Professional Documents

Culture Documents

10 Laboratory Exercise 1

10 Laboratory Exercise 1

Uploaded by

marjorie ArroyoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Laboratory Exercise 1

10 Laboratory Exercise 1

Uploaded by

marjorie ArroyoCopyright:

Available Formats

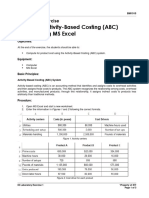

BM1915

Laboratory Exercise

Applying Pricing Decisions in MS Excel

Objectives:

At the end of the exercise, the students should be able to:

▪ Determine the selling price using different cost bases.

Equipment:

▪ Computer

▪ MS Excel

Basic Principles:

Below is the general formula to determine the markup percentage based on cost. Note again that the cost

referred to here could be composed of different amounts incurred by the firm.

Profit required to achieve + Total annual costs not

Markup percentage

= target ROI included in the cost base

applied to cost base

Annual volume x Cost base per unit used

Selling price per unit = Cost base per unit x (100% + markup on cost)

Problem:

Marby Corporation started operations on January 1, 201A and expected to produce 200,000 units in its first

year of operations. The cost data per unit based on expected production are shown below:

Direct materials P48 Fixed manufacturing overhead P3.00

Direct labor 12 Fixed selling expenses 2.00

Variable manufacturing overhead 6 Variable selling expenses 2.50

Management is trying to decide on what selling price would they project the 201A sales. You are tasked to

compute the mark up percentage and selling price based on each of the following independent cases below:

1. 25% markup on prime costs

2. 70% markup based on conversion costs

3. 20% markup based on total manufacturing costs

4. 22% markup based on variable manufacturing costs

5. 20% markup based on total costs

6. 24% markup based on variable costs

The markup percentage may be expressed in decimal form or in percentage. Round it off in two (2) decimal

places.

10 Laboratory Exercise 1 *Property of STI

Page 1 of 4

BM1915

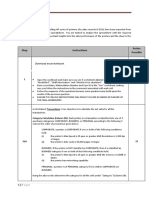

Procedure:

1. Open MS Excel and start a new worksheet.

2. Enter the information following the correct formats.

For the given values, use the following:

Heading, Column Titles Font style: Arial, bold

Font size: 10 pt

Alignment: Center

Row height: 15

Account Titles Font style: Arial

Font size: 10 pt

Alignment: Align Left

Row Height: 15

Column Width: 36

Amounts Font style: Arial

Font size: 10 pt

Alignment: Align Right

Row Height: 15

Column Width: 12

For the answer and problem solving, use the following format:

Heading, Column Titles Font style: Arial, bold

Font size: 10 pt

Alignment: Align Left

Row height: 15

Account Titles Font style: Arial

Font size: 10 pt

Alignment: Align Left

Row Height: 15

Column Width: 36

Amounts Font style: Arial

Font size: 10 pt

Alignment: Align Right

Row Height: 15

Column Width: 12

3. Using standard costing and variance analysis, compute for the variances and indicate whether it is

favorable or unfavorable.

4. Enter the following information in Figure 1 for the given values.

Figure 1. Cost data

10 Laboratory Exercise 1 *Property of STI

Page 2 of 4

BM1915

5. Enter the following information in Figures 2‒7 for the problem solving.

Figure 2. Markup based on conversion costs

Figure 3. Markup based on conversion costs

Figure 4. Markup based on total manufacturing costs

Figure 5. Markup based on variable manufacturing costs

10 Laboratory Exercise 1 *Property of STI

Page 3 of 4

BM1915

Figure 6. Markup based on total costs

Figure 7. Markup based on variable costs

6. Save the Excel file as Surname_ProjMgtExer10 and place it on the network drive.

Rubric for grading the output:

CRITERIA PERFORMANCE INDICATORS POINTS

Neatness and The spreadsheet has exceptional formatting, and the information is well-

20

Organization organized.

The spreadsheet formulas are well-developed and will correctly

Formulas 30

determine the needed information.

Titles, Labels, and

The spreadsheet contains clearly labeled rows and columns. 10

Headings

The spreadsheet meets all the necessary requirements to interpret the

Content 40

result of the operation.

TOTAL 100

10 Laboratory Exercise 1 *Property of STI

Page 4 of 4

You might also like

- Sas 1Document292 pagesSas 1divya kolluri100% (1)

- Chapter 18 TestbankDocument44 pagesChapter 18 TestbankHuu LuatNo ratings yet

- Strategy for the Corporate Level: Where to Invest, What to Cut Back and How to Grow Organisations with Multiple DivisionsFrom EverandStrategy for the Corporate Level: Where to Invest, What to Cut Back and How to Grow Organisations with Multiple DivisionsRating: 5 out of 5 stars5/5 (1)

- Football Field AnalysisDocument15 pagesFootball Field AnalysisAkash SahuNo ratings yet

- Using Stata For Quantitative AnalysisDocument239 pagesUsing Stata For Quantitative AnalysisFelipe Javier Ruiz Rivera100% (1)

- Marketing Analysis - Breakeven AnalysisDocument25 pagesMarketing Analysis - Breakeven AnalysisFaiq Ahmad KhanNo ratings yet

- IGCSE EXCEL PAPER, ICT, Year 10, 11Document2 pagesIGCSE EXCEL PAPER, ICT, Year 10, 11Howard Gilmour33% (3)

- Firdaria CalculatorDocument4 pagesFirdaria CalculatorpalharjeetNo ratings yet

- Self Assessment 2018 PDFDocument11 pagesSelf Assessment 2018 PDFtestNo ratings yet

- Applying Capital Budgeting Techniques Using MS Excel: Laboratory ExerciseDocument4 pagesApplying Capital Budgeting Techniques Using MS Excel: Laboratory ExerciseMa Trixia Alexandra CuevasNo ratings yet

- Applying Activity-Based Costing (ABC) System Using MS Excel: Laboratory ExerciseDocument3 pagesApplying Activity-Based Costing (ABC) System Using MS Excel: Laboratory ExerciseCurt sah jie SolermoNo ratings yet

- 09 Laboratory Exercise 1Document3 pages09 Laboratory Exercise 1Shai GomezNo ratings yet

- Lesson 2: Activity Name Demonstration NotesDocument3 pagesLesson 2: Activity Name Demonstration NotesLexy AnnNo ratings yet

- Applying Actual and Normal Costing Systems Using MS Excel: Laboratory ExerciseDocument4 pagesApplying Actual and Normal Costing Systems Using MS Excel: Laboratory ExerciseMochi MaxNo ratings yet

- FCFF Valuation Model: Before You Star What The Model Inputs Master Inputs Page Earnings NormalizerDocument33 pagesFCFF Valuation Model: Before You Star What The Model Inputs Master Inputs Page Earnings NormalizerJatin NandaNo ratings yet

- F1F9 Example Model August19Document114 pagesF1F9 Example Model August19Parth GandhiNo ratings yet

- Description:: Download Excel WorkbookDocument3 pagesDescription:: Download Excel Workbookyu zuyuNo ratings yet

- Excel Introductory Capstone1 Year End Report InstructionsDocument4 pagesExcel Introductory Capstone1 Year End Report InstructionsQaisar iqbalNo ratings yet

- Advancedexcelexamples 000Document45 pagesAdvancedexcelexamples 000Puneeth KumarNo ratings yet

- SolvsampDocument12 pagesSolvsampTabassum AkhtarNo ratings yet

- Ch11 P18 Build A ModelDocument7 pagesCh11 P18 Build A Model2019n00984No ratings yet

- Assignment 20 09 20Document9 pagesAssignment 20 09 20Sherwin AuzaNo ratings yet

- SolvsampDocument15 pagesSolvsampHello WorldNo ratings yet

- Semas Handout 5Document6 pagesSemas Handout 5GONZALES, MICA ANGEL A.No ratings yet

- 02 Laboratory Exercise Template17Document8 pages02 Laboratory Exercise Template17Ma. Trina AnotnioNo ratings yet

- Calculate Your Sales Commission With Excel ScenariosDocument3 pagesCalculate Your Sales Commission With Excel ScenariossumantrabagchiNo ratings yet

- Cost Management Problems CA FinalDocument266 pagesCost Management Problems CA Finalksaqib89100% (1)

- Quick Tour of Microsoft Excel Solver: 419525239Document15 pagesQuick Tour of Microsoft Excel Solver: 419525239Yl Wong100% (1)

- Cost Volume Profit AnalysisDocument6 pagesCost Volume Profit AnalysisCindy CrausNo ratings yet

- Mês Total Sazonalidade Valor Das VendasDocument6 pagesMês Total Sazonalidade Valor Das VendasEmerson CesarNo ratings yet

- HANDOUT CVP Methods of Acct TeachingDocument4 pagesHANDOUT CVP Methods of Acct TeachingMalesia AlmojuelaNo ratings yet

- Income Approach CVP - Choo and Tan (2011)Document14 pagesIncome Approach CVP - Choo and Tan (2011)abel chalamilaNo ratings yet

- Excel 3E Revenue InstructionsDocument2 pagesExcel 3E Revenue InstructionsAster 07No ratings yet

- Quick Tour of Microsoft Excel Solver: Color CodingDocument6 pagesQuick Tour of Microsoft Excel Solver: Color CodingKhalid EurekaNo ratings yet

- Instructions For Lab Report and Lab TasksDocument2 pagesInstructions For Lab Report and Lab TasksRahab IqbalNo ratings yet

- General Guidelines SOFTLINEDocument7 pagesGeneral Guidelines SOFTLINEFullertron IndiaNo ratings yet

- Financial Modeling NotesDocument10 pagesFinancial Modeling NotesAna Alejandra GarciaNo ratings yet

- Processing Is Broken Down Into Simple Steps: Ravi Jaiswani FMA Quiz 2Document5 pagesProcessing Is Broken Down Into Simple Steps: Ravi Jaiswani FMA Quiz 2RAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- A2 Assignment 2 HaDocument2 pagesA2 Assignment 2 HaMariam AdnanNo ratings yet

- Cost Volume Profit (CVP) Analysis2UPDATEDDocument33 pagesCost Volume Profit (CVP) Analysis2UPDATEDAthira RidwanNo ratings yet

- Module 4 Cost Volume Profit AnalysisDocument6 pagesModule 4 Cost Volume Profit AnalysisJackielyn RavinaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro Davaovane rondinaNo ratings yet

- MODULE1 CVP AnalysisDocument4 pagesMODULE1 CVP AnalysisLuming0% (2)

- Chap 4 CVPDocument60 pagesChap 4 CVPManju SreeNo ratings yet

- Micro Eportfolio Assign PC and MonopDocument20 pagesMicro Eportfolio Assign PC and Monopapi-291512694No ratings yet

- WPLCaseStudy Solution ShareafteraweekDocument52 pagesWPLCaseStudy Solution ShareafteraweekYogendra RathoreNo ratings yet

- Cost-Volume-Profit (CVP) Relationship: C O STDocument22 pagesCost-Volume-Profit (CVP) Relationship: C O STRod ELNo ratings yet

- Contribution Margin: TechniquesDocument4 pagesContribution Margin: TechniquesMaria BeatriceNo ratings yet

- Reverse DCFDocument16 pagesReverse DCFwisimex143No ratings yet

- 0418 s08 QP 3Document8 pages0418 s08 QP 3Hubbak Khan100% (3)

- Break-Even Analysis: K6: Worksheet 1Document7 pagesBreak-Even Analysis: K6: Worksheet 1cutie cailyNo ratings yet

- Chapter 6 Cost-Volume-Profit Relationships: True/False QuestionsDocument51 pagesChapter 6 Cost-Volume-Profit Relationships: True/False Questionsmimi supasNo ratings yet

- BEA Handouts 20Document8 pagesBEA Handouts 20Suraj KumarNo ratings yet

- 04 Mas - CVPDocument8 pages04 Mas - CVPKarlo D. ReclaNo ratings yet

- Chap 5 - Relative ValuationDocument58 pagesChap 5 - Relative Valuationrafat.jalladNo ratings yet

- Break Even Chart-Meaning-Advantages and TypesDocument12 pagesBreak Even Chart-Meaning-Advantages and TypesrlwersalNo ratings yet

- The Cost of CapitalDocument45 pagesThe Cost of CapitalMia KhalifaNo ratings yet

- CVP AnalysisDocument18 pagesCVP AnalysisKashvi MakadiaNo ratings yet

- Unit D - Excel Projects 2Document24 pagesUnit D - Excel Projects 2AbhishekVadadoriyaNo ratings yet

- 6Document5 pages6TroisNo ratings yet

- 0418 w07 QP 3Document10 pages0418 w07 QP 3Hubbak Khan100% (2)

- Corel Draw Beginner Tutorial: How To Make A Florist Flyer From Start To Finish.Document11 pagesCorel Draw Beginner Tutorial: How To Make A Florist Flyer From Start To Finish.Renee Liverpool100% (1)

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Excel Insights: A Microsoft MVP guide to the best parts of ExcelFrom EverandExcel Insights: A Microsoft MVP guide to the best parts of ExcelNo ratings yet

- 11 TASK PERFORMANCE g3Document3 pages11 TASK PERFORMANCE g3marjorie ArroyoNo ratings yet

- 09 Handout 1Document6 pages09 Handout 1marjorie ArroyoNo ratings yet

- 08 Task Performance 1-OSDocument4 pages08 Task Performance 1-OSmarjorie ArroyoNo ratings yet

- 05 eLMS Activity - ARROYO, ROSALIEDocument1 page05 eLMS Activity - ARROYO, ROSALIEmarjorie ArroyoNo ratings yet

- Arroyo 10 ACTIVITY 1 ARGDocument3 pagesArroyo 10 ACTIVITY 1 ARGmarjorie ArroyoNo ratings yet

- Arroyo-Task Perf Rizal'sDocument2 pagesArroyo-Task Perf Rizal'smarjorie ArroyoNo ratings yet

- Entrep-10 Journal 1Document1 pageEntrep-10 Journal 1marjorie ArroyoNo ratings yet

- 06 Activity 1 - ArroyoDocument1 page06 Activity 1 - Arroyomarjorie ArroyoNo ratings yet

- HP Business Service Management: RTSM Best PracticesDocument43 pagesHP Business Service Management: RTSM Best PracticesMouloud HAOUASNo ratings yet

- JCI Physical Inventory Cockpit - Product Supply Area (Non Handing Units)Document69 pagesJCI Physical Inventory Cockpit - Product Supply Area (Non Handing Units)Pavle ArsicNo ratings yet

- Computer TipsDocument6 pagesComputer TipsBelal AhmedNo ratings yet

- Guide To The RRRAP Issue 1 Rev 1Document95 pagesGuide To The RRRAP Issue 1 Rev 1Emma SilsbyNo ratings yet

- Abap TipsDocument160 pagesAbap TipsRui ClérigoNo ratings yet

- Ms Excel MCQDocument25 pagesMs Excel MCQKent LiewNo ratings yet

- Experion Scada PinDocument7 pagesExperion Scada PinKhalid AliNo ratings yet

- Heinemann Maths 9 - Chapter 10Document41 pagesHeinemann Maths 9 - Chapter 10OggieVoloderNo ratings yet

- Excel Shortcuts CompilationDocument1 pageExcel Shortcuts CompilationAbhimanyu LatherNo ratings yet

- OpenIGC Bridges and ParametersDocument14 pagesOpenIGC Bridges and ParametersЮлия БелоусоваNo ratings yet

- Difference Between .Delete and .Clear in Excel VBA - Stack OverflowDocument3 pagesDifference Between .Delete and .Clear in Excel VBA - Stack OverflowvaskoreNo ratings yet

- Cupertino Sunnyvale Adult and Community Education Quarter 3 CatalogDocument21 pagesCupertino Sunnyvale Adult and Community Education Quarter 3 Catalogmike_hathaway6671No ratings yet

- 10 Laboratory Exercise 1Document4 pages10 Laboratory Exercise 1marjorie ArroyoNo ratings yet

- How To Draw Histogram in Excel 2007Document2 pagesHow To Draw Histogram in Excel 2007Jayanta ChakrabartiNo ratings yet

- RCS-Productdescription2 0 PDFDocument25 pagesRCS-Productdescription2 0 PDFIgor SangulinNo ratings yet

- Whats NewDocument3 pagesWhats Newphani raja kumarNo ratings yet

- Front Invest Solutions (En)Document4 pagesFront Invest Solutions (En)brizlamNo ratings yet

- SAP Fiori Apps Reference Library: WarningDocument25 pagesSAP Fiori Apps Reference Library: WarningPaloma PolidoNo ratings yet

- HP-ALM-MSExcelAddin-UserGuide 11 0 1 15Document28 pagesHP-ALM-MSExcelAddin-UserGuide 11 0 1 15douglas.dcmNo ratings yet

- Project Economics Decision Analysis V1 Deterministic Models TOC SampleDocument15 pagesProject Economics Decision Analysis V1 Deterministic Models TOC SampleRalmeNo ratings yet

- Working Draft Using QGIS v3 in Mineral EDocument167 pagesWorking Draft Using QGIS v3 in Mineral EPedro PetitNo ratings yet

- Unit 1Document243 pagesUnit 1Shivam TanejaNo ratings yet

- Up and Running With Power BI ServiceDocument117 pagesUp and Running With Power BI ServiceSaha2No ratings yet

- %%%computer Programming - Java - Neural Network Gui With Joone (2002)Document91 pages%%%computer Programming - Java - Neural Network Gui With Joone (2002)Khalifa BakkarNo ratings yet

- 20 Tricks That Can Make Anyone An Excel Expert: 1. One Click To Select AllDocument13 pages20 Tricks That Can Make Anyone An Excel Expert: 1. One Click To Select AllCeferina LabroNo ratings yet

- DIYguru PYTHON Course Brochure CompressedDocument8 pagesDIYguru PYTHON Course Brochure CompressedajitramNo ratings yet