Professional Documents

Culture Documents

ANTHONY MOSCOSA - Financial Accounting-Activity Sheet 06

ANTHONY MOSCOSA - Financial Accounting-Activity Sheet 06

Uploaded by

RICARDO JOSE VALENCIAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ANTHONY MOSCOSA - Financial Accounting-Activity Sheet 06

ANTHONY MOSCOSA - Financial Accounting-Activity Sheet 06

Uploaded by

RICARDO JOSE VALENCIACopyright:

Available Formats

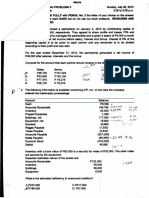

Activity Sheet 06

Name: _Moscosa, Anthony N.___________________________ Rating: __________________

Course / Year / Section : _BSIE-3A________________________

From the following information, prepare adjusting entries on December 31, 2019, the end of the

accounting period :

a.) Accrued interest on notes to suppliers, P 5,000.

b.) Accrued interest on notes from customers, P 2,000.

c.) Interest received and credited to Unearned Interest Revenue account is P 6,000 of which only P

2,500 was earned.

d.) Equipment acquired on July 1, 2019 for P 60,000 is expected to last for five years.

e.) Unrecorded or accrued salary, P 46,000.

f.) Use of the office supplies account of P 5,600 was P 2,500.

g.) Unexpired of the Prepaid Insurance account of P 40,000 was P 12,000.

h.) The Prepaid Rent of P 50,000 was for a period of 10 months starting Sept 1, 2019.

i.) The Notes Receivable of P 50,000 in a 12%, 90-day note dated November 1, 2019.

Account Title Debit Credit

a.) Interest Expense P 5,000

Interest Payable P 5,000

b.) Interest Expense P 2,000

Interest Revenue P 2,000

c.) Unearned Interest Revenue P 2,500

Interest Revenue P 2,500

d.) Depriciation Expense P 60,000

Accumulated-Depriciation Equipment P 60,000

e.) Salary Expense P 46,000

Salary Payable P 46,000

f.) Office Supplies Expense P 2,500

Office Supplies P 2,500

g.) Insurance Expense P 12,000

Prepaid Insurance P 12,000

h.) Rent Expense P 16,000

Prepaid Rent P 16,000

i.) Interest Expense P 1,000

Interest Revenue P 1,000

You might also like

- LQ 1 - Set A SolutionDocument14 pagesLQ 1 - Set A SolutionChristina Jazareno64% (11)

- 14.0 Final Quiz 1 Tax On IndividualsDocument8 pages14.0 Final Quiz 1 Tax On IndividualsRezhel Vyrneth Turgo100% (1)

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- Additional Income Tax QuizzerDocument2 pagesAdditional Income Tax QuizzerJohn Brian D. Soriano100% (1)

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Module 4 - Problem 5Document1 pageModule 4 - Problem 5Lycksele RodulfaNo ratings yet

- Adjusting Entry DrillDocument1 pageAdjusting Entry DrillJezeil Dimas50% (4)

- Sample Problems For Construction AccountingDocument2 pagesSample Problems For Construction AccountingHernandez Aliah Cyril M.No ratings yet

- HWChap003 ANSDocument68 pagesHWChap003 ANShelloocean100% (1)

- Solved Beacon Signals Company Maintains and Repairs Warning Lights Such As PDFDocument1 pageSolved Beacon Signals Company Maintains and Repairs Warning Lights Such As PDFAnbu jaromiaNo ratings yet

- All CaseletteDocument358 pagesAll CaseletteNish100% (1)

- Financial Accounting Activity Sheet 06 Valencia Ricardo Jose D.Document1 pageFinancial Accounting Activity Sheet 06 Valencia Ricardo Jose D.RICARDO JOSE VALENCIANo ratings yet

- REALYN TRIA - Fundamentals of Accounting-Activity Sheet 07Document1 pageREALYN TRIA - Fundamentals of Accounting-Activity Sheet 07RICARDO JOSE VALENCIANo ratings yet

- Exercise. AdjustmentsDocument6 pagesExercise. AdjustmentsDavid Con Rivero79% (14)

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- Accounting Process 3Document2 pagesAccounting Process 3Glen JavellanaNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Docsity Solutions 2010 1insurance Expenseprepaid Insurance P 33Document7 pagesDocsity Solutions 2010 1insurance Expenseprepaid Insurance P 33Pau LeonsameNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- 1.6.1 Quiz 3 Problems Accounting ProcessDocument4 pages1.6.1 Quiz 3 Problems Accounting ProcessyelenaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- FAR.2854 - Cash To Accrual.Document3 pagesFAR.2854 - Cash To Accrual.stephen ponciano100% (2)

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- Prof 6 Activity 29 To 33 Answer KeyDocument9 pagesProf 6 Activity 29 To 33 Answer KeySolana SilvestreNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- ACCTING Pg. 217Document2 pagesACCTING Pg. 217Now OnwooNo ratings yet

- Cpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsDocument14 pagesCpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsKyla MilanNo ratings yet

- Activity 6 (Adjusting Entries)Document4 pagesActivity 6 (Adjusting Entries)Angeline Gonzales PaneloNo ratings yet

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- Prelim Exam - Attempt Review (Page 2 of 50)Document1 pagePrelim Exam - Attempt Review (Page 2 of 50)christoper laurenteNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Discussion Questions On Accounting Cycle of A Service BusinessDocument6 pagesDiscussion Questions On Accounting Cycle of A Service BusinessGhillian Mae Guiang0% (1)

- Final Preboard Tax PDFDocument16 pagesFinal Preboard Tax PDFElla AlmazanNo ratings yet

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- Applied Auditing Perando PatriciaDocument32 pagesApplied Auditing Perando PatriciamaurNo ratings yet

- Advanced Financial Accounting and Reporting: ConceptualDocument6 pagesAdvanced Financial Accounting and Reporting: ConceptualYeji BabeNo ratings yet

- Long Exam Part 1Document11 pagesLong Exam Part 1yuwimiko27No ratings yet

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- CFAS ExercisesDocument10 pagesCFAS ExercisesDhea MaligayaNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- 4.3.2.5 Elaborate - Determining AdjustmentsDocument4 pages4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- ch4 2Document3 pagesch4 2hohrmpm2No ratings yet

- UEDocument1 pageUEfastslowerNo ratings yet

- FAR Adjusting HMDocument6 pagesFAR Adjusting HMpaololegardoNo ratings yet

- Assignment Accounting AJE GUIANGDocument14 pagesAssignment Accounting AJE GUIANGIce Voltaire B. GuiangNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessAngel TumamaoNo ratings yet

- Practical Accounting 1Document18 pagesPractical Accounting 1Unknown WandererNo ratings yet

- PR 4 Completing The Cycle 2022 1Document1 pagePR 4 Completing The Cycle 2022 1smthlikeyouNo ratings yet

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDocument3 pagesMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)

- Sol Man Sec 6 SQ1 PDFDocument4 pagesSol Man Sec 6 SQ1 PDFHope Trinity EnriquezNo ratings yet

- ABM 12 F Adjusting Entries 2017Document1 pageABM 12 F Adjusting Entries 2017Baltazar Justiniano100% (1)

- Exercises On Accounting CycleDocument7 pagesExercises On Accounting CycleXyriene RocoNo ratings yet

- TaxationDocument6 pagesTaxationAlexa ParkNo ratings yet

- Adjusting Entries Christine Gamba CargoDocument5 pagesAdjusting Entries Christine Gamba Cargoelma wagwag100% (2)

- FAR Adjusting Entries ExcerciseDocument3 pagesFAR Adjusting Entries ExcerciseSheena LeysonNo ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- JEROME LEGASPI Activity Sheet 10Document3 pagesJEROME LEGASPI Activity Sheet 10RICARDO JOSE VALENCIANo ratings yet

- Financial Accounting Activity Sheet 06 Valencia Ricardo Jose D.Document1 pageFinancial Accounting Activity Sheet 06 Valencia Ricardo Jose D.RICARDO JOSE VALENCIANo ratings yet

- BOSH Packet Requirements - TemplateDocument1 pageBOSH Packet Requirements - TemplateRICARDO JOSE VALENCIANo ratings yet

- Clause 7 of ISO 9001Document4 pagesClause 7 of ISO 9001RICARDO JOSE VALENCIANo ratings yet

- Iefp0413 Final ExamDocument9 pagesIefp0413 Final ExamRICARDO JOSE VALENCIANo ratings yet

- Ieom Activity 10Document1 pageIeom Activity 10RICARDO JOSE VALENCIANo ratings yet

- REALYN TRIA - Fundamentals of Accounting-Activity Sheet 07Document1 pageREALYN TRIA - Fundamentals of Accounting-Activity Sheet 07RICARDO JOSE VALENCIANo ratings yet

- 39 Creating HatchDocument5 pages39 Creating HatchRICARDO JOSE VALENCIANo ratings yet

- Session 3Document90 pagesSession 3Phuc Ho Nguyen MinhNo ratings yet

- Subject Overview: (MODULE 4 - The Adjusting Process)Document40 pagesSubject Overview: (MODULE 4 - The Adjusting Process)Samuel John GustiloNo ratings yet

- 01 Overview of AccountingDocument8 pages01 Overview of AccountingFaith0% (1)

- Tutorial ListDocument14 pagesTutorial ListAnggaNo ratings yet

- 2ND Online Quiz Level 1 Set B (Answers)Document5 pages2ND Online Quiz Level 1 Set B (Answers)Vincent Larrie Moldez100% (1)

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzNo ratings yet

- Adjusting Entries For Bad DebtsDocument6 pagesAdjusting Entries For Bad DebtsKristine IvyNo ratings yet

- Funda1 ReviewerDocument7 pagesFunda1 ReviewerKim Audrey JalalainNo ratings yet

- Adjusting Trial BalancesDocument21 pagesAdjusting Trial BalancesBethylGo100% (2)

- Adjusting EntriesDocument21 pagesAdjusting EntriesshielaNo ratings yet

- Modul Level 3Document39 pagesModul Level 3Marta GobenaNo ratings yet

- P4 1Document1 pageP4 1Arnalistan EkaNo ratings yet

- Quiz - Part 2Document4 pagesQuiz - Part 2Charmaine Bernados BrucalNo ratings yet

- BPA 11403-Wk 4 &5-Accruals & ClosingDocument115 pagesBPA 11403-Wk 4 &5-Accruals & ClosingChee Wai WongNo ratings yet

- Adjusting EntriesDocument24 pagesAdjusting EntriesHasnainNo ratings yet

- F 2019092615474369290942Document12 pagesF 2019092615474369290942Deta BenedictaNo ratings yet

- ACC 225 CheckPoint Adjustments and Accrual and Cash Basis AccountingDocument2 pagesACC 225 CheckPoint Adjustments and Accrual and Cash Basis AccountingPraveen SudarsanNo ratings yet

- LECTURE Jan. 3 2023Document17 pagesLECTURE Jan. 3 2023lheamaecayabyab4No ratings yet

- Intermediate Accounting: Accounting Changes and Error AnalysisDocument87 pagesIntermediate Accounting: Accounting Changes and Error Analysis12C1 LớpNo ratings yet

- Financial Accounting: Adjusting The AccountsDocument33 pagesFinancial Accounting: Adjusting The AccountsGiang PhungNo ratings yet

- Chapter 3 - The Adjusting ProcessDocument60 pagesChapter 3 - The Adjusting ProcessAzrielNo ratings yet

- Ch3 Practice Quiz2Document4 pagesCh3 Practice Quiz2Alyssa LexNo ratings yet

- INSTRUCTION: Please Answer All The Problems That Will Be Found in Your Textbook. Put Your Answers OnDocument6 pagesINSTRUCTION: Please Answer All The Problems That Will Be Found in Your Textbook. Put Your Answers OnMary Ann F. MendezNo ratings yet

- University of The Cordilleras Accounting 1/2 Lecture AidDocument3 pagesUniversity of The Cordilleras Accounting 1/2 Lecture AidJesseca JosafatNo ratings yet

- A221 MC 2 - StudentDocument7 pagesA221 MC 2 - StudentNajihah RazakNo ratings yet

- Adjusting Entries: Impairment Loss of ReceivablesDocument16 pagesAdjusting Entries: Impairment Loss of ReceivablesL Onifur100% (1)