Professional Documents

Culture Documents

202 - FM Question Paper

202 - FM Question Paper

Uploaded by

sumedh narwadeCopyright:

Available Formats

You might also like

- Corporate Finance-AssignmentDocument4 pagesCorporate Finance-AssignmentAssignment HelperNo ratings yet

- Building Lean Building BIMDocument420 pagesBuilding Lean Building BIMCristhian A. S.B.No ratings yet

- CASE STUDY - Political GlobalizationDocument5 pagesCASE STUDY - Political GlobalizationMichaela CatacutanNo ratings yet

- Brita CaseDocument2 pagesBrita CasePraveen Abraham100% (1)

- MTP_FM ECO_Aug18_Oct18_Mar19_Apr19_Oct19_May20_Oct20_Oct21_Nov21Document158 pagesMTP_FM ECO_Aug18_Oct18_Mar19_Apr19_Oct19_May20_Oct20_Oct21_Nov21sersdrNo ratings yet

- (2008 Pattern) PDFDocument231 pages(2008 Pattern) PDFKundan DeoreNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- FM QPDocument18 pagesFM QPjpkassociates2019No ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

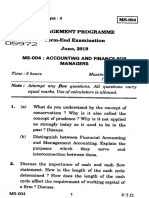

- Management Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersDocument4 pagesManagement Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Output PDFDocument81 pagesOutput PDFPravin ThoratNo ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- 6thSem-FM-Model QP by Puja Gupta -26Apr2020Document20 pages6thSem-FM-Model QP by Puja Gupta -26Apr2020sujitdey405No ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- Mba Ii Sem. Prelim Exam SUBJECT: Financial Management: Roll NoDocument4 pagesMba Ii Sem. Prelim Exam SUBJECT: Financial Management: Roll NoAkash raiNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- Inter_FMSM_MTP2_Document16 pagesInter_FMSM_MTP2_renudevi06081973No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Afm 2810001 May 2018Document4 pagesAfm 2810001 May 2018PILLO PATELNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- MBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021Document6 pagesMBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021subhasis mahapatraNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument29 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisEFRETNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- IFRS - 2019 - Solved QPDocument14 pagesIFRS - 2019 - Solved QPSharan ReddyNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- s6 Bcom Tax 2020 Regular - SupplyDocument33 pagess6 Bcom Tax 2020 Regular - SupplylekshmissavpmNo ratings yet

- FM (2nd) May2019 PDFDocument2 pagesFM (2nd) May2019 PDFJohnNo ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- 203-Hrm-Notes - Unit 2Document20 pages203-Hrm-Notes - Unit 2sumedh narwadeNo ratings yet

- PFP Assingmnet Unit 1Document1 pagePFP Assingmnet Unit 1sumedh narwadeNo ratings yet

- Assignment 1 - CFM - 12-7-22Document3 pagesAssignment 1 - CFM - 12-7-22sumedh narwadeNo ratings yet

- Important Questions - Unit 3 To 5Document6 pagesImportant Questions - Unit 3 To 5sumedh narwadeNo ratings yet

- Fmbo CH 5Document17 pagesFmbo CH 5sumedh narwadeNo ratings yet

- Assignment 5 - 1st YearDocument3 pagesAssignment 5 - 1st Yearsumedh narwadeNo ratings yet

- Fmbo Unit 4 Part 2Document16 pagesFmbo Unit 4 Part 2sumedh narwadeNo ratings yet

- Theatre ProjectDocument20 pagesTheatre Projectsumedh narwadeNo ratings yet

- Assingmnet Unit 2 BRMDocument1 pageAssingmnet Unit 2 BRMsumedh narwadeNo ratings yet

- Assignment 2 - CFM - 12-7-22Document3 pagesAssignment 2 - CFM - 12-7-22sumedh narwadeNo ratings yet

- Asean Integration 2015: Challenges and Opportunities For EducatorsDocument19 pagesAsean Integration 2015: Challenges and Opportunities For EducatorsButch CrisostomoNo ratings yet

- Maceda Vs Energy Regulatory BoardDocument15 pagesMaceda Vs Energy Regulatory BoardJan Igor GalinatoNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- MRP-I and MRP-IIDocument24 pagesMRP-I and MRP-IIakhil pillaiNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect PlusDocument2 pagesIllustration For Your HDFC Life Click 2 Protect Plusbommakanti.shivaNo ratings yet

- Practical Problems: Lustration 1 After 8Document4 pagesPractical Problems: Lustration 1 After 8Kiran Kumar KBNo ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- Analisa BEADocument20 pagesAnalisa BEATest AccountNo ratings yet

- Question 1061345Document11 pagesQuestion 1061345rocking guys yoNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Chapter 2 - Retail Strategic Planning and Operations ManagementDocument23 pagesChapter 2 - Retail Strategic Planning and Operations ManagementCedrick LabaoskiNo ratings yet

- 21-01-21 Siang Bahan Paparan BIM - Herry VazaDocument33 pages21-01-21 Siang Bahan Paparan BIM - Herry Vazaeryanto mrNo ratings yet

- Sub Order LabelsDocument10 pagesSub Order Labelsblack LoveNo ratings yet

- ICICI ProjectDocument90 pagesICICI ProjectSrusti ParekhNo ratings yet

- Taxation Midterm Exam With Answer KeyDocument25 pagesTaxation Midterm Exam With Answer Keychelissamaerojas100% (1)

- HEC Consulting Club - Cas Electric Mall ScootersDocument6 pagesHEC Consulting Club - Cas Electric Mall Scootersethan cohenNo ratings yet

- The Role of Gender and Women's Leadership in Water GovernanceDocument10 pagesThe Role of Gender and Women's Leadership in Water GovernanceADBGADNo ratings yet

- The Strength and Weaknesses of Each The Competitor's Products and ServicesDocument8 pagesThe Strength and Weaknesses of Each The Competitor's Products and ServicesEden Dela CruzNo ratings yet

- ValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04ChittaNo ratings yet

- Sample 1 Bakery Business PlanDocument18 pagesSample 1 Bakery Business PlanJohn Leric Dela MercedNo ratings yet

- Syllabus CPM DiplomaDocument6 pagesSyllabus CPM DiplomaGirman ranaNo ratings yet

- Chapter 1 - DDocument26 pagesChapter 1 - DSujani MaarasingheNo ratings yet

- 9 Steps To Overcome Competition in Retail BusinessDocument3 pages9 Steps To Overcome Competition in Retail BusinessMarina IvanNo ratings yet

- 485 BRIEF Assignment 1Document3 pages485 BRIEF Assignment 1Duyên MaiNo ratings yet

202 - FM Question Paper

202 - FM Question Paper

Uploaded by

sumedh narwadeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

202 - FM Question Paper

202 - FM Question Paper

Uploaded by

sumedh narwadeCopyright:

Available Formats

F. Y.

Master in Business Administration (Semester - II)

202: Financial Management (2019 Pattern)

SET- A

Time: 2 ½ Hours] [Max. Marks: 50]

_____________________________________________________________________________

Instructions to the candidates:-

1) Assume Suitable Data if necessary.

2) Black figures to the right indicate full marks.

3) All Questions are compulsory.

4) All questions have internal options.

Q1. Attempt any five questions

1. Which of the following is not a function of a finance manager?

a) Financial analysis & interpretation b) Determining financial needs

c) Working capital management. d) Manipulate share price of the company.

2. Key strategies of financial management are ___________.

a) Investment strategy b) Financial strategy c) Dividend strategy d) All of these.

3. The management of current assets is known as _______________

a) Current assets b) Working Capital Mgt. c) Both (a) & (b) d) None of these.

4. Cost of issuing new shares to the public is known as :________________.

a) Cost of equity b) Cost of Capital c) Flotation cost d) Marginal cost

5. Operating leverage arises because of ______________

a) Fixed cost of Production b) Fixed interest cost c) Variable cost d) None of these.

6. Cash inflows arise from ________ assets, __________liabilities, and _____________

stock holders’ equity.

a) Increasing; increasing; decreasing b) increasing ; decreasing ; decreasing c)

decreasing; increasing; increasing d) decreasing ; increasing; decreasing.

7. Financial management is concerned with the issues involved in __________ &

____________ of funds.

a) raising & allocation b) acquisition & allocation c) procurement & allocation

d) raising & acquisition

8. __________ decision relates to the appropriation of profits earned.

a) Investment b) Finance c) Dividend d) All of these.

Q2. Attempt any 2 questions.

Q1. State the objectives of Financial Management.

Q2. State the difference between operating & financial leverage.

Q3. Discuss the different sources of finance.

Q4. Explain in detail the process of capital budgeting.

Q3. A Proforma cost sheet of a company provides the following particulars:

Elements of cost Amount per unit

Raw material 80

Direct labour 30

Overheads 60

Total cost 170

Profit 30

Selling price 200

The following further particulars are available:

a. Raw materials are in stock for one month

b. Credit allowed by supplier is one month

c. Credit allowed to customers is two months

d. Lag in payment of wages 1½ weeks

e. Lag is payment of overheads one month

f. Materials are in process for an average of half month (50% to be considered for

labor and other overheads)

g. Finished goods are in stock for an average of one month

h. ¼ output is sold against cash

i. Cash in hand and at bank is expected to be Rs.25, 000.

Prepare working capital needed to finance a level of activity of 1, 04,000 units of product.

You may assume that production is carried on evenly throughout the year. Wages and overheads

accrue similarly and a period of 4 weeks is equivalent to a month.

OR

Q3. In considering the most desirable capital structure for a company, the following estimates of

the cost of debt and equity capital ( after tax) have been made a various levels of debt-equity

mix:

Debt as percentage of total Cost of Debt Cost of Equity

capital employed (%) (%)

0 5.0 12.0

10 5.0 12.0

20 5.0 12.5

30 5.5 13.0

40 6.0 14.0

50 6.5 16.0

60 7.0 20.0

You are required to determine the optimal debt-equity mix for the company by calculating

composite cost of capital.

Q4. A Co. is considering an investment proposal to install new milling control. The Project

will cost Rs 50,000. The facility has a life expectancy of 5 years and no Salvage Value. The

Company tax rate is 35%. The firm uses straight line depreciation. The estimated Profit before

tax from the propose investment proposal are as follows:

Year Profit before Depreciation

(Rs)

1 10,000

2 11,000

3 14,000

4 15,000

5 25,000

Compute:

1. ARR

2. Payback period

3. NPV @ 15%

4. PI @15%

OR

Q4. A company is contemplating to raise additional fund of Rs. 20, 00,000 for setting up a

project. The company expects, EBIT of Rs. 8,00,000 from the project. Following

alternative plans are available:

(a) To raise Rs. 20,00,000 by way of equity share of Rs. 10 each

(b) To raise Rs. 10,00,000 by way of equity shares and Rs. 10,00,000 by way of

debt @ 10%.

(c) To raise Rs. 6, 00,000 by way of equity and rest Rs. 14, 00,000 by way of

preferences shares @ 14%.

(d) To raise Rs. 6,00,000 by equity shares

Rs. 6, 00,000 by 10% equity

Rs. 8, 00,000 by 14% Preference shares

The company is in 60% tax bracket which option is best?

Q5. From the following Balance Sheet, prepare Comparative Balance Sheet of Sun Ltd.:

Particulars 31st March, 2019 31st March, 2018

(Rs) (Rs)

I. EQUITY AND LIABILITIES

1. Shareholder's Funds

(a) Share Capital 3,50,000 3,00,000

2. Non-Current Liabilities

Long-term Borrowings 1,00,000 2,00,000

3. Current Liabilities :

Trade Payables 1,50,000 1,00,000

Total 6,00,000 6,00,000

II. ASSETS

1. Non-Current Assets

Fixed Assets (Tangible) 4,00,000 3,00,000

2. Current Assets

Trade Receivables 2,00,000 3,00,000

Total 6,00,000 6,00,000

OR

Q5. Using the following information, complete the Balance sheet of XYZ ltd.

Long- term debt to net worth 0.5 to 1

Total Assets Turnover 2.5 times

Average collection period ½ months

Inventory turnover 9 times

Gross profit margin 10%

Acid test ratio 1:1

Balance Sheet of XYZ Ltd.,

As on 31ST DECEMBER, 2020

Liabilities Rs. Assets Rs.

Equity Share Capital 1,00,000 Fixed Assets -

Retained Earnings 1,00,000 Inventory -

Long –term debt - Debtors -

Creditors - Cash -

F. Y. Master in Business Administration (Semester - II)

202: Financial Management (2019 Pattern)

SET- B

Time: 2 ½ Hours] [Max. Marks: 50]

_____________________________________________________________________________

Instructions to the candidates:-

1) Assume Suitable Data if necessary.

2) Black figures to the right indicate full marks.

3) All Questions are compulsory.

4) All questions have internal options

Q1. Attempt any five questions

You might also like

- Corporate Finance-AssignmentDocument4 pagesCorporate Finance-AssignmentAssignment HelperNo ratings yet

- Building Lean Building BIMDocument420 pagesBuilding Lean Building BIMCristhian A. S.B.No ratings yet

- CASE STUDY - Political GlobalizationDocument5 pagesCASE STUDY - Political GlobalizationMichaela CatacutanNo ratings yet

- Brita CaseDocument2 pagesBrita CasePraveen Abraham100% (1)

- MTP_FM ECO_Aug18_Oct18_Mar19_Apr19_Oct19_May20_Oct20_Oct21_Nov21Document158 pagesMTP_FM ECO_Aug18_Oct18_Mar19_Apr19_Oct19_May20_Oct20_Oct21_Nov21sersdrNo ratings yet

- (2008 Pattern) PDFDocument231 pages(2008 Pattern) PDFKundan DeoreNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- FM QPDocument18 pagesFM QPjpkassociates2019No ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- Management Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersDocument4 pagesManagement Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Output PDFDocument81 pagesOutput PDFPravin ThoratNo ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- 6thSem-FM-Model QP by Puja Gupta -26Apr2020Document20 pages6thSem-FM-Model QP by Puja Gupta -26Apr2020sujitdey405No ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- Mba Ii Sem. Prelim Exam SUBJECT: Financial Management: Roll NoDocument4 pagesMba Ii Sem. Prelim Exam SUBJECT: Financial Management: Roll NoAkash raiNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- Inter_FMSM_MTP2_Document16 pagesInter_FMSM_MTP2_renudevi06081973No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Afm 2810001 May 2018Document4 pagesAfm 2810001 May 2018PILLO PATELNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- MBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021Document6 pagesMBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021subhasis mahapatraNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument29 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisEFRETNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- IFRS - 2019 - Solved QPDocument14 pagesIFRS - 2019 - Solved QPSharan ReddyNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- s6 Bcom Tax 2020 Regular - SupplyDocument33 pagess6 Bcom Tax 2020 Regular - SupplylekshmissavpmNo ratings yet

- FM (2nd) May2019 PDFDocument2 pagesFM (2nd) May2019 PDFJohnNo ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- 203-Hrm-Notes - Unit 2Document20 pages203-Hrm-Notes - Unit 2sumedh narwadeNo ratings yet

- PFP Assingmnet Unit 1Document1 pagePFP Assingmnet Unit 1sumedh narwadeNo ratings yet

- Assignment 1 - CFM - 12-7-22Document3 pagesAssignment 1 - CFM - 12-7-22sumedh narwadeNo ratings yet

- Important Questions - Unit 3 To 5Document6 pagesImportant Questions - Unit 3 To 5sumedh narwadeNo ratings yet

- Fmbo CH 5Document17 pagesFmbo CH 5sumedh narwadeNo ratings yet

- Assignment 5 - 1st YearDocument3 pagesAssignment 5 - 1st Yearsumedh narwadeNo ratings yet

- Fmbo Unit 4 Part 2Document16 pagesFmbo Unit 4 Part 2sumedh narwadeNo ratings yet

- Theatre ProjectDocument20 pagesTheatre Projectsumedh narwadeNo ratings yet

- Assingmnet Unit 2 BRMDocument1 pageAssingmnet Unit 2 BRMsumedh narwadeNo ratings yet

- Assignment 2 - CFM - 12-7-22Document3 pagesAssignment 2 - CFM - 12-7-22sumedh narwadeNo ratings yet

- Asean Integration 2015: Challenges and Opportunities For EducatorsDocument19 pagesAsean Integration 2015: Challenges and Opportunities For EducatorsButch CrisostomoNo ratings yet

- Maceda Vs Energy Regulatory BoardDocument15 pagesMaceda Vs Energy Regulatory BoardJan Igor GalinatoNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- MRP-I and MRP-IIDocument24 pagesMRP-I and MRP-IIakhil pillaiNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect PlusDocument2 pagesIllustration For Your HDFC Life Click 2 Protect Plusbommakanti.shivaNo ratings yet

- Practical Problems: Lustration 1 After 8Document4 pagesPractical Problems: Lustration 1 After 8Kiran Kumar KBNo ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- Analisa BEADocument20 pagesAnalisa BEATest AccountNo ratings yet

- Question 1061345Document11 pagesQuestion 1061345rocking guys yoNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Chapter 2 - Retail Strategic Planning and Operations ManagementDocument23 pagesChapter 2 - Retail Strategic Planning and Operations ManagementCedrick LabaoskiNo ratings yet

- 21-01-21 Siang Bahan Paparan BIM - Herry VazaDocument33 pages21-01-21 Siang Bahan Paparan BIM - Herry Vazaeryanto mrNo ratings yet

- Sub Order LabelsDocument10 pagesSub Order Labelsblack LoveNo ratings yet

- ICICI ProjectDocument90 pagesICICI ProjectSrusti ParekhNo ratings yet

- Taxation Midterm Exam With Answer KeyDocument25 pagesTaxation Midterm Exam With Answer Keychelissamaerojas100% (1)

- HEC Consulting Club - Cas Electric Mall ScootersDocument6 pagesHEC Consulting Club - Cas Electric Mall Scootersethan cohenNo ratings yet

- The Role of Gender and Women's Leadership in Water GovernanceDocument10 pagesThe Role of Gender and Women's Leadership in Water GovernanceADBGADNo ratings yet

- The Strength and Weaknesses of Each The Competitor's Products and ServicesDocument8 pagesThe Strength and Weaknesses of Each The Competitor's Products and ServicesEden Dela CruzNo ratings yet

- ValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04ChittaNo ratings yet

- Sample 1 Bakery Business PlanDocument18 pagesSample 1 Bakery Business PlanJohn Leric Dela MercedNo ratings yet

- Syllabus CPM DiplomaDocument6 pagesSyllabus CPM DiplomaGirman ranaNo ratings yet

- Chapter 1 - DDocument26 pagesChapter 1 - DSujani MaarasingheNo ratings yet

- 9 Steps To Overcome Competition in Retail BusinessDocument3 pages9 Steps To Overcome Competition in Retail BusinessMarina IvanNo ratings yet

- 485 BRIEF Assignment 1Document3 pages485 BRIEF Assignment 1Duyên MaiNo ratings yet