Professional Documents

Culture Documents

Chlor Alkali Industry in India Status

Chlor Alkali Industry in India Status

Uploaded by

VM OOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chlor Alkali Industry in India Status

Chlor Alkali Industry in India Status

Uploaded by

VM OCopyright:

Available Formats

Point of View

Chlor-alkali industry in India – status, shortcomings and

strategy

The chlor-alkali industry – producing caustic soda, chlorine, soda ash and a few other related products – is an important

segment of the chemical industry, providing inputs that go into a diverse range of industrial and consumer goods. The industry does

not grab headlines as the petrochemical and pharmaceutical industries do, and in times when self-reliance is all the talk, it is notable

for meeting most of India’s needs. The industry does operate under a threat of cheaper imports, but given inputs at competitive prices

and the right policy support, it can stand up to the heat.

A recent publication brought out by the Alkali Manufacturers Association of India (AMAI), which counts all of the producing units

amongst its members, highlights market trends for the industry’s main products. Thorough documentation of this kind is rare in the

chemical industry, though it is made easier by the fact that the chlor-alkali industry is a homogenous one, in which the issues facing

an unit, are usually those of all.

Build-up of capacity

The caustic soda/chlorine segment of the industry has nearly 30-odd companies of varying sizes, and has seen significant invest-

ments over the last few years. Installed capacity for caustic soda (and concomitantly that for chlorine, which is co-produced in an

unalterable ratio) has grown at a CAGR of 7.8% between FY16 and FY20 – rising from 33.7-ltpa (lakh tonnes per annum) to 45.44-ltpa.

Operating rates have hovered in the low- to mid-80% range for much of the recent past, and is, more often than not, limited by the

offtake of chlorine (more on this later). About 60% of the total new capacity in the last two years have been in western India, where

the broader chemical industry is mostly located. Overall, Gujarat accounts for about 55% of the total installed capacity for caustic soda.

Limited exports

The industry’s market focus is largely domestic, and historically only 3-5% of total production is exported (mainly as flakes). But

exports have been growing in the last six years (with the exception of FY19). Much of it are to the countries of Africa, where the

chemical industry is undeveloped and caustic soda flakes are needed to make basic goods such as soaps, as well as for textile pro-

cessing. Smaller quantities go to some of the South East Asian countries, notably Vietnam, Indonesia and Myanmar. In FY19, export

earnings of the industry were about US$105-mn.

Threat of imports & measures to combat it

The industry does, however, operate under the constant threat of cheap imports, though in the recent past these have been miti-

gated to some extent. Since 2015-16, when imports peaked to attain a share of nearly 17% of domestic consumption of caustic soda,

there has been a steady decline both in the quantity imported and as a share of domestic requirements. In FY19, imports reached a

low of about 235-kt – roughly 6.5% of the domestic requirement – but there has been a sharp uptick in FY20 to about 375-kt, repre-

senting about 10% of domestic consumption. In the current year, a Covid-related contraction in demand is expected to take a toll on

the industry in the form of reduced operating rates, and the spectre of cheap imports from overseas producers desperate to sell their

wares has re-emerged. Supplies are now coming in at prices of $250 per tonne, from $400 prior to the pandemic, and this will put

margins under pressure for producers here.

If the imports have been curbed in the past, it was due a few initiatives taken by the industry. For one, as mentioned earlier, the

industry has raised capacity over the last few years, and now has more than enough to meet domestic needs. The AMAI has also

been active in combating predatory imports by seeking the imposition of anti-dumping duties (ADDs). These now exist on imports

from China and South Korea, but will lapse in November, unless extended. The association is also lobbying to impose ADDs on imports

from Japan, UAE, Iran and Qatar, and filed a plea this August.

Some non-tariff measures have also helped to rein in imports. For one, imports are now restricted to membrane-grade product,

to the exclusion of mercury and diaphragm cell based alkali. More importantly, certification by the Bureau of Indian Standards (BIS)

is needed for any importer who wishes to operate in the domestic market.

The country-wise analysis of imports has lessons for the impacts Free Trade Agreements (FTAs) can have on the domestic industry.

Chemical Weekly October 20, 2020 85

Point of View

For the last five years, Japan has been the dominant supplier of caustic soda to India, largely due its FTA with India, which enables

caustic soda to come in at concessional basic customs duty (0.7% till April 1, 2021, going down to zero thereafter, compared to

7.5% for other countries). It also helps that producers in Japan (and in South East Asia, in general), have a logistical advantage when

shipping caustic soda lye to the east coast of India to meet the needs of the sizeable alumina industry there.

Fragmented consumption base

The major outlets for caustic soda in India are in textiles (21% share), alumina (12%), for making inorganic chemicals (13%), pulp

& paper (8%) and soaps & detergents (7%). Aside from alumina and pulp & paper, the demand is fragmented and widely dispersed,

which makes for expensive logistics to cater to it. Consequently, a sizeable portion of it is met through trade channels.

Much of the alumina capacity is located in the east coast, which does not have much of a chemical industry that can serve as a

sink for chlorine. This poses a challenge for any new caustic soda capacity created in the region to meet incremental demand from the

alumina sector. The best work-around to this is the setting up of a large-scale integrated polyvinyl chloride (PVC) plant at Paradeep,

integrated to, or in partnership with, the refinery operated by Indian Oil Corporation (IOC) at that location. IOC has ambitious plans for

its petrochemicals business and an integrated vinyls project, involving the manufacture of ethylene dichloride (EDC) and vinyl chloride

(VCM), using ethylene from the refiner, should form part of the scheme for the site.

Such a project will have twin benefits: it will put the demand-supply for chlorine, at least for the region, on a more even keel;

and also meet India’s growing demand for PVC resin. Indian imports of the polymer were a staggering 19.16-lt in FY20, far above the

domestic production of 15.14-lt, making India the world’s largest importer. This is an unsustainable situation that should be corrected

immediately by investments in world-scale plants for the polymer and its raw materials.

In the absence of a sizeable vinyl sink, chlorine demand in India is very different from the rest of the world. Uses such as chlorinated

paraffin wax, organic & inorganic chemicals, and chloromethanes account for a large chunk of the demand. The industry is also forced

to convert a significant portion – about 18% – of its chlorine to low value hydrochloric acid (HCl) by reacting it with hydrogen, which

is co-produced in its plants.

The hydrogen utilisation pattern of the industry has only now has begun to receive more attention. Close to 40% of the hydrogen

produced is captively used as a fuel in boilers or in the caustic soda fusion plants, and about 28% is converted to HCl. A higher ‘chemical

value’ is obtained for only the remaining 30%, either by captive consumption (for e.g., to make hydrogen peroxide) or by sale to third

party in a compressed form (for use in hydrogenation plants).

A related issue that needs deliberation is the HCl generation by consumers of chlorine. More often than not, only one atom in a

molecule of chlorine (which has two) is utilised, and the other comes out as HCl. The quantum of HCl thus generated is substantial,

and, at times, contaminated with impurities. The worrying fact is that there is no clear assessment of how much is generated and

what is being done to it. Regulators are now insisting that companies generating HCl in their processes outline a utilisation strategy

for it when seeking environmental approvals, but there is a big gap between promise and practice, and a large portion of waste HCl

is unaccounted for. While this is not the chlor-alkali industry’s problem per se, it will have repercussions!

Policy measures

There are some things the government can do to improve the lot of the industry. Power sector reforms are at the top of the

industry’s ask, as electric power is a major cost component for the industry, accounting for about 60% of manufacturing costs. Nearly

87% of the installed capacity for caustic soda is now based on captively produced power (CPP) (usually from coal-fired plants), as it

is cheaper than grid power, which on average costs the industry Rs. 7.36 per kWh. But levies, cesses and other taxes add to the cost

of CPP also and there is need for rationalisation of these, especially in Gujarat, home to 55% of the industry’s capacity.

Fair value for all products – key to sustained competitiveness

The economics of manufacturing chlor-alkali products requires that fair value is obtained for each of the products made in the

membrane cell. But, historically, the industry has focussed on the market for caustic soda and the utilisation of chlorine and hydrogen

has suffered. Correcting this is key to raising overall competitiveness, and enable the industry combat the threat of imports on its

own strengths, rather than depend on externalities in the form of tariff and non-tariff barriers.

Ravi Raghavan

86 Chemical Weekly October 20, 2020

You might also like

- JM Financial On PCBL - Initiating Coverage - 15.11.2023Document40 pagesJM Financial On PCBL - Initiating Coverage - 15.11.2023VM ONo ratings yet

- Unpaid Unclaimed Dividend IEPF-1Document33 pagesUnpaid Unclaimed Dividend IEPF-1VM ONo ratings yet

- KOHLER Mobile GeneratorDocument8 pagesKOHLER Mobile GeneratorRizki Heru HermawanNo ratings yet

- Petrochemicals - A SWOT AnalysisDocument2 pagesPetrochemicals - A SWOT AnalysisShwet KamalNo ratings yet

- Chemical Petrochemical SectorDocument6 pagesChemical Petrochemical SectorKu RatheeshNo ratings yet

- Indian Soda Ash Industry: Recent Developments & Industry OutlookDocument5 pagesIndian Soda Ash Industry: Recent Developments & Industry OutlookAtanu MukherjeeNo ratings yet

- Indian Aluminium IndustryDocument6 pagesIndian Aluminium IndustryAmrisha VermaNo ratings yet

- Building C1 Value Chains in Partnership Mode: Point of ViewDocument2 pagesBuilding C1 Value Chains in Partnership Mode: Point of Viewsumit6singhNo ratings yet

- Financial Analysis of Chlor-Alkali IndustryDocument33 pagesFinancial Analysis of Chlor-Alkali IndustryAakash Sharma100% (1)

- Case - Salvo ChemicalDocument12 pagesCase - Salvo ChemicalsabihaNo ratings yet

- ColursDocument4 pagesColursKamlesh SoniwalNo ratings yet

- Confederation of Indian IndustryDocument12 pagesConfederation of Indian IndustryMuthu Kumar RNo ratings yet

- 1foundry Status at National and International Level - Prof. UADDocument11 pages1foundry Status at National and International Level - Prof. UADrushabhkhotNo ratings yet

- Assignment 4Document7 pagesAssignment 4Yash DNo ratings yet

- Consolidated Sectors Report.Document68 pagesConsolidated Sectors Report.Neeraj PartetyNo ratings yet

- PEST Analysis of IOCDocument4 pagesPEST Analysis of IOCArpkin_love100% (3)

- Kanoria Chemicals & Industries LTD: Key Financial IndicatorsDocument4 pagesKanoria Chemicals & Industries LTD: Key Financial IndicatorsPradeep MunnaNo ratings yet

- India Chlor Alkali 2023Document4 pagesIndia Chlor Alkali 2023pinitNo ratings yet

- Indian Chlor-Alkali IndustryDocument31 pagesIndian Chlor-Alkali IndustryKu RatheeshNo ratings yet

- Prospect and Challenges of Basic Chemicals Industries in BangladeshDocument7 pagesProspect and Challenges of Basic Chemicals Industries in BangladeshAsiful IslamNo ratings yet

- Supply Demand Scenario of Organic Chemicals in IndiaDocument26 pagesSupply Demand Scenario of Organic Chemicals in IndiaShadab KhanNo ratings yet

- India Petrochemicals Report - Q1 2013Document5 pagesIndia Petrochemicals Report - Q1 2013ranamalay26No ratings yet

- B2B Scenario in Petrochemical IndustryDocument6 pagesB2B Scenario in Petrochemical IndustryDayaNo ratings yet

- We Live in An Era Where Chemicals and Petrochemicals Have Become Integral Part of Daily LivesDocument17 pagesWe Live in An Era Where Chemicals and Petrochemicals Have Become Integral Part of Daily LivesmegakiranNo ratings yet

- wg11 Chemical PDFDocument93 pageswg11 Chemical PDFNishi TaraiNo ratings yet

- Report 1Document2 pagesReport 1Ketan PoddarNo ratings yet

- Paper Presentation On Developing Supply Chain Management Stratergy For Indian Foundry SectorDocument14 pagesPaper Presentation On Developing Supply Chain Management Stratergy For Indian Foundry SectorGaurao WarungaseNo ratings yet

- Equity Report - RILDocument6 pagesEquity Report - RILAbhay ThakurNo ratings yet

- Feature 10306Document3 pagesFeature 10306Vandana PVNo ratings yet

- Reliance Industries Limted Company AnalysisDocument10 pagesReliance Industries Limted Company AnalysisDivya Prakash MishraNo ratings yet

- A Great Valuation Play Where Commodity Business Is A Cash CowDocument29 pagesA Great Valuation Play Where Commodity Business Is A Cash Cowgullapalli123No ratings yet

- India Forging 2004Document9 pagesIndia Forging 2004Talib KhanNo ratings yet

- The Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryDocument6 pagesThe Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryVishakh KrishnanNo ratings yet

- Liquid Energy of Cane in IndiaDocument7 pagesLiquid Energy of Cane in Indiaphanis9No ratings yet

- Industry Analysis Report Inorganic Chemicals IndustryDocument35 pagesIndustry Analysis Report Inorganic Chemicals Industrybalaji bysani100% (1)

- Group01 - End Term ProjectDocument35 pagesGroup01 - End Term ProjectSiddharth GuptaNo ratings yet

- Project Report: Submitted To: Submitted byDocument31 pagesProject Report: Submitted To: Submitted byKunwar PrinceNo ratings yet

- Ailing Indian PVC IndustryDocument5 pagesAiling Indian PVC IndustryCharu SharmaNo ratings yet

- Fulfiling Promise of India's Manufacturing SectorDocument10 pagesFulfiling Promise of India's Manufacturing SectorVishal BalaniNo ratings yet

- M&aDocument17 pagesM&aHetal GadhviNo ratings yet

- Polyamide MRKT IndiaDocument14 pagesPolyamide MRKT IndiagautamahujaNo ratings yet

- Prospect and Challenges of Basic Chemicals Industries in BangladeshDocument1 pageProspect and Challenges of Basic Chemicals Industries in BangladeshCH1253No ratings yet

- Indian Oil CoorporationDocument38 pagesIndian Oil CoorporationGheethu Maria JoyNo ratings yet

- Valves Market SizeDocument5 pagesValves Market Sizehimanshu_bjNo ratings yet

- Detergent Alkylates - World Markets To 2025 ProspectusDocument27 pagesDetergent Alkylates - World Markets To 2025 ProspectusRafflesia GroupNo ratings yet

- Hindalco - Novelis Acquisition: AbstractDocument14 pagesHindalco - Novelis Acquisition: AbstractVikas DiwanNo ratings yet

- Sadaf Anwer-20222-31588 - TPFMDocument25 pagesSadaf Anwer-20222-31588 - TPFMsadaf.anwerNo ratings yet

- Pretochemical Swot AnalysisDocument2 pagesPretochemical Swot AnalysisMamtha MNo ratings yet

- Hindalco-Novelis AcquisitionDocument8 pagesHindalco-Novelis AcquisitionAkashdeep SahNo ratings yet

- Aluminium Industry AnalysisDocument5 pagesAluminium Industry AnalysisManish AgarwalNo ratings yet

- Uses of Sulphuric Acid in Manufacturing of Caprolactum Used in Synthesis of NylonDocument4 pagesUses of Sulphuric Acid in Manufacturing of Caprolactum Used in Synthesis of NylonmastmonaNo ratings yet

- Kenil Jugal - Specialty ChemicalsDocument42 pagesKenil Jugal - Specialty ChemicalsKENIL MEHTANo ratings yet

- A Sustainable Integration Approach of CHDocument20 pagesA Sustainable Integration Approach of CHyoussef.hassaniNo ratings yet

- Sintex Industries Companyanalysis92384293424Document16 pagesSintex Industries Companyanalysis92384293424Vijay Gohil100% (1)

- PetrochemicalsDocument25 pagesPetrochemicalsNilton Rosenbach Jr100% (1)

- Chapter-1: Part A: About Industry Part B: Company Profile Part C: About The TopicDocument56 pagesChapter-1: Part A: About Industry Part B: Company Profile Part C: About The TopicTuhin RoyNo ratings yet

- Indian Polymer Industry OutlookDocument9 pagesIndian Polymer Industry OutlookHappy RoxNo ratings yet

- Balco. Vicky. Project Optimation of Product MixDocument67 pagesBalco. Vicky. Project Optimation of Product Mixvicky_rock00007No ratings yet

- The Chlor-Alkali Industry and Chemical IndustryDocument15 pagesThe Chlor-Alkali Industry and Chemical IndustryDeepugopalakrishnan100% (1)

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- COVID-19 and Energy Sector Development in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Energy Sector Development in Asia and the Pacific: Guidance NoteNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Deferred Taxes v1Document7 pagesDeferred Taxes v1VM ONo ratings yet

- B&K Trinity India - Post Conference NotesDocument490 pagesB&K Trinity India - Post Conference NotesVM ONo ratings yet

- shh0332 - 0Document725 pagesshh0332 - 0VM ONo ratings yet

- Revision Worksheet Class 6Document4 pagesRevision Worksheet Class 6VM ONo ratings yet

- AmbitAM Newsletter NovemberDocument12 pagesAmbitAM Newsletter NovemberVM ONo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

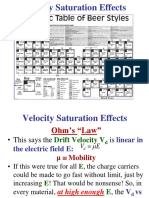

- Transport4 - High Electric Fields - Velocity SaturationDocument16 pagesTransport4 - High Electric Fields - Velocity SaturationMạnh Huy BùiNo ratings yet

- Diamond V ChakrabartyDocument7 pagesDiamond V ChakrabartyIndiraNo ratings yet

- L216B FEN 80306 1mmDocument2 pagesL216B FEN 80306 1mmThierry CouleauNo ratings yet

- Lesson Plan Thanksgiving and HalloweenDocument2 pagesLesson Plan Thanksgiving and Halloweenapi-298974620No ratings yet

- Sidha ArtheritesDocument9 pagesSidha ArtheritesSundara VeerrajuNo ratings yet

- SAT Score Report: Your Total Score Essay ScoresDocument2 pagesSAT Score Report: Your Total Score Essay ScoresMateo LundenNo ratings yet

- Alaris™ PK Syringe Pump: Directions For UseDocument50 pagesAlaris™ PK Syringe Pump: Directions For UseSalim AloneNo ratings yet

- The CockroachDocument4 pagesThe Cockroachnatalie100% (1)

- Research Paper On Drip Irrigation PDFDocument7 pagesResearch Paper On Drip Irrigation PDFafnhkvmnemelfx100% (1)

- Installation and Upgrade Guide: Access Manager Appliance 4.4Document84 pagesInstallation and Upgrade Guide: Access Manager Appliance 4.4anon_443133443No ratings yet

- ASLH-D (S) B 48 NZDSF (A20SA 53 - 7,3) : Optical Ground Wire (OPGW)Document1 pageASLH-D (S) B 48 NZDSF (A20SA 53 - 7,3) : Optical Ground Wire (OPGW)AHMED YOUSEFNo ratings yet

- ManagmentDocument91 pagesManagmentHaile GetachewNo ratings yet

- Addisonia Color Illustr and Popular Descriptions of Plants v05 1920Document109 pagesAddisonia Color Illustr and Popular Descriptions of Plants v05 1920Sitio KayapoNo ratings yet

- Scale Up of KG Final Version of NarrativeDocument50 pagesScale Up of KG Final Version of NarrativeBenjamin AgyareNo ratings yet

- Front Axle & SteeringDocument130 pagesFront Axle & Steeringjstdoma /No ratings yet

- Anti AIDS HerbsDocument6 pagesAnti AIDS Herbskhansa maryamNo ratings yet

- Camacho2007 PDFDocument24 pagesCamacho2007 PDFFabianOmarValdiviaPurizacaNo ratings yet

- Getting Started With Flurry Analytics Sample ChapterDocument20 pagesGetting Started With Flurry Analytics Sample ChapterPackt PublishingNo ratings yet

- English NotesDocument16 pagesEnglish NotesNerin MichaelNo ratings yet

- Lesson 19 (Structure - Incomplete or Missing Participial Phrases)Document3 pagesLesson 19 (Structure - Incomplete or Missing Participial Phrases)fadhilah projectNo ratings yet

- 1Q03 Lab1 Time CapsuleDocument2 pages1Q03 Lab1 Time Capsule2487601343No ratings yet

- ALH - Video Hub - Level3 - Worksheets - AnswerkeyDocument3 pagesALH - Video Hub - Level3 - Worksheets - AnswerkeyJulliana SantosNo ratings yet

- Dynamic Lateral Support On The Dynamic Seat, FunctionDocument1 pageDynamic Lateral Support On The Dynamic Seat, FunctionMaksNo ratings yet

- Getting Started With Kubernetes - Sample ChapterDocument22 pagesGetting Started With Kubernetes - Sample ChapterPackt Publishing100% (1)

- 21ST Century - Week 1 4Document39 pages21ST Century - Week 1 4jsudjdbrhdjfNo ratings yet

- Orinoco Training PlanDocument14 pagesOrinoco Training PlanAnand Raj DasNo ratings yet

- MNP Porting Process Guidelines 280410Document34 pagesMNP Porting Process Guidelines 280410Qais KaisraniNo ratings yet

- Hyperion 2 PDFDocument1 pageHyperion 2 PDFAbhishek Gite100% (1)

- Long-Term Planning Template: Ordering and Structuring TeachingDocument6 pagesLong-Term Planning Template: Ordering and Structuring TeachingNandini Raj100% (1)