may avail Manila Real Property Owners

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Latest Official Receipt RPT Taxpayer / CTO - RED

Tax Declaration to recognize PIN Department of Assessment

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Submit latest copy of 1. Generate State- Ord. No. 5 mins

RPT Official Receipt or ment of Account 8331

Tax Declaration to as amended

recognize PIN

TOTAL 5 mins

Manila Citizen’s Charter 134 | P a g e

12. Issuance of Certificate of Payment

Office or Division Real Estate Division - Tax Registry Section

Classification: Simple

Type of Transaction G2C

Who may avail Manila Real Property Owners

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

FOR MORTGAGE/LOAN/RECORD/LEGAL

Photocopy of RPT Receipts (Current) RPT Taxpayer / CTO-RED

Certified True Copy of Tax Declaration Department of Assessment

Valid ID of owner or authorization for representative RPT Taxpayer

FOR TAX DECLARATION/SEGREGATION

addl. Documents

Photocopy of Certified True Copy of Title Registry of Deeds

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Fill-up application form 1. Received and Ord. No.

for Tax Clearance evaluate submitted 8331

documents. as amended

1,1,Prepare & release

Order of payment for

miscellaneous fees

1.2 Issue claim slip

with due dates as to

release of Tax

Clearance / Cert. of

Payment

1.3. BARANGAY

LEADER- pull-out the

tax registry card and

print Payment History

1.4 TAXROLL CLERK-

Verify, check record

of payments

*with tax deficiency -

Manila Citizen’s Charter 135 | P a g e

required addl payment

1.5. Prepared Certifi-

cate of Payment with

Clearance Number

1.6 For Signature of

Division Chief / Asst.

City Treasurer

2. Claim Certificate of 2. Release Certificate

Payment of Payment

TOTAL

Manila Citizen’s Charter 136 | P a g e

13. Issuance of Transfer Tax Bill

Office or Division Real Estate Division - Tax Registry Section

Classification: Simple

Type of Transaction G2B / G2G

Who may avail Manila Real Property Owners

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

RPT Tax Receipts RPT Taxpayers / CTO-RED

Tax Declaration Department of Assessment

Other documents

Any of the following Taxpayer

Deed of Sale, Deed of Donation, Extrajudicial Settlement,

Deed of Exchange, Deed of Conveyance, Deed of

Assignment,

Affidavit of Consolidation, Affidavit of Self-Adjudication,

Certified True Copy of Title, Special Power of Attorney [SPA],

Secretary Certificate, for the purpose of paying the transfer tax

without surcharge & penalty: [CAR] is allowed to be

submitted later on / to follow.]

upon applying for Transfer Tax Clearance).

FEES

PROCESSING PERSON

CLIENT STEPS AGENCY ACTION TO BE

TIME RESPONSIBLE

PAID

1. Fill-up application form 1. Receive and check Ord. No.

and submit documents all the submitted 8331 as

documents, Issue amended

claim slip stating date

and time of release

1.1 BARANGAY

LEADER - pull out

registry card and

print Payment History

1.2 TAXROLL CLERK-

Review, submitted

documents, check

record of payment,

Assess and prepare

Manila Citizen’s Charter 137 | P a g e

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

Transfer Tax Bill

1.3 DIVISION CHIEF-

Approve/initial and

sign Transfer Tax

Bill

2. Claim Transfer Tax Release Transfer Tax

Bill Bill and Order of

Payment

TOTAL

Manila Citizen’s Charter 138 | P a g e

14. Issuance of Certificate of Payment for Transfer of Ownership (TCT)

Office or Division Real Estate Division - Tax Registry Section

Classification: Simple

Type of Transaction G2C

Who may avail Declared Owners / Representatives Developer / Representatives

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Certificate of Payment CTO - Real Estate Division

Transfer Tax Payment (Official Receipt) Taxpayer / CTO-Real Estate Division

Certificate Authorizing Registration (CAR) Bureau of Internal Revenue

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

1. Fill-up application form, 1. Receive Proof of Ord. No.

Proof of payment and Payment and all 8331

submit documents necessary documents as amended

and assign application

number

1.1. Issue claim slip

with due date as to

release of Tax

Clearance/ Certificate

of Payment

1.2 TAX ROLL CLERK

Review, record

Transfer Tax Payment

on Tax Registry Card

and initial on Cert.

1.3 Prepare Certificate

of Payment

1.4 CITY TREASURER/

DIVISION CHIEF -

Approve and sign

Cert. of Payment

2. Claim Certificate of 2. Release Certificate

Payment for Transfer of of Payment for

Ownership Transfer of

Ownership

Manila Citizen’s Charter 139 | P a g e

15. Issuance of Tax Credit for Business and Real Property Tax

Office or Division Real Estate Division and License Division

Classification: Complex

Type of Transaction G2C / G2B

Who may avail Manila Business Taxpayers and RPT owners

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Request Letter Taxpayer

Taxpayer / CTO - RED for Real Property Tax

CTO - License for Business Tax

FOR BUSINESS TAX

Audited Financial Statement for the year under review Taxpayer / Bureau of Internal Revenue

Quarterly / Monthly VAT for the year under review

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

1. Submit letter request 1. Receive and check None

and present documents documents submitted.

subject for Tax refund Issue claim slip with

date and time of

release of documents

1.1. Verify, check and

review documents

submitted

1.2 If verified with

excess payment,

Issue Tax Credit

Certificate

1.3 If not, request if

Denied

2. Claim Tax Credit for 2. Release Tax Credit

Business and Real for Business and Real

Property Tax Property Tax

Ownership

TOTAL

Manila Citizen’s Charter 140 | P a g e

16. Collection of Taxes, Fees and Charges

Office or Division Cash Division - Collection/Community Tax/Market Section

Classification: Simple

Type of Transaction G2C / G2B

Who may avail Manila Business Taxpayers and RPT owners

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Any of the following:

Statement of Account (SOA) for RPT/BPLS CTO - Real Estate Div or CTO - License Div

Order of Payment (OP) for Miscellaneous and CTO or other offices

other taxes

Information Sheet of Applicant / Tax Declaration CTO - Community Cert Section

for Community Tax Certificate

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Render payment for 1. Accept payment

Business, Real Property based on the State-

Tax, Market Fees, Misc. ment of Account for

and other taxes Business, Real

Property Tax, Market

Fees, Miscellaneous

and other taxes

1.1 Validate SOA/

Order of Payment

1.2 Issue Official

Receipt/Community

Tax Certificate /

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

Cash Ticket

TOTAL

Manila Citizen’s Charter 141 | P a g e

17. Payment of Salaries, wages, allowances and other benefits

Office or Division Cash Division - Disbursement Section and Miscellaneous Section

Classification: Simple

Type of Transaction G2G

Who may avail Officials and Other personnel of the City

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Approved Payroll and/or Disbursement Voucher

FEES TO PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

BE PAID TIME RESPONSIBLE

1. Submit approved payroll CASH PAYMENT None 2-3 days

and/or Disbursement 1. Secure cash (depending on

Voucher for cash payment advance the number of

or check preparation 1.1 Pay salaries, employees in

wages, allowances the payroll)

and other benefits

upon presentation of

valid ID

CHECK PAYMENT None 2-3 days

1. Preparation of (depending on

Check the number of

1.1 For signature of employees in

City Treasurer and the payroll)

City Administrator

1.2 Pay Contractor's

Tax, if applicable

1.3 Releasing of Check

AUTHORIZATION TO None 1 day

DEBIT (ATD)

1. Preparation of

OF ATDs

1.1. For signature of

City Treasurer and

City Administrator

1.2 Bank Validation and

crediting to corresponding

Bank accounts

TOTAL None 2-3 days

Manila Citizen’s Charter 142 | P a g e

18. Deposit of Collection

Office or Division Cash Division - General Teller Section

Classification: Simple

Type of Transaction G2G

Who may avail Tellers, Liquidating Tellers and other accountable Officers

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Report of Collection and Deposit Accountable Officers

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Remit collection together 1. Receive collection None 1 day

with Report of Collection from Tellers/Collectors

and Deposit 1.1 Prepare Deposit

Slip

1.2 BANK - Validate

deposit slip

TOTAL None 1 day

Manila Citizen’s Charter 143 | P a g e

19. Transmittal of supporting documents

Office or Division Cash Division - Miscellaneous Section

Classification: Simple

Type of Transaction G2G

Who may avail Accounting / Commission on Audit

CHECKLIST OF REQUIREMENTS WHERE TO SECURE

Paid Disbursement Voucher and/or Payroll Cash Division

FEES TO BE PROCESSING PERSON

CLIENT STEPS AGENCY ACTION

PAID TIME RESPONSIBLE

1. Submit original and 1. Receive original and None 1-2 days

supporting documents supporting documents depending on

1.1 Prepare Report of the number of

Checks Issued for issued checks

all checks issuance

1.2 Prepare Summary

Report of ATDs for

ATD payments

1.3 Transmit original

and supporting

documents of all

issued checks to

Office of the City

Accountant

TOTAL None 1-2 days

Manila Citizen’s Charter 144 | P a g e

You might also like

- Amendment - Affidavit of UndertakingDocument2 pagesAmendment - Affidavit of UndertakingKDANo ratings yet

- The New Revenue Code of Taguig (PDF Format)Document217 pagesThe New Revenue Code of Taguig (PDF Format)Anonymous cvFhSo67% (3)

- Rmo 21-2000Document15 pagesRmo 21-2000jef comendadorNo ratings yet

- BIR Ruling 456-2011 PDFDocument5 pagesBIR Ruling 456-2011 PDFLianne Carmeli B. FronterasNo ratings yet

- Picpa (Functions)Document18 pagesPicpa (Functions)Rheneir MoraNo ratings yet

- Bir Form No. 1702Document6 pagesBir Form No. 1702Mary Monique Llacuna Lagan100% (1)

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- Audit Report Real Property TaxDocument6 pagesAudit Report Real Property TaxJomar Villena0% (1)

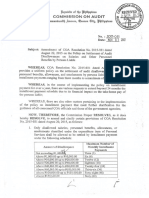

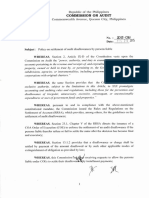

- Com /hssion On Audit: DateDocument3 pagesCom /hssion On Audit: DateAppleSamson100% (2)

- COA Resolution Number 2015-031Document3 pagesCOA Resolution Number 2015-031gutierrez.dorie100% (7)

- Cell Site Ordinance of ValenzuelaDocument5 pagesCell Site Ordinance of ValenzuelaDandolph TanNo ratings yet

- Republic Act No. 9184 For LGUsDocument110 pagesRepublic Act No. 9184 For LGUsNoel PunzalanNo ratings yet

- A Little Princess Folan Miller June 2018Document119 pagesA Little Princess Folan Miller June 2018Aiden Condron100% (1)

- BLGF Opinion Dated August 5Document2 pagesBLGF Opinion Dated August 5Reinier Jeffrey AbdonNo ratings yet

- Local Budget Circular No. 111 - Manual On The Setting Up and Operation of Local Economic Enterprises (Lees)Document3 pagesLocal Budget Circular No. 111 - Manual On The Setting Up and Operation of Local Economic Enterprises (Lees)Glaiza RafaNo ratings yet

- CFA Pakyaw Labor AggrementDocument4 pagesCFA Pakyaw Labor AggrementHafez EddingNo ratings yet

- AOM 2018 InsuranceDocument4 pagesAOM 2018 InsurancemocsNo ratings yet

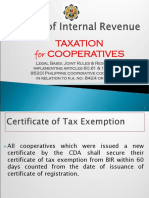

- Taxation For CooperativesDocument27 pagesTaxation For Cooperativesdecember231981No ratings yet

- Guidelines On LGU P4 (Revised)Document79 pagesGuidelines On LGU P4 (Revised)Vincent Bautista100% (3)

- Module 1 - Opinions and RulingsDocument42 pagesModule 1 - Opinions and RulingsElmar Perez BlancoNo ratings yet

- HGC 2015 - Notes To Financial StatementsDocument34 pagesHGC 2015 - Notes To Financial StatementsDeborah DelfinNo ratings yet

- CD Cover 2316 RR 2-2015 Annex BDocument1 pageCD Cover 2316 RR 2-2015 Annex BAndriana ArtiagaNo ratings yet

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- Bautista BTF Elcac Opcen EoDocument2 pagesBautista BTF Elcac Opcen EojomarNo ratings yet

- Reviewer in Local GovernmentDocument36 pagesReviewer in Local GovernmentNiles Adam C. RevillaNo ratings yet

- MOOg 45-64Document72 pagesMOOg 45-64Zeniah Arizo100% (1)

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- CONTRACT of LEASE Blank TemplateDocument2 pagesCONTRACT of LEASE Blank Templateronald ramosNo ratings yet

- IRR Leyte Investment Code of 2004Document22 pagesIRR Leyte Investment Code of 2004Ramil M PerezNo ratings yet

- Form 1945 - Application For Certificate of Tax Exemption For CooperativesDocument4 pagesForm 1945 - Application For Certificate of Tax Exemption For CooperativesDarryl Jay Medina100% (1)

- BRIEFER On MANDANAS CASEDocument3 pagesBRIEFER On MANDANAS CASERed TuazonNo ratings yet

- Dar Letter of RequestDocument1 pageDar Letter of RequestVictoria BonanzaNo ratings yet

- SBMA - Business Registration Application PDFDocument6 pagesSBMA - Business Registration Application PDFfallingobjectNo ratings yet

- Proforma-Recon of SCBA and SFPDocument3 pagesProforma-Recon of SCBA and SFPdianajeanbucuNo ratings yet

- Annex B - Post-Evaluation Guide FormDocument8 pagesAnnex B - Post-Evaluation Guide Formrheign plantasNo ratings yet

- Authority To SellDocument2 pagesAuthority To SellEthel Andico MalabananNo ratings yet

- Tax Alert BIR Ruling 142-2011Document3 pagesTax Alert BIR Ruling 142-2011Ia Bolos0% (1)

- Tax Compliance MonitoringDocument44 pagesTax Compliance MonitoringAcademe100% (2)

- The Revised Makati Revenue Code City Ordinance No. 2004-A-025Document3 pagesThe Revised Makati Revenue Code City Ordinance No. 2004-A-025marmiedyanNo ratings yet

- Joint Venture Agreement - BWSI and LGU 30 August 2022Document28 pagesJoint Venture Agreement - BWSI and LGU 30 August 2022MVSNo ratings yet

- 7 Sure-Ways To Cancel Bir Letters of Authority Internal Revenue ServiceDocument3 pages7 Sure-Ways To Cancel Bir Letters of Authority Internal Revenue ServiceDante Bauson JulianNo ratings yet

- SAOR 2015 Additional AOM DO ZDNDocument9 pagesSAOR 2015 Additional AOM DO ZDNrussel1435No ratings yet

- DBM Dilg Joint Memorandum Circular No 2021 1 Dated August 11 2021Document56 pagesDBM Dilg Joint Memorandum Circular No 2021 1 Dated August 11 2021Tristan Lindsey Kaamiño AresNo ratings yet

- Checklist of Documentary Requirements - Issuance by BIR of CARDocument1 pageChecklist of Documentary Requirements - Issuance by BIR of CARLRMNo ratings yet

- Bir RulingDocument4 pagesBir Rulingdranreb ursabiaNo ratings yet

- RR 2-98Document85 pagesRR 2-98restless11No ratings yet

- Routing SlipDocument12 pagesRouting SlipSean Palacpac-ResurreccionNo ratings yet

- HBN 4125 (Ease of Paying Taxes)Document21 pagesHBN 4125 (Ease of Paying Taxes)DonaldDeLeonNo ratings yet

- Warrant of Levy On Real Property TaxDocument1 pageWarrant of Levy On Real Property TaxRhestie IlaganNo ratings yet

- 05 ConceptsonQRRPADocument20 pages05 ConceptsonQRRPARochelle Balincongan LapuzNo ratings yet

- Local Revenue Generation and LGU ForecastingDocument17 pagesLocal Revenue Generation and LGU ForecastingRichard Mendez100% (1)

- RA 7160 Situs of The Tax - IRRDocument71 pagesRA 7160 Situs of The Tax - IRRErnie F. CanjaNo ratings yet

- 2018 - COA-Audited-Financial Statements PDFDocument66 pages2018 - COA-Audited-Financial Statements PDFAnna Marie AlferezNo ratings yet

- Accounting and Business ServicesDocument1 pageAccounting and Business ServicesJam UsmanNo ratings yet

- Waiver of Pre-Emptive RightsDocument5 pagesWaiver of Pre-Emptive RightscamileholicNo ratings yet

- Agra Lgu PPP CodeDocument36 pagesAgra Lgu PPP CodeRain Rivera RamasNo ratings yet

- Cancellation of Encumbrance Sec 7 Ra 26 - Google SearchDocument2 pagesCancellation of Encumbrance Sec 7 Ra 26 - Google Searchbatusay575No ratings yet

- AOM NO. 01-Unserviceable PPEDocument3 pagesAOM NO. 01-Unserviceable PPERagnar LothbrokNo ratings yet

- 16 Citizen's Charter Maria Aurora Aurora 2019 1st EditionDocument27 pages16 Citizen's Charter Maria Aurora Aurora 2019 1st EditionAntonio V. RanqueNo ratings yet

- Citizen Charter April 2023Document25 pagesCitizen Charter April 2023Parody CentralNo ratings yet

- Command Area Development by Using FAO Cropwat 8.0 Model and Impact of Climate Change On Crop Water Requirement-A Case Study On Araniar Reservoir Basin (Pichatur Dam)Document14 pagesCommand Area Development by Using FAO Cropwat 8.0 Model and Impact of Climate Change On Crop Water Requirement-A Case Study On Araniar Reservoir Basin (Pichatur Dam)Jonathan QuirozNo ratings yet

- B.tech Chem Lab ManualDocument40 pagesB.tech Chem Lab Manualsushil joshiNo ratings yet

- Hydro-Weight Master Indicator System: Service ManualDocument39 pagesHydro-Weight Master Indicator System: Service ManualAbdallah ElhendyNo ratings yet

- 1 CertDocument1 page1 CertWan Hakim Wan YaacobNo ratings yet

- All Dealers Username Password 8 6Document1,754 pagesAll Dealers Username Password 8 6Rajeswar Rayapati75% (4)

- Enhancing Efficiency and Reliability: Automation of Oil Desalination and Dehydration ProcessDocument14 pagesEnhancing Efficiency and Reliability: Automation of Oil Desalination and Dehydration ProcessYunusov ZiyodulloNo ratings yet

- Infant BathingDocument2 pagesInfant BathingAira SantosNo ratings yet

- ECGBiometricsMACS13 Sumair v5 ResearchGateDocument7 pagesECGBiometricsMACS13 Sumair v5 ResearchGatearlikaNo ratings yet

- TSX Cusb485Document2 pagesTSX Cusb485AurellioNo ratings yet

- Operator'S Manual: 9 In. Band SawDocument26 pagesOperator'S Manual: 9 In. Band SawMustafa KutanisNo ratings yet

- Galcon Manual UsuarioDocument65 pagesGalcon Manual Usuariopedro1981No ratings yet

- Pulse in The Stomach - Could It Be An Abdominal Aortic AneurysmDocument3 pagesPulse in The Stomach - Could It Be An Abdominal Aortic AneurysmLazar VučetićNo ratings yet

- Blastocystis HominisDocument25 pagesBlastocystis HominisRO Sa RioNo ratings yet

- How To Guide Developing A Customer Focused Quality Improvement Plan TRACC 3616Document18 pagesHow To Guide Developing A Customer Focused Quality Improvement Plan TRACC 3616Salih Erdem100% (1)

- Villaflor, Jesus Jr. O 2019-30506Document5 pagesVillaflor, Jesus Jr. O 2019-30506Jesus Villaflor Jr.No ratings yet

- Unit 4 HandoutsDocument8 pagesUnit 4 HandoutsRegan rautNo ratings yet

- 6.1 Differential Calculus 01 Solutions.pDocument1 page6.1 Differential Calculus 01 Solutions.pGerard VillonesNo ratings yet

- Emergency ProceduresDocument19 pagesEmergency ProceduresMilos Kalember100% (1)

- FusionServer Tools V2R2 Umate User Guide 21Document340 pagesFusionServer Tools V2R2 Umate User Guide 21Mwenya Scot MusondaNo ratings yet

- Alkaloid Grupo-1Document6 pagesAlkaloid Grupo-1BRENDA MARYSABEL ESTEBAN HUARINo ratings yet

- Marie Rochelle - Dangerous BetDocument4 pagesMarie Rochelle - Dangerous BetPaulette Jones50% (2)

- Zhengjue KAC User Manual - Toshiba Air ConditionerDocument10 pagesZhengjue KAC User Manual - Toshiba Air ConditionerAS Simple AutmationNo ratings yet

- Travel Motivations and State of DevelopmentDocument6 pagesTravel Motivations and State of Developmentphuong anh phamNo ratings yet

- Most Expensive Watch Brands 2024Document5 pagesMost Expensive Watch Brands 2024norahughes162No ratings yet

- (Download PDF) Pastoral Theology and Care Critical Trajectories in Theory and Practice First Edition Ramsay Online Ebook All Chapter PDFDocument42 pages(Download PDF) Pastoral Theology and Care Critical Trajectories in Theory and Practice First Edition Ramsay Online Ebook All Chapter PDFsarah.bronk892100% (11)

- Annex 1 - Preparation of GMP Report - ASPECT FinalDocument4 pagesAnnex 1 - Preparation of GMP Report - ASPECT FinalVõ Phi TrúcNo ratings yet

- Check Manual: ES SeriesDocument42 pagesCheck Manual: ES SeriesArturo CalderonNo ratings yet

- GEMs of Heaven - GOD's Eternal Memory StonesDocument5 pagesGEMs of Heaven - GOD's Eternal Memory StonesswijcomNo ratings yet

- The Objectives Behind The Opening of Insurance SectorDocument12 pagesThe Objectives Behind The Opening of Insurance SectortsrajanNo ratings yet