Professional Documents

Culture Documents

Defensive Stocks

Defensive Stocks

Uploaded by

Shanil VasuCopyright:

Available Formats

You might also like

- SWOT Analysis of Capital MarketDocument6 pagesSWOT Analysis of Capital Marketpassionmarket75% (4)

- Zawya Collaborative Sukuk ReportDocument130 pagesZawya Collaborative Sukuk ReportBRR_DAG100% (4)

- Comment - 2011 - Revisiting The Illiquidity Discount For Private Companies, A SkepticalDocument14 pagesComment - 2011 - Revisiting The Illiquidity Discount For Private Companies, A Skepticaljpkoning100% (1)

- MARKETING STRATEGY OF KUMAR BUILDER & DEVELOPER Real EstateDocument60 pagesMARKETING STRATEGY OF KUMAR BUILDER & DEVELOPER Real Estateshubham BaliyanNo ratings yet

- Dung Lam Va NuaDocument11 pagesDung Lam Va NuanguyentuandangNo ratings yet

- M4 Assignment 1Document4 pagesM4 Assignment 1Lorraine CaliwanNo ratings yet

- What Kinds of Stocks Are There?Document4 pagesWhat Kinds of Stocks Are There?Gilner PomarNo ratings yet

- Black BookDocument83 pagesBlack Bookmahekpurohit1800No ratings yet

- Diversification Through Commodity Mutual FundsDocument4 pagesDiversification Through Commodity Mutual FundsSrishti YadavNo ratings yet

- Investment PhilosophyDocument5 pagesInvestment PhilosophyDan KumagaiNo ratings yet

- Introduction of Mutual FundDocument50 pagesIntroduction of Mutual FundPranav ViraNo ratings yet

- Alternative InvestmentsDocument2 pagesAlternative InvestmentskautiNo ratings yet

- Introduction To Share MarketDocument26 pagesIntroduction To Share Marketsadforhappy08No ratings yet

- Sesión 1.3. Cyclical Vs Counter-Cyclical StockDocument4 pagesSesión 1.3. Cyclical Vs Counter-Cyclical StockVictorTRNo ratings yet

- Commodities As An Asset ClassDocument7 pagesCommodities As An Asset ClassvaibhavNo ratings yet

- The Basics For Investing in StocksDocument16 pagesThe Basics For Investing in StocksAditya KapoorNo ratings yet

- Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012Document4 pagesBasic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012cutiepattotieNo ratings yet

- Mini Project FileDocument41 pagesMini Project FileSonal Bandaware18No ratings yet

- What Is Diversification?Document4 pagesWhat Is Diversification?Jonhmark AniñonNo ratings yet

- Banking ConceptsDocument19 pagesBanking ConceptsjayaNo ratings yet

- Risk 2Document7 pagesRisk 2Vedha VetriselvanNo ratings yet

- Unit II: Mechanics of Futures MarketsDocument43 pagesUnit II: Mechanics of Futures MarketsAnu ShreyaNo ratings yet

- Reduction of Portfolio Through DiversificationDocument28 pagesReduction of Portfolio Through DiversificationDilshaad ShaikhNo ratings yet

- Case 1 UpdatedDocument7 pagesCase 1 UpdatedGaurav Kumar100% (1)

- Mutual Fund and Types of Mutual Fund A) What Is A Mutual Fund?Document14 pagesMutual Fund and Types of Mutual Fund A) What Is A Mutual Fund?Abhi PatilNo ratings yet

- L-1 Investment AvenuesDocument31 pagesL-1 Investment AvenuesDhairyaa BhardwajNo ratings yet

- Fixed Income Handbook PDFDocument55 pagesFixed Income Handbook PDFRamesh SathyamoorthiNo ratings yet

- Investment and Profolio ManagementDocument7 pagesInvestment and Profolio Managementhearthelord66No ratings yet

- IA - Limitation in PortfolioDocument4 pagesIA - Limitation in PortfolioJustina BaharunNo ratings yet

- IPT Stocks 2012Document16 pagesIPT Stocks 2012reachernieNo ratings yet

- Investment Analysis: There Are Two Concepts of InvestmentDocument37 pagesInvestment Analysis: There Are Two Concepts of InvestmentNiket DattaniNo ratings yet

- 1.1 Introduction To The StudyDocument68 pages1.1 Introduction To The Studyrajesh bathulaNo ratings yet

- What Are They? How Do They Differ From "Traditional" Investments?Document3 pagesWhat Are They? How Do They Differ From "Traditional" Investments?api-118535366No ratings yet

- Tacn - Tcnh-Unit 4-For StudentsDocument63 pagesTacn - Tcnh-Unit 4-For StudentsĐỗ Hoàng HàNo ratings yet

- Alternative InvestmentsDocument44 pagesAlternative Investmentspurna komaliNo ratings yet

- Hedge Funds: MII Presentation September 17, 2002 Priyanka ChopraDocument28 pagesHedge Funds: MII Presentation September 17, 2002 Priyanka ChopraPriya JagasiaNo ratings yet

- Derivatives Market FinalDocument19 pagesDerivatives Market FinalRohit ChellaniNo ratings yet

- Investment StrategiesDocument2 pagesInvestment Strategiesmyschool90No ratings yet

- Fin263 - Defensive ST0CKDocument14 pagesFin263 - Defensive ST0CKRose Syakila ElizaNo ratings yet

- Industry Analysis: Growth of Mutual Funds in IndiaDocument20 pagesIndustry Analysis: Growth of Mutual Funds in IndiaZea ZakeNo ratings yet

- Hedge FundsDocument29 pagesHedge FundsSruthi RadhakrishnanNo ratings yet

- Manajemen Investasi Summary Chapter 11: Dr. Vinola Herawaty, Ak.,MscDocument7 pagesManajemen Investasi Summary Chapter 11: Dr. Vinola Herawaty, Ak.,Mscmutia rasyaNo ratings yet

- CHP 1. Introduction To InvestmentDocument12 pagesCHP 1. Introduction To Investmentowusujeffery18No ratings yet

- Synopsis IDocument21 pagesSynopsis Iankurk124No ratings yet

- Investment EnvironmentDocument25 pagesInvestment EnvironmentK-Ayurveda WelexNo ratings yet

- Dipti Rikame Roll No 40Document5 pagesDipti Rikame Roll No 40Sameer ChoudharyNo ratings yet

- Money Managers Capital Gains or Income For The Fund's InvestorsDocument9 pagesMoney Managers Capital Gains or Income For The Fund's InvestorsKrishnan UnniNo ratings yet

- Investment Management2 PDFDocument170 pagesInvestment Management2 PDFThomas nyadeNo ratings yet

- Mutual Funds 2Document5 pagesMutual Funds 2Muhammad Afzal KhiljiNo ratings yet

- Ayushi PresentationDocument33 pagesAyushi Presentationkamendra chauhanNo ratings yet

- Types of Mutual Funds: (Arranged in Order of Increasing Risk Factor)Document13 pagesTypes of Mutual Funds: (Arranged in Order of Increasing Risk Factor)Osama SiddiquiNo ratings yet

- Cornerstone Houston CESITDocument13 pagesCornerstone Houston CESITlarrysmNo ratings yet

- Certain Features Characterize AllDocument5 pagesCertain Features Characterize Allprabin ghimireNo ratings yet

- Investment 1Document9 pagesInvestment 1Rocky KumarNo ratings yet

- MF AsddDocument6 pagesMF Asdddarshan0555No ratings yet

- Portfolio Diversification: Presented By:-Mudassar Husain Roll No. 19mbak23 Asim Abid Roll No. 19mbak61Document18 pagesPortfolio Diversification: Presented By:-Mudassar Husain Roll No. 19mbak23 Asim Abid Roll No. 19mbak61scribd2No ratings yet

- Types of FundsDocument5 pagesTypes of FundsandandanNo ratings yet

- Mutual FundsDocument40 pagesMutual Fundsaditi anandNo ratings yet

- Asset Classes: From Wikipedia, The Free EncyclopediaDocument2 pagesAsset Classes: From Wikipedia, The Free EncyclopediaSuhas PrabhakarNo ratings yet

- Common Stocks: Analysis and Strategy Impact of The MarketDocument7 pagesCommon Stocks: Analysis and Strategy Impact of The MarketDanneth TabunoNo ratings yet

- Types of Portfolios in FinanceDocument16 pagesTypes of Portfolios in FinanceMichelle LoboNo ratings yet

- ResearchDocument12 pagesResearchShanil VasuNo ratings yet

- FFE Ch.1Document20 pagesFFE Ch.1Shanil VasuNo ratings yet

- Marketing ManagementDocument10 pagesMarketing ManagementShanil VasuNo ratings yet

- Ecological PyramidDocument2 pagesEcological PyramidShanil VasuNo ratings yet

- DemonetizationDocument8 pagesDemonetizationShanil VasuNo ratings yet

- Self Help GroupDocument7 pagesSelf Help GroupShanil VasuNo ratings yet

- Land Settlement Policy of BritishDocument4 pagesLand Settlement Policy of BritishShanil VasuNo ratings yet

- Asset Management Group: Real Estate SectorDocument11 pagesAsset Management Group: Real Estate SectorDerek BannisterNo ratings yet

- The Case For Opportunistic InvestmentDocument20 pagesThe Case For Opportunistic InvestmentDavid KeresztesNo ratings yet

- Joe Smolira: Financial Management, Vol. 13, No. 1, 30-37Document5 pagesJoe Smolira: Financial Management, Vol. 13, No. 1, 30-37Reckon IndepthNo ratings yet

- FF Full Eng PDFDocument146 pagesFF Full Eng PDFAnonymous YgBIdKxvNo ratings yet

- RealEstate GlobalTop10Document2 pagesRealEstate GlobalTop10M N ZAKINo ratings yet

- Invesco Global Consumer Trends Fund of FundDocument10 pagesInvesco Global Consumer Trends Fund of FundArmstrong CapitalNo ratings yet

- 3aMFA3053 Regulatory Framework of ICM (W5)Document35 pages3aMFA3053 Regulatory Framework of ICM (W5)ksenju47No ratings yet

- Worldwide Reit Regimes Nov 2019Document105 pagesWorldwide Reit Regimes Nov 2019Diego FernandezNo ratings yet

- Baker Tilly DHC Budget Snapshot 22-23Document15 pagesBaker Tilly DHC Budget Snapshot 22-23Vi KiNo ratings yet

- Dow Jones IndicesDocument58 pagesDow Jones IndicesfayyazeasymoneyNo ratings yet

- Listening Section 2017Document5 pagesListening Section 2017Ayin KatiliNo ratings yet

- Real Estate Ownership and Investment in Saudi ArabiaDocument3 pagesReal Estate Ownership and Investment in Saudi ArabiasaifNo ratings yet

- SLG SL Green Realty 2010 Corporate Investor Presentation Slides Deck PDFDocument135 pagesSLG SL Green Realty 2010 Corporate Investor Presentation Slides Deck PDFAla BasterNo ratings yet

- ICICI Prudential Mutual FundDocument36 pagesICICI Prudential Mutual FundChintan JainNo ratings yet

- Public Mutual PDFDocument256 pagesPublic Mutual PDFDavid BockNo ratings yet

- Income Taxation Taxation of CorporationsDocument52 pagesIncome Taxation Taxation of CorporationsBianca Denise AbadNo ratings yet

- Keppel DC REIT - CircularDocument76 pagesKeppel DC REIT - Circulareuniceyl001No ratings yet

- Jurnal 1 - Kajian Hukum Bisnis Jasa Crowdfunding PropertiDocument17 pagesJurnal 1 - Kajian Hukum Bisnis Jasa Crowdfunding PropertiNicole PutriNo ratings yet

- Real Estate Capital Markets - Lecture NotesDocument2 pagesReal Estate Capital Markets - Lecture NotesCoursePinNo ratings yet

- Test 2 Tax 667 June 2021 QDocument4 pagesTest 2 Tax 667 June 2021 QMifzalIzzaniNo ratings yet

- Advanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzeDocument20 pagesAdvanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzekaragujsNo ratings yet

- Suncity, Sunway To Combine? Analysts See A Current Trend of M&AsDocument12 pagesSuncity, Sunway To Combine? Analysts See A Current Trend of M&AsFazlin GhazaliNo ratings yet

- Alternative Investments - Q1 Fund Launches and Pipeline (April 2023)Document18 pagesAlternative Investments - Q1 Fund Launches and Pipeline (April 2023)Yunfei YanNo ratings yet

- Deutsche Bank, Insider Trading Watermark)Document80 pagesDeutsche Bank, Insider Trading Watermark)info707100% (1)

- Starhill Global REIT Ending 1Q14 On High NoteDocument6 pagesStarhill Global REIT Ending 1Q14 On High NoteventriaNo ratings yet

- Pershing Square's Latest Presentation On General Growth PropertiesDocument55 pagesPershing Square's Latest Presentation On General Growth PropertiesDealBookNo ratings yet

- Annual Report 2012 FinalDocument65 pagesAnnual Report 2012 FinalAnnNo ratings yet

Defensive Stocks

Defensive Stocks

Uploaded by

Shanil VasuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Defensive Stocks

Defensive Stocks

Uploaded by

Shanil VasuCopyright:

Available Formats

defensive stock is a stock that provides consistent dividends and stable earnings

A

regardless of the state of the overall stock market.

There is a constant demand for their products, so defensive stocks tend to be more stable

during the various phases of the business cycle.

Defensive stocks should not be confused with defense stocks, which are the stocks of

companies that manufacture things like weapons, ammunition, and fighter jets.

ell-established companies, such as Procter & Gamble, Johnson & Johnson, Philip

W

Morris International, and Coca-Cola, are considered defensive stocks.

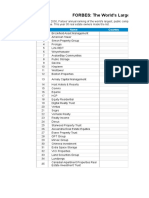

Defensive stocks in India-

Bharat Electronics, Tata Steel,Infosys Ltd, Hindustan Unilever, TCS, Larsen & Toubro,

Reliance Industries Limited,

Cochin Shipyard, HAL, Mazagon Dock Shipbuilders, and Bharat Dynamics.

efensive stocks offer the substantial benefit of similar long-term gains with lower risk than

D

other stocks.

On the downside, the low volatility of defensive stocks often leads to smaller gains during

bull markets and a cycle of mistiming the market.

Defensive stocks are also known as non-cyclical stocks because they are not affected by

the market swings.

Following is the industry list of defensive stocks.

Utilities

Utilities such as water, gas and electricity are basic requirements of livelihood. So, the

demand remains the same at all phases of the economy and thus are least affected from the

market changes. Further utility companies draw benefits at the time of recession as they get

borrowings at lower interest rates with minimal competition.

Consumer Staples

Companies producing or distributing consumer goods usually fall in the category of

defensive stocks. Consumer goods include food, beverages, certain household items,

tobacco, hygiene products, etc. These are day to day use items that have a certain cash flow

at all economic conditions. So, these stocks outperform during weak economic conditions

and under perform during strong economic conditions when compared with cyclical stocks.

Healthcare Stocks

Major pharmaceutical companies and manufacturers of medical devices are considered to

be defensive stocks because medical aid is required irrespective of the economic condition.

But now with increase in competition from new branded and generic drugs these stocks

have become less defensive.

Apartment REITs

Apartment real estate investment trusts (REITs) are also deemed defensive, as people

always need shelter. When looking for defensive plays, steer clear of REITs that focus on

ultra-high-end apartments. Also, avoid office building REITs or industrial park REITs, which

could see defaults on leases rise when business slows.

Characteristics

1.Sectors that do not go out of fashion

2.Sectors that have perennial demand

3.Attractive dividend yields

4.Large companies with stable business models

5.Conservatively valued in P/E and P/BV terms

6.The business is not exactly cyclical

7.Stocks with low beta as defensive bets

The feature of defensive stocks can be related to its low beta that is generally less than 1.

For example, if the beta of the stock is 0.5, and the market is expected to fall by 10%, then

the defensive stock will fall only by 5% (0.5 x 10%). Similarly, if the market rises by 20%,

then also the defensive stock will rise only by 10% (0.5 x 20%).

Pros Of Defensive Stocks

1. Stability

Defensive stocks belong to the sectors which do not go out of fashion and have stable and

predictable demands, which may enable them to offer steady returns for a long time.

Investors who cannot stomach higher volatility may consider these stocks.

2. Lower risk

Though any investment inherently involves risk, defensive stocks are considered relatively

less risky, as they are less likely to lose their value significantly. Investors who prefer capital

protection over high-risk-high-returns may pick defensive stocks.

3. Outperformance in economic decline

In economic decline, most companies might see temporary drops in revenue. However,

defensive stocks are likely to perform better than the overall market. They may maintain their

earnings during that time, enabling them to provide returns in the form of dividends. Plus,

many investors move towards these stocks in the unfavorable market, which may result in

price growth.

Cons Of Defensive Stocks

1. Lower probability of significant returns

A limitation of defensive stocks in India is that they rarely offer quick and significant returns.

They may help investors protect their wealth but may not help them quickly build wealth.

2. Higher price

If you turn to defensive stocks during an economic slowdown, you may find them high-priced

or overvalued because many investors do the same. High demand results in a price rise,

which may decrease your probable returns from the stock.

3. Underperformance in an economic boom

When defensive stocks are likely to perform well in an economic slowdown, they may

perform poorly in an economic boom compared to the overall market. They would not see

significant demand growth in an economic boom, which may not enable them to provide

great returns.

Role of defensive stock in a portfolio

Every investor wants to protect their investment at the time of recession in the economy or

from the high volatility of the market. This is where the role of defensive stocks comes into

play. A steady and certain return helps the investor to survive during hard economic crashes.

So, as an investor you can consider engaging a certain percentage of your investment

towards defensive stocks which at times acts like a protective shield. Even big companies

which have strong and steady cash flows with a fixed dividend rate for many years can be

considered as defensive stocks. These big, established companies have a certain capacity

to absorb market fluctuation and remain unaffected to market change.

Why Invest in Defensive Stocks?

1.Helps reduce portfolio volatility.

2.Serves as a viable option for less experienced investors3. Provides a steady revenue

stream (through dividends).

3. Provides a steady revenue stream (through dividends).

Practical Example

•The 2020 coronavirus pandemic’s caused substantial volatility with large stock market

drops, causing many investors to panic. While the Dow Jones Industrial Average (DJIA),

S&P 500, and Nasdaq plunge throughout the pandemic, defensive stocks become a safe

haven for fearful investors.

•B&G Foods Inc (BGS) is an example of a defensive stock that’s been able to offer a stable

return on investment during the pandemic. The company manufactures, sells, and distributes

shelf-stable foods, frozen foods, and household products. During the first six months of

2020, the company’s shares rose 36%.

You might also like

- SWOT Analysis of Capital MarketDocument6 pagesSWOT Analysis of Capital Marketpassionmarket75% (4)

- Zawya Collaborative Sukuk ReportDocument130 pagesZawya Collaborative Sukuk ReportBRR_DAG100% (4)

- Comment - 2011 - Revisiting The Illiquidity Discount For Private Companies, A SkepticalDocument14 pagesComment - 2011 - Revisiting The Illiquidity Discount For Private Companies, A Skepticaljpkoning100% (1)

- MARKETING STRATEGY OF KUMAR BUILDER & DEVELOPER Real EstateDocument60 pagesMARKETING STRATEGY OF KUMAR BUILDER & DEVELOPER Real Estateshubham BaliyanNo ratings yet

- Dung Lam Va NuaDocument11 pagesDung Lam Va NuanguyentuandangNo ratings yet

- M4 Assignment 1Document4 pagesM4 Assignment 1Lorraine CaliwanNo ratings yet

- What Kinds of Stocks Are There?Document4 pagesWhat Kinds of Stocks Are There?Gilner PomarNo ratings yet

- Black BookDocument83 pagesBlack Bookmahekpurohit1800No ratings yet

- Diversification Through Commodity Mutual FundsDocument4 pagesDiversification Through Commodity Mutual FundsSrishti YadavNo ratings yet

- Investment PhilosophyDocument5 pagesInvestment PhilosophyDan KumagaiNo ratings yet

- Introduction of Mutual FundDocument50 pagesIntroduction of Mutual FundPranav ViraNo ratings yet

- Alternative InvestmentsDocument2 pagesAlternative InvestmentskautiNo ratings yet

- Introduction To Share MarketDocument26 pagesIntroduction To Share Marketsadforhappy08No ratings yet

- Sesión 1.3. Cyclical Vs Counter-Cyclical StockDocument4 pagesSesión 1.3. Cyclical Vs Counter-Cyclical StockVictorTRNo ratings yet

- Commodities As An Asset ClassDocument7 pagesCommodities As An Asset ClassvaibhavNo ratings yet

- The Basics For Investing in StocksDocument16 pagesThe Basics For Investing in StocksAditya KapoorNo ratings yet

- Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012Document4 pagesBasic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012cutiepattotieNo ratings yet

- Mini Project FileDocument41 pagesMini Project FileSonal Bandaware18No ratings yet

- What Is Diversification?Document4 pagesWhat Is Diversification?Jonhmark AniñonNo ratings yet

- Banking ConceptsDocument19 pagesBanking ConceptsjayaNo ratings yet

- Risk 2Document7 pagesRisk 2Vedha VetriselvanNo ratings yet

- Unit II: Mechanics of Futures MarketsDocument43 pagesUnit II: Mechanics of Futures MarketsAnu ShreyaNo ratings yet

- Reduction of Portfolio Through DiversificationDocument28 pagesReduction of Portfolio Through DiversificationDilshaad ShaikhNo ratings yet

- Case 1 UpdatedDocument7 pagesCase 1 UpdatedGaurav Kumar100% (1)

- Mutual Fund and Types of Mutual Fund A) What Is A Mutual Fund?Document14 pagesMutual Fund and Types of Mutual Fund A) What Is A Mutual Fund?Abhi PatilNo ratings yet

- L-1 Investment AvenuesDocument31 pagesL-1 Investment AvenuesDhairyaa BhardwajNo ratings yet

- Fixed Income Handbook PDFDocument55 pagesFixed Income Handbook PDFRamesh SathyamoorthiNo ratings yet

- Investment and Profolio ManagementDocument7 pagesInvestment and Profolio Managementhearthelord66No ratings yet

- IA - Limitation in PortfolioDocument4 pagesIA - Limitation in PortfolioJustina BaharunNo ratings yet

- IPT Stocks 2012Document16 pagesIPT Stocks 2012reachernieNo ratings yet

- Investment Analysis: There Are Two Concepts of InvestmentDocument37 pagesInvestment Analysis: There Are Two Concepts of InvestmentNiket DattaniNo ratings yet

- 1.1 Introduction To The StudyDocument68 pages1.1 Introduction To The Studyrajesh bathulaNo ratings yet

- What Are They? How Do They Differ From "Traditional" Investments?Document3 pagesWhat Are They? How Do They Differ From "Traditional" Investments?api-118535366No ratings yet

- Tacn - Tcnh-Unit 4-For StudentsDocument63 pagesTacn - Tcnh-Unit 4-For StudentsĐỗ Hoàng HàNo ratings yet

- Alternative InvestmentsDocument44 pagesAlternative Investmentspurna komaliNo ratings yet

- Hedge Funds: MII Presentation September 17, 2002 Priyanka ChopraDocument28 pagesHedge Funds: MII Presentation September 17, 2002 Priyanka ChopraPriya JagasiaNo ratings yet

- Derivatives Market FinalDocument19 pagesDerivatives Market FinalRohit ChellaniNo ratings yet

- Investment StrategiesDocument2 pagesInvestment Strategiesmyschool90No ratings yet

- Fin263 - Defensive ST0CKDocument14 pagesFin263 - Defensive ST0CKRose Syakila ElizaNo ratings yet

- Industry Analysis: Growth of Mutual Funds in IndiaDocument20 pagesIndustry Analysis: Growth of Mutual Funds in IndiaZea ZakeNo ratings yet

- Hedge FundsDocument29 pagesHedge FundsSruthi RadhakrishnanNo ratings yet

- Manajemen Investasi Summary Chapter 11: Dr. Vinola Herawaty, Ak.,MscDocument7 pagesManajemen Investasi Summary Chapter 11: Dr. Vinola Herawaty, Ak.,Mscmutia rasyaNo ratings yet

- CHP 1. Introduction To InvestmentDocument12 pagesCHP 1. Introduction To Investmentowusujeffery18No ratings yet

- Synopsis IDocument21 pagesSynopsis Iankurk124No ratings yet

- Investment EnvironmentDocument25 pagesInvestment EnvironmentK-Ayurveda WelexNo ratings yet

- Dipti Rikame Roll No 40Document5 pagesDipti Rikame Roll No 40Sameer ChoudharyNo ratings yet

- Money Managers Capital Gains or Income For The Fund's InvestorsDocument9 pagesMoney Managers Capital Gains or Income For The Fund's InvestorsKrishnan UnniNo ratings yet

- Investment Management2 PDFDocument170 pagesInvestment Management2 PDFThomas nyadeNo ratings yet

- Mutual Funds 2Document5 pagesMutual Funds 2Muhammad Afzal KhiljiNo ratings yet

- Ayushi PresentationDocument33 pagesAyushi Presentationkamendra chauhanNo ratings yet

- Types of Mutual Funds: (Arranged in Order of Increasing Risk Factor)Document13 pagesTypes of Mutual Funds: (Arranged in Order of Increasing Risk Factor)Osama SiddiquiNo ratings yet

- Cornerstone Houston CESITDocument13 pagesCornerstone Houston CESITlarrysmNo ratings yet

- Certain Features Characterize AllDocument5 pagesCertain Features Characterize Allprabin ghimireNo ratings yet

- Investment 1Document9 pagesInvestment 1Rocky KumarNo ratings yet

- MF AsddDocument6 pagesMF Asdddarshan0555No ratings yet

- Portfolio Diversification: Presented By:-Mudassar Husain Roll No. 19mbak23 Asim Abid Roll No. 19mbak61Document18 pagesPortfolio Diversification: Presented By:-Mudassar Husain Roll No. 19mbak23 Asim Abid Roll No. 19mbak61scribd2No ratings yet

- Types of FundsDocument5 pagesTypes of FundsandandanNo ratings yet

- Mutual FundsDocument40 pagesMutual Fundsaditi anandNo ratings yet

- Asset Classes: From Wikipedia, The Free EncyclopediaDocument2 pagesAsset Classes: From Wikipedia, The Free EncyclopediaSuhas PrabhakarNo ratings yet

- Common Stocks: Analysis and Strategy Impact of The MarketDocument7 pagesCommon Stocks: Analysis and Strategy Impact of The MarketDanneth TabunoNo ratings yet

- Types of Portfolios in FinanceDocument16 pagesTypes of Portfolios in FinanceMichelle LoboNo ratings yet

- ResearchDocument12 pagesResearchShanil VasuNo ratings yet

- FFE Ch.1Document20 pagesFFE Ch.1Shanil VasuNo ratings yet

- Marketing ManagementDocument10 pagesMarketing ManagementShanil VasuNo ratings yet

- Ecological PyramidDocument2 pagesEcological PyramidShanil VasuNo ratings yet

- DemonetizationDocument8 pagesDemonetizationShanil VasuNo ratings yet

- Self Help GroupDocument7 pagesSelf Help GroupShanil VasuNo ratings yet

- Land Settlement Policy of BritishDocument4 pagesLand Settlement Policy of BritishShanil VasuNo ratings yet

- Asset Management Group: Real Estate SectorDocument11 pagesAsset Management Group: Real Estate SectorDerek BannisterNo ratings yet

- The Case For Opportunistic InvestmentDocument20 pagesThe Case For Opportunistic InvestmentDavid KeresztesNo ratings yet

- Joe Smolira: Financial Management, Vol. 13, No. 1, 30-37Document5 pagesJoe Smolira: Financial Management, Vol. 13, No. 1, 30-37Reckon IndepthNo ratings yet

- FF Full Eng PDFDocument146 pagesFF Full Eng PDFAnonymous YgBIdKxvNo ratings yet

- RealEstate GlobalTop10Document2 pagesRealEstate GlobalTop10M N ZAKINo ratings yet

- Invesco Global Consumer Trends Fund of FundDocument10 pagesInvesco Global Consumer Trends Fund of FundArmstrong CapitalNo ratings yet

- 3aMFA3053 Regulatory Framework of ICM (W5)Document35 pages3aMFA3053 Regulatory Framework of ICM (W5)ksenju47No ratings yet

- Worldwide Reit Regimes Nov 2019Document105 pagesWorldwide Reit Regimes Nov 2019Diego FernandezNo ratings yet

- Baker Tilly DHC Budget Snapshot 22-23Document15 pagesBaker Tilly DHC Budget Snapshot 22-23Vi KiNo ratings yet

- Dow Jones IndicesDocument58 pagesDow Jones IndicesfayyazeasymoneyNo ratings yet

- Listening Section 2017Document5 pagesListening Section 2017Ayin KatiliNo ratings yet

- Real Estate Ownership and Investment in Saudi ArabiaDocument3 pagesReal Estate Ownership and Investment in Saudi ArabiasaifNo ratings yet

- SLG SL Green Realty 2010 Corporate Investor Presentation Slides Deck PDFDocument135 pagesSLG SL Green Realty 2010 Corporate Investor Presentation Slides Deck PDFAla BasterNo ratings yet

- ICICI Prudential Mutual FundDocument36 pagesICICI Prudential Mutual FundChintan JainNo ratings yet

- Public Mutual PDFDocument256 pagesPublic Mutual PDFDavid BockNo ratings yet

- Income Taxation Taxation of CorporationsDocument52 pagesIncome Taxation Taxation of CorporationsBianca Denise AbadNo ratings yet

- Keppel DC REIT - CircularDocument76 pagesKeppel DC REIT - Circulareuniceyl001No ratings yet

- Jurnal 1 - Kajian Hukum Bisnis Jasa Crowdfunding PropertiDocument17 pagesJurnal 1 - Kajian Hukum Bisnis Jasa Crowdfunding PropertiNicole PutriNo ratings yet

- Real Estate Capital Markets - Lecture NotesDocument2 pagesReal Estate Capital Markets - Lecture NotesCoursePinNo ratings yet

- Test 2 Tax 667 June 2021 QDocument4 pagesTest 2 Tax 667 June 2021 QMifzalIzzaniNo ratings yet

- Advanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzeDocument20 pagesAdvanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzekaragujsNo ratings yet

- Suncity, Sunway To Combine? Analysts See A Current Trend of M&AsDocument12 pagesSuncity, Sunway To Combine? Analysts See A Current Trend of M&AsFazlin GhazaliNo ratings yet

- Alternative Investments - Q1 Fund Launches and Pipeline (April 2023)Document18 pagesAlternative Investments - Q1 Fund Launches and Pipeline (April 2023)Yunfei YanNo ratings yet

- Deutsche Bank, Insider Trading Watermark)Document80 pagesDeutsche Bank, Insider Trading Watermark)info707100% (1)

- Starhill Global REIT Ending 1Q14 On High NoteDocument6 pagesStarhill Global REIT Ending 1Q14 On High NoteventriaNo ratings yet

- Pershing Square's Latest Presentation On General Growth PropertiesDocument55 pagesPershing Square's Latest Presentation On General Growth PropertiesDealBookNo ratings yet

- Annual Report 2012 FinalDocument65 pagesAnnual Report 2012 FinalAnnNo ratings yet