Professional Documents

Culture Documents

Land Bank v. CA, GR No. 118712, 06 October 1995 (Digest 02)

Land Bank v. CA, GR No. 118712, 06 October 1995 (Digest 02)

Uploaded by

Maizee KeenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Land Bank v. CA, GR No. 118712, 06 October 1995 (Digest 02)

Land Bank v. CA, GR No. 118712, 06 October 1995 (Digest 02)

Uploaded by

Maizee KeenCopyright:

Available Formats

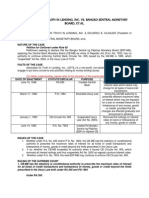

6. Landbank vs CA, GR No. 118712, July 5,1996& DAR vs CA, GR No.

118745, July 5,

1996

Ratio: When the law speaks in clear and categorical language, there is no reason for

interpretation or construction, but only for application. Thus, recourse to any rule which allows

the opening of trust accounts as a mode of deposit under Section 16(e) of RA 6657 goes beyond

the scope of the said provision and is therefore impermissible.

Facts:

The case involves how the government pays “just compensation” in expropriation proceedings.

Petitioners filed their respective motions for reconsideration contending mainly that, contrary to

the Court’s conclusion, the opening of trust accounts in favor of the rejecting landowners is

sufficient compliance with the mandate of RA 6657.

Sec. 16, RA 6657. Procedure for Acquisition of Private Lands –x x x x x x xxx

(e) Upon receipt by the landowner of the corresponding payment or, in case of rejection or no

response from the landowner, upon deposit with an accessible bank designated by the DAR of

the compensation in cash or in LBP bonds in accordance with this Act, the DAR shall take

immediate possession of the land and shall request . . .”

Moreover, it is argued that there is no legal basis for allowing the withdrawal of the money

deposited in trust for the rejecting landowner spending the determination of the final valuation of

their properties.

Issue: Whether or not the opening of trust accounts is sufficient compliance with the mandate of

RA6657.

Ruling: No, the opening of trust accounts is not sufficient compliance. The provision is very

clear and unambiguous, foreclosing any doubt as to allow an expanded construction that would

include the opening of “trust accounts” within the coverage of the term “deposit.” Accordingly,

we must adhere to the well-settled rule that when the law speaks in clear and categorical

language, there is no reason for interpretation or construction, but only for application. Thus,

recourse to any rule which allows the opening of trust accounts as a mode of deposit under

Section 16(e) of RA 6657 goes beyond the scope of the said provision and is therefore

impermissible.

Notes: The rule-making power must be confined to details for regulating the mode or

proceedings to carry into effect the law as it had been enacted, and it cannot be extended to

amend or expand the statutory requirements or to embrace matters not covered by the statute.

Any resulting discrepancy between administrative regulations and provisions of the law will

always be resolved in favor of the basic law.

You might also like

- Law On Sales (Case Digests 1-79)Document90 pagesLaw On Sales (Case Digests 1-79)Jaclyn Wyatt62% (13)

- Pryce Corporation v. China Banking CorporationDocument2 pagesPryce Corporation v. China Banking CorporationAaron AristonNo ratings yet

- Landbank V CA and Ya DigestDocument1 pageLandbank V CA and Ya DigestIvyGwynn21475% (4)

- SPOUSES POON v. PRIME SAVINGSDocument3 pagesSPOUSES POON v. PRIME SAVINGSJohn Ray PerezNo ratings yet

- Advocates of Til vs. BSPDocument3 pagesAdvocates of Til vs. BSPIrene RamiloNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Jones V HortiguelaDocument2 pagesJones V Hortiguelaapbuera100% (2)

- Former President Trump's Attorney's Letter To Town of Palm BeachDocument3 pagesFormer President Trump's Attorney's Letter To Town of Palm BeachWTSP 10No ratings yet

- Landbank vs. CADocument2 pagesLandbank vs. CAMikkaEllaAnclaNo ratings yet

- Land Bank of The Philippines v. CA Francisco, R.J. - October 6, 1995 FactsDocument1 pageLand Bank of The Philippines v. CA Francisco, R.J. - October 6, 1995 FactsMigs RaymundoNo ratings yet

- LBP vs. CA GR No. 118712 Oct. 6 1995 MC BendoDocument2 pagesLBP vs. CA GR No. 118712 Oct. 6 1995 MC BendoChristopher AdvinculaNo ratings yet

- Case Name Topic Case No. - Date G.R. No. 118712 - October 6, 1995 Ponente DoctrineDocument2 pagesCase Name Topic Case No. - Date G.R. No. 118712 - October 6, 1995 Ponente DoctrineNathalie Jean YapNo ratings yet

- Land Bank V CADocument3 pagesLand Bank V CABill MarNo ratings yet

- Landbank Vs Ca - AdminDocument2 pagesLandbank Vs Ca - AdminErisa RoxasNo ratings yet

- CASE 33 DigestDocument2 pagesCASE 33 DigestMeeJeeNo ratings yet

- Landank vs. YapDocument4 pagesLandank vs. Yaplehsem20006985No ratings yet

- Land Bank V CA and Yap FullDocument4 pagesLand Bank V CA and Yap FullCeledonio ManubagNo ratings yet

- Fria Case DigestsDocument11 pagesFria Case DigestsRegion Ten100% (2)

- Landbank vs. CA, G.R. No. 118712Document3 pagesLandbank vs. CA, G.R. No. 118712Aderose SalazarNo ratings yet

- New Sampaguita Builders Construction, Inc Vs Philippine National BankDocument2 pagesNew Sampaguita Builders Construction, Inc Vs Philippine National BankLoNo ratings yet

- Land Bank Versus Pedro Yap and Court of AppealsDocument12 pagesLand Bank Versus Pedro Yap and Court of AppealsHarold ApostolNo ratings yet

- Landbank V CA 1996 (Agrarian Law)Document4 pagesLandbank V CA 1996 (Agrarian Law)Rynor Selyob SomarNo ratings yet

- B148 Land Bank of The Phil vs. CADocument2 pagesB148 Land Bank of The Phil vs. CASherine Lagmay Rivad100% (5)

- Consolidated Additional FRIA CasesDocument10 pagesConsolidated Additional FRIA CasesAndrea De Jesus100% (1)

- LBP v. CA GR 118745Document13 pagesLBP v. CA GR 118745AnonymousNo ratings yet

- Yambao vs. RepublicDocument2 pagesYambao vs. RepublicmlicudineNo ratings yet

- Claude L. Rice, Trustee, Estate of Willie D. Mimms v. Willie D. Mimms, in The Matter of Willie D. Mimms, Debtor, 291 F.2d 823, 10th Cir. (1961)Document5 pagesClaude L. Rice, Trustee, Estate of Willie D. Mimms v. Willie D. Mimms, in The Matter of Willie D. Mimms, Debtor, 291 F.2d 823, 10th Cir. (1961)Scribd Government DocsNo ratings yet

- Agra Law Batch 2 Case No. 2 LBP V. Ca Facts:: in Cash or in BondsDocument1 pageAgra Law Batch 2 Case No. 2 LBP V. Ca Facts:: in Cash or in BondsZushmita Ambolodto AlaNo ratings yet

- FRIA CasesDocument37 pagesFRIA CasesJane DominNo ratings yet

- 21.1 - Landbank V CADocument2 pages21.1 - Landbank V CAMae ThiamNo ratings yet

- FRIA DigestsDocument14 pagesFRIA DigestsTen LaplanaNo ratings yet

- 02 Allied Bank v. Equitable PCI BankDocument4 pages02 Allied Bank v. Equitable PCI BankEcob ResurreccionNo ratings yet

- C0MM AmlaDocument21 pagesC0MM AmlaBeatta RamirezNo ratings yet

- Supreme Court Reports Annotated Volume 435Document57 pagesSupreme Court Reports Annotated Volume 435Janice LivingstoneNo ratings yet

- Abrera V BarzaDocument3 pagesAbrera V Barzachappy_leigh118No ratings yet

- Case Digest Involving The FRIADocument2 pagesCase Digest Involving The FRIAMarinelle CAGUIMBALNo ratings yet

- Land Bank of The Philippines v. Yatco Agricultural Enterprises, G.R. No. 172551, January 15, 2014Document3 pagesLand Bank of The Philippines v. Yatco Agricultural Enterprises, G.R. No. 172551, January 15, 2014Leizandra PugongNo ratings yet

- LBP vs. J.L. Jocsons and SonsDocument3 pagesLBP vs. J.L. Jocsons and SonsVilpa VillabasNo ratings yet

- 14 - LBP Vs CADocument2 pages14 - LBP Vs CAKhenett Ramirez PuertoNo ratings yet

- Case 33Document5 pagesCase 33montenegroloveNo ratings yet

- Speccom CasesDocument10 pagesSpeccom CasesPrincess Dayana PacasumNo ratings yet

- New SampaguitaDocument54 pagesNew Sampaguitania coline mendozaNo ratings yet

- 261 Ligot VS RepublicDocument33 pages261 Ligot VS RepublicSephronJdmNo ratings yet

- PNCC Vs CA DigestsDocument2 pagesPNCC Vs CA DigestsTinersNo ratings yet

- Overriding Effect of Arbitration Act Over Insolvency and Bankruptcy CodeDocument11 pagesOverriding Effect of Arbitration Act Over Insolvency and Bankruptcy CodeAditi BhawsarNo ratings yet

- Confederation of Sugar Producers Association vs. DAR - DigestDocument2 pagesConfederation of Sugar Producers Association vs. DAR - Digestsherwin100% (2)

- Relief Can Only Be Obtained WhenDocument4 pagesRelief Can Only Be Obtained WhenGerald Bowe ResuelloNo ratings yet

- Cetus Development, Inc. vs. Court of Appeals, 176 SCRA 72Document89 pagesCetus Development, Inc. vs. Court of Appeals, 176 SCRA 72gerlie22No ratings yet

- E B ' O Verdict: Accept: Ditorial Oard S BservationsDocument5 pagesE B ' O Verdict: Accept: Ditorial Oard S BservationsRichik DadhichNo ratings yet

- Association of Small Landowners and Paras and Land Bank DIGESTDocument3 pagesAssociation of Small Landowners and Paras and Land Bank DIGESTseventhwitchNo ratings yet

- Landbank vs. CADocument1 pageLandbank vs. CAIrish PrecionNo ratings yet

- Agra Cases Part 2Document23 pagesAgra Cases Part 2RichardNo ratings yet

- In Re Caribbean Food Products, Inc., Debtors-Appellees v. Banco Credito Y Ahorro Ponceno, 575 F.2d 961, 1st Cir. (1978)Document8 pagesIn Re Caribbean Food Products, Inc., Debtors-Appellees v. Banco Credito Y Ahorro Ponceno, 575 F.2d 961, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- Digest G.R. No. 109835 Nov. 22, 1993Document1 pageDigest G.R. No. 109835 Nov. 22, 1993Isay San JoseNo ratings yet

- #1 Equitable PCI Banking Corp (Digest)Document3 pages#1 Equitable PCI Banking Corp (Digest)Vittorio Ignatius RaagasNo ratings yet

- (Credit Trans) de La Paz vs. L&JDocument24 pages(Credit Trans) de La Paz vs. L&JCHERRIE LOU A AGSOYNo ratings yet

- 2023 151 Taxmann Com 176 NCLAT Chennai 27 02 2023 Nirej Vadakkedathu Paul Vs SunstaDocument45 pages2023 151 Taxmann Com 176 NCLAT Chennai 27 02 2023 Nirej Vadakkedathu Paul Vs SunstabhaviknagoriNo ratings yet

- 11.digested Allied Bank vs. EPCI GR. No. 191939 March 15 2018Document5 pages11.digested Allied Bank vs. EPCI GR. No. 191939 March 15 2018Arrianne ObiasNo ratings yet

- People of The Philippines vs. Joselito Del RosarioDocument3 pagesPeople of The Philippines vs. Joselito Del RosariomyschNo ratings yet

- Poon vs. Savings Bank PDFDocument2 pagesPoon vs. Savings Bank PDFJaime Rariza Jr.No ratings yet

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsFrom EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsRating: 3 out of 5 stars3/5 (1)

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- 3D. Liang v. People, G.R. No. 125865Document2 pages3D. Liang v. People, G.R. No. 125865Maizee KeenNo ratings yet

- 1D. Ient v. Tullett Prebon, G.R. No. 189158Document2 pages1D. Ient v. Tullett Prebon, G.R. No. 189158Maizee KeenNo ratings yet

- 2D. Minucher v. Scalzo, G.R. No. 142396Document2 pages2D. Minucher v. Scalzo, G.R. No. 142396Maizee KeenNo ratings yet

- Beja, Sr. v. CA, GR No. 97149, 31 March 1992Document2 pagesBeja, Sr. v. CA, GR No. 97149, 31 March 1992Maizee KeenNo ratings yet

- Presidential Anti-Dollar Salting Task Force v. CA, GR No. L-83578, 16 March 1989Document2 pagesPresidential Anti-Dollar Salting Task Force v. CA, GR No. L-83578, 16 March 1989Maizee KeenNo ratings yet

- Eugenio v. CSC, GR No. 115863, 31 March 1995Document2 pagesEugenio v. CSC, GR No. 115863, 31 March 1995Maizee KeenNo ratings yet

- People v. Capalac, G.R. No. L-38297 October 23, 1982Document1 pagePeople v. Capalac, G.R. No. L-38297 October 23, 1982Maizee KeenNo ratings yet

- CIR v. CA, GR No. 108358, 20 January 1995 (Full Text)Document4 pagesCIR v. CA, GR No. 108358, 20 January 1995 (Full Text)Maizee KeenNo ratings yet

- Cruz vs. Stanton Youngberg, 56 Phil. 234Document1 pageCruz vs. Stanton Youngberg, 56 Phil. 234Maizee KeenNo ratings yet

- REPUBLIC v. DRUGMAKER'S LABORATORIES, GR No. 190837, 05 March 2014Document4 pagesREPUBLIC v. DRUGMAKER'S LABORATORIES, GR No. 190837, 05 March 2014Maizee KeenNo ratings yet

- Slide 1: Financial Accounting For Specialized IndustriesDocument9 pagesSlide 1: Financial Accounting For Specialized IndustriesGrace LimNo ratings yet

- Soccoro vs. Van Wilsem Case DigestDocument3 pagesSoccoro vs. Van Wilsem Case DigestLoid AguhobNo ratings yet

- Brillantes v. Castro, G.R. No. L-9223, June 30, 1956Document7 pagesBrillantes v. Castro, G.R. No. L-9223, June 30, 1956Angela CanaresNo ratings yet

- Land Bank of The Philippines V PerezDocument1 pageLand Bank of The Philippines V PerezAnonymous qjsSkwFNo ratings yet

- Student HandbookDocument12 pagesStudent HandbookGogo Soriano100% (1)

- Walt Nauta MTD Florida Classified Docs CaseDocument25 pagesWalt Nauta MTD Florida Classified Docs CaseRobert GouveiaNo ratings yet

- Aspects of Justice in Ancient IndiaDocument13 pagesAspects of Justice in Ancient IndiaToshi BharatNo ratings yet

- Eduardo T. RODRIGUEZ, Petitioner, Commission ON ELECTIONS, BIENVENIDO O. MARQUEZ, JR., RespondentsDocument2 pagesEduardo T. RODRIGUEZ, Petitioner, Commission ON ELECTIONS, BIENVENIDO O. MARQUEZ, JR., RespondentsErick Jay InokNo ratings yet

- Reforms by Hazrat UmarDocument2 pagesReforms by Hazrat Umarhati1100% (1)

- Taxflash: Tax Indonesia / June 2018 / No.07Document3 pagesTaxflash: Tax Indonesia / June 2018 / No.07Daisy Anita SusiloNo ratings yet

- Seventh Day Adventist Conference Church of Southern Philippines Inc Vs Northeastern Mindanao Mission of 7th Day Adventist IncDocument2 pagesSeventh Day Adventist Conference Church of Southern Philippines Inc Vs Northeastern Mindanao Mission of 7th Day Adventist IncKharrel Grace100% (4)

- 2021-12-08 - Bundle of Documents (Wang V Galati)Document45 pages2021-12-08 - Bundle of Documents (Wang V Galati)Canadian Society for the Advancement of Science in Public PolicyNo ratings yet

- Unite Housing Corporation V DayritDocument2 pagesUnite Housing Corporation V DayritTin VillarosaNo ratings yet

- Order Granting Motion To DismissDocument5 pagesOrder Granting Motion To DismissDavid Oscar MarkusNo ratings yet

- RFBT.04 Law On Credit TransactionDocument2 pagesRFBT.04 Law On Credit TransactionRhea Royce CabuhatNo ratings yet

- Roxas Vs CTADocument1 pageRoxas Vs CTAhanabi_13No ratings yet

- Affidavit of HeirshipDocument2 pagesAffidavit of HeirshipZarjoshkyen MactarNo ratings yet

- Art. 538 - 558Document23 pagesArt. 538 - 558Julius ManaloNo ratings yet

- What Is Harvard Model Congress and How Does It Connect To The American GovernmentDocument25 pagesWhat Is Harvard Model Congress and How Does It Connect To The American GovernmentXánh ThẩmNo ratings yet

- Attorney's LiensDocument2 pagesAttorney's LiensMarkyHeroiaNo ratings yet

- Briefing Note RevDocument4 pagesBriefing Note Revrishi madanNo ratings yet

- Kams International Inc vs. NRC I GR No. 128806 Sept. 28 1999Document3 pagesKams International Inc vs. NRC I GR No. 128806 Sept. 28 1999TonGalabinIIINo ratings yet

- Jurists Bar Review Center: Online Preweek Lectures 2019Document1 pageJurists Bar Review Center: Online Preweek Lectures 2019MaanNo ratings yet

- The Great Qing CodeDocument5 pagesThe Great Qing CodeDavid Slobadan0% (1)

- Hidden DefectsDocument6 pagesHidden DefectsSK Tim RichardNo ratings yet

- Henderson County ComplaintDocument11 pagesHenderson County ComplaintMitchell BlackNo ratings yet

- United States v. Tom J. Billman, 86 F.3d 1153, 4th Cir. (1996)Document6 pagesUnited States v. Tom J. Billman, 86 F.3d 1153, 4th Cir. (1996)Scribd Government DocsNo ratings yet