Professional Documents

Culture Documents

Module 10 - The Financial Statements II

Module 10 - The Financial Statements II

Uploaded by

Nina AlexineCopyright:

Available Formats

You might also like

- Altonomy Market Making ServiceDocument15 pagesAltonomy Market Making Servicepieter_houbenNo ratings yet

- Fringe Benefit Part 3Document24 pagesFringe Benefit Part 3kitkathyNo ratings yet

- BIR Form 1702-RTDocument8 pagesBIR Form 1702-RTDianne SantiagoNo ratings yet

- A Short Review On Basic FinanceDocument4 pagesA Short Review On Basic FinanceJed AoananNo ratings yet

- Letter Seeking Permission To Use InstrumentDocument1 pageLetter Seeking Permission To Use InstrumentNina Alexine100% (1)

- HPC LPG Intl Time Charter Party 05 03 2013Document30 pagesHPC LPG Intl Time Charter Party 05 03 2013Sumeet Sud100% (1)

- AE 27 Lesson 3 Understanding FSDocument26 pagesAE 27 Lesson 3 Understanding FSMARC BENNETH BERIÑANo ratings yet

- Tax For CorpDocument28 pagesTax For CorpNiki DimaanoNo ratings yet

- Mergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleDocument27 pagesMergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleRizza Mae EudNo ratings yet

- Chapter 15 PDFDocument14 pagesChapter 15 PDFAvox EverdeenNo ratings yet

- Corporate Income Taxation-Special CorporationDocument24 pagesCorporate Income Taxation-Special CorporationXyla Marie EstorNo ratings yet

- Session 1 - Income Tax On CorporationsDocument12 pagesSession 1 - Income Tax On CorporationsMitzi WamarNo ratings yet

- Chapter08 PDFDocument22 pagesChapter08 PDFBabuM ACC FIN ECONo ratings yet

- FM 130 Philippine Monetary PolicyDocument5 pagesFM 130 Philippine Monetary PolicyHerminio NiepezNo ratings yet

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- The Role of Strategic Planning On The Sustainability of Selected MSMEs in The 2nd District of AlbayDocument7 pagesThe Role of Strategic Planning On The Sustainability of Selected MSMEs in The 2nd District of AlbayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Introduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPADocument35 pagesIntroduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPAKyla Marie HubieraNo ratings yet

- Mortgage Markets Practice Problems SolutionsDocument8 pagesMortgage Markets Practice Problems Solutionsjam linganNo ratings yet

- JFINEX Accomplishment Report 1st Semester 2022 2023Document20 pagesJFINEX Accomplishment Report 1st Semester 2022 2023Jelwin BautistaNo ratings yet

- Module 2. Lesson 1. Taxation of Minimum Wage EarnersDocument6 pagesModule 2. Lesson 1. Taxation of Minimum Wage EarnersRaniel AnidoNo ratings yet

- 8 Responsibility AccountingDocument8 pages8 Responsibility AccountingXyril MañagoNo ratings yet

- Chapte R: Short-Term Finance and PlanningDocument57 pagesChapte R: Short-Term Finance and PlanningMohammad Salim HossainNo ratings yet

- Discussion ProblemsDocument23 pagesDiscussion ProblemsJemNo ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- Reviewer-Stock ValuationDocument7 pagesReviewer-Stock ValuationSheira Mae GuzmanNo ratings yet

- 11 - PFM - Chapter 10 - Financing Health and Care LiabilityDocument9 pages11 - PFM - Chapter 10 - Financing Health and Care LiabilityLee K.No ratings yet

- Comparison Chart of Thrift, Rural and Cooperative Banks and Nssla Thrift Banks Rural Banks Cooperative Banks NsslasDocument1 pageComparison Chart of Thrift, Rural and Cooperative Banks and Nssla Thrift Banks Rural Banks Cooperative Banks NsslasReginald Matt Aquino SantiagoNo ratings yet

- Financial Planning and ForecastingDocument16 pagesFinancial Planning and ForecastingAzain UsmanNo ratings yet

- CHAPTER 1 Intermediate 2Document32 pagesCHAPTER 1 Intermediate 2Sherly CabiaoNo ratings yet

- Module 05 Final Income TaxationDocument19 pagesModule 05 Final Income TaxationSly BlueNo ratings yet

- Chapter 5 - Final Income Taxation Chapter Overview and ObjectivesDocument22 pagesChapter 5 - Final Income Taxation Chapter Overview and ObjectivesCindy Felipe50% (2)

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- Module 6 PPT ContentDocument3 pagesModule 6 PPT ContentANZEL JUSTIN DE LEONNo ratings yet

- Introduction To Investment Decision in Financial Management (Open Compatibility)Document5 pagesIntroduction To Investment Decision in Financial Management (Open Compatibility)karl markxNo ratings yet

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Document16 pagesGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Working Capital Management - Introduction - Session 1 & 2Document56 pagesWorking Capital Management - Introduction - Session 1 & 2Vaidyanathan RavichandranNo ratings yet

- Strategic Cost Management PrelimDocument6 pagesStrategic Cost Management Prelimailel isagaNo ratings yet

- Strategic Tax Management - Week 3Document14 pagesStrategic Tax Management - Week 3Arman DalisayNo ratings yet

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- Loan ImpairmentDocument22 pagesLoan ImpairmentJEFFERSON CUTENo ratings yet

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Document6 pagesTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaqueNo ratings yet

- ACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Document14 pagesACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Migz labianoNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Financial Management - Chapter 1 NotesDocument2 pagesFinancial Management - Chapter 1 Notessjshubham2No ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Characteristics of Good GovernanceDocument3 pagesCharacteristics of Good GovernanceRoseanneNo ratings yet

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocument4 pagesLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Multiple Choice: Property of STIDocument2 pagesMultiple Choice: Property of STIJanineD.MeranioNo ratings yet

- Business Combinations (Ifrs 3)Document29 pagesBusiness Combinations (Ifrs 3)anon_253544781No ratings yet

- Toa Lecture 7 Ias 10Document5 pagesToa Lecture 7 Ias 10Rachel LeachonNo ratings yet

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- BAIACC3X - Intermediate Accounting 3Document7 pagesBAIACC3X - Intermediate Accounting 3Mitchie FaustinoNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- Analysis of Consumer Behavior in Buying Instant Noodles: (Case Studies in The Bogor City Area)Document14 pagesAnalysis of Consumer Behavior in Buying Instant Noodles: (Case Studies in The Bogor City Area)ich chiNo ratings yet

- Prelim Good GovernanceDocument7 pagesPrelim Good GovernanceDDDNo ratings yet

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Document57 pagesMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosNo ratings yet

- Chap 11 Notes Mba Standard CostsDocument49 pagesChap 11 Notes Mba Standard CostsHarlinni ZainuddinNo ratings yet

- Consolidated Financial StatementsDocument7 pagesConsolidated Financial StatementsParvez NahidNo ratings yet

- Income Taxation SchemesDocument7 pagesIncome Taxation SchemesLeonard CañamoNo ratings yet

- MAC 406 Performance Management SystemsDocument38 pagesMAC 406 Performance Management SystemsRhodemar CuartoNo ratings yet

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Module 13 - Other Merchandising TransactionsDocument9 pagesModule 13 - Other Merchandising TransactionsNina AlexineNo ratings yet

- Module 12 - Accounting Process For A Merchandising EntityDocument8 pagesModule 12 - Accounting Process For A Merchandising EntityNina AlexineNo ratings yet

- Module 9 - The WorksheetDocument13 pagesModule 9 - The WorksheetNina AlexineNo ratings yet

- Module 4 - The Account and The Rules of Debit and CreditDocument18 pagesModule 4 - The Account and The Rules of Debit and CreditNina AlexineNo ratings yet

- Module 7 - The Need For Adjusting Journal Entries, Part IDocument12 pagesModule 7 - The Need For Adjusting Journal Entries, Part INina AlexineNo ratings yet

- Module 8 - The Need For Adjusting Journal Entries, Part IIDocument8 pagesModule 8 - The Need For Adjusting Journal Entries, Part IINina AlexineNo ratings yet

- Module 5 - Recording Transactions in A JournalDocument5 pagesModule 5 - Recording Transactions in A JournalNina AlexineNo ratings yet

- According To SopDocument2 pagesAccording To SopNina AlexineNo ratings yet

- Module 6 - The General Ledger and Trial BalanceDocument8 pagesModule 6 - The General Ledger and Trial BalanceNina AlexineNo ratings yet

- Unisite Subdivision, Del Pilar, City of San Fernando, 2000 Pampanga, PhilippinesDocument1 pageUnisite Subdivision, Del Pilar, City of San Fernando, 2000 Pampanga, PhilippinesNina AlexineNo ratings yet

- 6 Business Beyond Profit PDFDocument10 pages6 Business Beyond Profit PDFNina AlexineNo ratings yet

- List of Iconic CPG Projects in SingaporeDocument2 pagesList of Iconic CPG Projects in SingaporeKS LeeNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- Purchaseworkbook PDFDocument56 pagesPurchaseworkbook PDFNikkie WhiteNo ratings yet

- Chapter - 4 - Cash Flow and InterestDocument19 pagesChapter - 4 - Cash Flow and InterestAhmed freshekNo ratings yet

- Haut Lac Postion PaperDocument4 pagesHaut Lac Postion Paperbm9gvfxj6hNo ratings yet

- S&P 500 Index Duke Energy StockDocument12 pagesS&P 500 Index Duke Energy Stockshrijit “shri” tembheharNo ratings yet

- Pestel Analysis: Karenz Jonah Solis, CpaDocument21 pagesPestel Analysis: Karenz Jonah Solis, CpaJay100% (1)

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Priyadarshini Sahoo100% (1)

- Issue69 PDFDocument164 pagesIssue69 PDFsilvofNo ratings yet

- PHP K Vut OkDocument29 pagesPHP K Vut OkrahulNo ratings yet

- Econ 501 Amid Answ 09Document6 pagesEcon 501 Amid Answ 09Eva YirgaNo ratings yet

- Rbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/IndiaepapersDocument14 pagesRbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/Indiaepapersaashmeen25No ratings yet

- The Fall of Communism in Eastern EuropeDocument3 pagesThe Fall of Communism in Eastern EuropeAugusto NuñezNo ratings yet

- ENR TOP 250 Global Contractors in 2019Document72 pagesENR TOP 250 Global Contractors in 2019yoonhkimNo ratings yet

- Financial Investment EXERCISE-1Document16 pagesFinancial Investment EXERCISE-1Quynh NguyenNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Document6 pagesECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Diệp TrịnhNo ratings yet

- Coronavirus: A Visual Guide To The Economic Impact - BBC NewsDocument18 pagesCoronavirus: A Visual Guide To The Economic Impact - BBC NewsTrần Diệu QuỳnhNo ratings yet

- Biczok Master ThesisDocument48 pagesBiczok Master Thesisthe libyan guyNo ratings yet

- Amadeus Basic Codes 1Document6 pagesAmadeus Basic Codes 1Jorja OfianaNo ratings yet

- NCERT Class 12 English Lost SpringDocument10 pagesNCERT Class 12 English Lost SpringashNo ratings yet

- Ghosts of WarDocument61 pagesGhosts of WarΘεονύμφη ΜουσκάριαNo ratings yet

- Financial Accounts Questoin Paper UNOM 2018Document4 pagesFinancial Accounts Questoin Paper UNOM 2018lucy artemisNo ratings yet

- Paris CDG Airport Transport Map EutouringDocument1 pageParis CDG Airport Transport Map EutouringFernando GonzalezNo ratings yet

- Reading Comprehension (13) TextDocument2 pagesReading Comprehension (13) TextAdam Kamal100% (1)

- The Agriculutral RevolutionDocument8 pagesThe Agriculutral Revolutionayas67240No ratings yet

- CSB BANK LIMITED Stat Ad FinalDocument1 pageCSB BANK LIMITED Stat Ad FinalJAYASREE K.KNo ratings yet

- 27-Villages Development Plan Modifications List PDFDocument13 pages27-Villages Development Plan Modifications List PDFVikrant PatilNo ratings yet

Module 10 - The Financial Statements II

Module 10 - The Financial Statements II

Uploaded by

Nina AlexineOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 10 - The Financial Statements II

Module 10 - The Financial Statements II

Uploaded by

Nina AlexineCopyright:

Available Formats

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

Module 10

A. Course Code – Title : C-AE13: Financial Accounting and Reporting

B. Module No – Title : M10 – The Financial Statements

C. Time Frame : 1/2 week (Week 10 ) – 3 hrs

D. Materials : Course Syllabus

1. Overview

This learning material provides a comprehensive discussion and illustration of the

four financial statements namely, the Income Statement, the Statement of Changes in

Owner’s Equity, the Balance Sheet or Statement of Financial Position, and the Statement

of Cash Flows.

You should read clearly and understand well the topics explained herein. It is also

expected that you answer the assigned problems and exercises. Please finish reading

Chapter 5 of your textbook.

2. Desired Learning Outcomes

At the end of the learning session, I can:

a) Describe the four financial statements and cite the importance of each; and,

b) Prepare, in good form, properly classified financial statements.

3. Content/Discussion

Lesson 1 – The Income Statement

The financial statements serve as the means by which the financial information

accumulated, recorded, and processed in accounting is periodically communicated to the

various stakeholders, so that they can use the information contained in these statements

in order to arrive at sound economic decisions. These are general-purpose statements,

because they are intended to meet the needs of all users or stakeholders, and not the

particular needs of a specific user.

Note: The illustrative financial statements given in this module were prepared from the

worksheet completed in Module 9. Every financial statement has a heading that is written

above at the middle or center. It is composed of three items: the name of the business, the

title or name of the financial statement, and the specific date of the Balance Sheet or the

period covered in the case of the other three statements.

The Income Statement is the statement that is usually prepared first to determine the profit

earned/ loss incurred, because this amount is needed to prepare the capital statement or

the Statement of Changes in Owner’s Equity.

Faculty: SISINIA T. QUIZON 1 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

The Income Statement shows the results of operation or the performance of an entity by

presenting the income earned and the expenses incurred for a given period of time,

usually a month, quarter, semester or year.

The income may be subdivided into the (a) regular or operating income which arise from

the normal course of business and (b) other income which may be earned from activities

other than its normal operating activities.

There are two presentation forms for cost and expenses: (a) nature of expense and (b)

function of expense.

The nature of expense form also known as the single step form is normally used for simple

businesses such as those which render services. It may have two sections, one for

revenues and another for expenses. This form makes a single step of deducting expenses

from the revenues to determine the result of operations, which may either be a profit or

a loss. This form also presents expenses according to their nature, such as: depreciation,

advertising, rent, utilities, employee benefits.

The function of expense form also known as the multi-step form presents expenses according

to use or function, like cost of goods sold, administrative expenses, distribution costs.

This will be discussed in a subsequent module on the accounting for merchandising

activities.

Faculty: SISINIA T. QUIZON 2 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

Illustrative income statement prepared from the worksheet is given below

Our Car Wash

Income Statement

For the year ended December 31, 2020

Revenues:

Cleaning Fees Income P 970,000

Expenses:

Taxes and Licenses P 15,000

Salaries Expense 130,000

Repairs and Maintenance 28,000

Rent Expense 120,000

Utilities Expense 66,000

Advertising Expense 12,000

Bad Debts Expense 3,150

Supplies Expense 60,000

Insurance Expense 32,000

Depreciation Expense-Furniture & Fixtures 4,500

Depreciation Expense-Office Equipment 16,000

Depreciation Expense-Car Wash Equipment 36,000 ( 522,650)

Profit before Financial Cost P 447,350

Interest Expense ( 90,000)

Profit for the year P 357,350

In preparing the income statement, please be guided by the following:

a) Below the heading are the other main parts: revenue/income earned, expenses

incurred and the profit for the period.

b) Always present first the main source of revenue or income earned from the principal

line of operations, followed by other income, if any. Expenses may be presented in a

descending order, from the highest to the lowest amount, or alphabetically. Interest

Expense being a financial cost is always presented as the last expense.

c) Margin on the left side – The extreme margin is used to describe the major sections:

revenue, expenses and profit. The inner margin is for the accounts contained or

under the main section.

d) Money columns on the right side – The extreme money column is used for the

amounts of the total revenue/income, total expenses and the profit, while the inner

money column is for the individual amounts of the accounts in the main sections.

Faculty: SISINIA T. QUIZON 3 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

e) Single rule the last amount added or deducted, and always double rule the final

amount.

Lesson 2 – The Statement of Changes in Owner’s Equity or Capital Statement

This statement is also known as the capital statement, which summarizes and explains

what happened to or the changes that occurred in the capital or claim of the owner

during a period of time, that is, the accounting period.

Illustrative Statement of Changes in Equity

Our Car Wash

Statement of Changes in Equity

For the year ended December 31, 2020

Corona Capital, January 1, 2020 P 653,000

Add; Profit for the year 357,350

Total P1,010,350

Less: Withdrawals 36,000

Corona, Capital, December 31, 2020 P 974,350

Note: The profit shown in the income statement is presented as an addition to or an

increase in the beginning capital balance in the statement of changes in equity. On the

other hand, if the result of operations is a net loss, this is deducted from the beginning

capital balance. This is the reason why the income statement is prepared first, followed

by the capital statement.

Lesson 3 – The Statement of Financial Position or Balance Sheet

This statement shows the financial position of the entity by presenting in detail the assets,

liabilities, and the residual interest or claim of the owner as of a given date.

There are two acceptable forms of this statement: (a) the account form which follows the

account and the accounting equation, wherein the assets are presented on the left or debit

side, and the liabilities and owner’s equity are on the right or credit side; (b) the report

form which shows the assets followed by the liabilities and owner’s equity in one straight

column or in a vertical manner.

Faculty: SISINIA T. QUIZON 4 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

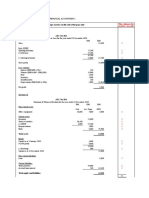

Illustrative Statements of Financial Position:

Our Car Wash

Statement of Financial Position

December 31, 2020

ASSETS

Current Assets:

Cash P850,000

Accounts Receivable P 63,000

Less: Allowance for Bad Debts (3,150) 59,850

Unused Supplies 10,000

Prepaid Insurance 16,000

Prepaid Rent 30,000

Total current assets P 965,850

Non-current Assets:

Furniture and Fixtures P 65,000

Less: Accumulated Depreciation ( 4,500) P 60,500

Office Equipment P250,000

Less: Accumulated Depreciation ( 16,000) 234,000

Car Wash Equipment P950,000

Less: Accumulated Depreciation ( 36,000) 914,000

Total non-current assets 1,208,500

Total Assets P2,174,350

LIABILITIES and OWNER’S EQUITY

Current Liabilities:

Accounts Payable P 100,000

Interest Payable 90,000

Loans Payable 1,000,000

Unearned Cleaning Fees 10,000

Total Current Liabilities P1,200,000

Owner’s Equity:

Corona, Capital _ 974,350

Total Liabilities and Owner’s Equity P2,174,350

Statement of Financial Position in the Report Form

Faculty: SISINIA T. QUIZON 5 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

Our Car Wash

Statement of Financial Position

December 31, 2020

Assets Liabilities and Owner's Equity

Current Assets: Current Liabilities:

Cash P 850,000 Accounts Payable P 100,000

Accounts Receivable P 63,000 Interest Payable 90,000

Allowance for Bad Debts 3,150 59,850 Loans Payable 1,000,000

Unused Supplies 10,000 Unearned Cleaning Fees 10,000

Prepaid Insurance 16,000 Total current liabilities P 1,200,000

Prepaid Rent 30,000

Total current assets P 965,850 Owner's Equity:

Non-current Assets: Corona, Capital 974,350

Furniture and Fixtures P 65,000

Accum. Depreciation 4,500 P 60,500

Office Equipment 250,000

Accum. Depreciation 16,000 234,000

Car Wash Equipment 950,000

Accum. Depreciation 36,000 914,000

Total non-current assets 1,208,500 __________

Total Assets P 2,174,350 Total Liabilities and Owner's Equity P 2,174,350

Statement of Financial Position in the Account Form

Note: The capital balance in the statement of changes in owner’s equity should be the capital

balance that will appear in the owner’s equity in the balance sheet.

In preparing the statement of financial position or the balance sheet, please be guided by

the following:

a) Prepare a properly classified balance sheet by presenting the current assets, non-

current assets, current liabilities and non-current liabilities.

b) There is no particular order prescribed in presenting the items in the balance sheet.

An entity may present assets and liabilities in the order of liquidity if such

presentation based on liquidity will make the accounting information more

meaningful, and therefore, more useful to the users or stakeholders. In this case, the

assets are presented in a decreasing order of liquidity, cash being the most liquid to

be presented first. Liabilities which are currently due are shown first.

c) The extreme left margin is used for describing the major classifications such as

Current Assets, Non-current Assets, and Current Liabilities, while the inner margin

is used for the accounts under each classification, like Cash, Supplies, Office

Equipment, Accounts Payable.

d) The placement of the amounts in the money columns on the right side follows the

margin on the left side: extreme right money column for the total amounts of the

Faculty: SISINIA T. QUIZON 6 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

major classifications, and the inner money columns for the amounts of the individual

accounts under each classification.

e) In the extreme right money column, put a peso sign on the first and last amounts per

accounting value, and in the inner money column, put a peso sign on the first

amount of every column of figures.

f) Single rule the last amount to be added or deducted, and double rule the final

amount or figure.

Lesson 4 – The Statement of Cash Flows

This statement presents information regarding the entity’s cash receipts (cash inflows) as

well as its cash payments (cash outflows) during a certain period. It further classifies this

cash information into operating, investing and financing activities, and shows the net

increase or decrease in cash during the specified period, that will be added to (if an

increase) or deducted from (if a decrease) the beginning cash balance to arrive at the

ending cash balance, which should be the same as the balance of the Cash account in the

Balance Sheet or Statement of Financial Position.

Operating activities relate to income from the sale of goods or services and expenses

incurred in producing and delivering these goods or services. Cash flows from operating

activities are usually the effects of transactions that are reflected in the income statement,

that is, those that are taken into consideration in the determination of the profit or loss.

This cash flow may be presented using either the direct or indirect method. The direct

method will be discussed and illustrated in this module. The other method will be taken

up comprehensively in a higher course.

In the direct method, the entity’s net cash provided by or used in operating activities is

obtained by adding the operating cash inflows or receipts and deducting therefrom the

itemized operating cash outflows or payments. If the cash inflows exceed the cash

outflows, the net effect is the net cash provided by operating activities; on the other hand,

if it is the cash outflows that exceed the cash inflows, the net effect is the net cash used in

operating activities.

Investing activities include cash inflows from the sale of property and equipment as well

as investments in securities, and cash outflows that arise from the acquisition or purchase

of plant, property and equipment as well as securities or investments.

Financing activities generally include cash inflows arising from contributions of owner/s

as well as loans from creditors, while cash outflows arise from cash withdrawals of or

distributions to owner/s and payments of loans.

Faculty: SISINIA T. QUIZON 7 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

Below is an illustration of a Statement of Cash Flows.

Our Car Wash

Statement of Cash Flows

For the year ended December 31, 2020

Cash flows from operating activities:

Collections from customers (Sched 1) P 917,000

Payments for:

Supplies (Sched 2) P 70,000

Insurance (Sched 3) 48,000

Taxes and Licenses 15,000

Salaries Expense 130,000

Repairs and Maintenance 28,000

Rent (Sched 4) 150,000

Utilities Expense 66,000

Advertising Expense 12,000 (519,000)

Net cash provided by (used in) operating activities P 398,000

Cash flows from investing activities:

Payments for the purchase of:

Furniture and Fixtures P ( 65,000)

Office Equipment ( 250,000)

Car Wash Equipment (Sched 5) (850,000)

Net cash provided by (used in) investing activities (1,165,000)

Cash flows from financing activities:

Cash investment of the owner P 653,000

Proceeds of loan 1,000,000

Cash withdrawal of the owner ( 36,000)

Net cash provided by (used in) financing activities 1,617,000

Net increase (decrease) in cash P 850,000

Cash balance at the beginning of the period (Jan 1, 2020) -

Cash balance at the end of the period (Dec 31, 2020) P 850,000

Note: The cash balance at the end of the period should be the same as the cash balance

in the Balance Sheet at the end of the same period.

Faculty: SISINIA T. QUIZON 8 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

Sched 1: Cleaning fees income P970,000

Add: Unearned cleaning fees 10,000

Less: Accounts Receivable, end ( 63,000)

Cash received from customers P917,000

Sched 2: Supplies used P 60,000

Add: Supplies unused 10,000

Cash paid for supplies P 70,000

Sched 3: Insurance expense P 32,000

Add:Prepaid insurance 16,000

Cash paid for insurance premiums P 48,000

Sched 4: Rent expense P120,000

Add: Prepaid rent 30,000

Cash paid for rent P150,000

Sched 5: Cost of car wash equipment P950,000

Less: Accounts payable (100,000)

Cash paid for car wash equipment P850,000

4. Progress Check

a) Which are the four financial statements?

b) Briefly describe each.

c) What is the purpose of each statement?

d) Why are they called general purpose statements?

5. Assignment (Optional)

Answer end-of- Chapter 5 prob 4 (Prepare the income statement, statement of

changes in equity, and the statement of financial position), prob 5 (only reqmt #4),

probs 7, 13 & 15.

6. Assessment

Atty. Dina Bale began business on January 1, 2020.

Following is the unadjusted trial balance at the end of the first year of operations, Dec

31, 2020.

Faculty: SISINIA T. QUIZON 9 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

Dina Bale Law Office

Unadjusted Trial Balance

December 31, 2020

Account Titles Debit Credit

Cash P 191,000

Accounts Receivable 30,000

Notes Receivable 60,000

Office Supplies 39,000

Furniture and Fixtures 65,000

Office Equipment 280,000

Accounts Payable P 8,000

Unearned Legal Fees 17,000

Atty. Bale, Capital 175,000

Atty. Bale, Drawing 16,000

Legal Fees Revenue 658,000

Rent Expense 93,000

Taxes and Licenses 15,000

Utilities Expense ___69,000 _________

Total P858,000 P858,000

The following are the adjustment data:

a) The note receivable is dated December 16, 2020, bears interest of 18% per year, and

is due to be paid by the customer on February 14, 2021.

b) A count of the Office Supplies showed P11,000 still unused.

c) Bad debts should be provided at 4% of accounts receivable.

d) The furniture and fixtures, acquired on Feb 1 of the year, have a scrap value of

P5,000 and an estimated useful life of 10 years.

e) The office equipment acquired on Feb 28 of the year, have a scrap value of P40,000.

They are estimated to be useful for 20 years.

f) Of the Unearned Legal Fees, P10,000 has already been earned.

g) Unpaid taxes amounted to P19,500.

h) Included in Rent Expense is P9,000 which is applicable to January 2021.

i) Utility bills for December received but not yet paid, P7,000.

Required: Prepare in good form the financial statements of Dina Bale Law Office

Faculty: SISINIA T. QUIZON 10 | Page

COLLEGE OF ACCOUNTANCY

C-AE13: Financial Accounting and Reporting

First Semester | AY 2020-2021

7. References

Manuel, Zenaida Vera-Cruz (2018) 21st Century Accounting Process, Basic Concepts and

Procedures, Manila, Philippines: Zenaida Vera-Cruz Manuel.

Ballada, Win. (2020) Basic Financial Accounting and Reporting, Cavite, Philippines:

Dom Dane Publishers & Made Easy Books.

Cabrera, Ma. Elenita B. & Cabrera, Gilbert Anthony B. (2018) Financial Accounting and

Reporting,Manila, Philippines: GIC Enterprises & Co., Inc.

Ferrer, Rodiel C. & Millan, Zeus Vernon B. (2017) Fundamentals of Accountancy,

Business and Management, Part 1, Baguio City, Philippines: Bandolin Enterprise.

Warren, Carl S., Reeve, James M., & Duchac, Jonathan E. ((2015) Accounting 25th

Edition, Pasig City, Philippines: Cengage Learning Asia Pte Ltd (Philippine Branch).

Gilbertson, Claudia B., Lehman, Mark W., & Gentene, Debra H. (2017) Century 21

Accounting Multi-column Journal 10th Edition, Boston, MA 02210 USA: Cengage

Learning.

Wild, John; Kwok, Winston; Venkatesh, Sundar; Shaw, Ken W. & Chiappetta,

Barbara. (2016) Fundamental Accounting Principles 2nd Edition, 2 Penn Plaza, New York:

McGraw-Hill Education.

Faculty: SISINIA T. QUIZON 11 | Page

You might also like

- Altonomy Market Making ServiceDocument15 pagesAltonomy Market Making Servicepieter_houbenNo ratings yet

- Fringe Benefit Part 3Document24 pagesFringe Benefit Part 3kitkathyNo ratings yet

- BIR Form 1702-RTDocument8 pagesBIR Form 1702-RTDianne SantiagoNo ratings yet

- A Short Review On Basic FinanceDocument4 pagesA Short Review On Basic FinanceJed AoananNo ratings yet

- Letter Seeking Permission To Use InstrumentDocument1 pageLetter Seeking Permission To Use InstrumentNina Alexine100% (1)

- HPC LPG Intl Time Charter Party 05 03 2013Document30 pagesHPC LPG Intl Time Charter Party 05 03 2013Sumeet Sud100% (1)

- AE 27 Lesson 3 Understanding FSDocument26 pagesAE 27 Lesson 3 Understanding FSMARC BENNETH BERIÑANo ratings yet

- Tax For CorpDocument28 pagesTax For CorpNiki DimaanoNo ratings yet

- Mergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleDocument27 pagesMergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleRizza Mae EudNo ratings yet

- Chapter 15 PDFDocument14 pagesChapter 15 PDFAvox EverdeenNo ratings yet

- Corporate Income Taxation-Special CorporationDocument24 pagesCorporate Income Taxation-Special CorporationXyla Marie EstorNo ratings yet

- Session 1 - Income Tax On CorporationsDocument12 pagesSession 1 - Income Tax On CorporationsMitzi WamarNo ratings yet

- Chapter08 PDFDocument22 pagesChapter08 PDFBabuM ACC FIN ECONo ratings yet

- FM 130 Philippine Monetary PolicyDocument5 pagesFM 130 Philippine Monetary PolicyHerminio NiepezNo ratings yet

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- The Role of Strategic Planning On The Sustainability of Selected MSMEs in The 2nd District of AlbayDocument7 pagesThe Role of Strategic Planning On The Sustainability of Selected MSMEs in The 2nd District of AlbayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Introduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPADocument35 pagesIntroduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPAKyla Marie HubieraNo ratings yet

- Mortgage Markets Practice Problems SolutionsDocument8 pagesMortgage Markets Practice Problems Solutionsjam linganNo ratings yet

- JFINEX Accomplishment Report 1st Semester 2022 2023Document20 pagesJFINEX Accomplishment Report 1st Semester 2022 2023Jelwin BautistaNo ratings yet

- Module 2. Lesson 1. Taxation of Minimum Wage EarnersDocument6 pagesModule 2. Lesson 1. Taxation of Minimum Wage EarnersRaniel AnidoNo ratings yet

- 8 Responsibility AccountingDocument8 pages8 Responsibility AccountingXyril MañagoNo ratings yet

- Chapte R: Short-Term Finance and PlanningDocument57 pagesChapte R: Short-Term Finance and PlanningMohammad Salim HossainNo ratings yet

- Discussion ProblemsDocument23 pagesDiscussion ProblemsJemNo ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- Reviewer-Stock ValuationDocument7 pagesReviewer-Stock ValuationSheira Mae GuzmanNo ratings yet

- 11 - PFM - Chapter 10 - Financing Health and Care LiabilityDocument9 pages11 - PFM - Chapter 10 - Financing Health and Care LiabilityLee K.No ratings yet

- Comparison Chart of Thrift, Rural and Cooperative Banks and Nssla Thrift Banks Rural Banks Cooperative Banks NsslasDocument1 pageComparison Chart of Thrift, Rural and Cooperative Banks and Nssla Thrift Banks Rural Banks Cooperative Banks NsslasReginald Matt Aquino SantiagoNo ratings yet

- Financial Planning and ForecastingDocument16 pagesFinancial Planning and ForecastingAzain UsmanNo ratings yet

- CHAPTER 1 Intermediate 2Document32 pagesCHAPTER 1 Intermediate 2Sherly CabiaoNo ratings yet

- Module 05 Final Income TaxationDocument19 pagesModule 05 Final Income TaxationSly BlueNo ratings yet

- Chapter 5 - Final Income Taxation Chapter Overview and ObjectivesDocument22 pagesChapter 5 - Final Income Taxation Chapter Overview and ObjectivesCindy Felipe50% (2)

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- Module 6 PPT ContentDocument3 pagesModule 6 PPT ContentANZEL JUSTIN DE LEONNo ratings yet

- Introduction To Investment Decision in Financial Management (Open Compatibility)Document5 pagesIntroduction To Investment Decision in Financial Management (Open Compatibility)karl markxNo ratings yet

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Document16 pagesGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Working Capital Management - Introduction - Session 1 & 2Document56 pagesWorking Capital Management - Introduction - Session 1 & 2Vaidyanathan RavichandranNo ratings yet

- Strategic Cost Management PrelimDocument6 pagesStrategic Cost Management Prelimailel isagaNo ratings yet

- Strategic Tax Management - Week 3Document14 pagesStrategic Tax Management - Week 3Arman DalisayNo ratings yet

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- Loan ImpairmentDocument22 pagesLoan ImpairmentJEFFERSON CUTENo ratings yet

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Document6 pagesTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaqueNo ratings yet

- ACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Document14 pagesACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Migz labianoNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Financial Management - Chapter 1 NotesDocument2 pagesFinancial Management - Chapter 1 Notessjshubham2No ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Characteristics of Good GovernanceDocument3 pagesCharacteristics of Good GovernanceRoseanneNo ratings yet

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocument4 pagesLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Multiple Choice: Property of STIDocument2 pagesMultiple Choice: Property of STIJanineD.MeranioNo ratings yet

- Business Combinations (Ifrs 3)Document29 pagesBusiness Combinations (Ifrs 3)anon_253544781No ratings yet

- Toa Lecture 7 Ias 10Document5 pagesToa Lecture 7 Ias 10Rachel LeachonNo ratings yet

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- BAIACC3X - Intermediate Accounting 3Document7 pagesBAIACC3X - Intermediate Accounting 3Mitchie FaustinoNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- Analysis of Consumer Behavior in Buying Instant Noodles: (Case Studies in The Bogor City Area)Document14 pagesAnalysis of Consumer Behavior in Buying Instant Noodles: (Case Studies in The Bogor City Area)ich chiNo ratings yet

- Prelim Good GovernanceDocument7 pagesPrelim Good GovernanceDDDNo ratings yet

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Document57 pagesMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosNo ratings yet

- Chap 11 Notes Mba Standard CostsDocument49 pagesChap 11 Notes Mba Standard CostsHarlinni ZainuddinNo ratings yet

- Consolidated Financial StatementsDocument7 pagesConsolidated Financial StatementsParvez NahidNo ratings yet

- Income Taxation SchemesDocument7 pagesIncome Taxation SchemesLeonard CañamoNo ratings yet

- MAC 406 Performance Management SystemsDocument38 pagesMAC 406 Performance Management SystemsRhodemar CuartoNo ratings yet

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Module 13 - Other Merchandising TransactionsDocument9 pagesModule 13 - Other Merchandising TransactionsNina AlexineNo ratings yet

- Module 12 - Accounting Process For A Merchandising EntityDocument8 pagesModule 12 - Accounting Process For A Merchandising EntityNina AlexineNo ratings yet

- Module 9 - The WorksheetDocument13 pagesModule 9 - The WorksheetNina AlexineNo ratings yet

- Module 4 - The Account and The Rules of Debit and CreditDocument18 pagesModule 4 - The Account and The Rules of Debit and CreditNina AlexineNo ratings yet

- Module 7 - The Need For Adjusting Journal Entries, Part IDocument12 pagesModule 7 - The Need For Adjusting Journal Entries, Part INina AlexineNo ratings yet

- Module 8 - The Need For Adjusting Journal Entries, Part IIDocument8 pagesModule 8 - The Need For Adjusting Journal Entries, Part IINina AlexineNo ratings yet

- Module 5 - Recording Transactions in A JournalDocument5 pagesModule 5 - Recording Transactions in A JournalNina AlexineNo ratings yet

- According To SopDocument2 pagesAccording To SopNina AlexineNo ratings yet

- Module 6 - The General Ledger and Trial BalanceDocument8 pagesModule 6 - The General Ledger and Trial BalanceNina AlexineNo ratings yet

- Unisite Subdivision, Del Pilar, City of San Fernando, 2000 Pampanga, PhilippinesDocument1 pageUnisite Subdivision, Del Pilar, City of San Fernando, 2000 Pampanga, PhilippinesNina AlexineNo ratings yet

- 6 Business Beyond Profit PDFDocument10 pages6 Business Beyond Profit PDFNina AlexineNo ratings yet

- List of Iconic CPG Projects in SingaporeDocument2 pagesList of Iconic CPG Projects in SingaporeKS LeeNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- Purchaseworkbook PDFDocument56 pagesPurchaseworkbook PDFNikkie WhiteNo ratings yet

- Chapter - 4 - Cash Flow and InterestDocument19 pagesChapter - 4 - Cash Flow and InterestAhmed freshekNo ratings yet

- Haut Lac Postion PaperDocument4 pagesHaut Lac Postion Paperbm9gvfxj6hNo ratings yet

- S&P 500 Index Duke Energy StockDocument12 pagesS&P 500 Index Duke Energy Stockshrijit “shri” tembheharNo ratings yet

- Pestel Analysis: Karenz Jonah Solis, CpaDocument21 pagesPestel Analysis: Karenz Jonah Solis, CpaJay100% (1)

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Priyadarshini Sahoo100% (1)

- Issue69 PDFDocument164 pagesIssue69 PDFsilvofNo ratings yet

- PHP K Vut OkDocument29 pagesPHP K Vut OkrahulNo ratings yet

- Econ 501 Amid Answ 09Document6 pagesEcon 501 Amid Answ 09Eva YirgaNo ratings yet

- Rbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/IndiaepapersDocument14 pagesRbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/Indiaepapersaashmeen25No ratings yet

- The Fall of Communism in Eastern EuropeDocument3 pagesThe Fall of Communism in Eastern EuropeAugusto NuñezNo ratings yet

- ENR TOP 250 Global Contractors in 2019Document72 pagesENR TOP 250 Global Contractors in 2019yoonhkimNo ratings yet

- Financial Investment EXERCISE-1Document16 pagesFinancial Investment EXERCISE-1Quynh NguyenNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Document6 pagesECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Diệp TrịnhNo ratings yet

- Coronavirus: A Visual Guide To The Economic Impact - BBC NewsDocument18 pagesCoronavirus: A Visual Guide To The Economic Impact - BBC NewsTrần Diệu QuỳnhNo ratings yet

- Biczok Master ThesisDocument48 pagesBiczok Master Thesisthe libyan guyNo ratings yet

- Amadeus Basic Codes 1Document6 pagesAmadeus Basic Codes 1Jorja OfianaNo ratings yet

- NCERT Class 12 English Lost SpringDocument10 pagesNCERT Class 12 English Lost SpringashNo ratings yet

- Ghosts of WarDocument61 pagesGhosts of WarΘεονύμφη ΜουσκάριαNo ratings yet

- Financial Accounts Questoin Paper UNOM 2018Document4 pagesFinancial Accounts Questoin Paper UNOM 2018lucy artemisNo ratings yet

- Paris CDG Airport Transport Map EutouringDocument1 pageParis CDG Airport Transport Map EutouringFernando GonzalezNo ratings yet

- Reading Comprehension (13) TextDocument2 pagesReading Comprehension (13) TextAdam Kamal100% (1)

- The Agriculutral RevolutionDocument8 pagesThe Agriculutral Revolutionayas67240No ratings yet

- CSB BANK LIMITED Stat Ad FinalDocument1 pageCSB BANK LIMITED Stat Ad FinalJAYASREE K.KNo ratings yet

- 27-Villages Development Plan Modifications List PDFDocument13 pages27-Villages Development Plan Modifications List PDFVikrant PatilNo ratings yet