Professional Documents

Culture Documents

The Knowledge

The Knowledge

Uploaded by

Rahil AfricawalaCopyright:

Available Formats

You might also like

- 1 Prof Chauvins Instructions For Bingham CH 4Document35 pages1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- Direct TAX Part ADocument497 pagesDirect TAX Part Ashubh karaniaNo ratings yet

- AAA Accounting Standards Part 1Document3 pagesAAA Accounting Standards Part 1Gauri WastNo ratings yet

- Return Filing Procedure: Things You Need To Know BeforehandDocument10 pagesReturn Filing Procedure: Things You Need To Know BeforehandtalhaNo ratings yet

- Basic Concepts in Income Tax LawDocument39 pagesBasic Concepts in Income Tax LawSiddharth KaranNo ratings yet

- PEM ReportDocument6 pagesPEM Reportxx69dd69xxNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Word ImportanteDocument5 pagesWord Importantetc mleNo ratings yet

- Taxation System in IndiaDocument46 pagesTaxation System in IndiaNiket Dattani100% (1)

- Tax PlaningDocument78 pagesTax PlaningSahilSahoreNo ratings yet

- Consolidated Question Book-AccountingDocument31 pagesConsolidated Question Book-AccountingRubel KhanNo ratings yet

- Presumptive Taxation For Business and ProfessionDocument17 pagesPresumptive Taxation For Business and ProfessionRupeshNo ratings yet

- Guide 04: Tax Overview For Businesses, Investors & IndividualsDocument8 pagesGuide 04: Tax Overview For Businesses, Investors & IndividualsAbdul NafiNo ratings yet

- Analysis of The 2018 Finance BillDocument37 pagesAnalysis of The 2018 Finance BillLEENIE MUNAHNo ratings yet

- Rmo 41-2011Document51 pagesRmo 41-2011Christian Albert HerreraNo ratings yet

- Income Tax Refund PDFDocument3 pagesIncome Tax Refund PDFArunDaniel100% (1)

- Audit Requirements and Compliance For Micro and Small EnterprisesDocument2 pagesAudit Requirements and Compliance For Micro and Small EnterprisesCora NovusNo ratings yet

- Union Budget Group 6Document18 pagesUnion Budget Group 6GayatriNo ratings yet

- Basic Concepts: 1.1 What Is A Tax?Document31 pagesBasic Concepts: 1.1 What Is A Tax?sourav kumar rayNo ratings yet

- Search Results: Equalisation Levy - Income Tax DepartmentDocument3 pagesSearch Results: Equalisation Levy - Income Tax DepartmentforallNo ratings yet

- Deduction Under Income Tax Act 1961Document5 pagesDeduction Under Income Tax Act 1961Suman kushwahaNo ratings yet

- NRB News Vol.36 20770404 PDFDocument6 pagesNRB News Vol.36 20770404 PDFNarenBistaNo ratings yet

- Tax FinalDocument16 pagesTax FinalAnany UpadhyayNo ratings yet

- Module 1, 2 & 3Document30 pagesModule 1, 2 & 3JAGRITI SINGH JUNo ratings yet

- Deadlines & Due DatesDocument6 pagesDeadlines & Due DatesGummy BearNo ratings yet

- Pre-1. Introduction To Government AccountingDocument24 pagesPre-1. Introduction To Government AccountingPaupauNo ratings yet

- 139 2016 ND-CP 327644Document5 pages139 2016 ND-CP 327644Hoang My VuNo ratings yet

- Tax Filing Reminders: OutlineDocument30 pagesTax Filing Reminders: OutlineMarc Nathaniel RanayNo ratings yet

- Fiscaladministrationhistoryoverviewdefinitionlgubudgetprocessbydaisyt Besing Mpa 120916195508 Phpapp02 PDFDocument34 pagesFiscaladministrationhistoryoverviewdefinitionlgubudgetprocessbydaisyt Besing Mpa 120916195508 Phpapp02 PDFRochelle EstebanNo ratings yet

- Revenue Memorandum Order No. 2-2018: Bureau of Internal RevenueDocument7 pagesRevenue Memorandum Order No. 2-2018: Bureau of Internal RevenueLarry Tobias Jr.No ratings yet

- FABM2 12 Quarter2 Week4Document9 pagesFABM2 12 Quarter2 Week4Princess DuquezaNo ratings yet

- 1.concepts of Taxation & Tax Structure in PakistanDocument24 pages1.concepts of Taxation & Tax Structure in Pakistanuzma batool93% (14)

- L4 - Demonetisation Post-TruthsDocument10 pagesL4 - Demonetisation Post-TruthsAyushNo ratings yet

- Crowe Tax Handbook 2019Document47 pagesCrowe Tax Handbook 2019Ahmad SubhaniNo ratings yet

- Tax Incentives 10708Document5 pagesTax Incentives 10708Hib Atty TalaNo ratings yet

- Income Declaration Scheme 2016Document5 pagesIncome Declaration Scheme 2016rqpNo ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- Mr. Rajendra Jain File Scanned.Document36 pagesMr. Rajendra Jain File Scanned.tharundigistudiotmkNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Canvass: Capturing News With An Analytical EdgeDocument6 pagesCanvass: Capturing News With An Analytical EdgeRanjith RoshanNo ratings yet

- Company Overview of Auditing FirmDocument14 pagesCompany Overview of Auditing FirmDarwin LopezNo ratings yet

- Article About Provisional TaxDocument6 pagesArticle About Provisional Taxduanedejager01No ratings yet

- Press Release IDS 02 09 2016Document2 pagesPress Release IDS 02 09 2016ElvisPresliiNo ratings yet

- Pajak InternasionalDocument60 pagesPajak InternasionalTutunKasepNo ratings yet

- Ddo ChecklistDocument14 pagesDdo ChecklistJuan David MateusNo ratings yet

- Thesis On Taxation in IndiaDocument5 pagesThesis On Taxation in Indiatit0feveh1h3100% (2)

- Tax Combined NotesDocument48 pagesTax Combined NotesignatiousmugovaNo ratings yet

- Concept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureDocument15 pagesConcept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureAnany UpadhyayNo ratings yet

- Amir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentDocument6 pagesAmir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentMehreen KhanNo ratings yet

- Introduction To Financial Statements and AuditDocument26 pagesIntroduction To Financial Statements and AuditAbu MusaNo ratings yet

- Business Taxation Module 1&2Document13 pagesBusiness Taxation Module 1&2Khushboo Parikh100% (1)

- Income TaxDocument10 pagesIncome Taxvadivelu7007No ratings yet

- Ranjan Sir Lecture - Details - (Updated in Light of FA 2014) (SECURED)Document137 pagesRanjan Sir Lecture - Details - (Updated in Light of FA 2014) (SECURED)Sakib Ahmed Anik0% (1)

- Rbi Report On DemonetisationDocument2 pagesRbi Report On DemonetisationshaktiNo ratings yet

- Viability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityDocument16 pagesViability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityHimanshumalikNo ratings yet

- Republic Act NoDocument28 pagesRepublic Act NoAyen GarciaNo ratings yet

- Indian Economy The Show Must Go On Growth PaddleDocument8 pagesIndian Economy The Show Must Go On Growth PaddleNehaNo ratings yet

- 127 2015 TTBTC 291797docDocument6 pages127 2015 TTBTC 291797docHằng Trần ThịNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Carchedi - Frontiers-Of-Political-EconomyDocument28 pagesCarchedi - Frontiers-Of-Political-EconomyFélixCamarasaNo ratings yet

- ReceiptDocument2 pagesReceiptAjinder Pal Singh ChawlaNo ratings yet

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 2Document9 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 2DesreNo ratings yet

- All India Open MOCK CAT Test 2018Document85 pagesAll India Open MOCK CAT Test 2018PRABHAT GARGNo ratings yet

- Problem Market StructureDocument3 pagesProblem Market StructureTonny NguyenNo ratings yet

- Florio Perrucci Steinhardt & Cappelli Pay To PlayDocument66 pagesFlorio Perrucci Steinhardt & Cappelli Pay To PlayRise Up Ocean CountyNo ratings yet

- Understanding The Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument20 pagesUnderstanding The Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanysynwithgNo ratings yet

- Asian Clearing UnionDocument2 pagesAsian Clearing UnionragyaNo ratings yet

- Chapter. 1 ColonialismDocument5 pagesChapter. 1 Colonialismawaisphotostudio1No ratings yet

- Approaches of Working Capital ManagementDocument3 pagesApproaches of Working Capital ManagementSwati KunwarNo ratings yet

- The 10 Principles of FinanceDocument18 pagesThe 10 Principles of FinanceChiquilyn GaldoNo ratings yet

- Ifm Forex MarketDocument42 pagesIfm Forex MarketAruna BetageriNo ratings yet

- Dupont Contractinfg Inc. !undefined Bookmark, CAD0.00Document1 pageDupont Contractinfg Inc. !undefined Bookmark, CAD0.00Rox ChangNo ratings yet

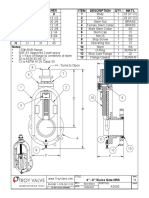

- Sluice Gate NRS 4 To 8 IN DRAWINGDocument1 pageSluice Gate NRS 4 To 8 IN DRAWINGRoberto RosasNo ratings yet

- Tapescript Unit 11Document7 pagesTapescript Unit 11vietnhat1912No ratings yet

- Httpswisconsindot - Govgeneraluploadweb Report Bid Lic PDFDocument247 pagesHttpswisconsindot - Govgeneraluploadweb Report Bid Lic PDFHassane BAMBARANo ratings yet

- 2020 First Quarter Non-Life Industry ReportDocument49 pages2020 First Quarter Non-Life Industry ReportPropensity MuyamboNo ratings yet

- ACRA - Ordinary Members ListDocument2 pagesACRA - Ordinary Members ListVery LiciousNo ratings yet

- BOC Aviation Investor Presentation - FINALDocument27 pagesBOC Aviation Investor Presentation - FINALFIIM12No ratings yet

- Module 3 Classic Theories of Economic Growth and DevelopmentDocument4 pagesModule 3 Classic Theories of Economic Growth and Developmentkaren perrerasNo ratings yet

- Trading As A Game..the Need To Focus, and Why She Keeps NotebooksDocument4 pagesTrading As A Game..the Need To Focus, and Why She Keeps Notebooksfreebanker777741No ratings yet

- Inv 20-21 127878Document1 pageInv 20-21 127878ayyappadasNo ratings yet

- Câu hỏi review lý thuyết tiền tệDocument4 pagesCâu hỏi review lý thuyết tiền tệKim TiếnNo ratings yet

- Questionnaire 1 PDFDocument3 pagesQuestionnaire 1 PDFPaulson JamesNo ratings yet

- Business Plan BasicsDocument5 pagesBusiness Plan BasicsMETANOIANo ratings yet

- The Impact of Digital Transformation On Geo-Territorial Restructuring of Bank BranchesDocument1 pageThe Impact of Digital Transformation On Geo-Territorial Restructuring of Bank BranchesVladimir GaleasNo ratings yet

- ???????? ???????Document2 pages???????? ???????Gabriely MligulaNo ratings yet

- Tutorial Sheet 1Document6 pagesTutorial Sheet 1Samrat BhattaraiNo ratings yet

- International Financial Management (BUS423), Section: 02: Group 1 Sector: RMG (Apex Spinning & Knitting) S.L. Name IDDocument4 pagesInternational Financial Management (BUS423), Section: 02: Group 1 Sector: RMG (Apex Spinning & Knitting) S.L. Name IDJahid Khan Rahat (171011211)No ratings yet

The Knowledge

The Knowledge

Uploaded by

Rahil AfricawalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Knowledge

The Knowledge

Uploaded by

Rahil AfricawalaCopyright:

Available Formats

Dear Professional Friends,

Jai Jinendra!!!!!!

I take this opportunity to send a copy of the monthly Newsletter Vol. 1 of J. Kala &

Associates, Mumbai. The Newsletter enclosed with a brief review of the most recent

highlights of corporate, finance, direct taxes, and indirect taxes field.

The articles selected have all been published in reputable peer-reviewed media

newspaper and I believe that this information will be valuable to you all in helping you

get updated with the ongoing activities in the field of corporate, finance, direct taxes,

and indirect taxes in the month of April 2016.

It is my intent to become a resource for you by providing important updates. I hope

that you find this information helpful.

I would welcome your comments and suggestions in respect of our endeavours and

expect your continued support in promoting this newsletter.

It„s great feeling sharing my views and I am with you and for you always.

With Warm Regards,

Truly Yours,

Team J Kala & Associates

The Knowledge For Private Circulation Only

News Update

BANKING SECTOR

RBI cuts repo rate, home loans could RBI eases liquidity in the banking

become cheaper system

The Reserve Bank of India (RBI) cut the The RBI had announced measures to ease

benchmark repo rate by 25 basis points to liquidity in the banking system. The daily

6.5 per cent, as widely expected, with requirement for maintaining cash reserve

Governor Raghuram Rajan assuring that

ratio has been reduced to 90 per cent from

the monetary stance will remain

95 per cent from April 16, the marginal

“accommodative.”

standing facility rate (the penal rate at

which banks borrow from the RBI) was cut

The rate cut could help lower the cost of

by 75 basis points and the reverse repo

loans for consumers, including automobile

rate (the rate banks earn when they park

and home buyers. The repo rate, which is

money with the RBI) raised by 25 bps.

at its lowest in five years, will help banks

reduce borrowing costs, helping boost

economic growth. The interest rates have (Source: The Hindu: April 6, 2016)

been cut down by 150 basis points since

the beginning of the accommodative cycle.

INCOME TAX

Tax appeal before Commissioners must be e-filed: CBDT

Aiming to reduce the compliance burden, revenue department has started appeals before

Income Tax Commissioner should be filed in electronic format by those assessees‟ who e-file

their returns.

Electronic filing of appeals along with documents, before the CIT (Appeals), will remove

human interface, cut paperwork and decrease transaction costs for taxpayers, as said by

Central Board of Direct Taxes (CBDT). It would ensure consistent and error free service as

validations will be inbuilt resulting in fewer deficient appeals. Online filing will also facilitate

fixation of hearing of appeals electronically.

The existing Form 35 for filing of first appeal has been substituted by a new Form. The new

format for filing of appeals is more structured, objective, systematic, and aligned with the

current provisions of the I-Tax Act. With these changes, the burden of compliance on the

taxpayers in appellate proceedings will be significantly reduced.

(Source: CBDT)

2 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

New requirement of filing Form No 61A New ITR Forms Calling for Broad

for statement of financial transactions Information for Certain Assessees

wef 1st April 2016

To keep a watch on high value transactions The Central Board of Direct Taxes (CBDT)

undertaken by the taxpayer, the Income-tax has notified the new income tax return

Law has framed the new concept of furnishing forms for assessment year 2016-17

of “Statement of financial Transactions” in wherein with Assessment Year 2016-17,

Form No 61A (previously called as „Annual individuals and HUFs filing their returns of

Information Return (AIR)‟. With the help of income in ITR-1, ITR-2, ITR-2A and ITR-

the statement the tax authorities will collect 4S, having total income exceeding Rs. 50

information on certain prescribed high value lakhs will now be required to furnish

transactions undertaken by a person during the information regarding assets and liabilities

year. in Schedule-AL of the relevant ITR form. It

is a welcome measure as it will help in

New Rule 114E of the income tax rules requires identifying accumulation of illegal wealth,

all assessees liable for tax audit u/s 44AB will black money and minimise tax evasion.

have to file statement of financial

transactions in Form 61A, in case of receipt of This complements Government's earlier

cash payment exceeding of Rs. 2,00,000/- for legislation the Black Money (Undisclosed

sale of goods/services of any nature which are Foreign Income and Assets) and Imposition

accounted by him on or after 1st Day of of Tax Act, 2015, legislation aimed at

April,2016. amending the Benami Transactions

(Prohibition) Act, to bring tax evaders into

The statement of financial transactions (online the tax fold.

return in Form No. 61A with digital signature)

shall be furnished on or before the 31st May, (Source: CBDT)

immediately following the financial year in

which the transaction is registered or recorded.

(Source: CBDT)

Income Tax department likely to summon all Indians named in Panama Papers

The income-tax department is likely to summon all those Indians whose names appeared

in the Panama Papers and seek sworn declarations on whether they held any undisclosed

offshore accounts, and the purpose if that is the case.

There are about 500 Indians named in the list which includes prominent businessmen, film

celebrities and those belonging to lucrative professions featured in the millions of

documents leaked from Mossack Fonseca, the Panama law firm that is at the centre of a

massive global controversy for allegedly helping wealthy and powerful people in making

shady and secret investments.

3 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

The move to summon the Indians comes two weeks after the tax department sent notices

to about 50 of them figuring in the list. The persons were asked how their names featured

in the documents. The government is checking whether they siphoned off money earned in

India to tax havens, or violated any law while making investments abroad.

The government has created a Multi-Agency Group (MAG) of probe agencies to go into

these cases, comprising the IT department (CBDT), its foreign tax wing that probes

money-laundering cases, the RBI, Financial Intelligence Unit and the Enforcement

Directorate.

"The tax officers can demand explanations of income generated and tax paid in the last 16

years," said the tax consultant, who is helping a client in the Panama leak issue. This

means, the tax department can dig up cases from as early as 2000 to see if taxes had

been paid.

(Source: ET Bureau | 27 Apr, 2016 & PTI | 29 Apr, 2016)

Changes in due date of Filing TDS statement wef 01.06.2016

The Due date as per income tax rule is different for Government deductors and non

Government deductors, which is as follows:-

Sr. Date of ending Due date for Due Date for Non-

no. of the Quarter Government Deductors Government

of the financial Deductors

year

1. 30th June 31st July of the financial 15th July of the financial

year year

2. 30th September 31st October of the 15th October of the

financial year financial year

3. 31st December 31st January of the 15th January of the

financial year financial year

4. 31st March 31st May of the financial 15th May of the financial

year immediately year immediately

following the financial following the financial

year in which deduction year in which deduction

is made is made

To bring uniformity and to give deductors sufficient time in filing of TDS Statement CBDT

has vide Notification No. 30/2016 Dated: 29.04.2016 has revised due date for filing above

referred TDS statements for Government and Non-Government Deductors wef 01.06.2016

to as follows:

4 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

Sr. Date of ending Due date wef 01.06.2016 for Government

no. of the Quarter Deductor &

of the financial Non-Government Deductor

year

1. 30th June 31st July of the financial year

2. 30th September 31st October of the financial year

3. 31st December 31st January of the financial year

4. 31st March 31st May of the financial year immediately following

the financial year in which deduction is made

(Source: CBDT)

Due Date for Payment of TDS on immovable property extended to 30 days

The CBDT has vide Notification no. 30/2016 dated 29-04-2016 extended Due Date for

payment of TDS on transfer of immovable property u/s 194IA to 30 days from existing 7

days.

The Section 194IA requires buyer of the Property to deduct 1% TDS while making

payment to seller if consideration of the Property exceeds 50 Lakh Rupees. Such TDS was

required to be paid within 7 days from the end of the month in which payment been made

but now CBDT has extended such 7 day period to 30 days for all payments to be made on

or after 01st June 2016.

Thus any sum deducted under Section 194IA on or after 01st June 2016 shall be paid to

the credit of the Central Government within a period of 30 days form the end of the month

in which the deduction is made and shall be accompanied by a challan-cum-statement in

Form No. 26QB.

(Source: CBDT)

CENTRAL EXCISE - Extension of Time Limit for taking registration by Jewellers

The CBEC vide Circular No. 1021/9/2016-CX, Dated: March 21, 2016 provided for

constitution of a Sub-Committee of the High Level Committee to Interact with Trade &

Industry on Tax Laws, chaired by Dr. Ashok Lahiri to study the issues relating to the

imposition of excise duty on jewellery including the issues related to compliance procedure

for the excise duty, records to be maintained, operating procedures and any other issues

that may be relevant..

In this regard, CBEC vide Circular No. 1025/13/2016-CX, Dated: April 22, 2016 has

provided that names of the committee members with a request that all associations may

submit representations before the subcommittee in writing and the all India associations

would need to state their cases in person.

5 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

Further CBEC vide Circular No. 1026/14/2016-CX, Dated: April 23, 2016 has provided that

now a jeweller may take central excise registration of an establishment upto 01.07.2016.

However, it is to be noted that excise duty would be payable w.e.f from 1 st March 2016

itself. Further, jewellers may make the payment of excise duty for the months of March,

2016; April, 2016 and May, 2016 along with the payment of excise duty for the month of

June, 2016.

[Circular No. 1025/13/2016-CX, Dated: April 22, 2016 & Circular No. 1026/14/2016-CX,

Dated: April 23, 2016]

Comments: The extension of date may require suitable amendment along with interest,

penalty and machinery provisions on issuance of invoice, time for payment of duties as an

unregistered assessee in the statutory provisions so as to allow jewellers to take

registration upto 1st July 2016. Even the Government is not permitted to do unlawfully,

that which is necessary to be done. The duty payment and interest applicable on monthly/

quarterly basis on delayed payment would apply.

CORPORATE SECTOR

MCA Notifies Companies (Auditor's Report) Order, 2016

The Ministry of Corporate Affairs has notified the Companies (Auditor's Report) Order, 2016

(CARO 2016) vide its Notification no. S.O. 1228(E) dated 29th March, 2016. This Order

supersedes the Companies (Auditor's Report) Order, 2015 dated 10 th April, 2015 and shall

be applicable for the audit reports relating to financial year commencing on or after 1 st April,

2015.

The new CARO 2016, which brings in mandatory reporting by the Statutory Auditors, aims to

make reporting under this order more contemporary and valuable for corporate

stakeholders. It strengthens the corporate governance and evolves transparency in

functioning of the corporates.

The Auditing and Assurance Standards Board (AASB) of the ICAI has already finalised and

released the Guidance Note on CARO 2016 to benefit its members by providing guidance in

discharging their professional responsibilities in this regard.

(Source: ICAI)

Applicability of Accounting Standards amended by MCA vide Notification dated

March 30, 2016

The Ministry of Corporate Affairs, vide its Notification No. G.S.R. 364 (E) dated 30th March,

2016, has issued Companies (Accounting Standards) Amendment Rules 2016, amending AS

2, AS 4, AS 13, AS 21 and AS 29; and replacing the existing AS 6 and AS 10 with revised AS

10.

6 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

The aforesaid Amendment Rules did not specify in respect of which accounting periods the

amended Accounting Standards shall come into effect. It is noted that Rule 3, sub-rule (2),

of the 2006 Rules, the relevant extract of which specified that “the accounting standards

shall come into effect in respect of accounting periods commencing on or after the

publication of these Accounting Standards”, has not been amended by the said Amendment

Rules. In view of this, many stakeholders had approached the Institute of Chartered

Accountants of India, to seek guidance on the applicability of the amended Accounting

Standards particularly in the case of listed companies who prepared their financial results of

preceding quarters based on the unamended Accounting Standards.

With a view to have consistent approach by companies on the applicability of the Accounting

Standards as amended by the Companies (Accounting Standards) Amendment Rules 2016,

amended Accounting Standards should be followed for accounting periods commencing on or

after the date of publication of the notification in the Official Gazette.

(Source: ICAI, April 26, 2016)

Real Estate Regulator Bill: Salient Features

The long-awaited Real Estate (Regulation and Development) Bill (2016) has been passed by

Rajya Sabha and Lok Sabha, paving the way to set up a regulatory mechanism for the real

estate sector, and to secure the rights of homebuyers. It has now been sent to the President

for necessary approval, following which, it will become an Act. It is expected to usher in

accountability and transparency in the real estate sector, increase customer confidence, and

benefit the industry as a whole

Salient features one should know about this bill, touted as a key reform measure in the vast

real estate sector: -

The Real Estate Bill would regulate transactions between the buyers and

promoters/developers of real estate projects. It aims to set up a Real Estate Regulatory

Authority (RERA) in each state and union territory to monitor the sector and oversee

property transactions.

The Bill will cover both residential and commercial real estate projects.

It will make registration compulsory for both real estate agents and projects with the

authority. The Bill states that all builders must disclose details of registered projects,

including information about the promoter, building plan, municipal approval, land status,

architects, contractors, structural engineer, and agreements as well as details of the real

estate agents.

All information must be uploaded to the RERA website in respective states. Real estate

agents also have to register with RERA. Even projects under construction have to be

registered with the authority.

7 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

The Bill seeks to get fast track dispute redressal through appellate tribunals and

adjudicating officers in every state. It bars civil courts from taking up matters that falls

under the tribunal‟s jurisdiction.

Consumer courts, however, have been allowed to hear real estate cases. India has 664

consumer courts. A greater number of grievance redressal avenues would mean lower

cost of litigation for appellants. It will also reduce the number of cases in conventional

courts that are already overburdened with pending matters.

If the promoter or developer doesn‟t register the property, then he/she has to pay 10 per

cent project cost as a penalty. They are liable to imprisonment of up to three years

and/or an additional 10 per cent fine of the project cost in case of evading RERA orders

or summons.

For violating other provisions of the proposed act, the builder would have to pay up to 5

per cent of the project cost. Fine for the agents is Rs 10,000/- per day for the entire

period of violating any provision.

Builders can‟t advertise or sell their homes till they have all project approvals in place.

The Bill, when it becomes an Act, would bolster customer confidence because it will bring

transparency to the sector. The slowing down of home sales is having its effect on the

economic revival.

The Real Estate Bill sets a firm foot on the sector and would be its foundation in the coming

years. With the changing skylines in Indian cities, the Bill covers various issues like

developing and redeveloping, thus ironing out many problem areas.

(Source: Rediff.com, April 29, 2016)

Zone Startups India launches accelerator empower for women

Mumbai-based Zone Startups India has launched a six-week accelerator for women focused

on building technology-based ventures.

The programme, empoWer, seeks to shortlist 15 woman entrepreneurs. It will be supported

by partners including Google, the Department of Science and Technology, GIZ, Vodafone

India and SheEO, a Toronto-based organisation supporting woman entrepreneurs.

Post the six-week programme, Zone Startups plans to provide the woman entrepreneurs

continued support for up to a year. Through road shows across Mumbai, Bengaluru and the

National Capital Territory, the accelerator plans to scout for applicants. The programme aims

to identify women focused on solving local issues, as well as enabling them creating systems

based on artificial intelligence and other high-tech devices that could be converted into

global products.

8 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

During the last 26 months of operations, Zone Startups India has accelerated the growth of

72 startups; 11 being co-founded by woman entrepreneurs. Three of these women have

gone on to raise more than 30 crore for startups.

(Source: ET Bureau, April 30, 2016)

Sebi to Tighten Disclosure Norms for Rating Agencies

Concerned over a severe spillover impact of recent drastic downgrades by rating agencies,

the Securities and Exchange Board of India (Sebi) plans to strengthen its disclosure

guidelines for issuance and review of the ratings by such entities.

Besides, market regulator Sebi is also considering asking the credit rating agencies (CRAs)

to hive off their activities involving rating of instruments other than securities, as they do

not fall under Sebi's jurisdiction, a senior official said.

Besides debt and other securities, the CRAs also give ratings for various financing facilities,

projects and fixed deposits, while some of them also undertake works like grading of NGOs

and Real Estate properties.

"Hiving off such activities will also ensure that there is no dual reporting or action by two or

more regulators for the same violation," the official added. Sebi had set up a committee,

comprising members from all Credit Rating Agencies (CRAs), to review the functioning of

CRAs in order to enhance the standards and procedures related to assignment of ratings and

review of the same.

The committee submitted its report after incorporating recommendations and suggestions of

all CRAs. Besides, the issues related to functioning of CRAs have also been deliberated upon

by the International Advisory Board of Sebi. The markets regulator is now finalising its policy

actions with regard to CRAs after taking into account the suggestions made by the expert

committee as well as by its International Advisory Board.

Among the proposed measures, CRAs would have to adopt a policy regarding suspension

and subsequent withdrawal of rating and disclose the same publicly. It has also been

suggested that Sebi would provide a format of the press release regarding suspension to

remove any ambiguity and ensure uniformity across various CRAs.

Sebi also wants disclosure of all ratings assigned by the CRA, whether accepted or not by

the issuer, even in case of non-public issues. Other proposed measures include

strengthening the agreement between the Issuer and CRA to improve client co-operation,

public disclosure of the CRAs' procedures for ongoing monitoring of credit ratings and

disclosure of rating transition of the issuer.

The CRAs would also need to publicly disclose various 'criteria' used for rating and the same

would need to be referenced in their press releases.

9 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

There would be a periodic review of the criteria used for rating and public disclosure of the

periodicity of review.

The internal document governing rating process would need to be made available on the

website of CRAs. Sebi also plans to put in place a mechanism for evaluating and enhancing

the performance of CRAs, along with terms of reference for internal audits of CRAs.

Accountability of the CRAs, rating committee, analysts, including provisions for checks and

balances, would need to be clearly defined in the internal governing document and rating

manual of the CRA. There would be restrictions on participation of business development

team and other employees with revenue targets in analytical processes. Besides, a defined

process would be required for evaluating performance of Rating Committee members.

(Source: Livemint, April 18, 2016)

REGISTRATION ACT (MAHARASTRA)

Reduction in registration fees on instrument of gift between blood relatives

The Maharashtra Government vide it's GR dated 25.04.2015 has already reduced the stamp

duty on Gift of immovable property and agricultural land between the blood relatives from

5% or 2%, as the case may be, to Rs.200/- only .The blood relatives include spouse, son,

daughter, grandchild and daughter in law of a deceased son.

Even though the Gift deeds to the blood relatives started attracting stamp duty of Rs 200/-

only, the Registration fees remained to be 1% of the market value of the immovable

property or Rs.30000/- whichever is less.

The Maharashtra Government vide it's notification no.RGN-2016/51/CR-11/M-1 dated 31st

March, 2016, has reduced the Registration Fees to be max Rs.200/- on the Gift Deeds of

immovable property between the blood relatives.

10 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

Due date for the month of May 2016

Due Date Type of Tax Description of tax Form Type

Payment/Sub payment/submission of

mission of return

Return

06/05/2016 Service Tax Service Tax Payment for Month

April in online mode (Other Than Online Service Tax

Individuals/Firms/LLP/Proprietors Challan

hip)

06/05/2016 Central Excise Duty Payment (Online mode) for

Online Excise Duty

the Month of April 2016 (other

Challan

than SSI Units)

07/05/2016 Income Tax Due date for deposit of Tax

deducted/collected for the month Challan No. 281

of April, 2016

07/05/2016 Income Tax Due date for furnishing of

challan-cum-statement in respect

of tax deducted under Section Form 26QB

194-IA in the month of April,

2016

10/05/2016 Central Excise Filing ER-1 Return (Other than

Form Ann -12

SSI Units)

Central Excise Filing ER-2 monthly return by

100% EOU (removing goods in Form Ann -13

domestic tariff area)

Central Excise Filing monthly ER-6 Return by

specified class of Assesses

regarding principal inputs on

which cenvat credit was availed Form Ann -13AC

(Assessee who paid duty of

excise more than Rs. 1 crore in

the preceding financial year)

Central Excise Exports – Procurement of

specified goods from EOU for use

in manufacture of Export goods

Form Ann-17B

for DTA units, procuring specified

goods from EOU for manufacture

of export goods.

Proof of Exports, once in a month

for all exporters, exporting goods Form Ann.-19

under Bond

Export details, for Manufacturing

following simplified export Form Ann.-20

procedure.

Removal of excisable goods at

concessional rate, for

Manufacturers receiving the

Form Ann. -46

excisable goods for specified use

at concessional rate of duty in

terms of Rules

11 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

15/05/2016 Provident Fund PF Payment for month of April 2016

(Including PF Challan

EDLI)

15/05/2016 Income Tax Quarterly TDS Return for the

Form 24Q and 26Q

quarter ending March 31, 2016

15/05/2016 Income Tax Quarterly TCS Return for the

Form 27EQ

quarter ending March 31, 2016

16/05/2016 Central Excise Duty Payment (Online mode) for Online Excise Duty

the Month of April 2016 (SSI Units) Challan

21/05/2016 ESIC ESIC Payment and Return for month

Challan to be

of April 2016

generated online

and payment by

cheque

21/05/2016 MVAT/CST MVAT(WCT)-TDS Payment for

Form MTR - 6

month of April 2016

21/05/2016 MVAT/CST Monthly Return for April (Tax Return Form for

liability >100000/-) MVAT:

231/232/233/234/23

5

Return Form for CST:

Form III(E)

22/05/2016 Income Tax Due date for issue of TDS Certificate

for tax deducted under Section 194- Form 16B

IA in the month of April, 2016

25/05/2016 Provident Fund PF Return filing for April Month

(includes EDLI) (including pension and insurance Form 5, 10 and 12A

scheme forms)

30/05/2016 ROC Return Filing of Annual Return by Limited

Form 11

Liability Partnership

30/05/2016 Income Tax Quarterly TDS/TCS certificates in

respect of tax deducted (for

payment other than salary) or tax Form 16A

collected during the quarter ending

March 31, 2016

31/05/2016 Income Tax Certificate of TDS to employees in

respect of salary paid and tax Form 16

deducted during FY 2015-16

31/05/2016 Income Tax Tax deduction returns on amounts

paid by trustees of

-

authorized/approved

superannuation funds

31/05/2016 Income Tax Due date to furnish statement of

reportable accounts (in Form No.

Form No. 61B

61B) for calendar year 2015 by

reporting financial institutions

31/05/2016 Profession Tax Payment and Return of April ( For

assessee whose Tax Liability > = Challan No MTR-6 &

50000 or in case of First Year of Return for Form III

Registration)

12 The Knowledge- For Private Circulation Only

April 2016

The Knowledge For Private Circulation Only

Disclaimer

This Newsletter has been sent by J Kala & Associates and is meant for the recipient for use

as intended and not for circulation. The information contained herein is from the public

domain or sources believed to be fair and correct. It cannot be warranted or represented

that it is accurate or complete and it should not be relied upon as such.

J Kala & Associates

Chartered Accountants

Head Office: 504, Rainbow Chambers, Near Kandivali Tel Exchange, S. V. Road,

Kandivali (W), Mumbai – 400 067.

Phone:- +91 22 28625129/ 5153

Email: admin@jka.co.in

Jaipur Branch: 401, Corporate Park, Near Ajmer Puliya, Ajmer Road,

Jaipur - 302 006.

Phone: - +91 141 23 697 78

Email: adminjpr@jka.co.in

Bengaluru Branch: 1753/B/C, 1st Floor C Main Road, D Block, 2nd Stage,

Rajaji Nagar, Bengaluru- 560 010.

Email: adminbnglr@jka.co.in

Ahmedabad Branch: E-1205, Titanium City Centre, Near Sachin Tower, 100 feet

Anandnagar Road, Satelite, Ahmedabad - 380015.

Email: adminahmd@jka.co.in

New Delhi Branch: 121/9, Shivpuri Near Sector 7, Gurgaon, New Delhi-122001

Email: admindelhi@jka.co.in

Website: www.jka.co.in

13 The Knowledge- For Private Circulation Only

April 2016

You might also like

- 1 Prof Chauvins Instructions For Bingham CH 4Document35 pages1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- Direct TAX Part ADocument497 pagesDirect TAX Part Ashubh karaniaNo ratings yet

- AAA Accounting Standards Part 1Document3 pagesAAA Accounting Standards Part 1Gauri WastNo ratings yet

- Return Filing Procedure: Things You Need To Know BeforehandDocument10 pagesReturn Filing Procedure: Things You Need To Know BeforehandtalhaNo ratings yet

- Basic Concepts in Income Tax LawDocument39 pagesBasic Concepts in Income Tax LawSiddharth KaranNo ratings yet

- PEM ReportDocument6 pagesPEM Reportxx69dd69xxNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Word ImportanteDocument5 pagesWord Importantetc mleNo ratings yet

- Taxation System in IndiaDocument46 pagesTaxation System in IndiaNiket Dattani100% (1)

- Tax PlaningDocument78 pagesTax PlaningSahilSahoreNo ratings yet

- Consolidated Question Book-AccountingDocument31 pagesConsolidated Question Book-AccountingRubel KhanNo ratings yet

- Presumptive Taxation For Business and ProfessionDocument17 pagesPresumptive Taxation For Business and ProfessionRupeshNo ratings yet

- Guide 04: Tax Overview For Businesses, Investors & IndividualsDocument8 pagesGuide 04: Tax Overview For Businesses, Investors & IndividualsAbdul NafiNo ratings yet

- Analysis of The 2018 Finance BillDocument37 pagesAnalysis of The 2018 Finance BillLEENIE MUNAHNo ratings yet

- Rmo 41-2011Document51 pagesRmo 41-2011Christian Albert HerreraNo ratings yet

- Income Tax Refund PDFDocument3 pagesIncome Tax Refund PDFArunDaniel100% (1)

- Audit Requirements and Compliance For Micro and Small EnterprisesDocument2 pagesAudit Requirements and Compliance For Micro and Small EnterprisesCora NovusNo ratings yet

- Union Budget Group 6Document18 pagesUnion Budget Group 6GayatriNo ratings yet

- Basic Concepts: 1.1 What Is A Tax?Document31 pagesBasic Concepts: 1.1 What Is A Tax?sourav kumar rayNo ratings yet

- Search Results: Equalisation Levy - Income Tax DepartmentDocument3 pagesSearch Results: Equalisation Levy - Income Tax DepartmentforallNo ratings yet

- Deduction Under Income Tax Act 1961Document5 pagesDeduction Under Income Tax Act 1961Suman kushwahaNo ratings yet

- NRB News Vol.36 20770404 PDFDocument6 pagesNRB News Vol.36 20770404 PDFNarenBistaNo ratings yet

- Tax FinalDocument16 pagesTax FinalAnany UpadhyayNo ratings yet

- Module 1, 2 & 3Document30 pagesModule 1, 2 & 3JAGRITI SINGH JUNo ratings yet

- Deadlines & Due DatesDocument6 pagesDeadlines & Due DatesGummy BearNo ratings yet

- Pre-1. Introduction To Government AccountingDocument24 pagesPre-1. Introduction To Government AccountingPaupauNo ratings yet

- 139 2016 ND-CP 327644Document5 pages139 2016 ND-CP 327644Hoang My VuNo ratings yet

- Tax Filing Reminders: OutlineDocument30 pagesTax Filing Reminders: OutlineMarc Nathaniel RanayNo ratings yet

- Fiscaladministrationhistoryoverviewdefinitionlgubudgetprocessbydaisyt Besing Mpa 120916195508 Phpapp02 PDFDocument34 pagesFiscaladministrationhistoryoverviewdefinitionlgubudgetprocessbydaisyt Besing Mpa 120916195508 Phpapp02 PDFRochelle EstebanNo ratings yet

- Revenue Memorandum Order No. 2-2018: Bureau of Internal RevenueDocument7 pagesRevenue Memorandum Order No. 2-2018: Bureau of Internal RevenueLarry Tobias Jr.No ratings yet

- FABM2 12 Quarter2 Week4Document9 pagesFABM2 12 Quarter2 Week4Princess DuquezaNo ratings yet

- 1.concepts of Taxation & Tax Structure in PakistanDocument24 pages1.concepts of Taxation & Tax Structure in Pakistanuzma batool93% (14)

- L4 - Demonetisation Post-TruthsDocument10 pagesL4 - Demonetisation Post-TruthsAyushNo ratings yet

- Crowe Tax Handbook 2019Document47 pagesCrowe Tax Handbook 2019Ahmad SubhaniNo ratings yet

- Tax Incentives 10708Document5 pagesTax Incentives 10708Hib Atty TalaNo ratings yet

- Income Declaration Scheme 2016Document5 pagesIncome Declaration Scheme 2016rqpNo ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- Mr. Rajendra Jain File Scanned.Document36 pagesMr. Rajendra Jain File Scanned.tharundigistudiotmkNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Canvass: Capturing News With An Analytical EdgeDocument6 pagesCanvass: Capturing News With An Analytical EdgeRanjith RoshanNo ratings yet

- Company Overview of Auditing FirmDocument14 pagesCompany Overview of Auditing FirmDarwin LopezNo ratings yet

- Article About Provisional TaxDocument6 pagesArticle About Provisional Taxduanedejager01No ratings yet

- Press Release IDS 02 09 2016Document2 pagesPress Release IDS 02 09 2016ElvisPresliiNo ratings yet

- Pajak InternasionalDocument60 pagesPajak InternasionalTutunKasepNo ratings yet

- Ddo ChecklistDocument14 pagesDdo ChecklistJuan David MateusNo ratings yet

- Thesis On Taxation in IndiaDocument5 pagesThesis On Taxation in Indiatit0feveh1h3100% (2)

- Tax Combined NotesDocument48 pagesTax Combined NotesignatiousmugovaNo ratings yet

- Concept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureDocument15 pagesConcept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureAnany UpadhyayNo ratings yet

- Amir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentDocument6 pagesAmir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentMehreen KhanNo ratings yet

- Introduction To Financial Statements and AuditDocument26 pagesIntroduction To Financial Statements and AuditAbu MusaNo ratings yet

- Business Taxation Module 1&2Document13 pagesBusiness Taxation Module 1&2Khushboo Parikh100% (1)

- Income TaxDocument10 pagesIncome Taxvadivelu7007No ratings yet

- Ranjan Sir Lecture - Details - (Updated in Light of FA 2014) (SECURED)Document137 pagesRanjan Sir Lecture - Details - (Updated in Light of FA 2014) (SECURED)Sakib Ahmed Anik0% (1)

- Rbi Report On DemonetisationDocument2 pagesRbi Report On DemonetisationshaktiNo ratings yet

- Viability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityDocument16 pagesViability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityHimanshumalikNo ratings yet

- Republic Act NoDocument28 pagesRepublic Act NoAyen GarciaNo ratings yet

- Indian Economy The Show Must Go On Growth PaddleDocument8 pagesIndian Economy The Show Must Go On Growth PaddleNehaNo ratings yet

- 127 2015 TTBTC 291797docDocument6 pages127 2015 TTBTC 291797docHằng Trần ThịNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Carchedi - Frontiers-Of-Political-EconomyDocument28 pagesCarchedi - Frontiers-Of-Political-EconomyFélixCamarasaNo ratings yet

- ReceiptDocument2 pagesReceiptAjinder Pal Singh ChawlaNo ratings yet

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 2Document9 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 2DesreNo ratings yet

- All India Open MOCK CAT Test 2018Document85 pagesAll India Open MOCK CAT Test 2018PRABHAT GARGNo ratings yet

- Problem Market StructureDocument3 pagesProblem Market StructureTonny NguyenNo ratings yet

- Florio Perrucci Steinhardt & Cappelli Pay To PlayDocument66 pagesFlorio Perrucci Steinhardt & Cappelli Pay To PlayRise Up Ocean CountyNo ratings yet

- Understanding The Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument20 pagesUnderstanding The Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanysynwithgNo ratings yet

- Asian Clearing UnionDocument2 pagesAsian Clearing UnionragyaNo ratings yet

- Chapter. 1 ColonialismDocument5 pagesChapter. 1 Colonialismawaisphotostudio1No ratings yet

- Approaches of Working Capital ManagementDocument3 pagesApproaches of Working Capital ManagementSwati KunwarNo ratings yet

- The 10 Principles of FinanceDocument18 pagesThe 10 Principles of FinanceChiquilyn GaldoNo ratings yet

- Ifm Forex MarketDocument42 pagesIfm Forex MarketAruna BetageriNo ratings yet

- Dupont Contractinfg Inc. !undefined Bookmark, CAD0.00Document1 pageDupont Contractinfg Inc. !undefined Bookmark, CAD0.00Rox ChangNo ratings yet

- Sluice Gate NRS 4 To 8 IN DRAWINGDocument1 pageSluice Gate NRS 4 To 8 IN DRAWINGRoberto RosasNo ratings yet

- Tapescript Unit 11Document7 pagesTapescript Unit 11vietnhat1912No ratings yet

- Httpswisconsindot - Govgeneraluploadweb Report Bid Lic PDFDocument247 pagesHttpswisconsindot - Govgeneraluploadweb Report Bid Lic PDFHassane BAMBARANo ratings yet

- 2020 First Quarter Non-Life Industry ReportDocument49 pages2020 First Quarter Non-Life Industry ReportPropensity MuyamboNo ratings yet

- ACRA - Ordinary Members ListDocument2 pagesACRA - Ordinary Members ListVery LiciousNo ratings yet

- BOC Aviation Investor Presentation - FINALDocument27 pagesBOC Aviation Investor Presentation - FINALFIIM12No ratings yet

- Module 3 Classic Theories of Economic Growth and DevelopmentDocument4 pagesModule 3 Classic Theories of Economic Growth and Developmentkaren perrerasNo ratings yet

- Trading As A Game..the Need To Focus, and Why She Keeps NotebooksDocument4 pagesTrading As A Game..the Need To Focus, and Why She Keeps Notebooksfreebanker777741No ratings yet

- Inv 20-21 127878Document1 pageInv 20-21 127878ayyappadasNo ratings yet

- Câu hỏi review lý thuyết tiền tệDocument4 pagesCâu hỏi review lý thuyết tiền tệKim TiếnNo ratings yet

- Questionnaire 1 PDFDocument3 pagesQuestionnaire 1 PDFPaulson JamesNo ratings yet

- Business Plan BasicsDocument5 pagesBusiness Plan BasicsMETANOIANo ratings yet

- The Impact of Digital Transformation On Geo-Territorial Restructuring of Bank BranchesDocument1 pageThe Impact of Digital Transformation On Geo-Territorial Restructuring of Bank BranchesVladimir GaleasNo ratings yet

- ???????? ???????Document2 pages???????? ???????Gabriely MligulaNo ratings yet

- Tutorial Sheet 1Document6 pagesTutorial Sheet 1Samrat BhattaraiNo ratings yet

- International Financial Management (BUS423), Section: 02: Group 1 Sector: RMG (Apex Spinning & Knitting) S.L. Name IDDocument4 pagesInternational Financial Management (BUS423), Section: 02: Group 1 Sector: RMG (Apex Spinning & Knitting) S.L. Name IDJahid Khan Rahat (171011211)No ratings yet