Professional Documents

Culture Documents

Chapter 9 Case Question Finance Solved

Chapter 9 Case Question Finance Solved

Uploaded by

Owais Khan KhattakCopyright:

Available Formats

You might also like

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Lincoln SportDocument8 pagesLincoln SportArtiar AnjaniNo ratings yet

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- IFRS 9 - ECL ModelDocument38 pagesIFRS 9 - ECL ModelAntreas Artemiou50% (2)

- Brita CaseDocument2 pagesBrita CasePraveen Abraham100% (1)

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- NP EX19 9b JinruiDong 2Document10 pagesNP EX19 9b JinruiDong 2Ike DongNo ratings yet

- Q21 SolutionDocument2 pagesQ21 Solutionneeldholakia27No ratings yet

- Team Kingdom of Mesopotamia - Round 1Document4 pagesTeam Kingdom of Mesopotamia - Round 1KapishNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Ms. Excel International Brews: Income StatementDocument9 pagesMs. Excel International Brews: Income StatementAphol Joyce MortelNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- Cost Analysis FinalDocument7 pagesCost Analysis Finalmuneem.hasaniNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Quant Methods ToolsDocument54 pagesQuant Methods ToolsRonNo ratings yet

- Allied Sugar CompanyDocument9 pagesAllied Sugar CompanyFurqanTariqNo ratings yet

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- my np hwDocument5 pagesmy np hwyewjun14No ratings yet

- Spreadsheet ModellingDocument33 pagesSpreadsheet ModellingSecond FloorNo ratings yet

- Q4 2010 Quarterly EarningsDocument15 pagesQ4 2010 Quarterly EarningsAlexia BonatsosNo ratings yet

- Category Assumptions Name Category Price - Min. Price - Max. Volume Year 1Document6 pagesCategory Assumptions Name Category Price - Min. Price - Max. Volume Year 1Evert TrochNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- Real EstateDocument8 pagesReal EstatenguyentrantoquynhtqNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- F - Valuation template-POSTED - For Replicate WITHOUT FORMULASDocument4 pagesF - Valuation template-POSTED - For Replicate WITHOUT FORMULASSunil SharmaNo ratings yet

- Capitulo 7Document19 pagesCapitulo 7thalibritNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- Q22 SolutionDocument2 pagesQ22 Solutionneeldholakia27No ratings yet

- Data Driven Decision Making - Course 3 Scenario Analysis Student WorkbookDocument5 pagesData Driven Decision Making - Course 3 Scenario Analysis Student WorkbookSharys Mea MaglasangNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- She DianeDocument4 pagesShe DianeShenna Mae LibradaNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Document4 pagesProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioNo ratings yet

- Review Spreadsheet - FrancieleDocument6 pagesReview Spreadsheet - FrancieleIkramNo ratings yet

- Excel To Business Analys ExamDocument15 pagesExcel To Business Analys Examrhea23aNo ratings yet

- PepperTea P&LDocument2 pagesPepperTea P&Lstock marketNo ratings yet

- Student Names Student Id Test 1 Test 2 Test 3 Final Internal Assesment Final GradeDocument12 pagesStudent Names Student Id Test 1 Test 2 Test 3 Final Internal Assesment Final GradeThùy DungNo ratings yet

- Homework FinanceDocument1 pageHomework FinanceMai PhamNo ratings yet

- Economic Engineering - Solution Chapter 9Document19 pagesEconomic Engineering - Solution Chapter 9ScribdTranslationsNo ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- Swimskin Inc.: ParametersDocument25 pagesSwimskin Inc.: ParametersAbhijeet singhNo ratings yet

- Case Study - Caribbean Internet CaféDocument7 pagesCase Study - Caribbean Internet CaféANo ratings yet

- Income Statement: New Customers Average OrderDocument11 pagesIncome Statement: New Customers Average OrderSheena Rose AbadNo ratings yet

- Ex1 Sensitivity AnalysisDocument21 pagesEx1 Sensitivity AnalysisP MarpaungNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- Foxrun S Deck Pitch 1626400315Document9 pagesFoxrun S Deck Pitch 1626400315choong PohNo ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Cost Breakdown YTD OctDocument1 pageCost Breakdown YTD OctBreckenridge Grand Real EstateNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Pakistan StudiesDocument9 pagesPakistan StudiesOwais Khan KhattakNo ratings yet

- Relation 1 FQC SpssDocument3 pagesRelation 1 FQC SpssOwais Khan KhattakNo ratings yet

- M.Alam 12567Document4 pagesM.Alam 12567Owais Khan KhattakNo ratings yet

- BInary, Octal, HexaDocument6 pagesBInary, Octal, HexaOwais Khan KhattakNo ratings yet

- Cost Accounting Questions Chapter 5Document7 pagesCost Accounting Questions Chapter 5Owais Khan KhattakNo ratings yet

- Akansha Topani - No ShortcutsDocument3 pagesAkansha Topani - No Shortcutsakansha topaniNo ratings yet

- Suitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisDocument8 pagesSuitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisAlazar DestaNo ratings yet

- Double Taxation ReliefDocument10 pagesDouble Taxation ReliefJeeva Antony VictoriaNo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Module 2-3Document9 pagesModule 2-3Rizwan FaridNo ratings yet

- Time Value of Money 8Document11 pagesTime Value of Money 8Debi PrasadNo ratings yet

- Slavery in The Roman Empire: Alex Grigoriou 2ADocument5 pagesSlavery in The Roman Empire: Alex Grigoriou 2AAlex GrigoriouNo ratings yet

- Project On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre DivisionDocument52 pagesProject On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre Divisiondave_sourabhNo ratings yet

- Foreign Exchange Market: Presentation OnDocument19 pagesForeign Exchange Market: Presentation OnKavya lakshmikanthNo ratings yet

- The Budgeting Process and Budget Trends in The National Government of The PhilippinesDocument60 pagesThe Budgeting Process and Budget Trends in The National Government of The PhilippinestentenNo ratings yet

- Revitalization of City Core: Petta Zone, BangaloreDocument57 pagesRevitalization of City Core: Petta Zone, BangaloreArchiesivan22No ratings yet

- Annual Work Accident - Illness Exposure Data ReportDocument1 pageAnnual Work Accident - Illness Exposure Data ReportJon Allan Buenaobra100% (1)

- Pcpar Backflush Costing and JitDocument2 pagesPcpar Backflush Costing and Jitdoora keysNo ratings yet

- Central Bank Circular No. 905: General ProvisionsDocument6 pagesCentral Bank Circular No. 905: General ProvisionsRaezel Louise VelayoNo ratings yet

- OD119185277796277000Document4 pagesOD119185277796277000Awadhesh PalNo ratings yet

- Enhancing Malaysian Public Sector Transparency and Accountability Lessons and IssuesDocument14 pagesEnhancing Malaysian Public Sector Transparency and Accountability Lessons and IssuesSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Tata-Digital-India-Fun0 2222233333333Document42 pagesTata-Digital-India-Fun0 2222233333333yasirNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- Chapter 3 Marginal Analisys For Optimal DecisionsDocument20 pagesChapter 3 Marginal Analisys For Optimal DecisionsNadeen ZNo ratings yet

- Credit RatingDocument2 pagesCredit RatingSumesh MirashiNo ratings yet

- I To B Ok AssignmentDocument4 pagesI To B Ok AssignmentHashim MalikNo ratings yet

- Taxation Midterm Exam With Answer KeyDocument25 pagesTaxation Midterm Exam With Answer Keychelissamaerojas100% (1)

- MVE Individual AssignmentDocument2 pagesMVE Individual AssignmentRishiRevanthNo ratings yet

- Repayment Notification 123583047 2014-12-16Document2 pagesRepayment Notification 123583047 2014-12-16MiguelThaxNo ratings yet

- GNFC Neem Project - The Ecosystem of Shared ValueDocument15 pagesGNFC Neem Project - The Ecosystem of Shared ValueIsha AggNo ratings yet

- JitDocument15 pagesJitYashovardhan MaheshwariNo ratings yet

- Cheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935Document6 pagesCheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935MarkNo ratings yet

Chapter 9 Case Question Finance Solved

Chapter 9 Case Question Finance Solved

Uploaded by

Owais Khan KhattakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9 Case Question Finance Solved

Chapter 9 Case Question Finance Solved

Uploaded by

Owais Khan KhattakCopyright:

Available Formats

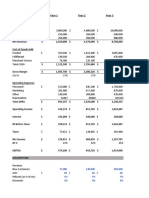

particulars

Amount spent on prototype $ (750,000.00)

Amount spent on study $ (200,000.00)

Variable Cost per Unit $ 185.00

Fixed Costs $ 5,300,000.00

Sales Price per phone $ 480.00

Equipment $ 38,500,000.00

Equipment Salvage Value $ 5,400,000.00 If Conch Republic does not introduce the new smart phone

Net Working Capital 20%

Corportate Tax Rate 35% Year 1

Required Return 12% (74000*480)-(15000*310)-[(80000-15000)*($310-$275)] 28595000

Estimating sales Volume 30870000 - 2275000 33,145,000.00

Year Amount sold price Total Sales net sales 28595000

1 $ 74,000.00 $ 480.00 $ 35,520,000.00 $2,275,000 $ 2,375,000.00 $ 6,925,000.00

2 $ 95,000.00 $ 480.00 $ 45,600,000.00 2275000 $ 43,325,000.00 $ 33,145,000.00 Year 2

3 $ 125,000.00 $ 480.00 $ 60,000,000.00 (95000*480)-(15000*310)-[(60000-15000)*($310-$275)]

4 $ 105,000.00 $ 480.00 $ 50,400,000.00

5 $ 80,000.00 $ 480.00 $ 38,400,000.00 40950000 - 2275000

Sales based on MACRS Depreciation 38675000

Year Beggin Book Value Decreciation % Depreciation Ending Book Value

1 $ 38,500,000.00 14% $ 5,501,650.00 $ 32,998,350.00 (74000*360)-(15000*290)-[(80000-15000)*(290-255)]

2 $ 32,998,350.00 24% $ 9,351,650.00 $ 23,646,700.00 22290000 2275000 20015000

3 $ 23,646,700.00 17% $ 6,733,650.00 $ 16,913,050.00

4 $ 16,913,050.00 12% $ 4,808,650.00 $ 12,104,400.00

5 $ 12,104,400.00 9% $ 3,438,050.00 $ 8,666,350.00 #NAME?

$ 29,833,650.00

Income Statement

Year 1 Year 2 Year 3 Year 4 Year 5

Sales $ 28,595,000.00 $ 39,375,000.00 $ 60,000,000.00 $ 50,400,000.00 $ 38,400,000.00

Variable Cost $ 13,690,000.00 $ 17,575,000.00 $ 23,125,000.00 $ 19,425,000.00 $ 14,800,000.00

Fixed Costs $ 5,300,000.00 $ 5,300,000.00 $ 5,300,000.00 $ 5,300,000.00 $ 5,300,000.00

Depreciation $ 5,501,650.00 $ 9,351,650.00 $ 6,733,650.00 $ 4,808,650.00 $ 3,438,050.00

EBIT $ 4,103,350.00 $ 7,148,350.00 $ 24,841,350.00 $ 20,866,350.00 $ 14,861,950.00

Taxes $ 1,436,172.50 $ 2,501,922.50 $ 8,694,472.50 $ 7,303,222.50 $ 5,201,682.50

Net Income $ 2,667,177.50 $ 4,646,427.50 $ 16,146,877.50 $ 13,563,127.50 $ 9,660,267.50

Changes Net Working Capital

Year 1 Year 2 Year 3 Year 4 Year 5

Beginning $ - $ 5,719,000.00 $ 7,875,000.00 $ 12,000,000.00 $ 10,080,000.00

Ending $ 5,719,000.00 $ 7,875,000.00 $ 12,000,000.00 $ 10,080,000.00 $ 7,680,000.00

NWC Cash Flow $ (5,719,000.00) $ (2,156,000.00) $ (4,125,000.00) $ 1,920,000.00 $ 2,400,000.00

Opperating Cash Flow

Year 1 Year 2 Year 3 Year 4 Year 5

Opperating Cash Flow $ 8,168,827.50 $ 13,998,077.50 $ 22,880,527.50 $ 18,371,777.50 $ 13,098,317.50

After Tax Salvage Value

Macrs depreciation value $ 8,666,350.00

Actual Salvage Value $ 5,400,000.00

The difference $ 3,266,350.00 Since positive the company depreciated too slow

Taxes $ 1,143,222.50

Taxed Salvage value $ 2,123,127.50

Projected Total Cash Flow

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Operating Cash Flow $ 8,168,827.50 $ 13,998,077.50 $ 22,880,527.50 $ 18,371,777.50 $ 13,098,317.50

Changes in NWC $ (5,719,000.00) $ (2,156,000.00) $ (4,125,000.00) $ 1,920,000.00 $ 2,400,000.00

Capital spending $ (38,500,000.00) $ 2,123,127.50

Total Projected Cash Flows $ (38,500,000.00) $ 2,449,827.50 $ 11,842,077.50 $ 18,755,527.50 $ 20,291,777.50 $ 17,621,445.00

Cumulative cash flow $ (38,500,000.00) $ (36,050,172.50) $ (24,208,095.00) $ (5,452,567.50) $ 14,839,210.00 $ 32,460,655.00

Total Projected Cash Flows

Year Amount

0 $ (38,500,000.00)

1 $ 2,449,827.50

2 $ 11,842,077.50

3 $ 18,755,527.50

4 $ 20,291,777.50

5 $ 17,621,445.00

You might also like

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Lincoln SportDocument8 pagesLincoln SportArtiar AnjaniNo ratings yet

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- IFRS 9 - ECL ModelDocument38 pagesIFRS 9 - ECL ModelAntreas Artemiou50% (2)

- Brita CaseDocument2 pagesBrita CasePraveen Abraham100% (1)

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- NP EX19 9b JinruiDong 2Document10 pagesNP EX19 9b JinruiDong 2Ike DongNo ratings yet

- Q21 SolutionDocument2 pagesQ21 Solutionneeldholakia27No ratings yet

- Team Kingdom of Mesopotamia - Round 1Document4 pagesTeam Kingdom of Mesopotamia - Round 1KapishNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Ms. Excel International Brews: Income StatementDocument9 pagesMs. Excel International Brews: Income StatementAphol Joyce MortelNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- Cost Analysis FinalDocument7 pagesCost Analysis Finalmuneem.hasaniNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Quant Methods ToolsDocument54 pagesQuant Methods ToolsRonNo ratings yet

- Allied Sugar CompanyDocument9 pagesAllied Sugar CompanyFurqanTariqNo ratings yet

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- my np hwDocument5 pagesmy np hwyewjun14No ratings yet

- Spreadsheet ModellingDocument33 pagesSpreadsheet ModellingSecond FloorNo ratings yet

- Q4 2010 Quarterly EarningsDocument15 pagesQ4 2010 Quarterly EarningsAlexia BonatsosNo ratings yet

- Category Assumptions Name Category Price - Min. Price - Max. Volume Year 1Document6 pagesCategory Assumptions Name Category Price - Min. Price - Max. Volume Year 1Evert TrochNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- Real EstateDocument8 pagesReal EstatenguyentrantoquynhtqNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- F - Valuation template-POSTED - For Replicate WITHOUT FORMULASDocument4 pagesF - Valuation template-POSTED - For Replicate WITHOUT FORMULASSunil SharmaNo ratings yet

- Capitulo 7Document19 pagesCapitulo 7thalibritNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- Q22 SolutionDocument2 pagesQ22 Solutionneeldholakia27No ratings yet

- Data Driven Decision Making - Course 3 Scenario Analysis Student WorkbookDocument5 pagesData Driven Decision Making - Course 3 Scenario Analysis Student WorkbookSharys Mea MaglasangNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- She DianeDocument4 pagesShe DianeShenna Mae LibradaNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Document4 pagesProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioNo ratings yet

- Review Spreadsheet - FrancieleDocument6 pagesReview Spreadsheet - FrancieleIkramNo ratings yet

- Excel To Business Analys ExamDocument15 pagesExcel To Business Analys Examrhea23aNo ratings yet

- PepperTea P&LDocument2 pagesPepperTea P&Lstock marketNo ratings yet

- Student Names Student Id Test 1 Test 2 Test 3 Final Internal Assesment Final GradeDocument12 pagesStudent Names Student Id Test 1 Test 2 Test 3 Final Internal Assesment Final GradeThùy DungNo ratings yet

- Homework FinanceDocument1 pageHomework FinanceMai PhamNo ratings yet

- Economic Engineering - Solution Chapter 9Document19 pagesEconomic Engineering - Solution Chapter 9ScribdTranslationsNo ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- Swimskin Inc.: ParametersDocument25 pagesSwimskin Inc.: ParametersAbhijeet singhNo ratings yet

- Case Study - Caribbean Internet CaféDocument7 pagesCase Study - Caribbean Internet CaféANo ratings yet

- Income Statement: New Customers Average OrderDocument11 pagesIncome Statement: New Customers Average OrderSheena Rose AbadNo ratings yet

- Ex1 Sensitivity AnalysisDocument21 pagesEx1 Sensitivity AnalysisP MarpaungNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- Foxrun S Deck Pitch 1626400315Document9 pagesFoxrun S Deck Pitch 1626400315choong PohNo ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Cost Breakdown YTD OctDocument1 pageCost Breakdown YTD OctBreckenridge Grand Real EstateNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Pakistan StudiesDocument9 pagesPakistan StudiesOwais Khan KhattakNo ratings yet

- Relation 1 FQC SpssDocument3 pagesRelation 1 FQC SpssOwais Khan KhattakNo ratings yet

- M.Alam 12567Document4 pagesM.Alam 12567Owais Khan KhattakNo ratings yet

- BInary, Octal, HexaDocument6 pagesBInary, Octal, HexaOwais Khan KhattakNo ratings yet

- Cost Accounting Questions Chapter 5Document7 pagesCost Accounting Questions Chapter 5Owais Khan KhattakNo ratings yet

- Akansha Topani - No ShortcutsDocument3 pagesAkansha Topani - No Shortcutsakansha topaniNo ratings yet

- Suitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisDocument8 pagesSuitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisAlazar DestaNo ratings yet

- Double Taxation ReliefDocument10 pagesDouble Taxation ReliefJeeva Antony VictoriaNo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Module 2-3Document9 pagesModule 2-3Rizwan FaridNo ratings yet

- Time Value of Money 8Document11 pagesTime Value of Money 8Debi PrasadNo ratings yet

- Slavery in The Roman Empire: Alex Grigoriou 2ADocument5 pagesSlavery in The Roman Empire: Alex Grigoriou 2AAlex GrigoriouNo ratings yet

- Project On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre DivisionDocument52 pagesProject On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre Divisiondave_sourabhNo ratings yet

- Foreign Exchange Market: Presentation OnDocument19 pagesForeign Exchange Market: Presentation OnKavya lakshmikanthNo ratings yet

- The Budgeting Process and Budget Trends in The National Government of The PhilippinesDocument60 pagesThe Budgeting Process and Budget Trends in The National Government of The PhilippinestentenNo ratings yet

- Revitalization of City Core: Petta Zone, BangaloreDocument57 pagesRevitalization of City Core: Petta Zone, BangaloreArchiesivan22No ratings yet

- Annual Work Accident - Illness Exposure Data ReportDocument1 pageAnnual Work Accident - Illness Exposure Data ReportJon Allan Buenaobra100% (1)

- Pcpar Backflush Costing and JitDocument2 pagesPcpar Backflush Costing and Jitdoora keysNo ratings yet

- Central Bank Circular No. 905: General ProvisionsDocument6 pagesCentral Bank Circular No. 905: General ProvisionsRaezel Louise VelayoNo ratings yet

- OD119185277796277000Document4 pagesOD119185277796277000Awadhesh PalNo ratings yet

- Enhancing Malaysian Public Sector Transparency and Accountability Lessons and IssuesDocument14 pagesEnhancing Malaysian Public Sector Transparency and Accountability Lessons and IssuesSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Tata-Digital-India-Fun0 2222233333333Document42 pagesTata-Digital-India-Fun0 2222233333333yasirNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- Chapter 3 Marginal Analisys For Optimal DecisionsDocument20 pagesChapter 3 Marginal Analisys For Optimal DecisionsNadeen ZNo ratings yet

- Credit RatingDocument2 pagesCredit RatingSumesh MirashiNo ratings yet

- I To B Ok AssignmentDocument4 pagesI To B Ok AssignmentHashim MalikNo ratings yet

- Taxation Midterm Exam With Answer KeyDocument25 pagesTaxation Midterm Exam With Answer Keychelissamaerojas100% (1)

- MVE Individual AssignmentDocument2 pagesMVE Individual AssignmentRishiRevanthNo ratings yet

- Repayment Notification 123583047 2014-12-16Document2 pagesRepayment Notification 123583047 2014-12-16MiguelThaxNo ratings yet

- GNFC Neem Project - The Ecosystem of Shared ValueDocument15 pagesGNFC Neem Project - The Ecosystem of Shared ValueIsha AggNo ratings yet

- JitDocument15 pagesJitYashovardhan MaheshwariNo ratings yet

- Cheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935Document6 pagesCheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935MarkNo ratings yet