Professional Documents

Culture Documents

qCh.3 Topic 2-Taxes (Direct and Indirect)

qCh.3 Topic 2-Taxes (Direct and Indirect)

Uploaded by

Joshua Ma0 ratings0% found this document useful (0 votes)

20 views7 pagesThe document contains a diagram showing the demand and supply curves for a good with a specific tax imposed by the government. It also contains multiple choice questions about taxes, externalities, price elasticities, and other economic concepts. The questions are designed to test the understanding of how different government policies can impact markets.

Original Description:

Original Title

qCh.3 Topic 2-Taxes (direct and indirect)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains a diagram showing the demand and supply curves for a good with a specific tax imposed by the government. It also contains multiple choice questions about taxes, externalities, price elasticities, and other economic concepts. The questions are designed to test the understanding of how different government policies can impact markets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views7 pagesqCh.3 Topic 2-Taxes (Direct and Indirect)

qCh.3 Topic 2-Taxes (Direct and Indirect)

Uploaded by

Joshua MaThe document contains a diagram showing the demand and supply curves for a good with a specific tax imposed by the government. It also contains multiple choice questions about taxes, externalities, price elasticities, and other economic concepts. The questions are designed to test the understanding of how different government policies can impact markets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

Taxes

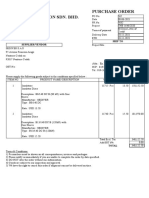

1.The diagram shows the demand curve and supply curve for a good on which the

government imposes a specific tax.

What will be the result of this tax?

A Most of the incidence of the tax will fall on the producer.

B There will be a new demand curve parallel to DD.

C The price will rise by the full amount of the tax.

D The quantity bought will fall proportionately to the tax rate.

ˊi

2. The production of a product generates a negative externality that increases as output

rises.

Which form of government intervention in the market is most suitable to tackle this

externality?

A a direct income tax

o

B a specific indirect tax

C a subsidy

D an ad valorem indirect tax

3.

o_

Kannan Narayanasamy-Economics teacher

4.

5.

Kannan Narayanasamy-Economics teacher

n s

iiiof

6.

Qp

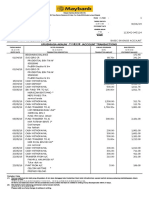

7. A government wishes to impose a tax on a good so that the consumer and not the

producer pays most of the tax increase.

Which type of elasticity would best achieve this aim?

A high price elasticity of supply B

low price elasticity of supply

C unitary price elasticity of supply

D perfectly inelastic price elasticity of supply

8.

Kannan Narayanasamy-Economics teacher

9.

10.

Kannan Narayanasamy-Economics teacher

12.

13.

Kannan Narayanasamy-Economics teacher

14.

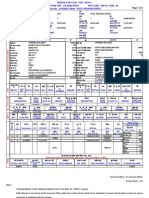

2440 60

15.

3X340

Kannan Narayanasamy-Economics teacher

16.

Kannan Narayanasamy-Economics teacher

You might also like

- Advance Tax FullDocument5 pagesAdvance Tax FullParthiban BanNo ratings yet

- 1.2 Eco Method-1-1Document9 pages1.2 Eco Method-1-1Khadija MasoodNo ratings yet

- Ebook Economics Today The Macro View 18Th Edition Miller Solutions Manual Full Chapter PDFDocument36 pagesEbook Economics Today The Macro View 18Th Edition Miller Solutions Manual Full Chapter PDFgebbiasadaik100% (11)

- Solutions Williamson 3e IM 05Document10 pagesSolutions Williamson 3e IM 05Diaconu MariannaNo ratings yet

- Macroeconomics 5th Edition Williamson Solutions Manual 1Document36 pagesMacroeconomics 5th Edition Williamson Solutions Manual 1luissandersocraiyznfw100% (28)

- Macroeconomics 5Th Edition Williamson Solutions Manual Full Chapter PDFDocument33 pagesMacroeconomics 5Th Edition Williamson Solutions Manual Full Chapter PDFdonna.morales754100% (12)

- Public Finance Revision-1Document77 pagesPublic Finance Revision-1mayar medhatNo ratings yet

- REVIEW 01 - Microeconomics - Chapter 5 PDFDocument8 pagesREVIEW 01 - Microeconomics - Chapter 5 PDFKiệt NguyễnNo ratings yet

- Principles of Macroeconomics July 16, 2016: A. Three Most Common Barriers To TradeDocument8 pagesPrinciples of Macroeconomics July 16, 2016: A. Three Most Common Barriers To TradeAllie ContrerasNo ratings yet

- Managerial Economics - MB0026 MBA - 1 SEM Assignment SetDocument5 pagesManagerial Economics - MB0026 MBA - 1 SEM Assignment SetsmartsoumyNo ratings yet

- Public Finance - Sample Exam 3 QuestionsDocument4 pagesPublic Finance - Sample Exam 3 QuestionsDanielle ForlenzaNo ratings yet

- WK 3&4 Ecs 203 NotesDocument5 pagesWK 3&4 Ecs 203 Notesnifemiakinleye20No ratings yet

- Worksheet On Fiscal PolicyDocument4 pagesWorksheet On Fiscal Policysubham chakrabortyNo ratings yet

- Workbook 2024 - Bab 9 PAJAKDocument10 pagesWorkbook 2024 - Bab 9 PAJAKrusydadahliaNo ratings yet

- Macroeconomics: Resource Market Resource MarketDocument4 pagesMacroeconomics: Resource Market Resource MarketArnab BaruaNo ratings yet

- IGCSE Economics Unit 4 KeytermsDocument2 pagesIGCSE Economics Unit 4 KeytermsNIRAJ VENKATNo ratings yet

- ECO1101 Economic Concepts, Issues and ToolsDocument30 pagesECO1101 Economic Concepts, Issues and ToolsChris TengNo ratings yet

- Chapter2 ExercisesDocument13 pagesChapter2 ExercisesAhsen AkbarNo ratings yet

- Ecs1601 CombinedDocument753 pagesEcs1601 CombinedsollytsakaniNo ratings yet

- In Class Checkpoint Quiz ManaeconDocument17 pagesIn Class Checkpoint Quiz ManaeconDũng HoàngNo ratings yet

- Economics Final Practice QuestionsDocument9 pagesEconomics Final Practice QuestionsMaranathaNo ratings yet

- Mba - I Sem MB0026 Managerial Economics SET - 2 AssignmentDocument7 pagesMba - I Sem MB0026 Managerial Economics SET - 2 AssignmentFaiha AfsalNo ratings yet

- Tutorial 8Document17 pagesTutorial 8Christie Ann WeeNo ratings yet

- ps5 - MacroDocument3 pagesps5 - MacroBhavik ModyNo ratings yet

- BBEK1103Document8 pagesBBEK1103Faiqah AzmirNo ratings yet

- 315310Document9 pages315310Kateryna TernovaNo ratings yet

- Fiscal Policy TutorialDocument44 pagesFiscal Policy TutorialKing DariusNo ratings yet

- Practice Quizzes Topic 10-C33Document6 pagesPractice Quizzes Topic 10-C33phươngNo ratings yet

- GR12 Economics Exam 24Document7 pagesGR12 Economics Exam 24Abdallah HassanNo ratings yet

- Please Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every QuestionDocument12 pagesPlease Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every QuestionRafaelWbNo ratings yet

- Ecs2602 Tut.102.2015Document144 pagesEcs2602 Tut.102.2015YOLANDANo ratings yet

- Practice Quiz Introducing The Economic Way of ThinkingDocument4 pagesPractice Quiz Introducing The Economic Way of ThinkingtheplumberNo ratings yet

- Answer: Yes, It Is True That Business Strategies and Structure Is Also Affected by TheDocument7 pagesAnswer: Yes, It Is True That Business Strategies and Structure Is Also Affected by TheSatwant SinghNo ratings yet

- Practice Quiz: (Answers Are Provided at The End of The Practice Quiz.)Document4 pagesPractice Quiz: (Answers Are Provided at The End of The Practice Quiz.)Kalwa MutofweNo ratings yet

- Principles of Economics 5Th Edition Mankiw Solutions Manual Full Chapter PDFDocument40 pagesPrinciples of Economics 5Th Edition Mankiw Solutions Manual Full Chapter PDFmohurrum.ginkgo.iabwuz100% (11)

- Micro Chapter 4 Study Guide Questions 14eDocument4 pagesMicro Chapter 4 Study Guide Questions 14eBeauponte Pouky MezonlinNo ratings yet

- (10 - IGCSE Economics (SEM1 - MIDSEM EXAM - 21-22)Document10 pages(10 - IGCSE Economics (SEM1 - MIDSEM EXAM - 21-22)Rangga NarindraNo ratings yet

- Exercise 4Document28 pagesExercise 4yu yuNo ratings yet

- Unit 4-5Document18 pagesUnit 4-5Thảo TrầnNo ratings yet

- Role of Government in An EconomyDocument7 pagesRole of Government in An EconomyIsabella EhizomohNo ratings yet

- Business Economics - Quiz 1: Name: DateDocument2 pagesBusiness Economics - Quiz 1: Name: Dateravibavaria5913No ratings yet

- Unit 4-5 CW-Trần Hồng QuânDocument18 pagesUnit 4-5 CW-Trần Hồng QuânLan Anh Ngô ThịNo ratings yet

- Principles of Microeconomics 7th Edition Gregory Mankiw Solutions Manual 1Document16 pagesPrinciples of Microeconomics 7th Edition Gregory Mankiw Solutions Manual 1irene100% (43)

- Principles of Microeconomics 7Th Edition Gregory Mankiw Solutions Manual Full Chapter PDFDocument36 pagesPrinciples of Microeconomics 7Th Edition Gregory Mankiw Solutions Manual Full Chapter PDFclifford.pellegrino879100% (15)

- Principles of Microeconomics 7th Edition Gregory Mankiw Solutions Manual 1Document36 pagesPrinciples of Microeconomics 7th Edition Gregory Mankiw Solutions Manual 1ashleygeorgetifkcpmsag100% (28)

- Econ Assignment AnswersDocument4 pagesEcon Assignment AnswersKazımNo ratings yet

- مالیه گذاریDocument11 pagesمالیه گذاریHashim AhmadiNo ratings yet

- Notes On Gov Policies (Leture 4, Tax Policy)Document9 pagesNotes On Gov Policies (Leture 4, Tax Policy)K60 Trương Hiểu LinhNo ratings yet

- Element of Income Tax l4Document11 pagesElement of Income Tax l4ZIHERAMBERE AnastaseNo ratings yet

- Notes Public EconomicsDocument132 pagesNotes Public EconomicsTWIZERIMANA EVARISTENo ratings yet

- Grangerland Intermediate School: K A R en R. JonesDocument8 pagesGrangerland Intermediate School: K A R en R. JonestoobaahmedkhanNo ratings yet

- Mid term TCC Trương Thị Khánh Ly 11205991Document3 pagesMid term TCC Trương Thị Khánh Ly 11205991Hưng TrịnhNo ratings yet

- Ec of Taxation Syllabus - MEcDevDocument13 pagesEc of Taxation Syllabus - MEcDevapriknNo ratings yet

- Ilovepdf MergedDocument113 pagesIlovepdf MergedSaket ShankarNo ratings yet

- Microeconomics Chapter 6 NotesDocument5 pagesMicroeconomics Chapter 6 Notesctazyflasher3No ratings yet

- Macro On TapDocument43 pagesMacro On Tap20070433 Nguyễn Lê Thùy DươngNo ratings yet

- Economy q3Document5 pagesEconomy q3obnamiajuliusNo ratings yet

- Principles of Microeconomics CH 1&2 NotesDocument9 pagesPrinciples of Microeconomics CH 1&2 NotesAnnyoung93No ratings yet

- Macroeconomics Suggestion (Sem 5)Document38 pagesMacroeconomics Suggestion (Sem 5)Vivaan BanerjeeNo ratings yet

- Inv 220902 00091795 - 001 - 5040Document13 pagesInv 220902 00091795 - 001 - 5040Hafizh MaulanaNo ratings yet

- Enmax - Alberta BillDocument3 pagesEnmax - Alberta BillmassinissamassinissamassinissaNo ratings yet

- VP 3K9FHMKS InvoicesDocument2 pagesVP 3K9FHMKS InvoicessamarNo ratings yet

- Formulario Amazon para EscritoresDocument1 pageFormulario Amazon para EscritoresAlberto AcevedoNo ratings yet

- Donors Trust 2017 990Document192 pagesDonors Trust 2017 990jpeppardNo ratings yet

- Thanks For Your Order!: Billing Information Payment Details Receipt DetailsDocument1 pageThanks For Your Order!: Billing Information Payment Details Receipt Detailschalapathi psNo ratings yet

- Receipt From STC Pay: Transaction ID: 46233368 Amount 20379.93 PKR MTCN 7693994926Document1 pageReceipt From STC Pay: Transaction ID: 46233368 Amount 20379.93 PKR MTCN 7693994926Imran AliNo ratings yet

- Approved Agent CommissionDocument2 pagesApproved Agent CommissionAdem Hasen100% (2)

- Ac Ileleji Clinton Ayinde February, 2019 731614505 FullstmtDocument1 pageAc Ileleji Clinton Ayinde February, 2019 731614505 FullstmtClinton AyindeNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- Guidelines For Investment Proof Submission 2018-19Document7 pagesGuidelines For Investment Proof Submission 2018-19AsifNo ratings yet

- Acct Statement XX8505 15122023Document6 pagesAcct Statement XX8505 15122023mohdfazal4545No ratings yet

- Roha General Trading PLC G-35A: Payroll Register For The Period From Mar 1, 2014 To Mar 31, 2014Document1 pageRoha General Trading PLC G-35A: Payroll Register For The Period From Mar 1, 2014 To Mar 31, 2014Beky ManNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasCeslhee AngelesNo ratings yet

- Earnings: Manoj Kumar Field ExecutiveDocument1 pageEarnings: Manoj Kumar Field ExecutiveSubhash SharmaNo ratings yet

- Tax Invoice GJ1212209 AG24105Document1 pageTax Invoice GJ1212209 AG24105CS Labdhi ShahNo ratings yet

- Tax Revalida NotesDocument36 pagesTax Revalida NotesRehina DaligdigNo ratings yet

- Receipt Template 4 WordDocument1 pageReceipt Template 4 Worddinepo3250No ratings yet

- Ambc Transmission Sdn. Bhd. Purchase Order: Supplier/Vendor Ship ToDocument2 pagesAmbc Transmission Sdn. Bhd. Purchase Order: Supplier/Vendor Ship ToQALINo ratings yet

- Tax Invoice: Local MunicipalityDocument2 pagesTax Invoice: Local MunicipalityEbiemNo ratings yet

- Billbackpage TECO BILL FLDocument1 pageBillbackpage TECO BILL FLsikeNo ratings yet

- Income Tax Calculator FY 2019-20 (AY 2020-21)Document1 pageIncome Tax Calculator FY 2019-20 (AY 2020-21)J DassNo ratings yet

- Jerteh 1 30/06/19Document2 pagesJerteh 1 30/06/19Juminah Binti MaduNo ratings yet

- Neb ExtDocument3 pagesNeb ExtAmit GuptaNo ratings yet

- Challan Sep Neha Zari ArtDocument2 pagesChallan Sep Neha Zari Artafroz khanNo ratings yet

- Intel Technology Philippines, Inc. vs. CommissionerDocument30 pagesIntel Technology Philippines, Inc. vs. Commissionervince005No ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2vinayak_patil72No ratings yet

- Nepali Talim Youtube Channel: Calculation of Taxable Income and Tax Liability Based On Income From EmploymentDocument20 pagesNepali Talim Youtube Channel: Calculation of Taxable Income and Tax Liability Based On Income From EmploymentsamNo ratings yet

- Scope and DelimitatonDocument3 pagesScope and DelimitatonTirso Jr.No ratings yet